Issue Summary: This week we celebrate our first anniversary by doing our first annual recap of the biggest stories in crypto of 2021.

In This Week’s Issue:

Crypto: 2021 in Review - Part One of Two

Ethereum’s Progress Toward Flipping Bitcoin

Solana, Terra, Avalanche, and Fantom Have Breakthrough Years

The Year of DeFi

Institutional Investment in Crypto Explodes

Ethereum Scaling Solutions Have Arrived and Are Working

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

🎆 Crypto: 2021 in Review

By Ryan Allis, Managing Partner at HeartRithm & Publisher of Coinstack

We’re writing this article in two parts. This week we write about the five biggest stories in crypto for 2021. Part two of the article with stories 5-10 will be published next week.

In 2021, we’ve published 55 issues of Coinstack and have grown from 0 to 21k subscribers. It’s been a big year for us!

As we celebrate our first anniversary as a publication, there’s no better time to do our first annual recap of the biggest stores in crypto.

So welcome to our first ever, “Crypto: 2021 in Review.”

The Ten Biggest Stories of 2021

Yes, the digital asset market has done exceptionally well this year. The total crypto market cap has expanded by 188% in 2021, from $770B to $2.2 trillion.

For the true believers, this year has led to major gains for those who weathered the bear markets and invested in the depths of 2018 and 2019.

For the skeptics, this year has also led many to look again and realize that the tokenized economy, made up of smart contracts running on distributed computers and coded by a passionate, decentralized, and unstoppable legion of builders, may just become the fundamental technological architecture of the new global financial system and yes, the entire metaverse.

One thing is clear: Smart contracts are the future and all financial assets are in the process of being tokenized as we build a more transparent world with markets running 24/7.

The nerds are taking over again. It’s like 1996 all over again -- and we’re living through a new Cambrian Explosion of innovation. Yes, 2022 for blockchain innovation will be a lot like 1997 in internet innovation. We’re just about to get off dial up and onto the first broadband.

So from DeFi to NFTs to Web3, here my friends are the biggest stories of 2021 in crypto…

Ethereum’s Progress Toward Flipping Bitcoin

Solana, Terra, Binance, Fantom, and Avalanche Have Breakthrough Years

The Year of DeFi

Institutional Investment in Crypto Explodes

Ethereum Scaling Solutions Have Arrived and Are Working

NFTs Go Mainstream

The Multi-Chain Future is Coming

The Year of the Crypto Hedge Fund

The First Country Makes Bitcoin Legal Tender: El Salvador

Digital Assets Are Taken Seriously in D.C. While China Makes a Major Geopolitical Blunder

Let’s look into each story -- one by one. This week we’ll be publishing the top 5 big stories of the year. Next week we’ll be publishing the big stories 5-10.

Big Story #1: Ethereum’s Progress Toward Flipping Bitcoin

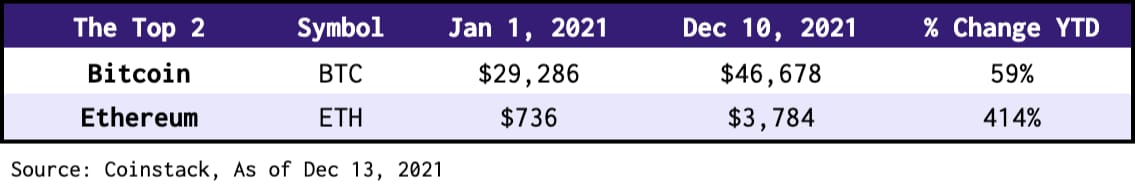

The biggest story among the macro cap digital assets in 2021 was Ethereum. Ethereum’s native token, Ether (ETH), is up 414% YTD compared to just 59% for Bitcoin (BTC).

Why has Ethereum been growing faster this year? It’s pretty simple. Ethereum can be built upon and has native smart contracts -- allowing a wide range of DeFi, NFT, and gaming applications to be built on top of it.

Ethereum also experienced a major upgrade in August with EIP-1559 that began reducing the available supply of Ether with each transaction, improving Ether’s monetary policy.

At the beginning of 2021, Bitcoin represented 70% of the total market capitalization of crypto. This is now down to 40% as BTC has appreciated slower than the overall digital asset market.

We expect Bitcoin dominance to continue to fall over the next five years as newer smart contract platforms and decentralized finance applications go mainstream.

Ethereum has grown from being worth just 21% of Bitcoin in January to more than 51% today. We’re more than halfway to the flippening…

When you look at the number of the total unique wallet addresses, total apps with more than $1B in TVL, total revenues, and the total value settled per day -- Ethereum is beating Bitcoin in every category -- by a lot.

So, will Ethereum eclipse Bitcoin in market cap in 2022? That’s the trillion-dollar question. We think it’s inevitable -- though it may take 2-4 more years and a successful Proof of Stake (PoS) rollout in mid-2022 for Ethereum 2.0.

We shall see.

Big Story #2: Solana, Terra, Avalanche, and Fantom Have Breakthrough Years

Driven by demand for lower fees and faster transaction speed than Ethereum 1.0, new smart contract platforms like Solana, Terra, Binance Smart Chain, Fantom, and Avalanche have had breakthrough years and achieved product-market fit this year.

While 2021 has been a very successful year for growing usage of the Ethereum blockchain, the biggest issue with Ethereum today is that it is only affordable for the big players to use (think hedge funds and Visa settling large transactions). Just to do a simple token swap right now on Uniswap v3 on the Ethereum blockchain costs over $80.

So while many are waiting for Ethereum scaling solutions like Polygon, Arbitrum, Optimism, and ZKRollups to become easier to use (see story #5 below), other blockchains have sprung up -- focusing more on speed and low costs.

Here’s how each of the major blockchains have performed this year on price appreciation.

As you can see above… 2021 was definitely Solana’s year based on price appreciation.

Congrats to Multicoin who had their fund made by investing early into Solana, part of the FTX/Alameda/SBF ecosystem — and to Polychain Capital, who had a great year by backing Avalanche early.

But who’s winning based on Total Value Locked? Ethereum remains king… by a lot -- and still had over 63% of the total value locked in DeFi.

Vitalik’s 2013 vision of a programmable smart contract platform built upon a decentralized world computer is paying off…

Based on the actual value stored on the chains, Ethereum has the most TVL, followed by Binance, Terra, Avalanche, Solana, and Fantom.

Big Story #3: The Year of DeFi

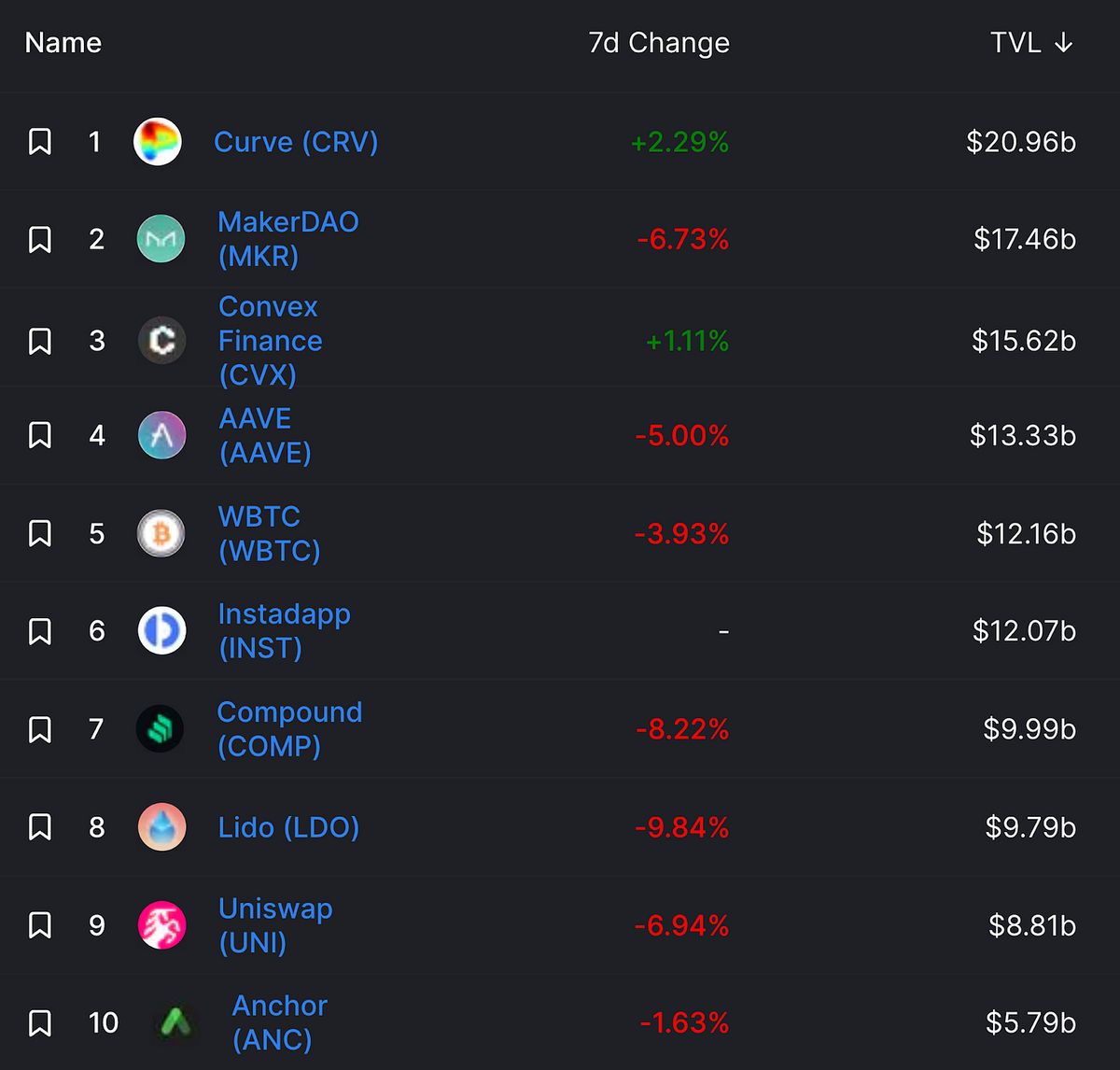

While 2020 was the birth of DeFi, 2021 saw the explosion of DeFi usage. Total value locked in DeFi grew from $21B at the beginning of 2021 to $239B+ today, an 11x growth so far this year.

Yes, there is now $239,000,000,000 generating yield in decentralized finance with over $66,000,000,000 alone in Curve, Maker, Convex, and Aave.

Total value locked is the amount of money stored by users inside the protocol. The treasury is the total amount of money that the protocol itself has, usually stemming from the price appreciation of the portion of its native tokens that it maintained at launch.

The treasuries of various DeFi apps have ballooned this year, with Uniswap leading the way with nearly $7 billion. Fifteen protocols now have over $100M in their treasuries.

To put this in perspective, here are some publicly traded companies with around $7B on their balance sheet: Mastercard, Coinbase, and Robinhood. Yes, that’s right Uniswap, a decentralized exchange that started in November 2018, has as much in its treasury as Coinbase, a publicly-traded centralized exchange founded in 2012.

What a brand new world we live in -- where firms/DAOs that keep 100% of their treasuries in digital assets (Uniswap) can amass a bigger balance sheet in 36 months than highly successful firms that kept 99%+ of their treasuries in USD.

Big Story #4: Institutional Investment in Crypto Explodes

Venture capital investment in blockchain companies and tokens is up more than 4.5x from 2020.

Through November 24 of this year, venture capital firms had invested over $27 billion in the digital asset and blockchain space, up massively from $6B last year.

Let’s break that down by quarter to show how fast things are growing right now…

And it wasn’t just the venture capital firms investing big. Public companies, private companies, and nation-states even got in on the action, piling up BTC on their balance sheet by the truckload.

Michael Saylor of Microstrategy and Jack Dorsey of Square (now called Block) began the trend of public companies buying BTC in late 2020.

As of December 13, 2021, over $34 billion of Bitcoin alone has been added to the balance sheets of countries ($13.2B), public companies ($12.1B), and private companies ($8.7B).

It’s also becoming more common for companies to hold Ether. Twelve public companies hold over 212,000 Ether (ETH) on their balance sheets, representing about $784M in value.

Congratulations to Galaxy Digital, which holds over $1B of Bitcoin and Ether on their balance sheet. Smart move indeed.

Yes, 2021 has been the year of the institutional investor in digital assets.

Big Story #5: Ethereum Scaling Solutions Have Arrived and Are Working

With Ethereum’s gas fees rising faster than a boy who sits on a handful of pushpins, it’s become patently clear in 2021 that Ethereum needed scaling solutions yesterday.

Fortunately, Ethereum scaling solutions like Polygon, Arbitrum, Optimism, and ZK-Rollups have all launched this year.

While they aren’t exactly easy to use yet (ever tried to bridge money over to them yourself?), at least they are working.

Polygon Hermez now offers fees that are 97% lower than Ethereum.

And the TVL on Ethereum Layer 2 solutions is now over $5 billion.

Here’s how the top L2 networks are faring from a total value-locked perspective.

Arbitrum is the leader with $2.34B in TVL, with StarkEx at $1.25B (which dYdX, ImmutableX, and DeversiFi built upon), and Optimism at $1.18B (which Boba also built upon).

Here’s an easy-to-read graph breaking down the top five.

As of today, Arbitrum is leading the way with StarkEx and Optimism right behind. We expect 2022 to bring good things to the Zero-Knowledge proof world as ZK Porter launches.

What’s Coming in Part Two Next Week

We hope you enjoyed this 2021 digital asset recap.

Next week we’ll be sharing top stories 6-10 for the year.

NFTs Go Mainstream

The Multi-Chain Future is Coming

The Year of the Crypto Hedge Fund

The First Country Makes Bitcoin Legal Tender: El Salvador

Digital Assets Are Taken Seriously in D.C. While China Makes a Major Geopolitical Blunder

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Celo is fully compatible with Ethereum, so you can run smart contracts built in solidity. It uses proof-of-stake consensus, has high throughput, and five-second transaction finality. Celo is now the fourth fastest-growing blockchain in all of DeFi. Learn more about Celo and its family of stablecoins by visiting http://celo.org.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like NEAR, GALA, and CEL had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Gala is a game, Sandbox is a metaverse, Oasis is an L1, Crypto.com is an exchange.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 13,280 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.