Learn More at www.amphibiancapital.com, and www.digitalassetresearch.substack.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week BlackRock's spot Bitcoin ETF surpassed 300,000 BTC, FTX creditor group filed objection against bankruptcy, Coinbase debuted Smart Wallet, and big new venture rounds for M^0 ($35M) and The Sandbox ($20M).

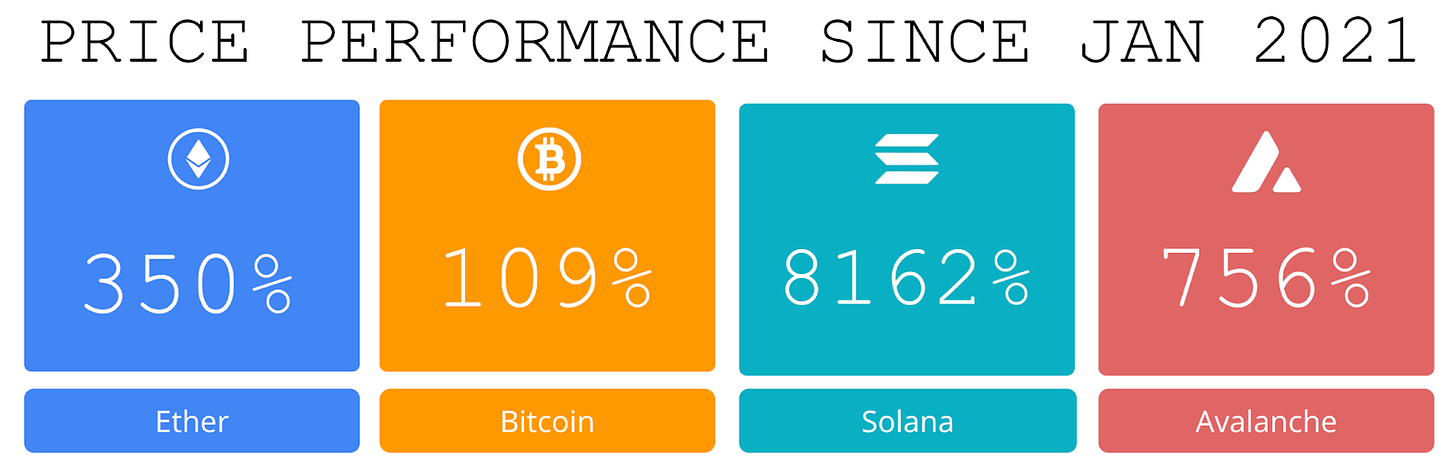

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $70M+ AUM, is a fund of the world's leading hedge funds. +11.20% net YTD with their USD fund, +9.29% net YTD in their ETH fund (80.01% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

1995 Digital Asset Research pushes the boundaries of conventional investment wisdom, uncovering hidden market secrets to provide you with a truly unique and unmatched edge. Our emphasis on broader market cycles and in-depth analysis of on-chain crypto projects aims to help you achieve your investment goals. With our actionable insights, market research, and Web 3 tech tutorials, we empower you in the crypto universe, awakening you to the immense power of digital assets.

Learn more: www.digitalassetresearch.substack.com.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

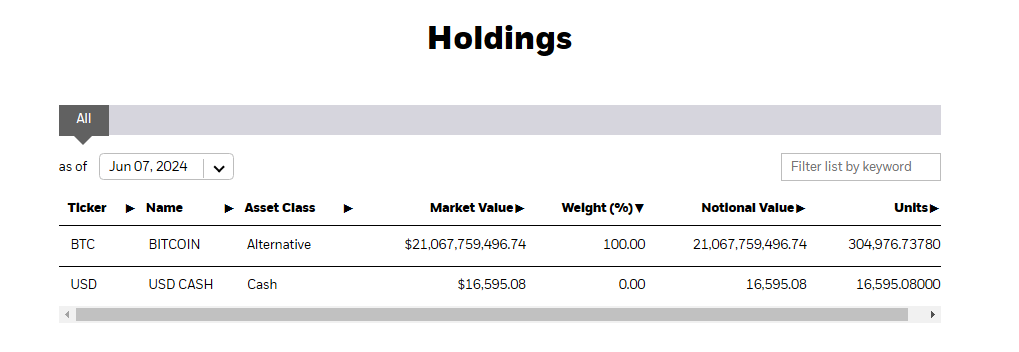

🚀 BlackRock's spot bitcoin ETF surpasses 300,000 BTC in assets under management: BlackRock’s Bitcoin ETF has now accumulated 302,534 BTC, according to its fund page, with around 4,920 BTC in net inflows yesterday taking it over the milestone.

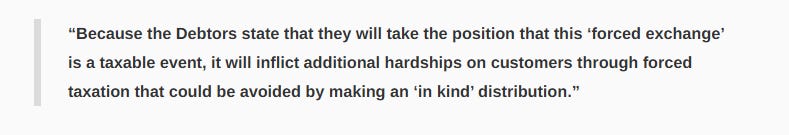

⚖️ FTX creditor group files objection against bankruptcy reorganization plan: A group of FTX creditors led by Sunil Kavuri has objected to the reorganization plan filed by the defunct exchange’s bankruptcy managers.

🚀 Coinbase Debuts Smart Wallet, Gunning to Bring 1 Billion Users to Crypto: Top U.S. crypto exchange Coinbase today unveiled its promised Smart Wallet, a product it says it designed to reduce hurdles for new users looking to get started in the DeFi space.

⚖️ SEC chair Gensler says spot Ethereum ETF launch timeline depends on applicants’ speed: SEC chair Gary Gensler said the timeline for spot Ethereum ETF launches depends on how quickly applicants respond to the regulator’s questions and comment on reasons for approvals.

✂️ Solana Foundation expels validators for sandwich attacks on retail users: The Solana Foundation has expelled several validators from its delegation program for conducting sandwich attacks on retail users. In a recent Discord announcement, Tim Garcia, the Team Lead of Solana Validator Relations, confirmed that the removals were permanent, stating that the foundation identified operators involved in mempool activities supporting sandwich attacks.

⛓️ How the proposed Hekima University and Crescite aim to drive innovation with agreement for new campus: With 75 acres of land in Kenya the Proposed Hekima University aims to build a state-of-the-art new campus following an agreement with the Crescite Innovation Corporation, an organization on a mission to deliver impact-driven innovation and economic activity with decentralized technologies. Its global ecosystem has a strong focus on scientific governance and includes the first faith-based token.

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @brian_armstrong

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. It's official: more v2 pools are being created on L2s than on Ethereum 🤯

Source: @Uniswap

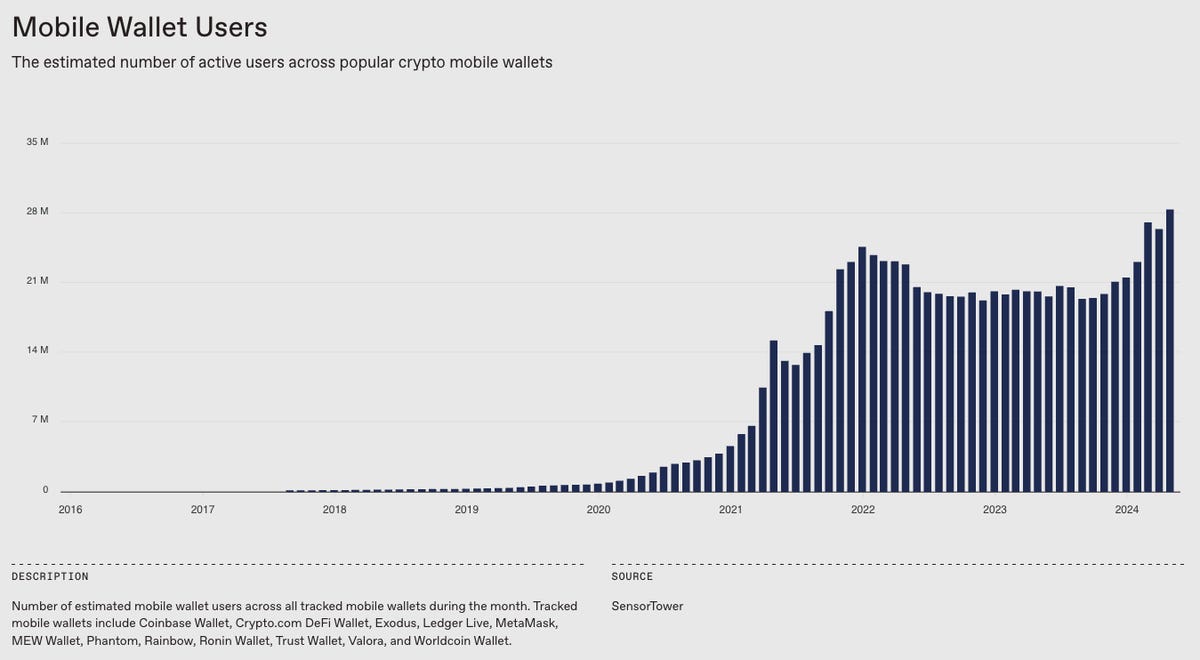

2. The number of mobile wallet users in crypto is now at an all-time high of 28 million, according to the data from our State of Crypto Index.

Source: @DarenMatsuoka

3. 🦄 Uniswap's monthly active traders by chain:

🥇Base 36.30%

🥈Ethereum 23.74%

🥉Arbitrum 12.98%

Source: @tokenterminal

4. Top 80 holders of the BTC ETF. A lot of familiar names.

Source: @dunleavy89

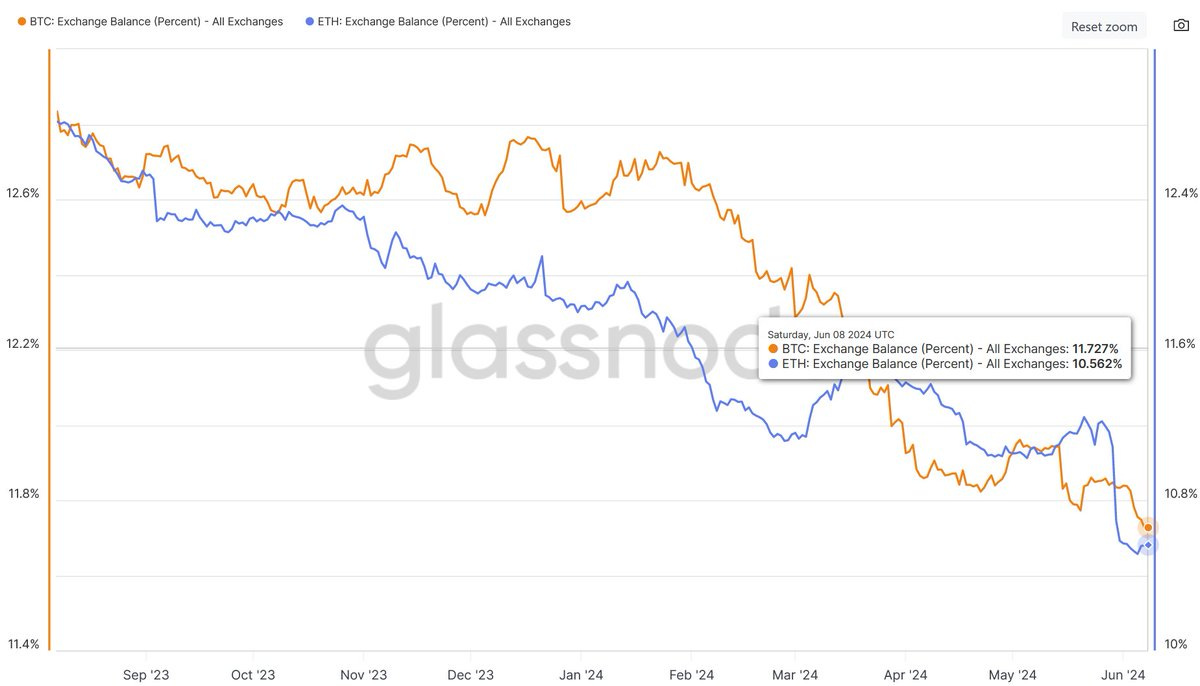

5. Only 10% of $ETH is left on exchanges. 💫

Source: @EthereanMaximus

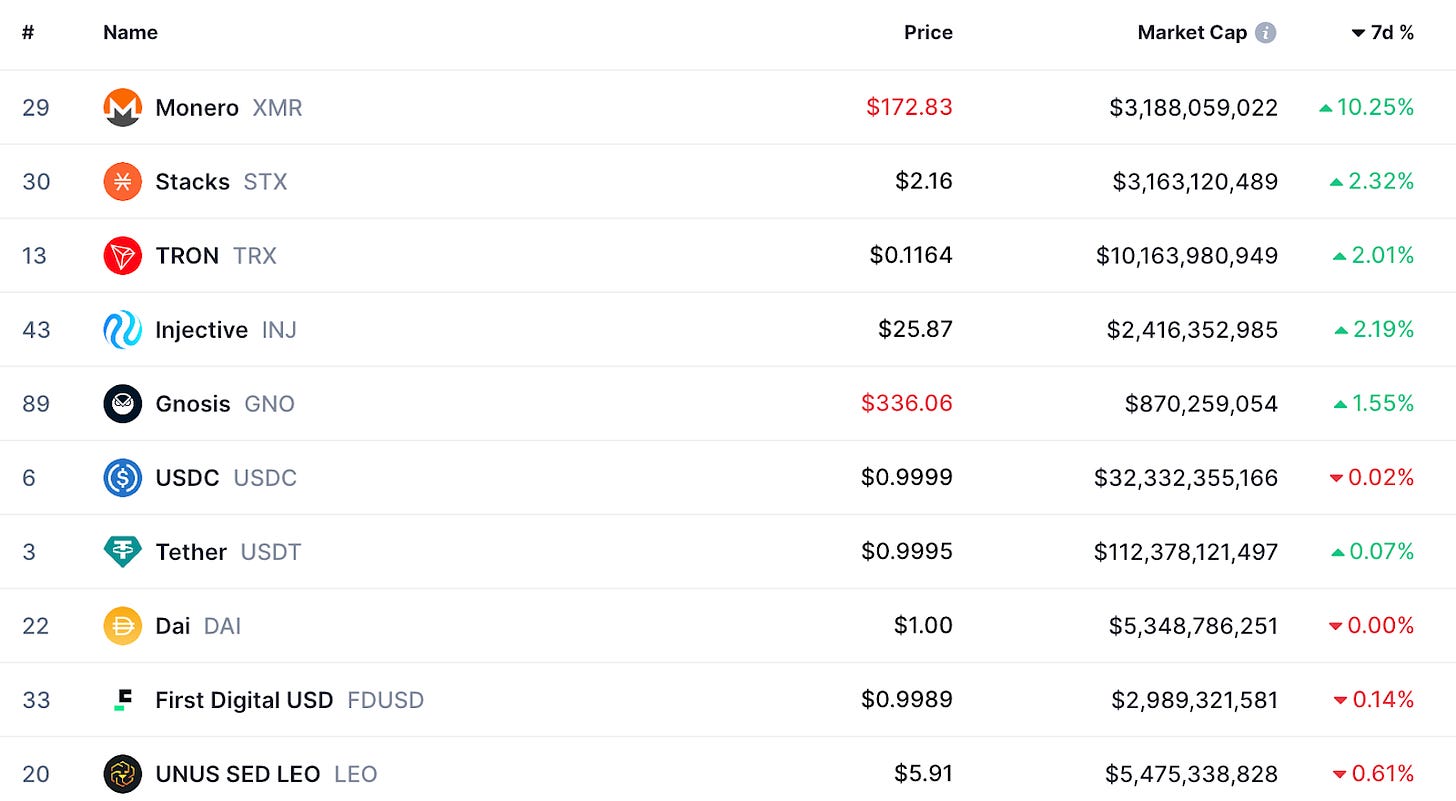

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Cole DeRousse serves as a Research Assistant at 1995 Digital Asset Research, where he blends technical research with social investing strategies. His primary focus is on fostering the growth of the Web3 community and ecosystem, aiming to awaken people to the transformative power of Web3 apps and technologies. This is an excerpt from the full article, which you can find here.

Introduction

The recent events involving Roaring Kitty (also known as DFV) have once again captured the attention of both retail and institutional investors. The dual strategies employed by Roaring Kitty highlight a sophisticated understanding of market dynamics and the impact of social media on trading. This report delves into two key maneuvers: the "Kansas City Shuffle" and DFV's 4D Chess Move, analyzing their implications for market manipulation and regulatory oversight.

Roaring Kitty’s 4D Chess Move: Using Memes to Expose Manipulated Prices to a Live Audience

During a live stream watched by over 600,000 viewers, Roaring Kitty ingeniously demonstrated how specific phrases could trigger algorithmic trading halts.

Traditionally, trading halts are programmed to activate when a stock's price moves significantly — either 5% up or down from its last 5-minute average. Anticipating this, DFV strategically mentioned "ending the stream," timing his phrases with the stock's price movements, which cunningly resulted in a trading halt following a minor 1-2% price drop.

This spectacle highlighted the absurdity and potential manipulation within the stock, raising serious questions about the integrity of trading mechanisms that respond mechanically to spoken phrases during a live broadcast. Now I want to show you a video of SEC Chairman Gary Gensler from 2 years ago talking about social media’s impact on meme stocks and the dark side of algorithmic trading that includes dark pool abuse. Dark pool abuse is when exchanges take retail public trades through wholesalers or other 3rd party trading entities instead of directly to the exchange.

This event begs the question of regulatory oversight with a hint of irony: "Hey SEC, how about that for manipulation?" Roaring Kitty just proved the GME stock is manipulated.

It's a stark commentary on the current state of traditional finance and SEC’s ability to protect retail investors, humorously summed up as an "absolute joke," where the real price of GME stock seems to be obscured, leading to a market where there's no logical way to calculate the fundamental value per share. This is why we Crypto. 🤷♂️🤠

Roaring Kitty’s 4D Chess Move: Using Memes to Expose Manipulated Prices to a Live Audience

Many speculate that Roaring Kitty was working with Ryan Cohen the Gamestop CEO. Roaring Kitty came on stream and cleared this up and said he was working alone on this. He is likely telling the truth because it’s public information that CEO Ryan Cohen reserves the right to empty the GME shares from Depository Trust Clearing Corp if it’s proven they are being manipulated which they just were during the Roaring Kitty Live stream. Here is the cryptic meme that Roaring Kitty posted on X

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com, and www.digitalassetresearch.substack.com