Social Links: Twitter | Telegram | Newsletter

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 260k weekly subscribers. This week, BlackRock's spot Ethereum ETF surpasses $1B, CZ was released from jail, Mango Markets agreed to settle SEC charges, and big new venture rounds came in for Mawari Network ($10.8M) and Mind Network ($10M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Become a Coinstack Sponsor

To reach our weekly audience of 260,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 BlackRock's spot Ethereum ETF surpasses $1 billion in value for the first time: US-based spot Ethereum exchange-traded funds have logged their highest weekly inflows since early August in a reversal of a streak of six straight weeks of negative outflows, with one fund broaching a significant milestone: more than $1 billion in net asset value.

⚖️ Former Binance CEO Changpeng Zhao released from custody on Friday: Changpeng Zhao, the former leader and co-founder of Binance, was released on Friday, two days earlier than scheduled.

⚖️ Mango DAO and Mango Markets agree to settle SEC charges involving unregistered sale of MNGO tokens: The SEC's charges were against Mango DAO and a Panama entity, Blockworks Foundation, for "engaging in the unregistered offer and sale of crypto assets" of governance tokens on the Mango Markets platform. The agency also said it settled charges against Blockworks Foundation and Mango Labs LLC for acting as a broker without being registered.

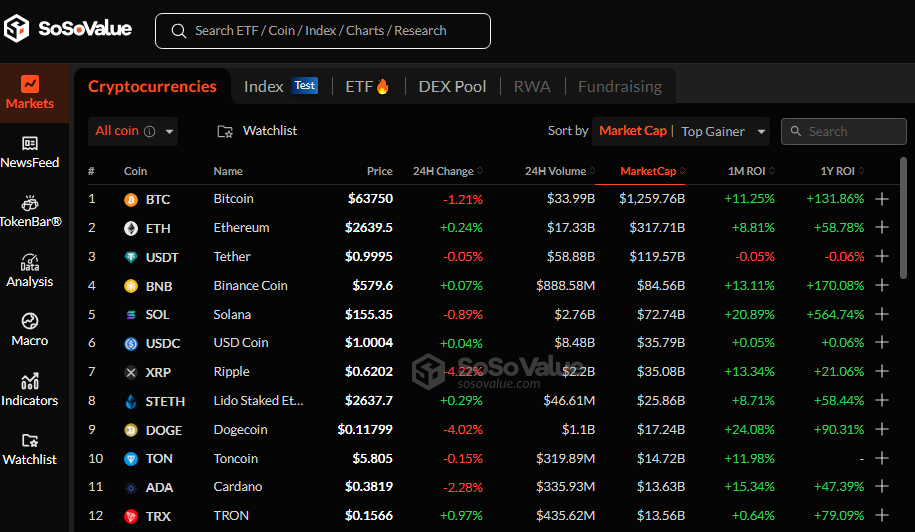

🚀 US spot Bitcoin ETFs continue net inflow streak, reaching $365 million on sixth day: Spot bitcoin exchange-traded funds in the U.S. recorded total daily net inflows of $365.57 million on Thursday, the largest since late July. Thursday’s inflows extended the positive run to its sixth consecutive day, according to SoSoValue data.

📜 Ethereum Co-Founder Vitalik Buterin Outlines His 'Alignment' Criteria:In a recent blog post, Buterin discusses how evaluating alignment could help ensure that the network’s developers, validators, and users share a unified vision that adheres to the core principles of Ethereum.

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. We closed out the month of September with $169B of total fiat-backed stablecoins in circulation, a new record, and an increase of 2.6% month-over-month and 40% from last September. This also marks the seventh consecutive month that a new all-time circulation level was achieved.

During this time, over $1.4T in total transaction volume occurred, along with 337M total transactions and 27M unique users.

2. We head into this week coming off $1.2B of institutional inflows, the highest weekly volume since July and the third consecutive week of net inflows. This includes over $1.1B in BTC ETFs ($494M of which occurred on Friday, the most in one day since July) and $85M in ETH ETFs.

3. Since the Fed cut interest rates by 0.5% on September 18th, Bitcoin ETFs have experienced over $862M of net inflows. This includes $365.7M yesterday, the most daily inflow since July ($530M). Daily trading volumes yesterday also reached a new monthly high of $2.4B.

4. NEAR Continues Strong performance in Q3, Adds 30M New users and 600M Transactions

5. Consumer Apps Continue to Thrive on NEAR, DAUs Grow to 3.1M in Q3

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Introduction

It’s been a couple weeks since we covered the broader market and the underlying conditions necessary for the next advance to take place. After calling the lows in August and September it’s important for the market to confirm these viewpoints and that is just what we are going to show you here today. Confirmation of a new trend emerging.

But, before we get started I want to reiterate the importance of staying long in a bull market. Moves like these do not come around very often and it’s the big swings that will make you the most money but you have to have the patience, fortitude, and conviction to hang in there, not overtrade, and don’t sell out of your positions early. If you want to know the correct way to ride the trend and take profits we covered that in a special report last week that you can find here. Furthermore, I shared this important insight from a legendary trader in the book “Reminiscences of a Stock Operator.”

Now, if history and time are any indication of whats to come then it will be confirmed by the underlying conditions necessary. The conditions that are currently presenting themselves are that of a typical global risk on environment. We covered several of these key indicators back in Mid August where we got very bullish. Today, even more evidence is emerging of that trend.

Just over the last month we have seen stock indexes break out to new highs both in the US and abroad. This is all coinciding with major central banks around the world broadening their easing policies.

Coming off one of the best September performances ever, in both stocks and crypto this is only going to add fuel to the fire. On a similar note, we are seeing several risk on indicators ramping up. These include the DXY falling below a major support level, the IWM small cap stock index making a new 52 week high while in a very bullish pattern and, the dealmaking on Wall Street making a comeback.

Now, this is nothing new or groundbreaking, we have been covering these developments for a while. But, what is new and groundbreaking is the massive Chinese stimulus package released just last week. In an effort to bolster their struggling economy they just injected the largest stimulus effort since the pandemic.

This had an immediate effect on their markets sending them from 52 week lows to 52 week highs in record time. It also has enormous implications on the Yuan and the Dollar not to mention the global liquidity picture. All of these charts we will cover below to show you how the macro risk on environment is shaping up.

Given our indicators and the confluence of cycles these developments were only a matter of time. Remember, we don’t know exactly what the news will be but it’s no surprise that these things happen to come out at the same time we forecast major changes in trend.

The one thing I am going to highlight in all the below charts (aside from the breakouts) is the time reversals we are seeing. I want to point out the 3 week overbalances in time. This is a simple signal but it’s a key sign of a changing market structure. Time will always be the strongest indication of a changing in trend. Most people do not understand this simple principle but that’s because they only look at price which keeps them guessing. Viewing time as the most powerful force in the market will give you a major advantage in staying ahead of the crowd.

Simply put, in a bull market the price will move up for longer periods of time than it moves down and vice versa in a bear trend. That is what we are going to show you in the below charts.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com