Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Issue Summary: Welcome back to Coinstack, the best weekly newsletter for crypto investors and industry insiders, where we review the top news and reports in the digital asset ecosystem. This week we welcome our new sponsors Revix and Connect Financial. We also cover El Salvador’s debt repayment, the Genesis Bankruptcy filing, Nexo’s $45M settlement with the SEC, Pantera’s 2023: The Year Ahead report, and huge new rounds from Blockstream ($125M) and QuickNode ($60M). After a two month slowdown due to FTX, the time of massive crypto venture rounds has thankfully returned.

Solana is leading the way among top L1s in terms of token price performance since we started writing Coinstack in January 2021

Thanks to Our 2023 Coinstack Sponsors…

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has built relationships with the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Revix is a multi-asset WealthTech business targeting the African and Middle Eastern market. It allows for effortless purchase of crypto, stocks, thematic ETFs, real estate, currencies, commodities, and more. With Revix, everyday people can easily grow and manage their own wealth, using a personal wealth management platform that is effortless, automated, and engaging. Learn more at www.revix.com.

Connect Financial empowers people and businesses to do more with their digital assets. Their flagship credit cards allow users to enjoy their crypto's spending power, without selling their digital assets and earn rewards on everyday purchases. Learn more at www.connect.financial.

Viridius is a Decentralized Autonomous Organization (DAO) building a modern, community-driven carbon credit registry that solves the massive problem of transparent carbon credit verification. Learn more at www.viridius.io.

WeMeta is the Bloomberg for web3 and the metaverse, combining on-chain data, social data, and news data from many sources into a single dashboard and API source designed for web3 investors, app builders, and brands. Learn more at www.wemetalabs.com.

InvestDEFY bridges TradFi regulatory and risk management with CeFi’s liquidity and DeFi’s innovation. InvestDEFY has deep expertise in quantitative trading, digital assets, technology, AI, risk management, derivatives, global equities, regulatory compliance and investment banking. Learn more at www.investdefy.com.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

1) ✂️ El Salvador Makes Good on $800M Debt Despite ‘Bitcoin Bet’- El Salvador’s President, Nayib Bukele, said Monday his country has paid back $800 million on an external bond despite concerns last year the country would default due to its “bitcoin bet.”

2) 💥 Genesis Finally Files for Chapter 11 Bankruptcy - Genesis Global Trading, a subsidiary of Digital Currency Group (DCG), filed for a much anticipated Chapter 11 bankruptcy in the Southern District of New York (SDNY) court on Thursday night. Genesis still owes Gemini Earn customers over $900M in customer deposits, with withdrawals paused since November. Genesis stated it has over $150 million in cash, which it plans to use as liquidity to support its ongoing operations and facilitate its restructuring process. Read more in the press release.

3) ⚖️ Gemini Co-founder Cheers Bankrupcy Filing, Threatens Lawsuit Against DCG, Barry Silbert- Gemini co-founder Cameron Winklevoss threatened a lawsuit against crypto conglomerate Digital Currency Group (DCG) and its CEO Barry Silbert if they failed to make a “fair offer” to creditors like Gemini Earn users. Gemini is prepared to take “direct legal action against Barry, DCG, and others who share responsibility for the fraud that has caused harm to the 340,000+ Earn users and others duped by Genesis and its accomplices.”

4) ⚖️ Nexo Settles With SEC, Will Pay $45 Million and Kill Crypto Lending Product - It has been a tough week for Nexo Capital. On Sunday, Bulgarian authorities said they have evidence of Nexo customers using the platform for illegal activities, including laundering money, “tax offenses,” and financing terrorist activities—all claims the crypto lender denies. Adding to Nexo’s headache, the Securities and Exchange Commission charged the crypto lending firm on Thursday with selling unregistered securities, saying the company failed to register with the SEC before offering its plainly named crypto lending product, “Earn Interest.”

5) 🎉 Robinhood Rolls Out Its MetaMask Wallet Competitor to 1 Million Users- Robinhood is finally entering the software wallet game.The company today launched the Robinhood Wallet, a smartphone app that allows users to swap and transfer crypto, and view owned NFTs and crypto. It’s currently being slowly rolled out to over 1 million waitlisted users via an access code, according to Robinhood. It was previously released in beta to just 10,000 waitlisted customers in September.The Robinhood Wallet uses Polygon, an Ethereum sidechain, to offer swaps without network fees. It also added support for Ethereum today.

💬 Tweet of the Week

Source: @Blockworks_

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. The Optimal Portfolio for the Past 5 Years Would Have Been: 27% ETH, 4% BTC, 62% Bonds, 7% Stocks

Source: @dunleavy89

2. Ethereum Still Generating By Far The Highest Revenues Among All Blockchains and Dapps

Source: CryptoFees.info

3. ETH Has Been Deflationary Since Jan 15th

Source: @UltraSoundMoney

Source: Pantera 2023 The Year Ahead

5. Gains Network Is Having Its Best Week for Fees Ever, Surpassing It’s Previous Peak in March of Last Year

Source: @Dynamo_Patrick

6. We’re Currently on a Four-Day Streak of Positive Stablecoin Supply Growth

Source: @Dogetoshi

📝 Thread of the Week - Top Takeaways From Pantera’s Annual Report

By: @milesdeutscher

This thread will be broken up into 5 parts:

1. Crypto Market Outlook: joeykrug

State of Blockchain Venture: veradittakit

BlockChain Infrastructure: _will_reid

Structurally Safe DeFi: chiajy2000

PanteraCapital's 2023 Fund Overview

-- CRYPTO MARKET OUTLOOK by @joeykrug --

1. DeFi is the foundation for the next crypto cycle.

Centralised entities failing due to hacks, greed, or illegal activity is a "tale as old as financial markets."

"Actual crypto, like on-chain, smart contract, protocol-based crypto really mitigates these problems."

"It seems fairly evident that the historical arc of the world’s financial rails will end up as blockchain-based systems using smart contracts."

"Despite lower prices, I think the space is clearly in a much better position than ever."

Why? Because:

• We finally have scalability solutions that enable transactions with sub-ten cent transaction fees.

• It’s much easier to write smart contract-based systems now compared to last cycle.

Joey's vision:

"The average person will have apps on their phone that give them access to DeFi, where they’ll be able to engage in financial transactions without banks/brokers, with lower fees, global liquidity, and markets operating 24/7. The internet, but for finance."

For DeFi to reach this stage, these 2 problems need to be solved:

1. Increasing liquidity within and for the DeFi ecosystem.

2. Making DeFi as easy as possible to use.

Joey states 2 solutions to the liquidity problem:

1. More institutional asset custodians that support using Ethereum directly.

2. Aggregate liquidity across multiple chains, Layer-2s, and liquidity pools on those chains.

As for the usability issue, there are 3 possible solutions:

1. Improve Wallet UX (with enhanced mobile support).

2. Allow gas fees to be paid in other tokens instead of $ETH (economic abstraction).

3. Create better fiat on-ramps that can integrate natively with dApps.

-- STATE OF BLOCKCHAIN VENTURE by @veradittakit --

1. Despite the bear market, private market deal activity continued (but slowed towards Q4).

2. DeFi is venture capital's biggest investment sector, followed by Gaming.

For DeFi, infrastructure, derivatives, and institutional DeFi products were key areas of focus.

3. NOW is the time to start a web3 business.

"We believe this is a tremendous time to start a company in the blockchain space."

"Talent is more educated and passionate about the industry than in previous cycles. A plethora of capital has been raised and is awaiting deployment."

-- BLOCKCHAIN INFRASTRUCTURE by @_will_reid --

1. The importance of The Merge can't be overstated.

"Ethereum’s Merge is one of the most technically impressive software updates ever performed."

It has:

• Reduced inflation

• Improved transaction inclusion times

• Vastly reduced its electricity consumption

2. The Merge is just the beginning. Ethereum's development is far from complete.

The period of most rapid change is ahead of us.

@VitalikButerin shared this graphic at EthCCParis in 2022.

Ethereum’s upgrades can be divided into 6 distinct sections: The Merge, The Surge, The Scourge, The Verge, The Purge, and The Splurge.

3. L2s are only getting stronger.

• Arbitrum has had a 516% growth in active developer teams since January.

• Cumulative volume on StarkEx platforms has more than doubled to $795 billion from a little over $300 billion at the start of the year.

"Looking forward, L2s will need to contend with the implementation of EIP-4844 , which is expected to reduce rollup fees by a factor of 10-100x."

"However, the ecosystem could equally benefit from the end of costly alt-L1 incentive programs that are running out of funding."

4. Interoperability is still a major pain point.

Over $2bn was lost in bridge hacks in 2022, accounting for over 70% of total crypto hacks for the year.

Bridges can either be natively or externally verified.

Most bridges so far have been externally verified.

"But the rise of natively verified bridges, such as IBC, could prove to be the antidote to the bridge hacking issue."

"IBC saw enormous success in 2022, emerging as the de facto bridge for Cosmos and one of the top three crypto bridges by volume."

The Merge and recent advancements in ZK-tech have also created a possible path for IBC to be launched on Ethereum.

Zero-knowledge based bridges could also be a solution to building native bridges, "and have seen considerable attention in the final quarter of 2022."

-- STRUCTURALLY SAFE DEFI by @chiajy2000 --

1. We can't eliminate criminally greedy actors, but we can reduce their ability to succeed.

"In order to succeed, DeFi must be able to protect user funds with only code - and in an increasingly adversarial, open global environment."

There are 3 pillars to do so (creating structurally safer DeFi)

1. Programming and code as “the executor”

2. Traditional legal structures and regulations — law as “the guarantor”

3. Market expectations as “the filter”

2. "2023 will see the bifurcation (splitting) of regulated and censorship-resistant infrastructure."

Some dApps will come under increased regulatory scrutiny, highlighting the importance of building "credibly neutral infrastructure" that has an element of censorship resistance."

3. "We should expect to see more real-world yield and fixed-income assets grow on-chain."

Crypto can unlock global liquidity by "providing real world assets for customers all over the world in ways that traditional fintech institutions are constrained."

"Just as the last bull market was a catalyst for alternative investment platforms, so too will this bear market be a catalyst for a new wave of safer investment instruments."

This is a vast crypto use case that, to this date, is largely untapped.

-- PANTERA CAPITAL FUND OVERVIEW 2023 –

Pantera Capital is First U.S. institutional asset manager focused exclusively on blockchain technology.

Lead by @dan_pantera, they have multiple funds focusing on venture equity, early-stage tokens, and liquid tokens with over $3.8B AUM.This is what their portfolio looks like in 2023. See graphic here.

It's segmented into 5 categories: An early-stage token fund, a blockchain fund, and 3 venture funds.

I highly recommend reading the "The Year Ahead" for yourself.

Well done to all the writers and editors for creating a great report.

Let me know what you think of the report in the comments, I'd love to hear your thoughts!

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

Portfolio management is hard.

Of the 26,000 stocks traded since 1926, a mere 1,000 have accounted for all appreciation of the last 100 years. Just 86 stocks — 0.33% — have been responsible for half of those gains. Individual stock pickers have had a tough time winning. Even the best portfolio managers have underperformed the market 80% of the time.

Portfolio management is even harder when you are trying to manage a portfolio of startups with unknown regulatory, event, and tech risks. Of the ~22,000 cryptocurrencies in existence, far fewer than 86 will likely account for the long-term returns of the asset class.

This is the frontier, my friends. But despite the risks of the frontier, there may be some gold nuggets for the settlers willing to adventure there.

This piece explores portfolio management on the edge of the event horizon for those settlers and offers some considerations for how to better manage a dedicated crypto portfolio.

Portfolio Theory and Crypto Applications

MPT provides a useful lens for building long-term portfolios. With long histories of how these asset classes perform under a range of scenarios and how they interact with one another, we can guide long-term allocation decisions.

The problem is obvious when trying to build a crypto portfolio.

For most traditional assets, long-term is more than a handful of years, if not decades. Crypto performance history is short, volatility is high, and correlations are largely unstable.

Using MPT in traditional portfolio management, allocators are trying to solve for an expected return to meet or exceed their benchmark. If you are a pension fund, your benchmark is likely some set number (i.e., 7%). If you are an endowment, it may be a target above some set spending rate (i.e., 4% annually). If you are an individual investor or fund, it may be a simple benchmark (i.e., 60% stocks / 40% bonds). These allocators move along the risk/return spectrum until they can build a portfolio with a mix of assets that have been historically likely to help them reach their desired return for the lowest level of perceived risk.

In addition to serving as a tool to measure investment performance against, benchmarks also provide easy avenues for passive investors seeking market exposure. If planning to invest passively, the benchmark and the portfolio are one and the same. For example, if you are planning to buy the S&P 500, you buy SPY, an index representing the benchmark. Your portfolio and the benchmark are essentially the same.

Building a representative benchmark to capture the upside of the asset class is paramount to expanding capital flows as this nascent sector evolves.

Bitcoin and Ether Performance in a Modern Portfolio

First, an analysis of BTC and ETH contributions to a portfolio. Today, most managers or investors with exposure to crypto judge their performance solely based on these two assets. Investors considering an allocation to crypto will also naturally turn toward the two most well-known assets.

Since inception returns are fantastic for both BTC and ETH, there are no surprises there. Bitcoin has returned over 300,000% since 2009, while Ether has returned over 5,000% since 2014. The S&P 500 is up roughly 260% and 140% over those respective time periods. The Sharpe Ratio, a measure of risk-adjusted performance, has consistently averaged well above one for both assets; above-average performance for any asset class based on this metric.

The Sharpe Ratio notably penalizes investments for their volatility to both the downside and upside. This is less of an issue in traditional asset management, but a meaningful one in crypto. The Sortino Ratio adjusts the Sharpe Ratio to consider only downside deviations. BTC and ETH's performance historically has been in line with or above stocks and bonds on this measure. Since 2019, bitcoin has had a Sortino Ratio above the S&P 500 66% of the time, while ether has exceeded the index 67% of the time.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

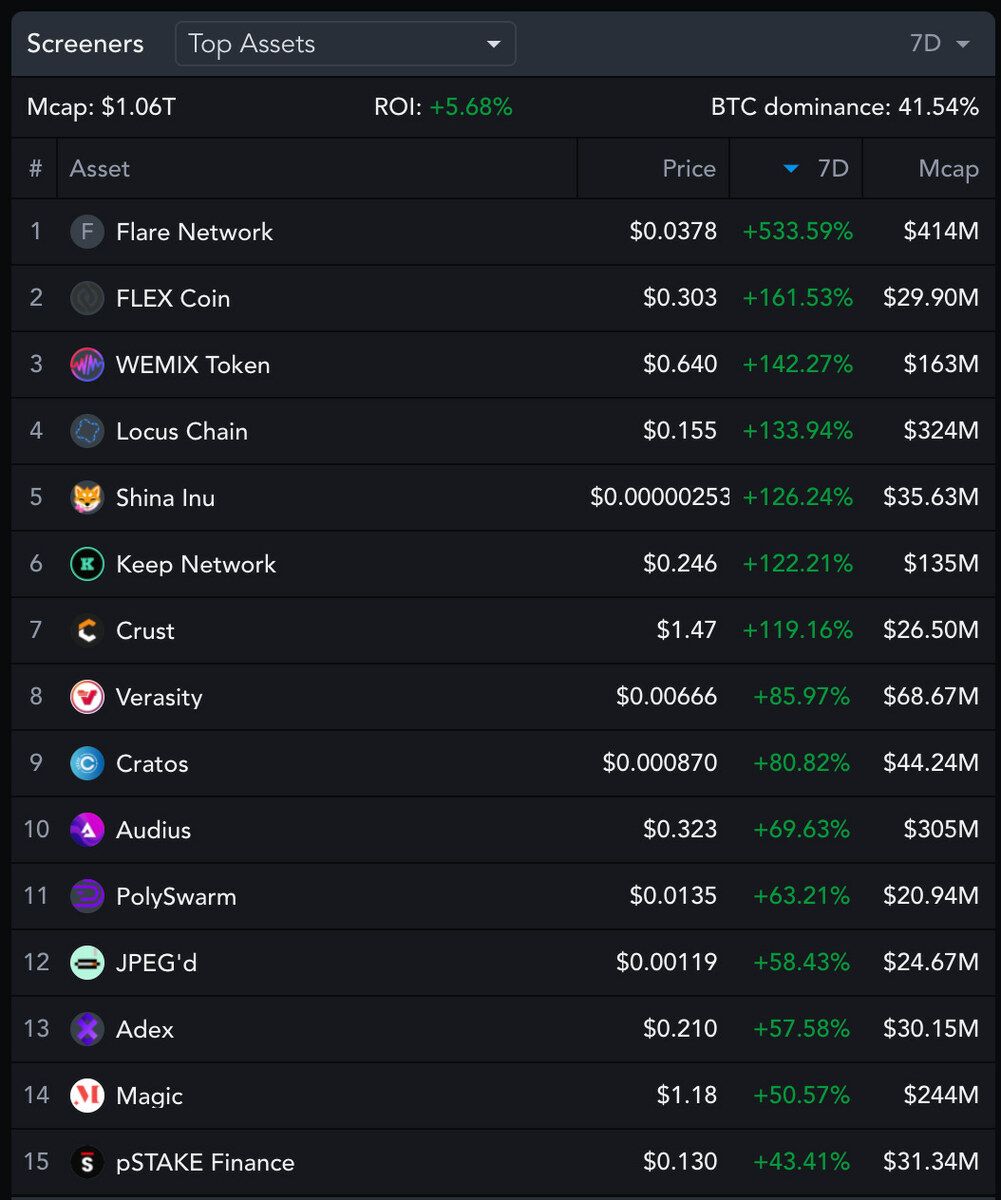

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 34,705 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.revix.com, www.connect.financial, www.viridus.io, and www.wemetalabs.com.