Issue summary: Following last week’s DeFi & The Future of Finance Part One, today we share part two -- explaining which L1 blockchains are winning in DeFi and the rapidly growing Dapps that are creating the future of finance. We also highlight the most important news and stats of the week in This Week in Crypto. If you want to understand DeFi, start here…

In This Week’s Issue:

DeFi & The Future of Finance: Part II

Meet the Silicon Valley Entrepreneur Using Cryptocurrency To Create Social Impact

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

📈 Top 10 Performers

🎧 Best Podcasts

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

🏦 DeFi & The Future of Finance: Part II

By Ryan Allis, Managing Partner of Crypto Quant Fund HeartRithm

About this article: In this two-part feature article, Coinstack founder and HeartRithm Managing Partner Ryan Allis writes about how decentralized finance is the future of finance. Last week we published part one.

Last week in part one, I shared the foundation for why DeFi (also known as open finance) is taking over from the legacy financial system.

DeFi uses blockchains, smart contracts, price oracles, AMMs, and open source code to allocate and store capital more efficiently and securely than traditional markets. Instead of needing to trust a large institution, decentralized blockchains, validated by thousands of distributed node operators, offer better security and speed than the legacy system, with much of its legal structuring dating back to the 1930s and 1940s and much of its code written in the 1970s and 1980s.

Legacy markets are centralized, opaque, and are open less than 35 hours per week. Blockchain-based markets are available continuously, trade 24/7/365, are transparent and interoperable, and their contracts are smart -- built with code instead of words. Filing cabinets and terabytes of Docusign repositories are being replaced by Github, the world’s open-source code repository.

Even governments are getting on board with China, Europe, the USA, the UK, Nigeria, and many others actively launching blockchain-based Central Bank Digital Currencies (CBDC). Welcome to the era of programmable money.

Here’s what The Economist, the relatively conservative magazine first published in England in 1843, had to say on September 18th about DeFi.

“Conventional banking requires a vast infrastructure to maintain trust between strangers, from clearinghouses and compliance to capital rules and courts. It is expensive and often captured by insiders: think of credit-card fees and bankers’ yachts. By contrast, transactions on a blockchain are trustworthy, cheap, transparent, and quick...

The rise of an ecosystem of financial services, known as decentralized finance, or “DeFi,” deserves sober consideration. It has the potential to rewire how the financial system works, with all the promise and perils that it entails. The proliferation of innovation in DeFi is akin to the frenzy of the invention in the early phase of the web...

As with the internet in the 1990s, no one knows where the revolution will end. But it stands to transform how money works and, as it does so, the entire digital world.” - The Economist, September 18, 2021

The Blockchains Powering DeFi - Which is Winning?

DeFi, smart contracts, and blockchains are the foundation of the new technology displacing the old Post-WWII Bretton Woods-era of financial services that have operated from 1946 until now.

Ultimately, DeFi apps operate on top of blockchains -- the decentralized databases taking over the legacy world of data storage. Here are the blockchains with the most total value locked (TVL) in DeFi as of September 29, 2021.

Above I show the top blockchains by total value locked in their DeFi ecosystem, with data from DeFiLlama.com.

There are two interesting takeaways here:

Fantom, Arbitrum, and Avalanche are growing the fastest right now. It might be worth getting some FTM and AVAX tokens if you don’t already have some. Arbitrum doesn’t have a token yet -- and is funded by venture capital firms like Polychain, Pantera, and Alameda.

The amount of money locked in Ethereum DeFi is now 1000x that of Bitcoin. $122B vs. $122M. Bitcoin DeFi remains a joke that maximalists don’t quite get yet. Maybe Stacks, Sovryn, and Jack Dorsey will change this in the years to come… but I don’t see it as likely. Bitcoin is like the TI-83 calculator, Ethereum is the PC, and Solana, Fantom, Avalanche (and soon Polkadot) are the supercomputers -- though their speed does have security tradeoffs.

Let’s take a look at the same data in graph format:

The takeaway here is that Ethereum remains the King of DeFi, with a 7x+ lead of its nearest competitors BSC and Solana.

With the most nodes (3,000+), the longest lifespan among smart contract platforms, and the most TVL -- Ethereum remains in a big lead.

In fact, you have to remove Ethereum from the chart to truly evaluate the competition. Let’s take a look:

Overall, the TVL in DeFi has increased from $8B a year ago to over $172B today, a 21x increase in 365 days. This isn’t speculation. This is a full-scale and lightning-speed revolution in finance -- unlike we’ve ever seen before.

The Biggest DeFi Dapps By Total Value Locked

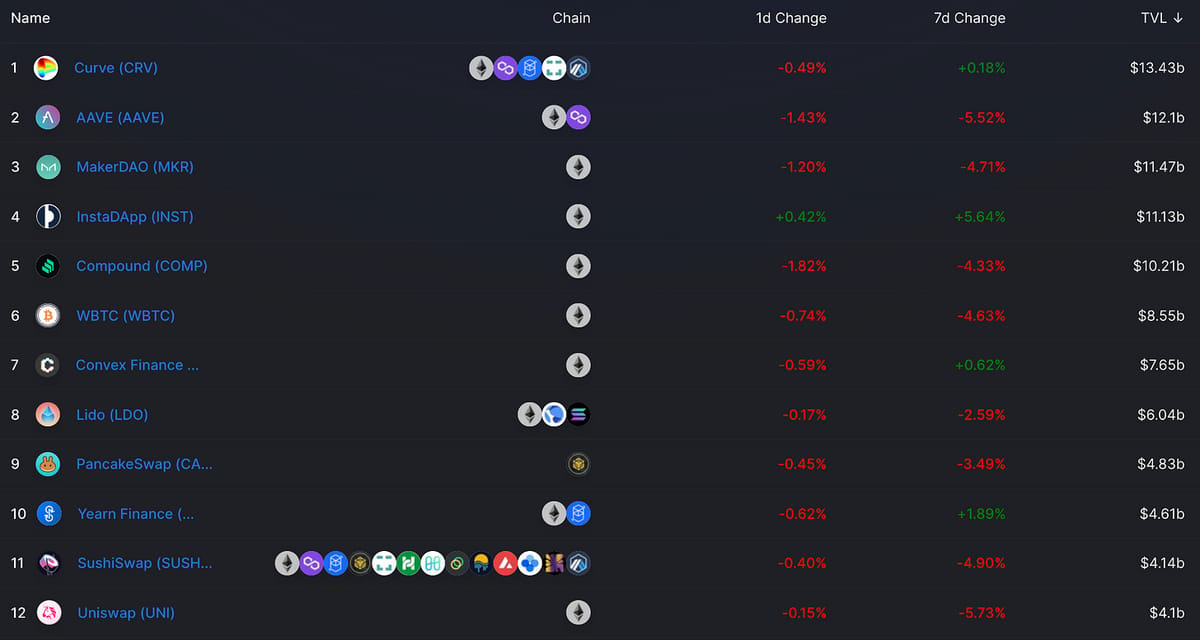

Below are the top 12 DeFi Dapps by Total Value Locked. Curve is winning with $13B, and Uniswap rounds out the top 12…

Here’s what each of these decentralized DeFi applications actually do...

Curve - Money market / lending

Aave - Money market / lending

Maker - Money market / lending

InstaDapp - Composable platform for integrating multiple platforms

Compound - Money market / lending

WBTC - Bitcoin represented on the Ethereum blockchain

Convex - Curve yield booster

Lido - Staking

PancakeSwap - DEX

Yearn - Yield optimization

SushiSwap - DEX

Uniswap - DEX

These new DeFi platforms are the 21st century equivalents of Bank of America and the New York Stock Exchange in the old world -- but are open, composable, auditable, code-based, and transparent -- and cut out the middlemen in suits taking fat commissions.

While the above dDpps are the largest by TVL, these aren’t necessarily the fastest growing any longer… for the sake of picking the next potential winners, let’s explore the fastest growing.

Which Dapps Are Winning On the Fastest Growing Chains

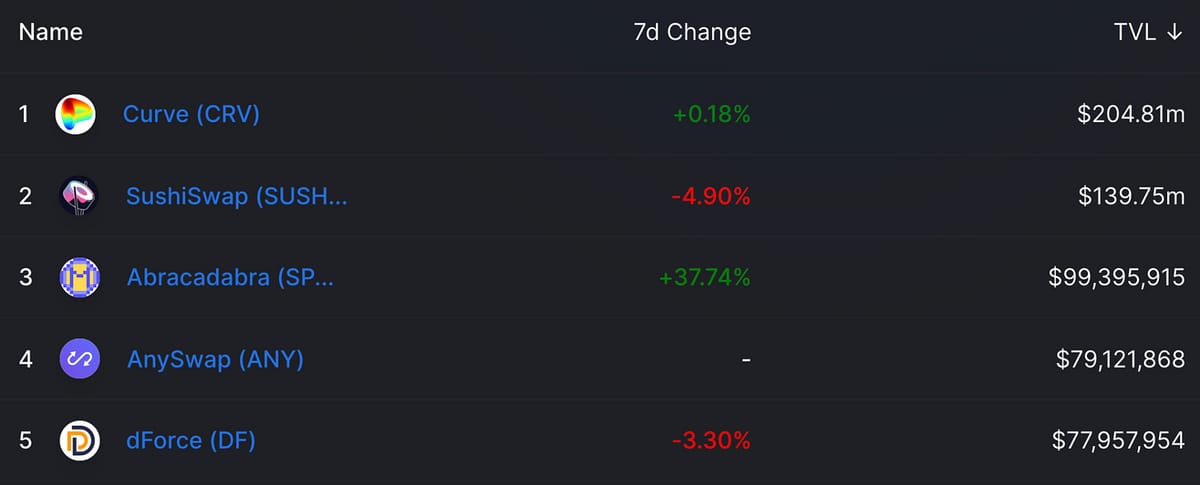

The blockchains that are growing the fastest in terms of DeFi TVL right now are Fantom (FTM), Avalanche (AVAX), and Arbitrum.

Below are the top DeFi Dapps of each of these chains.

On Fantom it’s ANY, BOO, CRV, BIFI, and SCREAM leading the way.

On Avalanche it’s QI, JOE, PNG, YAK, and TED leading the way.

On Arbitrum it’s CRV, SUSHI, SPELL, ANY, and DF leading the way.

Lastly, here’s the fastest overall growing Dapps from the last week. Many of these are off very small baselines and just launched, so definitely do your diligence on each of these before investing. YFII and FEI have been around for a while, however, and still grew their TVLs by over 100% in the alst week.

DeFi Is Here To Stay…

DeFi is here to stay -- and is the foundation of the new open financial system.

Get yourself a copy if you haven’t already picked up a copy of the book DeFi & The Future of Finance. It’s worth it.

And if you’re an active crypto investor, definitely do some usage research on DeFiLlama.com and consider picking up some of the tokens for the fastest-growing overall Dapps as well as the tokens for the top Fantom, Avalanche, and Arbitrum Dapps.

They may become the Compound, Aave, and Makers of tomorrow.

🌎 Meet the Silicon Valley Entrepreneur Using Cryptocurrency To Create Social Impact

HeartRithm is an algorithmic crypto quant fund with AUM in the top 10% of crypto funds. This week, Entrepreneur Magazine published the following story about their CEO and founder Nick Sullivan. Learn more about HeartRithm here.

Long before launching four successful tech companies, Bay Area crypto connoisseur Nick Sullivan was accustomed to the high-wire act of balancing career and family. After having his first child at 17, Sullivan started working as a data entry clerk, copying and pasting by day and teaching himself to code in the evenings. Welcoming a quick promotion alongside the arrival of his second child, he doubled down to get ahead: “There was one week I worked 105 hours. It was like, come home, shower, turn around, get back to it, sleep under the desk,” Sullivan recalls.

It was a later role as a web developer with Brassring in 1999 that launched Sullivan’s technological career in earnest. As a high school dropout with a family to support, Sullivan credits his steady advancement to Silicon Valley’s meritocratic structure: “It didn’t matter that I didn’t have a degree. It mattered what I could do, how hard I could work, and what I could accomplish.”

Click here for the full article.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚡ Bitfinex Spent $23.7 Million in Fees To Make a Single Ethereum Transaction - A wallet belonging to crypto exchange Bitfinex covered the fees for a payment of $100,000 of tether (USDT) on behalf of the non-custodial exchange DeversiFi. The majority of the funds were returned to the Bitfinex-controlled wallet the following day. (Source)

😮 Cardano’s Commercial Arm To Invest $100M in DeFi, NFTs and Blockchain Education - Emurgo, the commercial and venture arm of Cardano, is investing $100 million to boost decentralized finance (DeFi), non-fungible token (NFT) products, and blockchain education efforts. (Source)

💳 Arca Labs and Securitize Partner on Tokenized US Treasury Fund - Arca Labs teamed up with Securitize to launch a regulated, ‘40 Act, tokenized US Treasury fund to provide a stable way for investors to gain crypto exposure. (Source)

💰 US Senators Launch Bill To Keep Tabs on Overseas Crypto Mining - Two US Senators have introduced a bill that would have the US Treasury keep tabs on foreign countries' cryptocurrency activity. (Source)

🤑 Peruvian Stablecoin Launches on Stellar Blockchain - Latin American stablecoin issuer Anclap is expanding its Stellar-based stablecoin network by launching a new stablecoin in Peru. (Source)

🏦 Dex Tokens Boom As Chinese Investors Look for Alternatives - DEX tokens soared over the weekend with, some protocols trading volumes surpassing those of large centralized exchanges. (Source)

🇺🇸 Sen. Pat Toomey Presses SEC Chair Gensler for Crypto Clarity - The Senate Banking Committee member wants Gensler to explain what makes a digital asset a security. (Source)

📈 Facebook Announces $50M Investment Fund Tasked With Developing Its Virtual Metaverse - Facebook has slated $50 million to be spent over the next two years through its XR Programs and Research Fund. (Source)

🎆 Deutsche Bank Sees Bitcoin (BTC) Becoming ’21st Century Gold - A senior analyst with the Deutsche Bank believes that Bitcoin has the potential to become the 21st century’s answer to gold. (Source)

🏧 The U.S. Fed Seeks Consensus on CBDC With Biden Administration - The central bank will work with Congress and the Biden administration on any digital currency development, Chair Jerome Powell emphasized Wednesday. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. ETH’s Burn Rate Reaches ~$14k USD per Minute, According to the Latest Ultrasound Money Metrics

2. Uniswap V3 Reaches Over 3k Tradeable Tokens, With a Majority Being Traded Against ETH

3. Negative Yields Reaching Historic Peaks Giving Investors a Bullish Signal for the Crypto Market

4. Week Over Week Growth in TVL’s Continue With Terra an L1 and Avalanche an Eth L2 Taking the Lead

5. Rmrk, an NFT Marketplace for Kusama, Crosses $3M in Volume in 2 Weeks Since Launch

6. Solana Becomes 3rd Largest Crypto Derivative Market With Over $800M in Open Interest

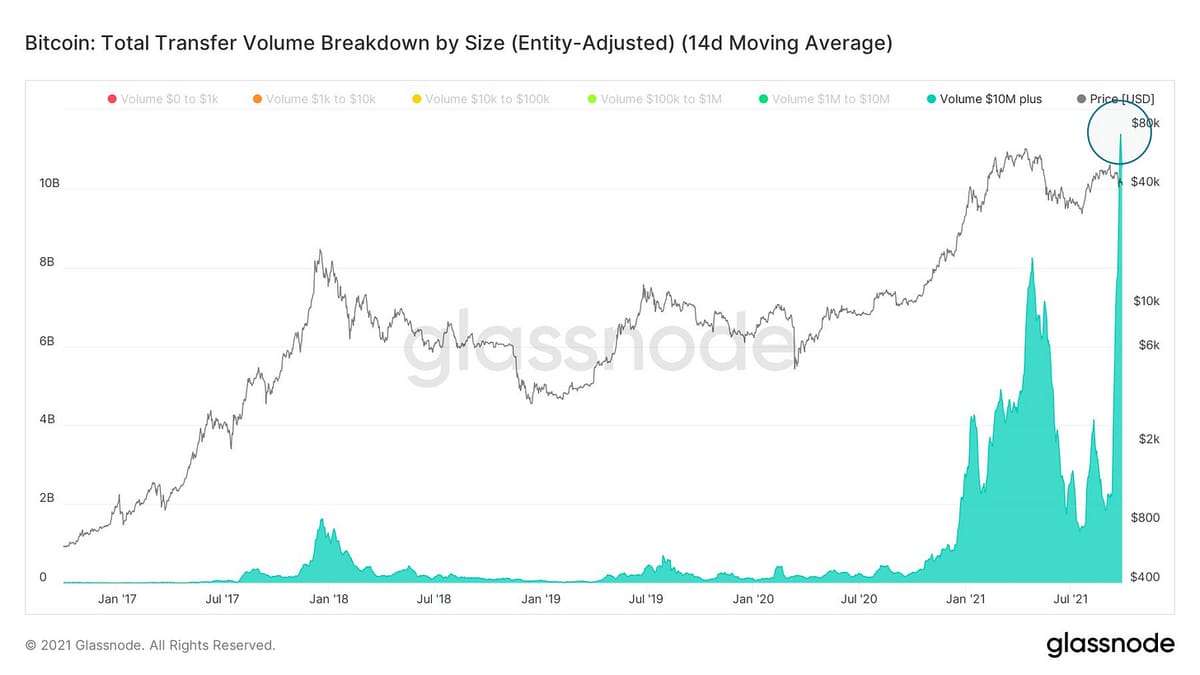

7. Total Transfer Volume of $10M+ Transactions Reaches a New ATH As Whales Continue Moving Record Amounts of BTC… $10B+ transferred in 14 Days

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. CBDCs Can Cut Cross Border Remittance Costs By Half

The Bank for International Settlements (BIS) recently published a report stating the benefits of central bank digital currencies (CBDC), specifically in reducing the cost of cross-border payments and cutting remittance costs by half.

“In the absence of multilateral solutions for cross-border payments, correspondent banks currently act as bridges, moving payments from one jurisdiction to another. To achieve this, they have built extensive correspondent banking networks and arrangements. While serving a critical economic role, these networks and structures also introduce more intermediary steps in the system. Corresponding banks are spread across multiple time zones and different operating hours, leading to increased operational complexity, possible bottlenecks, and duplication. For example, every bank is repeated know-your-customer (KYC) processes in the correspondent banking process flow. As illustrated in the published report of Inthanon-LionRock Phase 1, this leads to higher costs and a slower speed of cross-border payments. This process complexity also is paired with high FX settlement risk, low transparency, and a high reporting burden.”

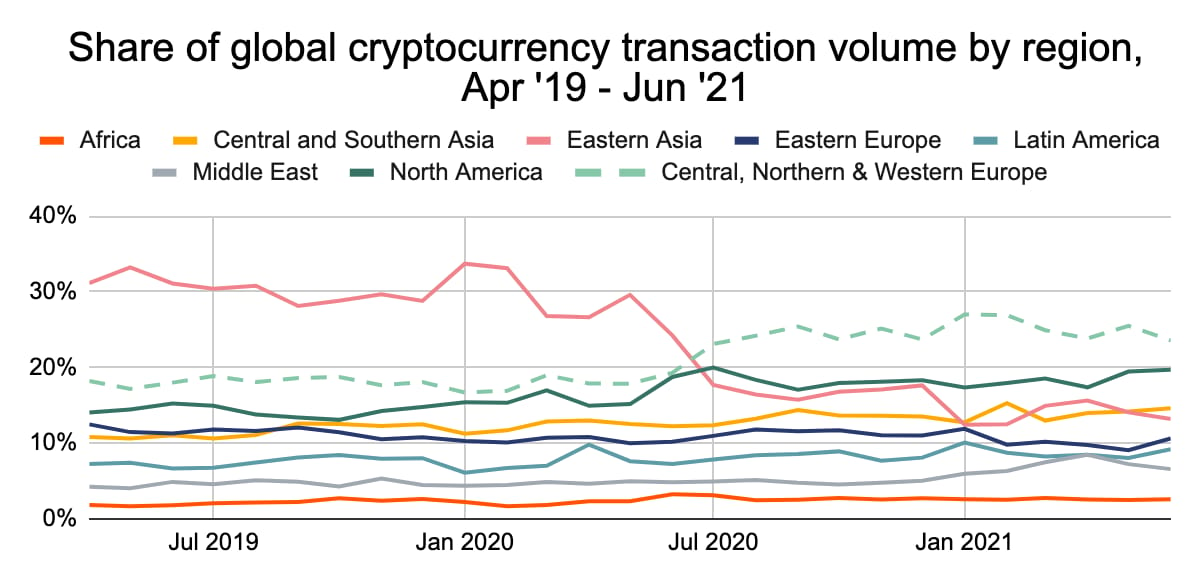

2. Europe Becomes Largest Crypto Economy With Over $1T In Transactions

Chainalysis, an on-chain research firm, released an in-depth report regarding cryptocurrency, the countries moving the most economical value. Central, Northern, & Western Europe (CNWE) is currently transacting over $1 trillion worth of cryptocurrency over the last year, representing 25% of global activity.

“Central, Northern, & Western Europe (CNWE) transaction volume grew significantly across virtually all cryptocurrencies and service types, especially on DeFi protocols. An influx of institutional investment, signaled by large transactions, drove most of the growth, though retail activity also increased.

Large institutional cryptocurrency transaction value grew from $1.4 billion in July 2020 to $46.3 billion in June 2021, at which point it made up more than half of all CNWE activity.”

3. Bitcoin’s Energy Consumption Is Insignificant Globally

Bitcoin Net Zero, Sept 28, 2021NYDIG, a subsidiary of Stone Ridge, is a leading technology and financial services firm dedicated to Bitcoin. In their latest report, NYDIG evaluated Bitcoin's energy consumption in the context of its role in society, ultimately finding its energy consumption to be insignificant on a global scale.

“Bitcoin’s absolute electricity consumption and carbon emissions are not significant in global terms, representing 0.04 percent of global primary energy consumption, 0.2 percent of global electricity generation, and 0.1 percent of global carbon emissions.

Bitcoin’s electricity consumption and carbon emissions are not significant in global terms. Its estimated electricity consumption of 62 TWh in 2020 represented just 0.04 percent of the global primary energy consumption of 170,000 TWh and 0.2 percent of the global electricity generation of 27,000 TWh. Bitcoin’s carbon emissions were 33 MtCO2 in 2020, or 0.1 percent of the global total of 36,000 MtCO2.

In the future, under a wide range of Bitcoin price scenarios, Bitcoin’s electricity consumption and carbon emissions will remain a small proportion of global totals. Even under our highest price scenario, where Bitcoin’s electricity consumption and carbon emissions peak at 706 TWh and 234 MtCO, this only accounts for 0.4 percent of global primary energy consumption, 2.0 percent of electricity generation, and 0.9 percent of carbon emissions.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like DYDX, LUNA, AXS and UNI had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

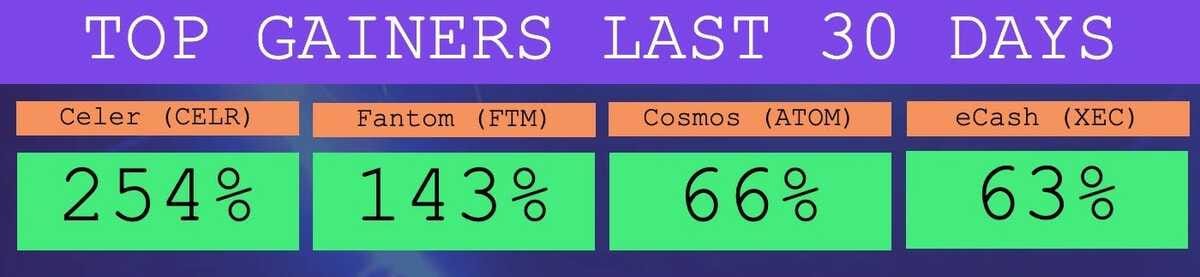

The Top Performers This Month from the Top 100: Celer is an L2 scaling solution, Fantom and Cosmos are L1 blockchains, and eCash is a BTC fork.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 5,435 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 4: ETH, DOT, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.