Learn more at www.ftx.us and www.amphibiancapital.com

About Coinstack: Welcome back to Coinstack, your favorite weekly newsletter for the institutional crypto market, covering the rise of programmable money, smart contracts, web3, and the creation of an open, efficient, and transparent global financial system as all financial assets become tokenized and begin trading on 24/7 markets during this decade.

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Coin Center Sues US Treasury, Texas Probes FTX, Buterin Advocates for Censorship Tolerance, Aptos Mainnet Launches

💵 Weekly Fundraises - Copper ($196M), Stardust ($30M), ChainSafe ($18M), Pillow ($18M)

📊 Key Stats - ETH Deflation, L2 Active User Growth, Average Stake Yield Shows Resilience

🧵 Thread of The Week - MEV Deep Dive

📝 Report Highlights - Messari - Hackathon Developer Activity

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

📈 Top 10 Tokens of the Week

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

📚 How to Get Started in Crypto Learning

Ether continues to lead the way in price appreciation among major L1 tokens since the June ‘22 bottom

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Amphibian Capital recently launched the Amphibian ETH Alpha Fund, with the goal of outperforming staking Ether. The fund offers a way for accredited investors and institutions who are large holders of Ether (150+ ETH) to invest in a diversified portfolio of ETH quant trading funds that pay out returns in ETH. Learn more and see fund results at www.amphibiancapital.com.

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms for Series A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 100 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

We have one open sponsorship spot available - please see our sponsor deck and schedule a call to discuss.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) ⚖️ Coin Center Sues U.S. Treasury Over Tornado Cash Sanctions- Non-profit blockchain advocacy group Coin Center has filed a lawsuit against the US Treasury over its Tornado Cash sanctions, saying the move criminalizes American citizens wanting to protect their privacy while using their own crypto assets and that the U.S. Treasury cannot sanction smart contracts. David Hoffmann from Bankless has joined the suit.

2) 🚩 Vitalik Advocates for Validator Censorship Tolerance in Special Cases- Ethereum (ETH) co-founder Vitalik Buterin has said validators should be tolerated if they censor blocks in certain cases, as the debate over whether or not to include U.S. Office of Foreign Asset Contract (OFAC) censored transactions on Ethereum.

3) ⚖️ FTX & Sam Bankman-Fried Being Probed by Texas Regulators- Cryptocurrency exchange FTX, its FTX US division, and founder and CEO Sam Bankman-Fried are being investigated by Texas regulators over potential securities violations related to offering yield on accounts, according to a state filing.

4) 🚀 Aptos Launches Highly Anticipated Mainnet- With its secret sauce conjured at Facebook and a mission to provide "the safest and most scalable layer 1 blockchain," Aptos launched its mainnet this week, the culmination of four years of technical development. Leading exchange FTX, an Aptos investor, has already listed Aptos' APT token on Wednesday. In testing, Aptos claims it has handled 130,000 transactions a second (TPS), though it is currently operating live at just 39 TPS.Source: Aptos Explorer

5) 🎭 TempleDAO Loses $2 Million in Latest Exploit- TempleDAO, a yield-farming DeFi protocol, has been hacked for around $2.34 million. All funds exploited were converted to ether and then moved to a new wallet.

6) 🥳 Coinbase Secures Crypto Payments License in Singapore- Crypto exchange Coinbase has secured in-principle approval for a digital asset license from the central bank of Singapore, part of its journey to becoming fully-regulated in the country.

7) 🟩 Mango Markets DAO to Approve $47 Million Bounty for Hacker- A governance proposal has passed to pay $47 million to the Mango Markets hacker Under the proposal, the hacker will return up to $67 million and keep the remaining $47 million as a bug bounty.

8) 🏠 Roofstock sells first on-chain house as NFT for $175k - A rental property located in Columbia, SC was sold by transferring the Home’s NFT to an Ethereum address owned by the house buyer.

9) ⛏️ Elizabeth Warren Calls Texas a 'Deregulated Safe Harbor' for Bitcoin Miners - Massachusetts Senator Elizabeth Warren and a group of six other U.S. lawmakers have requested information on the energy usage and potential environmental impact of Bitcoin mining operations in the state of Texas.

10) 💳 Ethereum Wallet MetaMask Adds Instant Bank-to-Crypto Transfers- Crypto wallet MetaMask is making it easier for users to turn their fiat into crypto through an integration with fintech firm Sardine, MetaMask parent company ConsenSys announced this week.

📺 Webinar: ETH Whales - What’s Better Than Staking?

Tomorrow afternoon (Thursday) we’re hosting a webinar for large ETH holders (150+ ETH) explaining why we are bullish on ETH over the 2-10 year time frame and describing an alternative to staking ETH.

Amphibian Capital, a crypto fund of funds we work with, recently launched the Amphibian ETH Alpha Fund, with the goal of outperforming simply staking Ether. The fund offers a way for accredited investors and institutions who are large holders of Ether (ETH) to invest in a diversified portfolio of ETH quant trading funds that pay out returns in ETH.

We will be giving a webinar on this topic on Thursday afternoon and explaining how the fund works and why we are bullish on ETH. You can learn more and register here.Thursday, October 20, 202212pm PT / 3pm ET / 7pm GMT55 minutes on Zoom / Register herePresented by Ryan Allis: Publisher of Coinstack & Partner at Amphibian Capital

💬 Tweet of the Week

Source: Twitter

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. In the Past 24 Hours $ETH Went Deflationary As 787 Eth ($1,027,822) Were Taken Out of Supply

Source: @CryptoGucci

2. Active Users on L2s Are Trending Up, While TX Fee Revenue Is Trending Down

Source: @tokenterminal

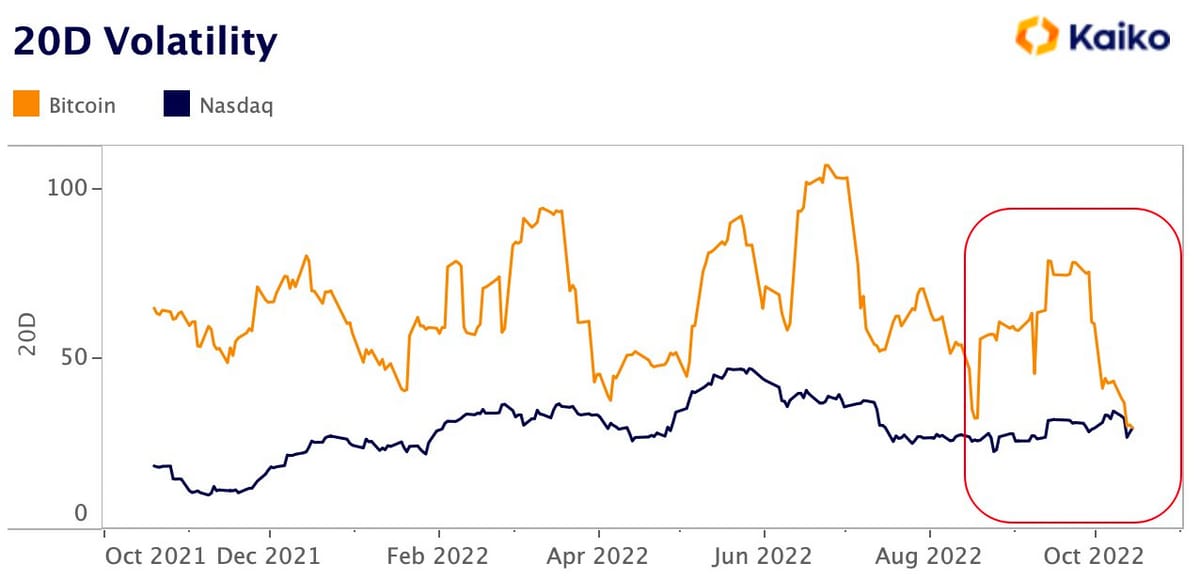

4. NASDAQ Volatility Equal to Bitcoin’s for Oct 2022

Source: @Clara_Medalie

5. Tether’s Share of the Stablecoin Market Has Dropped From 88% to 48% Since 2020

Source: @WClementeIII

6. Top Avalanche Tokens by Txn Count

Source: @AVAXDaily

7. Ethereum Number of Addresses Sending to Exchanges Just Hit a 2 Year Low (Bullish Due to Fewer Sellers)

Source: @CryptoGucci

8. Bridge Exploits Account for ~50% of All DeFi Exploits, Totaling ~$2.5B in Lost Assets

Source: @tokenterminal

9. 52% of Ethereum Blocks Have Been OFAC Compliant In the Last 24 Hours

Source: MevWatch.info

10. There Has Been a Record Number of Ethereum SDK Installs in 2022, A Leading Indicator of Developer Growth

Source: @CryptoGucci

🧵 Thread of the Week - MEV Deep Dive

By: @JackNiewold

1/ Most of us know how an Ethereum transaction works from a user perspective: you can swap, bid, buy, sell, or do pretty much anything else.

Today, let's look at a token swap transaction: it's one of the simplest, most frequent transactions on the network.

Let's sell ETH for USDC

2/ In this case, where does the transaction start?

Uniswap.

You connect Uniswap to your Metamask wallet, then make the swap.

From here, the transaction (TX) is sent out via an RPC (remote procedure call). This is the first 'stop' down the transaction pipeline.

3/ If you haven't messed with your Metamask settings, the RPC endpoint that you connect to by default is called Infura (a Consensys product).

Think of Infura as the 'waiter' that submits your 'order' to the Ethereum.

It's an intermediary between you and the network.

4/ Here, your transaction heads to the Ethereum mempool: a public pool of transactions that hang around until they're included in a block.

Normally, these TXs are ordered in the block based on the priority fee/tip paid.

Unless there's MEV (Maximal Extractable Value) available.

5/ Here, our story splits into two parts:

1. How is MEV created?

2. What are the mechanics of how MEV flows through the Ethereum network?

(TERMINOLOGY NOTE: MEV searchers are the people who try to find MEV opportunities in a network)6/ Let's start with the first part of the story: how is MEV created in the first place?

Imagine you sell 10,000 $ETH on-chain.

AMMs 'slip' a bit on every transaction: every dollar of asset sold pushes the new price down a little bit more.

7/ If I sell a lot of a single asset (ETH in this case), then the new price of the asset might be lower than the current market price.

In that case, it makes sense for an MEV searcher to buy up ETH at the new price and sell it back at the market price. It's a risk free arbitrage.

8/ Sometimes MEV searchers buy up an asset immediately before you, and sell it to you at a marked up price (backrunning)

There are plenty of other forms of MEV (including 'long-tail' MEV) that can get wildly complex, but these AMM-slippage arbs are some of the most common MEV TXs.

9/ Now for Part Two: The mechanics

MEV searchers rely on the specific order of TXs in an Ethereum block to earn a profit.

Take the previous example: when I sell my ETH, you (the MEV searcher) need to be the FIRST transaction after my purchase to take advantage of the arbitrage.

10/ If someone else beats you to the first transaction after my ETH sale, you've lost out.

They'll buy the ETH up and sell it for a profit instead of you.

Thus, everything comes down to a race between different MEV searchers.

11/ The basic question around MEV, then, comes down to how a searcher can get their transaction included.

Normally, this comes down to the size of the priority fee/tip paid.

If I pay the highest tip of all the transactions in a given block, my TX gets included first.

12/ Since tips/priority fees went to miners pre-merge, the name 'Miner Extractable Value' emerged.

MEV is often a competition for who will pay the most for a given transaction slot.

Most of the 'meat on the bone' goes to the network participants, not the MEV searchers themselves.

13/ But there was an incentive for cartels to form: if I'm an MEV searcher and I can work directly with whoever is building a block, I gain advantage over other searchers.

But cartels are not healthy for Ethereum: they make MEV permissioned and lead to a poor user experience.

14/ That's where Flashbots comes in: Flashbots is a giant auction, a way for MEV searchers to bid on blockspace slots.

If you want the TX immediately after mine, you can pay for it. If you win the auction, you get to backrun my transaction.

The ecosystem with Flashbots looks like:

15/ If you've bid successfully for the slot, you get to submit your 'bundle' of TXs simultaneously: in this case, my TX + your backrunning transaction.

This bundle goes to a block builder, who will include it with other lucrative transactions to try to make the most valuable block.

16/ Then, the block builder passes that block to a service called a relay, which 'escrows' a block on their behalf.

A relay:

• Receives blocks from builders

• Show the block 'bids' (payout) to the validators

Many relays operate simultaneously, all in competition with each other

17/ Important to note: some relays, including the Flashbots relay, censor transactions.

These relays comply with OFAC guidelines and don't pass on OFAC-noncompliant transactions. It's a huge problem:

18/ Other relays, like @FoldFinance, are non-compliant, meaning that non-OFAC compliant transactions can still go through, although they often take longer.

It's hugely important for non-OFAC compliant blocks to go through, or Ethereum is, on some level, a US gov't-controlled system.

19/ The relays take all the blocks and bids and 'show' them to the validator. Then the validator picks a block to propose.

Validators connect to relays and use a middleware software (MEV-boost is the most popular, but others exist) to select the most profitable block (most likely).

20/ The relay 'escrows' the contents of the block so that the validator doesn't steal the MEV for itself.

After the validator selects the block they want to propose, the relay passes on the full contents, and the validator passes that on to the network.

21/ From there, your MEV transaction goes through.

Your MEV arbitrage is completed, with much of the profits distributed to the MEV value chain for making sure you got the right TX slot.

THE END.

Now you know a bit more about MEV, Ethereum, and how they relate to each other.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

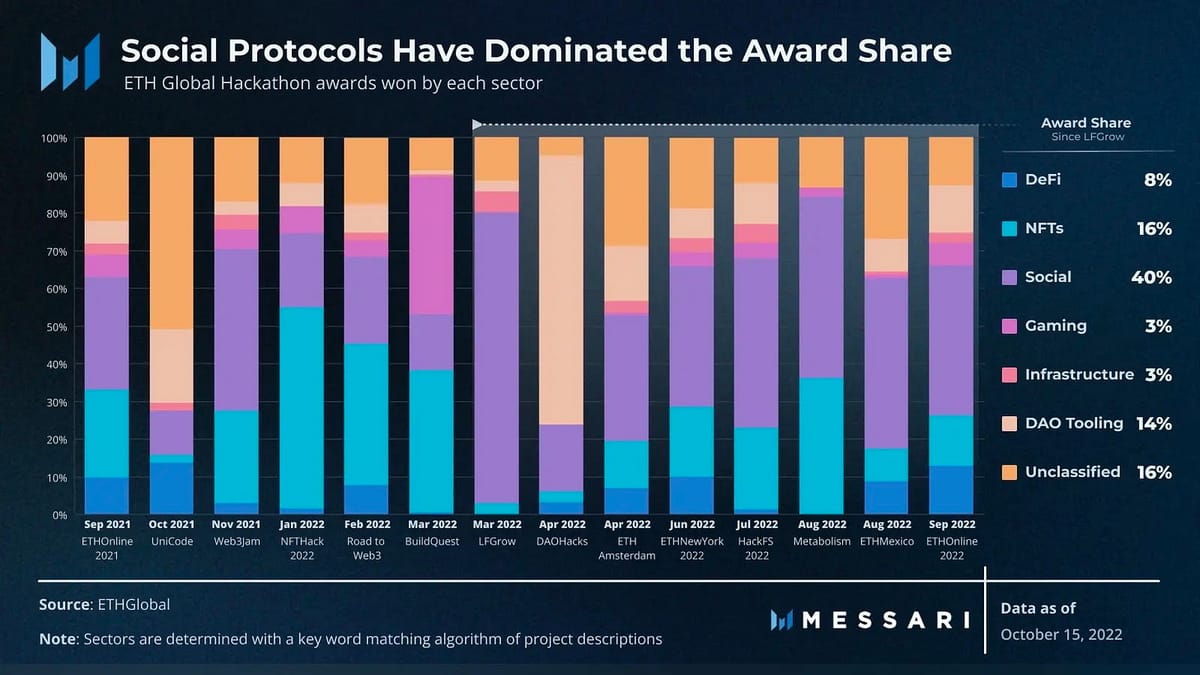

Applications and bull markets don’t appear out of thin air. They are the product of developers toiling away on new projects. In this sense, developer activity is a leading indicator of which application sectors and ecosystems are likely to receive future market attention.

Tracking developer activity, however, is far easier said than done. Github commits and social metrics are often easily manipulated and noisy as a result. Hackathons, on the other hand, incorporate a human judgment element, which leads to a higher signal perspective on developer activity.

Historically, the application sectors that have dominated hackathon submissions and awards have gone on to be leaders in market rallies.

In 2020, DeFi, with 25% of submissions, was the most represented sector at hackathons. By Q4 2020, the top DeFi protocols hit their all-time-high price measured in ETH terms. In the five months following DeFi’s dominance of hackathon submissions, the sector’s market cap continued to climb, hitting 185% growth over the period.

NFTs displayed a similar pattern of growth following a majority of hackathon submissions. In the first two quarters of 2021, NFT projects accounted for 27% of the submissions which was followed by an 8x increase in unique NFT the next quarter. Volumes similarly increased by nearly 17x in Q3 2021 compared to Q2.

Now, aided by significant sponsorship from Aave’s Lens protocol and others, social projects are the majority of hackathon submissions with nearly 36% of all submissions since March 2022. Submitted social projects range from social media frontends and live-streaming platforms to niche features in the social stack. The increased development activity within Web3 social has helped push Lens engagements up 110% from its second month of operation through its sixth (September 2022). Even more than overall submissions, social protocols have dominated the share of awards since April’s LFGrow hackathon.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

T

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 32,101 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.amphibiancapital.com