Social Links: Twitter | BitClout | Telegram | OpenSea | Substack

Welcome to the CoinStack Newsletter. This issue makes a detailed forecast for the December 31, 2021 price for Bitcoin ($120k-$150k) and Ethereum ($6k to $9k) and explains why the ETH price has been growing much faster than BTC price over the last 18 months. And this week, anyone who buys a Mrs. Bubble NFT will get a 30 minute 1:1 call with me in the next two weeks to help you optimize your crypto investing strategy.

Chart of the Week: Forecasting the 2021 Bitcoin Cycle Top

In This Issue:

The Bitcoin 2021 Cycle Top Price Forecast

The Bitcoin Supercycle

How We Will Know When We’re At the Cycle Top

How We Know We’re Not At the Cycle Top Now

A Bitcoin Price Drop in 2022?

Ethereum Scaling Update - 30 TPS to 100,000 TPS by End of 2021

The Ethereum 2021 Cycle Top Price Forecast

The Ethereum Cash Flow Report 2021 - Why You MUST hold ETH

The Crypto Adoption Curve - Faster than the Internet

Mrs. Bubble’s New NFTs - Llamacorn Angel Auction

Get a 30 Minute Crypto Investing Call With Me (By Buying an NFT)

A Long-Term Crypto Portfolio

How to Get Started in Crypto

What Will Be the 2021 Bitcoin Cycle Top Price?

I’ve spent a lot of time this week working on refining my December 31, 2021 forecast for both Bitcoin and Ethereum.

Forecasting a crypto asset price 8 months in advance is not exactly easy. You have to take into factors like:

Market cycle timing

Capital inflows

User inflows

Search interest volume

App development and usage

Token supply changes

Blockchain functionality changes

Regulatory environment

Market sentiment

Competitive disruption

While Ethereum and Bitcoin currently represents only 40% of my total crypto portfolio (ETH 30%, BTC 10%), it’s clear that the rest of the market follows these two leaders -- so if I want to know where the rest of the market is generally going -- I need to get good at forecasting BTC and ETH.

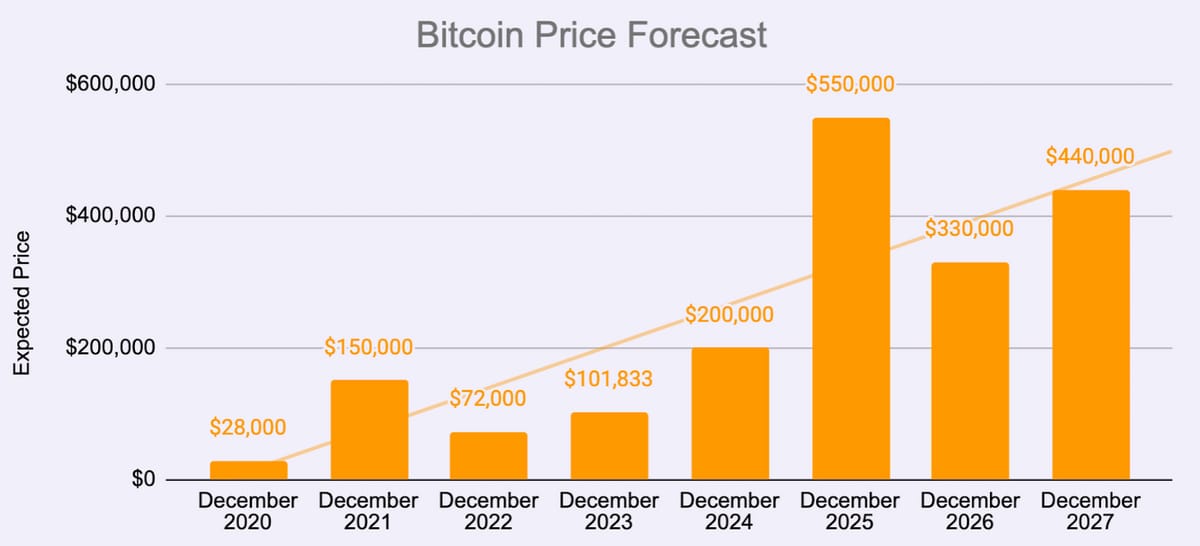

Let’s start by refining my Bitcoin forecast. In my March 31 Coinstack issue I forecasted a Bitcoin price by December 31, 2021 of $150,000.

Three weeks later, that remains the midpoint of my expectation for this cycle top.

Let’s take a look at where we are currently in this Bitcoin cycle. We are now 346 days after the last halving on May 11, 2021. The 2017 cycle lasted 519 days from halving to top… and each cycle so far has lasted longer than the one before it.

Chart #1: Bitcoin’s 2017 Cycle (Purple) Compared to 2021 (Orange)

When you layer the chart for 2016-2017 Bitcoin cycle (in purple) on top of the 2020-2021 Bitcoin cycle (in orange), starting from the date the last halving on May 11, 2020, it implies we will reach a price point of $253,021 by October 6, 2021. And considering we’re currently ahead of cycle 2, some like Willy Woo are projecting a $300k top.

Personally, I see $250k as a maximum for this cycle. Why? Because each cycle tends to not grow quite as much as the prior cycle.

This can be seen when you layer each of the four Bitcoin cycles on top of each other.

Chart #2: The First Four Bitcoin Cycles

As you can see, in Cycles 1, 2, and 3 -- each cycle lasts longer than the cycle before it. This is called “cycle lengthening theory” by many Bitcoin analysts.

Assuming cycle lengthening theory holds, in which each Bitcoin cycle from market halving until peak price lasts long than the one before it, and extrapolating the declining logarithmic growth of each cycle, I expect that Bitcoin could peak in this cycle somewhere near $108k roughly around 600 days after the May 11, 2020 halving -- which nicely ties in exactly with the end of 2021.

However, large institutional capital flows this cycle may make the actual peak higher than this forecast. My best guess is that we get to somewhere between $120k to $150k by the end of 2021.

Chart #3: It’s Getting A Lil Bubbly, But We’re Not There Yet

This Bitcoin price chart with Logarithmic Regression Lines offers a guide on when to buy and when to sell for active investors. Buy in green. Sell when we get near the top of the red. The chart indicates that we’re getting closer to “Bubble” territory but we aren’t there yet.

Back in 2017, when the Bitcoin price first hit the black line at the bottom of the red regression, we were at $13k. We peaked at $20k in December 2017. Based on this simple model, this would indicate that we will reach at least $85k in this market cycle. This is what I consider the “floor price” or “minimum price” for a 2021 Bitcoin cycle top.

However, as I wrote above, based on the amount of institutional capital coming into the space most analyst models ranging from the Stock to Flow model to Pantera to Willy Woo to Benjamin Cowen are predicting a Bitcoin cycle top of $100k to $300k by the end of 2021.

Chart #4: The 2021 Bitcoin Cycle Top Forecast

Taking into account all of the above, I see $85k as the minimum cycle top price for this Bitcoin cycle and $300k as the maximum possible. My median expectation is a price point in the $120k to $150k range. You can see here a 2 minute video I made today explaining the above chart.

A Bitcoin Price Drop in 2022

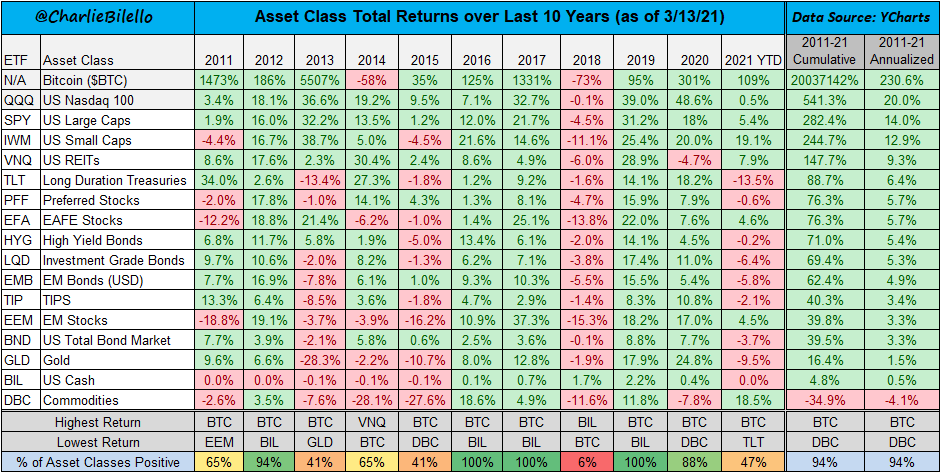

The only two years in Bitcoin history that BTC dropped in price was the year that is 2 years after a halving (2014 and 2018).

In 2014, Bitcoin dropped 84.9% from peak to bottom (and ended the year down -58%). In 2018, Bitcoin dropped 84.3% from peak to bottom (and ended the year down -73%).

2022 happens to be 2 years after a halving -- so most expect Bitcoin to drop next year.

But will Bitcoin drop by 85%?

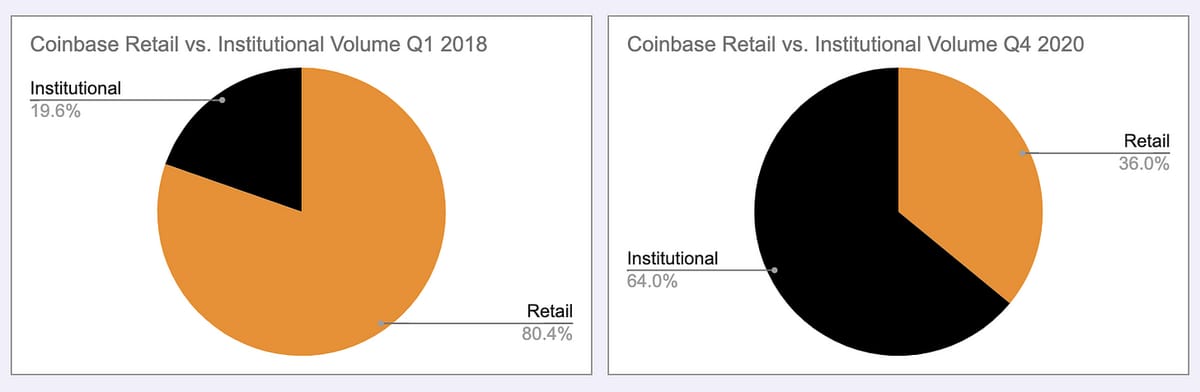

I highly doubt it. Coinbase for example reported 3.26x more institutional volume in the market in Q4 2020 than in Q1 2021.

There are more stable capital flows coming into this market than ever before.

This 2021 crypto market isn’t driven by nervous retail buyers like 2017’s market was. It’s driven by institutions who make long-term multi-year bets, who understand why this technology has fundamental long-term value, and who are making a 10+ year bet that Bitcoin and Ethereum are going to be a key part of the new global economic system.

And unlike in 2017 there are many more real and developed blockchain use cases including payments, DeFi, NFTs, medical records, supply chains, security tokens, DAOs, mirrored stock trading, CBDCs, and token-enabled companies turning their customers into token-holders.

So I don’t expect a 85% drop. I’m currently forecasting a 50-60% peak to bottom drop in 2022.

The only way I could see a 80% drop happening in 2022 is if we get way ahead of ourselves and end 2021 with a $300k Bitcoin price point or higher. I could see a 80% drop from $300k to $60k if we get up that high -- before recovering very nicely in 2023 and onward.

If we stay around a reasonable $110k to $150k peak, we will likely see a pull back to about where we are now ($60k to $70k) before resuming an upward trend toward $500k in the 2024/2025 bull cycle, kicking off in earnest toward the time of the April 2024 halving.

With all the use cases and institutional money coming into the space, I do not expect the drawdown in 2022 will not be as severe as 2018 and 2014.

The Bitcoin Supercycle?

Some like Dan Held talk about a Bitcoin Supercycle in which there isn’t a Bitcoin price haircut in 2022 and the market continues in a generally up direction toward where all believe it is eventually heading -- above $500k per Bitcoin and toward the market cap of gold ($11T).

I’m pretty sure that the moment we all finally lose all fears and believe that we are in a Bitcoin Supercycle is the moment we are gearing up for an imminent 50% drop.

Could I be wrong? Of course. This is only what I have been able to synthesize in four months of deep study and analysis.

Yes, we are eventually headed to $500k+ Bitcoin, but I believe it’s going to take another 4-5 years for us to get there -- and there will be lots of volatility along the way as we continue to go through the media hype and deflation cycle.

Even though the blockchain ecosystem keeps maturing, the human behavior of overinvesting too much and then underinvesting in waves in the early stages of any new disruptive technology-driven asset class will likely continue for quite some time.

Just wait until you see the coming media headlines of Q4 2021. Fireworks my friends. Fireworks. And then another 24 month bear market where we huddle up, make friends, and actually do the building so that blockchain tech work smoothly for everyone rather than for the technologically sophisticated.

We sort of do need another 2-3 years of UI/UX and scaling work before this technology is truly ready to be a candidate to run the world’s financial system, anyway.

How Will We Know We’ve Reached This Cycle Top?

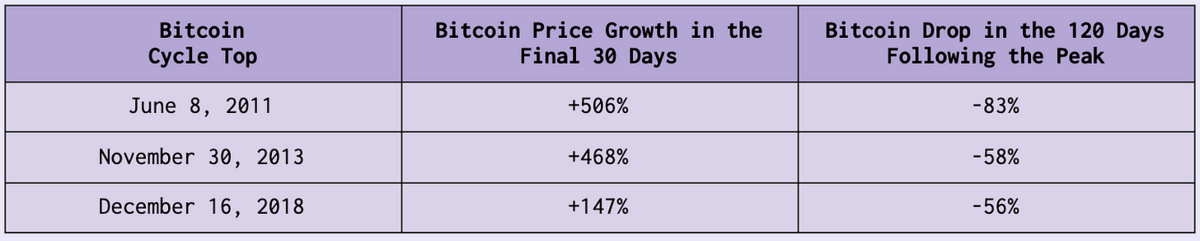

How will we know we are nearing the top? Well, in every Bitcoin cycle so far the top is marked by a final 4 week highly volatile period in which the price doubles or more.

When we see the price of Bitcoin go from X to 2X in 30 days that is when we will know we’re nearing a cycle top.

As you can see so far, each cycle has been a little less volatile than the one before it.

This time, I expect that in the four weeks leading up to the peak the price will go up by ~75%-100%.

I expect Bitcoin will trade mostly in the $50k to $80k range between now and the end of summer. At some point I expect to see a final move of 75%+ before we reach the cycle top peak -- peaking somewhere around $150k.

We shall see.

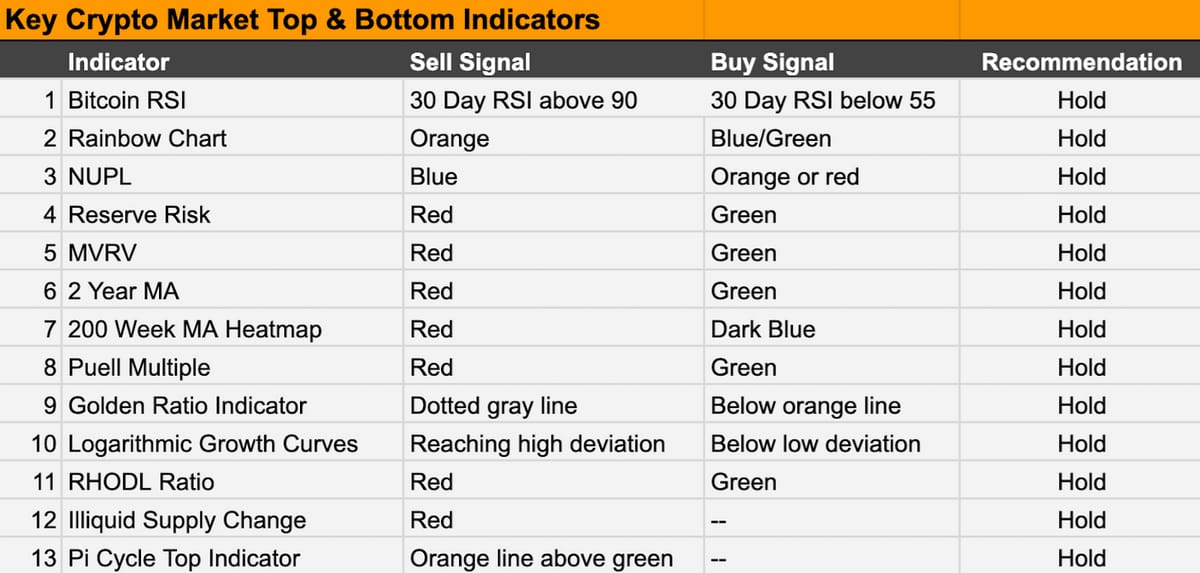

As we get closer to $100k Bitcoin and as my 13 Bitcoin cycle top indicators start getting tripped, I’ll be taking some portfolio preservation steps like converting some of my portfolio into interest-generating stablecoins.

If we get very overheated, I may take out a short on a BTC Perpetual market (using Binance, FTX, or Deribit) in order to lock in my gains (with any drop in long value offset equally by the gain in short value). I’m in the process of learning how to do this type of trade now to prepare.

I will certainly leave some on the table by moving some portion to stablecoins before the ultimate top, but I will at least preserve most of my capital for the next cycle. I have a feeling by 2023 I’ll really have the hang of this :). Just gotta make it there with my coin stack intact.

How Do We Know We’re Not At The Top Now

How do we know the top isn’t now? Well, you never really know till it’s over. But there are some key clues. The Bitcoin price has basically been flat now for 60 days mostly staying in the mid-50s. Bitcoin has never before reached a cycle top after being flat for two months. Historically, it only reaches cycle tops after periods of extreme and rapid growth.

Straight up 2x and then straight down 50%+ -- that’s the telltale sign of a top.

Would I get a bit worried if Bitcoin doubled in the next 30 days. Why yes, I would probably be calling for a top if it did. But it’s likely not going to do that. It’s going to go on its merry way up 20% some months, down 15% other months.

Just wait until the second half of 2021 for the probable fireworks and euphoria. I’m more excited for Q4 2021 than any other quarter I can remember in a long time.

What’s the takeaway of everything so far?

If Bitcoin goes above $100k in 2021, start getting a little cautious. If it goes above $150k in 2021, get very cautious.

Play to stay in the game.

It’s going to $500k in the long term, but we just aren’t going to get there before 2024/2025.

Chart #5: Bitcoin’s Monthly Retrace Happening Like Clockwork

This Bitcoin Open Interest & Price Chart from Messari’s Mira Christanto shows that like clockwork Bitcoin has a small 15-25% retrace every 3-5 weeks. These nearly monthly retraces are all part of the normal growth pattern during a bull market cycle like we are in. They are healthy for the market as they reduce leverage. With each bottom above the prior bottom and each top above the prior top, we are looking good. HODL.

Two steps forward, one step back is healthy.

While some get freaked out by 20% drops like we saw earlier this week, I just HODL and smile, knowing that we’re nowhere near the top yet.

I reiterate my original March 30, 2021 Bitcoin price forecast, using the midpoints of my expectations.

Ethereum Scaling Update - 30 TPS to 100,000 TPS by End of 2021

Ahh, my favorite blockchain. Ethereum. I love you so.

Your mythical unicorns fly through the ether with such beauty.

You’ve empowered the world with your innovative use cases, smart contracts, and Dapps.

The scaling your builders are working on this year is impressive.

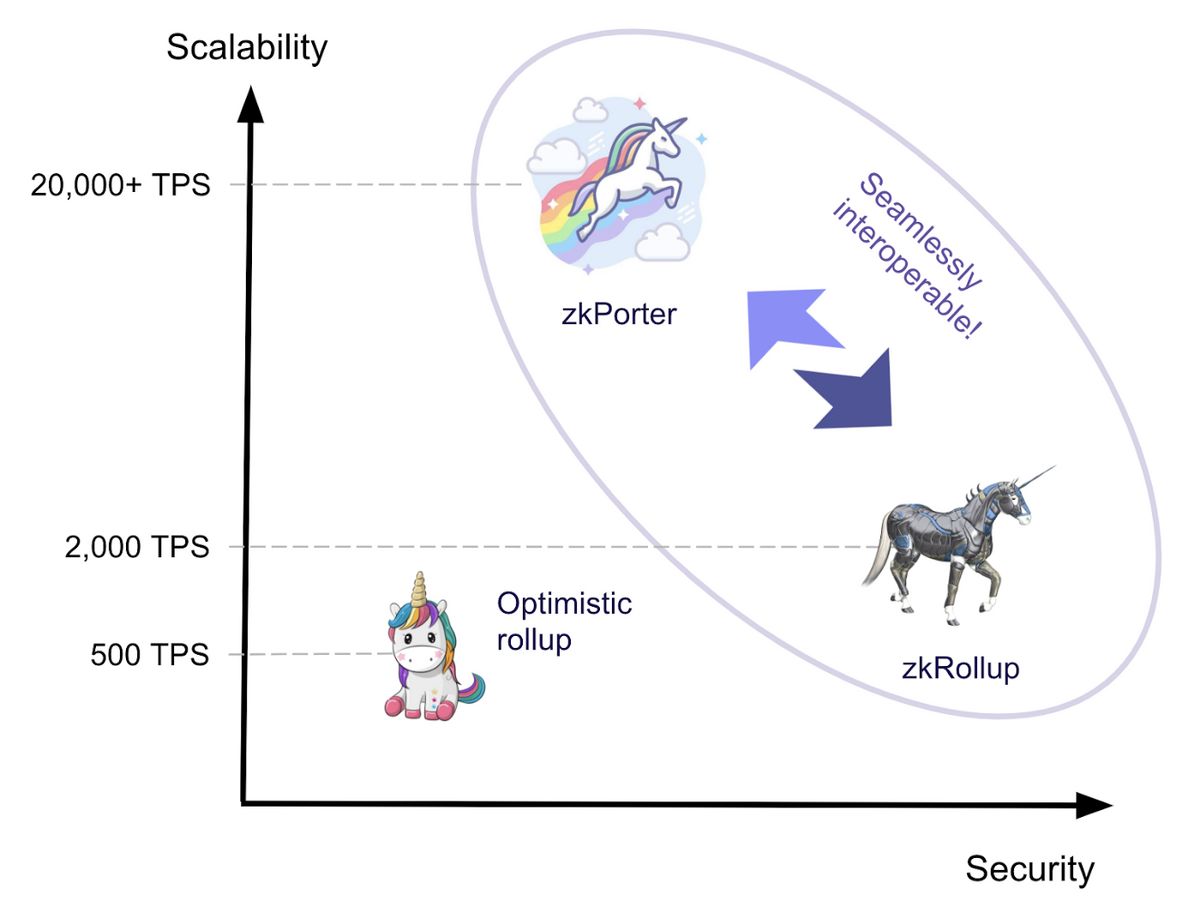

Few people have attempted to properly model the implications of a 3000x improvement in transaction scalability in the next 8 months.

Few get that by this time next year you will be blowing your BSC and Solana competition out of the water with speed, low gas fees, AND real decentralization.

But I dive deep trying to model these improvements and their impact on usage and price.

Forecasting the Ethereum 2021 Cycle Price Top

Few understand the amazing implications of EIP-1559 yet. But I study these daily.

Yes, it means that in a short 90 days from now (July 2021) -- ETH will start being a deflationary asset in which it’s monthly supply issuance will be lower than its monthly burn.

Yes, in 90 days Ether will be a sounder store of value (SoV) than Bitcoin once and for all.

And yes, few understand what the transition to PoS by the end of 2021 actually means… it means that all that sell pressure from miners will simply go away.

Mining won’t exist anymore. Stakers (aka long term token holders) will get all the revenues that aren’t used to burn supply. Now we’re talking.

Lower supply + no sell pressure + staking rewards = ETH over $7k by December 2021.

I’m stacking ETH now like Michael Saylor stacks Bitcoin.

Buy now my friends. Once people figure this all out… it’s gonna be fun.

Chart #6: Ethereum to Bitcoin Ratio Growing

Back in September 2019, 1 ETH was worth 0.016 BTC. Today 1 ETH is worth 0.045 Bitcoin, almost 3x as much. While 1 Bitcoin was previously worth 60 ETH, now it is worth just 22. Ethereum continues to gain ground on Bitcoin.

I expect Ethereum to continue to grow faster than Bitcoin due to EIP-1559 launching in July, which will burn transaction fees and reduce the available supply of ETH, layer 2 scaling solutions like ZkRollups, ZkPorter, and Optimism launching this year, and ETH 2.0 introducing sharding for even more scalability in 2022.

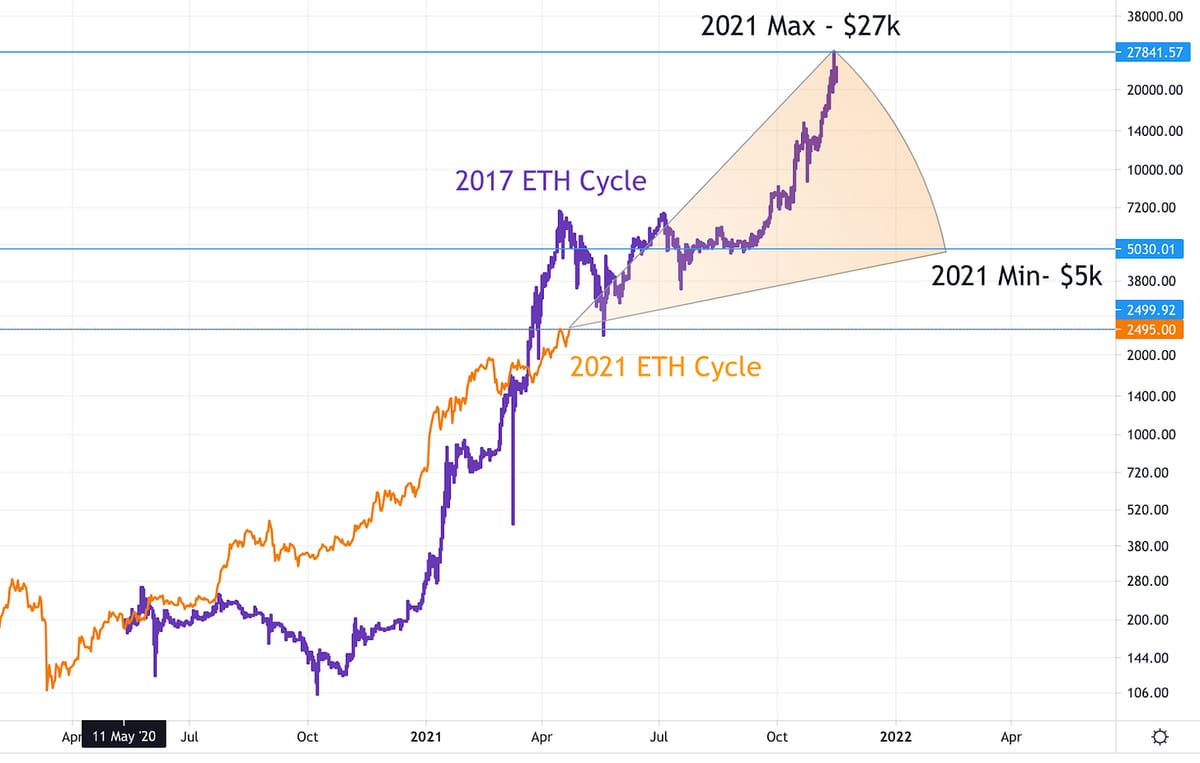

Chart #7: Ethereum Price Forecast

In this Ethereum price forecast chart above, I layer on the same time period from the 2017 cycle on top of the current cycle, starting from the date of the cycle start (which is defined as the moment of the Bitcoin halving) until the prior cycle Ethereum peak in January 2018.

Assuming that we have about another 6-9 months in this current cycle, I am forecasting a minimum Ethereum price of $5k by December 31, 2021 and a maximum of $27k. My best estimate is somewhere around $6k to $9k.

I reiterate my most recently published Ethereum price forecast, noting that based on this new Ethereum DCF analysis which indicates a present value of ETH should be $16,770 and taking into account the positive impact on Ethereum cash flows of both EIP-1559 and ETH 2.0 scalability we could see a spike to $16k+ faster than by the end of 2023.

As you can tell, I’m substantially more bullish on ETH than I am BTC. I like Bitcoin. But I love Ethereum.

Bitcoin is for the Boomers. Ethereum is for the Zoomers.

Ethereum is just like Bitcoin, but with actual utility (smart contracts, programmability, DeFi, apps)and actual annual cashflows already in the tens of billions of dollars that starting in July 2021 will go to holders through supply reduction from transaction fee burning (like stock buybacks) and staking (like dividends that go out to long term holders).

Starting 90 Days... Ethereum has cash flows that go to holders -- Bitcoin doesn’t. Game over.

I want to become the Michael Saylor of Ethereum. I’m working on it :). I just need a wooden ship for my Zoom background.

My wooden ship has a unicorn on its mast, of course.

The Ethereum Cash Flow Report 2021

My new friends Ryan Berkmans and Vivek Raman published the Ethereum Cash Flow Report this week at https://ethereumcashflow.com/. I helped build the Ethereum DCF model that they used in the report that indicates that as of today, Ethereum is worth around $16,770 per token based on its cash flows alone.

Here are choice excerpts from it…

$27.8M daily transaction fee revenue (+29,902% YoY)

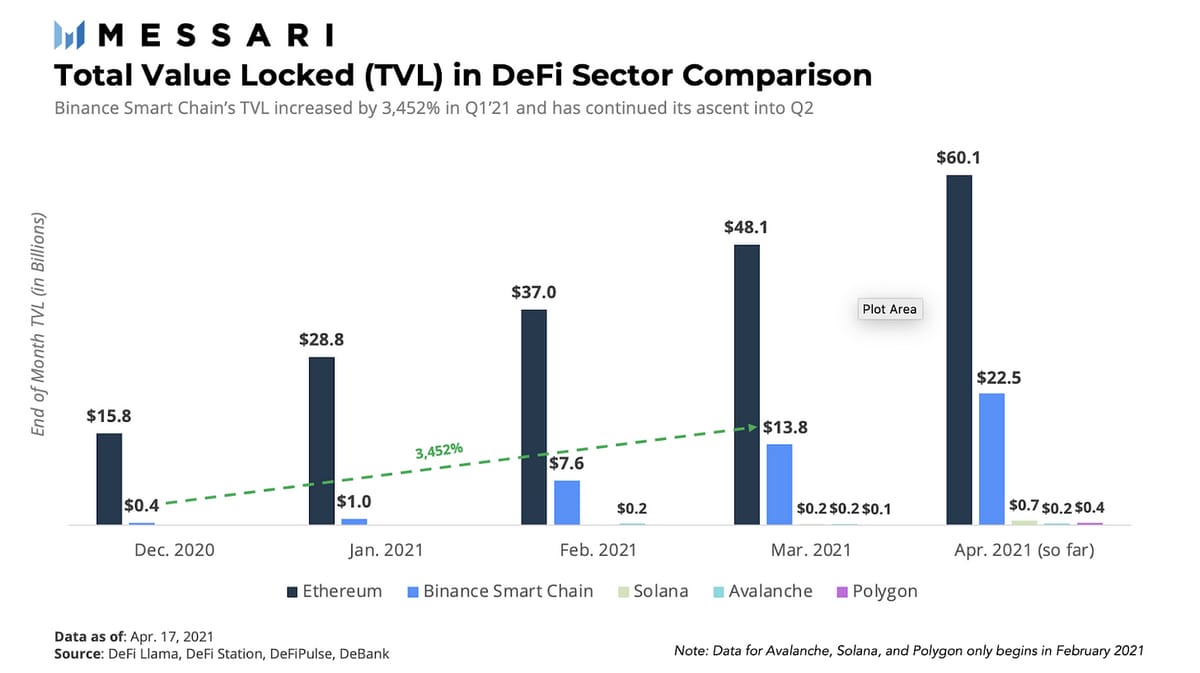

$54.8B 9 total value locked in DeFi (+6,347% YoY)

$2.57B 10 daily exchange volume in DeFi (+10,239% YoY)

Take a moment and share the link (www.ethereumcashflow.com) with a couple friends.

Chart #8: The Crypto Adoption Curve - Faster than the Internet

I’ll end this section with this incredible graph from Remi Tetot showing Total Crypto Adoption (2016-2030) versus Total Internet Adoption (1992-2006). Right now we are in the equivalent of 1996.

As Ryan and David from Bankless say at the end of each of their podcasts, “Crypto assets are risky. All of crypto is risky. So is DeFi. You can lose what you put in. But we are headed west. This is the frontier. It’s not for everyone. But thanks so much for joining us on the journey.”

Ethereum Competitors

Here’s a relatively comprehensive list of all the Ethereum competitors, sorted by market cap. I think all of these will do well as we are still in the very early stages of this market.

Ethereum (ETH) - $287B

Binance (BNB) - $84B

Cardano (ADA) - $37B (not yet live)

Polkadot (DOT) - $32B (not yet live)

VeChain (VET) - $14B

Solana (SOL) - $10B

Tron (TRON) - $8.5B

NEO (NEO) - $6.7B

EOS (EOS) - $6.2B

Cosmos (ATOM) - $4.2B

Tezos - $4.1B

Algorand (ALGO) - $3.5B

Avalanche (AVAX) - $3.3B

NEM (NEM) - 3.1B

Elrond (EGLD) - $3.0B

I think Ethereum and Polkadot will do the best in the next 24 months.

Ethereum because it has the best monetary policy and is by far the most used blockchain network in the world with the most apps, most validator nodes, and most total value locked in DeFi.

Polkadot will do well because it’s the best speciality use-case blockchain technology that allows each application to essentially run on its own blockchain -- while enabling shared security.

I think Binance Smart Chain, while it’s gotten off to a very fast start, will fade away a bit as Ethereum launches its scaling solutions.

Today Binance Smart Chain has low gas fees while Ethereum has high gas fees. That temporary market advantage for BSC is going away with the launch of ZkRollups, ZkPorter, and Optimism scaling solutions for Ethereum which will reduce the cost of gas fees by 99% with the end of 2021, skyrocketing the number of expected transactions per day settled to the Ethereum network.

Below are some great graphs from Messari’s recent Layer 1 research report, written by Wilson Withiam.

I expect the Ethereum dominance will expand as Optimism and ZKRollups launch their scaling solutions that will get rid of gas fees on most Ethereum-based exchanges and apps this Summer and Fall 2021.

Mrs. Bubble NFT Update - Available on OpenSea

A photo of myself and my wife Morgan Allis, also known as Mrs. Love Bubble the NFT Artist

I don’t charge for Coinstack (it’s free). However, if you are getting value out of it and want to help us grow, my only ask is that you purchase a Mrs. Bubble NFT if you can afford to. They are priced from 0.1 ETH to 1.11 ETH. These NFTs are hand painted and then digitized by my wife Morgan Allis and a team of digital animators we are building.

Our dream is to build a big animation studio (like Disney) that takes the characters she creates and turns them into shows and movies that spread a positive message.

Thank you to 27CEB7 who purchased Bubble #19 - Llamacorn Angel last week for 1.11 ETH.

These LuvMonster collection NFTs include the original framed and signed painted artwork by the artist Mrs. Bubble herself -- shipped directly to you anywhere in the world.

3D Llamacorn Angel - Now on Auction on OpenSea

This week, Mrs. Bubble’s Llamacorn Angel has become an animated 3D llama. It was created in Maxon3D by one of Mrs. Bubble’s new animation team members, based on Mrs. Bubble painting of Llamacorn above.

You can bid in the auction for the above 3D Llamacorn now. Starting bids are 0.5 ETH. The auction ends this Saturday, April 24th at 5:54pm ET.

Get a 30 Minute Crypto Investing Call With Me

The winner of the above auction gets both the Llamacorn Angel NFT and a 30 minute crypto trading Zoom call with me in the next two weeks where I give you personal 1:1 advice on how to build your crypto investing portfolio. Just message me at [email protected] or on Telegram to claim it.

Take a watch of this 20 second video of Llamacorn angel. It will bring JOY and a SMILE to your face for sure.

By investing in this animated Mrs. Bubble NFT, you’re supporting Mrs. Bubble’s dream of bringing uplifting and joyous animated shows and movies based on these characters into the world. This amazingly joyous and fun animated NFT is for sale for 1.11 ETH.

And if our dream comes true of building entire worlds and animated series based on these characters -- who knows what these NFTs could be worth in 10 years <3.

While the original Llamacorn painting has now sold for 1.11 ETH, we still have a few LuvMonsters left, all of which include the original signed and framed painting shipped to your home -- a beautiful gift for a child. Here are some of the LuvMonster NFTs still available. They range in price from 0.1 ETH to 1.11 ETH.

Bubble #99 - The Queen of Moons - 0.25 ETH (includes 30 min call with me)

Buy one of Mrs. Bubble’s NFTs and you’ll make her day -- and mine!

Please support our dream of building an animation studio for this incredibly joyous characters — and help me make it up to my wonderful wife for all the time I spend writing this newsletter each week :).

Yes, anyone who buys any Mrs. Bubble NFTs this week will get a bonus of a 30 minute 1:1 Zoom call with me to be held in the next two weeks where I help you optimize your crypto investing strategy.

In return, I’ll keep putting out these Coinstack newsletters for free every week -- and together we can build our crypto wealth and our NFT collections!

<3 - Ryan (aka Mrs. Joy Bubble)

CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1000 members on our Telegram.

A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

75% of Portfolio

Ethereum (ETH) 25% of portfolio

Bitcoin (BTC) 10% of portfolio

Polkadot (DOT) 10% of portfolio

Nexo (NEXO) 10% of portfolio

ThorChain (RUNE) 10% of portfolio

Kusama (KSM) 10% of portfolio

25% of Portfolio - About 1.5% Each

Voyager (VGX)

Uniswap (UNI)

Chainlink (LINK)

Terra (LUNA)

Cosmos (ATOM)

Polygon (MATIC)

Decentraland (MANA)

Ocean Protocol (OCEAN)

Harmony (ONE)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymath (POLY)

Origin (OGN)

PankcakeSwap (CAKE)

Note that my actual portfolio that I trade in-and-out of may vary a bit from this longer term portfolio. My actual portfolio holdings as of today (that I actively manage with 30+ trades per week) is below. As of this moment I am up 489% YTD.

The People I’m Following Closely on Twitter

Mrs. Bubble The NFT Artist (my wife Morgan Allis)

How To Get Started With Crypto

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The CoinStack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Substack at CoinStack.substack.com

Please share with your friends and colleagues.