Social Links: Twitter | BitClout | Telegram | OpenSea | Substack

Welcome to the CoinStack Newsletter. This issue talks about how I’ve been able to increase the value of my crypto portfolio by 488% year-to-date while Bitcoin has increased by 116%. I also explain how to use Binance, Metamask, and Uniswap. This is a 28 page issue with lots of specifics, so take a quick look now — AND you might want to set aside 30 minutes to read it again tonight.

In This Issue:

Crypto Portfolio Update: +488% YTD 👀

Crypto Tools: How to Use Binance, Metamask, and Uniswap

Am I Starting a Crypto Fund?

Your Own Crypto Investing Experiment

Where To Get 20%+ Yield on Your Stablecoins

A DCF Valuation on Ethereum Predicts $17k ETH

Mrs. Bubble’s New NFTs

Who I’m Following on Twitter

A Long-Term Crypto Portfolio

How to Get Started in Crypto

Chart of the Week: My Actual Crypto Portfolio Returns

Portfolio Update: +488% YTD 👀

I write down everything I learn to both document the dawn of this new era of programmable money AND so you too can create life changing wealth for you and your family.

I want you to rise too. The more people around me who have been able to build life changing wealth for their families, the better.

So here’s an update on my portfolio and how we got here...

I started actively investing in crypto on January 7, 2021 -- exactly 100 days ago.

I put in $200k that I got from my savings and from selling some SpaceX stock from a 2013 investment in a secondary round.

Today, on April 14, 2021 that $200k has turned into exactly $1,176,185.

On paper, I’ve made $976k in 100 days. I’m up 488% year to date.

Pretty wild. Here’s my current actual crypto portfolio as of this moment:

You can see my top eleven investments and their performance the last 30 days are::

NEXO - The best crypto bank +43%

ETH - The most used blockchain in the world +23%

BTC - The original king of crypto +9%

RUNE - A new cross-chain Uniswap +107%

BNB - The core token of Binance ecosystem +111%

KSM - The early stage Polkadot network, launching June +34%

BAKE - A DeFi tool and exchange on the Binance network +74%

DOT - The main Polkadot network, launching around Sep +13%

CAKE - The Uniswap of the Binance ecosystem +120%

LINK - The #1 data oracle +16%

BURGER - A DeFi tool in the Binance ecosystem. +107%

As you can see, the worst performer the last 30 days by far was Bitcoin. I am holding 3 Bitcoin and I don’t plan to sell them, but in general Bitcoin doesn’t perform as well as earlier stage quality projects with lower market caps. BTC is there as a portfolio anchor, but not for returns.

The above 11 tokens represent 80% of my portfolio. The biggest positions in the other 20% are:

PPAY - DeFi for the masses +60%

LUNA - Programmable internet money +15%

HOT - The blockchain optimized for Daap development +531%

SOL - The blockchain built by Alameda +85%

WRX - India’s largest crypto exchange +604%

ZEFU - The best multi-exchange trading platform, MVP live +5%

POLS - The Polkadot ecosystem Uniswap +1%

XVS - A DeFi tool in the Binance ecosystem +55%

ANKR - Staking across multiple blockchains +129%

You can see Holochain (HOT) and WazirX (WRX) are my biggest winners of the last 30 days. I’m still bullish on both Polkastarter (POLS) and Zenfuse (ZEFU), even though they are both about 6 months from fully launching. It’s often better to acquire positions in quality projects before big increases -- and then just hold until their launch.

I’m also still very bullish on the Polkadot ecosystem, but most of those projects aren’t likely to substantially increase in value until closer to their Fall 2021 launch dates.

Overall, my portfolio has gone from $789,226 one month ago on March 13 to $1,176,185 today, up 49% in 30 days.

My Thoughts on Bitcoin Maxis

I love Bitcoiners, but those Bitcoin maxis who say all you should do is just keep your money in Bitcoin are ‘quantitatively incorrect’, to phrase it nicely.

In Bitcoin terms, the last 100 days I’ve turned what started out as 5.06 BTC ($200k when BTC was $39k per BTC) into 18.58 BTC ($1.17M).

BTC year to date: 116%

ETH year to date: 206%

My portfolio year to date: 488%

Can I keep it up? Well, I promise one thing. To keep writing about it one per week no matter what happens.

Yep, I’m All In On Crypto...

In case you’re wondering, I have 100% of my net worth in cryptographically-secured blockchain-based digital assets (aka crypto) right now, with the small exception of some early stage angel investments that are illiquid and can’t be sold.

I made good money back in 2012 when I sold the SaaS company I co-founded, iContact, but I lost all that money between 2012 and 2018 in a series of bad Silicon Valley angel investments while living in San Francisco. I learned exactly what NOT to do and hopefully have learned some good lessons there.

So yes, I’m all in.

No house. No car. Just a wonderful wife, a dog, a motorbike, a rented home in Canggu, Bali, some illiquid private company stock, a good job advising SaaS CEOs and blockchain projects, and $1.17M in crypto.

And in some ways, I’m more than all-in. I’ve even taken out a $400,000 instant loan from Nexo.io to invest further. No paperwork. No credit check. Collateralized by my crypto.

This NEXO loan is crypto-collaterized, which means my crypto is at risk and nothing else. Thankfully, Nexo uses small mini-liquidations so in a worst case scenario I simply end up with the loan paid off and no crypto. So it’s not possible for me to end up with a negative amount thankfully.

So in reality the only thing I have at risk is the original $200k I put in.

That’s $200k at risk for the possibility of life changing wealth. I’ll take it. Asymmetric return possibilities at their finest.

100 days later, I’m now managing $1.57M in crypto assets, of which $1.17M is the net amount. I have a Loan to Value ratio of 34.1%. I plan to get that down under 10% over the next 4 months.

Yep, I plan to pay off most of that 6% per year NEXO loan before Bitcoin gets to $100k (which I expect will happen around August/September 2021). No sense risking liquidations once we get closer to the market top -- even if we happen to be in a Supercycle combining institutional capital with massive adoption and brand new technical capacity.

It’s been a great 100 days. And I expect the next 100 days will be even better. We shall see. I’ll write about it each week as we go and I’ll share any changes I see to the on-chain metrics that right now are showing capital inflows up and coins leaving exchanges (supply down).

Tomorrow’s Coinbase listing on NASDAQ is similar to the Google IPO in August 2004 that kicked off 15 years of incredible returns for internet investors.

I estimate we have about 180-250 days left in this market cycle before I will need to adjust my strategies to focus more on generating yield from stablecoins in DeFi. Yes, in crypto, you can earn 20% in your down years just by shifting to stablecoin holdings.

Why would you EVER want your money back in the fiat system, ever?

If you need to buy something, just use your normal income or take a crypto loan out. But don’t ever get out of digital assets.

My Top Investments So Far in 2021

My top investments so far in 2021 by return from the moment I invested in them are:

How Do I Decide What to Invest in?

My crypto investing strategy is simple.

I invest in what I use and like (that’s how I found NEXO and BNB)

I invest in projects I hear about from trusted friends (that’s how I found KSM, DOT, HOT, and PPAY)

I invest in projects I hear about repeatedly from the 1000+ trusted sources I follow on Twitter.

Every day, I invest about $1000 (roughly 0.1% of my portfolio) into the three biggest gaining projects of that day, as determined by the top 24 hr gainer list posted in the CryptoDiffer Gainers List Telegram Channel. I call this the Unicorn Strategy. Here’s an example of their daily chart…

The Unicorn Strategy - Finding the Gems Early

Almost all the top gaining tokens are on Binance or Uniswap. Very very few are on Coinbase, as Coinbase is just for later stage tokens that have already increased a lot in value. You want to get them BEFORE they increase in value, not AFTER.

My Unicorn strategy thesis is simple, tokens that have been increasing in value tend to keep increasing in value. By getting them as soon as they show up on the Top 7 list each day, I get them early when the price is lowest.

Roughly half of the investments turn out to be winners and half turn out to be losers. But what matters is that the winners tend to increase by 500-2000% while the losers tend to lose 50% -- making the overall portfolio a big winner.

This strategy works great now during a bull market. When the bull market ends, it will be a good time to switch to a strategy of simply getting 20-25% annual yield on stablecoins -- but for now, keep investing.

Key Tool #1 - How to Use Binance

Many of the tokens you’ll want to invest in will be listed on Binance, but not on Coinbase.

To use Binance, go to www.binance.com.

A word on Binance for those in the United States: If you’re in the United States, you’ll need to use a VPN. If you’re in the USA, don’t fund your Binance account with a credit card or bank transfer. Instead, fund your Binance account by transferring USDC, USDT, BTC, or ETH from another exchange or wallet. Binance doesn’t work in the USA unless you’re on a VPN.

Trying to invest in crypto assets without Binance is like trying to play pool with one hand tied behind your back. It has about half of the fast growing tokens, the rest are usually on Uniswap. Binance as of today has 348 tokens while Coinbase has just 53. Binance is a must-have tool. And you should invest some time into learning the interface.

Once you’re into Binance, send some crypto (USDT, BTC, or ETH) from another crypto wallet or exchange into your Binance wallet (Under Wallet > Fiat and Spot). That takes about 10 minutes to transfer over. It looks like this…

Once you deposit your crypto, you’re ready to trade with it. Just click on the Trade > Classic tab. It should look something like this…

Every token on Binance has a trading pair. The most common trading pairs are USDT, BTC, ETH, BUSD, and BNB.

You may need to convert your existing crypto into USDT, BTC, ETH, BUSD, or BNB to buy the token you choose. You can do that under the Trade > Convert page. It should look something like this…

Key Tool #2 - How to Use Metamask

If you’re wanting to buy an earlier stage project that aren’t isn’t yet listed on Binance, you can usually get the token on Uniswap.

The easiest way to use Uniswap is through your Metamask wallet. Go ahead and install Metamask’s Chrome browser extension and/or mobile phone app. Here’s a good video overview of Metamask from Blockgeeks.

Once you have Metamask installed, create your account. Be sure to print out and save your seed phase in a secure physical location, like with your passport or in a safe. Meta mask seed phrases usually are 12 random words.

Your Metamask seed phrase might look something like:

Inspect entrance fry love illusion oblivious llama jump potato package unreal suspect

That’s obviously a made up one.

If you lose your actual Metamask seed phrase, you lose all your money and there is absolutely no way to get it back -- as there’s no centralized company that knows it. It’s literally just decentralized software.

Once you’re into Metamask, it will look something like this…

Send some ETH there from another wallet or exchange to get it started.

ETH is the primary crypto asset used on Uniswap (and in most of DeFi).

Key Tool #3 - How to Use Uniswap

Once you’ve got ETH in your Metamask wallet, you’re ready to use Uniswap to buy a token.

Now go to App.uniswap.org and click Connect to a Wallet. It will look something like this.

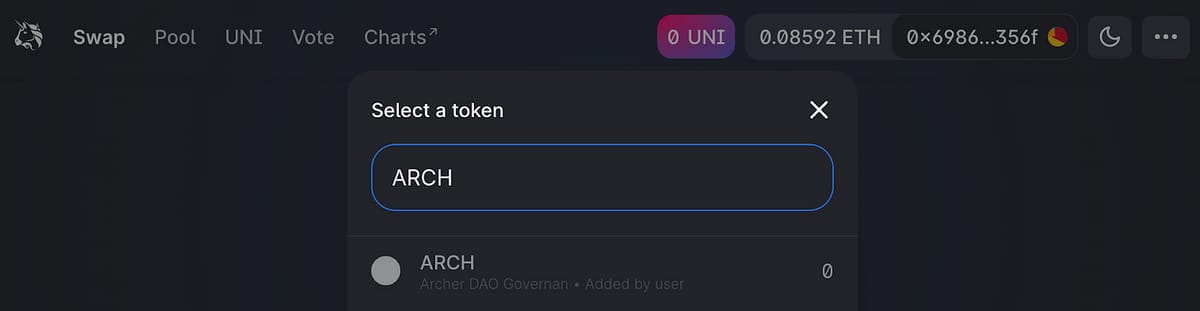

Let’s say I wanted to buy some ARCH token because it was on the CryptoDiffer Top Gainers list.

I would type in ARCH and then trade my ETH for ARCH.

Now I’m ready to swap my ETH for ARCH. When ready, click Swap and then authorize the transaction in your Metamask wallet. Within about 10 minutes, the ARCH will show up in your Metamask wallet.

Note that right now gas fees for each token exchange on Uniswap are roughly $30. This is a fee paid to the Ethereum network to confirm and secure the transaction.

As of May 12, 2021 (less than a month away), these gas fees are going away as Uniswap launches its Layer 2 Ethereum scaling solution called Optimism. This is one of the reasons why I’m so bullish on Ethereum. It’s the most used blockchain technology in the world AND it is about to scale through layer 2 solutions AND ETH 2.0 sharding. Uniswap gas fees on layer 2 will be roughly $0.30 instead of $30. Talk about rapid improvements!

Now those long tail token buys will cost $0.30 to buy instead of $30, which should greatly increase the number of people who can afford to use Uniswap to invest in early stage projects.

If your new token doesn’t show up after 10 minutes in Metamask, you may need to add the token to Metamask by going to CoinGecko and clicking on the Contract Address and/or the Metamask icon. This happens a lot when it’s a new token that might not be in the list of “standard tokens” that Metamask uses by default.

Wahoo… I’ve not got $148 worth of ARCH in my Metamask wallet.

Your Own Crypto Investing Experiment

There you have it. I’m an open book. You’ve got the strategy.

Now all you have to do is spend 1-2 hours per day executing it.

It doesn’t need to be a full-time job. Just a couple hours per day to potentially quintuple your money in 100 days.

Here’s what I’d like to propose… that you do you own crypto investing experiment the next 100 days… between April 15, 2021 and July 22, 2021…Let’s see if you can 5x your own investment capital during the next 100 days. Keep me posted in the comments!

How Do I Know When to Sell?

Ideally I will hold most of my crypto assets for at least a year before I sell them as that gets taxed at lower rates in the USA.

That said, I do plan to move about 50-67% of my portfolio to stablecoins once we reach a few weeks of the cycle top.

Only in very rare circumstances do I sell these days. If I need more to invest in something new I just take out a small 6% annual loan from Nexo to invest more.

As I wrote above, I plan to pay most of my $400k Nexo loan off before Bitcoin hits $100k -- to ensure that none of my crypto gets liquidated in case we see a 50-70% drawdown, which commonly happens in year 3 of the market cycle. I am currently forecasting a Bitcoin rise to $150k by around the end of 2021 and then a 55% pull back to around $70k before starting to rise again.

This cycle pull back shouldn’t be as much as the 2018 pullback as there is a LOT more institutional capital flows and substantial cashflows in the major blockchain projects (Ethereum for example generated $1.38B in cash flows last month that will soon be used for token supply reduction and staking payouts) that allow for DCF-type valuations to be done.

So how will you know when to sell? Well, if I do my job right… you’ll be able to keep reading Coinstack and I’ll keep you posted on when things are getting a bit frothy based on the data. And then… we’ll move to stablecoins.

One Difference Between Crypto and Stocks

Unlike stock markets -- when we never quite know when we’re getting to a top besides PE ratios getting overheated -- since all the data on blockchains is publicly available we can build rather good models to predict when we’re getting close to a cycle top. We can actually see the capital inflows and outflows -- making it possible to predict the future.

Using metrics like Reserve Risk, NUPV, MVRV, coins leaving exchanges, and what happened in the 2013 and 2017 cycle, we can see when we are getting close to the top. And we’re definitely not at the cycle top yet based on how much institutional and retail capital is coming into the space.

That means there’s most likely still enough time for you to substantially grow your money as well, during this current bull run.

Both the macro big picture (blockchain tradeable assets going from $2T to $400T+ the next 15 years) as well as the current cycle analytics are showing that now is the time to invest. Once Bitcoin gets above $100k, I’d be a little more cautious and by then keep half of my portfolio in stablecoins earning 20% on

I will be publishing this newsletter every single week and when we get close to the top I’ll let you know. I know one thing… Bitcoin will be over $100k before this cycle tops out.

My actual median prediction for this cycle top is $150k. Until then, keep investing -- and keep reading Coinstack. I’ll send alerts on the Telegram group and/or the email newsletter when we start reaching some of the major quantitative top signals.

Am I Starting a Crypto Fund?

I’m looking into it. Please reach out if you have expertise in any of the below.

I especially need a good Ethereum developer who can help me build #2 below...

I am currently deciding between:

Starting a traditional crypto hedge fund

Starting a decentralized pool of managed capital that you invest in via your Metamask wallet and can enter into and withdraw from at any moment.

Using Shrimpy or Zignaly to allow others to copy trade me automatically (waiting on DEX integration (aka Uniswap/PancakeSwap), which is a feature I really need).

I’m looking into all three possibilities at the moment.

It would be nice if you could leverage the work I’m already doing anyway. I’ll keep you updated in the next 8 weeks about this.

Where to Get 20%+ Annual Yield on Your Stablecoins

I write a lot about how to get 20%+ annual interest on holding dollar-denominated stablecoins. Here’s where you can do that.

PoolTogether - 35% on USDC

KeeperDao - 30% on DAI, 26% on USDC

Yearn - 29% on MUSD, 16.5% on USDC

Aave - 28.05% on TUSD, 16.4% on GUSD

Terra Luna - 26% on UST

Curve - 23% on SUSD

And if DeFi is too difficult to figure out initially, you can always use Nexo to get 10% annual yield on Stablecoins. Or you can go to your bank and get 0.01% in savings account.

As always, be sure the DeFi platform you are using has been audited and comes recommended by others. It is still early and there are numerous hacks on DeFi platforms where users simply lose their money. To offset risk, never put more than 20% of your stablecoins in one single DeFi platform.

A DCF Valuation of Ethereum

Everyone in finance and anyone with an MBA knows that the value of an asset is the present value of its future cash flows.

I decided to put that Harvard MBA of mine to work and come up with a Discounted Cash Flow (DCF) analysis of Ethereum.

The takeaway -- based on its cashflows alone Ethereum *should* be worth around $17,609 today per ETH, for a total market cap of $2.02 trillion.

Source: The Block

While currently Ethereum’s $1.38B in monthly profits get paid out to miners, that is ALL changing in the next 12 months, making it possible to do a proper DCF for Ethereum.

In March 2021, according to The Block, Ethereum had the following revenues:

Miner fees: $650.88M per month

Transaction fees: $727.47M per month

Total fees: $1.378B per month

The simplest way to value Ethereum would be to annualize these total fees and then apply a standard price to earnings (PE) ratio for a fast-growing company.

So if we annualize $1.378 billion we get $16.540 billion. Give that a nice 100x PE ratio (appropriate for a very fast growing technology platform with billions of dollars of monthly cashflows) and you get to $1.654 Trillion in market cap based on PE ratios.

Let’s look at what that means for what the valuation of Ethereum should be based on applying a simple PE Ratio range…

Yes, Ethereum is a decentralized blockchain protocol with zero costs (all the costs are paid for by the validators), so 100% of the revenue can be classified as earnings.

And now, let’s look at what the Ethereum valuation would be if we used the present value of future cash flows (Here’s my DCF model).

In case the image is too small… yes that’s a $2.02 Trillion valuation for Ethereum (ETH) today based on the present value of its expected cash flows, assuming modest 15-50% annual growth (the actual growth should be much higher than that… it’s up 1825% in the last 12 months alone).

Long story short, from a fundamental traditional finance perspective, Ethereum is heavily undervalued. Accumulate as much as you can between now and $4000 price point--and hold till AT LEAST 2025.

Note: I recommend holding around 25% of your total portfolio in ETH as it has large growth potential and it’s one of the safest bets being by far the most used blockchain in the world.

*Unfortunately for Bitcoin, you can’t do a DCF on it as there’s no cash flows from holding Bitcoin. There’s no way to stake Bitcoin and transaction fees go to miners, not users. In other words, Bitcoin doesn’t generate cash flow for holders, while Ethereum will starting in July 2021. This is one of the major reasons Ethereum is probably going to beat Bitcoin it total market cap by 2025.

Art on the Blockchain - Mrs. Bubble NFT Update

If you get value out of this weekly newsletter, the only thing I ask in return is you buy and some of my wife Morgan’s art from time-to-time when you can afford to. It’s a nice way to bring joy to her -- plus her work is absolutely incredible.

In each week’s Coinstack, I’ll be writing about the story behind my very talented wife’s NFT art. Her goal is to bring joy to the world through art. She is known online as Mrs. Love Bubble (or Mrs. Bubble for short). She has 16k Instagram followers and 12k Twitter followers and growing -- and so far she’s made 1.6 ETH worth of NFT sales -- and growing -- money that funds art supplies for the incredible amount of output she’s creating.

She hand paints each art piece and then digitizes the on the chain with OpenSea. She makes a new one every single day. They are available here on OpenSea. You can buy and collect them with your Metamask wallet. She would love to be the first NFT artist you’ve ever supported.

Thanks to Coinstack reader StevensHill who last week bought Bubble #88 - The Goddess of Trees for 0.2 ETH. Morgan shrieked with joy when she found out! Let’s take a look at The Goddess of Trees.

Here are her newest NFTs from the last week…

My favorite new piece from the last week is Bubble #91 - The God of Dragons. Let’s look at this rad guy close up. He has a red dragon and purple sloth on his shoulders… AND an epic staff with a grasshopper in the center globe.

The God of Dragons was handpainted on a life sized 7 foot by 3 foot canvas, and then digitized. Pretty fricken’ cool. She said this reminds her of me at festivals <3. He is available for 0.33 ETH. This one took her about 10 days to make.

And here is one of my all time favorites, Mrs. Llamacorn Angel. When you buy Llamacorn you get in the mail the actual signed and framed artwork (shipped globally). Bubble #19 - Llamacorn Angel is available for 1.11 ETH.

In the next week Mrs. Bubble will be minting her first 3D animated character based on Llamacorn Angel. Take a look at what’s coming below! She’s beautiful.

Yes, Llamacorn Angel has been turned into an animated character using Maxon Cinema 4D. She will soon fly joyously through the Bubbleverse as we build animated skits with our LuvMonster characters.

Take a look at that detail. Sure to bring a smile to any child or adult’s face! Let me know what you think in the comments.

Also coming soon is Mrs. Fishlegs. Wow, she’s sexy and fun and playful…

As you can see, Mrs. Bubble is quite talented and has the consistency and talent to become a top NFT artist this decade. Like Beeple, she creates publishes a new NFT every single day. She blows me away some days, and I’m lucky to be her man.

See Mrs. Bubble’s website and join Mrs. Bubble’s telegram channel here to be the first to know when her new NFTs drop.

So when your gains are enough from reading this newsletter, pick up a Mrs. Bubble original for your Metamask Wallet. It would mean the world to us both.

CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

80% of Portfolio

Ethereum (ETH) 20% of portfolio

Bitcoin (BTC) 10% of portfolio

Polkadot (DOT) 10% of portfolio

Kusama (KSM) 10% of portfolio

Nexo (NEXO) 10% of portfolio

ThorChain (RUNE) 5% of portfolio

20% of Portfolio - About 1.5% Each

Voyager (VGX)

Uniswap (UNI)

Chainlink (LINK)

Terra (LUNA)

Cosmos (ATOM)

Polygon (MATIC)

Decentraland (MANA)

Ocean Protocol (OCEAN)

Harmony (ONE)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymath (POLY)

Origin (OGN)

PankcakeSwap (CAKE)

Note that my actual portfolio that I trade in-and-out of may vary a bit from this longer term portfolio.

The People I’m Following Closely on Twitter

Mrs. Bubble The NFT Artist (my wife Morgan Allis)

Start Here If You’re Getting Started With Crypto

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

About The CoinStack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Substack at CoinStack.substack.com