Issue summary: In this issue, we write about the new financial system for the world, decentralized finance, and explain simply why it is taking over from traditional finance. We also highlight the most important news and stats of the week and do a deep dive on Avalanche. Please pass this issue along to friends interested in learning about DeFi.

In This Week’s Issue:

Latest Crypto Market Forecast

DeFi & The Future of Finance: Part I

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

📈 Top 10 Performers

🎧 Best Podcasts

🚀 Deep Dive on Avalanche - AVAX Up 53% in 30 Days

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

📈 Latest Crypto Market Forecast

The selloff in equities from China’s Evergrande crisis and then the “China Banning Crypto For the 38th Time” news took the crypto market down with it temporarily, testing floor prices for BTC ($40k) and ETH ($3k). Now that September options contracts expired earlier today, we are expecting a nice rebound into October. Based on on-chain analytics, TVL trends in DeFi, and the amount of capital coming into the space from institutional investors, crypto markets appear headed toward new all-time highs. We expect to see new all-time highs this Fall for both Bitcoin and Ethereum. While things could always change, we expect to see $80k+ BTC and $6k+ ETH by the end of 2021.

🏦 DeFi & The Future of Finance: Part I

By Ryan Allis, Coinstack Founder

About this article: In this two-part feature article, Coinstack founder and HeartRithm Managing Partner Ryan Allis writes about how decentralized finance is the future of finance. This week we published part one, and next week we will publish part two.

On August 28, 2000 -- just twenty-one years ago -- the New York Stock Exchange (NYSE) shifted to the decimal system -- quoting stock prices in pennies instead of 1/8th increments.

Stocks went from being priced at 34 and 1/8ths to being priced in decimals -- a significant advance to pave the way for digital trading.

Yet--we still had those guys in the trading pits in the colorful jackets -- yelling and signaling to place buy and sell orders. Talk about an analog 20th-century process that seems ancient today.

Until July 2015, the last trading pit -- on the Chicago Mercantile Exchange (CME) -- shut down -- and digitization took entirely over.

Yep -- guys yelling at each other to buy and sell stocks, bonds, futures, and commodities -- that’s actually how our financial system worked not that long ago.

Today there are similar signs of the analog past in financial markets -- that by 2030 will all be gone -- as a new and open global financial system is built, deployed, and scaled.

The Issues with the Current Financial System

I often wonder…

Why do stock trades still take two business days to settle -- when blockchains settle in 10 minutes? Remember Gamestop?

Why is it that the stock markets are still only open for trading 32.5 hours per week -- while blockchains trade 168 hours per week? What century are they even operating in?

Why do retailers still have to pay 2.5-3% on every single credit card transaction to Visa and Mastercard -- when sending money globally on L2 blockchains and rollups like Loopring, ZkSync, and Arbitrum costs just pennies?

Why do international bank wires on the legacy SWIFT system still take 2 business days to clear and cost $35, when sending money on blockchains takes minutes and costs pennies?

And why is it that many of the institutional trades in the stock market still happen in dark pools -- hidden off-exchange liquidity pools that give larger players an advantage -- when blockchains are open and transparent and globally accessible?

Yes, there are a lot of inefficiencies in the old financial system that still dominates.

It’s a classic startup story -- disintermediation, rent-seeking, middlemen, inefficiencies...

The New System — Built With Code

Thankfully, the old system is being replaced by code that operates 24/7/365.

“The scaffolding is emerging for a historic disruption of our current financial infrastructure. DeFi, or decentralized finance, seeks to build and combine open-source financial building blocks into sophisticated products with minimized friction and maximized value to users utilizing blockchain technology.” - DeFi and The Future of Finance

Yes, all of traditional finance is being recoded this decade into the interoperable, composable, and transparent world of DeFi -- built using smart contracts on top of blockchains.

Take note.

This is a full re-invention of the global financial system -- one that will cut out the middlemen rent-seekers and bring global access to financial services to all human beings.

Thank God for GitHub, Solidity, Rust, and Python.

By 2030 we will have an entirely new global financial system built primarily upon open-source code -- with composable Dapps, flash loans, on-chain collateral, trustless verification, and instant settlement.

And the technologists and investors who realize this now will do very, very well.

Financial Institution Leaders Must Understand DeFi

Showing that she doesn’t quite get it yet, European Central Bank Christine LaGarde said on the David Rubenstein Show on September 15th:

“Cryptos are not currencies. Full stop. Cryptos are highly speculative assets that claim their fame as currency, but they’re not. They are not... Cryptos are highly speculative, suspicious occasionally, and high-intensity in terms of energy consumption.”

What she’s not quite getting yet, or at least not saying aloud, is that cryptography, blockchains, and smart contracts are the foundational technology layers that allow a brand new global financial system to be built…

Tokens for Layer 1 Blockchains like Ether, Solana, and Terra are essential for actually utilizing those chains to use the new financial system -- making them highly likely to be worth a LOT more in 5 years than they are now. These either already are (Solana, Terra) -- or will soon be (Ethereum) -- Proof of Stake systems -- making the energy consumption argument moot.

And tokens for DeFi apps like Uniswap, Curve, Aave in the Ethereum ecosystem and Saber, Sunny, and Raydium in the Solana ecosystems -- are also essential to utilizing those tools -- again creating the possibility that these tokens aren’t overvalued -- but remain substantially undervalued versus where they will trade by 2026.

You’d think the head of the European Central Bank would understand the basics of DeFi -- but it seems from her statements she does not yet have any meaningful competency in this emerging field. It’s as if she’s advocating for stock prices to remain in 1/8ths or to go back to ticker-tape trading from the 1800s.

I get so mad when regulators in their 60s and 70s dismiss smart contracts, blockchains, stablecoins, and DeFi. It’s not only the future; it’s the now. Wake up and read a book or two. There are zero excuses not to understand the basics of FinTech if you’re leading a global financial institution.

If you don’t know what Solidity and Rust are, get the heck out of the leadership of global financial institutions. If you don’t get the difference between Ethereum and Solana, you should no longer be running the European Central Bank.

It would be like the CEO of Ford, not understanding cars.

I hope her staff gets DeFi, smart contracts, and blockchains -- especially as the ECB works to roll out a CBDC over the next few years.

Like an oblivious fish in water, she appears to not even realize there’s a brand new system that in 10 years will have completely revolutionized European (and global) payments, settlement, and financial services.

The Five Key Problems of Centralized Finance Systems

Let’s take a moment to layout where the inefficiencies are in the current financial system, according to the wonderful book DeFi and The Future of Finance by Duke Finance Professor Campbell Harvey.

Centralized Control - The four largest U.S. banks have 44% of FDIC-insured deposits -- up from 15% in 1984. Highly powerful oligopolies are influencing both the cost of financial services (making it higher) while reducing their cost of capital, advocating for cheap capital and quantitative easing from the Federal Reserve, the quasi-governmental entity that is literally run by the banking industry -- with 6 of the 9 members of each Federal Reserve Bank appointed by the banks. The result -- the number of U.S. dollars in circulation has gone up by more than 32% since January 1, 2020, and we already see the highest annual inflation levels since the 1980s.

Limited Access - 1.7B people are unbanked globally and are outside of the financial system, relying on costly remittance services that charge 7-20% fees and on payday loans for advances, which charge 60-80% APRs. Crypto makes financial services (Aave, Compound, Maker, Benqi, Nexo, etc.) available globally for pennies per transaction.

Inefficiency - Paying for pretty much anything costs merchants 2.5-3% in credit card fees. This will thankfully go to under 0.1% as merchants begin to accept stablecoins and CBDCs in the next few years. Visa and Mastercard are going to have to adapt or pull a Blockbuster and die.

Lack of Interoperability - Why the heck does it still take two business days to wire money from New York City to Toronto or Cairo to Dubai? International borders are man-made and fake. Money should be digital, programmable, and transferable globally instantly 24/7 -- and with crypto, it is. The SWIFT system is getting swiftly disrupted.

Opacity - Data about the current financial system is hidden, which can create hidden systemic vulnerabilities and lead tax payers to subsidize overly risky behavior (2008) hidden in old school contracts (we all remember how hidden CDOs and mortgage backed securities crashed our economies and put millions out of work 13 years ago). With blockchains and smart contracts, all the data is transparent and out in the open in places like Etherscan, DeFiLlama, Glassnode, IntoTheBlock, The Block, and Messari.

And I’ll add a 6th problem…

The Savings Rate - Due to ‘Central Banks Gone Wild’, the annual interest on savings accounts is currently around 0.2% in the USA and negative in some European countries. On the blockchain, I can go on Nexo, Celsius, BlockFi, Aave, Compound, Maker, or Benqui and get 5-10% annual yields on my savings, without much effort at all. With low savings rates payouts come low savings rates and high consumption -- good in the short term but bad for long-term economic stability. It also creates massive inequality where the rich get massive capital gains on the homes and equities -- while those without assets have the value of their savings inflated away annually.

These problems lead to lower economic growth and less fairness as the wealthy get access that regular people do not. Thankfully, crypto solves all six of these significant problems with the current financial system.

It’s The Current Financial System That is Opaque and Inefficient, Not the New One

So when you hear people say that crypto is speculative, tell them the current opaque and outdated 1946-Bretton Woods-based financial system is what’s speculative.

It’s time for an upgrade.

Cryptography, smart contracts, oracles, tokens, AMMs, and DeFi are the foundational technology layers for the new financial system for humanity.

As HeartRithm founder Nick Sullivan often says here at our home in Colorado, “DeFi is the foundation of the largest transfer of wealth in human history -- all taking place over the next 15 years.”

You can either be a part of it and join the movement or continue to be the skeptics who don’t understand that this IS the financial internet revolution.

Choose to be part of it. Read everything you can about the topic. And tell everyone.

Me? I’m in. I’m all in. Let’s go.

Spread the gospel, my friends. Be an acolyte of financial inclusion and an efficient and fair global financial system for all. Pass this along to your few holdout friends -- especially those in traditional finance and especially those in Washington D.C. and Brussels.

Someone, please send this essay to ECB President Christine Lagarde so she can welcome this new technology the right way -- as it is, in fact, the key to Europe’s economic future in the 2020s and 2030s.

It’s time to see the light. The technology is here. We are building something new together. The time is now. And it’s an exciting time. The most exciting of times!

What’s Coming Next Week in Part 2?

Now that I’ve laid out the foundation, next week we will explain the DeFi stack across Ethereum, Solana, Polygon, Terra, Fantom, Avalanche, and BSC -- and share our perspective on which chain is going to win DeFi.

For a little preview, here’s how the top chains stack up in terms of Total Value Locked in DeFi as of September 23, 2021.

Ethereum - $121 billion

Binance Smart Chain - $16.2B

Solana - $8.9B

Terra - $8.2B

Polygon - $4.3B

Avalanche - $3.2B

Fantom - $1.25B

Huobi Chain - $993M

Celo - $980M

Arbitrum - $800M

Bitcoin - $125M (there’s very little DeFi running on Bitcoin as Bitcoin isn’t programmable and very slow). DeFi on Bitcoin is a joke among those who know. 😃

🗞️ Crypto News Recap: The Top Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top stories of the week...

🇨🇳 China Bans Crypto… Again - BTC and ETH were down 5% on Friday amidst news that China is banning all mining (again). Anthony Pompliano commented, “It would seem like a negative thing to have China ban bitcoin and cryptocurrencies, but the market barely cares after the 100th time.” Based on the below chart, Bitcoin has only risen since previous announced bans. China is choosing control over innovation, potentially leaving themselves out of the largest shift in financial markets since the Internet.

⚡ Sec Chair Gensler Responds to Coinbase Allegations - SEC Chair Gary Gensler appears on CNBC, speaking in generalities and not addressing Armstrong’s comments against the SEC, further fueling speculation. (Source)

😮 Federal Reserve Could Taper ‘Soon’ As Officials See Interest Rate Hike Next Year - Many cryptocurrency investors speculate that “quantitative easing” could weaken the dollar, pushing up the value of bitcoin. (Source)

💳 Ripple (XRP) To Partner With the Royal Monetary Authority of Bhutan for Cbdc Development - Bhutan’s central bank, the Royal Monetary Authority (RMA), has partnered with Ripple to use its infrastructure to pilot a central bank digital currency. (Source)

💰 Circle Taps Plaid for ACH Payments As USDC Market Cap Hits $30B - Stablecoin issuer Circle said it is partnering with financial data aggregator Plaid to make it easier for consumers to move their money out of the bank and into Circle’s USDC. (Source)

🤑 UAE Regulators Approve Crypto Trading in Dubai Free Zones - Financial regulators in the United Arab Emirates have reached an arrangement to officially allow and support cryptocurrency trading in an economic-free zone in Dubai. (Source)

🏦 New Research Shows Bitcoin Price Tops Follow Chinese Debt Cycles - Looking back at Bitcoin’s history, Material Scientist shows that previous cycle tops in Bitcoin have coincided with tops in Chinese debt cycles. (Source)

🇺🇸 Biden To Nominate Anti-Crypto and Anti-Big Bank Law Professor To Run the OCC - Omarova has criticized both crypto assets and the legacy banking sector in the past, having once pledged to “end banking as we know it.” (Source)

📈 Regulators Racing Toward First Major Rules on Cryptocurrency - The Treasury Department is working on an oversight framework as regulators are worried about whether stablecoin firms hold enough liquid assets to back up the value of the currency they issue. (Source)

🎆 New Jersey Delays Effective Date of Cease-and-Desist Order for BlockFi Until December - NJ issues a cease-and-desist for new interest accounts at BlockFi, which will take effect on Dec 1. (Source)

🏧 Kava Announces $185M DeFi Fund To Incentivize Top-Tier Projects and Developers - DeFi platform Kava is kickstarting its ecosystem expansion with a mission to cater to early DeFi adopters. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

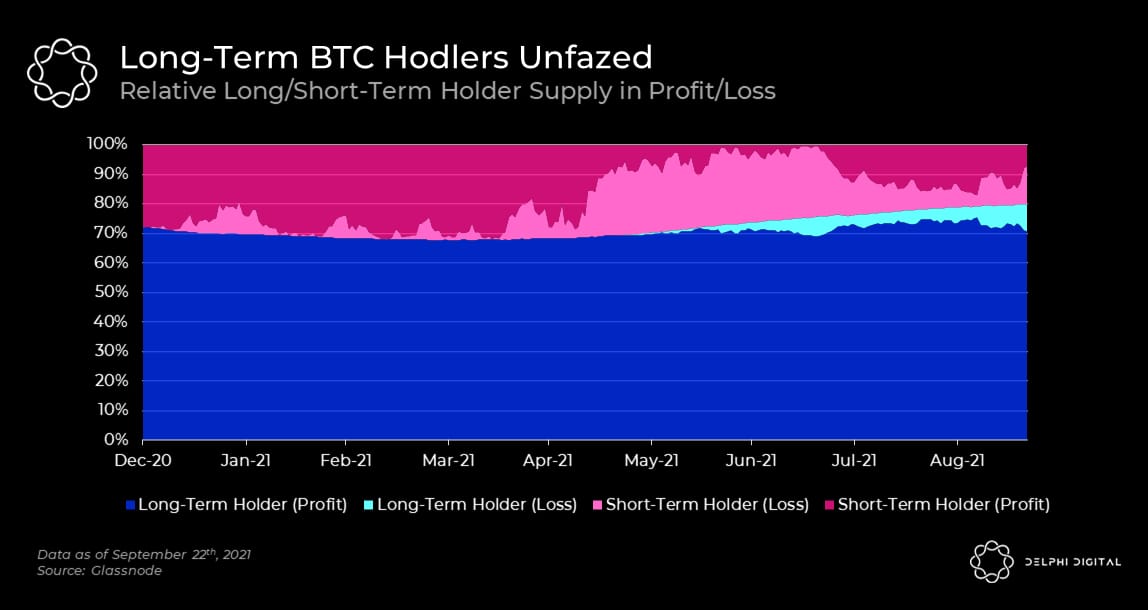

1. Despite a Heavy Sell-Off Earlier in the Week, Long-Term Holders Seem To Be Unfazed and Continue To HODL

2. OpenSea Continues To Be the Leading Dapp in Terms of Total Eth Burned, With Over 46k Eth That Has Been Burned From Transactions Since EIP-1559 Went Live

3. Three Hundred Forty-Eight Total Investments Came From Investment DAOs Since They Launched With Csp Dao, DuckDAO, the Lao, and Metacartel Ventures Being the Most Active in 2021

4. 95% of Outstanding Loans on Lending Protocols in DeFi Remain Stablecoin-Denominated

5. L2’s Now Consistently Cutting 95% of Gas Fees on Ethereum

6. Markets Remain Healthy With Low Levels of Leverage for Both BTC and ETH

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. ETH Looks To Consolidate At New Price Floors

In his latest report, famed on-chain analyst Willy Woo outlines his latest short-term market forecast while ensuring that his macro forecast remains unchanged. Willy forecasts a consolidation between the $3k-$3.2k price range for ETH before beginning its ascent to new ATH’s later this year.

“ETH saw a price sell-off that was deeper than BTC. Underneath this, we also saw a weakening of on-chain investor demand while BTC strengthened. The chart below shows this by comparing the ETH and BTC’s supply shock (purple line).

Taking into account ETH’s technical analysis picture, which remains bearish, ETH looks like it’s in for multiple weeks of consolidation.”

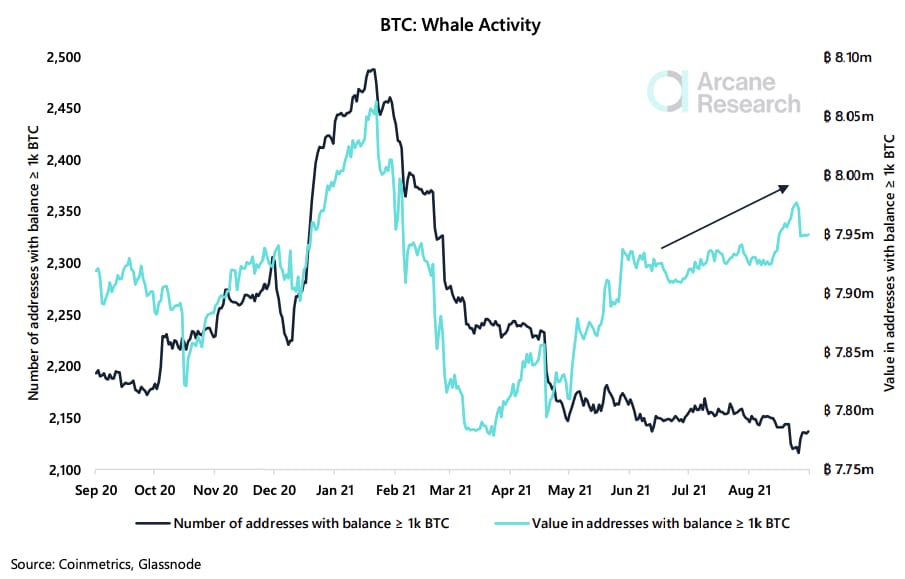

2. BTC Whales Are Accumulating

Arcane Research, a data-driven research firm out of Norway, released their latest Weekly Update highlighting the mass accumulation with whale addresses. A whale is a BTC address holding more than 1k bitcoin, and although the total number of whales is in a downtrend, their total holdings are increasing, which signals a bullish macro trend.

“Since the all-time whale high on February 8th, the number of whales has decreased by almost 15%. In the same period, these addresses' total number of bitcoin held has only reduced by around 1%.

During the bull run around the year change, the number of whales increased rapidly. The sudden decrease after February 8th suggests that many of these new whales coming in were not in bitcoin for the long game but just trading it short term.

When the short-term whales have been selling, the long-term whales have been buying.”

3. Institutional Interest Growing For NFTs

CoinMetrics, an on-chain data platform, releases a weekly report on the significant activity inside our favorite protocols. This week, they look at the rise of NFTs by taking a data-driven overview of non-fungible tokens.

“We believe institutions might be attracted to NFTs for the investment benefits of provable digital scarcity and as a scalable vehicle for social signaling.

NFTs as an asset class might be compared best to the fine art market right now. While the traditional art market is a more niche investment area, there is precedent for institutional activity. Many institutions and banks have long amassed extensive corporate art collections. For example, UBS and Bank of America have curated collections of around 30,000 and 50,000 works, respectively. Art serves a dual purpose of being both an uncorrelated investment six and as a means of cultural engagement. While at the surface, it may appear perplexing to purchase 24x24 pixel images for hundreds of thousands of dollars, NFTs share some of these benefits while having powerful advantages to the traditional art market.

More data is needed, but it may also be reasonable to assume some NFTs will exhibit uncorrelated returns, making them an attractive alternative asset to diversify portfolios.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

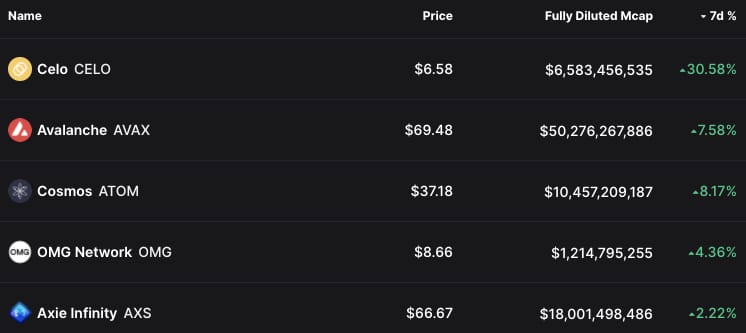

📈 Top Performers This Week

Here are the top 5 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like AVAX, and AXS had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: eCash is a BTC fork, Fantom and Solana are L1 blockchains. Celo is a blockchain-based payment infrastructure.

🚀 Coin Of The Week

We write about a new token each week to help spread the word about new and upcoming projects. As always, investing in early-stage crypto projects is particularly risky with the opportunity for major gains and major losses.

Coin: AvalancheSymbol: AVAXPrice: $74.47Available On: Binance, Gate.io, OKExFully Diluted Market Cap: $53BPrice Change Last 30 Days: +53%Coin Ranking: #11 by Market Cap

Background:Avalanche is a smart contracts platform that utilizes a direct acyclic graph (DAG) in its protocol for consensus. DAG allows Avalanche to reach an estimated 4,500 TPS with under 3-second transaction settlement. Avalanche aims to solve the blockchain trilemma by being extremely fast and highly scalable while maintaining decentralization and being highly secure. AVAX is a Proof-of-Stake with a fixed supply. Validators lock up AVAX to secure the network and earn staking rewards. Governance utility in that AVAX holders have the power to vote on proposals, including managing the inflation rate.

Growth & Longevity:Although Avalanche doesn't have the longevity of other projects, it has some serious backers, including Galaxy Digital, Bitmain, Dragonfly Capital, etc. Avalanche was still quite a new project, having launched in August 2020, yet it's been expanding rapidly in terms of projects being built on the platform, with 227 projects in 9 months.

Why It’s Pumping:The Avalanche Foundation finished a $230M private round led by Polychain and Three Arrows Capital and included a handful of other participants. The Avalanche Foundation, which maintains and develops the Avalanche blockchain, has said that it will use the funds to promote the growth of DeFi and business applications and other uses for its network. News of the significant capital injection courtesy of big investment from a group of private investment firms signaled a substantial vote of confidence from some well-connected sources, and the AVAX token currently trades at a lifetime high. (Source)

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 5,157 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 4: ETH, DOT, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.