Issue summary: In this issue, we share what every financial advisor should know about digital asset investing going into 2022. We also summarize the most important crypto news, stats, and reports. Happy Thanksgiving to our readers in the USA.

In This Week’s Issue:

Crypto for Financial Advisors By Ryan Allis

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Podcasts

📈 Top 10 Performers

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

🏦 Crypto for Financial Advisors

By Ryan Allis

About the Author: Ryan is a Managing Partner at HeartRithm, a crypto quant fund, and the Publisher of Coinstack. He is providing this guide to help financial advisors get up to speed on the digital asset market.

I’ve spoken to quite a few financial advisors this year helping them get up to speed on crypto, and frankly, many have no idea what to make of digital assets.

I’ve been helping financial advisors understand the questions:

Are digital assets still speculative in nature? Or is there real value in digital assets? What drives their fundamental value?

Which types of digital assets should one consider? What does a good digital asset portfolio look like?

What % of overall net worth should an individual investor allocate to the digital asset sector?

To be honest, many financial advisors are still getting straight the difference between a metaverse (a borderless digital playground) and a metamask (the most used crypto wallet).

So I’ve written this guide to digital assets for financial advisors and wealth managers. Share it with yours!

While I am not a financial advisor, hopefully the below article will help provide more context and background on the crypto and digital asset market.

Below is what every financial advisor at UBS, Credit Suisse, Morgan Stanley, Charles Schwab, and similar firms needs to know.

Avoiding A Generational Mistake in Asset Allocation

First, it’s important to understand that not investing in digital assets in 2022 is like having a 0% allocation to internet stocks in 1997 -- a generational mistake.

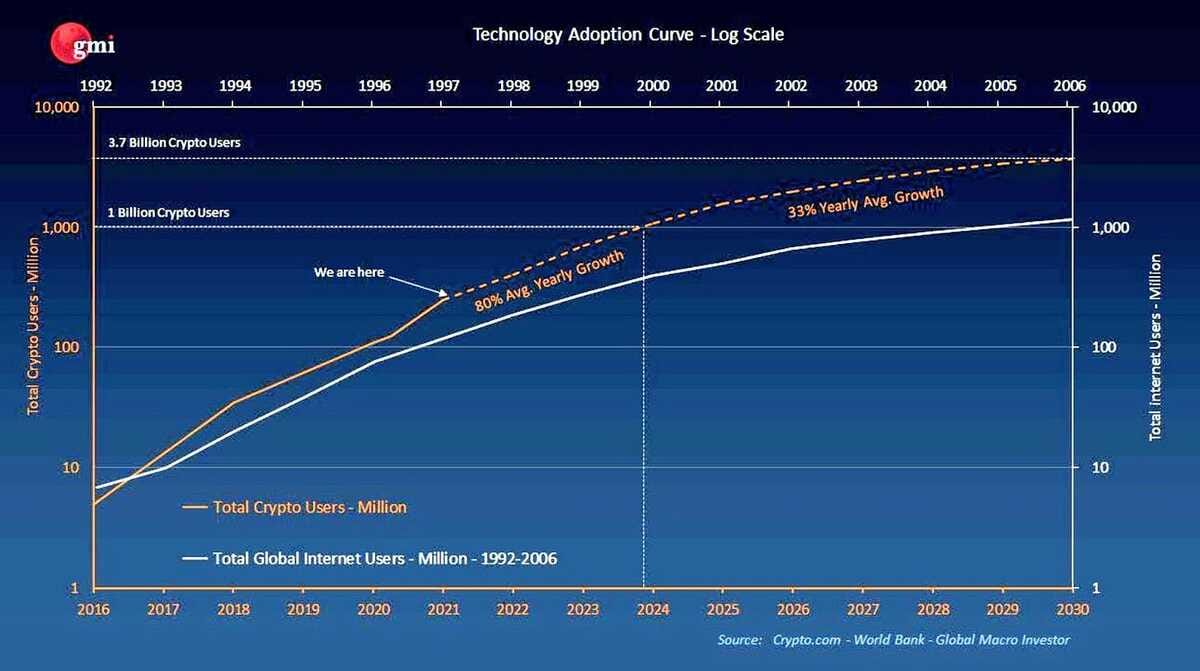

The user growth for digital assets is even eclipsing the user growth of the Internet. It took seven years for the internet to go from 100M to 1B users (1997 to 2004). Crypto is growing even more quickly and is on track to go from 100M to 1B users worldwide within just four years (2021-2024). See below…

Once you realize that smart contract platforms like Ethereum, Solana, Avalanche, Fantom, and Celo are technologically the foundation of the next generation of global financial services, and that their utility tokens are needed to be able to use their platforms, it becomes an obvious financial opportunity and meta-thesis for the next 10 years.

A Space That Can No Longer Be Ignored

Yes, going into 2022, every financial advisor now needs to have an understanding of digital assets. It is a now $2.5 trillion rapidly growing asset class, up from just $150B four years ago.

While this space could reasonably be ignored in 2017, Bitcoin is now the 9th largest asset in the world and Ethereum is the 15th largest asset in the world. It can no longer be written off as just a speculative field. There’s real innovative technology here.

Bitcoin is now worth more than Facebook and Ethereum is now worth more than JPMorgan Chase, the largest bank in the world. Read that sentence again and take it in.

Ethereum and its fellow smart contract platforms and DeFi dapps are the underlying technologies that will power most of global finance in ten years. And their utility tokens (aka digital assets) are needed to be able to use this new system and to govern where the value flows.

Think of tokens as the gas needed to drive a car — but instead of driving a car you’re interacting with financial services, Web 3.0 services, NFT platforms, and virtual worlds.

The Returns

Below are the actual returns over the past decade from investing in Bitcoin (BTC) and Ethereum (ETH).

Bitcoin has achieved a 175% CAGR for the last 11 years while Ethereum (ETH) has averaged a 291% CAGR since inception (2015-2021).

Yep, they have averaged triple digit annual returns.

Ethereum & Other Smart Contract Platforms

Ethereum, the smart contract platform that underpins most of decentralized finance, is growing even faster than Bitcoin -- as it actually has utility for software developers building the next generation of global finance.

The overall crypto market capitalization has grown from being worth $17.5B in 2017 to $2.6 trillion today, a CAGR of 330% in the last 5 years. This means that the digital assets outside of the blue chips of Ethereum and Bitcoin are growing even faster than the top two.

And newer smart contract platforms like Solana, Avalanche, Fantom, and Celo are growing even faster than Ethereum.

So if you’re still telling your clients to have 0% exposure to BTC, ETH, and other high quality digital assets you’re quantitatively failing them.

What Morgan Stanley Recommends...

According to Morgan Stanley’s 2021 report, “The Case for Cryptocurrency as an Investable Asset Class” adding 2.5% exposure to Bitcoin (BTC) the last seven years would have increased average portfolio annual returns without additional volatility or drawdown.

Now imagine if you would have added Bitcoin plus the better performing Ethereum -- and if you would have allocated 10% of your portfolio instead of 2.5%.

While past performance doesn’t guarantee future results, the reality is that investing in digital assets, smart contract platforms, and decentralized financial services is like investing in one of the biggest growth industries of the 2020s.

I liken it to investing in the personal computing sector in 1978. It’s a 10-15 year technology bet, similar to betting on Google at their IPO in 2004.

We recommend learning as much as you can about this quickly growing asset class. As a fiduciary for your clients’ funds, it’s essential. A good book to start with is called DeFi & The Future of Finance by Duke MBA Professor Cambpell Harvey.

While there is certainly greater volatility in the space as the market matures, there is no doubt that the average long term returns have been substantially higher than equities or bonds.

While there will be a lot of ups and downs along the way I expect the average annual return over the next 10 years in the digital assets space to be around 40%-50%, higher in 2022-2025 period and a bit lower in 2026-2031 as the space matures.

I get this by taking the total market cap for all digital assets ($2.5 trillion) and assuming this will grow to $100 trillion by 2032, giving a CAGR of 45%. Yes, I do expect digital assets to end up with a market cap north of $100T as all equities, bonds, and real assets are tokenized the next 10-15 years.

What Are The High-Quality Digital Assets to Consider?

Here at Coinstack, we recommend considering buying and holding for 10 years the following digital assets. Based on our research and analysis, every portfolio should at minimum have exposure to the below 20 tokens:

Smart contract platforms: Ethereum, Solana, Avalanche, Fantom, Terra, Polkadot, Celo

DeFi Leaders: Uniswap, Sushi, Compound, Aave, Maker, Curve, Yearn

Web3 Infrastructure Platforms: Chainlink, Theta, Filecoin

Exchange Tokens: Binance Token, FTX token

NFT & Gaming Platforms: Axie, Sandbox

The above are what I consider the Blue Chips of Digital Assets. The “IBM” and “Google” of the 2020s. There are many other high quality digital assets -- I’ve just named 20 of the biggest ones above for those just getting started.

Are there some you should avoid? You should avoid the following digital assets as they aren’t likely to hold their value over time:

Failed Forks With No Apps - Ethereum Classic, Litecoin, Bitcoin Cash

Memecoins with Little Real Value - Dogecoin, Shiba Inu

But Where’s the Actual Value in Tokens?

The fundamental value of investing in a company of course comes from the value of its cash flows. Shareholders receive dividends and the potential for an exit. If the value gets too low, other investors, or the company itself, will come in to buy up shares.

For tokens, the fundamental value comes from:

The utility of the token itself, which drives continual purchasing demand for it

The on-chain cashflows that go back to holders/stakers of the token (dividends)

The on-chain cashflows that go back to reduce token supply (buybacks)

This above statement is what the large majority of financial advisors and regulators STILL don’t understand. Many think that digital assets have no fundamental value and are purely speculative. However this is no longer true.

The Fundamental Value of Ethereum

Take Ethereum’s token, Ether (ETH), for example.

To use the Ethereum blockchain in the last 365 days, people have paid more than $7B in fees.

Today it’s up to $54M per day in fees, or a $20B per year run rate.

Those fees aren’t going to enrich a Private Equity Firm or a handful of shareholders.

Instead 100% of those fees are paid out to miners who provide network security or used to reduce the supply of Ethereum tokens (like a stock buyback).

Starting in Q2 2022 when Ethereum upgrades to Proof of Stake (PoS) 100% of the revenues will be paid out to stakers of the token (any holder can become an Ethereum staker at no cost using Lido or RocketPool for example and participate in validating transactions on the decentralized network) or will go to reduce the supply of the token.

Thus, there are real and meaningful cashflows coming to Ethereum token (ETH) holders -- and thus one can even do a DCF valuation for Ethereum (which by the way, gives an implied value of $14,256 per Ether token), more than 3x where we are today.

While every token has different token economics (or “tokenomics”) most tokens utilize some form of demand generation through utility, buy backs, or cash flows to stakers.

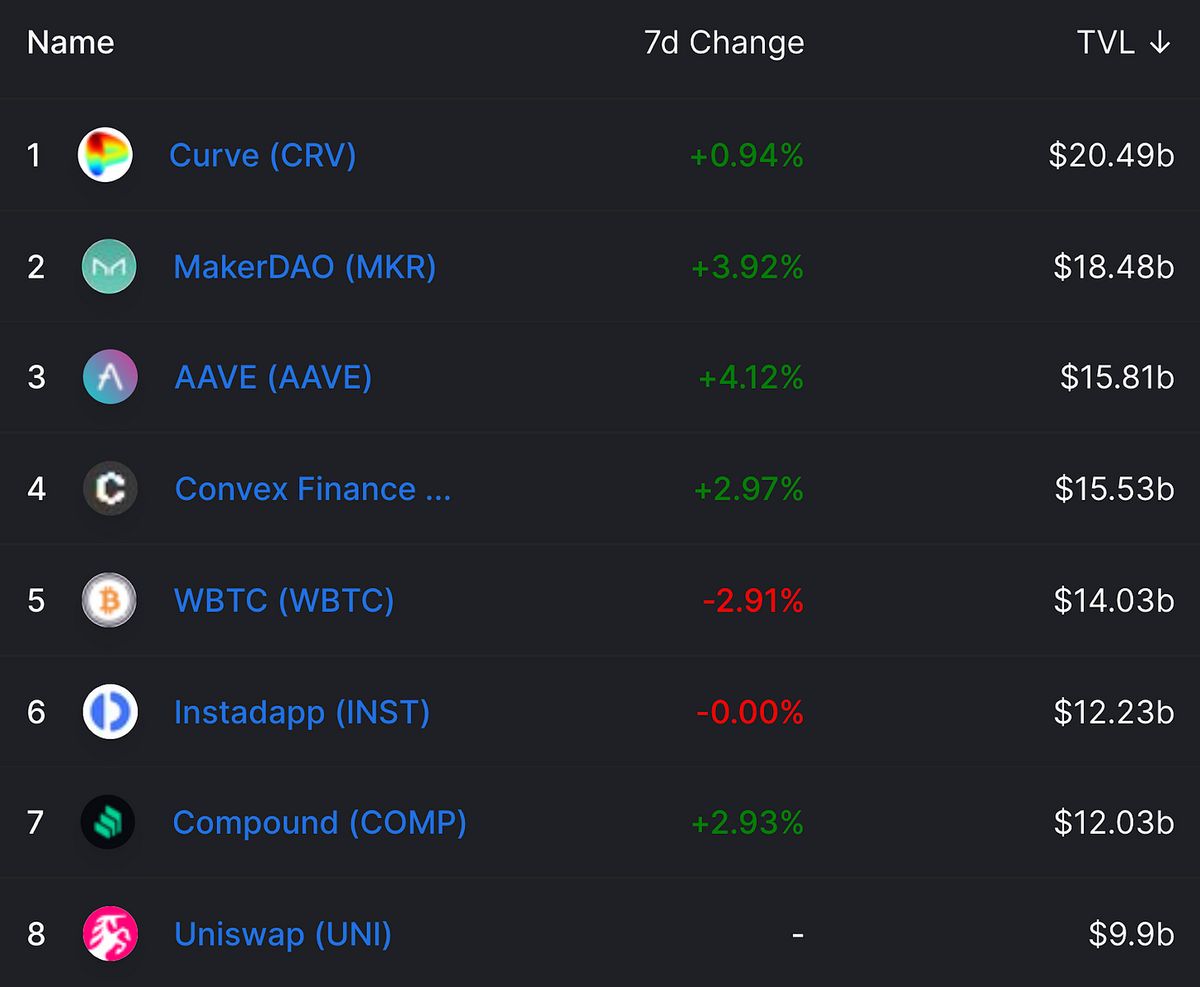

You can see the top smart contract based financial applications on DeFiLlama.com, which tracks the space. These applications currently have between $9.9B and $20.5B stored in their smart contracts.

In total, there is now more than $260B in total value locked in DeFi, up from just $20B in January 2021. This is a very rapidly growing space

Investing in Index Tokens For Broad Market Exposure

You can even invest in index tokens for broad market exposure.

The most well known index tokens for digital assets are:

DeFi Pulse Index - DPI

Metaverse Index - MVI

Bitcoin Ethereum & DeFi - BED

Total Crypto Market Cap Coin - TCAP

You could even create your own index token using Set Protocol.

Investing in A Crypto Fund

If you don’t want to do all the work to figure out the digital asset market, you can leave it to the professionals to do it for you. I’m a Managing Partner at a crypto quant fund called HeartRithm, and we’d be happy to help.

I wrote a full overview of the full crypto hedge fund ecosystem three weeks ago in Coinstack, including analysis of 35 different funds including:

Crypto Yield Funds

Crypto Quant Funds

Crypto Token Funds

Crypto Venture Funds

What % of An Investors Portfolio Should Be in Digital Assets

For investors who have a long time horizon (5+ years), I recommend putting in between 10% and 50% of ones total investment portfolio into digital assets, toward the lower end of the range for those who are more passive and conservative, and toward the higher end of the range for those who are tracking the space closely.

While you have to be willing to hold through inevitable 60-85% pullbacks if you can hold for at least 4 years you may do quite well.

As a note on timing, 2022 will be the 3rd year of the current Bitcoin cycle (2020 when the halving happened was the 1st year), and the 3rd year of each Bitcoin cycle has historically been the worst. So if you do allocate newly to the space, consider doing some now and also keep some dry powder on the side for after the next 50% pullback. That’s the best time to come in big from my experience.

Where Financial Advisors Can Learn More About Digital Asset Investing

Where can you learn more to get you ready for this decade of of rapid growth? We recommend looking at the Certified Digital Asset Advisor program. It is the only CFP approved certification for Continuing Education credits granted by the CFP Board.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚡ El Salvador Plans To Create a ‘Bitcoin City’ and Raise $1 Billion via a ’Bitcoin Bond’ - El Salvador plans to construct a “Bitcoin City” near a volcano that the cryptocurrency will fund, President Nayib Bukele announced Saturday. (Source)

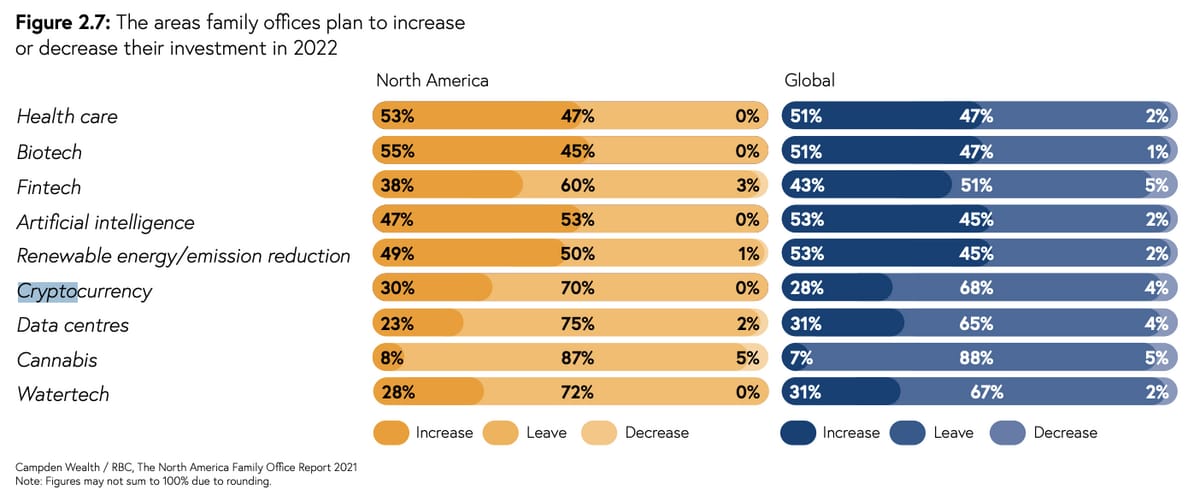

😮 Billionaires Own 4% of All Cryptocurrency Through Discrete Family Offices - Roughly one-third of family offices have invested in cryptocurrency in North America alone. (Source)

🏧 Binance Seeks Investments From Sovereign Wealth Funds - Binance is in preliminary discussions with “several” sovereign wealth funds about investing in its global entity, CEO Changpeng “CZ” Zhao said in an interview with the Financial Times. (Source)

💰 Binance Integrates Ethereum Layer-2 Protocol “Arbitrum” As Scaling Race Heats Up - Binance now supports Arbitrum deposits on its platform in a bid to remain the top crypto exchange in the world. (Source)

🤑 Citi Plans To Hire 100 Staffers for Beefed-Up Crypto Division - The bank has also named Puneet Singhvi as head of digital assets for its institutional client’s group starting Dec. 1. (Source)

🏦 Citadel CEO Kenneth Griffin Outbid ConstitutionDAO for a Copy of the U.S. Constitution - The 53-year-old billionaire paid $43.2 million for the historical document and planned to lend it to the Crystal Bridges Museum in Arkansas. (Source)

🇺🇸 The IRS Seized $4 Billion Worth of Bitcoin and Other Cryptos This Year - Between 2020 and 2021, the IRS seized around $3.5 billion in crypto, roughly 93% of all the funds seized by the tax agency. (Source)

🎆 Argentina Introduces a Crypto Tax Regime on the Back of El Salvador’s Bitcoin Story - Argentina has revealed a new crypto tax regime that would see all transactions charged a flat 0.6%. (Source)

📈 Crypto Fever: The Pressure Grows on Wealth Managers - Many advisers remain skeptical about digital assets, but some are forced to respond to client demand. (Source)

💳 Nigeria’s eNaira Stablecoin Becomes the Focus of the New IMF Report - IMF has revealed that Nigeria’s eNaira project is drawing interest from around the globe though it could still face some challenges. (Source)

💬 Tweet of the Week

😂 Meme of the Week

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Celo is fully compatible with Ethereum, so you can run smart contracts built in solidity. It uses proof-of-stake consensus, has high throughput, and five-second transaction finality. Celo is now the fourth fastest-growing blockchain in all of DeFi. Learn more about Celo and its family of stablecoins by visiting http://celo.org.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. The Bull Market Remains Intact With STH-LTH Cost Basis Ratio Maintaining an Upward Trend

2. DeFi Is Still <1% of Global Financial Industry With a $15T+ Industry Potential

3. 28D Trend Showing ETH Gas Fees Cheapest Between 6 Am and 11 Am EST

4. Boba Network Showing the Largest L2 TVL Change Over the Past Week With Over $800M in TVL

5. Normalizing BTC’s Volatility, a 12% Move-in BTC Would Be Equivalent to a 1.7% Move in the SPY.

6. Metamask Leads Top DeFi Protocols in Revenue With $200M in the Last 11 Months

7. Ethereum Burns Over 1M ETH ($4.2B USD) Since EIP-1559 Launching Roughly 4 Months Ago

8. Polkadot Remains Most Commonly Held Asset by Crypto Funds in Q3

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. 31% of Family Offices Currently Invest in Cryptocurrency

RBC Wealth Management provides trusted advice and wealth management solutions to individuals, families, and institutions. Their latest study shows cryptocurrency investments gaining traction, with nearly one-in-three family offices on board.

"Thirty-one percent of North American family offices and 28 percent globally currently invest in cryptocurrency, and another 30 percent and 28 percent, respectively, plan on increasing their allocations over the coming year. Achieving an average 2020 return of 40 percent across family offices worldwide, it is no wonder that over two-in-five family offices in North America agree that cryptocurrency is a promising investment."

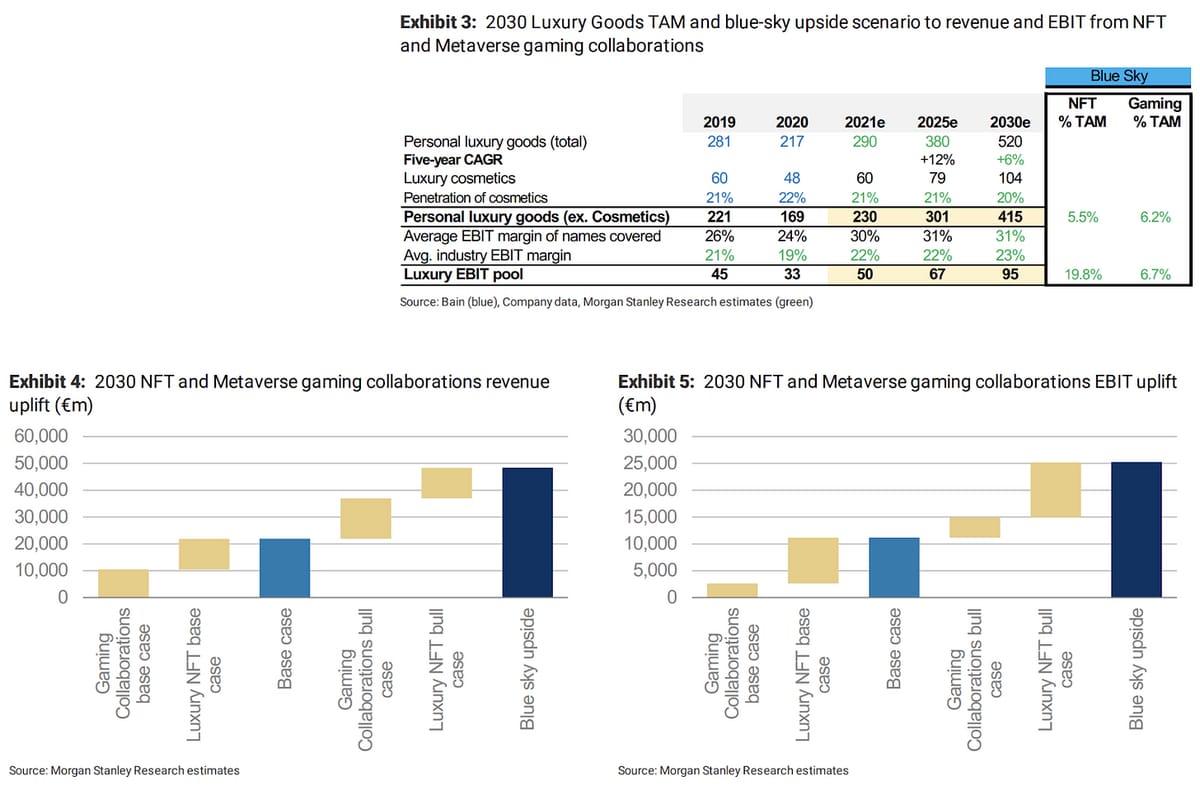

2. NFTs Could Constitute 10% of the Luxury Goods Addressable Market by 2030

Morgan Stanley estimates, €50bn revenue opportunity and a c25% uplift to the industry's profit pool through metaverse gaming and NFTs.

“However, as we discuss in Luxury Goods as NFTs and Luxury Goods in Social Gaming, the contribution to the industry's profit pool should be even greater given the inherent profitability of digital goods. In our base case, we model an ~€8.5bn (75% drop-through) and ~€2.6bn (25%) contribution to the industry profit pool by 2030, from NFT and social gaming, respectively. In our bull case, the contribution would be ~€18.5bn (90% drop-through) and ~€6.3bn (25%), respectively. Given that we estimate the personal luxury goods industry profit pool to reach ~€95bn by 2030 (vs.~€50bn in 2021), this implies ~12% potential upside in our base case (but 26% upside in our bull case). The key variables here will be not just the underlying growth in the market but also to what extent gaming/social interaction is done on decentralized blockchain platforms rather than closed platforms (e.g., Fortnite) and to what extent NFTs move from their current collectibles usage to be used on people's avatar.”

3. EIP-1559 Saved Users $844M in Transaction Fees

“The main benefit of EIP-1559 to users is accurate fee estimations. Instead of guessing the optimal fee for a transaction to be processed on Ethereum, users only specify their maximum willingness to pay. If a user overestimates what they think the base fee of the network is, the difference between their maximum willingness to pay and the base fee will be refunded back to their account. Users who do not specify a maximum willingness to pay to forfeit any difference from their fee payment and the base fee to miners through the priority fee.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like SAND, CRO, and AVAX had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Sandbox and Decentraland are metaverses, Loopring is a zkRollup, Gala is game.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 11,724 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.