There’s a revolution in global finance happening before our eyes. In this issue we explain why DeFi, built upon transparent smart contracts, is eating all of traditional finance and how you can invest in this massive multi-trillion dollar trend through the UMACS trade. Coinstack is tracking the important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. Let’s jump in to this week’s issue…

Inside This Issue:

Latest Market Forecast by Ryan Allis

The Decade of DeFi is Here: What You Need to Know by Ryan Allis

DeFi Will Eat ALL of Traditional Finance

The Promise of Decentralized Finance on Smart Contracts

The Data: DeFi is Already Winning in Payments, Lending, & Exchanges

Introducing the UMACS Trade (Uniswap, Maker, Aave, Compound, Sushi)

Institutional DeFi Is Here via Compound Treasury and Aave Pro by Ryan Allis

Aave and Compound Launch Institutional Offerings

Another 100x is Coming to $10T TVL

Token Terminal Launches The PE Ratio (Axie & QuickSwap Winning)

Ethereum Is Winning the Smart Contract Wars: The Latest Data

How to Avoiding Crypto Scams by Masha Prusso

Coinstack Podcast Episodes

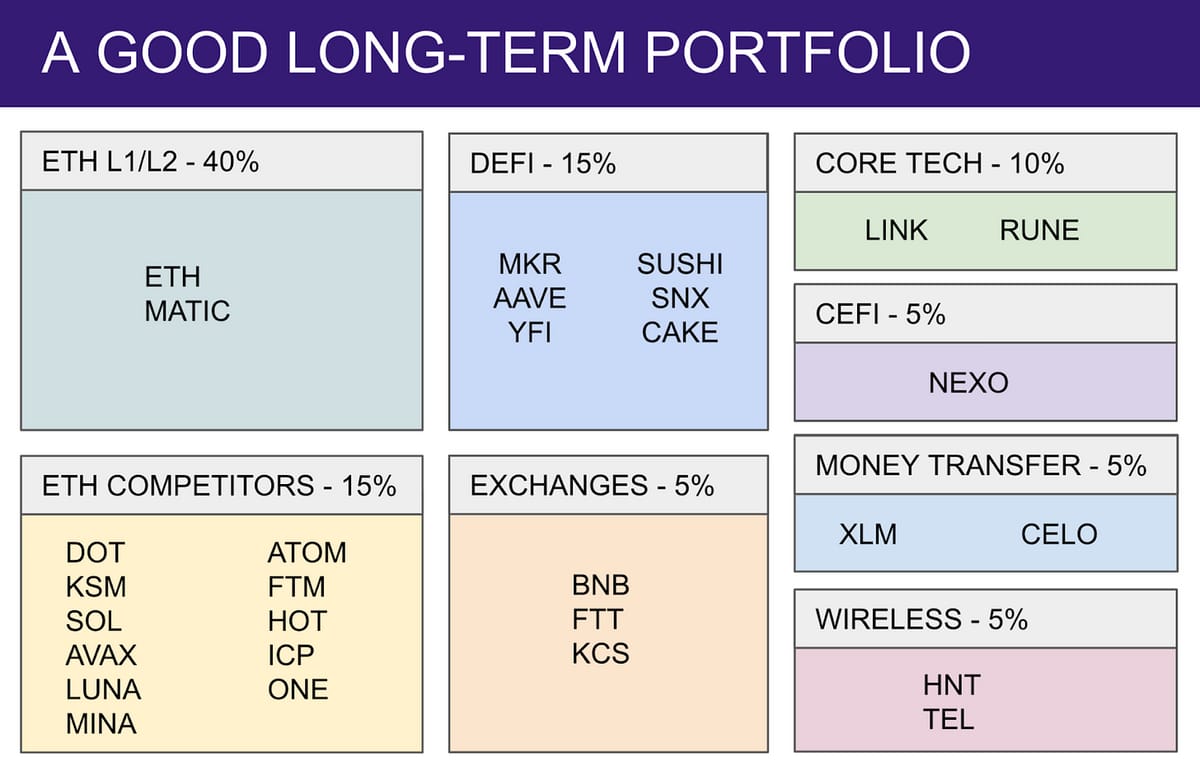

A Good Long-Term Crypto Portfolio

Tuesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

The Decade of DeFi is Here: What You Need To Know

By Ryan Allis

Back in August 2011, A16Z founder Marc Andressen wrote in a Wall Street Journal op-ed that, “software is eating the world.”

He wrote the following, supporting his thesis that SaaS and mobile software was finally ready for prime time:

“Six decades into the computer revolution, four decades since the invention of the microprocessor, and two decades into the rise of the modern Internet, all of the technology required to transform industries through software finally works and can be widely delivered at global scale.”

Andressen was undoubtedly right, with the market value of FAANG companies increasing by 12x during the last decade. $10,000 invested in 2010 in each of the five firms would have turned into $122,228 by December 31, 2020.

Back in June 2021 when Andreessen Horowitz announced their $2.2B Crypto Fund III, they wrote:

“We believe that the next wave of computing innovation will be driven by crypto. We are radically optimistic about crypto’s potential to restore trust and enable new kinds of governance where communities collectively make important decisions about how networks evolve, what behaviors are permitted, and how economic benefits are distributed.”

1960-1975: Mainframe Computing

1975-1990: Personal Computing

1990-2005: Internet Computing

2005-2020: Mobile Computing

2020-2035: Crypto Computing

Yep, it’s a new era in computing that is about to cause an open financial revolution. In their very forward looking June 2018 crypto investment thesis, A16Z went on to write about open financial instruments, stablecoins, and payment services.

“Smart contract platforms like Ethereum enable the creation of, among other things, application-specific currencies, digital property rights, open financial instruments, and software-based organizations. Developers are working on upgrading the core infrastructure of the internet, including storage, networking, identity, and distributed computation. Stablecoins can enable more mainstream user experiences for digital payments and financial services. Cryptogoods can unlock new experiences and business models for games and other forms of media. Entrepreneurs are developing crypto-powered financial services like the tokenization of traditional assets, and payment services for the unbanked.”

Now it’s 2021 and all of these predictions are coming true.

All of Traditional Finance is Now Being Recreated With Smart Contracts

Arthur Cheong, CEO of Defiance Capital a DeFi fund with $500M assets under management, wrote last May,

“As software ate the world over the last decade, DeFi will eat traditional finance during the next one.”

Yes, smart contracts on top of cryptographically secured blockchains are eating the world of finance. And as Robert Leshner, CEO of Compound, said recently on the Bankless podcast...

In short, crypto is eating all of finance. Yummmm…

The total addressable market for DeFi is the same as the TAM for all of finance…

There’s just no reason for financial applications that reference and store trillions of capital to use centralized databases that are easily hacked and managed by costly manual people-heavy processes.

Instead they can use decentralized databases (blockchains) and protocols built with smart contracts that operate at a much lower cost.

Ever wonder how Uniswap has 30 people while Coinbase has 1300 — yet they are doing almost the same trading volume?

Soon enough, all of global finance will be operating on decentralized blockchains running smart contracts by the end of this decade. Every loan, every CBDC, every stablecoin, every securities investment, and every house title -- all will be settled and recorded on blockchains. A more open, efficient, fair, transparent, programmable, and borderless global financial system is currently being built right before our eyes.

The Top DeFi Apps Today

Decentralized Finance (DeFi) offers a global open alternative to every financial service you use -- including payments, savings, loans, trading, insurance, asset management, and more.

DeFi uses smart contracts automatically executing code residing on blockchains, primarily on Ethereum. The top DeFi applications by Total Value Locked today are:

The Big Promise of DeFi

DeFi is a ‘super massive black hole’ that is about to suck up trillions of dollars in additional capital into it -- in order to generate substantially higher risk-adjusted returns.

While traditional banks are offering <0.1% yields on their deposits, well-known and tested DeFi protocols are offering 4-10% annual yields on Stablecoins. And in finance -- everything comes down to risk-adjusted yield.

The promise of DeFi is:

Programmable money that natively integrates with stablecoins

Instant settlement across borders - no more 2 day wait time for stock trades to settle or for wires to move across SWIFT

Full transparency and auditability — no more opaque derivatives contracts stored in filing cabinets creating massive liability to the financial system

Ability to trust participants without knowing them

Removing financial middlemen

Smart contracts dramatically increase efficiency and reduce cost of financial services

Open source code that can be built upon by anyone

Financial services built as composable money legos (like open APIs) that any developer or institution can connect to and build upon to create unique services

Fairness, with no market participant having better access than anyone else

As Fabrice Alamo, CEO of Nepri Finance wrote in “DeFi Will Eat TradFi and Early Investors will Reap the Rewards”...

“The success of DeFi didn't come overnight, the groundwork has been laid since Satoshi Nakamoto created Bitcoin 11 years ago. However, it is difficult to build finance protocols on top of Bitcoin given its limited programmability. This is made possible with the arrival of Ethereum, a permissionless blockchain with Turing-complete, smart contract functionality that makes it possible to build more complex financial applications on top. Financial derivatives and stablecoins were mentioned in the Ethereum whitepaper as far back as 2014.”

And it’s not all just promises either. DeFi is already winning with payments, lending, and exchanges.

DeFi Is Already Winning With Payments: Paypal vs. Ethereum

Let’s compare Paypal to Ethereum using this great chart from Dmitry Berenzon. He notes that “Ethereum has been able to process ~1.7x the payments volume of Paypal with ~0.2% of the headcount in ~26% of the time.”

DeFi Is Already Winning With Loans: LendingClub vs. Maker

Dmitry continues in his thread to point out that “MakerDAO has been profitable after 6 years of operation while LendingClub is still booking losses after 15 years.”

DeFi Is Already Winning With Exchanges: Coinbase vs. Uniswap

Lastly, Dmitry shares that “In 2020, Uniswap processed ~30% of Coinbase's volumes with ~27% of the headcount and ~2.6% of the venture funding.”

So how can you invest in DeFi? You can get some of the DPI token which tracks the 14 of the top DeFi protocols… or you can invest directly in what we call the UMACS trade…

The FAANG Trade Vs. The UMACS Trade - Investing in DeFi Blue Chips

As we saw above, investing in Facebook, Apple, Amazon, Netflix, and Google (known as the FAANG stocks) was one of the best investment bets for the 2010s. A $10,000 investment in them in 2010 is now worth over $122,000.

So if the 2010s was indeed the decade of SaaS and mobile eating the world -- what will be the best investments for the 2020s?

I think it will be Decentralized Finance protocols… specifically Uniswap, Maker, Aave, Compound, and Sushi currently leading the way.

UNISWAP

MAKER

AAVE

COMPOUND

SUSHI

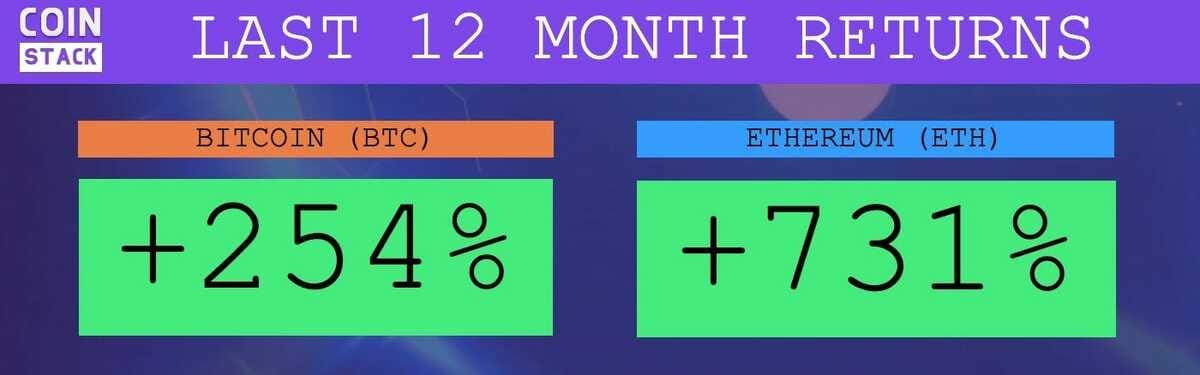

These five DeFi protocols alone today have a total locked value (TVL) of $29.6 billion and their tokens have appreciated by an AVERAGE of 319% in the last 12 months since July 2020.

Let’s see if these UMACS DeFi protocols can outperform the FAANG stocks in the 2020s. I think their returns will blow FAANG returns away over the next 10 years. Let’s track this in the years to come.

Now that we’re in the Summer Doldrums and prices have come back into a very reasonable range, it is likely a very good time to stack up on your UMACS investments before a Fall 2021 run up.

You can get exposure to each of these tokens by investing in them on Coinbase, Binance, FTX, or your favorite exchange.

Institutional DeFi Is Here - A KYC’d Sandbox for Predictable Yield by Ryan Allis

The biggest issue in DeFi -- that it is difficult to use for regular people -- is getting solved. DeFi was never meant to be used by average people -- it was meant to be used by institutions controlling billions of dollars to generate higher yields on their capital.

These institutions are creating easy UI/UX front ends that make investing in DeFi as easy as tapping an “Earn” button in Coinbase, Zapper, or Zerion -- and soon directly within your banking account.

The Launch of Institutional DeFi Offerings

With Compound launching Compound Treasury this month and Aave launching Aave Pro, now any institution can utilize DeFi and put hundreds of millions of dollars to work -- generating predictable yield.

The main difference with these institutional DeFi platforms is that they enforce the KYC/AML rules that are required to comply with FATF regulations. This single change allows the floodgates to open for verified and known market participants to interact with DeFi and put trillions more capital to work.

If you’re a regulated institution like an endowment, asset manager, or pension fund you simply couldn’t invest in DeFi -- until NOW.

I can’t overemphasize how big this is for Compound and Aave -- I expect it will ~10x their TVL in the next twelve months.

Sean Dikens from CoinRivets wrote the following about Aave Pro’s launch:

For KYC processes required to use Aave Pro, Aave has partnered with digital asset custody firm Fireblocks to onboard new clients. Aave Pro will require stringent Know Your Customer (KYC) completion due to the strict regulations that apply when offering products to institutions. Fireblocks will also “implement AML compliance and antifraud controls” for Aave Pro. According to the email, Aave Pro will support four assets – Bitcoin, Ether, Aave and USDC – as institutional demand and ownership is concentrated into these assets. Additionally, Aave will add a “whitelisting layer” onto its existing V2 smart contracts to ensure that only KYC-compliant “institutions, corporates and fintechs” have access to the platform.

This is big. Much bigger than most people get -- as it provides, for the first time, a legally-compliant way to get large pools of capital easily into DeFi.

You can learn more about this from these two great podcasts from the last two weeks:

While only a minority of companies and countries may put Bitcoin or Ethereum on their balance sheet (about 50 have done this so far) -- nearly every company and sovereign wealth fund in the world will be interacting with DeFi to generate better yields on their treasury holdings within a few years -- often through trusted and insured intermediaries that make it easy by offering a traditional known counterparty.

As we wrote earlier, yes, all of global finance will be operating on decentralized blockchains running smart contracts by the end of this decade. Every loan, every CBDC, every stablecoin, every securities investment, and every house title -- all will be settled and recorded on blockchains. And the step to bring in institutional capital will only accelerate this transition.

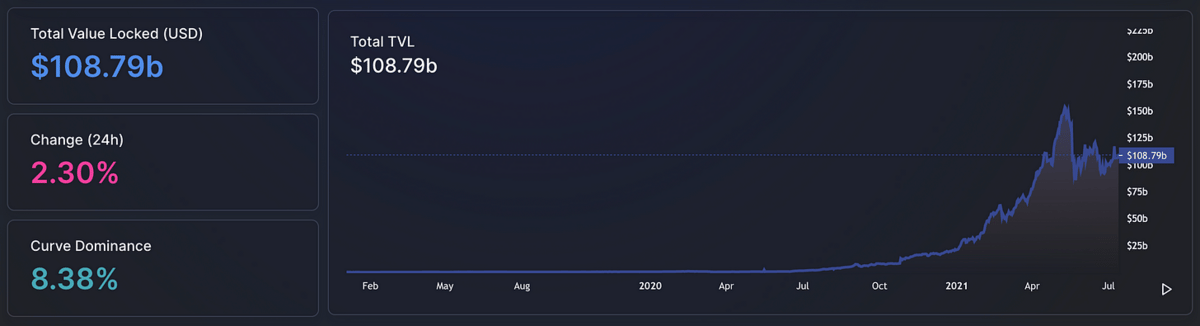

Another 100x is Coming… We’ll Eventually Surpass $10 Trillion TVL in DeFi

We'll end this section with a graph from DeFi Llama showing that we are now above $100B in total value locked in DeFi. Where will be in 2030? I estimate closer to $10T (another 100x).

Token Terminal Launches PE Ratios (Axie & Quickswap is Winning)

By Ryan Allis

If you know me, you’ll know I’m a quant. I really like numbers.

The ideal crypto investor is like Neo -- seeing the stream of usage and earnings data and making well-researched investment decisions based on metrics.

I’m a metrics junkie and I like to invest based on fundamentals -- not word of mouth.

And my favorite fundamental is “Earnings to token holders” either directly in the form of on-chain payouts to stakers or indirectly through using protocol revenue for token buybacks (which reduces supply and establishes a price floor).

So what is a PE ratio? A PE ratio is the simply price divided by earnings.

In crypto, a PE ratio is calculated as Total Market Cap / Cash Flows to Token Holders.

So when I saw that Token Terminal launched their PE ratios this week, I got super excited. The nerd in me woke up… and I dove in.

Let’s take a look at which cryptoassets have the best PE ratio according to the new Token Terminal metric. Here are the top 10:

So far, we have Maker, Perpetual Protocol, SushiSwap, and Authentix in the Coinstack Alpha Fund, and will add the others as soon as Enzyme allows it.

Here is the same data (for a slightly different time period) shown as a graph:

You can see the live data at: https://www.tokenterminal.com/terminal/metrics/pe

As you can see, Axie Infinity and QuickSwap are the best crypto investments based on Price to earnings ratios -- and both have performed exceptionally well the last three months as many other cryptoassets have faltered.

In the last 90 days here how each of these has performed:

Axie Infinity (AXS): +203%

QuickSwap (QUICK): +121%

With their revenue skyrocketing from their decentralized game, Axie Infinity has been killing it the last 30 days.

Fundamentals are the only thing that matter in the long term. So keep an eye on the PE ratios on Token Terminal!

Ethereum is Winning the Smart Contract WarsBy Ryan Allis

Many people talk about Ethereum killers, but when you look at the data, Ethereum is actually the one killing it.

Ethereum settled $2.5 trillion in transactions in Q2 2021, up from $1.5 trillion in Q1 2021 and 0.5 trillion in Q4 2020. Per Messari, “this represents +65% QoQ and +1,490% YoY, and puts Ethereum on pace to settle $8 trillion in 2021.”

Now let’s look at the Total Value Locked by Smart Contract Platform. You can see that after reaching a LOW of 71% in April, Ethereum has recovered to 77% of TVL.

Ethereum remains the very large majority of the Total Value Locked on DeFi Llama, representing $83B of $109B as of today.

And comparing Ethereum to Bitcoin (a non-smart contract platform), Ethereum is currently settling 3x as money value each day.

And lastly looking at amount of revenue generated -- Ethereum is beating Bitcoin by more than 400%.

While I do think Solana and Polkadot are promising and have potential, Solana is sitting at less than 1.5% market share and Polkadot hasn’t launched yet.

So for now, Ethereum is the King. Long live the Kingdom of Etherea.

Crypto Scams are Out of Control, Again… Here’s How to Stop Them Forever

By Masha Prusso, July 7, 2021

// Publishers Note: Masha Prusso is a friend and one of our favorite crypto columnists here at Coinstack. Below we share an excerpt from her recent Defiant article. She writes about how to avoid crypto scams. //

You may have seen this statistic floating around blogs and influencer feeds recently: an estimated 80% of ICO’s in 2017 were scams. This may have been four years ago but there is good reason to be concerned. That’s an alarming number, and it underscores a sober reality in the crypto community — grifters remain a serious threat. But users and developers in the DeFi space are creating robust measures to ensure more reliability and security in the decentralized community.

Recently, Mark Cuban got a taste of being “rugged” when the price of $TITAN, a stablecoin from Iron Finance, tanked from $60 a coin to $0. While the mogul claims the loss was only a small percentage of his crypto portfolio – and that investing in burgeoning tokens is just as risky as angel investing – he also admits that soft regulatory measures and crypto literacy are necessary.

There are three steps we can all take to reduce this 80% to a fraction, or even zero. First, the community needs to learn what to avoid. Second, the community needs to establish guidelines for new projects if they want to be accepted as a legitimate coin. Third, we need to develop and deploy our own regulatory agents into the ecosystem that are governed in a decentralized manner.

Step One: Know What to Avoid

Types of scams

One of the most appealing components of decentralized tech, specifically in DeFi, can be a vulnerability as well. Distributed ledgers and smart contracts allow users to operate under the armor that is blockchain anonymity. It’s worn by both defense and offense. Scammers are able to get in and get out with investors’ money with none the wiser.

This anonymity is the main source of two common schemes: exit scams and rug pulls. Both involve ICO’s connected to vague promises of growth and ROI, only to see the coin’s value pulled from the market as soon as the scammer has raked in a satisfactory haul. Users are left depleted of cash and unable to sell or trade the coin.

Exit scams involve a developer heavily promoting a new ICO and then ghosting investors and “exiting” with their money. Rug pulls, a variation on this move, differ only in the timing of the exit.

Exit scams: heavily promote, release coin, gain lots of immediate buyers, sell, and then ghost.

Rug pulls: promote, release coin, continue to promote, let coin go up in value, steal the value from the liquidity pool.

These scams have so riddled the industry (accounting for 99% of all crypto fraud in 2020), that securing the trust of investors has now become a vital variable in executing a DeFi business model.

Another double-edged sword of DeFi is its almost non-existent barrier to entry. Popular exchange protocols like Uniswap, which allow free and open token listings, create a saturated market susceptible to fraud from malicious players. Additionally, many exchanges offer flexibility that encourages users to be creative and innovative in the contracts for their coins and transactions.

This often invites forms of crypto fraud that are more sophisticated, such as social engineering.

One scammer utilized an advanced feature on Uniswap’s signature “swap” screen, manipulating the transaction logs. This setting allowed the stealthy trader to change the “recipient” of the coin, making it appear as though popular crypto influencer and Lead Casting Couch Interviewer at eGirl Capital, DegenSpartan, had purchased a large amount of the scam coin. The swindler used a celebrity-endorsement tactic that tricks investors into purchasing an illegitimate ICO. Though roundabout in its strategy, this is just an exit scam with extra steps.

Another example of advanced fraud is contract manipulation. Twitter user and self-professed anti-rugster, R0฿ST3R, explains how scammers with programming knowledge can exploit the legitimate function of apps like DEXTools, a dapp providing real-time crypto market data analysis, to produce fake, convincing contracts that mimic legitimate code to the untrained eye. Users’ trust in well-curated platforms, as well as their low experience in interpreting data and code, can render even the most credible dapps and DEXs susceptible to high rates of fraud.

Clear Evidence

Many fake projects will tout extravagant return projections (“folks we anticipate ROI to be 150% or more – if you get in NOW”). Some will even double down on the scam once they’ve lured in buyers, directing investors to pay a fee in order to see those returns, a scheme called advance fee fraud scam.

Research should always precede investment rather than being considered extra leg work. And with blockchain and crypto in a stage of innovative infancy, that due diligence becomes even more important. Legitimate developers and users alike are facing the challenge of recognizing and combating the novel forms of fraud born from decentralization. Fortunately, consistent patterns are emerging in identifying developers and ICO’s that are legitimate versus scams.

One of the easiest ways to differentiate between the good, the bad, and the ugly is team credibility. If a new ICO becomes available on the market, an investor’s very first action of recourse should be to vet the development team and founders. Founders should be real people with somewhat successful histories. Do these people have a social media presence? If so, are they engaging with that community? Does a quick browser search bring up any material? If so, do they seem to have a good reputation?

Dodgy Founders

Take a look at the team page at SafeMars. (Warning: this coin is not legitimate, do not purchase!) It’s strange that five out of the eight team members have the same astronaut illustration as their profile photo. Also, those same members use pseudonym usernames. You may think that anonymity is a perfectly reasonable consequence of decentralization, but with potentially millions of dollars on the line founding members of any large, public-facing project must be identifiable.

This red flag is affirmed by the fact that every member’s Twitter link leads to the same profile: the SafeMars Twitter profile. Every individual Telegram link leads to an “inactive user” message. And the CEO, Kenneth Churchill, has a vague LinkedIn profile without any past work experience.

Bogus Whitepapers

Another box to check is the company’s whitepaper. A whitepaper is a document that a company creates in order to provide a detailed breakdown of its purpose, business model, plans for longevity, and an actionable road map to get there. Check out the Ethereum whitepaper written by Vitalik Buterin. The document is extremely well-developed, including a history, explanation of concepts, applications of the technology, and a section addressing the concerns over ETH scalability.

Of course, ETH was the first of many to come that would expand on the concept of blockchain technology, creating the smart-contract system that the majority of the world’s decentralized tech would operate within. So you would expect its whitepaper to be exhaustive. But even if new software, products, and technologies are piggybacking off of this project, they should be able to provide a solid case for why you should invest your money (i.e., buying their ICO).

Unfortunately, scammers have caught on to this prerequisite. They know investors are getting serious and will be looking for a strong whitepaper, or at least some sort of persuasive material to entice them to buy.

Unrealistic Promises

And lastly, be wary of heavily promoted offerings. A common phenomenon, called “shilling” in the world of crypto, enlists paid actors to endorse an ICO and generate buzz. If you see phrases like “will solve world hunger” or “the most promising solution to fighting climate change” or similar pseudo-activist statements, a coin is likely being shilled. In early 2018, Twitter, along with most other major social media networks, moved to ban advertisements of ICO’s after a significant amount of deceptive fraud tactics. But, naturally, scammers know that when one door closes, it’s only a matter of time before they’re able to find an open window.

We have a new Coinstack podcast. You can listen to it on Anchor, Spotify, or Google Podcasts. Here are the episodes we’ve released so far...

Episode 1 - Algotrading Crypto in Sideways Markets

Episode 2 - Are We Near the Bottom for Bitcoin and Ethereum: We Think So.

Episode 3 - Crypto: Explain It Like I’m 5 (Bitcoin, Cryptography, & Blockchains)

Episode 4 - Crypto: Explain It Like I’m 5 (Ethereum & Smart Contracts)

Episode 5 - Crypto: Explain It Like I’m 5 (DeFi, NFTs, DAOs, & Tokens)

Episode 6 - Will the Crypto Bull Market Come Back? We Think So.

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends. So far we’re at 979 plays and growing!

Our Top 30: A Long-Term Crypto Portfolio

Everything is on sale right now and from our vantage point, it’s a great time to buy.

If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be absolutely sure to include our top 5: ETH, DOT, KSM, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short-term.

If you don’t want to manage your own crypto portfolio, we can manage it for you. Check out the Coinstack Alpha Fund on Enzyme. Our current portfolio allocation in our fund is:

There is some difference between our top 30 above and the Enzyme fund as Enzyme can only invest in certain assets currently.

Join The CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1650 members on our Telegram.

The People We’re Following Closely on Twitter

How To Get Started With Crypto Learning

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

Crypto: Explain It Like I’m 5 (Article)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.