In this issue we introduce Double Peak Theory and the on-chain signals that show we have likely bottomed and are on our way up to new All Time Highs (ATHs) in 2021. Since the June 26 bottom that we called, BTC is up 14% from $30,184 to $34,294 and ETH is up 32% from $1719 to $2275. We’re not fully out of the woods yet, but now is the time to invest.

Inside This Issue:

Double Peak Theory - Now’s the Time To Invest

The Double Bitcoin Peaks of 2013 and 2021

What’s Next for The Bitcoin Price?

The Double Ethereum Peak of 2017 and 2021

What Our Analysis is Based On: Macro, History, & On-Chain

Now’s the Time to Allocate Capital to Crypto

A Bullish Echo-Chamber or Something Real?

Everyone We Follow Is Bullish Right Now

Willy Woo is Bullish on The BTC Rally Continuing

Lark Davis Says Its Time to Buy Due to the Puell Multiple

Ryan Selkis is Bullish on the Tech & Overall Sector

Coinstack Alpha Fund up 30% In The Last Week

The Bitcoin Mining Council Reports 56% Sustainable Energy

Coinstack Podcast Episodes

A Good Long-Term Crypto Portfolio

Tuesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

Double Peak Theory - Now’s The Time To InvestBy Ryan Allis

The first half of 2021 is now officially over.

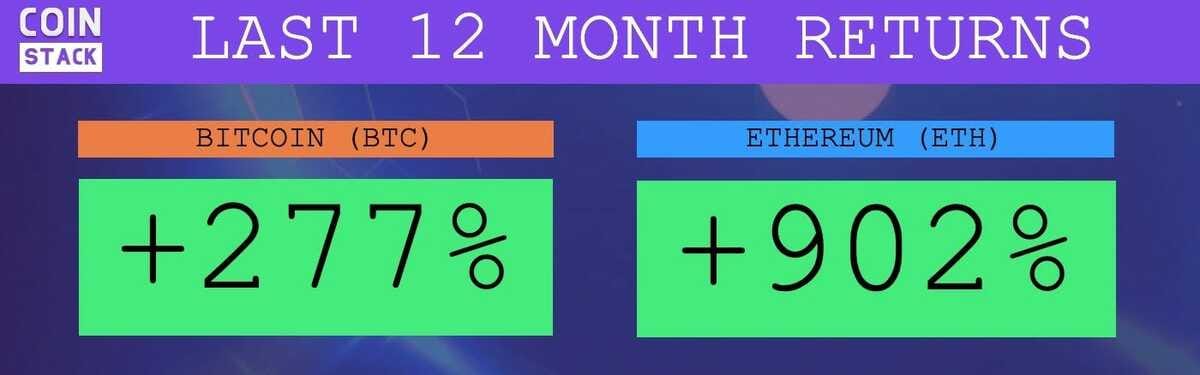

In the first half of this year, Bitcoin was up 20% and Ethereum was up 208%. Ethereum’s rise was astounding, growing in value at 10x the rate of Bitcoin.

However, as many of our readers may know, the price of Bitcoin peaked on April 13 at $64k and Ethereum peaked on May 11 at $4300.

The trillion dollar question is whether there will be a second peak for crypto markets later in 2021. We believe there will be -- and that we will be reaching new All-Time Highs (above $64k) by the Fall of 2021.

Double Peak Theory is the thesis that we will have another big run up later this year… to new highs…

Here’s what makes us think this will happen.

A Double Peak for Bitcoin in 2013 and 2021?

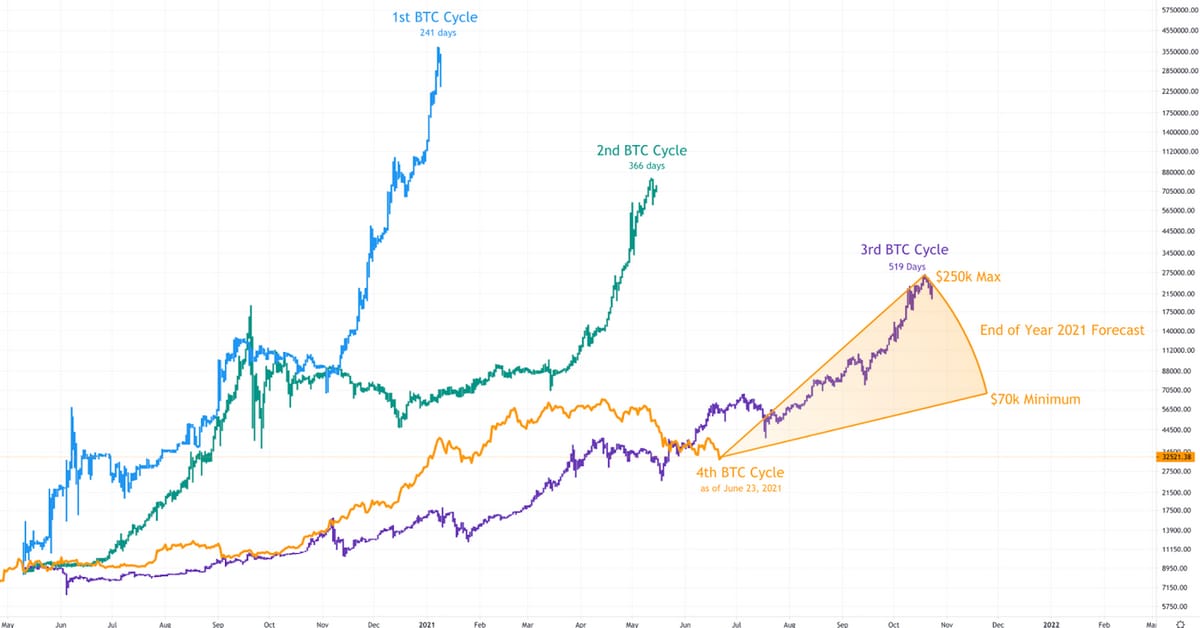

Let’s first look at what happened to Bitcoin in 2013, in the cycle after its very first halving event -- and compare it to our forecast for 2021.

In 2013, Bitcoin went up 18x in the Spring, dropped 68% from its first peak into a period of consolidation over the summer, and then climbed another 9x in the Fall.

In 2021, Bitcoin went up ~2.2x in the Spring (29k to 64k) and then dropped 55% from its April peak and is now in a period of consolidation over the summer, driven primarily by the relocation of Chinese mining capacity.

What’s Next for the Bitcoin Price?

What’s next for the Bitcoin Price in the 2nd half of 2021? Well that depends on whether we think institutional, sovereign, and retail demand will continue to increase and reach new highs as more countries come on board the alternative rails in the Post-SWIFT monetary system.

We think this demand will continue to expand, as countries like El Salvador take the lead with making Bitcoin legal tender, officially starting on September 7, 2021.

Well played, President Bukele, well played.

We forecast Bitcoin will ~3x before the end of 2021 from current levels, ending the year above $100k.

While no one knows for sure, based on past cycles and the current Bitcoin network user growth, our median forecast has Bitcoin reaching $100k by the end of the year.

Low forecast: $70k

Median forecast: $100k

High forecast: $130k+

Based on the 519 day length of the 2017 cycle from halving to the cycle peak, and each cycle becoming slightly longer than the past (cycle lengthening theory), we expect the current bull cycle will reach a peak sometime between December 2021 and February 2022.

A Double Peak for Ethereum in 2017 and 2021?

What’s Happening to Ethereum? Well, Ethereum wasn’t around in 2013, but it was around in the 2017 bull cycle. This cycle and that cycle are VERY similar… let’s take a look at the Ether (ETH) chart...

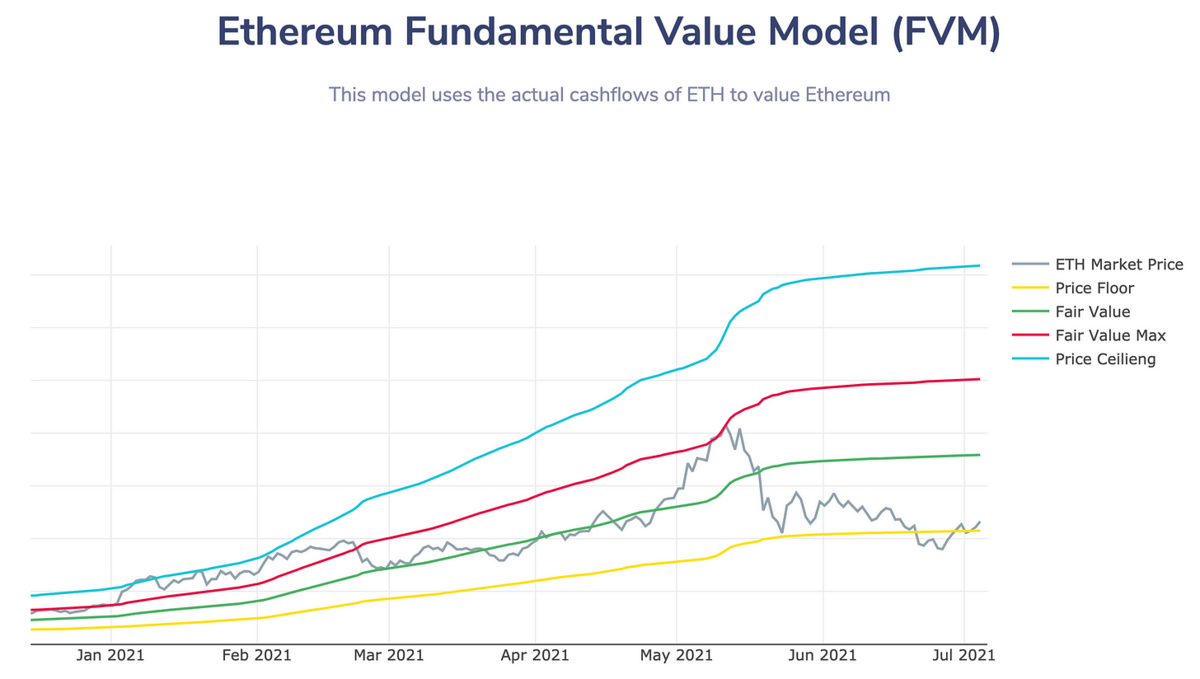

We expect ETH to reach new All-time Highs by October 2021 and end 2021 around 7k+.

Our Ethereum Fundamental Value Model (FVM) that we introduced last month, has at least so far nailed the Ether price floor at 60x trailing twelve month (TTM) Ethereum’s transaction revenues…

Any time we’re under the green line, it’s a good time to buy. And now, my friends, is a good time to allocate as we prepare for big Fall of 2021.

What Our Analysis Is Based On: Macro + History + On-Chain

This 2H 2021 Forecast is essentially based on a few simple realizations:

If it weren’t for China announcing their new stronger enforcement of their existing ban on Bitcoin mining during May 2021 and causing their miners to sell quickly to cover the costs of relocating mining equipment we’d be sitting pretty right now around BTC $55k -- and on our way to $100k.

It’s actually pretty normal in the middle of a cycle to see a 55-60% drop and then recover to All-time Highs in the same year (see Bitcoin 2013 & Ethereum 2017).

Bull markets after a halving tend to last 18 months NOT 12 months -- and they’ve been getting longer each cycle. The last halving was May 2020 -- so we believe we have till the end of this year for continued strong momentum.

There are actual countries buying Bitcoin now to give to their citizens (El Salvador). This will accelerate the Institutional Narrative and give us a new Sovereign Narrative.

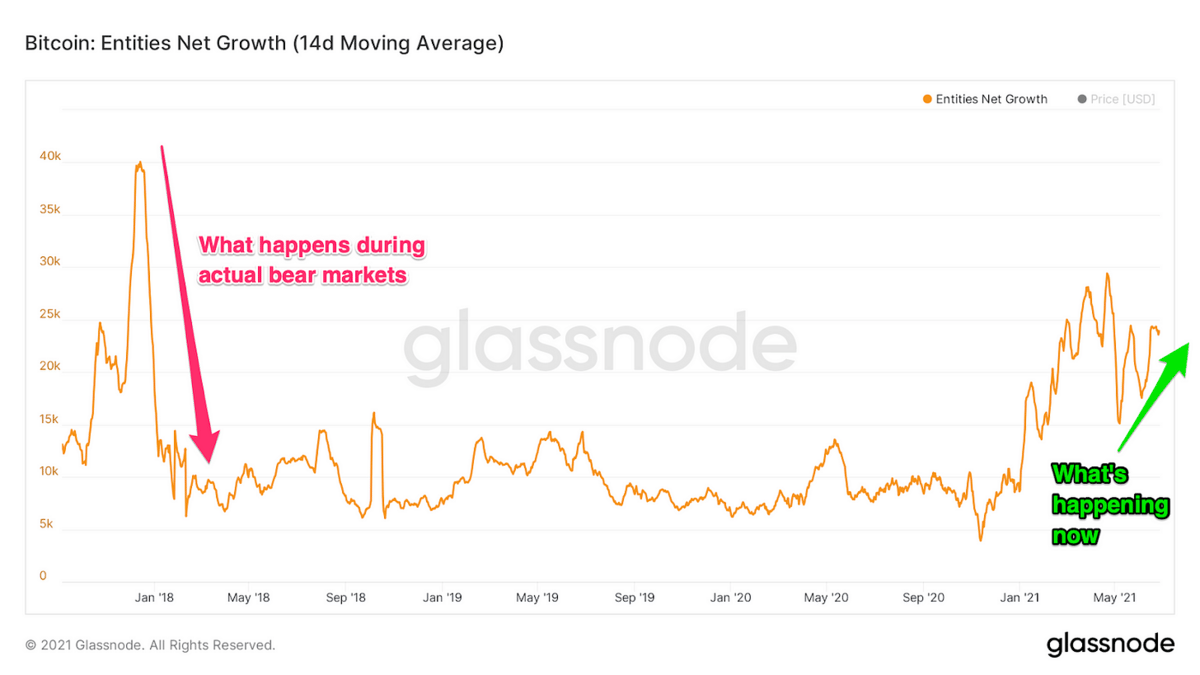

On-chain activity levels (more on that below) have recovered the last 2-3 weeks and are actually looking pretty good right now. If this were an actual bear market, they’d still be dropping. Take a look at this Bitcoin chart of Entities Net Growth from Glassnode…

You can read our article from two weeks ago, “Are We At the Crypto Bottom Yet? We Think So” for even more reasons we’re bullish right now.

Now Is A Good Time To Invest & Put Capital To Work in Crypto

Two weeks ago I wrote the following, calling the market bottom:

“It strikes me that not a lot of people are wanting to put their neck on the line right now and call the bottom. But I think around $25k-$29k is the likely bottom range for this mini-cycle for Bitcoin and $1500-$1750 for ETH. Frankly we don’t have a lot further down we could go.”

While we’re not completely out of the woods yet, based on everything we’ve written above -- it seems like the China situation has stabilized and hash power is now recovering, miners are making sincere efforts to improve their energy sustainability, and both the Institutional Narrative and Sovereign Narrative will continue to create buying pressure on this long-term path toward Bitcoin eventually surpassing the market cap of gold ($11 trillion).

I expect that the next month or two will be an exceptionally good time to allocate capital into crypto as we prepare for a likely big upswing this Fall.

Remember, when the markets are slightly down (like they are now compared to May) it’s a good time to allocate!

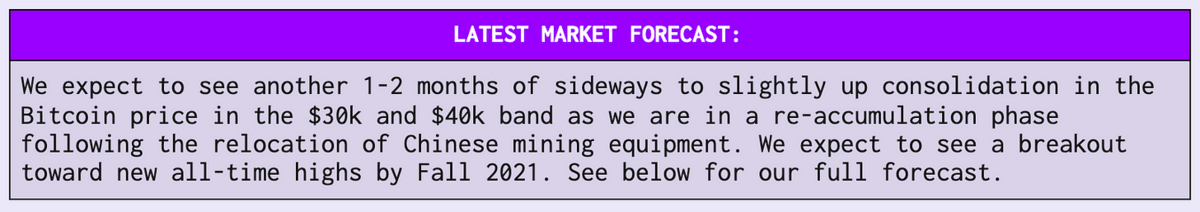

With most of the rally being led this year by institutional investors, we may see a bit of a quieter sideways to slightly up period the next 60 days during the Summer Doldrums (a good time to buy), followed by a faster ascent as people come back into full time focus after Labor Day. We expect September-December 2021 to be a very active time for crypto that may bring us above $100k Bitcoin for the first time.

If you’re looking for a good place to allocate as we prepare for the next leg up in the cycle, check out our Coinstack Alpha Fund on Enzyme. I personally manage that fund with the goal of substantially outperforming Bitcoin.

Inside a Bullish Echo-Chamber? Or Is There Something Real Here?

While it is true that pretty much everyone I follow is bullish right now on what will happen in the 2nd half of 2021 and on-chain signals are looking solid… it is quite possible that I am existing within a bullish echo chamber -- where I’ve somehow found only the bullish analysts -- so take all my forecasts now and in the future with a grain of salt.

I’m still learning and am only 6 months into my deep dive into crypto.

While I am confident that BTC will eventually get over $100k and ETH will eventually get over $10k… the exact timing of this is something that is well, unknown.

I think it’s a relatively safe bet to make if your holding period is 5-10 years -- but if your holding period is 2 years or less -- be sure to use extra risk management and caution -- as it is also possible that we WON’T see another peak in 2021 and that we may be in for another 2-3 years of sideways or down price movements.

My personal belief is that the 2020s will show quality cryptoassets as the best performing financial asset type of the decade. Buy now, DCA in over time, and hold for 10 years and you’ll likely do quite well.

What’s definitely real? That decentralized cryptographically-secured blockchain-based applications are the future of global finance and that digital currency is the future of money -- and that we are a LONG way to go up this decade in the cryptoasset market.

Everyone We Follow is Bullish Right NowBy Ryan Allis

Let’s take a moment to hear from three of our favorite crypto analysts, Willy Woo, Lark Davis, and Ryan Selkis -- who have all put out super bullish reflections in the last week.

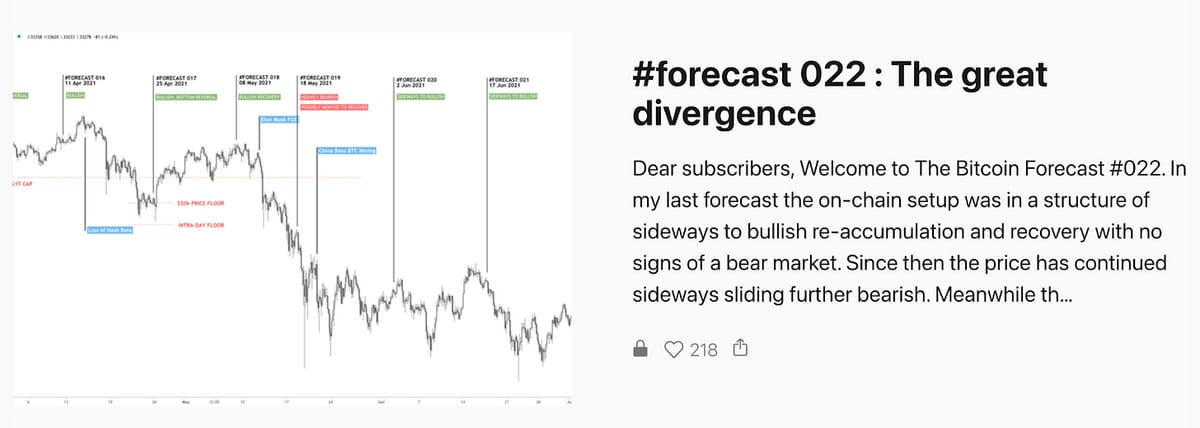

Willy Woo is Bullish On The BTC Rise Continuing

Willy Woo, perhaps the most prominent Bitcoin analysts, has written a bullish note on Bitcoin on-chain signals on Friday indicating his belief we have bottomed and fundamentals show we are heading upwards in the next few months. Here are some excerpts from his recent letter.

The bull market is intact with user growth continuing to climb higher. Macro indicators continue bullish.

Re-accumulation and recovery is still in play and is indeed strengthening, thereby creating a classic price to fundamentals divergence.

Long term investors are quietly absorbing coins unnoticed by the market. I expect this supply shock to squeeze the market upwards.

Under technical analysis, the price action looks scarily bearish to speculators and chartists are pointing to a further price collapse to $20k, claiming we are in a bear market. The fundamentals do not support this.

The on-chain picture is strikingly bullish. A supply shock is quietly forming unnoticed by the market.

Per Glassnode, the Bitcoin network is onboarding a healthy 32,000 new users per day which is a new high for 2021.

The newly launched Canadian Purpose Bitcoin ETF has added 4100 BTC to its holdings during this dip, supporting what we see on-chain; long term investors are buying.

When miners are culled from the network, the surviving miners hold their coins knowing the sell pressure from miners that went out of business has subsided and a price floor is in place. We can see this effect visually as compressions in the Difficulty Ribbon. This has historically been a reliable signal for price bottoms.

You can subscribe to Willy’s full letter including really great analysis and charts at willywoo.substack.com. While it’s $50/month, it’s well worth it if you are a professional investor.

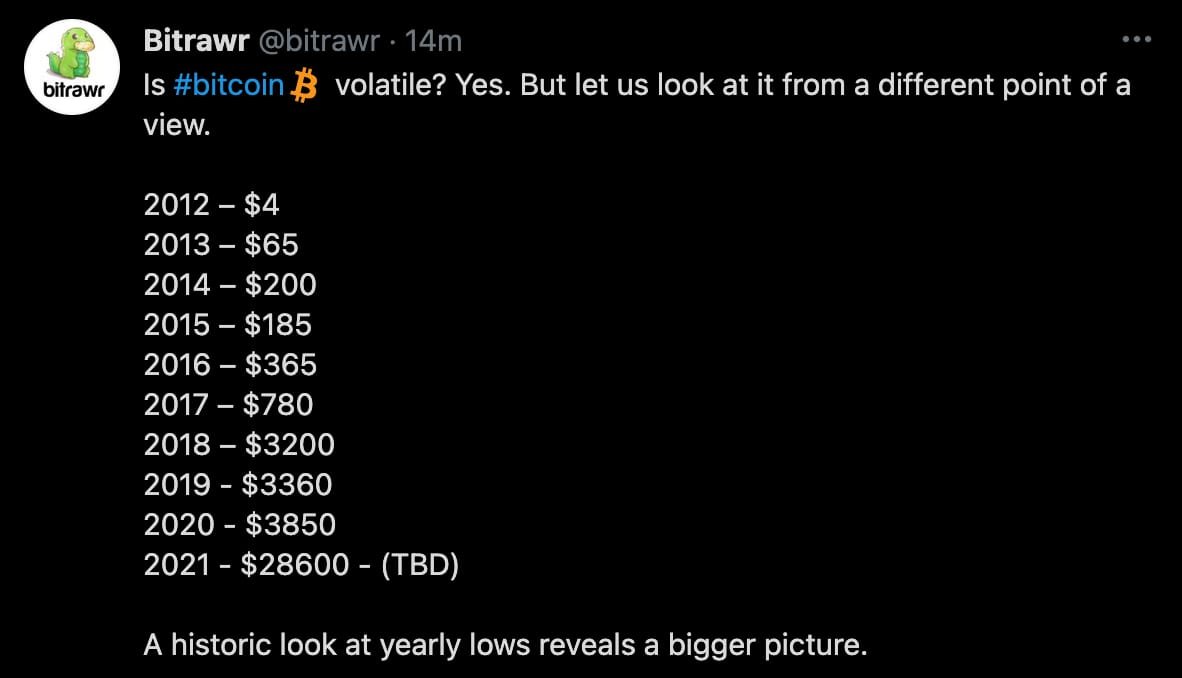

Lark Davis Says It’s Time to Buy Based on the Puell Multiple

Well known crypto investor Lark Davis from the Wealth Mastery crypto newsletter tweeted the below on June 29…

Bitcoin has only ever entered the green “buy zone” on the Puell Multiple four prior times (2012, 2015, 2019, and March 2020) -- so this fifth signal was something to watch.

The next day, Lark continued his bullish Tweets…

Here’s what Lark had to say on June 30 about why he’s bullish that the crypto market will grow into the tens of trillions this decade (from $1.5T today).“While the bitcoincrypto markets are going through this "meh" phase, I remain as bullish as ever on this asset class!Here are some reasons why the entire crypto market will rise to be worth tens of trillions this decade.

We're seeing an unprecedented phase of adoption by financial institutions. Major banks are now letting customers buy and sell Bitcoin. NYDIG has built relationships to allow almost any US bank to offer Bitcoin. Paypal now providing services for over 300 million customers. Meanwhile in the US alone around 16 trillion is sitting in low yield bank accounts. You know that some of that money is going to find its way to crypto especially since it has never been easier to buy!

Millennials will inherit 68 trillion worth of wealth over the next 2 decades. 49% of millennials own #crypto! Basically millenials will bring a mega flood of money into the market.

Globally crypto is capturing the hearts and dollars of investors. This recent report from India highlights that investors are starting to opt for Bitcoin over gold!

Country level adoption is happening at various levels which is mega mega bullish!

El Salvador is making Bitcoin into legal tender, which is insanely big news!

Sovereign wealth funds (investment arms of countries like Singapore) have started to buy and accumulate Bitcoin.

Iran's Central Bank buys Bitcoin directly from local miners now.

Institutional interest remains super high for crypto assets. Globally publicly traded companies are sitting on $10 trillion, hedge funds have around $4.2 trillion AUM, private equity funds $4.5 trillion, family offices control trillions.

Big stories like Tesla and Square buying Bitcoin are important, but most of this money is being invested much more discretely. And the recent 2.2 billion raise by A16Z proves that the demand is still red hot from these institutional groups.

Bitcoin ETFs are happening. Canada has multiple popular BTC ETF products. Brazil just released their ETF. Currently there are 13 applications in the USA. When not if! If gold can teach us any lessons then it will likely unleash a mega rally for Bitcoin.

The craziest thing about this post is that it is just the tip of the iceberg! Cardano smart contracts, ETH 2.0, Polka Dot parachains, NFTs, Defi, etc etc etc.... we are witnessing the evolution of finance! Yet we are still early on the adoption curve.”

Thanks Lark for some great analysis!

Messari’s Ryan Selkis is Also Bullish

Lastly, let’s hear from Messari founder Ryan Selkis. He posted the below thread on June 26.

“I've never been more excited for the future of crypto than I am right now. Q2 has been a bit of a shitshow, but that doesn't take away most of the progress that's been made. 👇

On bitcoin, we've known for a while the next phase would include financial institutions and sovereigns. Those two groups would also be the "final bosses" to beat in the mass adoption game. Q2 progress has been overwhelmingly positive.

We had major milestones like the Coinbase IPO. Wall Street started to seriously initiate coverage on bitcoin and other top assets. More institutional managers went from 0 to 1 - directly or via mammoth investments to crypto VCs like a16z.

Bitcoin ran into two headwinds that were arguably healthy (THIS IS ACTUALLY GOOD NEWS). 1. The ESG stonewall 2. China bans bitcoin. Both were meaningful de-risking events for the entire ecosystem, and we made it through unscathed.

First on China: Others have covered this, but the China "ban" has been a long-standing source of FUD. In reality, everything we expected to happen in an actual "ban" played out: + temporary selling headwinds + migration of mining capacity + reduced geopolitical risks

This isn't a panacea. China basically wrote the playbook for effectively banning BTC within its borders. If other states followed suit, the future would be bleak indeed, but we're betting on free markets, democratic rule of law, and bureaucratic dysfunction to curb that risk.

Then there's the ESG risk associated with bitcoin mining's associated environmental costs. This was the much bigger risk to continued adoption than China's warm embrace (which was never, ever going to happen), and ironically, the China ban helped mitigate ESG risk...

Since some of the dirtiest mining was happening within Chinese borders. As mining capacity migrated outside of the great firewall, it got almost immediately cleaner. That + the PR push we'll see from Western miners in the coming months will reverse the Q2 ESG hiccup.

As BTC goes, so goes the market...in the short-term. But the two biggest hits to BTC in Q2, are also the two biggest tailwinds for ETH as it transitions to PoS. 1. It is harder to locate and censor ETH staking capacity than BTC mining capacity? 2. Institutions like PoS vs. PoW?

I underestimated how strategically important ESG friendliness would be to the winning crypto. I think it is meaningful enough that it opens the door to a flippening. That plus the fact that you only really need ETH to *participate* in 99% of crypto have made me think...

DeFi, NFTs, Web3, DAOs, etc are like 2017 ICOs. The mere success of the MVP dapps (much like the MVP of decentralized capital formation in 2017), means these genies will *never* be put back in the bottle. The crypto VC $$$ explosion means we'll have sustenance for a decade.

It's this last bucket that has me so excited. When we started it wasn't clear *any* shitcoins would achieve their potential and become LT viable assets. Now it seems obvious crypto will spawn millions of crypto assets. Hyper-financialization of the economy. In a good way.

Come build with us. We're building data tools & governance infrastructure for the universe of decentralized assets at Messari. If you're an engineer and want to help, DM! We've got a big vision, a ton of momentum, and we'll pay $10k for referrals.”

Thanks for the great analysis, Ryan. Everybody be sure to go check out Messari. We use it every day.

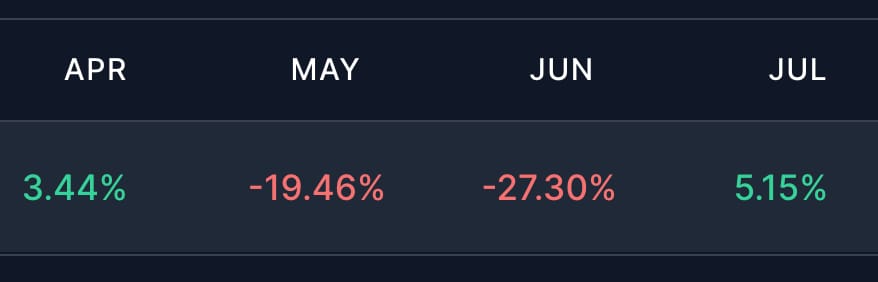

Coinstack Alpha Fund Up 30% Last Week

By Ryan Allis

If you’re looking for a good place to allocate as we prepare for the next leg up in the cycle, check out our Coinstack Alpha Fund on Enzyme.

Our goal is to substantially outperform simply holding Bitcoin.

Our fund is up 30% in the last week while BTC is flat holding at $34k week over week.

So far we have $176k under management from 27 investors. You can invest both USDT and ETH directly from your crypto wallet (like Metamask or any WalletConnect-compatible wallet).

Our top 10 holdings are currently:

Ether (ETH)

Polkadot (DOT)

Maker (MKR)

ThorChain (RUNE)

Melon (MLN)

Sushi (SUSHI)

Perpetual Finance (PERP)

Aave (AAVE)

Yearn (Yearn)

Chainlink (LINK)

Our fund got creamed in May and June, but held up substantially better than many other crypto assets that experienced 50-70% drops. Below is the actual performance, which is always shown transparently and updated automatically every few minutes.

If you would like to invest, you can invest here on Enzyme. We recommend investing at least $1,000 to make it worthwhile as you have to pay a gas fee to deposit into the vault that is currently about $50.

We can’t make any promises in the short-term — but in a 5-10 year period we think we will do exceptionally well and be good stewards of a part of your crypto portfolio.

Bitcoin Mining Council Reports 56% Sustainable Energy Use

Last week the Bitcoin Mining Council released their Q2 report on Bitcoin Mining energy usage. They announced that their Q2 2021 estimate for miner energy is that 56% of it comes from sustainable sources including wind, solar, nuclear, or traditional energy with carbon offsets.

You can read their PDF here.

We have a new Coinstack podcast. You can listen to it on Anchor, Spotify, or Google Podcasts. Here are the episodes we’ve released so far...

Episode 1 - Algotrading Crypto in Sideways Markets

Episode 2 - Are We Near the Bottom for Bitcoin and Ethereum: We Think So.

Episode 3 - Crypto: Explain It Like I’m 5 (Bitcoin, Cryptography, & Blockchains)

Episode 4 - Crypto: Explain It Like I’m 5 (Ethereum & Smart Contracts)

Episode 5 - Crypto: Explain It Like I’m 5 (DeFi, NFTs, DAOs, & Tokens)

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends. So far we’re at 566 plays and growing!

We plan to continue to publish 1-2 podcasts each week along with 1-2 substack issues.

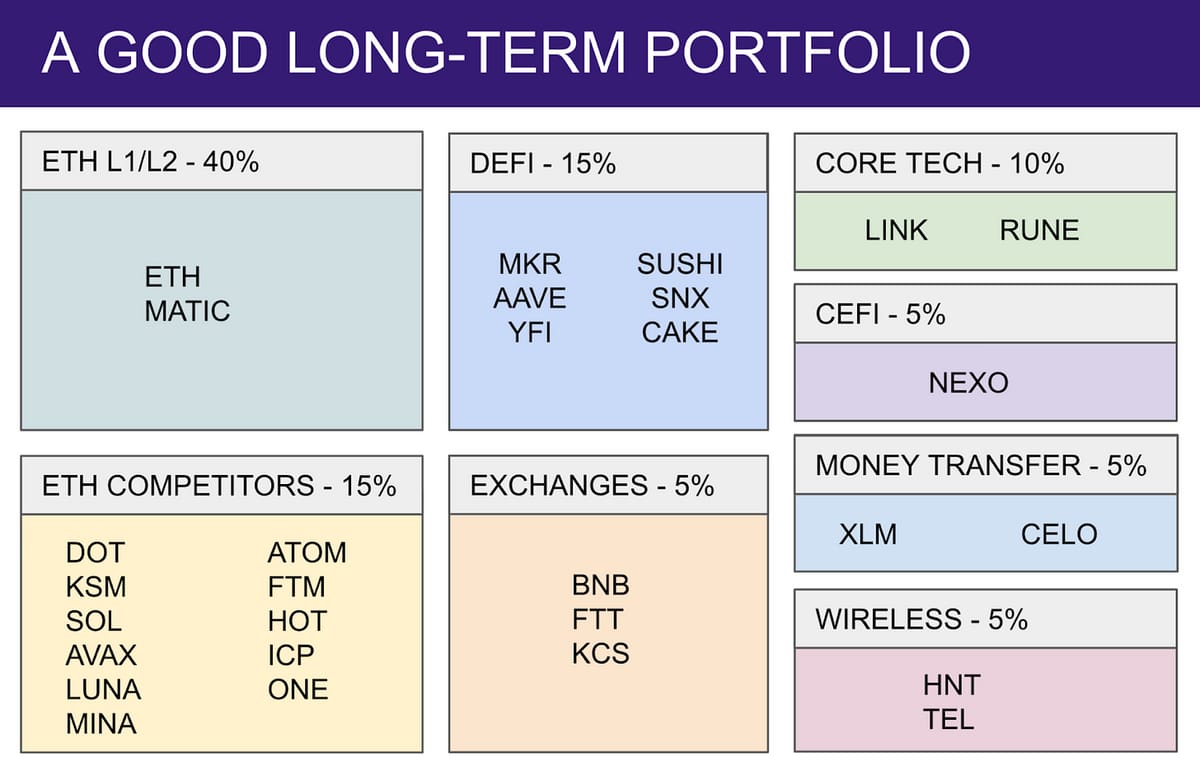

Our Top 30: A Long-Term Crypto Portfolio

Everything is on sale right now and from our vantage point, it’s a great time to buy.

If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be absolutely sure to include our top 5: ETH, DOT, KSM, RUNE, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short-term.

Join Our Tuesday Crypto Community Zoom Calls

Every Tuesday Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 8:30am PT / 11:30am ET / 4:30pm GMT.

All buyers of Mrs. Bubble’s NFTs and investors in the Coinstack Alpha Fund are invited to join and ask questions and share learnings with each other.

Just buy any Mrs. Bubble NFT on OpenSea and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite.

You can think of buying the NFT as supporting beautiful joyous art AND a ticket into our community. We had 10 callers on last week’s call.

Join our weekly calls by getting a Mrs. Bubble NFT or investing in the Coinstack Alpha Fund. With prices on most quality crypto assets about 50% lower than last month, now’s a good time to invest.

Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1600 members on our Telegram.

The People We’re Following Closely on Twitter

How To Get Started With Crypto Learning

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

Crypto: Explain It Like I’m 5 (Article)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at CoinStack.substack.com

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.