Inside This Issue:

Crypto - The Definitive Explain It Like I’m 5 (ELI5)

Cryptography & Blockchains

Bitcoin

Ethereum & Smart Contracts

Exchanges, Wallets, & Stablecoins

Decentralized Finance (DeFi)

Other Important Crypto Basics

Learning More About Crypto

Why A16Z’s $2.2B Crypto Fund Is A Big Deal & is Leading to Regulatory Clarity

What Morgan Stanley Thinks About Crypto. It’s Time to Allocate.

Subscribe to The Coinstack Podcast

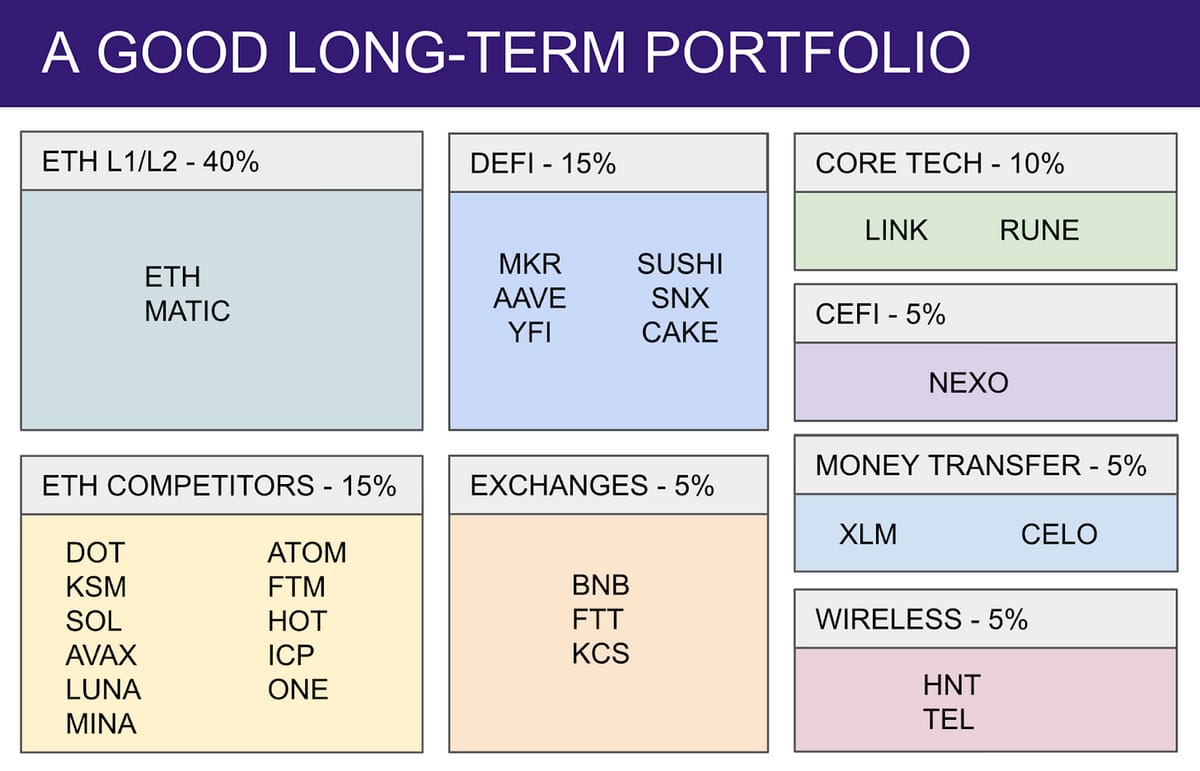

A Long-Term Crypto Portfolio

Tuesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

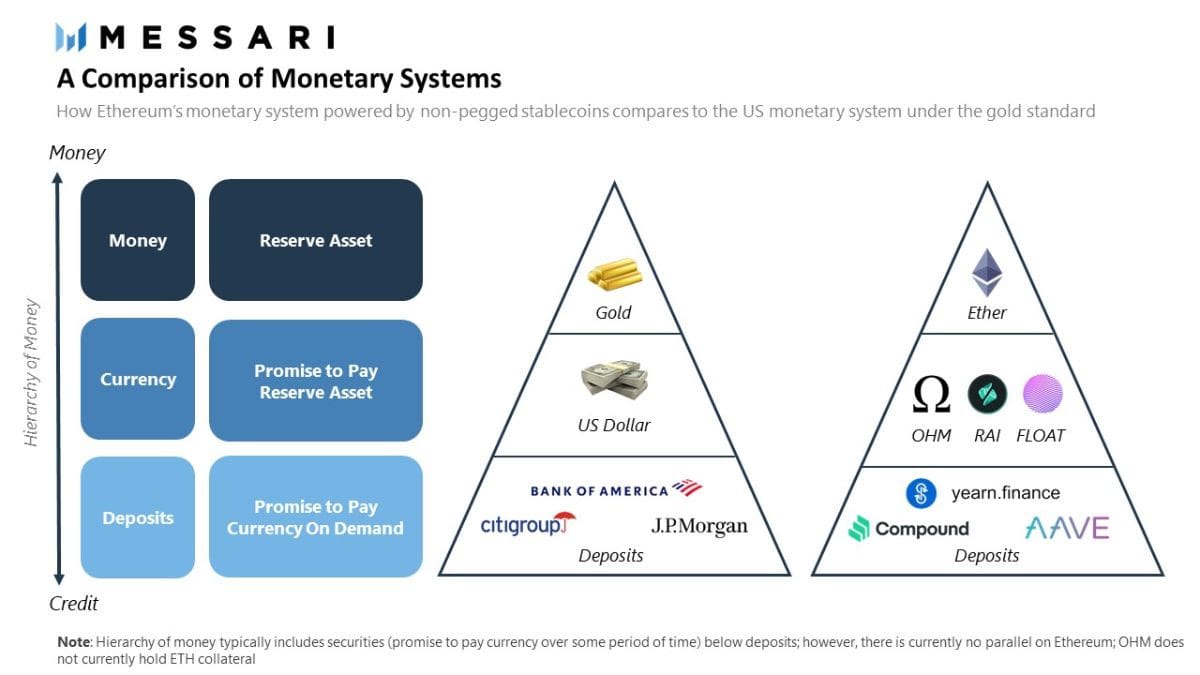

Meme of the Week

Here’s our meme of the week from Ryan Watkins of crypto research firm Messari.

Crypto - The Definitive Explain It Like I’m 5 (ELI5)

By Ryan Allis

ELI5 stands for “explain like I'm 5.” When people use it on Twitter or Reddit, it means asking others to explain a complex topic simply.

And yes, sometimes there is a LOT of technological complexity in the blockchain space.

I’m writing this “Crypto ELI5” in order to help anyone understand the basics, become a better crypto investor, and be able to understand how cryptographically-secured decentralized blockchain applications are changing the world.

I’ve structured the article as a Q&A with the answers to 60 very important questions that every crypto investor should understand.

I hope this article helps you increase your understanding of the space and become a better investor.

Feel free to send a link to this post to any new in your network who’s trying to wrap their head around crypto.

The link to share is: https://coinstack.substack.com/p/crypto-explain-it-like-im-5

So let’s jump in and see what we can learn...

PART 1 - Cryptography & Blockchains

1. What is Cryptography?

Crypto is short for “cryptography.” Cryptography is a way of making a piece of information really hard for a computer to guess. The word comes from the Greek words for “hidden writing.”

2. What is a Blockchain?

A blockchain is a new type of database that stores its data across multiple computers instead of just one centralized computer. A “block” is a collection of data and a “chain” is what ties the blocks together across multiple computers.

3. What Are the Use Cases of Blockchains?

A blockchain transparently records data in a trustable way without a centralized database. It can be used to record payments, loans, votes, health records, product inventories, stock ownership, house ownership, digital art, game collectible ownership, or even identification. Blockchains can also be used to store files and information in a way that can’t be censored.

4. What Does Decentralized Mean?

Decentralization happens when the data on a blockchain is stored in many different places -- instead of just one central database. Blockchains that store data in enough different computers (called nodes) become unstoppable and can’t be shut down.

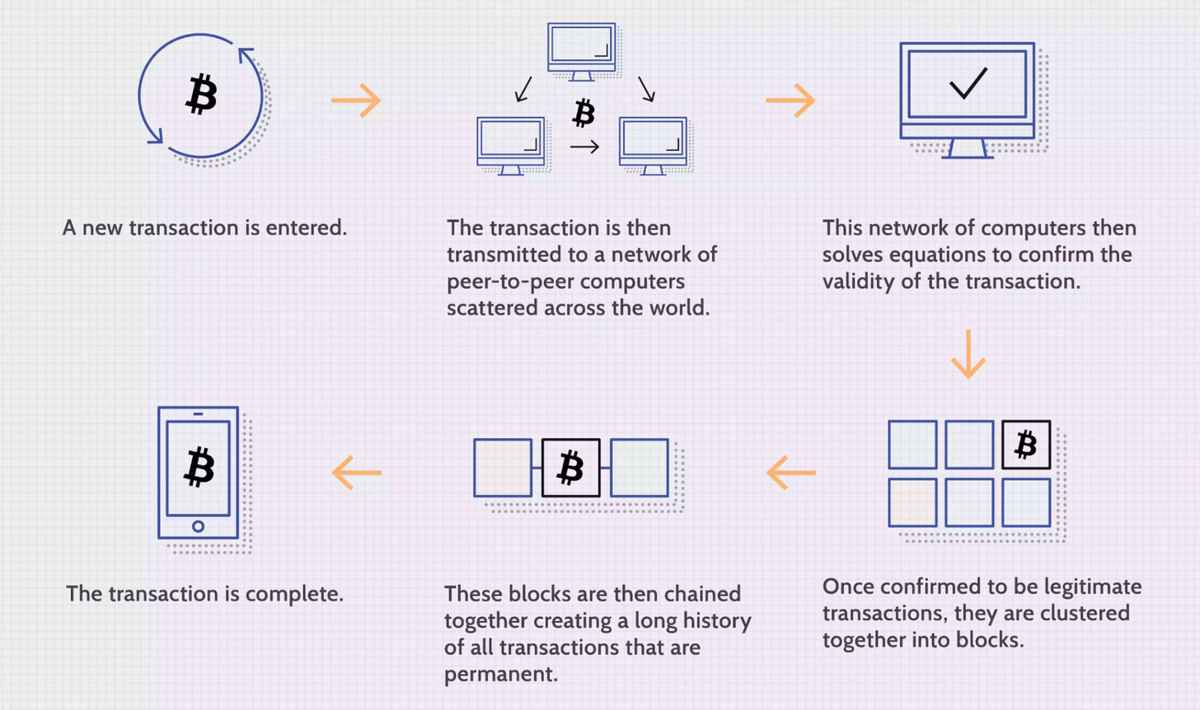

5. How does a Blockchain get into Consensus?

There are now over 11,000 computers around the world that have downloaded and run a Bitcoin node. About every ten minutes, a new block is added to the Bitcoin blockchain and becomes part of a permanent ledger, which records who owns what. There have been 690,000 blocks added to the Bitcoin blockchain since it began in 2008.

6. What is the Benefit of Using a Blockchain?

When information is stored on tens of thousands of computers instead of just one computer, it makes that information very hard to be destroyed or edited. By sharing data across a network of computers, blockchains allows Bitcoin and other cryptocurrencies to operate without the need for a central authority.

7. Will All Software Run on Blockchains Eventually?No, most software is better off running on centralized databases (as it is faster and cheaper to store and access data that way). However, for very important pieces of financial data like payments, loans, or asset ownership records decentralized blockchains present a much safer and secure method of reliably storing the data for the long term in a way that people can trust. Blockchains are also really good ways for storing voting, identification, supply chain and health records. If there’s a mission-critical need for security, reliability, trustability, or a need for data that cannot be censored by anyone, blockchains are a good tool to use.

PART 2 - Bitcoin

8. What is Bitcoin?

Bitcoin is digital money that is verified by a network of thousands of computers around the world that all validate that the information in the blocks about who owns what is correct. The creator of Bitcoin, Satoshi Nakamoto, set a limit that can’t be changed for the number of Bitcoin that can be created, which is 21 million bitcoin. He also referred to Bitcoin as “a new electronic cash system that’s fully peer-to-peer, with no trusted third party.”

9. How Does Bitcoin Use Cryptography & Blockchains?

For security, Bitcoin issues a public key and a private key for each holder. The public key is the address of the holder and the private key is needed to be able to access the funds held on that address. The creator of Bitcoin, Satoshi, decided to use elliptical curve cryptography to protect the private key. If you lose your private key, in most cases you won’t be able to access your Bitcoin ever again.

10. Why is Bitcoin “Mined”?

Bitcoin miners use their computers to validate that the information about who owns what is correct. The first computer to solve the math puzzle that proves that the status is correct gets issued a small amount of new bitcoin as a reward. This will continue until the year 2140. After that, the rewards for Bitcoin miners will only be from transaction fees and not from new bitcoins.

11. What does peer-to-peer mean?

Peer-to-peer (P2P) means that there is no central place that Bitcoin is stored and operates. It operates in a distributed manner across the world. Because of this, Bitcoin cannot be shut down or stopped.

12. What is a Halving?

About every four years the amount of reward that Bitcoin miners receive goes down by 50%. This last happened on May 10, 2020. It also happened on July 9, 2016. As of 2021, miners receive 6.25 Bitcoin for every block they successfully mine. This will be reduced to 3.125 in 2024.

13. Why Do Prices for Bitcoin Usually Go Up After Halving Events?

With less new Bitcoin supply coming onto the market each day from miners, there is lower supply readily available for sale, which often causes prices to rise. The July 2016 halving caused the value of bitcoin to rise during 2016 and 2017 and the May 2020 halving caused the value of bitcoin to rise during 2020 and 2021.

14. Why is Bitcoin Important?

Bitcoin helps people save in a way that their money can’t be inflated away or taken away. The current money system is set up by governments of nation-states who consistently increase the supply of their currencies. They create more money in order to reduce their own debt and hopefully to increase employment. But creating more money it makes the existing money worth less and soon causes important things everyone needs like homes, food, and gas cost more money. With Bitcoin there is now a trustable and neutral digital money that can’t be hurt by inflation.

15. What Is The Social Benefit of Bitcoin?

New money creation causes the wealthy who have investments like homes and stocks to get even richer as their investments increase in value while the poor have their minimal savings inflated away. Since Bitcoin has a fixed supply it isn’t really affected by inflation. Also Bitcoin and other digital currencies make it easy to send money instantly across the world at a very low cost -- making remittances cheap and easy -- which is very important for people in the developing world. Blockchains like Bitcoin are also extremely secure and hard to hack -- so the status of who owns what is protected over time.

16. Can You Ban Bitcoin?

No. Because it’s a decentralized network running all over the world, Bitcoin can’t be banned or stopped. While nations can ban themselves from using Bitcoin, that usually disadvantages those nations in the global economy. No countries in the world have banned Bitcoin holding. However China has recently begun enforcing a ban on Bitcoin mining. Countries that welcome Bitcoin and other cryptographic-based currencies and applications will have a much greater opportunity in the 2020s to establish themselves as centers of technology and innovation.

17. Does Bitcoin Use Energy?

Bitcoin uses energy, however it uses a lot less energy than gold mining and the traditional banking industry. There are very important current efforts under way to make Bitcoin computers use energy from renewable sources that don’t create carbon emissions. The problem isn’t Bitcoin mining, it’s coal mining. Fortunately we as a society are moving toward 100% renewables by 2035. That day can’t come fast enough!

18. When Do Most Analysts Think This Bitcoin Current 2021 Cycle Will Peak?

While nobody knows for sure, most experienced Bitcoin analysts including Willy Woo, Benjamin Cowen, Pantera Capital, and Rekt Capital believe that this cycle will last a bit longer than the 2016/2017 cycle and that Bitcoin should surpass the $100k level by the end of 2021. This would make Bitcoin worth about 20% of the market capitalization of gold at that time.

19. Will Bitcoin Ever Pass The Market Cap of Gold?

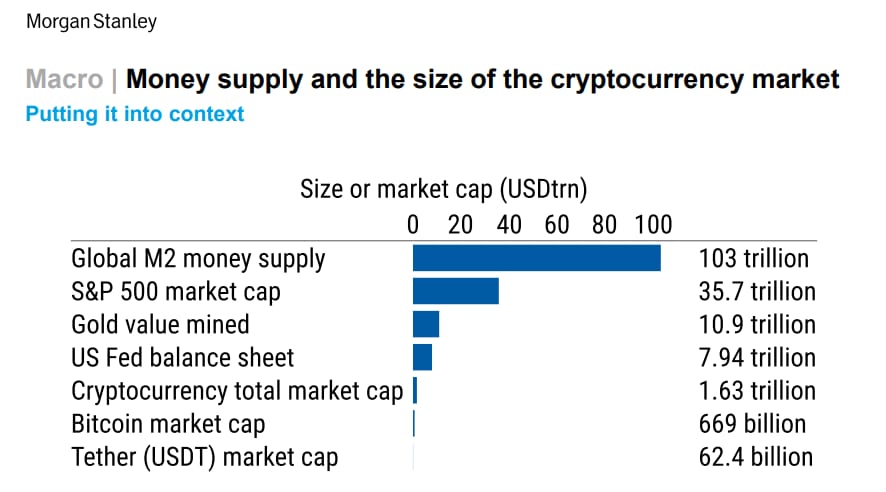

The total value of all the gold in the world is currently $11.3 trillion. Many believe it is inevitable that Bitcoin will eventually pass the value of gold. If Bitcoin were to reach a market value of about $550,000 it would surpass today’s market cap of gold. While nobody knows for sure, we believe this will happen around 2025/2026. The below graphic from Morgan Stanley shows that the value of Bitcoin is still well below the value of gold.

PART 3 - Ethereum & Smart Contracts

20. What is Ethereum?Ethereum is a blockchain-based software platform for creating and using smart contracts and distributed apps. Ethereum was founded in December 2013. The name of Ethereum’s cryptocurrency is called Ether (ETH). Ethereum has all the benefits of Bitcoin, but is also programmable, has smart contracts, and soon will have a lower net annual issuance that Bitcoin.

21. Why Has Ether Grown in Value So Much The Last Year?

Ether (ETH) is currently the second largest cryptocurrency based on its market capitalization, however it is the number one cryptocurrency based on the number of addresses who hold a positive balance, based on revenue generated, and based on the amount settled on the blockchain daily. Due to having smart contracts and soon a less inflationary monetary supply, some speculate that Ether could become the number one cryptoasset by value by 2025.

22. Will Ether Have a Better Monetary Supply Than Bitcoin in 2022?

Part of Bitcoin’s appeal is that its supply is fixed at 21 million. However, based on currently scheduled upgrades to Ethereum including EIP-1559 in July 2021 and the move to staking in early 2022, Ethereum will have a lower net supply issuance than Bitcoin in 2022. Bitcoin will have 1.7% new BTC mined in 2022 while Ethereum is on track to have a net issuance between -0.5% and 0.5%. Many believe this will be bullish for the Ethereum price in the 2nd half of 2021 and into 2022.

23. What is “Gas”?”Gas” is used to pay fees to put a transaction on the Ethereum blockchain. You use Ether (ETH) to pay your transaction fees. Recently is has cost around $15 in gas fees to perform a transaction on the Ethereum blockchain, like a token swap on Uniswap. A portion of this gas fee is burned with each transaction, in order to reduce the Ethereum supply.

24. What is a Smart Contract?

Ethereum was the first blockchain to offer fully functional smart contracts. Smart contracts are self-executing contracts with the terms of the contract between the buyer and seller written into the code. While smart contracts are very limited on script-based blockchains like Bitcoin, Ethereum allows the use of fully functional smart contracts. The entire global financial system is currently being recreated on top of blockchain-based smart contracts.

25. What is an Ethereum Virtual Machine?

The Ethereum Virtual Machine, or EVM, is a blockchain-based software platform that can run any type of computer application. It allows developers to create decentralized applications (Dapps) that execute their code within the decentralized network of computers. Developers value them for having no downtime and keeping data protected from unauthorized modification.

26. What is a Dapp?

A Dapp is a decentralized application that runs on top of a smart contract platform like Ethereum, Solana, Binance Smart Chain, or Polakdot. The top Dapps right now on Ethereum are Aave, Curve, Compound, and Maker.

27. What is Composability?

Because nearly all blockchain-based software is open source software with publicly available and transparent code, any new Dapp can utilize the function of an existing Dapp. Because developers can “compose” new functionality by using existing functionality, decentralized finance has what is called composability. Within the field, composability is known as “money legos” as you can build many different types of things with the same interoperable building blocks.

28. What Are the Most Promising Ethereum Smart Contract Competitors?

In our research we have found the following to be the most promising Ethereum competitors, in no particular order. None of these yet have anywhere close to the number of holders, node count (decentralization), or apps as Ethereum.

Polkadot (DOT)

Solana (SOL)

Avalanche (AVAX)

Luna (LUNA)

Mina (MINA)

Cosmos (ATOM)

Fantom (FTM)

Holochain (HOT)

Harmony (ONE)

Binance Smart Chain (BNB)

PART 4 - Exchanges, Wallets, & Stablecoins

29. What Are Centralized & Decentralized Exchanges?

A centralized exchange is a marketplace for buying and selling of cryptocurrencies and tokens. The top crypto exchanges in the world are: Binance, Huobi, Coinbase, Kraken, and FTX. Binace has the most volume with $16B per day of crypto traded. These exchanges use a central order book to directly match buyers and sellers.

Decentralized Exchanges (DEXs) like Uniswap, Sushiswap, Quickswap, and MDEX have no centralized order books and price token assets using automated market makers in which price fluctuates on a curve based on relative demand for a token. Uniswaps daily volume is now over $1B per day in trading volume (about 6% of Binance).

30. What is a Digital Wallet?A Digital wallet is a place you store your stablecoins and crypto assets. The most used wallet in the world today is Metamask. Metamask now has more than 5 million daily users. You can also store your stablecoins and cryptoassets on exchanges.

31. What Are Stablecoins?

Stablecoins are coins that are tied to the value of the U.S. dollar. The largest three stablecoins by value are Tether, USDC, Binance USD. As of writing there are $62 billion Tether (USDT) available globally, $26B USDC, $10B Binance USD (BUSD). There are also stablecoins tied to other currencies like the Euro (CEUR) and Singaporean Dollar (XSGD).

32. What Are Decentralized Stablecoins?

Decentralized stablecoins are stablecoins that do not rely on a trusted third party to maintain their value. The most successful decentralized stablecoins so far are Dai ($5B), Fei ($2B), and Terra USD ($2B).

PART 5 - Decentralized Finance (De-Fi)

33. What is Decentralized Finance (DeFi)?

The term DeFi, short for decentralized finance, was born in an August 2018 Telegram chat between Ethereum developers and entrepreneurs including Inje Yeo of Set Protocol, Blake Henderson of 0x and Brendan Forster of Dharma

Decentralized Finance is the term for all types of financial services that operate on top of blockchains. Many believe that by the end of this decade all of global finance will operate on blockchains, enabling instant global settlement and the use of smart contracts.

You can use DeFi tools makes it easy to get a loan or generate yield on your crypto investments using dapps like Aave, Compound, or Maker. While most DeFi today happens on Ethereum, there’s more and more defi happening these days on the Binance Smart Chain, Solana, and soon Polkadot.

Another competing name for decentralized finance was open finance.

Common applications that track your assets across DeFi tools include Zerion and Zapper.fi.

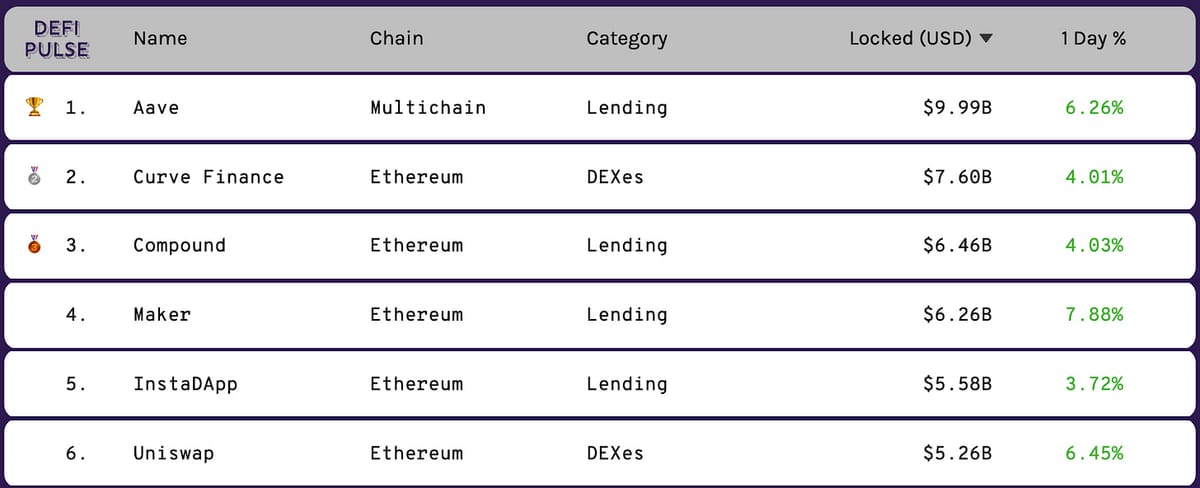

34. What Are the Top Decentralized Finance (DeFi) Applications on Ethereum?

Based on total value locked in the application, the top 5 decentralized finance applications on Ethereum are Aave, Curve, Compound, Maker, and InstaDapp:

35. What Are the Top Decentralized Finance (DeFi) Applications on Binance Smart Chain?

The top 5 decentralized finance applications on Binance Smart Chain are PancakeSwap, Venus, Ellipsis Finance, Belt Finance, and MDEX.

36. How Do I Make a Trade Using Uniswap?

Download and set up your Metamask wallet. Be sure to store your “secret recovery key” somewhere safe (like a physical safety deposit box or an actual safe in addition to a password manager tool like 1password). Then go to Uniswap.org and make your first decentralized exchange trade. With DeFi applications you often log into the application using your wallet such as Metamask, Trust Wallet, Argent, or Rainbow wallet.

37. How Do I Use DeFi to Get a Loan Against My Crypto?

You can get a low interest rate (5-8% per year) loan against your crypto collateral anytime you want on a centralized lending platform like Nexo, BlockFi, or Celsius or in a decentralized lending platform like Aave, Compound, or Maker.

38. How Do You Avoid Hacks and Rug Pulls?

New DeFi apps can get hacked from the outside or from have funds stolen from inside team members, which is called a rug pull. Our personal rule of thumb is to only use DeFi protocols that have been around at least a year and have had their smart contracts and code audited by a reputable auditor like Certik. And never put more than 5% of your total crypto portfolio a new DeFi protocol that hasn’t stood the test of time.

39. Are Decentralized Currencies Going to Replace Nation-State Currencies?Yes, we think so. We believe globally-neutral decentralized currencies that can’t be inflated will be used more than nation-state currencies by 2035. Nations that adopt and welcome the new global monetary system will prosper, while those who fight it and build their own closed networks will increasingly be cut off from innovation, technology, investment capital, and global commerce -- while stopping their citizens from accessible world-class financial services. The entire world of global finance is currently being rebuilt using smart contracts.

PART 6 - Other Important Crypto Basics

40. What is a Fork?

A fork is a copy of code. Since most blockchain-based applications use open source code, anyone can copy nearly anything. However if the majority of a community doesn’t follow after a fork happens, it is considered a failed fork. Failed Bitcoin forks include Bitcoin Cash (BCH) and Bitcoin SV (BSV). Failed Ethereum forks include Ethereum Classic (ETC). Don’t invest in failed forks as usually their future is very limited without community support or applications being built on top of them.

41. Will Staking Replace Mining?

Staking is a much more energy efficient form of providing security for a blockchain. Staking reduces electricity usage by over 99.95%. Ethereum is being upgraded to use Proof of Stake in early 2022. Stakers receive rewards for participating in network validation and security. Anyone can join a staking pool. Blockchains that use staking are called Proof-of-Stake (PoS) chains.

42. How Do I Get a Return On My Crypto Via Lending?

In addition to the returns from the change in market value, you can also earn 6-10% per year on your crypto through lending it out to others. You can lend out your crypto to others using Nexo, BlockFi, Celsius or Defi apps Aave, Maker, or Compound.

43. How Do I Get a Return On My Crypto Via Staking?

In addition to the returns from the change in market value, you can also earn 6-10% per year on your crypto by staking it. When you join a staking pool, you participate in the network security and transaction validation and earn a return from this service. You can stake your crypto on an exchange like Coinbase, Binance, Kraken, or FTX. You can also join a staking pool like Lido or RocketPool.

44. Which Popular Crypto Investments Can You Stake?

You can stake the popular cryptocurrencies like Etheruem, Cardando, BNB, and Polkadot, Solana, Tezos, and Algorand. It’s not possible to stake Bitcoin as Bitcoin uses the older Proof-of-Work model.

45. What is a VPN?

A VPN is a virtual private network. We recommend using ExpressVPN or NordVPN. These can be very useful when accessing an exchange that might not be available in the country your IP address is from.

46. How Do I Track the Value of My Crypto Investments Across Multiple Exchanges and Wallets?

Use Blockfolio or Coinstats.

47. How Do I Prepare my Crypto Tax Report?

Use a tool like TokenTax.

48. How Do I Avoid Scams?

In crypto to avoid scams, NEVER send money to anyone you don’t personally know. And definitely don’t send money to anyone that reaches out to you first. There are MANY people impersonating well known folks on Twitter, Instagram, Telegram, and Facebook pretending to be people they aren’t.

49. How Do I Avoid Losing My Money When Transferring Crypto?

When you transfer your crypto from one wallet or exchange to another, be sure that the address of the wallet you are transferring to is copied and pasted exactly correctly. If it’s not, your crypto will be sent to another wallet or a wallet that doesn’t exist and your funds are likely to be lost forever. Also be sure that your exchanges and wallets are using the same network. For example, last week a friend sent $71,000 of USDC from Metamask to Coinbase using the Binance Smart Chain BEP-20 network instead of the Ethereum ERC-20 Network. Coinbase doesn’t use the Binance Smart Chain network, so his funds were lost. Eventually more protections will be put in place to prevent against this type of easy error -- but for now be sure to double-check everything, especially on larger transactions.

50. What is an Oracle?An oracle is a piece of software that takes off-chain data (like weather, election results, stock prices, or cryptocurrency prices) and feeds it into blockchain-based applications and smart contracts. Examples include Chainlink, Band, and API3.

51. What is a Token?

A token allows you to do something within a network. Ether (ETH) allows you to perform many tasks within Decentralized Finance, for example. Tokens have value based on either their utility, their current cash flows, or their future cash flows.

52. What Makes A Token Worth Anything?

Fundamental value comes from either utility or a claim on current or future cash flows. A token only has actual long-term value if either:

It can be used to pay for something desired (buy something digital or physical)

It can be used to accomplish a desired task (get a transaction done on a blockchain)

A part of the revenues are used to buy back and reduce the supply of the token, creating a continual market demand for the token.

A part of the revenues are paid out to token holders as fees.

If none of the above exist, then a token doesn’t have any actual economic value, at least until the point when the token holders vote to provide cash flow to token holders.

53. What Are Some Example of Tokens That Provide Cash Flows To Holders Via Buybacks or Dividends?

Examples of tokens that already provide a portion of their cashflows to holders via either buybacks or on-chain dividends include Maker, Sushi, KuCoin, BNB, Nexo, and Kyber. Most tokens will have to eventually offer a part of their revenues to token holders, as without those the long term value of the tokens will be very low.

54. What is a DAO?

A DAO is a decentralized autonomous organization. DAOs are used to govern many dapps. A DAO is like a corporation -- but where the token holders are the voters.

55. What is an NFT?

An NFT is short for a non-fungible token. An NFT is a token that represents ownership of a digital asset -- like a piece of art, a game collectible, or a sports card. The most used NFT trading platforms are OpenSea, Rarible, and NiftyGateway. Many artists are publishing their art to the blockchain using NFTs, which provides the artist with lifetime royalties while providing the buyer with proof the art came directly from the artist.

56. What is The Metaverse?

The Metaverse is a collection of digital universes on platforms like Decentraland, BitCountry, Sandbox, CryptoVoxles, and AxieInfinity.

57. What is a Meme Token?

A meme token or dog token is a token with no supply cap and/or no actual utility or purpose that is designed to steal money from investors by using cute pictures of things like dogs (ex: Doge, Shibu Inu, Safemoon, Cumrocket) and by paying influential people to promote it on social media. They are created by scam artists who make millions of dollars promoting worthless tokens that then get dumped on the last ones in. Don’t invest in them as you are likely to get burned. A meme is short for a “memetic device” that makes something easy to remember.

PART 7 - How to Get Started In Crypto

58. What Are the Biggest Mistake People Make Who Are New To Crypto?

They trade too much. For most newbies, the best way to make money in crypto is simply to invest a little bit each week. Putting $100 per week automatically into Bitcoin and Ethereum on an exchange like Coinbase is a good strategy. The key is to decide up front that you will hold 10 years no matter what. If you buy and hold until 2030/2031 you are likely to do quite well.

59. How Do I Get Started Investing in Crypto?

Just open an account on an exchange like Binance or Coinbase, and start by buying some Bitcoin (BTC) and Ether (ETH). Once you’ve done that, start researching and looking into other really promising blockchains like Polkadot (DOT) and Solana (SOL) and consider studying some of the top dapps like Uniswap (UNI), Aave (AAVE), Maker (MKR), and Compound (COMP).

60. What Are The Best Crypto Podcasts To Learn More?

Subscribe to these ones, our own is included at the end:

I hope you’ve enjoyed this Crypto: Explain It Like I’m 5… let us know if you have any more questions or comments on our Telegram Channel.

Many people invest in cryptoassets without really understanding the world changing potential of the technology of blockchains and cryptography. Hopefully the above “Crypto ELI5” was helpful to you!

If you liked the above article, please pass it along to your friends.

Why A16Z’s $2.2B Crypto Fund is Actually a Really Big Deal

By Ryan Allis

The Perspective From Which I’m Watching America Evolve Into a Crypto-Friendly Country

I’ve had some really incredible opportunities the last fifteen years in getting to understand some of the inner workings of the U.S. government and Silicon Valley.

I was a Board Member of the United Nations Global Entrepreneur Council in Washington D.C. from 2009-2012.

I worked with the U.S. State Department in 2011 to mentor Egyptian entrepreneurs in Cairo.

I worked on the Obama Campaign in 2012 as a National Co-Chairperson for Technology with Marc Benioff of Salesforce and Reid Hoffman of LinkedIn.

I got an MBA from Harvard Business School in 2016 where George W. Bush, Mike Bloomberg, and Mitt Romney also got their MBAs.

I have either been the Founder, CEO or a Board member of tech companies providing email marketing and SMS marketing to presidential candidates during the last four U.S. Presidential elections (2008-2020).

I lived in Silicon Valley from 2012-2018 and have pitched many Sand Hill road venture capital firms. I even once pitched Marc Andressen inside the A16Z board room in early 2014 — they liked my presentation but said come back in 6 months when we had paying customers.

Having had these fantastic and eye-opening experiences, I’ve learned the importance of tracking and watching key moves at the intersection of technology, venture capital, and shifts in U.S. policy — especially when new industries that will power American innovation forward are formed.

In a dual-hegemonic world where China is more of the control state and America is more of the freedom state, it’s critical to watch and guide how the USA creates a policy environment that supports blockchain-based innovation this decade.

A16Z Announces a $2.2B Crypto Fund & Key Regulatory Hires

So whenever the world’s foremost venture capital and crypto fund (A16Z) raises a $2B+ crypto fund AND starts to bring in D.C. heavy hitters to help create a transparent and clear regulatory environment for blockchain-based startups and protocols, I sit up straight and start paying attention.

A16Z is up there with Sequoia, NEA, and Kleiner Perkins as the largest and most storied venture capital funds in business. The firm was founded in 2009 by Marc Andressen, who brought the web browser to the world by creating Netscape in 1994. Their biggest exits so far include Facebook, Airbnb, Asana, Box, Lyft, Coinbase, Slack, Instagram, and Pinterest.

And last week Andressen Horowitz (A16Z) announced the world’s largest crypto venture fund with $2.2B raised. This money is going to be used to invest in scaling up top crypto protocols and teams and for R&D for some of the top challenges in bringing crypto to the masses.

Creating Clarity in U.S. Blockchain Regulation

These moves really aren’t just about the money or the technology.

They’re also about the regulatory clarity for blockchain startups domiciled within or working with the United States.

A16Z announced the big raise with this statement,

“We believe that the next wave of computing innovation will be driven by crypto. We are radically optimistic about crypto’s potential to restore trust and enable new kinds of governance where communities collectively make important decisions about how networks evolve, what behaviors are permitted, and how economic benefits are distributed. That’s why today we’re pleased to announce a new $2.2 billion fund to continue investing in crypto networks and the founders and teams building in this space. This represents the beginning of an exciting new chapter for the a16z crypto team.”

They went on to state they are,

“Expanding our team to provide unrivaled regulatory and operational capabilities alongside our crypto-native data science and research services.”

This key statement is what caught my attention.

You see, when someone like Dr. Tomicah Tilleman joins Andreessen Horowitz as their Global Head of Policy to work on U.S. policy related to cryptographic assets and protocols, I take notice.

Dr. Tilleman has been working to bring open source technology into revolutionizing governmental institutions and who has Joe Biden’s trust and ear.

Per the A16Z announcement,

“Tomicah served as a senior advisor to now-President Joseph Biden and two Secretaries of State, as Hillary Clinton’s speechwriter, and has decades of experience at the highest levels of Washington and international policymaking. He was Chairman of the Global Blockchain Business Council and has held advisory roles with the United Nations, World Bank, World Economic Forum, and numerous blockchain companies. He’s an internationally recognized leader in applying new technologies to big opportunities.”

Dr. Tilleman will be supported in his work by new A16Z advisor Bill Hinman, formerly with the Securities and Exchange Commission.

“Bill Hinman is the former Director of the Securities and Exchange Commission’s Division of Corporation Finance. He spearheaded the SEC’s early work with digital assets, and made critical contributions that provided clarity to companies operating in the space. Bill will provide valuable insights to us and our portfolio companies as well as play a key role in shaping the future regulatory environment in which we and they operate.”

So when you have the former Director of part of the SEC and a leading tech connector within D.C. policy circles -- you’re clearly making a generational bet on crypto.

It’s good timing too — with former MIT blockchain professor Gary Gensler now leading the SEC.

These personnel moves can help form private-public partnerships that craft the guidelines that allow everything from stablecoins to DeFi and open finance to operate within the USA.

A16Z is Making a 15+ Year Bet

A16Z believes that decentralized computing is the 5th major computing wave, following Mainframes, PCs, the internet, and mobile. Here’s their published crypto investment thesis:

“Historically, new models of computing have tended to emerge every 10–15 years: mainframes in the 60s, PCs in the late 70s, the internet in the early 90s, and smartphones in the late 2000s. Each computing model enabled new classes of applications that built on the unique strengths of the platform. For example, smartphones were the first truly personal computers with built-in sensors like GPS and high-resolution cameras. Applications like Instagram, Snapchat, and Uber/Lyft took advantage of these unique capabilities and are now used by billions of people.

Blockchain computers were first proposed in 2008 by Satoshi Nakamoto in the Bitcoin whitepaper. Those original ideas have since been dramatically expanded by developers and researchers around the world. Blockchain computers are new types of computers where the unique capability is trust between users, developers, and the platform itself. This trust emerges from the mathematical and game-theoretic properties of the system, without depending on the trustworthiness of individual network participants.

Although the Bitcoin whitepaper is now more than 10 years old, we believe we are still early in the crypto movement. Crypto is purely a software movement and doesn’t depend on a hardware buildout, in contrast to, say, the internet, which required laying cables and building cell towers. Second, the space is developing extremely rapidly, partly because the code, data, and knowledge is largely open source, and partly because of the increasing inflow of talent.”

And just look at A16Z’s crypto portfolio. It’s clear they are in it for the long term, with investments in major crypto winners like Coinbase, Uniswap, Compound, Maker, Celo, Near, Filecoin, Arweave, and Avalanche.

Blockchain = A New Era of Computing

This industry isn’t about scamcoins and fly-by-night ponzi schemes (though those still exist and hopefully will soon be regulated away through industry and government coordination).

This industry is about bringing forth a brand new fundamental framework in computing--the type that only comes around every 15 years or so.

Yes, welcome to the 2020s -- the decade of decentralized computing.

1960-1975 - Mainframe Computing

1975-1990 - Personal Computing

1990-2005 - Internet Computing

2005-2020 - Mobile Computing

2020-2035 - Decentralized Computing

Welcome to the 5th major epoch of computing -- one that will ensure the global financial system is accessible to everyone.

Thanks to A16Z for leading the way.

What Morgan Stanley Thinks About Crypto

By Ryan Allis

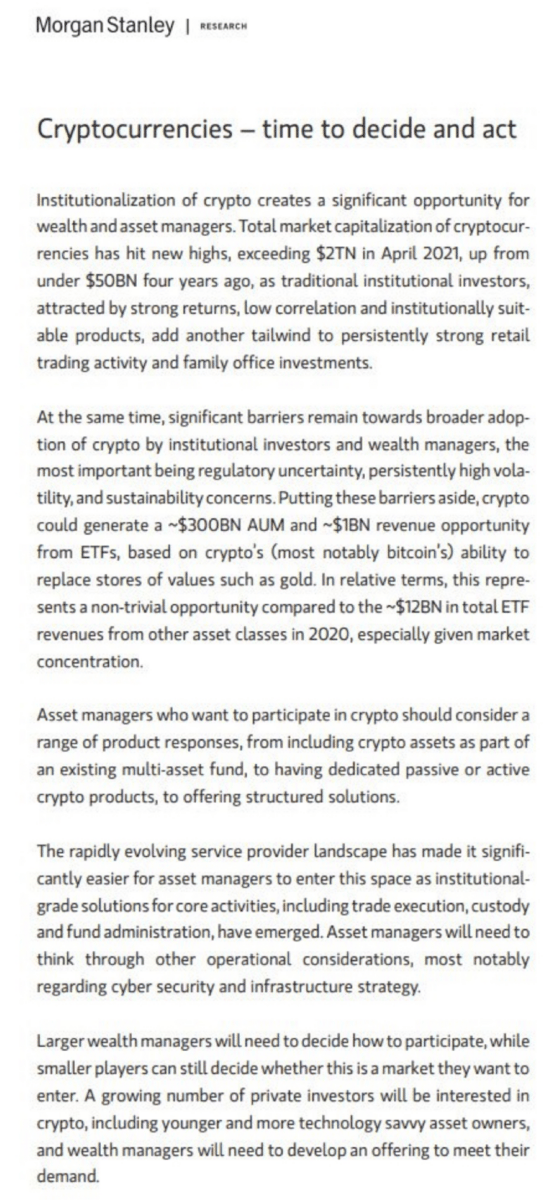

Morgan Stanley, which owns 28,200 shares of Grayscale’s Bitcoin Fund and recently co-led a $48M investment round to bring blockchain technology into traditional financial markets out out this research piece this week encouraging asset manager to “consider including crypto assets as part of an existing multi-asset fund.”

Morgan Stanley believes like we do that the “institutionalization of crypto creates a significant opportunity for wealth and asset managers.”

Let’s take a look at the full research piece.

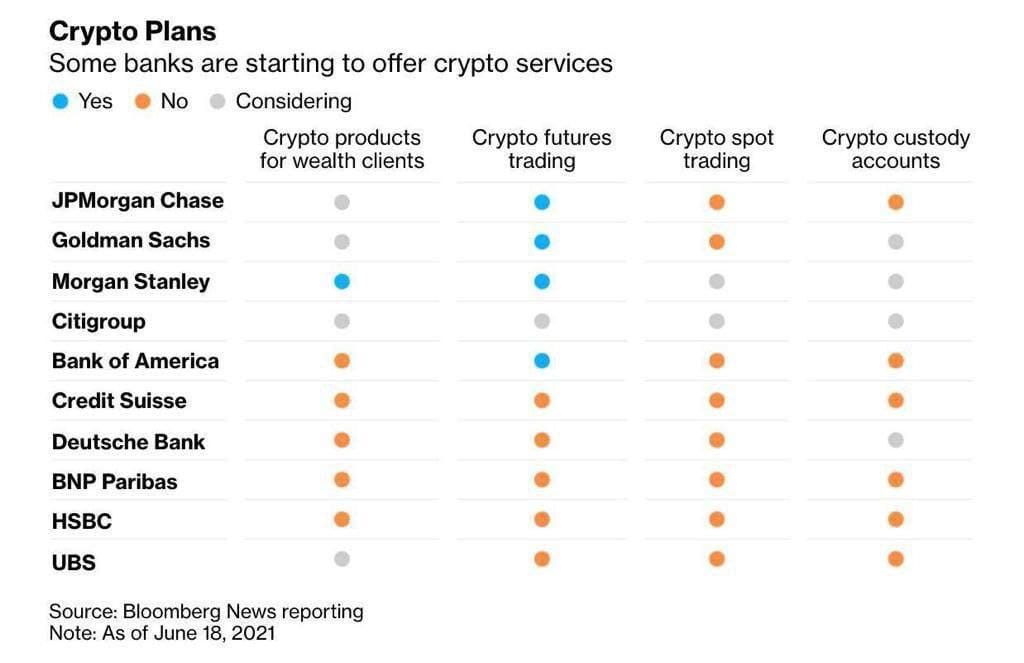

As you can see in the below table, JP Morgan Chase, Goldman Sachs, and Morgan Staley are in the lead within the traditional finance world with offering crypto offerings to their clients, with banks like Deutsche Bank, BNP Paribas, and HSBC still stuck with their heads in the sand.

We now have a new Coinstack podcast. Last week we published podcasts on Algorithmic trading and one on being at or near the crypto market bottom.

Episode 1 - Algotrading Crypto in Sideways Markets

Episode 2 - Are We Near the Bottom for Bitcoin and Ethereum? We Think So.

Right now each article is becoming its own podcast. I essentially read the article then add on to it at key points. I also plan to bring on guests within the crypto hedge fund, crypto venture fund, and DeFi space.

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends. So far we’re at 112 unique listeners and growing!

We plan to continue to publish 1-2 podcasts each week along with 1-2 substack issues.

Everything is on sale right now and from our vantage point, it’s a great time to buy.

If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be absolutely sure to include our top 5: ETH, DOT, KSM, RUNE, & NEXO. Here’s our top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short-term.

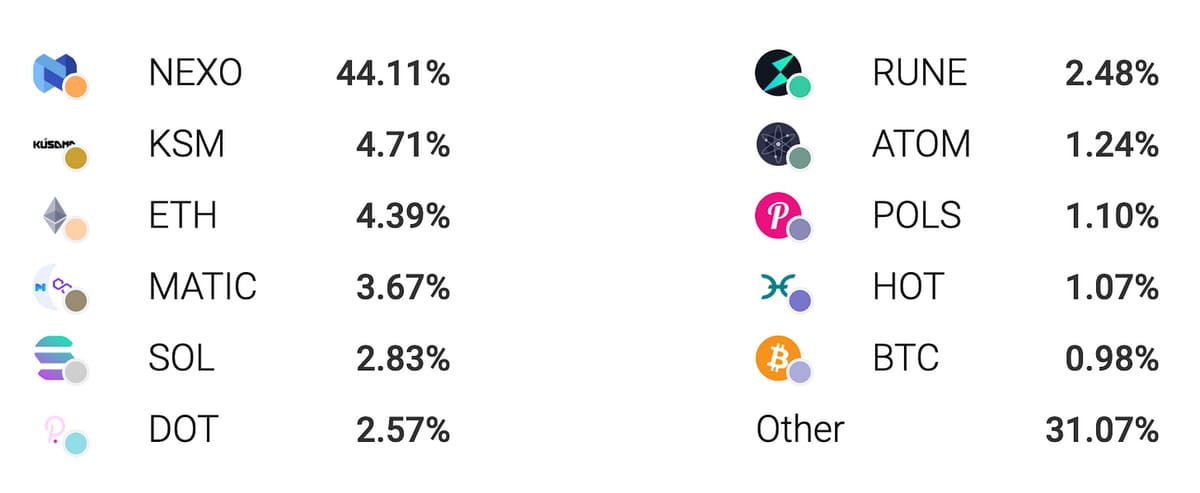

Here is the makeup of our current Coinstack Alpha Fund portfolio on Enzyme. I expect this portfolio to do very well the next 6 months.

And here is the current makeup of my personal portfolio:

Note that Enzyme doesn’t (yet) allow KSM, SOL, ATOM, POLS, or HOT tokens yet -- which is why there are differences.

Join Our Tuesday Crypto Community Zoom Calls

Every Tuesday Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 8:30am PT / 11:30am ET / 4:30pm GMT.

All buyers of Mrs. Bubble’s NFTs and investors in the Coinstack Alpha Fund are invited to join and ask questions and share learnings with each other.

Just buy any Mrs. Bubble NFT on OpenSea and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite.

You can think of buying the NFT as supporting beautiful joyous art AND a ticket into our community. We had 11 callers on last week’s call.

Join The CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1600 members on our Telegram.

The People We’re Following Closely on Twitter

How To Get Started With Crypto Learning

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at CoinStack.substack.com

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.