Learn More at www.hypelab.com and www.kuladao.io and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack — the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 325k weekly subscribers. This week: Circle’s market cap surged to $66B, the Fed joined other regulators in dropping the reputational risk factor, Coinbase secured MiCA approval, and major new funding rounds were announced by Digital Asset ($135M) and Veda ($18M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Kula is a decentralised impact investment firm that transforms overlooked assets into shared prosperity and thriving communities by re-shaping how value and opportunity are recognised worldwide. By tokenising real-world assets, we provide opportunity, transparency, and financial sovereignty to historically excluded communities. Our model aligns economic growth with sustainable development, ensuring that wealth is not extracted but reinvested into the communities that generate it.

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world's leading hedge funds. +20.4% net 2024 approx with their USD fund, +14.1% net BTC on BTC in 2024 (*+152% in USD terms), and +17.3% net ETH on ETH in 2024 (+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Become a Coinstack Sponsor

To reach our weekly audience of 325,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Circle’s Market Cap Surges to $66 Billion, Flips USDC: Stablecoin issuer Circle’s market capitalization on Monday surpassed the current circulating market cap of its stablecoin, USD Coin (USDC).

🧑⚖️ Fed joins regulators dropping reputational risk factor, clearing banks to serve crypto firms:The Federal Reserve Board on June 23 removed reputational risk from its bank supervision program, ordering staff to strike the term from examination manuals and to concentrate on measurable financial exposures.The Fed move positions the central bank alongside the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency, which made similar changes this year.

⚖️ Coinbase secures MiCA approval, shifts headquarters to Luxembourg:Coinbase, the largest US-based exchange, has taken a major step in its global expansion by securing approval under the European Union’s Markets in Crypto-Assets (MiCA) regulation, according to a June 20 statement.The exchange confirmed that Luxembourg’s financial watchdog, the Commission de Surveillance du Secteur Financier (CSSF), granted it the necessary license to operate across the EU.

👨⚖️ FTX fights back against 3AC’s ‘unreasonable and unsupportable’ $1.53B claim:FTX’s bankruptcy lawyers have pushed back forcefully against a $1.53 billion claim filed by failed crypto hedge fund Three Arrows Capital (3AC), calling the demand “illogical” and warning that it would unfairly drain funds from FTX’s legitimate creditors.

⚖️ Texas Joins Growing List of US States With Bitcoin Reserves:Texas has officially opened its state-managed fund for Bitcoin, with Governor Greg Abbott signing Senate Bill 21 into law Friday, establishing the state's Strategic Bitcoin Reserve and joining two other states in the process.

💬 Tweet of the Week

Source: @APompliano

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Geopolitical tensions continue to mount, yet digital asset investment products saw another $1.2B of inflows last week ($1.1B in BTC, $124M in ETH), marking the 10th straight week of net inflows.

More notably, and underscored, ETH has now seen over $1B of inflows in June alone, representing 41% of all ETH inflows in 2025, with a full week still remaining.

Source: @DavidShuttleworth

2. As Circle's post-IPO momentum rages on, the GENIUS act gets passed, and decentralized payment rails are now suddenly top of mind for all of TradFi, M0

has quietly surpassed $300M in circulating supply. $M has grown by 53% since May and now ranks in the top 20 stablecoins by market cap.

The onchain money layer and programmable money march on.

Source: @DavidShuttleworth

3. Total active loans on Maple recently surpassed $1B and now stand at $1.1B, up 235% since April. Meanwhile total deposits on the protocol also reached a new all-time high of $2.4B.

Massive growth as onchain credit markets continue to accelerate 💪

Source: @DavidShuttleworth

4. 📈 Arweave Achieved Record Endowment Growth in May 2025, Crossing 220k+ AR in Cumulative Endowment

Source: @OurNetwork

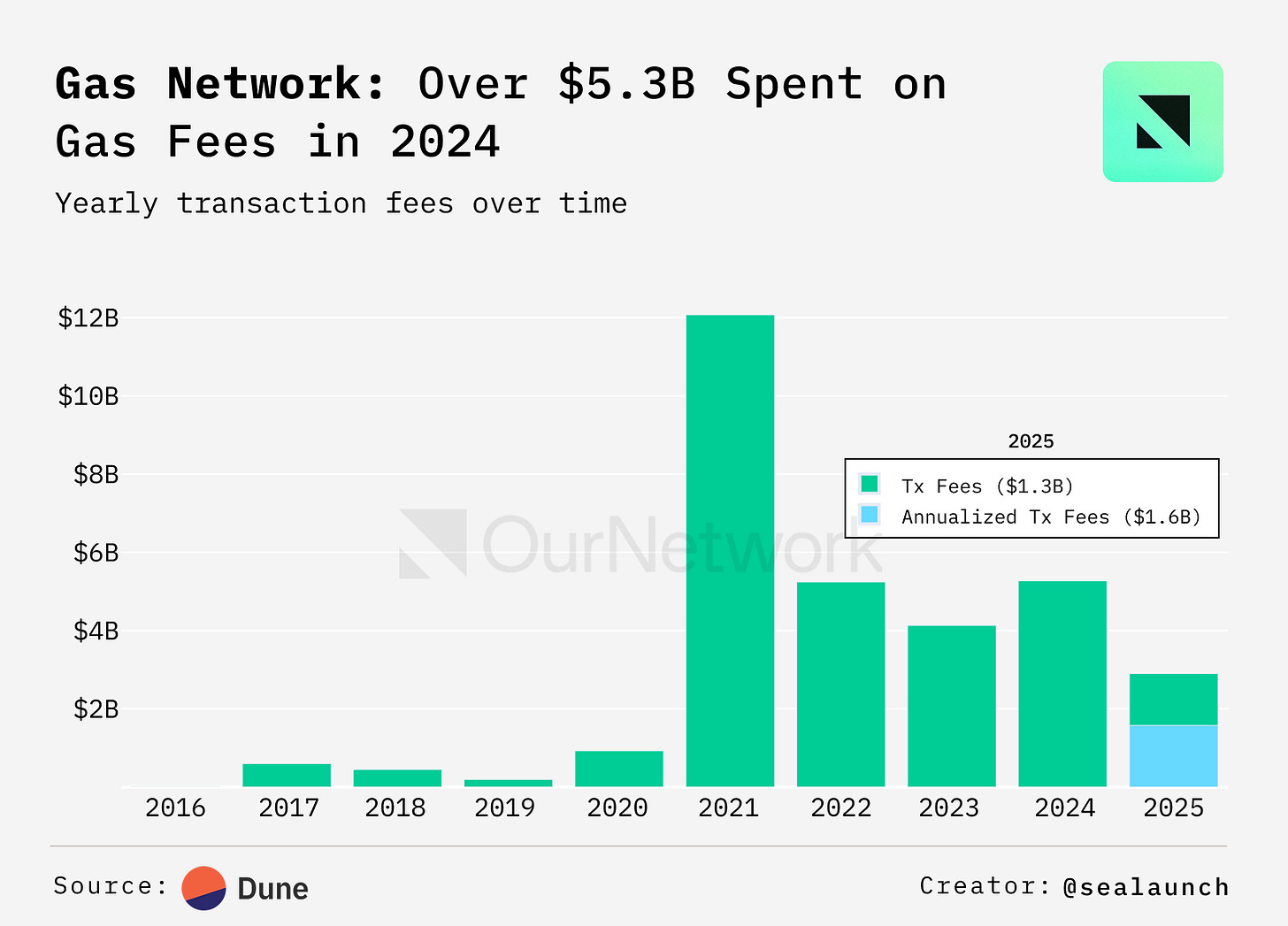

5. 📈 Not Just a Fee, Gas is the Foundation of Onchain Activity as the $5B Spent in 2024 Alone Reveals Where Real Demand Lives

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Real world assets, broadly defined as tokenized assets which exist in the physical world or in traditional finance, continue to be one of the more promising sectors in crypto. The value of RWAs has gone from an experiment with a few million in tokenized value to a space with the makings of a juggernaut with nearly $24B in onchain assets.

To explore this growth, we'll hear from the RWA.xyz team, a leading provider of analytics and research for the space. We'll also hear from Reuben who covered the freshly launched Plume Network. Biff, who covered Franklin Templeton, Graham from Centrifuge, WisdomTree, new to OurNetwork, and Henry who covered Tether's tokenized gold product, contributed as well.

– ON Editorial Team

📈 Tokenized Assets — Excluding Stablecoins — See Record Growth in Q2 2025, Led by Treasuries, Private Credit, and Gold

In Q2 2025, the market cap of tokenized assets surpassed $23B, having grown by over $3.5B. The rise was led by tokenized Treasuries, which added $2.1B. BlackRock’s BUIDL, Janus Henderson Anemoy’s JTRSY, and Superstate’s USTB, contributed most to the government bond-backed sector. Private credit followed with $1.1B in the ongoing quarter, led by Figure Technologies and Maple Finance. Commodities ranked third, adding $172M from Tether and Paxos’ tokenized gold products.

Tokenized Treasuries surged $2.1B in Q2 2025, largely driven by Spark’s $1B Tokenization Grand Prix, which allocated Sky's capital, formerly MakerDAO, to three winners — BlackRock's BUIDL received $500M, Superstate's USTB received $300M, and Janus Henderson Anemoy's JTRSY received $200M.

Figure and Maple led private credit growth, gaining $486M and $376M respectively via tokenized home equity lines of credit (HELOCs) and syrupUSDC vaults. Commodities grew through Paxos and Tether's tokenized gold, which gained $120M and $54M respectively. This growth was likely fueled by macro uncertainty and a weakening dollar driving increased investor demand for the tokenized metal.

🔦Transaction Spotlight:

Onchain data shows BlackRock’s BUIDL received most of its $500M allocation from Spark’s Tokenization Grand Prix over a 3-day span starting on Apr. 9. Three transactions minted ~$450M of BUIDL to Spark’s treasury address. Similar onchain data confirm allocations to Superstate and Anemoy-Centrifuge.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Bankless - Why ETH Might Be the Most Mispriced Asset in the World

The Defiant - Every Company Will Be a Crypto Company: Expert Insights with Sandy Kaul from Franklin Templeton

Coin Bureau - Wall Street’s $425M Bet on Ethereum: ETH's Michael Saylor!

The Breakdown: Who is Funding These Bitcoin Treasury Companies?

Forward Guidance: The Unwinding Of The Global U.S Dollar Trade | Weekly Roundup

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com and www.kuladao.io and www.amphibiancapital.com