Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem. This week’s issue presents our research on the Top 50 North American Crypto VC firms ranked by fund size and investment activity.

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Argentina Accepts Stablecoins, Meta Lets You Post NFTs, FBI Issues DeFi Warning

🚀 Crypto VC Issue: The Top 50 North American Crypto Venture Capital Firms

💵 Weekly Fundraises - Limit Break ($200M), Animoca Brands Japan ($45M), Thirdweb ($24M)

📊 Key Stats - Arbitrum’s Active Users, ETH Surpasses BTC Trading Volume, OpenSea Trading Volume Decreases 99%

📄 Whitepaper: Peer ICX Whitepaper: A New Method for Blockchain-Based Capital Raising - Part 5

💊 Vitamin3 of the Week: Crypto Payments- A Real Use Case

📝 Report Highlights - A Year of Bridge Exploits

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

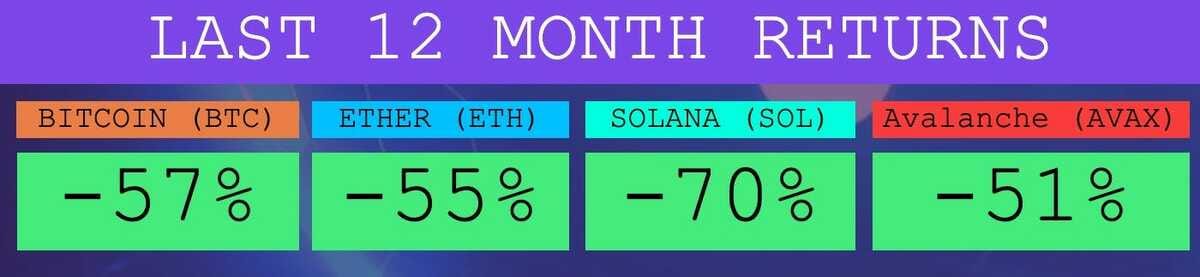

Among major L1s, Avalanche has performed the best over the last 12 months

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Amphibian Capital is a crypto quant fund of funds investing in the world’s leading crypto hedge funds. They have researched and vetted over 250+ funds and selected the best based on their proprietary scoring system, providing accredited investors with the ability to gain crypto fund exposure with one investment. Learn more at www.amphibiancapital.com

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) ⚖️ FBI Issues Warning Over DeFi Exploits, Open Source Development - The agency has warned investors to tread carefully around DeFi protocols, which have fallen victim to billions of dollars in theft this year.

2) 🎉 Meta Enables NFTs on Both Facebook and Instagram - Meta will now let users post their NFTs across both Instagram and Facebook. Users can connect their wallets like Rainbow, MetaMask, Trust Wallet, Coinbase Wallet and Dapper Wallet to post digital collectibles minted on Ethereum, Polygon, and Flow.

3) 🇦🇷 Argentina’s Mendoza Province Is Now Accepting Crypto for Taxes and Fees - In another shift toward widespread crypto adoption in Argentina, citizens from the Mendoza Province can now pay government fees and taxes using cryptocurrencies.

4) 👋 Alameda Research Co-CEO Sam Trabucco Steps Down To ’Relax' - Sam Trabucco, co-CEO of crypto trading firm Alameda Research, stepped down from his role Wednesday.

5) 🤨 3AC Co-Founder Fears Jail Term Over Liquidator’s Misrepresentation - Three Arrows Capital co-founder Su Zhu is worried he and other company directors could face jail terms for contempt of court due to the liquidators’ misrepresentation, Bloomberg News reported on August 26.

6) ✔️ Voyager Digital Gets Approval To Pay a $1.6M Bonus to 38 Employees - Voyager Digital has received the approval to commit $1.6 million as bonuses for employees who they expect to be crucial to its restructuring process.

7) 😏 Professor Re-Uploads Tornado Cash Code to GitHub for Research Purposes - Matthew Green, a professor of Computer Science at Johns Hopkins University, re-uploaded the source codes of Tornado Cash (TORN) and Tornado Nova on Github, saying he has been using the code for teaching purposes and his students have built great protocols so far.

8) 🧾 Washington D.C. Suing Michael Saylor and Microstrategy for $25M in Taxes - The attorney general’s office is suing Michael Saylor and Microstrategy for allegedly not paying taxes on Saylor’s earnings in D.C.

9) 🇷🇺 Arrested Tornado Cash Developer Allegedly Had Links to Russian Intelligence Agency FSB - The Fiscal Information and Investigation Service (FIOD) has confirmed that the arrested Tornado Cash developer was suspected of being involved in the hiding of criminal financial transactions and facilitating money laundering.

10) 📢 Lawmakers Probe Coinbase, Binance, FTX Over Crypto Fraud - The House Committee on Oversight and Reform has asked four US agencies and five crypto exchanges to detail how they combat fraud and scams.

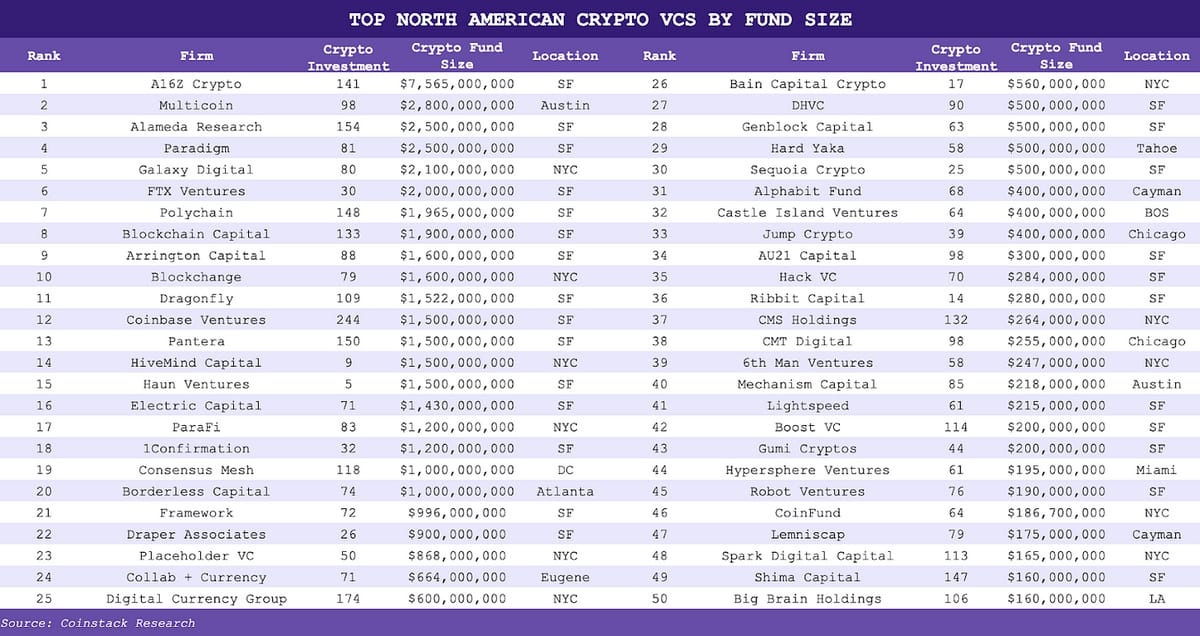

The Top 50 North American Crypto Venture Capital Firms

By Ryan Allis, Publisher of Coinstack and Partner at Amphibian Capital

About this article: This week’s issue presents our research on the Top North American Crypto VC firms. Next week we will cover the top Asian and European firms.

The Crypto VC Sector Is Booming in North America…

There are now 20 Crypto VCs in North America with “Unicorn” $1B+ funds. These twenty funds in total have an aggregate fund size of $39.88 billion.

The SF Bay Area dominates with 65% market share among all North American Crypto VCs with more than $34B under management, more than all other cities combined.

While the market value of digital assets like BTC and ETH are down so far this year, venture capital investment in the blockchain, cryptocurrency, web3, and metaverse space has grown.

The first eight months of 2022 saw over 1,900 VC/PE deals in the blockchain and cryptocurrency space, exceeding the pace for 2021.

It’s pretty incredible to note that even in a bear market like 2022, we’re on pace to set a new record for the number of venture investments into the blockchain/crypto sector.

There are some very smart capital managers betting big on the 10-15 year vision for the next generation of the web, finance, gaming, and money itself being built on top of the rails of blockchains, smart contracts, and tokenized assets.

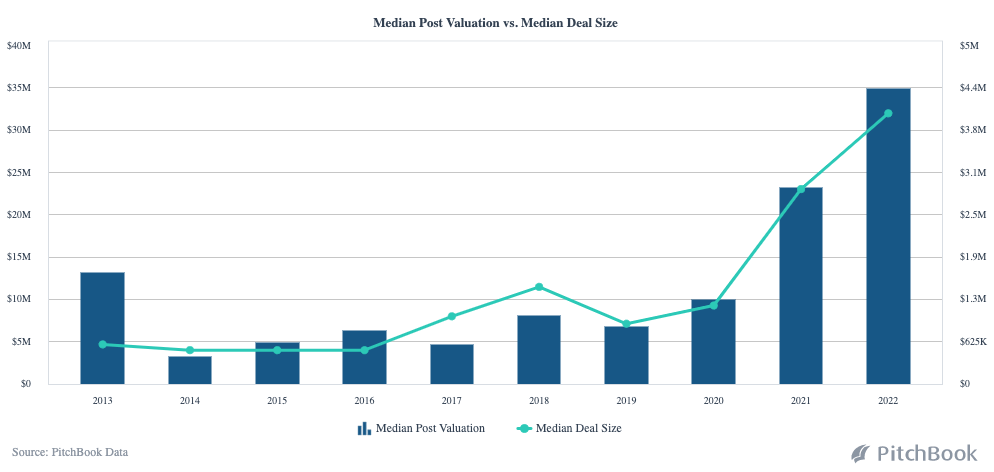

Deal Values & Sizes Growing

Median deal valuations are also way up this year. The median post-money valuation for deals (across all stages) so far in 2022 has risen to $35M and the median deal size is $4.4M (across all stages).

The 15 Largest Crypto VC Deals of 2022

There have been five venture investments so far this year for over $500M in capital raised. According to our research, the largest VC deals of 2022 so far have included:

Epic Games - $2B in April 2022 - Metaverse & Gaming

Trade Republic - $1.15B in Jun 2022 - European Crypto Brokerage

Robinhood - $600M in May 2022 - Crypto/Equity Brokerage

Fireblocks - $550M in April 2022 - Crypto Infrastructure

Copper - $500M in April 2022 - Crypto Infrastructure

Consensys - $450M in April 2022 - Crypto Infrastructure

Polygon - $450M in February 2022 - L1/L2 Blockchain

Yuga Labs - $450M in March 2022 - Metaverse/NFTs

FTX - $400M in January 2022 - Crypto Exchange

Circle - $400M in April 2022 - Stablecoins

Compute North, $385M in Feb 2022 - Crypto Mining

NEAR - $350M in April 2022 - L1 Blockchain

Crusoe - $350M in April 2022 - Clean Energy Crypto Mining

Blockdaemon - $253M in Aug 2022 - Crypto Infrastructure

Dapper Labs - $250M in March 2022 - Crypto Gaming

The Top 50 North American Crypto VCs - By Fund Size

Now let’s take a look at the full list of who the biggest crypto VCs are in North America. To compile this list we used sources including Pitchbook, Crunchbase, firm websites, Signal NFX, AUM13F, and our own internal estimations when necessary.

Here is the full list of the Top 50 North American Crypto VC Funds

The Top 50 North American Crypto VCs - By Investment Count

There are of course two ways to look at the data -- by fund size (shown above) or by investment count (shown below).

If you sort by investment count the top 50 North American VC Funds by activity are:

Next week, we’ll be focusing our research on the Asian and European Crypto VC market. While our research is preliminary for the non-North American contenders… here’s a little preview of the top 10 Asian crypto VCs from what we’ve found so far.

See you next week!

About Our Research Process: For this article the Coinstack Research team ranked the top crypto VCs by investment count and fund size. Our research tools included Pitchbook, Crunchbase, AUM13F, and Signal NFX. Where fund size was not disclosed, we estimated it by multiplying the number of crypto venture deals completed times half of the median investment deal size (since there are often other investors too). If you’d like to submit a correction or your firm for the next edition of this list, please reply to send us a message with your firm name, number of crypto investments, and crypto fund size.

MoneyWeb Podcast: How Machine Learning Has Made Crypto Investments Safe for Institutions

Ryan Allis, general partner at Amphibian Capital, explains how AI and machine learning are minimizing crypto drawdowns and beating the pants off more traditional investments with the help of a fund-of-funds approach.

Webinar: The Ethereum Merge: What You Need to Know

The Ethereum Merge is, happening on September 15, 2022 moving from Proof-of-Work to Proof-of-Stake. Join us for this webinar for accredited investors and institutional allocators on what you need to know about this major upgrade for the Ethereum network. You can learn more and register here.

Thursday, September 8, 202212pm PT / 3pm ET / 7pm GMT55 minutes on Zoom / register here Presented by Ryan Allis, Publisher of Coinstack and GP at Amphibian Capital

What You Will Learn

Why Ethereum is moving to Proof-of-Stake in September

How the Ethereum community prepared for the two year process of preparing for the switch

How Proof-of-Stake reduces electricity usage by 99.95% versus Proof-of-Work, while increasing security (the amount of capital needed to attack) of the underlying blockchain

How the new Proof-of-Stake model reduces daily issuance of ETH by 90% by removing the need to pay miners, instead paying yield to stakers

How ETH will have a lower annual inflation rate than BTC after the merge (~0.1% vs. 1.72%)

What we expect to happen to the price of ETH after $18M of daily miner sell pressure is removed from the market

The expected yields from staking ETH post-merge (6-10% per year)

Our thoughts on whether Ethereum (ETH) will become worth more than Bitcoin (BTC) and achieve the Flippening in the 2024/2025 cycle

How Ethereum has maintained a 57% market share in DeFi and an 81% market share in NFTs

How the Ethereum blockchain is achieving 9x the monthly revenues of the Bitcoin blockchain

Why the threat of a Proof of Work fork isn’t concerning (it’s the apps and stablecoins that matter)

How Layer 2 blockchains like Arbitrum and Optimism reduce usage fees dramatically while still using Ethereum mainnet security

Up-and-coming smart contract platforms that may challenge Ethereum’s dominance over time including Avalanche, Solana, Near, Fantom, Polkadot, Sui, and Aptos.

How our ETH-denominated fund works to generate ETH-on-ETH returns

The process we went through to create an Ethereum-denominated fund designed to grow ETH holdings over time

How accredited investors can invest in the Amphibian Capital crypto fund of funds.

Requirements

For institutional investors and accredited investors

For portfolio managers inside hedge funds or family offices

For financial advisors advising HNWIs

💬 Tweet of the Week

Source: @pedrouid

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Arbitrum Has Managed Consistent Active User Metrics Without Offering Any Incentives for Network Usage

Source: @MessariCrypto

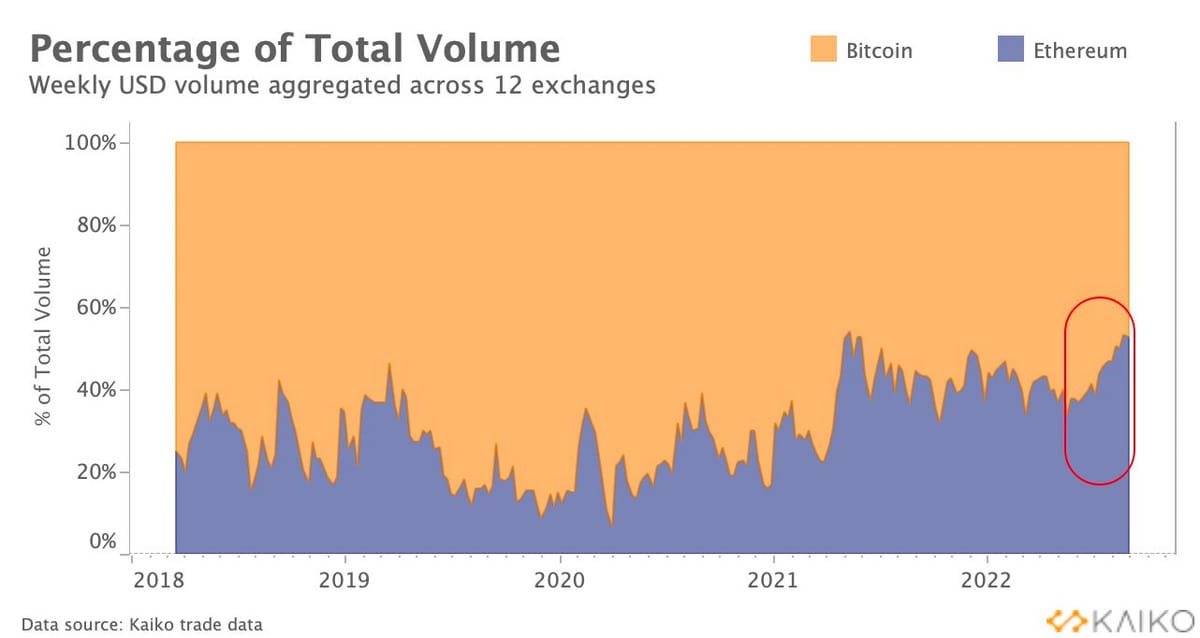

2. For the Past 4 Weeks, Weekly ETH Trade Volume Has Been Greater Than BTC Volume, the Longest Stretch of Time Ever

Source: @Clara_Medalie

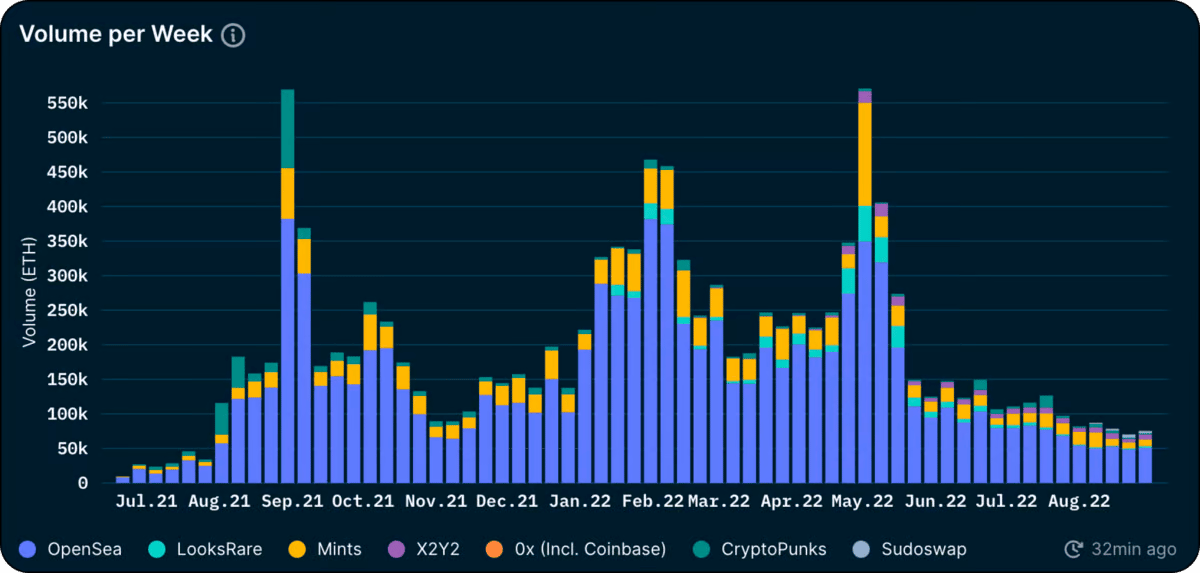

3. OpenSea NFT Trading Volume Down 99% Over the Last 4 Months

On May 1st, OpenSea processed ~$2.7b in transactions. On Sunday, OpenSea processed just ~$9.34m in transactions. Source: MilkRoad

4. After “The Merge”, 60% of Blockchain Market Cap Will Not Be Energy-Intensive

Source: PanteraCapital

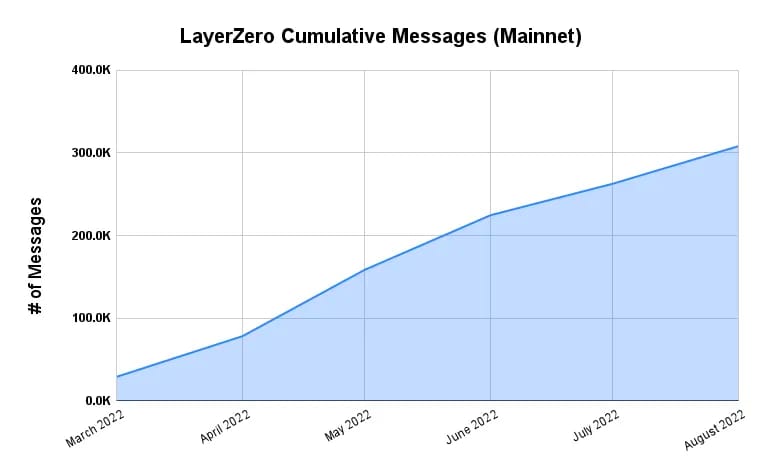

5. LayerZero Users Have Sent Over 300K Messages Across Supported Chains

Source: OurNetwork

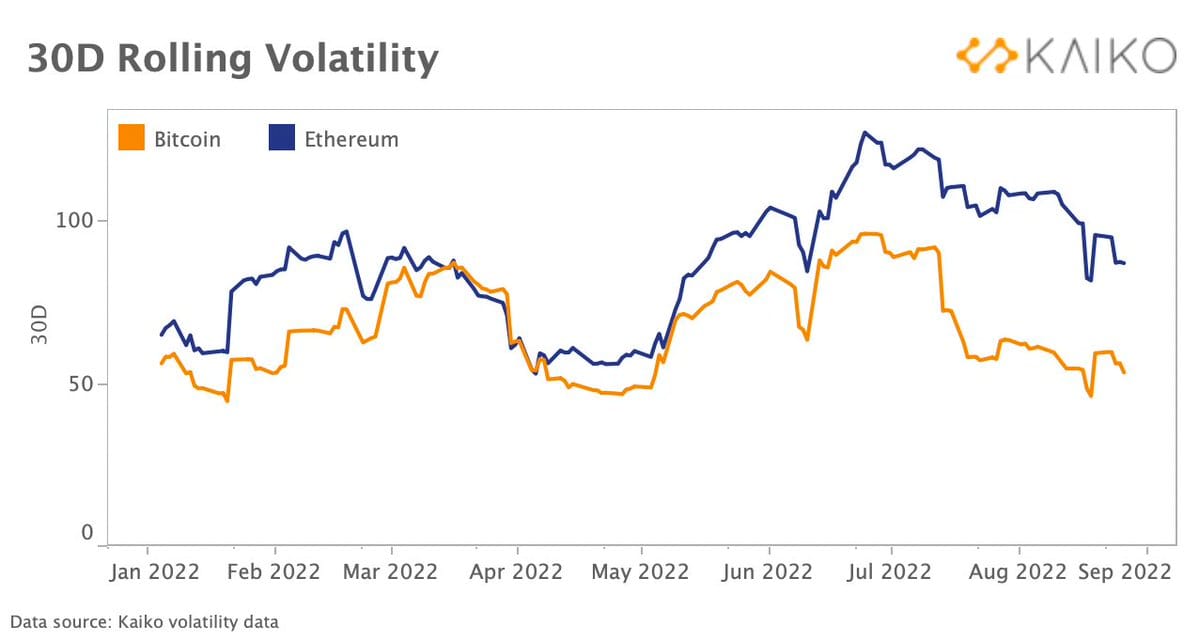

6. Not Only That, the Spread Between #ETH and #BTC Volatility Is at Its Widest Level in More Than a Year

Source: @Clara_Medalie

7. Texas Crypto-Mining Rush May Need As Much Power As Entire State of New York Demand Is 33% More Than What Grid Was Preparing To Handle

Source: Bloomberg

✨ The Metaverse for Augmented Reality: A Digital Layer on Top of the World - Part 5

About Peer: Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Part 5: A Path Forward - Introducing The ICX

What is an ICX?

An alternative to ICOs that actually vets projects is needed. That is why Peer, a Web3 social network and blockchain company, recently announced an alternative to the Initial Coin Offering (ICO) called the Initial Coin Exchange (ICX).

The ICX provides a framework for an evidence-based fundraising standard for established blockchains and decentralized apps that promotes responsible innovation, global participation, and rapid validation.

Essentially, an ICX is for crypto companies and projects past the prototyping phase and looking for their next round of funding before seeking seed-stage investors. An ICX involves a token that can be fully used on day one and is not just a pie-in-the-sky idea or whitepaper filled with marketing fluff.

The company must have proven and demonstrable substance through an IP-moat and follow the rules and regulations of its jurisdiction. Accredited investors in the U.S. and all non-U.S. persons outside the U.S. can sign up to exchange crypto or USD for PMC from Peer’s ICX Launchpad at icx.peer.inc.

The ICX is ready for global adoption, striking a balance between the tumultuous ICO and rigorous IPO.

The ICX is also regulation friendly, and conducted under strict adherence to US SEC rules to ensure transparency, accountability, and responsibility.

All ICX projects are vetted at the early stages and by definition will have proven merit, credibility, and feasibility.

The Requirements to Conduct An ICX

Any blockchain-based company or dApp can conduct an ICX as long as they follow these requirements:

The company is incorporated and legally established

The company has an existing product on a blockchain with a live mainnet

The coin or token being exchanged must have immediate utility, not eventual utility

The company has defensible IP that separates it from its competition

The founders of the company are identified and known

An ICX is essentially an ICO for established blockchain companies where the coins/tokens offered have immediate network use. The distinction between an ICO and an ICX is that a crypto project is a more developed project where the blockchain is already launched, there are already granted patents, or maybe at the very least, patent-pending IP. This requires companies to get out of the napkin plan phase and already generate some revenue or at least have an established product market fit.

The Benefits of an ICX for Startups

For blockchain startups, there are numerous benefits of conducting an ICX.

ICXs help accelerate product adoption by creating a large number of token holders who are now incentivized to spread the word about your company.

Companies can also access decentralized funding with an ICX -- allowing all investors outside the U.S. and accredited investors inside the U.S. to allocate capital and have an opportunity to participate in the growth of the app and network.

ICX Fundraising Example - The Peer Metaverse Coin

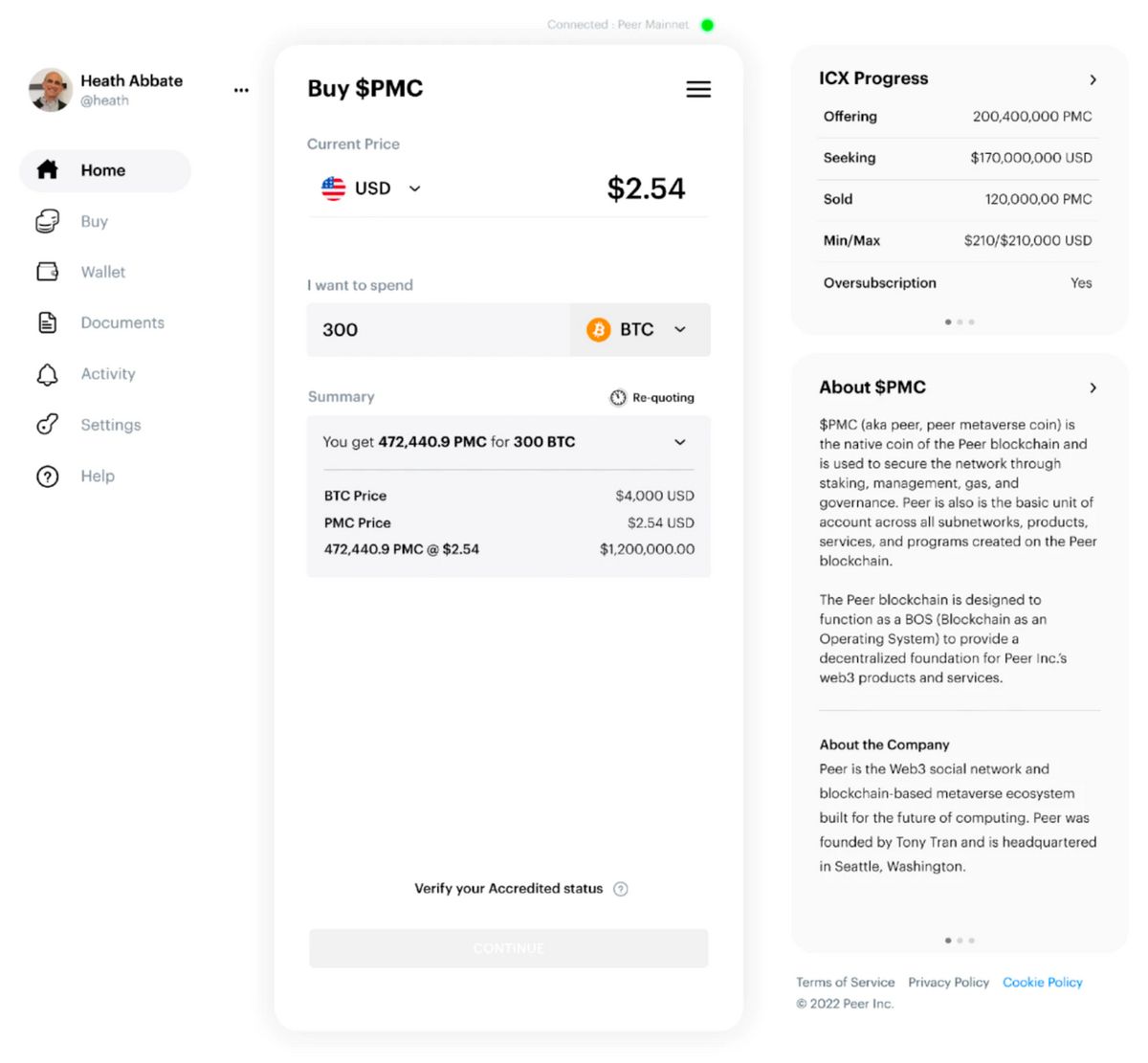

Below you can see an example of an active Initial Coin Exchange happening with the Peer Metaverse Coin (PMC). Within the application, users can exchange BTC, LTC, ETH, or USDT for PMC.

Peer is now selling its native coin PMC (Peer Metaverse Coin) during their ICX (Initial Coin Exchange) exclusively to accredited investors via a U.S. offering under Rule 506(c) of Regulation D under the U.S. Securities Act of 1933, and to non-U.S. persons in an offshore offering under Regulation S under the Act.

The initial supply for PMC is 2,100,000,000 (2.1B) with the goal to sell roughly 10% or 250M coins during mid-2022. Interestingly, Peer is conducting the Reg D and Reg S offerings of PMC pursuant to exemptions from registration under the Act available for digital assets classified as securities under the Act, often referred to as security tokens.

Before purchasing PMC, visitors to Peer’s website must establish that they are either (1) accredited investors or (2) non-U.S. persons accessing the site from outside the U.S. Accredited U.S. investors and non-U.S. persons visiting the site from outside the U.S. can view Peer's offering materials here. The ICX launchpad is a dApp built on the Peer blockchain. Peer plans to open the ICX Platform to all projects looking to raise capital following the ICX standard for later-stage projects.

Bringing Investor Confidence Back Through Project Vetting

Peer looks to evolve beyond the ICO and bring investor confidence back to the investor community regarding early-stage crypto investing. As it stands, an initial coin offering requires very little to launch and raise capital. In an ICX, a token offering must have day one utility, and the company or lab offering the token must have some IP moat such as a pending or issued patent.

Below is an example of the patent that Peer owns for its web3 social network timeline technology called the Fluid Timeline.

Source: Peer Patent

Similar to how STEPN raised a Seed Round before doing an IEO, Peer sees an ICX as an alternative fund raising method that can sit nicely between a Series A round and a Seed. In the case of STEPN, the project could have elected to do an ICX instead of an IEO. Because the STEPN team already had a working product as well as users, they would have qualified to do an ICX. Many crypto projects face uncertainty when raising capital between a Seed Round and Series A because they may need more funding before being able to bring the product to market or collect meaningful revenue. An ICX allows projects to raise a round before going back out to VCs.

The ICX Allows Projects to Stand Out

When it comes to an ICO, anyone can generate a whitepaper with a decent advertising budget and sell some tokens. IEOs and IDOs are vetted by a third-party exchange that has the incentive to pick and choose which projects they believe will generate higher trading volume for their platform and potentially filter out good projects.

With an ICX, anyone can raise capital without having to pay enormous listing fees. Retail investors can feel safe knowing that only vetted projects following all of the jurisdiction laws in their region can participate. Each ICX project is vetted by Peer to ensure the firm is properly incorporated and established, that the product exists and is live, that the coin or token has utility immediately, the founders are known, and the company has IP. Peer aims to create a new standard in blockchain fundraising where founders have an option to stand out in the sea of ICOs, IEOs, and IDOs.

Why The ICX Is Needed More Than Ever

Financing for innovation is more important than ever. The next breakthrough will grow on the world stage instead of siloed markets. Innovation can appear anywhere if financing comes from everywhere. Right now, the capital raising process does not reward riskier bets at the edge. They only bet on incremental technologies that are faster to market.

The market needs fundraising models that will invest in companies like SpaceX, Tesla, Modern, or Peer that are truly bringing major change to the world. Crypto is a rapidly growing global community, and it will be the next wealth creation engine as all financial assets become tokenized over the next 10-15 years.

Further, an ICX includes regulatory compliance, leaning on the U.S. Securities and Exchange Commission’s Regulation D and Regulation S to enable compliant fundraising. An ICX can democratize access to the funding of innovation. It’s a win/win/win for innovation, companies, and investors around the world.

While companies can conduct an ICX on their own if they follow all of the defined requirements, they also could use the official ICX Launchpad provided by Peer, providing an additional seal of approval for investors as well as access to additional vetted investors.

Conclusion - A New Platform for Global Crowdfunding

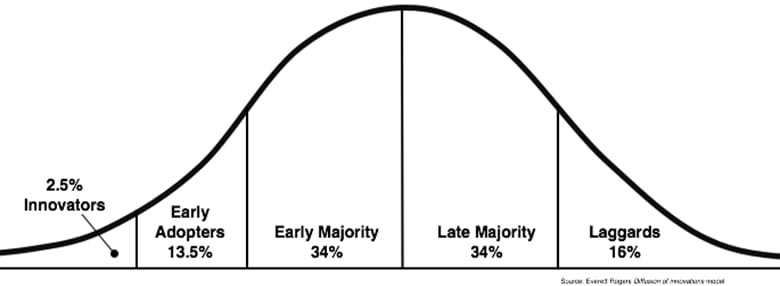

The ICX Launchpad will become an on-chain accelerator that democratizes access to high value technology companies in its formative years, as well as providing an express lane to both capital and global product-market validation. It will also change the Diffusion of Innovation curve to allow the creation of more Innovators and Early Adopters that would otherwise be Early or Late Majority. The bell curve will skew left.

Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Vitamin of the Week: Crypto Payments- A Real Use Case

About this Section: Our friends at Vitamin3 have launched a free daily SMS covering web3 topics. You can subscribe free by sending HELLO to 305-614-9440. Here’s an excerpt from their SMS earlier this week on the Metaverse.

(1/4) Tuesday we said payments have long been viewed as a long-term use case for Bitcoin. But, a decade after its launch, why aren't Bitcoin payments mainstream?

To answer, let's explore a real world experiment. In Sept '21, El Salvador made Bitcoin legal tender (official currency) & released a Bitcoin wallet ("Chivo"). The stated goal was to digitize the economy, decrease reliance on US Dollars

(2/4) & lower remittance fees. However, 6 months later, 86% of businesses said they've still never used Bitcoin (others tried & reverted back to cash). Only 1.9% of remittances to El Salvador during that period were in Bitcoin.

Despite strong initial interest in Chivo, there are roadblocks. Some are growing pains - like tech bugs & lack of crypto education. But, the biggest challenge will likely

(3/4) persist. Bitcoin's price is highly volatile. When Bitcoin became legal tender, its price was ~$50k. Today, it's less than $25k. Having your money lose 50% of its value might understandably scare you away from relying on it.

El Salvador's experience suggests the currency itself impacts crypto payments adoption. El Salvador updated & relaunched Chivo in February; yet, adoption remains low.

(4/4) It doesn't matter how much you save on fees, if your money is worth 50% less.

One key solution is the emergence of stablecoins. As described in DeFi week: Stablecoins are fungible tokens with value pegged to the value of another asset (often US Dollar). Using stablecoins (if safely designed & backed by collateral) allows users to enjoy the benefits of crypto payments without the volatility.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and is building data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here

Introduction

In the past year, over $3 billion has been stolen from the overall decentralized finance (DeFi) ecosystem, with over ⅔ of the stolen value stemming from bridge hacks. In order for DeFi to evolve as a credible and secure ecosystem, the vulnerabilities within the space need to be mitigated. This report dives into how a bridge works, the types of hacks that have occurred over the past year, and how one bridge in particular, was able to mitigate two separate exploit attempts.

Bridging Basics

A cross-chain bridge enables the transfer of data, primarily token assets, between blockchains to take advantage of greater liquidity, to build a better user experience in terms of cost and transaction finality, and to reduce main chain congestion by distributing transaction loads across the greater ecosystem.

Bridges vary in their degree of decentralization. In a trusted, or more centralized setup, the bridge derives its security from designated parties that oversee its operation. In a trust-minimized or more decentralized setup, the bridge derives its security from verifiers from the underlying chains and the algorithms that operate the bridge.

Most 2-way bridges use a combination of lock and mint and burn and mint models. Users deposit their tokens in a smart contract on the originating chain to transfer assets from one ecosystem to another. An equivalent amount of assets is then minted on the destination chain and withdrawn to the user. To transfer back to the original ecosystem, the user deposits the minted assets into a smart contract on the destination chain. These assets would then be burned, and the original assets would be released on the original source chain. This method ensures a constant token supply across all platforms.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

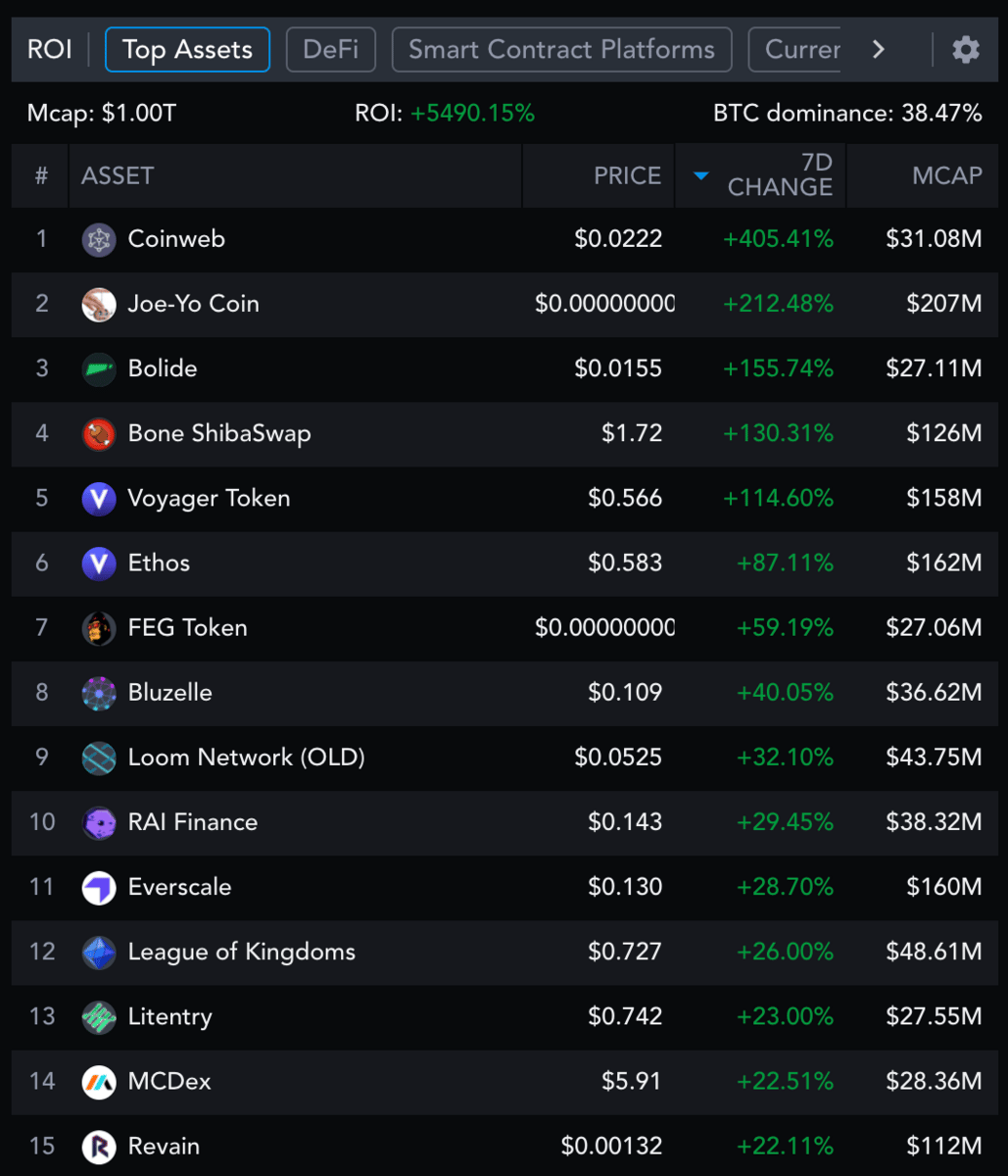

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: ABBC is a Payments Platform, Sperax is a Governance Token, Santos is a Fan Token, Manifold is an MEV Tool

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 29,813 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com