Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn more at www.wemetalabs.com, www.amphibiancapital.com, and www.investdefy.com

Issue Summary: Welcome to Coinstack, the best weekly newsletter for crypto insiders and investors, where we review the top news and reports in the digital asset ecosystem. This week we cover the BlockFi bankruptcy as well as big new venture rounds for Fenix Games ($150M) and Kiln ($28M). The engine of creative destruction is alive and well. While it took 10 years for the web industry to fully recover after the dot crash of 2000/2001 — we have a sense that the digital asset space (being built upon the breakthrough technologies of distributed ledgers, smart contracts, tokenized assets, 24/7 markets, and composability) will be bigger than ever within 36 months. Now’s the time to build, friends.

Another one bites the dust… First Terra (LUNA/UST), then Three Arrows Capital, Celsius, Voyager, FTX, and now BlockFi

In This Week’s Issue:

🗞️ Top Weekly Crypto News - BlockFi Files for Bankruptcy, BlockFi Owes $1 Billion to Three of Its Largest Creditors, BlockFi Suing FTX Founder Over Robinhood Shares Promised as Collateral

💵 Weekly Fundraises - Fenix Games ($150M), Matrixport ($100M), Kiln ($28M)

📊 Key Stats - Markets Trade Flat As Industry Awaits Genesis Outcome, Stablecoin Volumes Are at an All-time High, ETH L2 Transactions per Second Have Increased 33,550%

🧵 Thread of The Week - Valuing Governance Tokens

📝 Report Highlights - Messari: Drive-to-Earn with Hivemapper and DIMO

🎧 Best Crypto Podcasts

📈 Top 10 Tokens of the Week

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

📚 How to Get Started in Crypto Learning

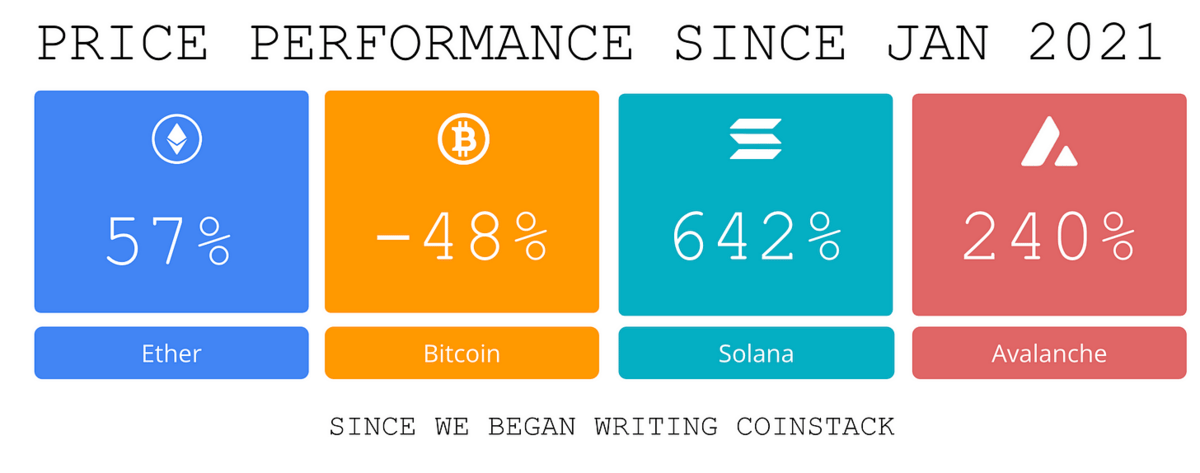

Among major L1 blockchains, Solana, Avalanche, and Ethereum lead the way in token price performance since we started writing Coinstack in January 2021

Thanks to Our 2022 Coinstack Sponsors…

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms for Series A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 200 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation. #timetobuild

InvestDEFY bridges TradFi regulatory and risk management with CeFi’s liquidity and DeFi’s innovation. InvestDEFY has deep expertise in quantitative trading, digital assets, technology, AI, risk management, derivatives, global equities, regulatory compliance and structured products. Learn more at www.investdefy.com.

WeMeta is the Zillow for Metaverse; their robust data insights and accessible UI makes it easier than ever to interface with the digital worlds. What's more - WeMeta is just getting started. They are constantly releasing new features and tools to address the growing needs of their users amidst the booming Metaverse. Learn more at www.wemeta.world.

Amphibian Capital recently launched the Amphibian ETH Alpha Fund, with the goal of outperforming staking Ether. The fund offers a way for accredited investors and institutions who are large holders of Ether (150+ ETH) to invest in a diversified portfolio of ETH quant trading funds that pay out returns in ETH. Learn more and see fund results at www.amphibiancapital.com.

We have one open sponsorship spot available for your firm - please see our sponsor deck and schedule a call to discuss.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

⚖️ Crypto Lender BlockFi Files for Bankruptcy Protection- Crypto lender BlockFi has filed for Chapter 11 bankruptcy protection. According to the firm's bankruptcy petition, BlockFi has more than 100,000 creditors and $1B-$10B in assets and liabilities. The biggest creditor is Ankura Trust Company, which the petition says has an unsecured claim worth roughly $729 million. The next largest creditors are FTX US ($275 million) and the U.S. Securities and Exchange Commission, to which BlockFi still owes $30 million of its $100M settlement from February.

How in the world did this happen? Well, BlockFi also announced it has $355 million frozen on bankrupt exchange FTX and that it lost $671 million in a loan to FTX sister company Alameda Research — bringing its total potential loss from FTX/Alameda to over $1 billion. 🤯BlockFi has $256 million in cash on hand, which is expected to provide sufficient liquidity to support certain operations during the restructuring process, according to a press release issued when BlockFi filed for Chapter 11 protection.

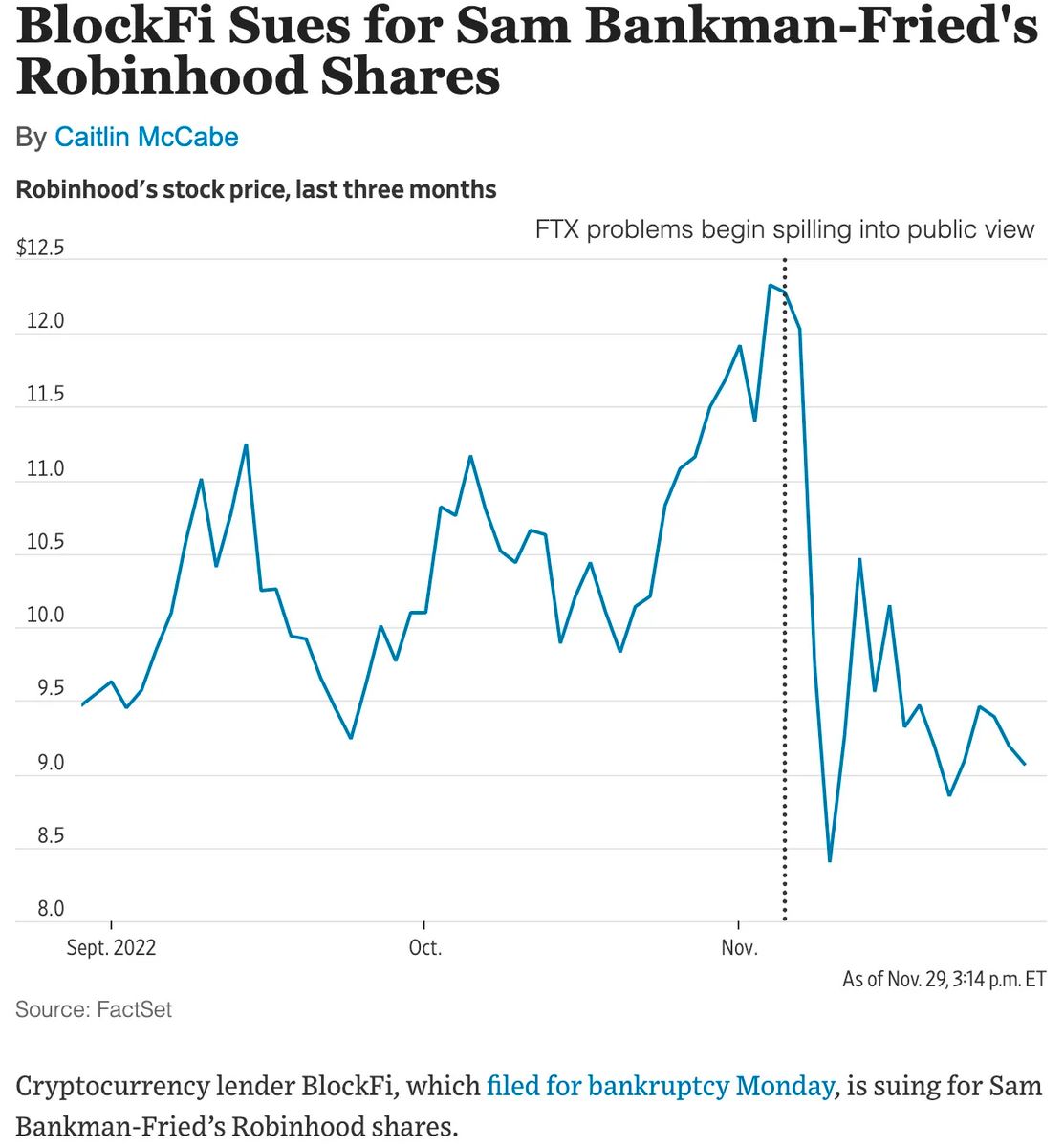

2) 🚩 Bankrupt BlockFi Suing FTX Founder Over Robinhood Shares Promised as Collateral - Cryptocurrency lender BlockFi, which filed for bankruptcy Monday, is suing for Sam Bankman-Fried’s Robinhood shares. BlockFi filed a lawsuit against Emergent Fidelity Technologies on Monday, alleging that it is owed the shares after they were pledged to BlockFi to guarantee the payment obligations of Alameda Research. Emergent Fidelity is the entity through which Mr. Bankman-Fried, the founder of bankrupt crypto exchange FTX, purchased a 7.6% stake of Robinhood’s Class A shares earlier this year. Mr. Bankman-Fried is also a founder of the crypto trading firm Alameda.

3) 🤔 Gemini Still Working With Genesis, Digital Currency Group to Unlock Earn User Withdrawals - There is still no word on when users of Gemini’s Earn service will be able to withdraw their funds, but this morning the exchange tweeted it’s continuing “to work with lending partner Genesis and its parent company Digital Currency Group (DCG) to find a solution.” Last week, Gemini warned of major delays for Earn users looking to withdraw their cash. Earn’s lending partner is of courseGenesis. This week, Genesis Creditors hired lawyers to help prevent a Genesis Bankruptcy and work out a restructuring deal.

4) Bahamas Releases Video Sharing Their Side of the FTX Story - On Monday, Bahamas Attorney General Ryan Pinder shared a 23 minute video covering their side of the FTX story — sharing that the Bahamas was fully committed to the rule of law and a full investigation into FTX and to staying a leader in digital asset regulation.

5) 🏳️ FTX's New leadership Cooperating with Law Enforcement and Regulators- The current corporate leadership of FTX is cooperating with investigators for the U.S. government and regulators, a lawyer representing the troubled firm said in the first bankruptcy hearing. “We are also in constant communication with the U.S. Department of Justice, including the Southern District of New York’s Cyber Crimes Unit, and in communication constantly with the SEC and CFTC,” said James Bromley, a partner at Sullivan and Cromwell and co-counsel representing the company in the U.S.

6) 🤝 Aptos Labs Partners with MoonPay for Petra Wallet Integration - Aptos, the Layer 1 blockchain, is partnering with web3 fintech firm MoonPay through an integration with Petra, the crypto wallet built by Aptos Labs. The partnership will make it easier for users to recruit into the Aptos ecosystem through MoonPay's offerings. “Integrating with the growing Aptos ecosystem, first through the Petra wallet, is another step to deliver on our mission, especially as the blockchain expands and its usage grows," said Bree Blazak, vice president of global sales at MoonPay in a company release.

7) 💼 Binance Launches $1 Billion Raise for Crypto 'Recovery Fund', Could Buy FTX Assets- Binance’s founder and CEO said the firm’s crypto rescue fund will initially have $1 billion to dole out as it steps into the role of industry white knight. In an interview with Bloomberg, Changpeng "CZ" Zhao said the fund would have a “loose” structure and be publicly visible on the blockchain, with other industry players also able to contribute.

8) 😥 BitGo to Custody FTX assets in Bankruptcy - Crypto custodian BitGo has been nominated as the official custodian to safeguard the remaining funds at FTX. Acting CEO John Ray III selected BitGo to take custody of the assets of the crypto exchange for the duration of the bankruptcy proceedings. FTX filed a motion to acquire a custodian in relation to the bankruptcy process on Nov. 23. A hearing is scheduled for Dec. 16 to confirm the appointment. Co-Founder of BitGo, Mike Belshe commented, “BitGo’s mission is to deliver trust in digital assets – and crypto needs that more than ever. By helping in this case, we intend to do our part to restore trust to our industry.”

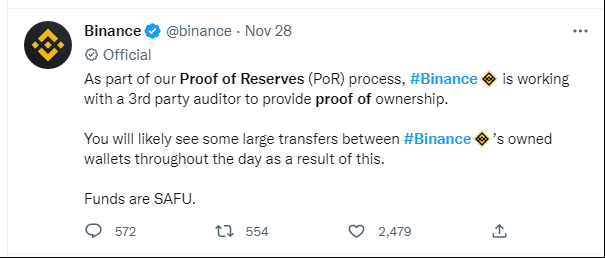

9) 💵 Binance Publishes BTC Proof of Reserves to Provide Transparency on Customer Funds- Following promises from Binance CEO CZ, the exchange has released proof of reserves for Bitcoin held on the platform. Customer funds are backed by on-chain reserves of over 582,000 BTC — 1% higher than total customer deposits.The customer net balance was 575,742.4228 BTC as of the snapshot taken on Nov. 11, and on-chain reserves came to exactly 582,485.9302 BTC.The proof currently focuses solely on BTC “with other tokens and networks being added in the next couple of weeks,” according to an announcement.

10) 🚀 Solana NFT marketplace Magic Eden expands multichain vision with Polygon integration - Leading Solana NFT marketplace Magic Eden recently announced plans to deploy on Polygon as part of its multichain strategy. Once integrated, Magic Eden will be available on three different blockchains, with Ethereum making up the other offering. A Magic Eden blog post explained the team is “open to all the possibilities that innovation brings.” When tied with the overall goal of growing the NFT industry as a whole, a multichain policy makes sense for the broadest possible exposure.

💬 Tweet of the Week

Source: @Dynamo_Patrick

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week..

1. Ethereum Leads Among All Dapps and Blockchains with $72M in Revenues Last 30 Days

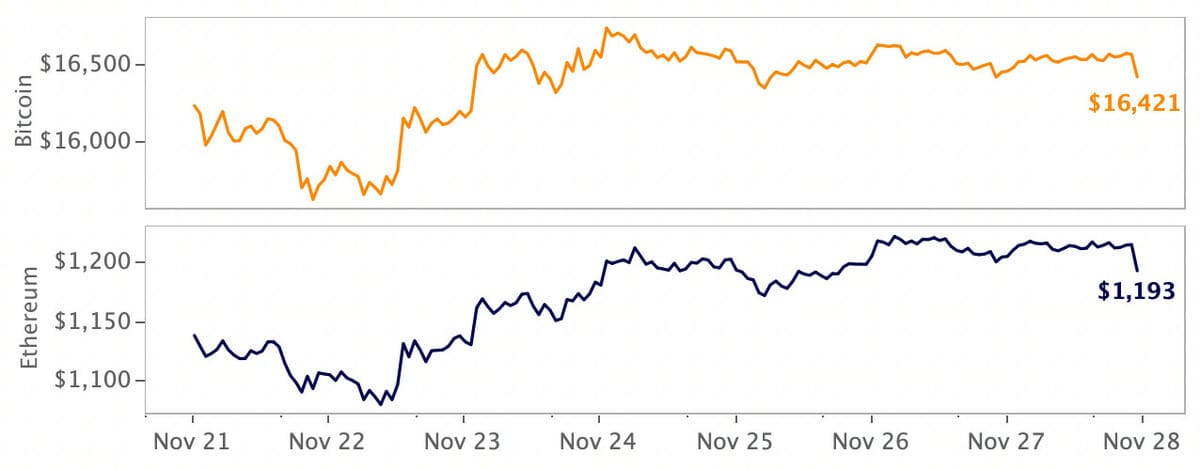

2. Markets Trade Flat As Industry Awaits Genesis Outcome

Source: @KaikoData

3. Despite the Bear Market, Stablecoin Volumes Are at an All-time High

Source: @dunleavy89

4. Since Nov 2020, Ethereum L2 Transactions per Second Have Increased 33,550%

Source: @CryptoGucci

5. Despite Having Migrated to Its Own Subnet in May 2022, Crabada’s Game Contract Remains the Highest Gas-Consuming Contract on Avalanche C-Chain

Source: @TokenTerminal

6. Ethereum Whales Are Accumulating ETH at the Highest Rate in Two Years

Source: @CryptoGucci

7. BUSD Market Share Approaches New All-time High

Source: @KaikoData

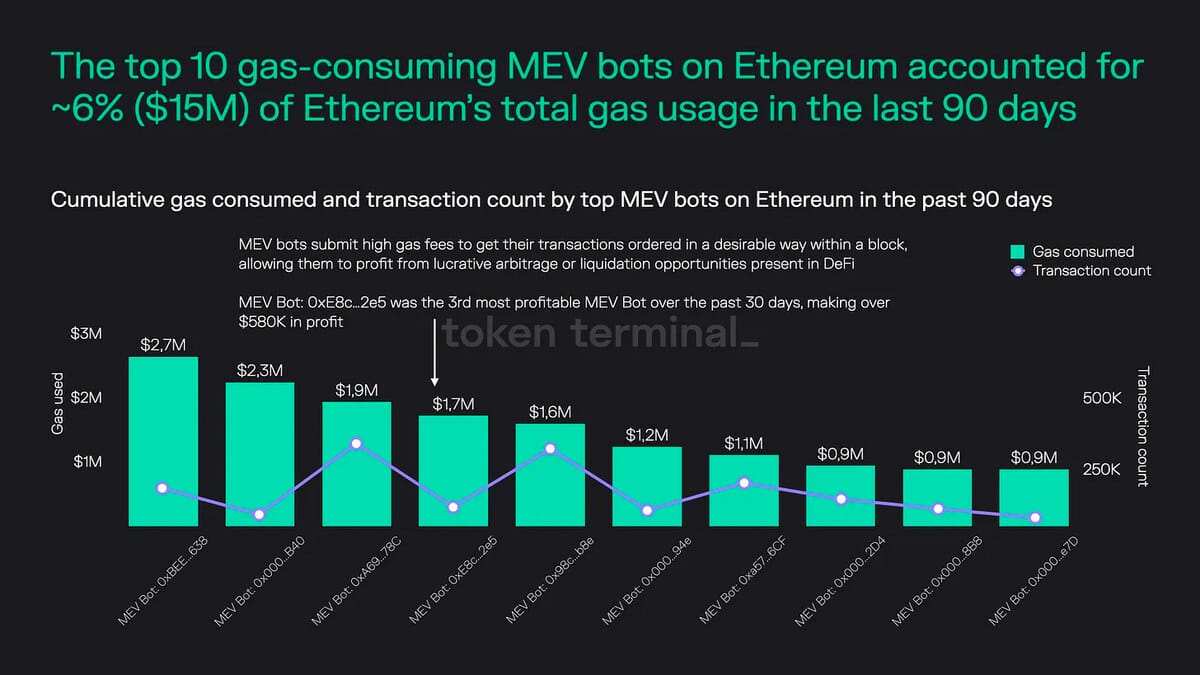

8. The Top 10 Gas-Consuming MEV Bots on Ethereum Accounted for ~6% ($15M) of Ethereum’s Total Gas Usage in the Last 90 Days

Source: @TokenTerminal

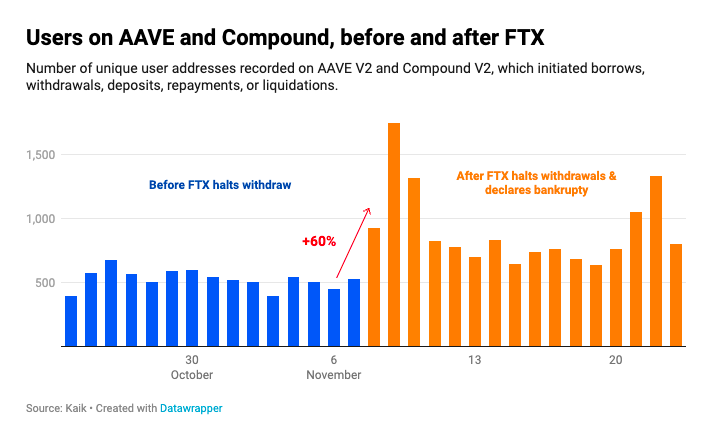

9. Following the FTX Collapse, Amongst Those Who Have Benefitted Are Decentralized Finance Protocols As Lending Protocols

Source: @KaikoData

10. Yesterday, GMX Had More Daily Fees Than Uniswap for the First Time Since $GMX’s Inception

Source: @Delphi_Digital

11. Ethereum’s Revenues 4.5x Higher Than Bitcoin’s, Remain at Annual Run Rate of $600M+

Source: CryptoFees.info

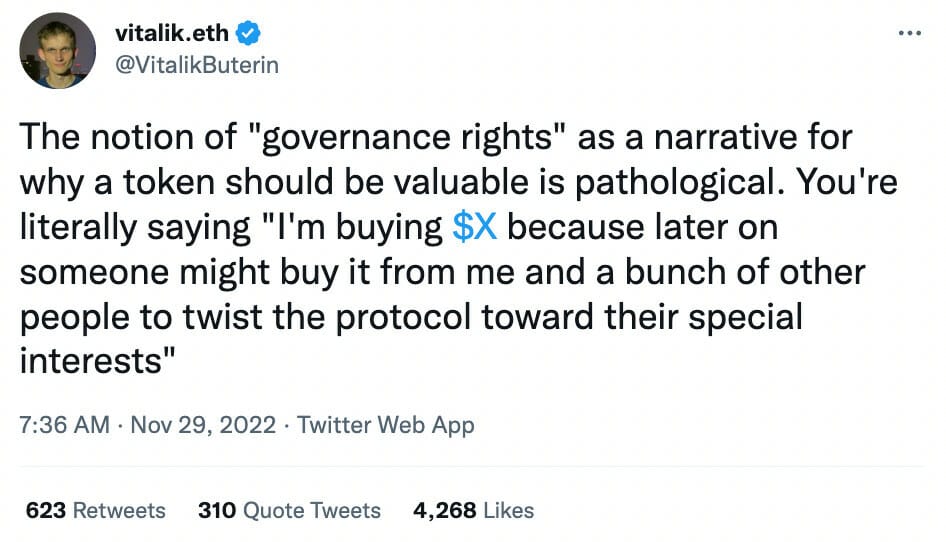

🧵 Thread of the Week - Valuing Governance Tokens

By Vitalik Buterin1/ The notion of "governance rights" as a narrative for why a token should be valuable is pathological. You're literally saying "I'm buying $X because later on someone might buy it from me and a bunch of other people to twist the protocol toward their special interests"

2/ As a regular individual, "pay $500 to get a 0.0001% chance to influence the outcome of some votes" is just not a good trade. The only people for whom it is a good trade are multimillionaires and hedge funds (including attackers).

3/ Existing Ethereum governance works pretty well imo. Certainly better than a coin vote would have.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

Hivemapper and DIMO are two projects in the mobility space utilizing cryptoeconomic protocols to build decentralized physical infrastructure networks. Both projects leverage a novel token distribution mechanism that rewards participants with tokens for completing verifiable activities in the real world.

Cryptoeconomic protocols effectively incentivize and coordinate human activity, making them useful for the development of real-world decentralized infrastructure networks. The main benefits associated with using cryptoeconomic protocols include:

Providing the ability to bootstrap and rapidly scale networks globally with significantly reduced CapEx and OpEx, removing the need for a centralized entity

Creating an ownership structure where the network is owned by its users and contributors, rather than a small group of shareholders

Hivemapper and DIMO incentive individuals to capture and share data from their vehicles using plug-and-play sensors. By installing a Hivemapper or DIMO hardware device, individuals passively earn tokens while driving. Additionally, Hivemapper and DIMO enable entrepreneurs to create franchise-like businesses around the protocols that manage a fleet of vehicles with hardware devices.

Hivemapper

Maps play a vital role in the daily lives of billions of people. In addition to navigation, maps are used in many industries, including insurance, real estate, logistics, delivery, and environmental protection.

Mapping the world is both capital and human resource intensive. Today, Google Maps owns more than 80% of the global digital mapping market, allowing them to continually increase the cost of their mapping API.

Google captures street view imagery using a fleet of specialized vehicles equipped with 3D cameras. Each Google Street View vehicle is estimated to cost around $500,000 after accounting for the sensor and camera hardware, driver’s salary, insurance, and gas. Because of the significant amount of resources required, even Google is limited in the number of vehicles it can have roaming the streets refreshing its map coverage. For this reason, Google's imagery is often out-of-date (two years in many cases), affecting its relevance or utility.

Additionally, a large part of the world (including large areas of Africa, Asia, and South America) doesn’t have imagery at all due to the lack of economic incentives. Furthermore, North America and Europe lack rural map coverage.

Hivemapper aims to create a decentralized, permissionless global map – similar to Google Maps – using a protocol that incentivizes quality map coverage and fresh data. Drivers install a 4K dashcam in their vehicle and are rewarded with HONEY tokens for collecting street-level imagery.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 33,596 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.wemetalabs.com, www.amphibiancapital.com, and www.investdefy.comSAVECROSS-POST