Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 200,000+ subscribers. This week we cover BlackRock's spot bitcoin ETF saw half a billion dollars in inflows, BlackRock’s CEO Larry Fink sees value in a spot Ethereum ETF, Gensler addresses the SEC X account hack, and big new venture rounds for Hashkey Group ($100M) and Renzo ($3.2M).

The countdown to one of the key historical catalysts for the start of each four-year bull market cycle

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2023 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund of the world's leading crypto funds, returning approximately 14.43% net for '23, 195%+ net (pro-forma) since '19 and aim to deeply mitigate downside. Amphibian offers BTC, ETH and USD share classes. January 23 webinar discusses navigating the institutional era of digital assets. Register here: www.amphibiancapital.com/institutional-era

Become a Coinstack Sponsor

To reach our weekly audience of 200,000 crypto insiders and daily audience of 60,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack. We’re filling up our 2024 sponsor slots now.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

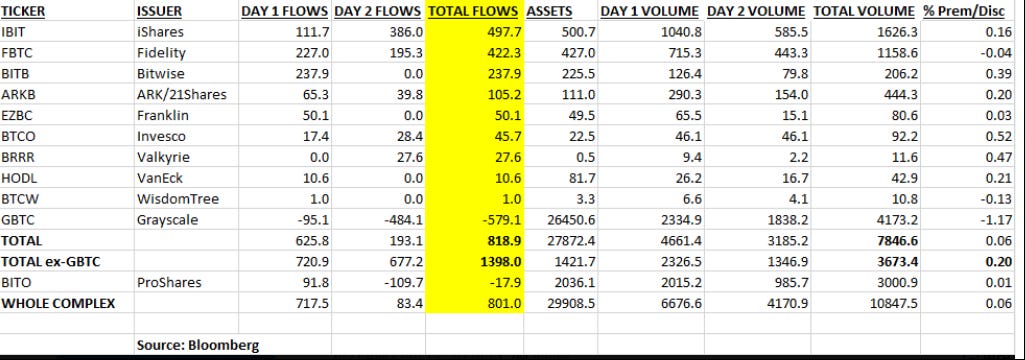

💸 BlackRock's spot bitcoin ETF saw half a billion dollars in inflows in first two days: The nine bitcoin ETFs that debuted on the stock market, out of the eleven total that were approved, (Grayscale's ETF is a conversion, while Hashdex is still converting its bitcoin futures fund) took in nearly $1.5 billion in new capital over the first two days of trading, according to preliminary data shared by Bloomberg senior ETF analyst Eric Balchunas. BlackRock has accumulated nearly 11,500 bitcoin for its newly-listed spot bitcoin exchange-traded fund (ETF) as the Wall Street titan rapidly builds one of the largest troves of BTC in the world.

💰BlackRock CEO Larry Fink 'sees value' in spot Ethereum ETF following successful Bitcoin launch: BlackRock's spot Bitcoin ETF (IBIT) reached $1.05 billion in trading volume on Thursday, surpassing BITO’s $1 billion first-day bitcoin futures ETF volume in 2021. “These are just stepping stones towards tokenization and I really do believe this is where we're going to be going,” Fink added.

📜 SEC Chair Gensler addresses X account hack in statement: 'Still assessing the impacts':The Securities and Exchange Commission has released a statement addressing the recent hijacking of its X account, through which an unknown agent posted a false spot bitcoin ETF approval announcement.

⚖️ Genesis Global Trading to pay $8 million in settlement after New York's regulator found cybersecurity failings: Genesis Global Trading settled with the New York State Department of Financial Services on Friday, agreeing to cease operations in the state and surrender its BitLicense — a license for virtual currency activities in the state.

🪓 GameStop axes NFT marketplace, citing regulatory uncertainty: GameStop has announced the closure of its NFT marketplace. In a statement posted to the site, the company cites "the continuing regulatory uncertainty of the crypto space" as the reason behind the closure. The marketplace officially launched on Halloween of 2022, focusing on gaming assets in partnership with ImmutableX, an Ethereum layer 2 blockchain.

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @ThorHartvigsen

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. The first day of spot Bitcoin ETF trading saw over $1B in volume within 30 minutes of going live and ended the day with $4.47B in total volume.

Source: @DavidShuttleworth

2. Underrated winner of the Bitcoin ETF approval? Prediction markets. Polymarket did more volume than OpenSea.

Source: @richardchen39

3. Manta TVL is skyrocketing. Now #10 on DefiLlama right behind Base.

Source: @hosseeb

4. Morpho Blue exceeds $1.5B+ deposits, $900M+ borrowed

Source: OurNetwork

5. Compound III grows to over $1.75B in total assets and $500M in borrows across all markets, surpassing Compound V2

Source: @OurNetwork

6. Top Moving Coins From the Top 100, Last 7 Days

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: George Leonardo is the founder of Cap Hill Crypto, a solo-entrepreneur venture focused on providing nonpartisan insights and analysis on U.S. federal crypto policy. This is an excerpt from the full article, which you can find here.

Key Insights

The House Financial Services Subcommittee on Digital Assets held a hearing examining FSOC's impact on innovation at which Members emphasized the need for Congress, rather than regulators, to lead on writing rules for crypto.

Key Members of Congress applauded the SEC's approval of a spot Bitcoin ETF and called for an investigation into how the agency allowed its Twitter/X account to be compromised.

FSOC Hearing

On Wednesday, the House Financial Services Subcommittee on Digital Assets, FinTech, and Innovation held a hearing examining recent guidance and reports from the Financial Stability Oversight Council and how the interagency body is impacting innovation in the digital asset and fintech space.

Key Takeaways:

Republicans promoted FIT 21 and the Clarity for Payment Stablecoins Act as solutions to FSOC's previous calls to address regulatory gaps in the spot market for crypto assets that are not securities and stablecoins.

Republicans pushed back strongly against any attempts by FSOC to use its authority to sidestep Congress when it comes to writing crypto laws.

How to regulate nonbank financial firms engaging in bank-like activities without stifling innovation or competition is likely to remain an ongoing issue within the committee.

What is FSOC?

Dodd-Frank established the Financial Stability Oversight Council ("FSOC") to improve interagency efforts to identify and respond to potential threats to financial stability. 12 U.S.C. § 5321-22.

Dodd-Frank empowered FSOC to designate financial institutions as Systemically Important Financial Institutions ("SIFIs") based on a consideration of various risk factors, such as the company's size, nature of assets and liabilities held, and interconnectedness to other financial firms. 12 U.S.C. § 5323. An entity that receives a SIFI designation becomes subject to Federal Reserve oversight and must comply with enhanced prudential requirements. See § 5325.

Since the law's enactment, FSOC has published three different versions of guidance, under three different administrations, regarding the specific process for determining when to designate an entity as a SIFI. Most recently, in November 2023, FSOC adopted updated guidance for designating nonbank financial companies.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com