Issue summary: In this week’s issue, we take a deep dive into the crypto hedge fund industry and look at which type of funds are best to invest in now as the bull market peaks. We also summarize and highlight the most important crypto news, stats, and reports — and celebrate Ethereum passing $4500 to a new All-Time High.

In This Week’s Issue:

Crypto Hedge Funds - An Ecosystem Map: By Ryan Allis

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Podcasts

📈 Top 10 Performers

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

🏦 Crypto Hedge Funds - An Ecosystem Map

By Ryan Allis, Managing Partner at HeartRithm & Founder of CoinstackFor the high net worth and institutional investors in our audience, here is an overview of the crypto hedge fund ecosystem.

A hedge fund is a private investment partnership that pools investor capital for accredited investors and institutions. You are essentially hiring experts to invest for you, and for that you pay a management and performance fee.

For many of the crypto funds mentioned below, the minimum investment is usually around $100,000 to $250,000. Many of the funds offer monthly or quarterly liquidity, except the venture funds which usually have 5-10 year lockups on each fund.

Below is a list of all the crypto hedge funds we know, split up into four categories:

Crypto Yield Funds - Invests in DeFi, arbitrage, and margin lending to generate positive yield at higher rates of return than corporate bonds or traditional fixed income, with low volatility. Often these funds can generate 15-25% returns per year in a market neutral way, allowing for safety during both bull and bear markets.

Crypto Quant Funds - Invests in crypto using algorithms and AI/ML to generate returns, often with high frequency trading. These are often highly volatile and affected by market conditions.

Crypto Token Funds - Invests in early stage token projects. These types of fund can offer high returns during bull markets but often achieves negative returns in bear markets.

Crypto Venture Funds - Invests in early stage token projects (in both tokens and equity). Has a 7-10 year lock up for their investors.

Here’s a map of the existing crypto hedge fund ecosystem.

Where We Are in the Current Cycle

Crypto markets have historically operated in four-year cycles, with crypto markets going up substantially in the 12-18 months following the Bitcoin halving. This has happened in 2012/2013 and 2016/2017 and now again in 2020/2021. The last halving happened in May 2020, so we may be coming to the end of this exceptionally bullish 18 month period over the next few months.

While some believe the current bull market will continue into a supercycle due to the level of institutional investing in the space today that wasn’t present in 2017/2018, others believe that after a blowoff top peak, 2022 will be more of a sideways to down year for crypto, similar to 2014 and 2018.

Thus, because of where we are in the market cycle, it may be good time to look into crypto yield funds that have positive returns in all market conditions and offer much higher yields than corporate or municipal bonds and usually with much lower volatility than traditional equities or crypto.

Crypto Yield Funds - Great for 2022

These types of funds are especially good to invest in when you want to protect your downside and generate positive returns while protecting yourself from a potential bear market. You may want to explore shifting funds into these types of funds when the bull market cycle is about to peak (which I expect to be happening over the next 2-4 months). Crypto yield funds are often a great alternative to traditional fixed income, often offering ~2-3x the rates of annual return with similar volatility.

HeartRithm’s HeartFund - Invests in DeFi yield farming, DEX liquidity, and margin lending to generate low volatility market neutral returns, with a major social impact mission (I work with this firm as a Managing Partner).

BlockTower Gamma Point - Invests in futures arbitrage, perpetuals lending, and hedged yield farming to generate market neutral returns.

TCM Digital Asset Income Fund - Invests in stablecoin DeFi yield vehicles and targets 15% net returns.

Digital Assets Capital Markets - Market Neutral Fund - Uses lower-risk, market-neutral futures, options and liquidity strategies and provides liquidity to select decentralised finance (DeFi) platforms.

ARCA Digital Yield Fund - A crypto yield fund offering around 12% annual net returns, with low volatility

Diffuse StableFi - A crypto yield fund generating yield on stablecoins

Crypto Quant Funds

These types of funds invests in crypto using algorithms and high frequency trading and have higher volatility. Many do well in bull markets and then not so well in bear markets, unless their algos have been trained on the market conditions seen in 2018/2019.

Ledger Prime - Derivatives market makers, early stage VC and DeFi investments, and arbitrage, momentum, and options trading.

Galois - OTC Trading and Algorithmic Market Making in Crypto

Nibbio - Crypto quant trading firm

Kbit - Systematic, quantitative, high-volume trading of cryptocurrencies

Orthogonal Capital - Arbitrage and options crypto quant fund

Coincident Capital - Long/short crypto investing fund using momentum strategies

Radkl - Crypto quant fund doing market making for major tokens, arbitrage across blockchains, and algorithmic trading.

Temple Capital - Fully systematic long short crypto investing strategy with nearly $25B traded, with decades of experience in time series research, engineering and data science from Google to Point72.

DFI Labs - French crypto quant fund using AI and big data

168 Trading - Gibraltar based crypto quant fund using arbitrage, futures, and overnight funding

BKCoin - A crypto quant fund doing market making and exchange arbitrage

FolkVang - A crypto quant fund and liquidity provider

Gattaca - UK-based crypto quant fund that provides capital to decentralized networks and exchanges

MGNR - Systematic proprietary trading firm that uses innovative quantitative research and rigorous engineering to capture trading opportunities (not open to outside capital)

Auros - Hong Kong based crypto prop trading firm (not open to outside capital)

Crypto Token Funds

Private investments in digital assets before they are tradeable on exchanges. These types of funds are great to invest in during the beginning or middle stages of a bull market. These types of funds can have returns of 300%+ during bull market years and losses of 50%+ during bear market years.

Pantera Liquid Token & Early Stage Token Fund - Offers a liquid token fund and a private token fund with quarterly liquidity.

ARCA Digital Assets Fund - A long-focused special situations strategy focused on capturing alpha in small and mid-cap digital assets

DeFiance Capital - Invests in DeFi tokens with superior value proposition vs incumbent traditional finance, visible product-market fit, and clear token value accrual

Digital Asset Capital Management (DACM) - Long exposure to the rapidly evolving digital asset sector through a high conviction portfolio of liquid digital assets across both large and smaller cap opportunities and flexibility to invest in select early-stage, illiquid, financing rounds.

Grayscale - Maintains token funds for Bitcoin, Ethereum, and around 15 of the top digital assets.

Galaxy Digital - Led by macro investor Mike Novogratz, the firm holds multiple index and long exposure funds

Crypto Venture Funds

Private investments in digital assets before they are tradeable on exchanges or in the underlying equity of the company. These types of funds often have 5-10 year lock ups for investors, so require a long-term multi-cycle approach. The difference between a token fund and a venture fund in our definition is longer lockup period and lack of liquidity for venture funds.

A16Z Crypto Fund - Invests in both tokens and equities. The largest fund in the business with $2.2B in AUM.

Blockchain Capital - San Francisco based crypto venture fund with $1.5B in AUM

Paradigm - Invests in disruptive crypto companies, protocols, and currencies

MultiCoin - Invests in liquid crypto assets and equity and tokens for pre-launched projects. Focused on open finance, web 3.0, and global state-free money.

Three Arrows Capital (3AC) - A crypto venture fund investing in L1 blockchains, DeFi, NFTs, and other crypto funds

Pantera Venture Fund - Focused on early stage venture equity investments in the blockchain space

Polychain Capital - Actively manage global blockchain assets to achieve exceptional returns for our investors

Framework Ventures - A thesis-driven venture capital firm whose team partners with founders to build token-based networks

If you’re an accredited investor or qualified purchaser and want to learn more about, work with, or invest in any of these funds, you can reach out to them via their websites.

On-Chain Funds

While these aren’t technically hedge funds, these are a few of the unregulated on-chain funds that use smart contracts to pool capital and then invest them into either tokens or DeFi yield strategies.

Enzyme - On-chain fund app with $160M in AUM

DHedge - On-chain fund app with $25M in AUM

IntoTheBlock - On-chain app that invests institutional capital into various leveraged DeFi yield strategies using smart contracts.

While digital asset markets may continue to expand next year due to the level of institutional investment and technological development that didn’t exist during the last major crash in early 2018, there is a sense that after an incredible 2020 and 2021, that 2022 may not be as bullish. Thus, it’s a good time to look into crypto yield funds and quant funds that perform positively in all market conditions.

To learn more about HeartRithm, the crypto yield, DeFi, and quant fund I work with, please reach out to me at [email protected].

Who Did We Miss? If we’ve left your crypto fund out of this ecosystem map and you’d like to be considered for our next review, please feel free to email us additional information.

About the Author: Ryan Allis is a Managing Partner at HeartRithm, a crypto DeFi and quant fund with a big social impact mission as well as the founder of Coinstack.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚡CME Introduces Micro Ether Futures As ETH Reaches ATH Above $4.5K - Micro Ether futures will become CME's fourth crypto derivatives product and is expected to be launched on Dec 6. (Source)

😮 Biden Administration Targets Stablecoin Digital Currency for Banklike Oversight - A Treasury-led panel asked Congress to set up a regulatory framework to address growing risks. (Source)

🏧 Financial Action Task Force Releases Finalized Crypto Guidance - The Financial Action Task Force has released revised and finalized crypto guidance, containing clarifications on who falls under its recommended requirements. (Source)

💰 Ethereum (ETH) Just Hit One Week of ‘Negative Issuance.’ - Following the successful Beacon Chain upgrade and the new ATH, the Ethereum network reached another major milestone. (Source)

🤑 Facebook Goes All In on Metaverse With New Company Name Meta, NFT Push - Facebook goes Meta as it showcases its vision for the future of social media, work, and play online. (Source)

🏦 Avalanche Launches $220 Million Crypto Growth Fund Targeting DeFi and NFTs - The Avalanche Foundation has launched a new fund dedicated to the development of the Avalanche blockchain’s ecosystem. (Source)

🇺🇸 U.S. Feds Freeze 10 Bitcoin (BTC) in Connection to $10 Million Scam on Coinbase - A Coinbase user who fell for a notification scam could be on the way to recovering his stolen asset as the court has approved to freeze the funds. (Source)

📈 Nike Trademark Applications and Job Postings Hint at Joining the Metaverse - Unlike reported issues with the company's physical shoe supply, virtual sneakers may not be limited by real-world problems stemming from the pandemic. (Source)

🎆 Ethereum Settled Over $500 Billion Worth of Transactions in Q3 - The Ethereum ecosystem has recorded substantial growth in its new Q3 report has the network settled over $500 billion worth of transactions. (Source)

💳 Nigeria Ranks Ahead of U.S., Others in Crypto Ownership. Bitcoin Remains Hot Favorite - According to research by Finders, over 50% of crypto holders in Nigeria are, in fact, Bitcoin Hodlers. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

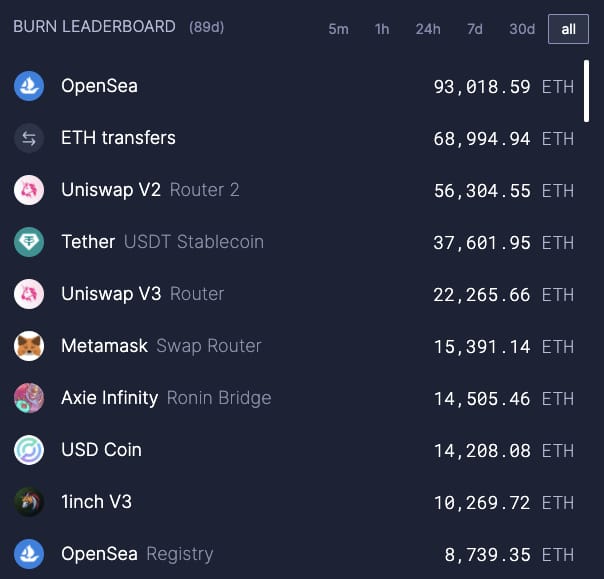

1. 3-Months Post EIP-1559, NFTs Continue To Lead ETH Burn With Over 93k ETH

2. 1.4M BTC Is Being Held on the Major Exchanges or About 7.7% of the Total BTC Supply

3. MANA, Decentraland’s Token, Had a 200% Price Surge Since FB “Meta” Rebranding Announcement

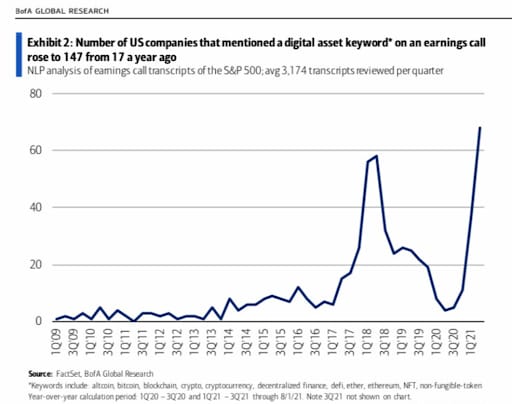

4. Public US Companies Mentioning Digital Asset-Related Keywords Reached an ATH, Signaling Bullish Demand for Blockchain Technology

5. Arbitrum Maintains Its Top Spot for TVL ($2.8B), but Optimism Has Seen the Largest Weekly Growth (+66%) Over the Past Week, Surpassing $450M

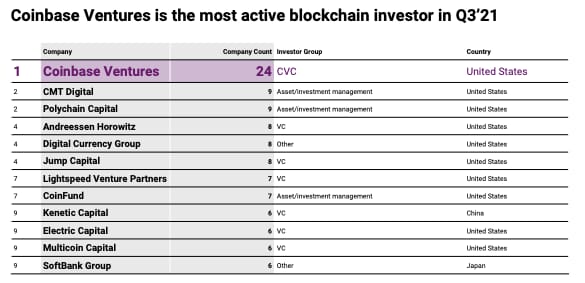

6. Coinbase Ventures Becomes the Most Active Blockchain Investor in Q3’21

7. Total TVL Reaches a New ATH of $253B This Week

8. Ethereum Q3 2021 Report Card: DeFi TVL Increased 13x YoY While Revenue Increased 5x

9. Instigation Protocol Shares Their Mental Model for Web 3.0

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. President’s Working Group on Financial Markets

The Biden Administration published its long-anticipated stablecoin report, confirming that the President’s Working Group on Financial Markets recommends that Congress enact a law to treat stablecoin issuers like their banks.

"To address prudential risks associated with the use of stablecoins as a means of payment, the agencies recommend that Congress act promptly to ensure that payment stablecoins are subject to appropriate federal prudential oversight on a consistent and comprehensive basis. Because payment stablecoins are an emerging and rapidly developing type of financial asset, legislation should provide regulators flexibility to respond to future developments and adequately address risks across a variety of organizational structures.

Legislation should address the risks outlined in this report by establishing an appropriate federal prudential framework for payment stablecoin arrangements.29 In particular, with respect to stablecoin issuers, legislation should provide for supervision on a consolidated basis; prudential standards; and, potentially, access to appropriate components of the federal safety net. To accomplish these objectives, legislation should limit stablecoin issuance, and related activities of redemption and maintenance of reserve assets, to entities that are insured depository institutions. The legislation would prohibit other entities from issuing payment stablecoins. Legislation should also ensure that supervisors have authority to implement standards to promote interoperability among stablecoins."

2. In Q3 VCs Invested Record $6.5B

Market intelligence firm, CB Insights, released their Q3 crypto fundraising report showing 286 crypto deals recorded, down slightly from the 291 in the second quarter.

“In our State Of Blockchain Q3’21 Report, we dig into global investment trends to spotlight takeaways including:

A record-shattering year for blockchain/crypto financing, already up 384% vs. 2020

Top equity deals of the quarter, including 6 of the top 10 raised outside the US

The new unicorns of Q3’21 and where the total blockchain/crypto unicorn count stands

The investor making the most blockchain/crypto deals

Which blockchain category had the biggest funding quarter

The category that has seen a funding increase of over 6,000% compared to 2020”

3. Parachain Crowdloan Returns

Parachain Auctions — What We’ve Learned, Oct 27, 2021Hypersphere Ventures is a Polkadot ecosystem venture firm that has led the seed rounds and advised eight out of the first eleven parachain auctions. In their latest report, they detail what they have learned.

“While we analyzed a number of different metrics here, more than anything, we found that the projects with the most community mindshare going into the parachain auctions were generally the most successful in raising KSM. As time goes on and more parachains are launched, we will have more data to work with and will likely be able to draw more significant conclusions. We expect future projects also to have less of a first-mover edge, and thus the project’s technical solution, incentives/implied valuation, and community will be more instructive, which parachains will be most popular.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

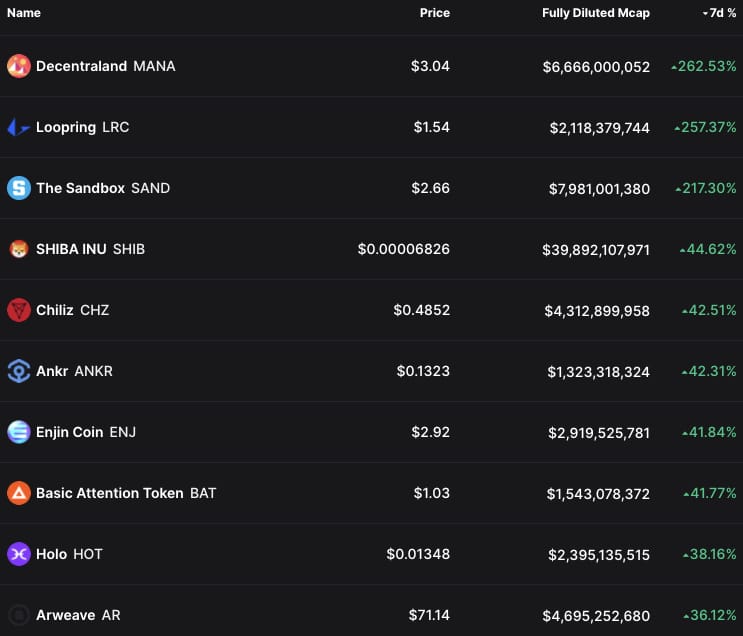

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like MANA, ENJ, and AR had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Shiba Inu is a meme coin, Loopring is a zkRollup, Decentraland and Sandbox are metaverses.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 9,059 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

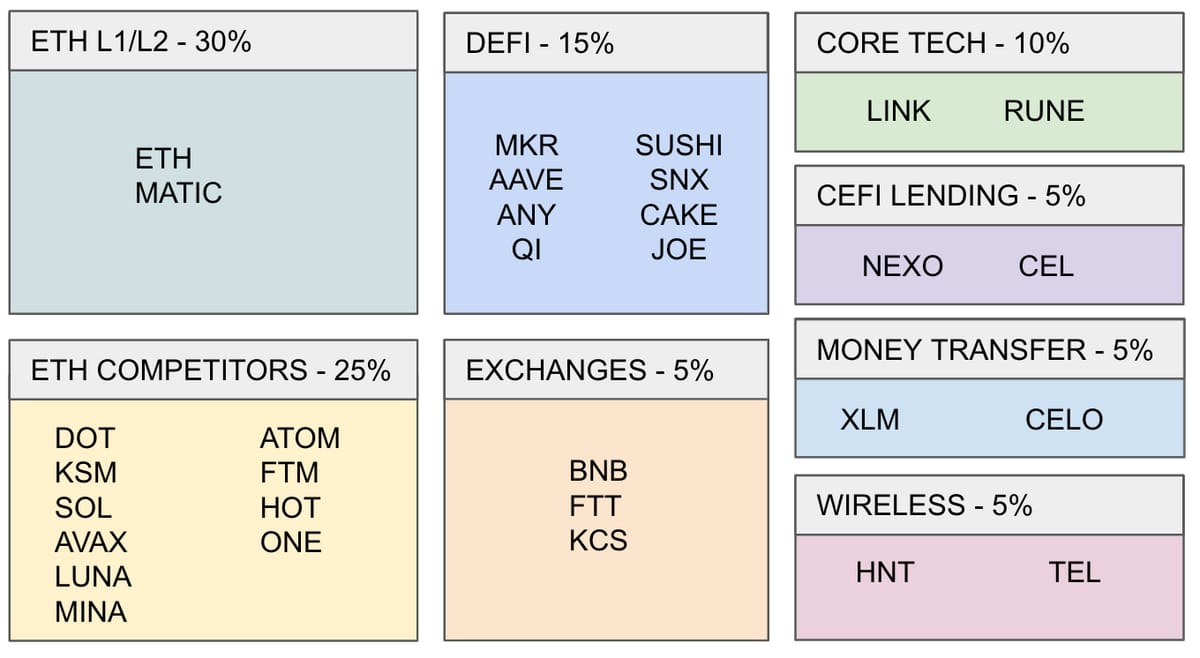

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.