Learn More at www.tokenx.is, and www.decard.io

Issue Summary: Welcome back to Coinstack, the newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 120k+ weekly subscribers. This week we cover the Curve DAO hack, Justin Sun’s big OTC trade, a judge denying Terra’s motion to dismiss, and big new venture rounds for Hi ($30M) and Aethir ($9M).

Price performance since we began writing Coinstack in January 2021

Published By Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’re launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Thanks to Our 2023 Coinstack Sponsors…

To reach our weekly audience of 120,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

Thanks to Our 2023 Coinstack Sponsors…

TokenX streamlines Web3 tokenization for Web2 companies, simplifying integration of blockchain technology into existing applications. Powerful APIs tokenize assets with on/off blockchain metadata, policies, and authentication. Leveraging TokenX, Web2 companies can access the benefits of decentralization, ownership, authentication, and transparency provided by Web3, unlocking new opportunities for growth, customer engagement, and innovation. Learn more at www.tokenx.is

Unleash the power of DECARD’s DEX, the decentralized exchange designed to conquer the $11.5 trillion spot market. DECARD’s unique and patented tech stack, build on Tagion infrastructure, ensures a seamless trading experience and delivers never-before-seen effective order books in a decentralized environment. Bid farewell to frontrunning and custody risks and embrace a secure future with DECARD’s DEX. Join and revolutionize the way you trade at DECARD.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🎭 Millions of Curve DAO tokens stolen minutes before a white hat rescue mission- Millions of curve DAO (CRV) tokens were stolen minutes before a white hat rescue mission to safeguard the funds, according to blockchain data and Curve contributor Banteg.

🤝 Crisis at DeFi Giant Curve Eases After Justin Sun and Others Step In With Help- Justin Sun, the founder of the Tron blockchain, stepped in to protect against a possible bad debt situation stemming from falling curve (CRV) token prices that could impact a massive loan tied to Curve Finance founder Michael Egorov.

⚖️ Judge Rejects Ripple Ruling Precedent in Denying Terraform Labs' Motion to Dismiss SEC Lawsuit - A federal judge denied stablecoin issuer Terraform Labs' motion to dismiss a lawsuit from the U.S. Securities and Exchange Commission (SEC) on Monday, saying the regulatory agency has sufficiently argued it has jurisdiction and "asserted a plausible claim" that TerraUSD (UST), the Anchor Protocol and LUNA may have violated securities law.

⚖️ FTX and Genesis Reach Agreement in Ongoing Bankruptcy Dispute- Bankrupt crypto firms FTX and Genesis have reached an agreement in principle that would resolve claims made by both parties in their ongoing dispute. “The Parties have reached an agreement in principle, subject to documentation, regarding a settlement that would resolve, among other things, the claims asserted by the FTX Debtors against the Debtors in these Chapter 11 Cases and the claims asserted by the Genesis Debtors against the FTX Debtors in the FTX Chapter 11 Cases,” a letter filed by their legal representatives to Judge Sean H. Lane reads.

⚖️ U.S. SEC Sues Richard Heart, Hex, PulseChain on Unregistered Securities, Fraud Allegations - The U.S. Securities and Exchange Commission (SEC) sued internet marketer Richard Schueler, known online as Richard Heart, and his projects Hex, PulseChain and PulseX, alleging he raised over $1 billion across three different unregistered securities offerings beginning in 2019.

💬 Tweet of the Week

Source: @Delphi_Digital

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Total Value Locked (TVL) in #Ethereum DeFi has fallen by almost 8% since Sunday. The decline, likely triggered by the uncertainty following the #Curve attack, represents a sharp decrease. To put this in context, the decrease amounts to $3.55B, with Curve's TVL on ETH comprising just a fraction of this figure.

Source: @TheBlockPro__

2. Arbitrum vs Optimism transactions over time. Yesterday was the first day in over 6 months where Optimism had more transactions.

Source: @Dynamo_Patrick

3. AI-related tokens have been losing momentum, hitting lowest weekly trade volume since Jan.

Source: @KaikoData

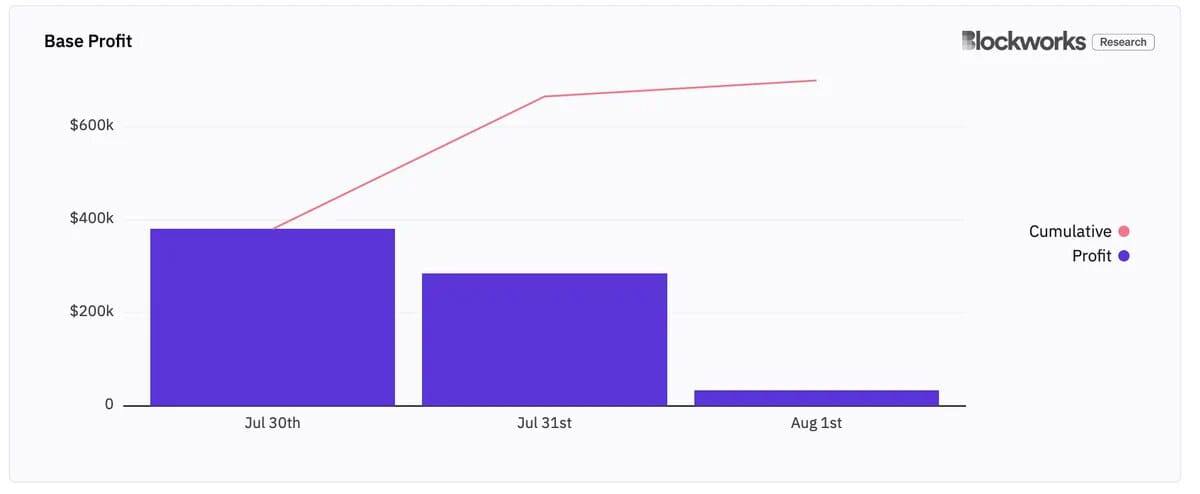

4. What people don't know about Coinbase's L2 Base is that it has accrued over $700k profit in just three days. This is ~$85M on an annual basis.

Source: @WestieCapital

5. After soaring in popularity in late 2021, the monthly trade volume for the top P2E tokens has fallen nearly 99% to just $3B in June 2023

Source: @KaikoData

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Primer on Pocket Network

Pocket Network is a Web3 node infrastructure protocol that creates a two-sided marketplace for RPC node providers to offer developers access to blockchain data.

A remote procedure call (RPC) is an application programming interface (API) interaction that allows apps to communicate with servers on a shared network like Ethereum. RPC nodes enable users (applications/developers) to communicate with blockchains. Relays (calls) to RPC nodes are usually required by apps, exchanges, wallets, and analytical tools for a range of tasks including, but not limited to, retrieving wallet balances and smart contract event logs, or interacting with DeFi liquidity pools.

Pocket Network’s protocol runs atop its Proof-of-Stake blockchain, which uses a Stake-for-Access (SFA) model, also known as a work token model. In other words, Pocket requires its node providers to stake the native token (POKT) to provide services on the network. Simultaneously, end users are required to stake POKT to access the network’s services. Previously, the protocol would mint new POKT for each relay, directly paying nodes through minting rather than paying for each RPC relay. Inflation is no longer tied to relays and is, instead, determined through Pocket DAO governance. Most recently, Parameter Update Proposal-32 (PUP-32) set the minting to roughly 220,000 POKT per day (~4.9% inflation). Currently, service nodes earn POKT in proportion to their stake-weight (and rewards multipliers).

Additionally, since the implementation of Pocket Improvement Proposal-29 (PIP-29) in May 2023, Pocket gateways (access portals) must pay a $0.00000085 fee per relay to the Pocket DAO, which is then burned. This fee is called the GatewayFeePerRelay parameter, which specifies how much USD-equivalent POKT the gateway operators owe for every relay they send through the network. Of note, paying Pocket users spend an average of $0.000004 per relay, which shows that gateways (currently only the Pocket Portal) are still net positive in fees earned after paying the gateway fee per relay to the DAO.

The key participants in Pocket Network are described below.

Service Nodes: These nodes stake POKT to provide servicing relays to users (applications/developers); get compensated in POKT per relay fulfilled and proved; retain 85% of total POKT rewarded for relays.

Validator Nodes: These nodes stake POKT to validate the PoS blockchain; confirm blocks that contain proofs of the relays serviced; retain 5% of total POKT rewarded for relays and 1% of POKT paid for transaction fees (the other 99% is sent to the Pocket DAO).

Users: Often applications or developers that stake POKT to request RPC relays to various blockchains. Currently, staking is conducted through the Pocket Portal. The Pocket V1 upgrade will change this dynamic by enabling decentralized demand-side access points for gateways and users.

Pocket DAO: A whitelisted group of holders of the POKTDAO token (on Gnosis Chain), which is strictly used for governance on Snapshot and currently has a supply of 61 POKTDAO. Members must go through a proof-of-participation onboarding process before admission to the DAO. The DAO votes on Pocket’s monetary policy, validator requirements, and other protocol updates while retaining 10% of total POKT rewarded for relays and 99% of transaction fees.

Gateways: Access points for developers to use the Pocket Network. Gateways must pay the Pocket DAO a $0.00000085 fee per relay serviced that is then burned by the DAO on a weekly basis. Currently, the Pocket Portal is the only gateway available and is operated by Pocket Network Inc. Pocket plans to launch its first community-run gateway by Q4’23.

Key Metrics

Activity on Pocket Network increased over the past four quarters, as relays serviced grew 2% QoQ and 41% YoY. The amount of POKT staked grew steadily over the past year, with Q2’23 seeing over 1 billion of total POKT staked for the first time. Regarding financials, the 38% QoQ fall in POKT-USD price and 15% QoQ decline in the POKT inflation in Q2’23 led total revenue to decrease by 45% QoQ in USD terms.

Relay Requests

Pocket users are usually applications or developers submitting relay requests (API requests) to service nodes. These relay requests are routed to any of the supported relay chains. Service nodes then receive a response from a relay chain and forward it to the requesting application. The interaction between users and service nodes represents the fundamental utility of Pocket Network. Thus, the demand for Pocket Network’s services can be derived by measuring relay requests.

Relays are the most important metric for determining the activity and health of Pocket. Despite falls in Pocket transaction volume, staked nodes, and the price of the POKT token, Pocket Network saw a 2% QoQ growth in relays serviced to 107 billion relays (i.e., almost 1.2 billion relays serviced daily). The movement builds on the overall growth in relays throughout the past year, up 41% YoY.

Staked and Jailed Service Nodes

Relays are the most important metric for determining the activity and health of Pocket. Despite falls in Pocket transaction volume, staked nodes, and the price of the POKT token, Pocket Network saw a 2% QoQ growth in relays serviced to 107 billion relays (i.e., almost 1.2 billion relays serviced daily). The movement builds on the overall growth in relays throughout the past year, up 41% YoY.

Staked service nodes route relay requests from users (applications/developers) to relay chains, then forward the responses back to applications. Nodes that unstake POKT are referred to as unstaking nodes and must wait 21 days before their POKT is unstaked. Jailed nodes are staked service nodes that double-sign a block or fail to sign a certain amount of blocks within a set time period.

While average staked nodes declined over the past four quarters to nearly 21,000 in Q2’23, the percentage of unstaking nodes versus staked nodes continued its downward trend as well. It fell to 4% in Q2’23, down from almost 6% in Q1’23. Simultaneously, jailed nodes followed a similar downtrend over the past four quarters.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.beehiiv.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.tokenx.is, and www.decard.io