As BTC and ETH both pumped by more than 25% this week, we ask, is the bull market resuming? We also feature three guest articles on Ethereum from Electric Capital, Bizantine Capital, and Cyber Capital. Read as an email below or as a Google doc.

Inside This Issue:

This Week in Crypto: Are the Bulls Back? BTC Jumps 33% In One Week…

Weekly Crypto News Recap

Weekly Crypto Fundraises

Best Crypto Podcasts of the Week

Ethereum Update - EIP-1559 Set to Begin Burning Fees Wed Aug 4 by Ryan Allis

Recommended Ethereum & DeFi Talks from EthCC 2021 in Paris

Report Highlights: Kraken’s on CeFi & CryptoCompare on Institutional Inflows

Featured Guest Articles on Ethereum

Ethereum: From Digital Oil to a Digital Nation by Gui Laliberte

ETH: The World’s Most Valuable Asset by Andrew Bakst

Proof of Stake: A Superior Alternative To PoW by Justin Bons

New Coinstack Podcast Episodes - Stablecoins, CBDCs, & SpaceX

A Good Long-Term Crypto Portfolio

The Coinstack Alpha Fund - Up 20% in Last Week

Wednesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

💬 Tweet of the Week

📰 Crypto News Recap: The Top 10 Stories

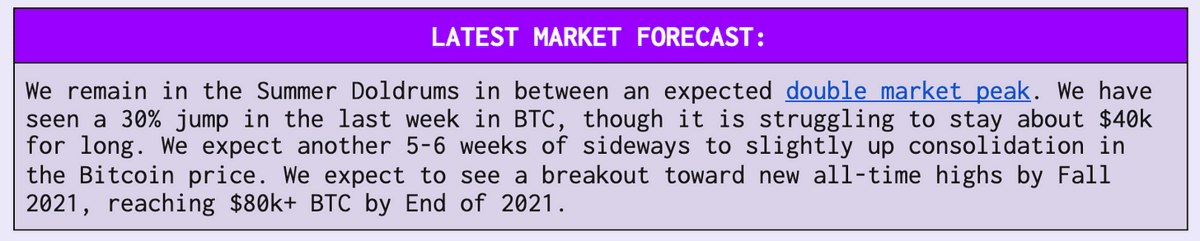

Here’s your weekly crypto news recap… it looks like the bulls are returning as Bitcoin has had its first daily close above its 200 day MA and grew in price from $29k to $39k (+33% in the last seven days)... but will it be a temporary bump or the start of a sustained rally toward the expected Fall 2021 Double Peak?

🚀 Amazon Helps BTC Pump to $40k With A Blockchain Product Lead Job Listing. On Monday, Amazon had posted a job listing for a, “Digital Currency and Blockchain Product Lead”. Market analysts were taken aback and questioned if Amazon was moving to accepting Bitcoin as a method of payment after British Newspaper City AM reported on the job listing and a potential Amazon token. An Amazon spokesperson later denied the idea of Amazon accepting cryptocurrencies causing the BTC price to fall back to $37,598. (Source)

💀 Over $200M in Short Positions Were Liquidated on Monday. Yes, the short squeeze was upon us. On Friday Will Clemente broke down his theory for the imminent #SupplySqueeze. His rationale for expecting the increase was:

RSI sitting beneath 7-month resistance

Perpetual Funding remains negative

Buyers with little selling history continue to accumulate heavily

Miners are accumulating and

Strong outflows from OTC Desks (Source)

😅 FTX and Binance Downgrade Maximum Leverage To 20x. After years of criticism for offering 100x leverage on their trading platforms, FTX and Binance have reduced their maximum leverage to 20x.Token Metrics Chief Quantitative Investment Officer Gurraj Singh Sangha told Blockworks that this is likely the product of behind-the-scenes conversations between regulators and exchanges. (Source)

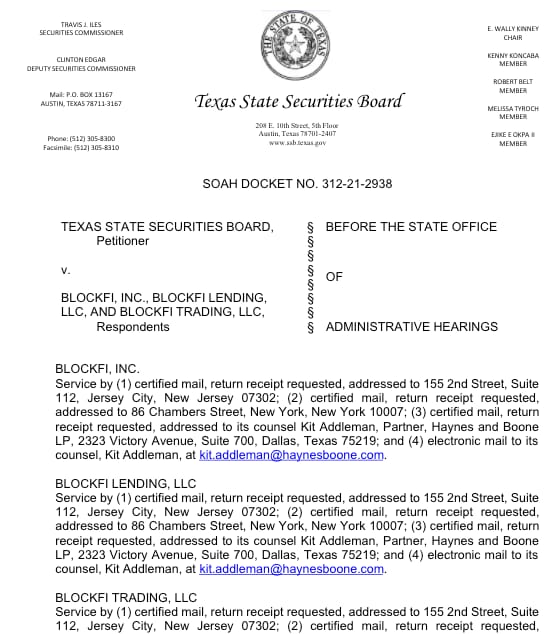

📶 BlockFi Aims IPO In The Next Year Despite Regulation. According to documents circulated to investors on Wednesday. The New Jersey-based company was handed a string of cease and desist letters from securities regulators in Vermont, Alabama, Texas and New Jersey. BlockFi is set to close its Series E on July 27. The round, as previously reported by The Block, amounts to $500 million, giving BlockFi a $4.75 billion post-money valuation. (Source)

💸 Binance US Also Considering IPO. Binance US is also looking at a potential IPO, while Binance CEO, CZ Zhao, is considering replacing himself with someone who is strong at regulatory compliance.

⚡ Nigeria to Pilot Central Bank Digital Currency In October. The Central Bank of Nigeria (CBN) will launch a pilot scheme called, “GIANT”. Rakiya Mohammed, CBN’s information technology director, emphasized that they could not afford to be left behind while the vast majority of central banks worldwide make headway with their own CBDC research and development. (Source)

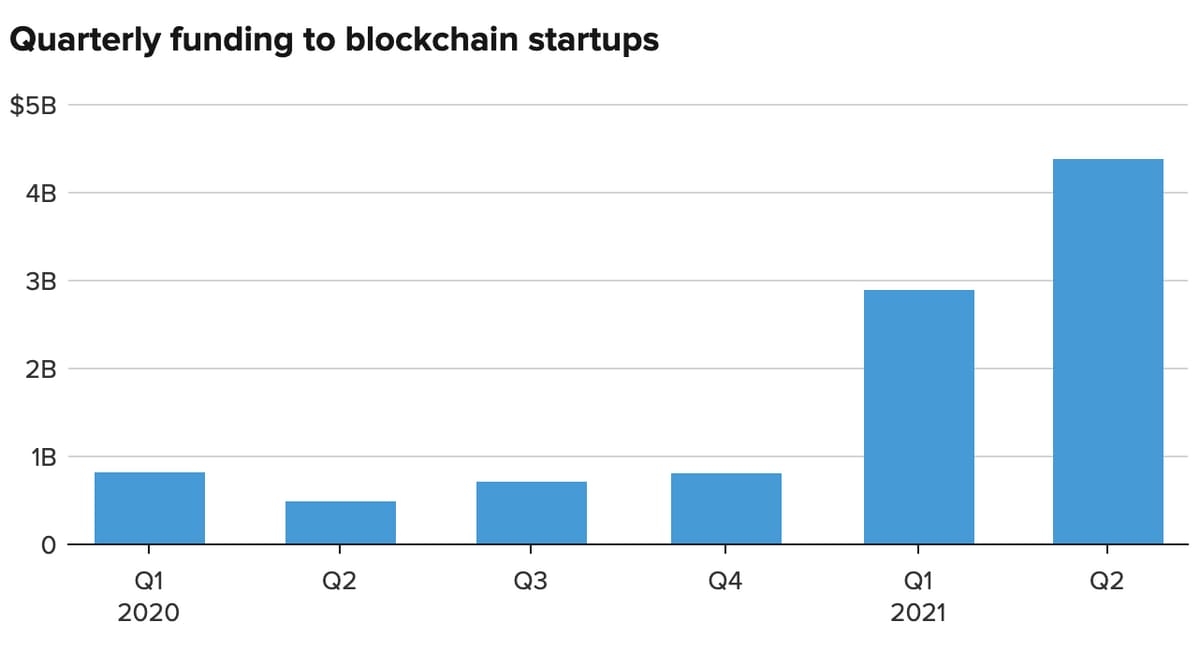

💰 Blockchain Startups Raise Record $4.4B in Q2 2021 - According to data from analytics firm CB Insights, blockchain startups raised a record $4.4 in Q2 2021. Chris Bendtsen, senior analyst at CB Insights commented, “At the current rate, blockchain funding will shatter the previous year-end record — more than tripling the total raised back in 2018. Blockchain’s record funding year is being driven by the rising consumer and institutional demand for cryptocurrencies. Despite short-term price volatility, VC firms are still bullish on crypto’s future as a mainstream asset class and blockchain’s potential to make financial markets more efficient, accessible, and secure.” (Source)

🏢 60% of Family Offices Want Crypto Exposure - Goldman Sachs surveyed 150 family offices and found that 60% either already own crypto or want to. 15% already owned digital assets while 45% planned to invest in them. 67% of the firms surveyed manage more than $1 billion worth of assets, with 22% of respondents boasting assets under management exceeding $5 billion. Melina Flynn, a partner and Global Co-Head of Private Wealth at Goldman Sachs said that “The majority of families want to talk to us about blockchain and digital ledger technology. Many think that this technology is going to be as impactful as the internet has been from an efficiency and productivity perspective.” (Source)

📈 71% of Institutions Want Crypto Exposure. According to Fidelity Digital Assets 2021 Institutional Investor Digital Assets Study, seven in ten institutional investors expect to buy or invest in digital assets in the future, and more than 90% of those interested in digital assets expect to have an allocation in their institution's or clients' portfolios within the next five years. Fidelity shared that in their study Institutional Investors cited high potential upside and low correlation to other assets as two of digital assets’ most appealing features. The survey included 1,100 institutional investors in the U.S. (408), Europe (393) and Asia (299), including high net worth investors, family offices, digital and traditional hedge funds, institutional investors, financial advisors and endowment and foundations. (Source)

💎 EIP-1559 launches next Wednesday on August 4, 2021. This is a major upgrade for Ethereum and as of launch it will begin to reduce the supply of Ether each day by burning around 70% of its transaction fees. More on this below in the Ethereum update. (Source)

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week... MAN it was BUSY…

Crypto infrastructure firm Fireblocks scores a $2 billion valuation with a $310 million Series D led by Sequoia Capital and Coatue Management

Genesis Digital Assets Announces $125 Million Raise to Expand Industrial-Scale Bitcoin Mining Operations

Activant Capital and L Catterton lead a $60M Round in Eco, a digital wallet and neobank, joining A16Z as investors.

Magic Labs, a decentralized identity startup that provides “passwordless login” solutions, has raised $27 million. With fresh capital at hand, Magic plans to scale its platform and double its team of over 30, CEO Sean Li told The Block.

Thesis, a crypto venture studio, has raised $21 million in a Series A funding round. The round was co-led by ParaFi Capital and Nascent, with participation from Fenbushi Capital, Polychain Capital, and Draper Associates.

Valora, a digital wallet built on Celo, has raised $20M from A16Z. Originally part of cLabs, Valora will become a stand-alone company led by Jackie Bona, former head of consumer growth for cLabs.

Argentinian Crypto Exchange Lemon Cash Raises $16M to Expand in Latin America.

Coin98 Labs has raised $11.25M to expand the scope of its DeFi applications. The funding round was led by Spartan Group and Hashed. The company is also launching the Coin98 Exchange.

Bitcoin shopping rewards provider Lolli raises $10 million in Series A funding. Acrew Capital led the round.

StormX, a rewards debit card provider, raises $9M in funding, led by Optimista Capital

Blockchain infrastructure provider Biconomy raises $9 million. DACM and Mechanism Capital led the round, with participation from Coinbase Ventures.

Saber, a Solana-based stablecoin exchange, has raised $7.7 million from Chamath Palihapitiya's Social Capital

Flurry Finance Announces $3 Million Raise to Expand Its DeFi Yield Aggregation Protocol Flurry Finance today announced it had closed its latest funding round which helped it raise $3 million. The leading investors in the funding round were AU21 Capital, GenBlock Capital, Shima Capital, CoinUnited.io, One Block, Soul Capital, and Dutch Crypto Investors.

🎧 Top Crypto Podcasts of This Week

Here are the crypto podcasts that are worth listening to this week...

Here are some really great quotes from the July 23, 2021 Santiago Santos interview on the Delphi podcast:

“Working in crypto is a ton of fun. I always come back to crypto because the smartest guys are here, it’s the hardest problem, and it’s leading to the most powerful social and economic transformation since the industrial revolution.” - Santiago Santos from Parafi Capital

When talking about Ethereum and Solana he said...

“It’s going to be a multi-chain world. It has to be. Gaming, NFTs, DeFi... There are different types of applications that are better suited for different protocols.” - Santiago Santos from Parafi Capital

When talking about why he is bullish on Ethereum he said…

“Visa is settling with USDC on Ethereum—they don’t want the egg on their face. Security becomes super important for the big players... Most of the users are on Ethereum. Most of the developers are on Ethereum. And it has the highest security.” — Santiago Santos from Parafi Capital

Ethereum Update - EIP 1559 Launching Next WeekBy Ryan Allis

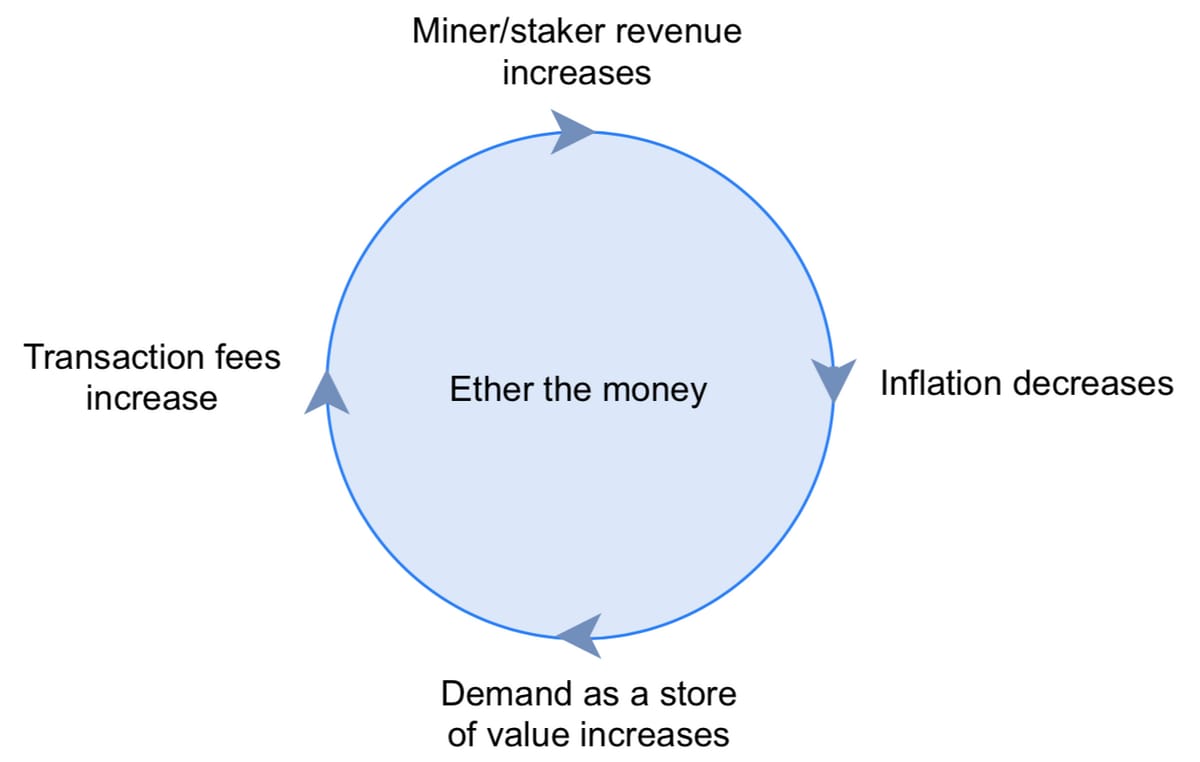

It’s exciting times in the world of Ethereum with the network’s much anticipated EIP-1559 set to go live next week on August 4, 2021 at Block 12,965,000 with the London Upgrade. This upgrade will begin to burn transaction fees, reducing the supply of Ether (ETH).

Once EIP 1559 goes live -- the next major step is EIP 3625 coming in early 2022 which will move Ethereum to a Proof of Stake Chain -- and make its net issuance negative for the first time (based on current levels of gas fees).

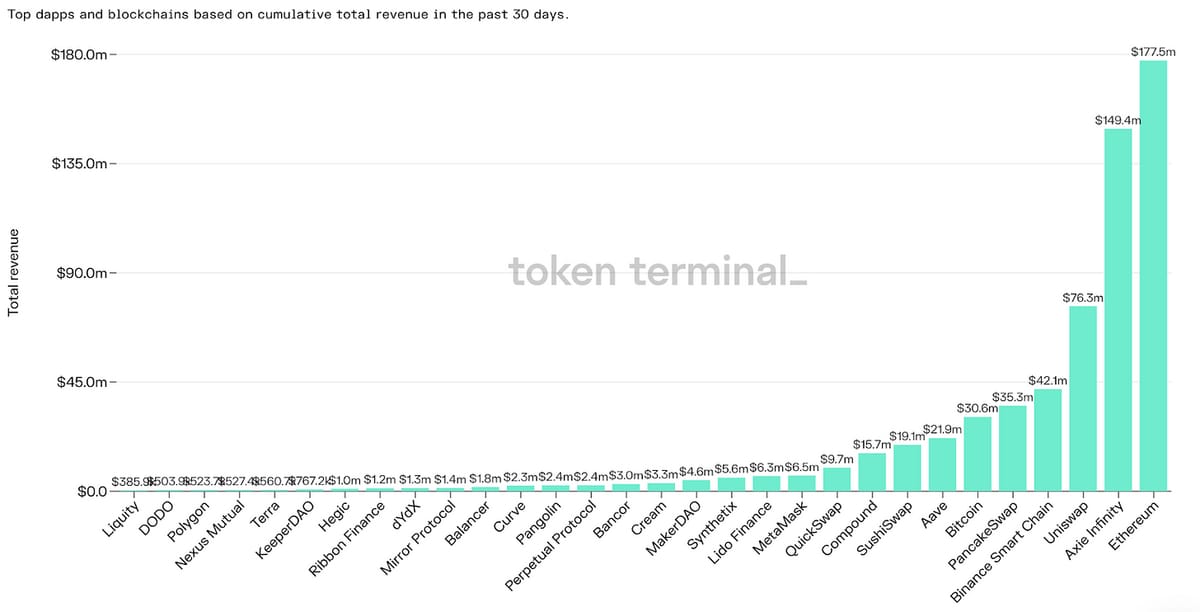

Even with scaling solutions like Optimism and Arbitrum coming onto the market, Ethereum’s revenues have been increasing steadily the last 30 days, up more than 50% from their early July 2021 lows of $4.4M per day to $6.8M this week.

Ethereum is currently pulling away as the top generator of on-chain revenue according to both TokenTerminal and CryptoFees.

With a monthly run-rate of $206M, Ethereum should be worth about $494 billion assuming a 200x PE Ratio (appropriate considering its rapid growth). It’s actual market cap is just $267 billion -- so there’s room to grow. If Ethereum were valued at the same PE ratio as Tesla (649x) Ethereum would be worth $1.6 trillion -- or about $10,000 per Ether Source: CryptoFees

Our Ethereum Fundamental Value Model (FVM) below has performed very well at predicting the floor, with the actual price of Ethereum only briefly going below our yellow line price floor.

As shared in previous issues, a good time to invest is when the actual price of Ether (ETH) is below the green line -- and a good time to sell a portion is when we get to the red line.

▶️ Recommended Ethereum & DeFi Talks From EthCC 2021 in Paris

Last week the annual Ethereum Community Conference was held in Paris, France. Here are the talks that Bankless recommends checking out.

Vitalik Buterin: Things That Matter Outside of DeFi

Aya Miyaguchi: Growing the Infinite Garden

Kain Warwick: DAO-first capital formation

Karl Floresch: Degens for Public Goods

Kevin Owocki: It’s All Coordination

Joseph Delong: Sushi Next Generation AMM

Ashleigh Schapp: Uniswap, DeFi, and the Future of Consumer Finance

Stani Kulechov: The Power of Credit Delegation

📝 Highlights from the Top Crypto Reports

Here are the best free crypto research reports this week…

🗞️ Featured Guest Articles

In honor of the upcoming launch next week of EIP-1559, we have three featured articles this week on the topic of, you guessed it, how awesome Ethereum is. The full articles are available online. Below we have simply linked to them and included a featured graphic.

From Digital Oil to a Digital Nation — Narratives for Ethereum in 2021 By Gui Laliberte of Electric Capital

An extremely well written article providing comparison of the 5 leading Ethereum investor narratives in 2021, and models to value each of them. We highly recommend reading this one.

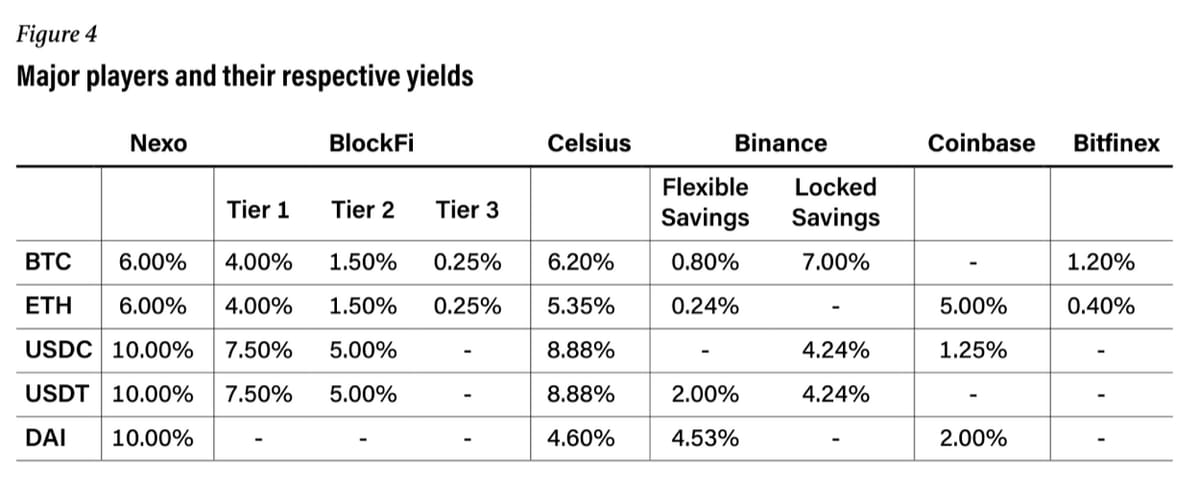

ETH: The World’s Most Valuable AssetWritten by Andrew Bakst, Partner at Bizantine Capital

Key Excerpts from the article:

Ethereum the technology is the world computer.

Because tokens and smart contracts on the new world computer can interact with each other at nearly zero additional cost (the only cost is a free market fee paid to Ethereum validators), innovation on the new world computer compounds incredibly quickly.

The best of Ethereum’s products, all of which are simply a combination of tokens and algorithms, have grown from zero to billions of assets under management (AUM) in matters of months, metrics unheard of on the old world computer.

Ethereum has two mutually compounding network effects that have already created an insurmountable moat for competing world computers: liquidity and developer tooling.

Ether is the first store of value asset to also attract demand as a productive and consumable asset. The demand for Ether as a productive asset is derived from the ability to use Ether to earn all of the transaction fees paid for using Ethereum the world computer

The demand for Ether as a consumable good also comes from Ethereum the world computer: every transaction or other smart contract execution on Ethereum, even those that have nothing to do with Ether, carry with it a free-market fee that must be paid in Ether

PoS: A Superior Alternative To PoWWritten by Justin Bons, Founder & CIO of Cyber Capital

This article explains how PoS is a more economically efficient, secure, fair, inclusive & decentralized alternative to PoW. The author is a fund manager specialized in providing exposure to the crypto-asset markets as an alternative asset class.

Key Excerpts:

In PoW today it is not financially viable for an “average” person to participate in mining. It requires economies of scale and at minimum several hundred thousand dollars if not closer to a million for the initial investment. At the same time it also requires access to cheap electricity, which are often derived from connections and special high value deals with electricity providers in particular jurisdictions. Making participation in PoW extremely exclusive, with a relatively small number of distinct parties being able to carry out this activity.

PoS on the other hand allows “average” people to participate through staking pools, for as little as 0.01 ETH (($19) at the time of writing).

In PoS, the financial return is equalized for all participants, unlike PoW where participants with the greatest economies of scale and lowest electricity rates gain a disproportionate profit over the protocol. This all means that PoS consensus algorithms can support a much larger number of distinct parties carrying out validation when compared to PoW.

Lowering the barrier for participation and allowing for a much larger amount of unique validators is what allows for this greater distribution of power. This greater distribution of power/validation is the very definition of decentralization in blockchain design.

🎧 The Coinstack Podcast

We have a new Coinstack podcast. You can listen to it on Anchor, Spotify, or Google Podcasts. Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends. So far we’re at 1,273 plays and growing!

📈 Our Top 30: A Long-Term Crypto Portfolio

Everything is on sale right now and from our vantage point, it’s a great time to buy.

If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be absolutely sure to include our top 5: ETH, DOT, KSM, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short-term.

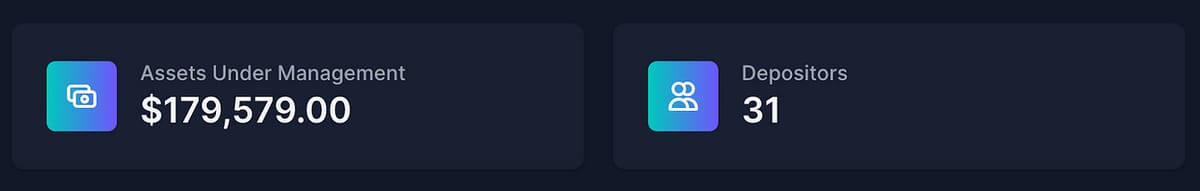

📈 The Coinstack Alpha Fund

Our Coinstack Alpha Fund is up 20% in the last week, driven by a resurgence in Ethereum, Polkadot, and Defi investments.

If you don’t want to manage your own crypto portfolio, we can manage it for you. Check out the Coinstack Alpha Fund on Enzyme. We are now up to $179k from 31 depositors in the Coinstack Alpha Fund.

Enzyme allows deposits with both USDT or ETH. We charge a 2% management fee annually plus 20% of profits. Withdrawals are allowed at any time, although we recommend a 5-10 year hold period for optimal returns.

You can invest directly via your Metamask, Argent, TrustWallet, or any wallet that works with WalletConnect. We don’t hold your funds, Enzyme does. We simply invest them on your behalf. You can learn more about Enzyme here.

Our current fund allocation is:

📞 Join Our Wednesday Crypto Community Zoom Calls

Every Wednesday Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 12PM PT / 3PM ET / 8pm GMT. All investors in our Coinstack Alpha Fund on Enzyme are invited to join and ask questions and share learnings with each other. After you invest, just reach out to Ryan Allis on Telegram (or reply to this email) to get added to the weekly call invite.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

Follow the right people in life — and everything changes!

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just my opinions. Not intended as financial advice. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.