Learn More at www.decard.io

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 145k weekly subscribers. This week we cover Coinbase’s stake in USDC, FTX and Genesis reaching $175M settlement, and big new venture rounds for BitGo ($100M) and ZetaChain ($27M).

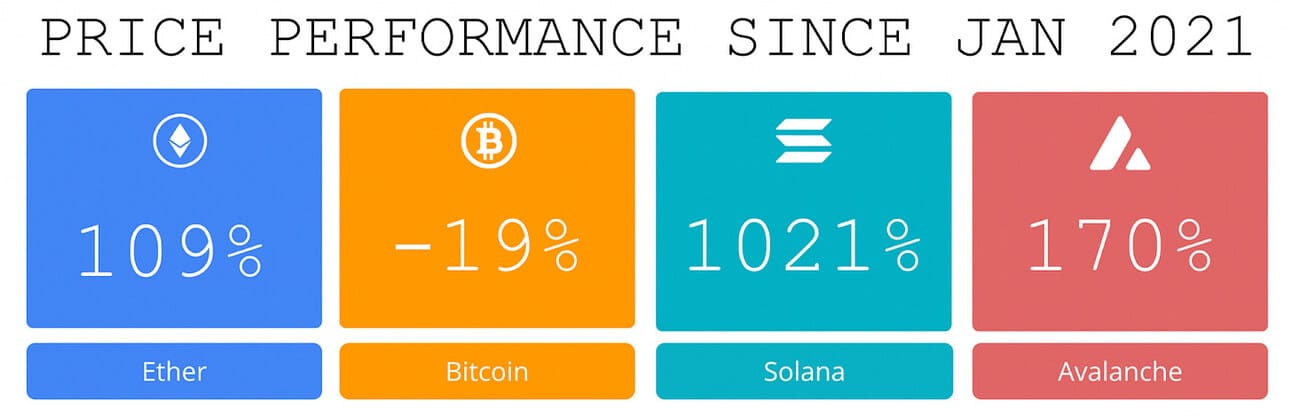

Price performance since we began writing Coinstack in January 2021

Published By Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’re launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Become a Coinstack Sponsor

To reach our weekly audience of 145,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

Thanks to Our 2023 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund for the world’s leading crypto funds, they returned approximately 5.35% net in Q1 ‘23, 186.33% net (pro-forma) since '19* and aim to deeply mitigate downside. They have USD and ETH share classes, soon BTC. Deck here: www.amphibiancapital.com.

Unveiling the next big leap in decentralized technology with Tagion. Dive into the first-ever permissionless and decentralized hashgraph. Revel in limitless transactions per second, ultra-low fees, and swift finality. With all data histories securely anchored on-chain with unbeatable Byzantine-proof ensures unparalleled data integrity. A technology leap unlike any other. Step into tomorrow's protocol, today.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Coinbase Gets a Stake in Stablecoin Operator Circle and USDC Adds 6 New Blockchains- Cryptocurrency exchange Coinbase (COIN) is getting a minority stake in Circle Internet Financial and the companies are dissolving their Centre Consortium partnership that had issued USD Coin (USDC), the world’s second-largest stablecoin

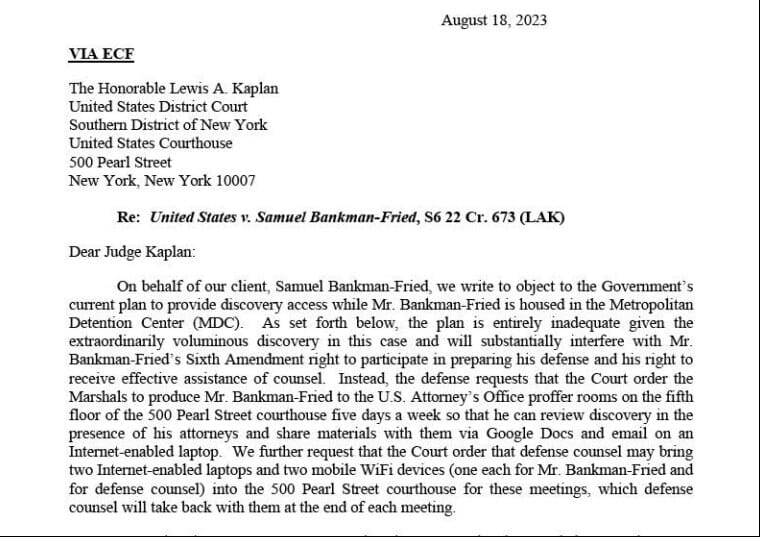

⚖️ Sam Bankman-Fried Due Back in Court as He Asks for Daily Releases- Former FTX CEO Sam Bankman-Fried is headed to jail, after a federal judge decided during a hearing on Friday in the U.S. District Court for the Southern District of New York to revoke his bail.

⚖️ FTX and Genesis Reach $175 Million Settlement After $4 Billion Demand- Bankrupt crypto exchange FTX has reached a $175 million settlement with collapsed crypto lender Genesis, following a nearly $4 billion claim made on behalf of FTX’s failed sister company, trading firm Alameda Research.

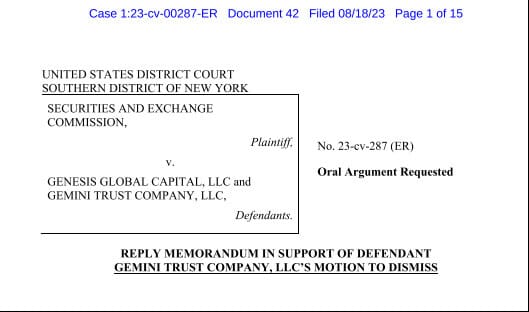

4. ⚖️ 'Failure to State a Claim': Gemini Pushes to Get SEC Case Dismissed- Embattled cryptocurrency exchange Gemini is urging a federal judge to throw out a lawsuit filed in January by the Securities and Exchange Commission because the federal regulator did not establish a clear case that the company was selling unregistered securities.

🚀 Shiba Inu’s Ethereum Layer-2 Blockchain Shibarium Goes Live Amid Push for DeFi Growth- Shiba Inu developers on Wednesday were set to push live the much-awaited Shibarium blockchain, an Ethereum layer-2 network that uses SHIB tokens as fees.

💬 Tweet of the Week

Source: @circle

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Base continues to be highly profitable for Coinbase. Assuming the current average of $168K in daily profits, Coinbase could see $61M in annual profit from it's new Layer 2 network.

Source: @TheBlockPro__

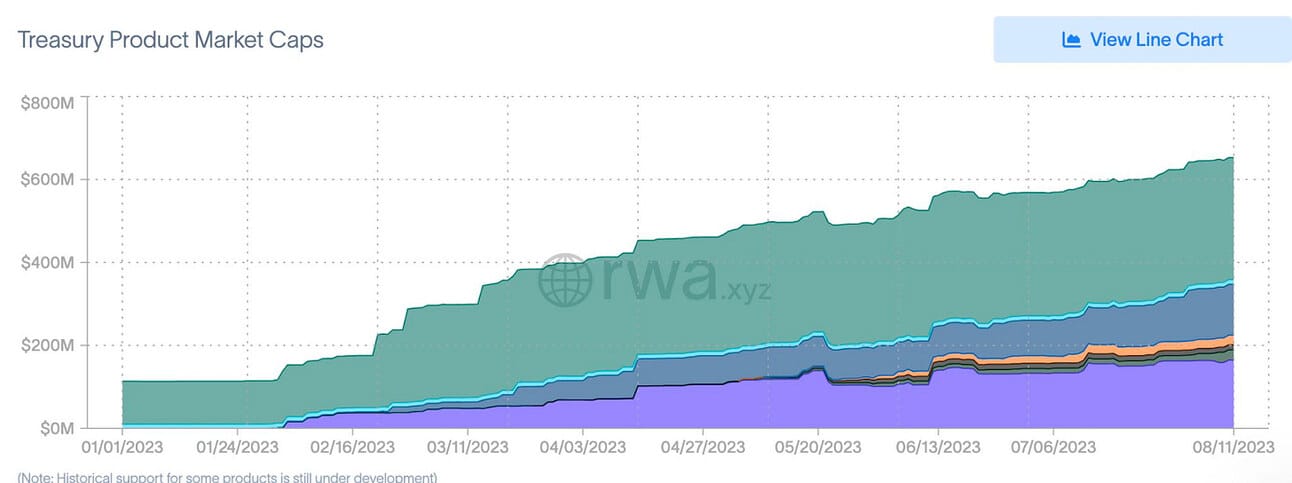

2. Tokenized real-world assets (RWAs), specifically treasury products (e.g. US treasuries, bonds, and cash-equivalents), continue to gain momentum and have now eclipsed $650M TVL.

Source: @David Shuttleworth

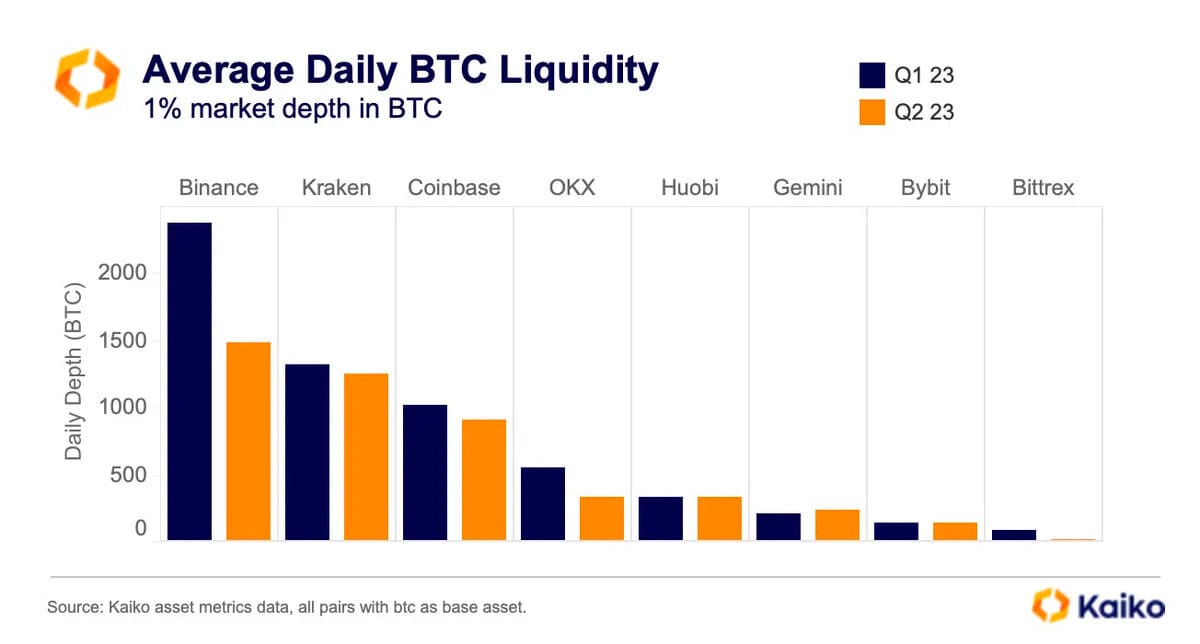

3. Binance has seen the strongest drop in BTC liquidity in Q2 relative to the previous quarter.

Source: @KaikoData

4. Uniswap flipped Coinbase’s spot trading volume in Q1 and Q2 2023.

Source: @Ryan Rasmussen

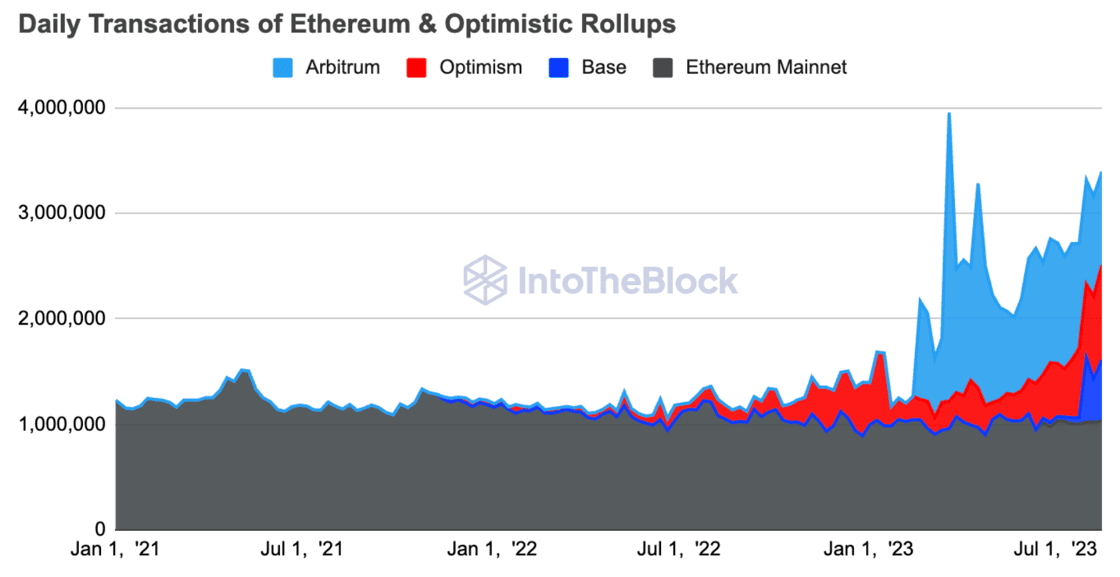

5. Transaction numbers between Ethereum Mainnet & major optimistic rollups just hit their 2nd highest value ever. The total number of transactions is now roughly 3x higher than during the bull market peak.

Source: @intotheblock

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

In 2017, a group of MIT Media Lab researchers claimed in Wired that decentralized social networks “will never work” [1]. In their piece, they cited three impossible challenges: (1) the question of onboarding (and retaining) users from scratch, (2) the (mis)handling of personal information of users, and (3) lucrative user-targeted user advertisements. In all three cases, they argued, incumbent tech giants, such as Facebook, Twitter, and Google, simply had too far-reaching economies of scale to make room for any significant competition.

Fast forward half a decade later, what was once hailed as “impossible” seems no longer so far-fetched, and we seem to be on the dawn of a paradigm shift in the way we conceptualize social media networks. In this three-part series, we will examine how new ideas in decentralized social (DeSo) seem to address these “age-old” questions, specifically, (1) the use of open social graphs in solving the cold start problem, (2) using proof-of-personhood and cryptographic techniques to solve the userhood problem, and (3) leveraging tokenomics models and incentive structures to solve the revenue problem.

Social Graphs and the Cold Start Problem

Social media platforms invariably face the cold-start problem: attracting and engaging users from scratch without an existing user base or network effects. Traditionally, nascent social media startups such as Snapchat, Clubhouse, or recently Threads have sought to overcome this through brute force and sheer marketing prowess. By capturing everyone’s attention at just the right moment, whether that is through a novel UX design, media headlines, or FOMO, they launch a huge blitz of signups to almost instantaneously build up a moat of users on the platform. For example, in a matter of 5 days, Threads was able to onboard a mind-whopping 100 million users [2].

But more often than not, these successful marketing campaigns are met with an existential crisis: how do you retain all of these users, and continuously generate new content (and profit)? This is the problem that Clubhouse previously faced, and Threads is currently facing. And as these applications die out, the lucrative user social graphs and profiles that these platforms build die out with it, so that future aspiring social media networks need to repeat the difficult marketing stunt all over again to bootstrap their network.

An example of a social graph [3]

The fundamental problem behind all of this is that in web2 social networks, the social graph layer (which annotates the relationships between users) is inseparably wound-up with the social application itself, such as Facebook, Twitter, or Instagram. The two layers are symbiotic: the novelty of the application bootstraps the social graph, which in turn acts as the primary moat of the social media application. Despite all their problems, the reason why users don’t leave Facebook, Twitter, Instagram is simple: all our friends are on it.

But what if we decouple the social graph and the social application? What if, even after Clubhouse (or Threads) dies out, we can still make use of the social graph created in their glory-days to easily bootstrap another social application? This is web3’s response to the cold start problem.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.decard.io