Are we at the bottom yet or is there more room to go down? Here’s our analysis.

In This Issue:

Are We At The Bottom Yet? Our Analysis

10 Reasons We’ll See New All-Time Highs This Year

What Vance Spencer of Framework Ventures Thinks

Introducing The Coinstack Podcast

A Long-Term Crypto Portfolio

Tuesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

Getting Started in Crypto Learning

Are We At the Bottom Yet? Our Analysis.

By Ryan Allis

Whenever things get shaky, it’s time to go back to the big picture. So here’s the big picture in crypto right now as I see it.

Decentralized cryptographically-secured protocols are the future of global finance and global monetary exchange.

By 2030, I believe that both Bitcoin and Ethereum will each be worth more than the market cap of gold ($11T), which would someday make BTC worth more than $500k and ETH worth more than $100k.

I mean which would you rather have:

A shiny rock that isn’t easily divisible, can’t be sent on wires, and can’t be built upon as a financial platform -- or...

A decentralized globally-neutral digital gold that can be transmitted instantly, divided simply, is needed to utilize a platform upon which any app can be built, and allows anyone to trust anyone across space and time without knowing them through an unstoppable network of 10,000+ global validators?

For me, it’s the latter, I’d rather have BTC and ETH than gold all day long. The only remaining question is which one is going to win more…

Bitcoin, a decentralized digital global store of value that can’t be easily programmed but has a fixed monetary supply -- or --

Ethereum, a decentralized app platform upon which the future of finance is currently being built and is about to have a major upgrade to Proof of Stake and to its monetary policy to have even lower annual net issuance than Bitcoin.

Time will tell which will win more -- but it’s not going to be nation-state money winning out in 2035. It’s going to be decentralized and programmable internet money.

Why BTC Has Done Well The Last Year

A year ago when BTC was at $9700, there weren’t 37 publicly traded companies with Bitcoin on their balance sheet and there definitely wasn’t a nation-state with Bitcoin as legal tender, and now there is.

So it makes sense that BTC is up big -- 219% in the last year against a very inflationary dollar.

Yet still, BTC has dropped by 50% since its April 14, 2021 high of $64k -- mostly on environmental concerns as we transition to more renewable energy and on concerns that China has finally decided to actually ban Bitcoin mining and usage.

So what’s coming next? That’s the trillion dollar question.

While some think we’re heading for a 2-3 year bear market — I highly doubt that.

Calling The Bottom Right Around Now

It strikes me that not a lot of people are wanting to put their neck on the line right now and call the bottom.

But I think around $25k-$29k is the likely bottom range for this mini-cycle for Bitcoin and $1500-$1750 for ETH.

Frankly we don’t have a lot further down we could go.

Never before in crypto history has a subsequent market cycle bottom ever gone below the all-time high of the prior cycle.

For BTC that means $20k is an absolute price floor.

For ETH that means $1.4k is an absolute price floor.

While this trend could break for the first time, as we only have 3 market cycles to look back on, I don’t think it will.

Here’s why…

The 10 Reasons Why We’re Heading Back Up At Some Point This Year

Here are the 10 reasons why I believe we will actually set new All-time highs in 2021...

The Bitcoin Fear & Greed Index (FGI) Shows We Are Way OversoldYou buy when FGI is under 15 and you sell when the FGI is over 80. The time to consider selling Bitcoin was March when we were over 80. Now that we are at 14, it’s time to buy (or hold if you are already in the market). Yesterday when we got to FGI of 10 and sub-$30k BTC was one of the best buying opportunities we’ve seen in a long time.

RSI is Showing We Are Majorly Oversold - You buy more when RSI is under 50 and you sell a bit when RSI is over 70. Right now 30 day BTC RSI is 44 and ETH RSI is 43. It’s time to buy (or hold), definitely not time to sell. Here’s the price chart and RSI chart for ETH making it clear now is a time to buy.

Massive Revenue Growth Since 2018 - In the last week alone ETH has generated $41.3 million in fee revenues. Back in February 2018 (a month after the last peak) Ethereum was generating just $4 million in fees per week. This means that Ethereum is doing 10x the revenue as early 2018, yet is trading at less than 2x the price as back then. It’s a great deal.

DeFi is Here & It Provides Lots of Usage, Even Now - We now have more than $70B in Total Value Locked in DeFi across the ETH and BSC chains. In Jan 2018 (the last cycle top) this was $0. This includes:

Aave - $7.9B TVL

Curve - $6.6B TVL

Compound - $6.1B TVL

Maker - $5.9B TVL

InstaDapp - $5.4B TVL

Uniswap - $5.1B TVL

Daap Daily Volume is Rising Rapidly - According to Dapp Radar, There are now 23 apps with more than $100 million in daily volume. The top 7 are:

Dfyn Network on Polygon, an exchange

Paraswap on Polygon

Fei, a stablecoin protocol

Uniswap, an exchange

dYdX, a perpetuals trading platform

Curve, a interest yield generation platform

Sushiswap, an exchange

Layer 2 Is Making Scaling High Throughput, High Security, Low Cost Blockchain Tech Easy - Layer 2 is Launching This Summer on Arbitrum, Optimism, and ZKRollups. These technologies will settle to Ethereum’s mainnet security but have a separate chain for transactions. This will reduce gas fees by 99%+ and make economically possible many more DeFi use cases that were previously too costly to accomplish.

The Quality of Talent Entering the Space - Top engineers from FAANG companies (Facebook, Apple, Amazon, Netflix, and Google) are joining DeFi protocol teams and top investment bankers and financial analysts from Goldman Sachs, JP Morgan, and Morgan Stanley are now joining industry research shops like Messari and Delphi. My friend and HBS sectionmate Mary Catherine Lader just joined Uniswap as COO this week — switching over from no less than Blackrock—the largest asset manager in the world.

Cash Flows To Token Holders - Unlike in 2017 when crypto was in fact primarily speculation -- today we have fundamentals -- actual on-chain cashflow flowing either indirectly to holders via token burns or directly to holders via on-chain dividends and staking rewards. This makes certain crypto investments (like ETH and Sushi for example) productive assets instead of speculative assets.

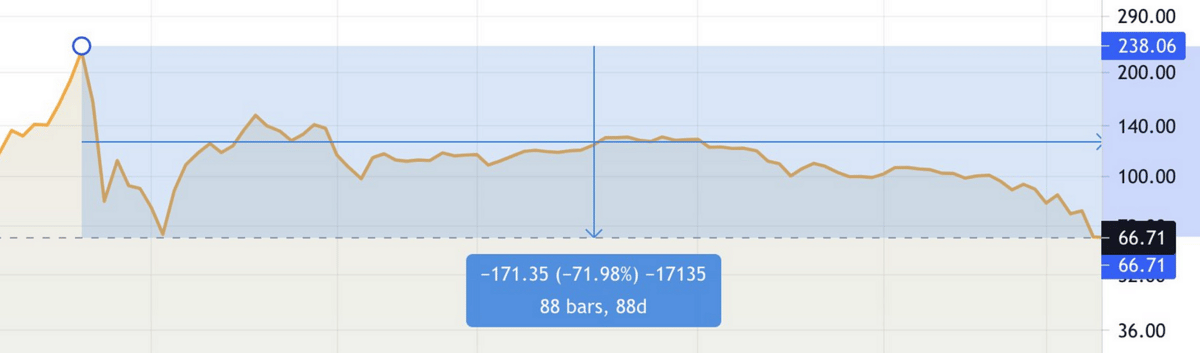

We May Be Following a Similar Pattern to the 2013 Double Peak Bitcoin Cycle - In the middle of the 2013 cycle in April - June 2013 Bitcoin registered a 71% decline before going on to have a 1622% gain between July and December 2013. I think we’re seeing a similar pattern now and may see BTC back above $80k by the end of this year. Let’s go to the charts...

The April-June 2013 Bitcoin Crash: -71% from $238 to $67

The July-December 2013 Recovery: +1622% from $67 to $1161

Will July-December 2021 be similar to the “Double Peak” of 2013. I think so. Time will tell.

So while we could range in the $25k to $35k BTC range and $1500 to $2500 ETH range for a few months, giving investors who believe time to accumulate more, I actually expect that within 1-2 months we will going back up -- and that we will reach new all-time highs (ATHs) again before the end of 2021.This is what analyst Benjamin Cowen thinks as well -- that we will see another ATH for both BTC and ETH before the end of this cycle.

Personally, I’m forecasting an end of December 2021 BTC price of $70k+ -- and that we will resume and continue to see general upward momentum at least through Q4 2021.

I’m a believer in a Double Peak for this 2021 cycle. We shall see!

What Vance Spencer of Framework Ventures Thinks

Vance Spencer, CEO of Framework Ventures tweeted today this great thread on what’s different in 2021 vs. 2018. Here writes:

“I could tell you all the war stories from '18-'20 bear:

But none of that matters. Post '17 - we didn't know what blockchains were useful for:

Today:

So yes, I am optimistic, and am looking forward to a continuation of the cycle shortly. This shakeout was needed.

Now we separate the few from the many so we may prosper once more.”

We now have a new Coinstack podcast. You can listen to it on Anchor or Spotify. We will also send around the Apple Podcast and Google Podcast link when they become available, so you can subscribe to the podcast on your phone and computer.

For now we are reading articles from our newsletter — however we plan to soon have on industry guests as well.

Let us know, who would you like us to have on the show?

Our Top 30: A Long-Term Crypto Portfolio

Everything is on sale right now and from our vantage point, it’s a great time to buy.

If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be absolutely sure to include our top 5: ETH, DOT, KSM, RUNE, & NEXO. Here’s our top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short-term.

Join Our Tuesday Crypto Community Zoom Calls

Every Tuesday Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 8:30am PT / 11:30am ET / 4:30pm GMT.

All buyers of Mrs. Bubble’s NFTs and investors in the Coinstack Alpha Fund are invited to join and ask questions and share learnings with each other.

Just buy any Mrs. Bubble NFT on OpenSea and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite.

You can think of buying the NFT as supporting beautiful joyous art AND a ticket into our community. We had 10 callers on last week’s call.

Join our weekly calls by getting a Mrs. Bubble NFT or investing in the Coinstack Alpha Fund. With prices on most quality crypto assets about 50% lower than last month, now’s a good time to invest.

Join The CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1600 members on our Telegram.

The People We’re Following Closely on Twitter

How To Get Started With Crypto Learning

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at CoinStack.substack.com

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.