This week we have a special edition in which I explain my strategy for investing in promising crypto projects during the next six months of this bull market cycle. Join our Telegram group here.

The Strategy: How I Made 161% The Last 30 Days Through Crypto Investing

One month ago on January 26, 2021 I decided to conduct a 30-day crypto investing experiment to see what I’d learn.

I’d been investing in only Bitcoin and Ethereum on Coinbase like a newbie and I wanted to be a little more adventurous for 30 days to see what would happen.

So after some in-depth research, I decided to take $250k of my own money and invest it in a mix of 25% Bitcoin, 25% Ethereum and 50% other high-growth projects. I took the plunge.

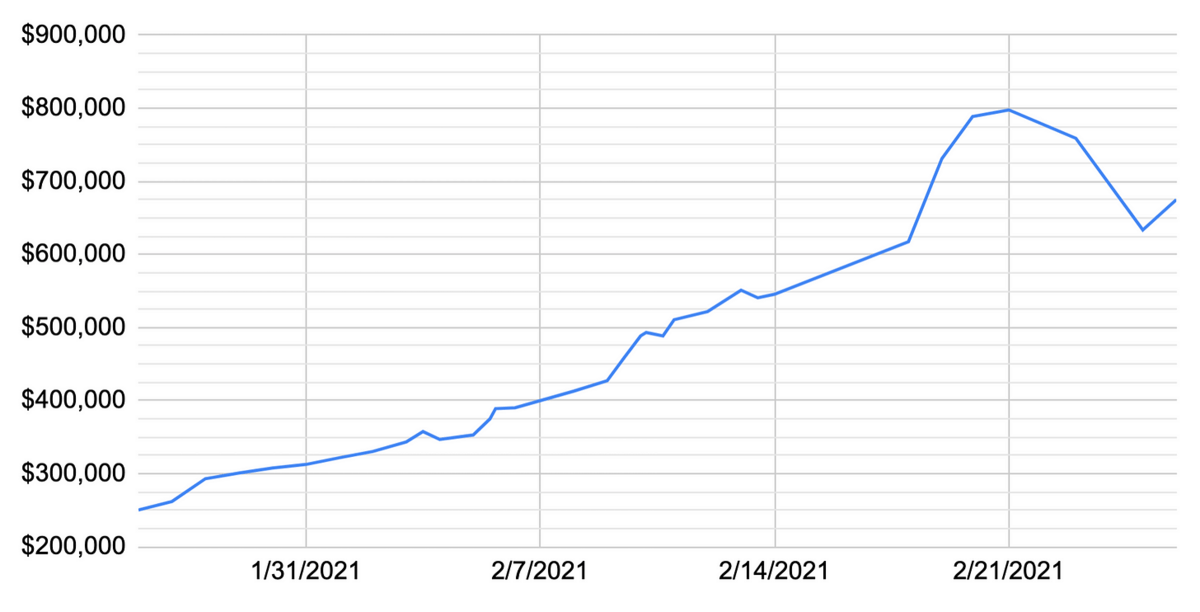

What happened? In the last 30 days my original $250k investment turned into $653k. As of today, I’m up $403k in thirty days for a one month return of +161%. Below is the actual daily chart for my portfolio value the last 30 days.

You can see my crypto portfolio reached a peak value of $800k on Feb 21 before a pullback the last five days as Bitcoin and Ethereum had a minor 15%-20% correction.

During this 30 day period (Jan 26-Feb 25), Bitcoin increased in price by 51%. So the investment strategy I used outperformed Bitcoin by 110%.

I was actually surprised by how well it performed.

In terms of Bitcoin, I turned 8.23 Bitcoin on January 26, 2021 into 13.34 Bitcoin on February 25, 2021.

So, how in the world did $250k turn into $650k in 30 days? Let’s take a closer look.

My strategy combined investing in Bitcoin, Ethereum, Polkadot, Nexo, and a number of promising up-and-coming blockchain projects -- using an approach I call “Crypto Venture Capitalist” -- investing in 20-25 fast-growing small cap projects each week with 25% of my total portfolio value. I also used Nexo to take a 6% annual interest rate loan against half of my crypto holdings, enabling me to invest more than I would have been able to otherwise.

I’m writing this extensive guide about what I learned because I am passionate about helping others invest in crypto--which I believe is the best overall investment sector for the 2020s.

If you read this guide in full (perhaps twice), I think you’ll get a lot out of this. My hope is that in some positive way, it changes your life. I care a lot about educating the “regular person” about crypto investing.

Passive vs. Active Crypto Investing

Everyone reading this should know there’s a tried and true path to crypto investment growth... just buy and hold for the long term. In other words, passive investing.

Buy now and hold for 10-15 years and you will likely do very well. I preach this as often as I can. This is the best strategy for most people -- who don’t want to become active investors.

So at the end of this post think to yourself:

Do I want to become an active investor and try to beat a simple portfolio of BTC, ETH, and DOT or…

Do I want to take a passive approach and just invest in BTC, ETH, DOT?

Because Bitcoin is worth $50k today and is likely to be worth roughly $500k+ by 2025 as Bitcoin inevitably becomes worth more than gold ($11 Trillion), it’s a no-brainer that if you just buy and hold Bitcoin, Ethereum, and Polkadot (my three favorites) for 10-15 years you’ll likely do very well.

Bitcoin is at least 10x better than gold at doing what gold does (stores value over time in a money supply that can’t be inflated) -- and will almost certainly become worth more than gold this decade (with some ups and downs along the way of course).

This long-term buy and hold BTC, ETH, and DOT strategy is simple, easy, and can be done on autopilot. For most people, this is the easiest path.

I call this the “set it and forget it” approach. Anyone can simply buy 33% BTC, 33% ETH, and 33% DOT -- automatically invest a bit more every week using dollar cost averaging, tune out all the short term noise, hold for 10 years, and do extremely well.

So if you don’t want to spend 2 hours per day actively managing your own crypto investments, it’s probably best to use the “buy and hold” strategy.

Why I Decided to Be An Active Crypto Investor

For me, I’m very passionate about crypto, I see how much of a positive impact it is having on the world, and see the blockchain field as core to my career the next 25 years.

So I wanted to experiment with an “active investor” approach for a month and see what would happen. I knew I’d learn a lot from doing this.

So I put in 4-5 hours per day for a month--listening to podcasts, reading research reports, watching YouTube videos, subscribing to newsletters, taking BlockGeeks courses, writing this newsletter, and learning to use many of the different exchanges.

I see this early 2021 moment as if it was October 1994 and Netscape Navigator was just released… finally making the world wide web actually usable by regular people.

Yes, I think blockchain tech will be just as transformative to the world the next 25 years as the Internet has been the last 25 years. Some of the projects we are investing in today will become the next Amazons, Googles, and Facebooks of a new era (not to mention the new banks).

How I Prepared to Be An Active Crypto Investor

So how did I prepare to be an active crypto investor?

I knew I needed to invest in my own education first. So in December 2020 and January 2021 I took the following steps to educate myself as deeply as I could about the field before I put a lot of money to work.

As a former tech CEO, I wanted to understand the underlying technology and which platforms had the most developers building on them. I found the answer was: 1) Ethereum 2) Polkadot 3) Bitcoin 4) Tezos 5) Cardano.

As a Harvard MBA, I wanted to understand why these blockchain-based projects had actual fundamental value and not just speculative value. What gave these tokens sustainable demand and intrinsic value? How could Neobanks offer 10% annual interest when regular banks offered 0.2%? And would these decentralized finance Dapps replace traditional financial corporations?

Here’s what I did to learn...

I read the book The Infinite Machine by Camila Russo about the history of Ethereum.

I read the Messari 2021 Crypto Thesis Report

The read the Grayscale Report: Valuing Bitcoin so I could understand what fundamentally made Bitcoin valuable (fixed supply, store of value, medium of exchange, near instant settlement, decentralized alternative to central bank monetary debasement).

I read the Messari Ethereum 2.0 Report. I dove deep into understanding EIP-1559 which goes live in July 2021 and the future token supply structure of Ethereum 2.0 when it goes live in 2023 (hint: it’s deflationary).

I read the Grayscale Valuing Ethereum Report so I could wrap my head around what fundamentally made Ether (ETH) valuable (the unstoppable foundational layer for decentralized finance, decentralized storage, and decentralized apps).

I subscribed to these excellent Substack Newsletters

I studied Plan B’s Stock to Flow Model in depth

I subscribed to these free crypto podcasts and started listening to every episode.

I subscribed to these free YouTube channels on crypto investing:

I subscribed to these crypto data and analysis tools:

I took video courses on BlockGeeks to better understand the underlying technology of cryptography, distributed ledgers, blockchains, smart contracts, Ethereum, and Polkadot.

I talked to the founders of Unit Ventures, HVN, Satoshi Pay, and Plasma Pay to get their take on the promising up-and-coming blockchains and projects (all who live here in Bali).

And on January 20, 2021, I started publishing this newsletter The Coin Times. Why?

I am a strong believer in the potential of blockchain technology, distributed ledger technology, and smart contracts to help create a much better global financial system and make a huge positive impact in our world.

I see how many brilliant developers and investors are committing themselves full-time into this industry.

I want to help others understand how to invest in crypto.

The process of writing helps me learn and think.

What I Learned During My Preparation Phase

After all this preparation work, a few things were obvious to me:

Smart contracts are the future.

The potential for decentralized finance is huge.

The future digital currency of the world will be decentralized.

Ethereum is the global computing platform for decentralized banking and decentralized apps.

Polkadot will connect all the various blockchains together (along with Cosmos and Cardano).

Bitcoin, Ethereum, and Polkadot are massively undervalued versus what they will trade at in 10 years

I believe Bitcoin will go up to a market cap of $20 trillion by the end of this decade (making 1 BTC worth about $1M)

I believe Ethereum will likely go up to a market cap of $10 trillion by the end of this decade (making 1 ETH worth about $80k)

I believe Polkadot will likely go up to a market cap of $5 trillion by the end of this decade (making 1 DOT worth about $5k).

We are about halfway through our current bull cycle based on the stock to flow model and what happened in 2013 and 2017.

This bull cycle began in May 2020 when the most recent halving occurred (the 50% reduction in Bitcoin mining supply that happens every four years).

Bitcoin will likely pass $100k during 2021.

Bitcoin will likely pass $500k around 2025.

Bitcoin will likely pass $1M around 2029.

My Six Rules

Based on what I had learned, I was almost ready to begin investing.

But first, I created some basic guidelines for myself. The rules of the experiment were:

I would keep about 50% of my portfolio in Bitcoin and Ethereum (the safer bets).

I would never sell my Bitcoin. I accumulate Bitcoin. I never sell it. I plan to hold until at least 2035. I don’t care what the market says what the Bitcoin is worth today. I care about how much Bitcoin I can accumulate and what it will be worth in 10-15 years.

I would invest the other 50% in other promising crypto projects based on my research.

I wouldn’t make short-term bets. I wanted to invest in things I could hold for longer than a year. I didn’t want to sell and create a taxable event. As long I held and didn’t sell, the positions wouldn’t be taxable.

I didn’t want to DeFi yield farm. While I plan to learn to yield farm on Harvest, PancakeSwap, and Aave this month, I didn’t want to learn that in my first month of active crypto investing.

I would take long-only positions (no futures, options, or shorts).

I was ready to go.

On January 26, 2021 the experiment was on. I would become an active crypto investor for 30 days and see what would happen.

Would I beat Bitcoin? Or would Bitcoin beat me?

My Investment Strategy That Generated 161% in 30 Days — Let’s Break it Down Into Ten Steps

Ladies and gentlemen… what you’ve been waiting for…

Here it is, step-by-step… the exact investment strategy I used to turn $250k into $650k in the last 30 days.

Yes, you can invest with this strategy too. It takes a couple hours per day to do it properly.

As always, please do your own research and only invest what you can afford to lose. Know that the below strategy is best utilized in a bull cycle like we are in now.

And remember if you don’t want to do all this work… just buy and hold for 10-15 years. But if you are open to doing 2-3 hours per day of active investing, you too can get ~100% monthly returns for as long as this bull cycle continues (it’s expected to last until around September/October).

I’m going to break down my crypto investing strategy step-by-step. Here we go...

Decide How Much to Invest: First, choose an amount of money you can afford to lose 100% of. I picked $250k because I knew that while it would be quite painful to lose that, I would still be okay from my monthly income from advising SaaS companies and blockchain projects and building Hive. I essentially took what I already had invested in crypto… and decided to use that for active trading for 30 days. With such big upside asymmetry, I was open to taking the risk of complete loss. Here’s how I thought about it:

Worst case scenario: I lose my investment.

Likely scenario: I make 20-40x my investment within 10-15 years

Best case scenario: I make 100x my investment within 10-15 years.

Open Accounts on Exchanges: I knew I would need access to more exchanges than Coinbase in order to get access to the promising high-growth blockchain projects I was going to invest in. Binance.com is the largest crypto exchange in the world by volume and the most important exchange to have an account on. I opened accounts on the following exchanges.

Binance (note: Use a VPN if accessing from the USA).

Huobi

KuCoin

Open an Account on Nexo: Next, I opened up an account on Nexo.io, my favorite NeoBank. Nexo is the best place to hold your Bitcoin and Ethereum (and about 16 other coins) as they will pay interest on it, insure it, and offer you loans against it that are approved instantly with no credit check.

They pay 6-8 % per year interest on your crypto holdings and 10-12% on cash and stablecoins like USDT and USDC.

They custody with BitGo and also insure deposits with Lloyd’s of London up to $375 million.

Nexo competes with BlockFi, Celsius, and Voyager but I prefer Nexo because of their ease of use.

Nexo gives you loans for 6% per year, collateralized against the crypto you already have, making it easy to invest more in crypto or pay for personal expenses without selling your crypto.

Get Your Crypto into Nexo: I transferred my existing Bitcoin and Ethereum from Coinbase over to my Nexo account. I now had $250k in Bitcoin and Ethereum in Nexo.

You could also buy the Bitcoin/Ethereum directly on Nexo via the Nexo Exchange (or transfer it over from any exchange).

To get Polkadot (my other big favorite) use Binance, Voyager, Huobi, Uphold, or Changelly.

Take Out a Loan on Nexo: Next, I took an immediate $125k loan on Nexo. This was at 6% annual interest, paid out daily. I got an immediate $125,000 loan for $20 per day in interest, without any paperwork. Pretty cool. You can get a loan on Nexo for up to 60% of the value of your Bitcoin and Ethereum. It takes about three minutes to do and ten minutes for the money to show up in your Nexo wallet.

You could also do the same thing on BlockFi or Celsius, but the interest rates are better on Nexo and their token is better. And a key part of my strategy was to buy the NEXO token with the loan I was taking out on Nexo.

Nexo uses an automatic liquidation model and starts liquidating (selling) your crypto to repay the loan the moment the amount owed of the loan goes above 83% of the value of your crypto. They don’t liquidate the whole position, just a small amount at a time needed to make the loan go back down below 83% of the value of your crypto.

Because I have confidence that a) the NEXO tokens are heavily undervalued vs. where they will be in 5-10 years and b) that we are in the middle of the current bull cycle, and not the end of it, I feel pretty good about taking out a Nexo loan to get NEXO tokens. I would *not* execute this strategy (within this four year cycle) once Bitcoin goes over $100k...as the risk of a major 70% pullback drop is too high once Bitcoin goes over $100k. A pullback that large would cause some auto-liquidations of your core crypto holdings, which we want to avoid if possible. Between now (when Bitcoin is $50k) and late Summer 2021 (when Bitcoin will likely surpass $100k) is a good time to execute this strategy.

Buy a Whole Bunch of NEXO tokens: Nexo pays 30% of its profits annually out to its token holders. They pay out every August.I love that you get real cash flow annually from holding their token, like a stock dividend. The NEXO tokens are very undervalued when you look how much their annual profits are projected at for 2021/2022. I used this $125k instant Nexo loan to buy $125k worth of NEXO tokens within the Nexo app.

Currently the NEXO tokens cost $2.12 each. They were $0.76 one month ago.

I believe they should be worth about $4.77 today based on their projected 2021 dividends and may be worth $132 per token by 2030 assuming reasonable annual profit growth.

I built a detailed forecast model for what the NEXO tokens should be worth, based on the value of their annual dividends.

I am projecting that in August 2021 for every token you hold you will receive about $0.15 in dividends and in August 2022 about $0.30 -- so you get real cashflow from holding these tokens, which is fantastic.

NEXO token holders also get higher interest on their deposits (up to 12%) and lower interest on their loans (6%) based on their loyalty program. By the end of this step, you’ll have about 33% in BTC, 33% in ETH, and 33% in NEXO.

Use the Appreciating Value of Your BTC, ETH, and NEXO to Get More Loans: As the value of your BTC, ETH, NEXO tokens appreciate over time, Nexo will enable you to take out additional loans (up to 60% of the value of your crypto collateral).

As the value grows, take out additional Nexo loans and invest them into other promising blockchain-based projects (using centralized exchanges like Binance or Decentralized Exchanges like Uniswap and PancakeSwap).

Take out the loans in USDT and then transfer the USDT into your Binance wallet to trade with.

Nexo currently allows 3 free withdrawals per month and after that they charge a small fee for a withdrawal.

Find Promising Projects to Invest In: I recommend using Messari Pro to research promising projects to invest in.

I found some real gems in February by sorting their token list by 24 Hour return.

I find tokens that have appreciated by more than 25% in the last day, and then I research each one by visiting their website.

Those that I like after I research them I put about 0.5% of my total capital into which for me has been around $1000 per investment.

I do this mostly on Binance and sometimes on Huobi or Uniswap. I do this for about 5 tokens per day.

You can see where you can buy the token for each project on CoinMarketCap.

I also take a look at the Binance top 24 hour gainers each day and do the same process.

Above you’ll see the Top Movers in the Last 24 Hours on Messari.io

Above you’ll see the Top Movers in the Last 24 Hours on Binance.

Next, Work to Understand Why Certain Projects Are Moving Up in Value - Get good enough to understand why each coin’s value is growing. Are they are new DeFi leader? Are they part of the solution to scaling Ethereum? Are they are super easy to use banking or trading platform? Actually become a user of the projects you are investing in and join the project’s Telegram group -- and you will become infinitely wiser.

Triple Down on The Projects That Keep Gaining & That You Understand - Once you watch this list every day for a week or so, you’ll start to recognize some coins that seem to grow in value by 15-30% per day consistently. Once you see a token consistently growing like that research it thoroughly, if it is an app see if you can use it yourself, and if it makes sense to you, instead of investing 0.5% of your portfolio in it, up the amount to about 1.5%.

On the above list, for example, PROM is up more than 1000% in the last month. Why? Because they make it easy for people to own their own data, instead of apps like social networks owning it.

And MATIC is up 700% in the last month. Why? Because it’s one of the best layer 2 scaling solutions for Ethereum.

If you can notice the coins that are moving AND understand why, you will do very very well.

The key is to look for the lower market cap ($20M to $200M) projects that are consistently growing at 15-20%+ per day, and investing in those. Those are the ones that can 100x in value.

I call this playing “Token Venture Capitalist” where you put a little bit in a lot of promising projects, and then double down on what works.

Throughout the experiment, I kept 75% of my portfolio in what I consider the much safer investments like BTC, ETH, and NEXO.

Of the 180 projects I’ve invested in since January 2021, I’m up on 101 of them and down on 79 of them. When I lose, I tend to lose 10-50%. When I win, I tend to gain 50-500%. With all of them, I plan to hold for the long term. Some will become worth nothing -- others will end up big winners.

When to sell? Personally, I think the best gains will be made if you hold quality projects for 10+ years. Since you don’t need to pay taxes if you don’t sell -- I recommend only selling your losers toward the end of each year.

My biggest wins of the last month include:

PPAY - Up 526%

LUNA - Up 349%

BAKE - Up 326%

SOL- Up 290%

FTM - Up 269%

RUNE - Up 221%

ADA - Up 191%

FRONT - Up 185%

DENT - Up 158%

POLY - Up 132%

STX - Up 119%

BNB - Up 81%

NEXO - Up 64%

BTC - Up 58%

And that’s how I turned $250k into $653k and generated a 161% return in the last 30 days. It’s been quite the ride!

While I have no idea how the next 90 days will look, I expect this strategy to continue to work well throughout this bull market cycle, which I anticipate will last until around September/October 2021.

In the short-term, it could crater or it could moon. The good news is: I’m not selling this decade. So there’s plenty of time for the actual price to be found. This bet has at least 10 more years on it before I would consider selling. Never sell while an asset is finding its true value and you understand it more than most.

I recommend following Willy Woo and Rekt Capital closely to stay close to the ground on how long this cycle will last. Rekt Capital thinks we will go to about $150k Bitcoin around October before pulling back. Willy Woo expects low 200s.

The below chart from Rekt Capital suggests that based on the pattern of the four year cycles, we will reach around $150k before pulling back. The first full year after the halving (which occured in May 2020) has historically always the biggest growth year. That’s this year, 2021.

As always, know the above strategy is risky, could lead to loss of most of your crypto if you take out loans and then the market crashes. This strategy requires daily management and becoming very informed in the space.

Time to Make A Choice: Active or Passive Investor

We’re now at the end of this post… it’s time to consider:

Do you want to become an active crypto investor and go for bigger potential returns?

Do I want to take a passive approach and just invest in the Blue Chips of BTC, ETH, and DOT?

Think about it. It may be one of the most important decisions you make this decade.

What’s next for me? I plan on spending the next thirty days perfecting this investing strategy, playing in DeFi tools, and exploring the world of NFT creation.

Got questions? Post a comment and I’ll answer them.

Why Centralized National Currencies Will Lose to Decentralized Digital Currencies

In The Coin Times Telegram group this week I wrote the following post...

The main issue with centralized national currencies is they are controlled by a few people and their supply keeps increasing dramatically, hurting the poor tremendously when the prices of assets and living goes up while the value of their savings and monthly income keeps going down.

On Twitter, the below Nigerian Bitcoiner (@SatsHodl) explains the situation to a somewhat confused American economist who doesn’t seem to quite get Bitcoin yet.

With decentralized digital currencies, there is a fixed supply (ex: there are only 21 million Bitcoin and more cannot be created) so you can trust that your savings are safe and not continuously debased.

We are now in a 15 year period of moving from nation-state backed currencies for medium of exchange to moving to decentralized and programmable digital currencies as the primary medium of exchange. Decentralized currency that moves across borders in milliseconds and programmable smart contracts are the foundational layer upon which we are creating a more transparent, fair, and innovative global financial system.

It’s an inevitable evolution for human society, and one that beautifully will greatly empower the poor and middle class as their savings and income won’t be able to be debased continually any longer.

Nation-states will attempt to issue their own digital currencies the next five years however these will have the same issues as their non-digital currencies—their supply can be increased at will.

Only decentralized currencies where the supply is fixed (ex: Bitcoin) or deflationary (Ethereum 2.0) will be accepted by the majority of the people.

Digital currency is the people’s money. 👍💛

What About Government Regulation?

This week someone asked in our Telegram channel, “What do you think about government regulation as it relates to the blockchain sector”

Here are my thoughts...

The Blockchain industry is becoming the #1 taxpayer industry this decade. Jurisdictions who embrace the industry will thrive as capital and talent and taxes flow into their borders.

Countries that embrace crypto (Singapore, Switzerland, USA) will thrive economically while those who don’t, won’t.

Municipalities like Miami, Geneva, New York, and Singapore are already competing for who will be the most blockchain innovation friendly. Why? They want to become/stay the leaders of the next 20 years and attract talent, companies, innovation, and tax dollars.

Smart regulators will focus on Know-Your-Customer (KYC) rules, Anti-Money Laundering (AML) rules, fraud prevention, and tax compliance.

Countries that attempt to ban blockchain-based innovation will wither economically this decade.

Countries who invest part of their reserves in Bitcoin and Ethereum will thrive in the next 20 years.

Decentralized exchanges (Uniswap, PancakeSwap, Loopring, BakerySwap) and decentralized blockchain currencies can’t technologically be stopped without blocking the entire internet. Satellites are now broadcasting the Bitcoin blockchain from space back to Earth, making it accessible even to places without internet access. It’s literally impossible to stop decentralized applications without taking down the entire internet.

Political candidates who support the blockchain industry in the next few political cycles will receive a lot of funding and contributions. Those who don’t, won’t. There’s a huge incentive for forward thinking public sector leaders like Andrew Yang, Cynthia Loomis, and Francis Suarez to embrace Blockchain tech.

For those who think carefully about game theory, the game is already over—it’s just playing out in front of our eyes the next 15 years.

The macro game of the 20th century was Controlled Government Economic Planning vs. Competitive Markets. Competitive markets won.

The macro game of the next 20 years is Centralized Control vs Decentralized Innovation.

Imagine the entire international legal and financial system rewritten on smart contracts and you’ll be able to imagine what is coming.

What’s coming:

A global economic and legal system that treats all people equally regardless of where they are from.

A global decentralized digital currency and medium of exchange that can’t be debased or controlled by the few.

The entire global financial and legal system (markets, stock exchanges, contract law, etc) rewritten on efficient and transparent smart contracts. Code = Law.

It’s going to be a really interesting next two decades. Here’s to creating a more beautiful world for all.

Are You Early to Crypto? Yes

Here’s a basic assessment, and the answer is… yes, you’re still early...

Invested before BTC $1k: Super super early

Invested before BTC $10k: Super early

Invested before BTC $100k: Early

Invested before BTC $500k: Not early, not late

Invested after BTC $500k: What most people will do

Invested after BTC $1M: Late, but still growth potential

There’s just no way that Bitcoin doesn’t eventually become worth more than gold, which would make it worth $534k per BTC.

Keep in mind today Bitcoin has about the same number of users as the internet did in 1997 (1.7% of humanity), but adoption is increasing at a pace that is faster than the internet.

Source: CoinMetrics

My Long-Term Crypto Portfolio Recommendations

Here are my big picture recommendations for anyone getting started in crypto investing with a balanced mix of potential return and asset preservation. I adjust these each week based on what I learn and any changes in the marketplace.

Never invest an amount you can’t afford to lose. Crypto is volatile and downswings of 80%+ happen. Don’t invest more than 50% of your total net worth in crypto.

Be careful investing on borrowed money (margin). We don’t recommend it until you’re experienced.

Unless you’re an experienced and professional trader with many years of training, your best bet is to buy and hold for the long term (10-15 years) and not attempt to time the market.

If you are going to attempt to time the market, be very familiar with the Stock to Flow model and the timing of BTC halvings and be very familiar with the research backing up the blue chips like BTC, ETH, DOT. While it will have swings along the way, we do expect the current bull market to continue until at least September 2021.

We recommend Coinbase for those investing small amounts (<$10K) and Binance (use a VPN if needed), Coinbase Pro, Huobi, Kucoin, Gemini, or Kraken for those investing larger amounts ($10k+). You can also use the no-fee Voyager or Nexo which give you no-commission trades and 6-8% annual interest in exchange for holding your cryptodeposits.

Many tokens don’t yet trade on Coinbase. Binance has most of them. Huobi, Kucoin, and Uniswap have anything Binance doesn’t have.

See the research at Simetri, Messari, Trade the Chain, and Flipside Crypto for even more due diligence.

For a mix of long-term capital preservation and growth, we recommend keeping 20% of your holding in BTC, 20% in ETH (“The Blue Chips”), 10% in Polkadot (“The New Ethereum”), 10% in Kusama (“Polkadot’s First Blockchain”), 10% in NEXO (“The best NeoBank”), 10% in Binance’s BNB, and the remaining 20% in up-and-coming projects. Here’s what we like the most right now based on months of research (the ones I like the most are bolded):

Blockchains: ETH,DOT,KSM, ATOM, ADA, SOL

NewFi Banks: NEXO,VGX, CAS

Exchanges: BNB, HT, UNI, SUSHI,FTT, 1INCH, BURGER

Binance DeFi Protocols: XVS, CAKE, BAKE, AUTO

Ethereum DeFi protocols: AAVE,COMP, SNX, CRV, BAL, DODO

Oracles: LINK, BAND

Layer 2 Scaling Tech: MATIC, LRC

Web 3.0 Tools: THETA, GRT, FIL

Insurance Tools: CVR, WNXM, ARMOR

Polkadot Apps: POLS, TRAC,OCEAN, ONT, RFUEL, XFT, PHA

Payment Platforms: EGLD,CELO, XLM

Security Token Platform: POLY

My Top 20 Right Now...

If I were creating a portfolio from scratch right now that I didn’t want to touch for 5 years, I would be absolutely sure to include:

80% of Portfolio

Bitcoin (BTC) 20% of portfolio

Ethereum (ETH) 20% of portfolio

Nexo (NEXO) 10% of portfolio

Polkadot (DOT) 10% of portfolio

Kusama (KSM) 5% of portfolio

Cardano (ADA) 5% of portfolio

Cosmos (ATOM) 5% of portfolio

Remaining 25% of Portfolio - About 1.% Each

Polygon (MATIC)

Voyager (VGX)

Uniswap (UNI)

PancakeSwap (CAKE)

Polystarter (POLS)

Chainlink (LINK)

OriginTrac (TRAC)

Ocean Protocol (OCEAN)

Ontology (ONT)

PolkaCover (CVR)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymarket (POLY)

The People I’m Following Closely on Twitter

If You’re Just Getting Started With Crypto, Start Here

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coin Times: Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published 2x per week. Published and written by Ryan Allis.

Comments and thoughts welcome:

Telegram channel at t.me/thecointimes

Substack at TheCoinTimes.com

Please share with your friends and colleagues.