In this Coinstack issue we look at why right now is a great time to buy crypto, Ethereum’s Q1 2021 Results, why Proof-of-Stake provides better security than PoW, and why Bitcoin energy usage is substantially lower than the traditional banking system. We also give an update on the Coinstack Alpha Fund which is up 18% in the last month.

In This Week’s Issue:

Buy The Dip & HODL by Ryan Allis

Ethereum Announces First Quarter 2021 Results by James Wang

Why Proof-of-Stake? A Mega-Thread

Energy Usage: Bitcoin vs. The Traditional Banking System by ARK Investments

Coinstack Alpha Portfolio - Up 18.45% in Last Month

Personal Portfolio Update - Up 559% YTD 👀

How to Join The Tuesday Crypto Advice Zoom Calls

NFTs of the Week by Mrs. Bubble

A Long-Term Crypto Portfolio

Who I’m Following Closely on Twitter

How to Get Started in Crypto

Buy The Dip & HODL: Crypto Market CommentaryBy Ryan Allis

In the last week there’s been a 19% dip in Bitcoin and a 13% dip in Ethereum.

Now’s a GREAT time to buy the dip.

As I wrote in my April 22 post, we’re nowhere near the top of this bull cycle yet.

Bitcoin prices have found support at $42k and Ether prices have found support at $3.2k after the unexpected dips from Elon Musk’s weekend tweetstorm.

Remember, buy when others are fearful and then just HODL till 2030 and you will do exceptionally well.

It’s really as simple as that.

Based on the past three cycles, we have about another 180 days left in the current bull market cycle.

Here’s an update ofthe Bitcoin price in this cycle compared to the last cycle, starting at the date of each halving.

As you can see we should have about another 4-8 months left in this cycle and that we are still actually AHEAD of the last cycle, even with the recent pullback from $64k to $43k.

And here’s how we’re doing compared to the last 3 Bitcoin cycles…

As you can see, each cycle tends to last longer than the one before it, making most analysts believe this cycle will last well past October 2021 and even into early 2022.

“We are at the typical mid-bull-cycle drop in RSI (yellow circles), in between 2013 and 2017. Excited about next couple of months.”

Bitcoin on-chain analysis Willy Woo (one of the greats) pointed out on Twitter yesterday that only 6 times in the history of Bitcoin has the actual market price dipped below his NVT price floor. And right now is one of those times (due to the short term effects of the Elon FUD). A great time to buy!

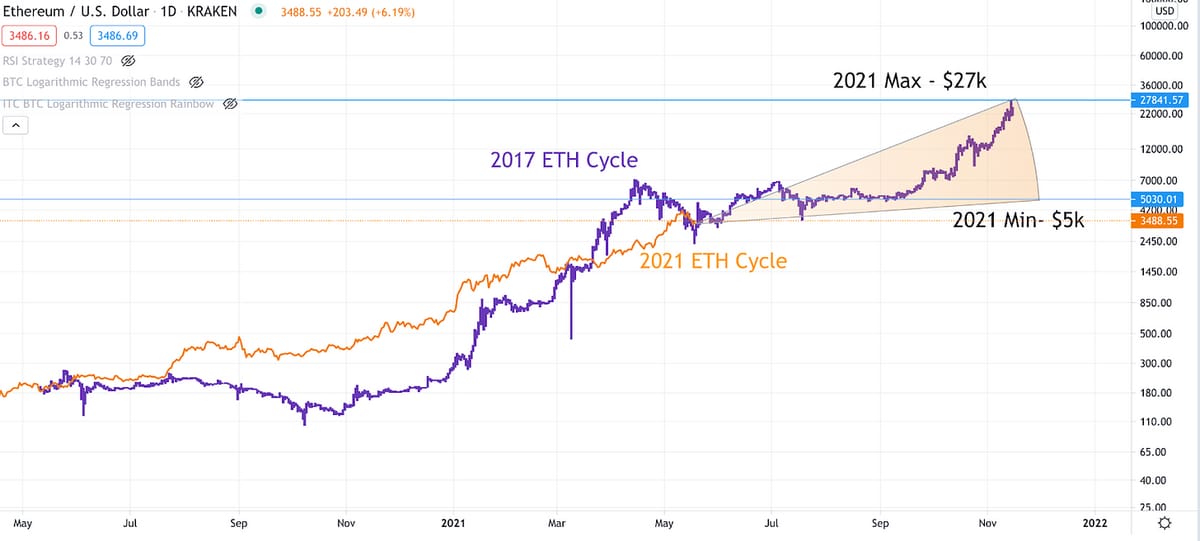

And here’s an update of the Ethereum price in this cycle compared to the last cycle.

Like Bitcoin, we have around another 6+ months to go in this bull cycle and perhaps longer due to the upside from both EIP-1599 in July 2021 and the PoS launch in December 2021.

We should see some major growth in both BTC and ETH the second half of this year. My December 31, 2021 price target is $85k+ for BTC and $8k+ for ETH.

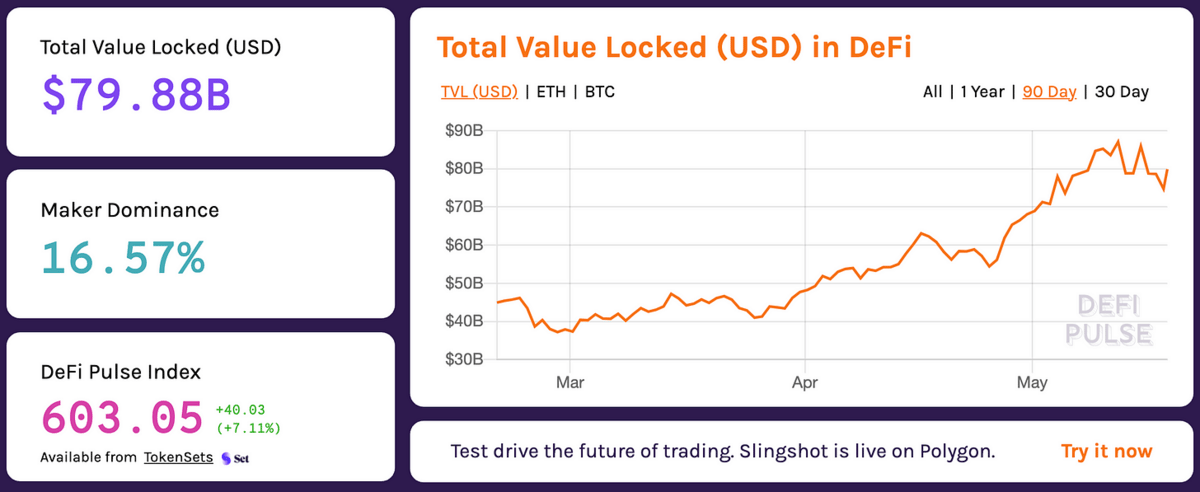

And based on how much core utility there is now within DeFi that didn’t exist in 2017/2018, I expect there to be continued growth in the crypto total market cap well into 2022, especially within the Ethereum and Polkadot ecosystems -- and across all of DeFi.

This week AAVE, MATIC, and SUSHI have been growing incredibly quickly as more capital flows into both Ethereum scaling solutions and Ethereum DeFi apps take advantage of the much faster throughput and MUCH lower layer 2/sidechain gas fees. DeFi Summer 2021 is going to be one to remember as we can finally have DeFi with low gas fees — on Ethereum.

Remember, we are ALL still early and crypto and DeFi are the biggest trend of the 2020s. Buy now and hold -- and don’t let anyone convince you to sell.

Later in the year, if you want to take some risk off and convert 50% of your positions into stablecoins generating yield in DeFi toward Q4 2021 that’s a good idea -- but NEVER exit your full position this decade. And don’t switch anything over to stablecoins until BTC is above $75k and ETH is about $7500.

Just wait.

You’re in what will be the best asset classes of the decade. Just hodl and wait. And buy the dips when you can.

It’s weeks like the past one where you earn your stripes and do what most don’t -- hold.

As the wonderful Bitcoin On-Chain Analyst Will Clemente said in his May 17 newsletter...

“I like to think this way:

1) Are the broader on-chain (bull market structure) metrics over-heated? No.

2) Ok, then let’s zoom in from our macro top indicators (MVRV-Z Score, Market cap-Thermocap, R-HODL Waves, Reserve Risk, etc.) to our micro bottom indicators. (SOPR on different time frames, funding rates, RSI reset/bullish divergences, etc.) Are they saying oversold? Yes.

3) All of our micro bottom indicators are screaming oversold, so BTFD!”

Yep, that’s right. Buy The F-ing Dip. With nearly all the leverage out of the market, we are looking like we’re headed toward $80k Bitcoin and $8k ETH before Christmas 2021.

Ethereum Announces First Quarter 2021 ResultsBy James Wang

About This Release

This release is not an official release of Ethereum or the Ethereum Foundation. The purpose of this release is to encourage analysts and press to cover Ethereum as they would a high growth software company rather than a speculative cryptocurrency. For enquiries please contact the author @draecomino.

May 17, 2021 — Ethereum (ETH), the world’s leading decentralized, open source blockchain reported financial results for its first quarter ended March 31, 2021.

Key Results

Total transaction fees, also known as network revenue, increased 200x to $1.7 billion in Q1 2021, compared with $8 million in Q1 2020. For the month of April, Ethereum generated annualized revenue run rate of $8.6 billion—comparable to AWS in 2015.

Total transaction volume on Ethereum increased 20x to $713 billion in Q1 2021, compared with $33 billion in Q1 2020.

Median transaction fee increased 126x to $7.63 in Q1 2021, compared with $0.06 in Q1 2020.

Daily active addresses, a proxy for daily active users, increased 71% to 607k in Q1 2021, compared with 364k in Q1 2020.

Staked Ethereum reached 3.6 million ETH in Q1 2021. Staking was launched in December 2020.

Ethereum Ecosystem Results

Decentralized exchange (DEX) volume increased 76x to $177 billion in Q1 2021, compared with $2.3 billion in Q1 2020.

Decentralized Finance (DeFi) total value locked increased 64x to 52 billion in Q1 2021, compared with $0.8 billion in Q1 2020.

Stablecoin volume increased 100% to $40 billion in Q1 2021, compared with $20 billion in Q1 2020.

Wrapped BTC volume increased 95x to 170k BTC in Q1 2021, compared with 1.8k BTC in Q1 2020. Approximately 1% of bitcoin supply is wrapped as ERC-20 tokens and traded on top of Ethereum.

NFT art sales increased 560x to $396 million in Q1 2021, compared with $0.7 million in Q1 2020.

“Q1 was a phenomenal quarter for Ethereum. On-chain metrics from active addresses to transaction volume reached all time highs,” said Anthony Sassano, founder of The Daily Gwei.

“The popularity of DeFi shows that Ethereum is more than just a crypto currency, it is the world’s best programmable money.” said David Hoffman, Founding Father of Bankless.

“People are realizing that Ethereum isn’t just money, it’s ultra-sound money,” said Justin Drake, a researcher at the Ethereum Foundation. “While other crypto currencies may boast of having a supply ceiling, Ethereum will soon have no supply floor.”

Ethereum’s strong Q1 growth was not without pains. Gas prices spiked in Q1 due to the incredible popularity of DeFi and NFT applications. Level 2 scaling, which is already being deployed across the ecosystem, aims to alleviate congestion and bring cost and power consumption down to near zero.

Ethereum Ecosystem Highlights

Metamask—the popular Ethereum wallet for desktop and mobile—reached 4 million monthly active users (MAUs) in Q1 and crossed 5 million MAUs in April. Metamask mobile saw strong global growth, especially in India, Indonesia, Vietnam, and Nigeria. Metamask’s MAUs is now comparable to mainstream consumer applications such as Robinhood and Clubhouse.

Visa announced that it now settles payments in the USDC stablecoin on the Ethereum blockchain. This makes Visa the first major payments network to use stablecoin as a settlement currency.

Meitu, a Chinese mobile software company, bought 16,000 ETH for its balance sheet. Meitu’s board has allocated up to $100 million for the purchase of cryptocurrencies to diversify its treasury. Ethereum makes up its largest position. Meitu is also evaluating launching applications on the ethereum blockchain.

Canada approved four ETFs for buying and trading ether. Evolve Ether ETF (TSX: ETHR), CI Galaxy Ethereum ETF (TSX: ETHX), Purpose Ether ETF (TSE: ETHH), and 3iQ CoinShares Ether ETF (TSX:ETHQ) provide easy and cost effective ways to hold ether within a traditional brokerage account.

Ethereum Outlook

2021 is perhaps the most important year in Ethereum’s history. The two key themes for 2021 are economic security and scalability.

In April the Ethereum core dev team approved EIP1559—a software update that improves the bid process for block space and introduces a burn mechanism for the base portion of the transaction fee. Fee burn will offset a substantial portion of Ethereum issuance, paving the way for long term network security with minimum dilution. EIP1559 is on track to be deployed on test nets on June 16th followed by official rollout via the London hard fork on July 14th.

Ethereum has a dual pronged approach to scaling network capacity—rollups and sharding. Rollups batch and compress transactions off-chain, increasing transaction throughput by ~100x. Sharding breaks the Ethereum main chain into sub-chains to enable parallel computation, further improving throughput by ~100x. By employing both technologies, Ethereum 2.0 at maturity could process upward of 100,000 transactions per second versus 15 today.

In early Q2, Ethereum ecosystem partners launched a number of projects powered by rollups.

dYdX launched its zk-rollup platform for perpetual futures trading while Immutable X launched a zk-rollup based platform for minting and trading NFTs. Rollups consume negligible energy compared to the main chain, addressing one of the main criticisms of the NFT economy. Uniswap—the most popular decentralized exchange for Ethereum is expected to launch rollups via Optimism in the coming weeks.

Toward the end of the year, Ethereum aims to switch from its current proof of work algorithm to proof of stake. The initial version of the proof of stake chain (“beacon chain”) was released in December 2020. On May 12th developers conducted a successful merge of the two chains in a test environment. Proof of stake will reduce Ethereum’s energy consumption by 99% while providing democratic access to staking rewards for all ETH holders.

Ethereum’s Balance Sheet

At the start of Q1 2021, the Ethereum Foundation’s treasury had 460k ether valued at $560 million. At the end of Q1 2021, the treasury’s balance was 430k ether, valued at $826 million. The Ethereum Foundation spent 30k ether during the quarter but the treasury’s value in USD terms grew due to ether-USD appreciation.

Results Table

About Ethereum

Ethereum is the world’s leading decentralized, open-source blockchain. Ethereum powers ether, the native currency of the Ethereum blockchain and thousands of decentralized applications ranging from exchanges to digital banks. Ethereum is not a company or organization, it is a community organized project. The Ethereum Foundation is a Swiss based non-profit organization that supports the Ethereum project.

Why Proof-of-Stake? A Mega-Thread…by @EthereumPropaganda

There has been a lot of discussions on PoW vs PoS recently.

PoW has many elegant and succinct explanations throughout the years.

With the most notable one recently from @dergigi (love his work. go buy his book)

However, there has been minimal comprehensive posts on PoS.

The general impression of PoS within the overall Bitcoin/alts community is very similar to a no-coiner conception of PoW.

Full of strawman & no steelman.

Within the ETH community, let's be real, all you degens (we love our degens) spend too much time crawling through the seediest discord chat rooms for crumbs of alpha and not enough time studying the actual protocol and defending it.

Let’s change that and arm yourself with the knowledge of Why PoS.

This is the real alpha.

1) PoS offers more security for the same cost.

GPU-based PoW

GPUs are ubiquitous and can be *rented* cheaply. For every $1 of block reward, it costs nearly $1 for miners to win the race.

If the total daily block reward is $1 then it will cost just over $1 to attack. Miners are chain agnostic and will not take a loss to protect the network.

Total costs of attack/day = ~$1.01

ASIC-based PoW

ASIC is a hot commodity and an *extremely* specialized equipment designed for the Bitcoin SHA-256 algorithm.

You *must* buy ASIC in order to attack the network as miners are always using it to mine.

On average, ASIC mining is ⅓ OpEx (electricity/labor), ⅔ CapEx (capital cost) of acquiring the ASIC, and roughly 2 years before obsoletion.

$1 per day in block reward = $0.33 of OpEx and $0.67 of CapEx.

Assuming each ASIC lasts 2 years, it requires $489.1 per $1 per day in block reward *just* for the hardware to even begin attacking the network.

Total costs of attack/day = $489.1 + $0.33 = $489.43.

*500x more expensive than GPU to attack*

Note: massive bottleneck with manufacturing = all ASICs that will be produced in *2022* have mostly already been bought.

It costs *10s of billions* to build a new chip foundry.

Needless to say, this is a massive centralization of block production/minting (not consensus).

Only those with connections and capital will be able to mine effectively and reap the rewards.

Is it… the rich getting richer…? Mining companies are now giant publicly listed companies. I see no Average Joes being involved.

The Benefits of Proof of Stake

PoS, on the other hand, is almost entirely CapEx (the Ether being staked) and minimal OpEx ( <0.01% of electricity).

Furthermore, Ether does not depreciate. It is a pristine sci-fi-grade productive asset.

Validators should be willing to pay a much higher CapEx for the same quantity of rewards.

Assuming a 10% rate of return (will be much lower at 3-5%) excluding transaction fee earned.

$1 per day of reward will attract 10 years of return staked or $3650.

Assuming 10% of OpEx (likely much less),

Total cost of attack/day = $3285

As the rate of return continues to drop as more validators come online, the cost of attack will rise to be at least >$10,000 per dollar of total daily rewards.

This leads to 5-20x in security-per-cost.

Only a non-physical stake (Ether instead of ASICs) allows for a near 100% CapEx cost with *absolutely* zero depreciation.

This is the sci-fi crypto-economics that the @bankless podcast talks about.

As @danheld points out here, ASICs production *may* trend towards commoditization. This leads to lower CapEx and therefore will trend towards an attack set up similar to GPU-mining.

The benefit is that this decentralizes block-productions.

In fact, as Ethereum is projected to be deflationary with EIP-1559, the stake will even appreciate.

All that is to say, the security-per-cost is only going to go up from here.

Furthermore, as Ether becomes sound money, much like bitcoin, it leads to an ever reducing time preference (people will hold onto their money tightly unlike fiat).

At the same time, more and more Ether is being locked up indefinitely in DeFi as collateralization.

This leads to an increasingly dwindling amount of Ether to be purchased in the open market for an attack.

As the attacker tries to acquire more Ether, the price must go up reflexively and becomes prohibitively costly.

Finally, the daily block reward (issuance + transactions) for Ethereum miners is growing at an incredible rate ever since DeFi summer of 2020.

On May 11th, it was 25x more than the total fee on the BTC network.

Currently, it’s averaging around 10x.

Yes 25x MORE than BTC.

Of course, you will never see this fact within the $BTC circle.

In fact, there is SO MUCH activity on ETH that a single dApp @Uniswap on ETH is nearly doubling the fees spent on BTC.

Talk about real demand.

How Can High Fees Be Good?

"but... but... how can high fees be good???"

I hear a sweet innocent child ask.

L1 fee may even be *higher* in ETH2.0 as the activity grows.

But you won't even be using it and you will be living on magical L2 lands where things will be cheap, fast, and full of unicorns.

Recall from above that the calculation is based on $ per day of total block rewards.

Greater total block rewards (fee + issuance) = greater security.

Transaction fees to validators will reduce due to 1559 exactly because the transaction fee is excessively rewarding miners instead of all ETH holders via burning of Ether.

On-chain economic activity (thx fellow degens) -> increase block rewards -> incentivise more validators + excess are burnt -> network more secure + deflationary -> NgU + more sound + incentivise more validators -> more secure -> more economic activity.

Truly a flywheel.

FUD of “bUt DeFlAtIoNaRy mEaNs No OnE wIlL wAnT tO sPeNd” will be addressed in another thread. If you want to know now, go read @saifedean nook.

Phew… still with us?

2) Attacks are easier *to recover* from in PoS

In PoW, if you get 51% attacked, the only thing you can do is wait until the attacker is done or hard fork and change the algorithm.

This makes PoW susceptible to something called a spawn camping attack.

Once attacked, the attacker can just wait until the community hard-forks (which renders all ASIC useless).

Once forked, the attacker can attack the new GPU-based algo freely again.

PoW can only respond to 1 attack and will not be able to withstand an immediate 2nd attack.

It’s reasonable to assume that any attacker will have accounted for this cost as the cost to attack will be much less relative to the 1st ASIC attack.

This is not the case in PoS.

There is a built-in slashing mechanism at the protocol level by which a large % of an attacker's stake will get destroyed if they attempt to revert finalised blocks.

Effectively, an attacker can attack and will get their ether burned.

This is extremely anti-fragile for the network, rewards the remaining honest ETH holders and asymmetrically makes future attacks exponentially costly.

Furthermore, if a scenario of which a 51% coalition was able to be established and

begin censoring transactions (FUD from @nic__carter ), the community can coordinate a user-activated soft fork (UASF, similar to the 2017 block-size war, an amazing story of the community beating “the rich”) and once again destroy the attacker’s ether.

There is a built in mechanism at the protocol level for this. The community only needs to select a minority block and the protocol will take care of the rest.

The end result of an attacker of PoS will be like an annoying fly with each attack becoming exponentially costly and less annoying.

3) PoS is more decentralised than ASIC *gasp*

GPU-based Algo is likely the most decentralised. However, it suffers from the low security-per-cost issue described above.

The common FUD of “the rich getting richer” for PoS deserves its own thread.

However, the same is *worse* in the PoW system as ASICs becomes increasingly hard to obtain. On the other hand, *if* ASICs commoditise, it runs the same risk as GPU-PoW.

Finally, due to ultra-low OpEx of PoS, anyone can run it at home on consumer level equipment *without* an obvious amount of electricity consumption + heat signature.

PoS validators can literally be anywhere like a cyber-cockcroach.

Before ETH 2.0 is even live, there are already decentralized staking pooling efforts such as Lido and rocket pool, which further lowers the capital required to validate...

There is more to address but this thread is long enough.

Retweet, follow & like to help combat the strawman.

Much more to come.

Note from Ryan: Many like Elon Musk have been questioning in the last week the amount of energy required to operate the Bitcoin network within a Proof-of-Work system. While I believe the most successful blockchains of this decade will be the much more energy efficient Proof-of-Stake variety, it’s still important to point out like this below article excerpt from ARK Investments does that Bitcoin uses substantially less electricity than both gold mining and the traditional banking system. The issue isn’t Bitcoin. It’s coal and other carbon-emitting energy sources. It’s time as a global society we move 100% of global electricity production off of carbon-emitting sources.

Energy Usage: Bitcoin vs. The Traditional Banking System

An Short Excerpt from ArkInvest’s Debunking Bitcoin MythsBy Yassine Elmandjra, ARK Investments Analyst

Bitcoin’s energy footprint is open to superficial criticism. However, as measured by electricity costs alone, Bitcoin is much more efficient than traditional banking and gold mining on a global scale.

Traditional banking consumes 2.34 billion gigajoules (GJ) per year and gold mining 500 million GJ, while Bitcoin consumes 184 million GJ, less than 10% and 40% of traditional banking and gold mining, respectively. Additionally, Bitcoin mining’s estimated dollar cost per GJ expended is 40 times more efficient than that of traditional banking and 10 times more efficient than that of gold mining.

Contrary to consensus thinking, we believe the environmental impact of bitcoin mining is di minimis. Renewables, particularly hydroelectric power, accounts for a large percentage of bitcoin’s energy mix. As Castle Island Ventures partner, Nic Carter, has noted, in their search for the cheapest form of electricity, miners will continue to flock to regions offering a glut of renewable electricity, unlocking stranded energy assets as “electricity buyer[s] of last resort, creating a highly mobile base-demand for any electricity sources able to produce at prices below current producers, regardless of location.” As a result, from a climate perspective, bitcoin mining could be a net positive.

Coinstack Alpha Fund Update - Up 18% in Past 1M

For months friends would ask me if I could manage their crypto investments for them. They wanted to invest in something other than just Bitcoin and Ethereum, but didn’t know what to invest in.

I started to look for a way I could do this easily for them. I only wanted to do it if I didn’t have to hold their money, and could find a way to invest on their behalf without needing to manage bank wire transfers.

I was looking for a fully on-chain solution.

In April, I found Enzyme, which is one of the first on-chain fund management platforms that allows crypto funds to be set up that anyone can invest in from anywhere, with instant deposits and withdrawals.

I diligenced the firm and listened to their founder Mona El Isa on the DeFi Times podcast.

On May 5, I announced an on-chain crypto fund on Enzyme that anyone can invest in, with a minimum investment of $10k.

The fund, called the Coinstack Alpha Fund is up 18.45% in the last month while Bitcoin is down 27% in the same time period.

So far I am managing $229,000 in crypto for 19 depositors. Performance and holdings are shown transparently down to the minute. You can invest here.

My goal is to reach $1B in crypto AUM by the end of this decade.

I generate these returns by spending 4-6 hours per day researching and learning about the crypto space, understanding what the best long-term investments are, and then investing actively on your behalf in what I expect to grow during both up markets and sideways markets.

You get the returns of smart active management with a passive investment. And since you exchange ETH or USDT for fund shares, you only pay your taxes on gains when you exit the fund (not with each trade).

During up markets, I invest long. When markets get overheated (like they may toward the end of this year), I switch to 50% stablecoins within DeFi to generate 10-15% annual returns and minimize downside risk where possible.

The large majority of investments in the fund are in mid-cap or large-cap Blue Chip crypto projects and protocols.

My top investments by allocation in the fund so far are:

Ethereum (ETH)

ThorChain (RUNE)

Polkadot (DOT)

Aave (AAVE)

YearnFinance (YLN)

Enzyme (MLN)

Perpetual Protocol (PERP)

Compound (COMP)

Sushi (SUSHI)

Chainlink (LINK)

You can now invest yourself if you’d like me to manage some of your crypto portfolio for you. Enzyme holds your crypto and I invest it for you, hopefully generating a better return than you would on your own through passive investing.

The fee to invest is the standard hedge fund fee of 2/20, which is 2% annually of assets under management (AUM) and 20% of profits.

You use ETH or USDT to invest from Metamask or any crypto wallet that supports WalletConnect (like TrustWallet, Argent, RainbowWallet, etc.).

I invest the funds deposited in what I believe will get an optimal return in both up markets (now) and potential sideways/bear markets (2022).

As always, know that crypto investing is risky no matter how good the investor is. You should never invest an amount you aren’t prepared to lose.

When you deposit you pay a gas fee of around $500-$700 when you invest and when you withdraw, so only invest if you’re prepared to hold for at least 6 months. The exact cost to deposit and withdraw varies based on Ethereum network gas fees.

I recommend investing and holding 5-10 years for optimal compounded results.

Month-to-date in May 2021 we are in the top 15 performing funds out of 500 (top 3% of all Enzyme funds).

If you have any questions you can message me on Telegram. I’ll keep folks updated on our progress through this newsletter.

Portfolio Update: Up 559% YTD 👀

Below is my actual crypto portfolio holdings as of today. I actively manage my own portfolio and make about 20-30 trades per week. As of this moment I am up 559% YTD while ETH is up 349% YTD and BTC is up 55% YTD.

Polygon (MATIC) has moved into my top 10 this week after having a great week of performance. CAKE and BAKE have fallen out of my top 10 after I’ve sold off some to provide capital for my leveraged ETH longs.

Kusama has also had a great week. Their parachain auctions have now begun, driving up demand for their tokens by a long-line of Kusama and Polkadot app developers who want a slot in the Kusama blockchain.

While this table says that I have 4.62% in USDT, I actually have 0% in USDT right now. That 4.62% represents the leveraged ETH longs I have on Binance (which are shown in USDT in Coinstats).

This means that 47% of my portfolio is now in ETH with another 4.6% in 3x leveraged ETH. That’s how much I believe in it and how much I believe ETH will overtake BTC in market cap in the next 18 months.

Programmable money will win. And without native smart contracts, BTC just isn’t programmable.

In mid-April, I swapped 1 of my BTC for more ETH based on my conviction that ETH will continue to substantially outperform Bitcoin.

I also plan to accumulate more DOT this summer as we prepare for Polkadot’s launch in Q3 2021. You can read more here about my crypto investing strategy. You can also invest in my Coinstack Alpha Fund here using Metamask or WalletConnect and USDT or ETH.

Get Added to My Tuesday Crypto Advice Zoom Calls When You Invest in a Mrs. Bubble NFT

I am now doing a live 30 minute Crypto Advice Zoom call at 9am PT / 12pm ET / 5pm GMT every Tuesday. All buyers of Mrs. Bubble’s NFTs are invited to join and ask questions and share learnings with each other. Just buy any Mrs. Bubble NFT on OpenSea and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite.

Think of buying the NFT as supporting beautiful joyous art AND a ticket into our community. We had 5 callers on this week’s call and we went deep on perpetuals, leverage trading, Ethereum, Polkadot, and timing the market cycle. Join our community by getting a Mrs. Bubble NFT!

Mrs. Bubble’s NFTs of the Week

Mrs. Bubble the artist is of course my wife Morgan Allis, so supporting her work directly supports our family and this newsletter -- and makes her shout with joy with every sale notification!

Here is the featured Mrs. Bubble art piece for this week. Mrs. Bubble is putting up a new piece each day and plans to build a long-term NFT following that we plan to keep covering within the Coinstack community.

You can think of her NFTs as both beautiful art that uplifts the world AND your digital ticket into my live weekly crypto advice calls (see above).

This week we will feature the newly minted Bubble #126 - Camel Pup which is available for 0.11 ETH on OpenSea…

Camel Pup says, “I love the world I see! I love to sniff and play, quack, and walk. I look for playmates who want to ride on my humps. Let us go on an adventure and create magic wherever we flow. I am loving all beings and all things. I am riding the rainbows and sniffing my way to newness.”

This week we are also featuring Bubble #55 - The God of Heart which is available for 0.5 ETH on OpenSea…

Thank you to our 18 NFT buyers from all over the world who are now part of the Mrs. Bubble joyous art community. When you’re ready to invest in an NFT of your own, you can see Mrs. Bubble’s full OpenSea art collection here. Just connect your Metamask, Formatic, TrustWallet, or Argent wallet up and get a beautiful piece of digital art history as you support the Coinstack family efforts.

Join The CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1300 members on our Telegram.

A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

70% of Portfolio

Ethereum (ETH) 30% of portfolio

Polkadot (DOT) 10% of portfolio

ThorChain (RUNE) 10% of portfolio

Kusama (KSM) 5% of portfolio

Nexo (NEXO) 5% of portfolio

Bitcoin (BTC) 5% of portfolio

Binance (BNB) 5% of portfolio

30% of Portfolio - About 1-2% Each

Uniswap (UNI)

Chainlink (LINK)

Cosmos (ATOM)

Solana (SOL)

Polygon (MATIC)

Sushi (SUSHI)

Voyager (VGX)

Decentraland (MANA)

Aave (AAVE)

Maker (MKR)

Yearn (YFI)

Polymath (POLY)

Terra (LUNA)

PancakeSwap (CAKE)

I made a few updates to the above list this week toward quality De-Fi projects.

The People I’m Following Closely on Twitter

Mrs. Bubble The NFT Artist (my wife Morgan Allis)

How To Get Started With Crypto Learning

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

Coinstack Twitter at twitter.com/coinstackcrypto

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Substack at CoinStack.substack.com

Please share with your friends and colleagues.