Learn More at www.fyde.fi

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders.

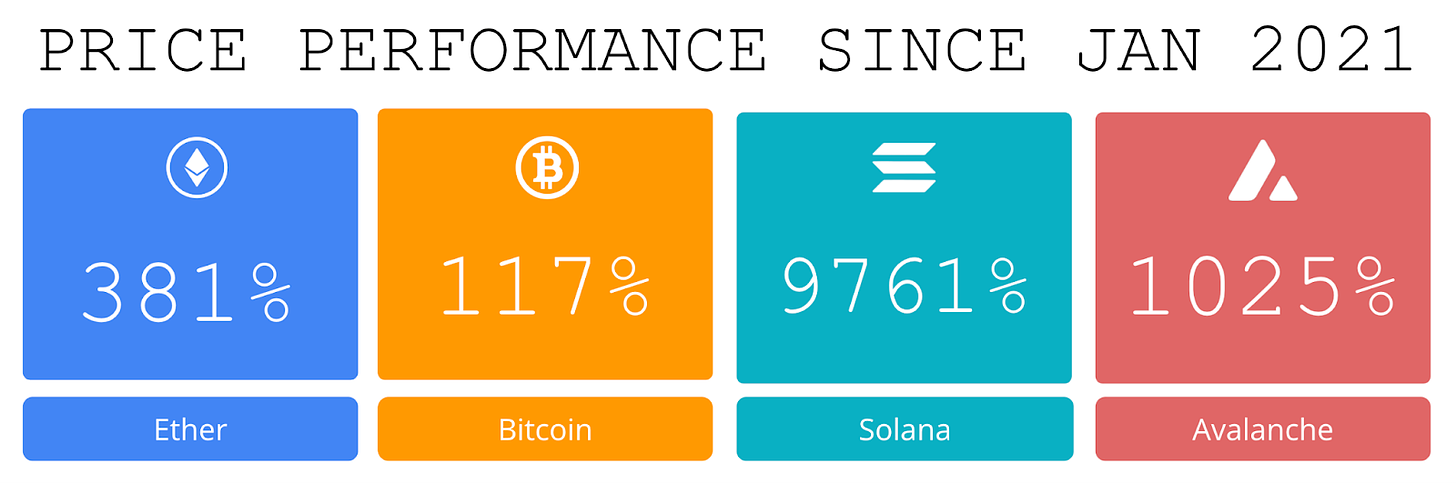

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Fyde introduces AI-driven 'Liquid Vaults' to help crypto investors consistently lock in gains, earn yield, and stay liquid. Liquid Vaults are tokenized bundles of assets that can be traded and transferred, and use AI to mitigate risks. This innovation allows Fyde’s users to grow their crypto holdings faster with less volatility. To learn more, visit: Fyde Protocol or follow @FydeTreasury.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

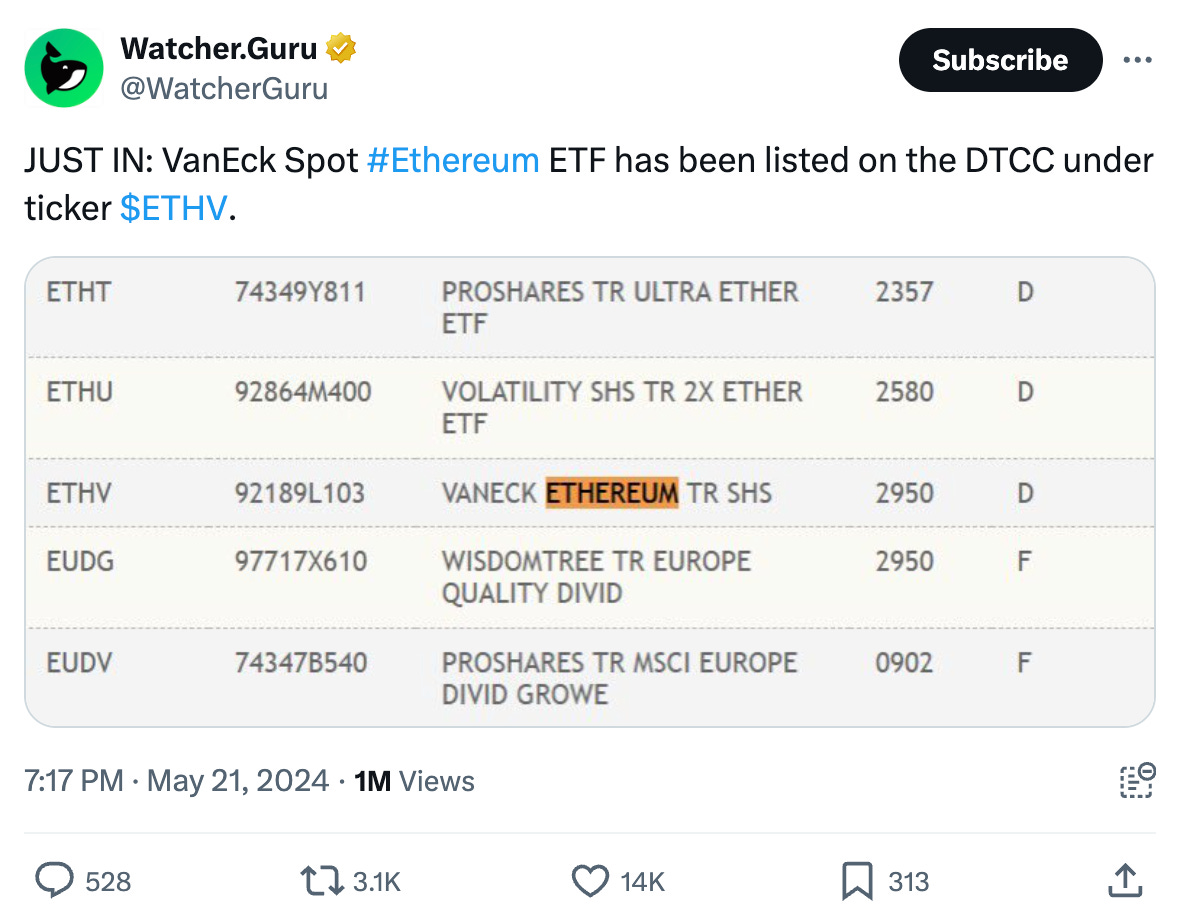

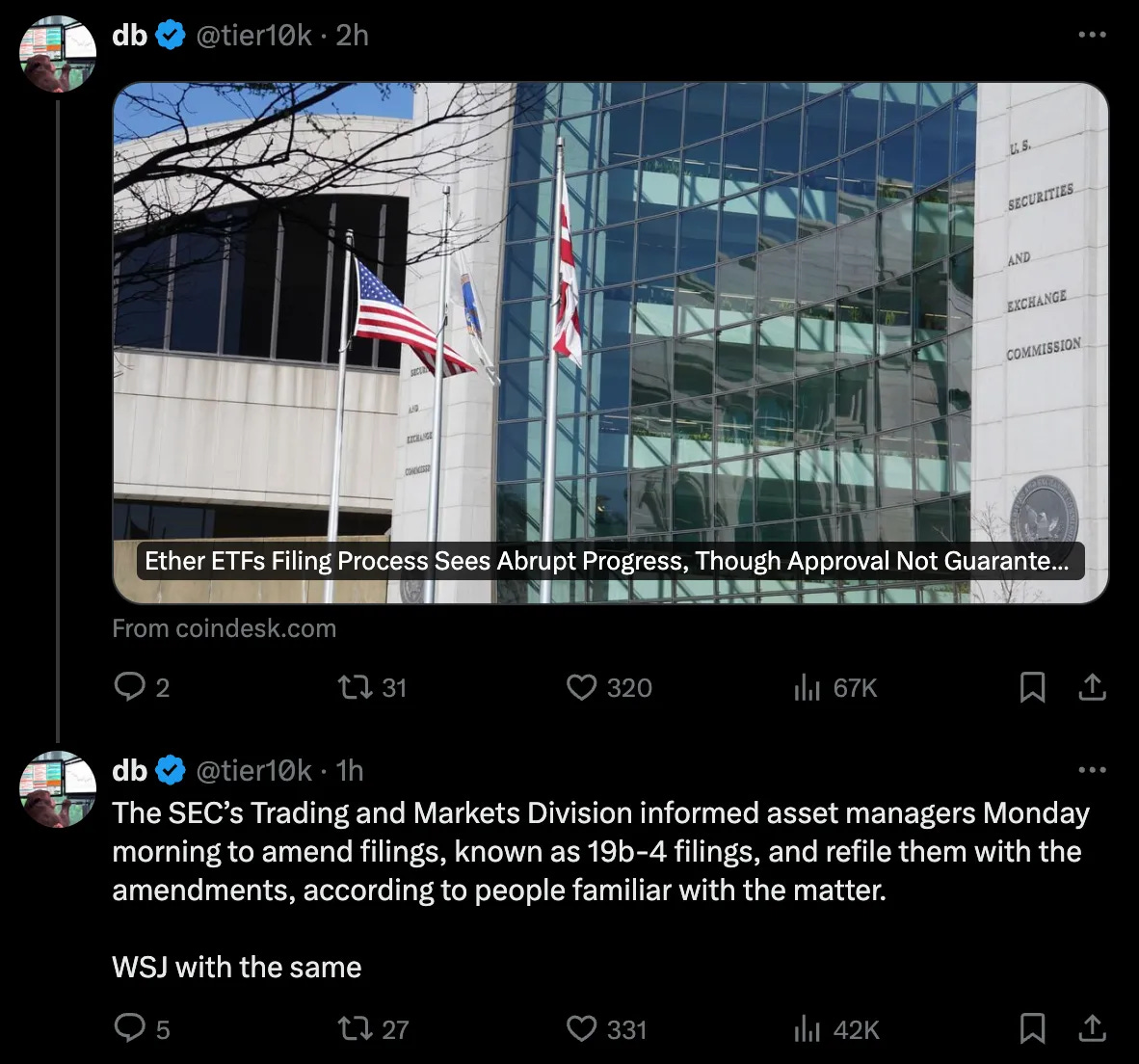

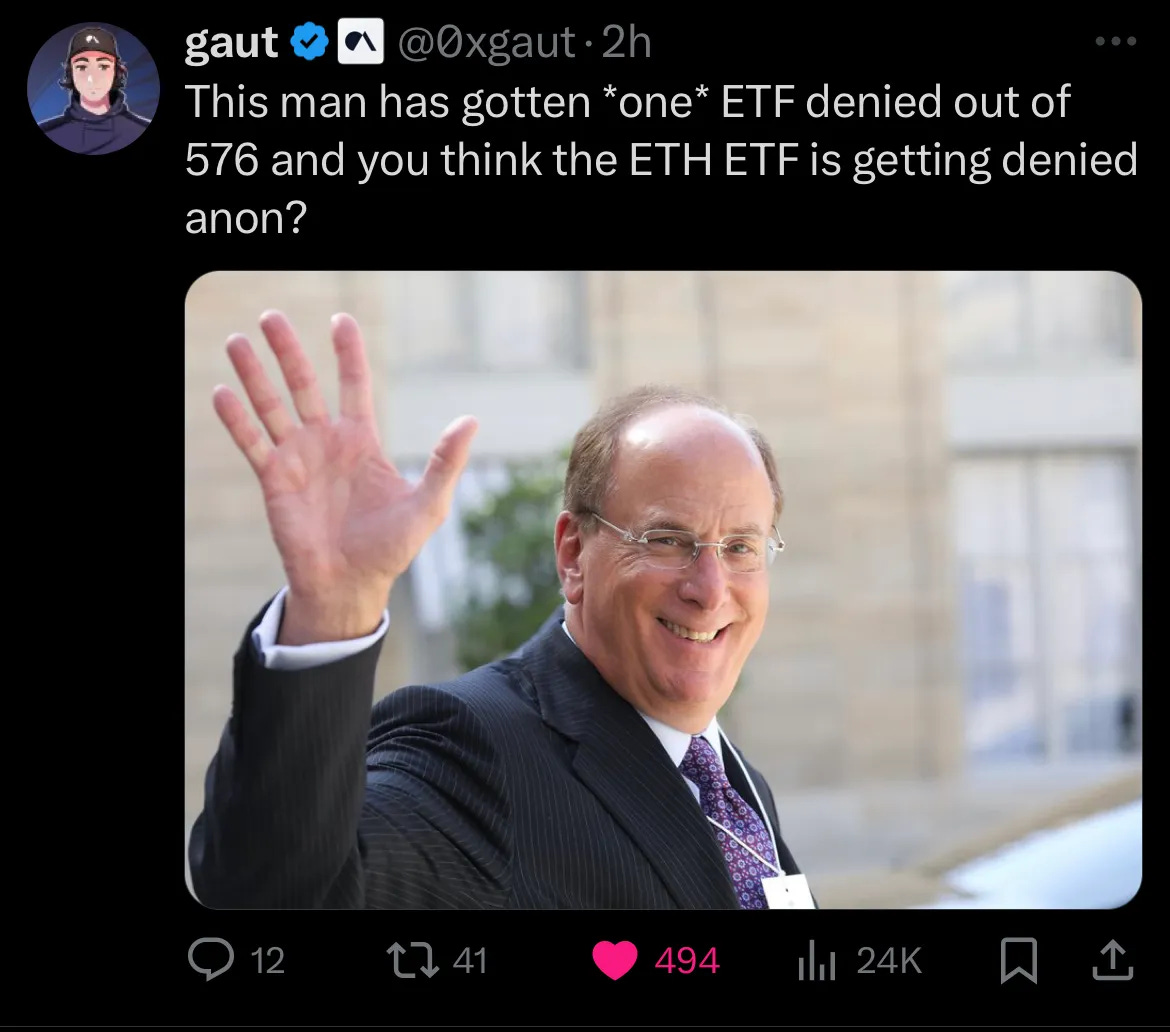

Bloomberg analysts up ETH ETF approval odds to 75% amid rumors of SEC flip - The SEC has asked spot Ethereum ETF applicants to update their 19-b4 filings, leading to greater optimism around potential approvals. Bloomberg’s Balchunas and Seyffart updated their odds for a spot Ethereum ETF approval to 75% from their most recent prediction of 30%. The ETH ETF has also received a ticker from the Depository Trust & Clearing Corporation (DTCC) of ETHV.

🎭 The Crypto Industry Is Trying to Elect Political Allies: The Stakes Couldn’t Be Higher: The industry has amassed a formidable war chest and is working to elect politicians it sees as allies and defeat those who are critical. A trio of super political-action committees has together raised more than $85 million, one of the largest amounts among PACs engaged in the 2024 elections.

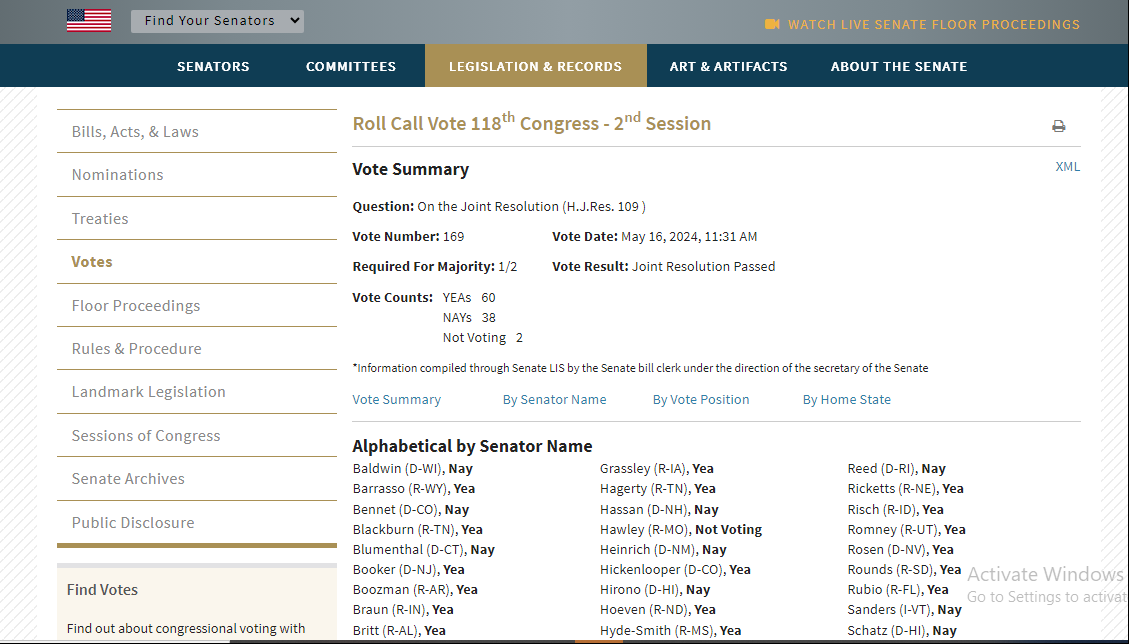

⚖️US lawmakers vote in favor of repealing controversial SEC accounting rules for crypto: The US Senate voted in favor of repealing the SEC’s Staff Bulletin 121 (SAB 121) on May 16. In all, 60 Senators voted in favor of HJ Res. 109, a resolution to overturn the bulletin, while 38 Senators voted against it.

🤝Grayscale CEO Michael Sonnenshein departs role, former Goldman Sachs exec to step in: Michael Sonnenshein, CEO of the crypto asset manager Grayscale Investments, has stepped down from his position to "pursue other interests," according to a company release.

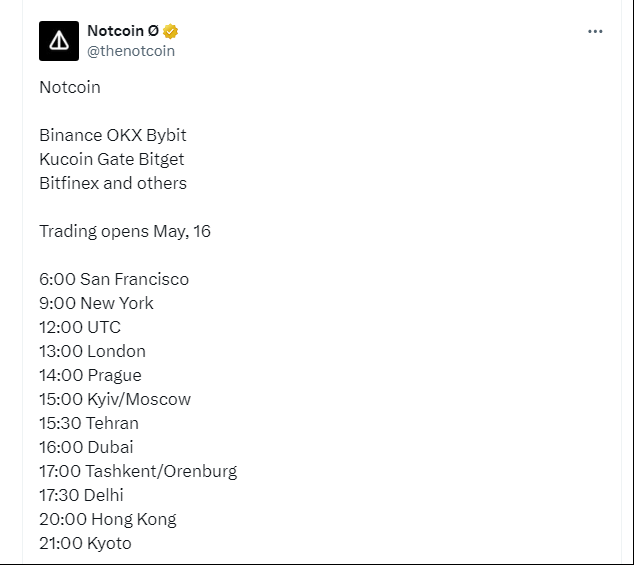

🚀Notcoin goes live on TON blockchain, airdrops over 80 billion tokens:Viral web3 clicker game Notcoin has issued its cryptocurrency on the The Open Network blockchain — airdropping more than 80 billion NOT tokens to participants as it opens for trading on crypto exchanges.

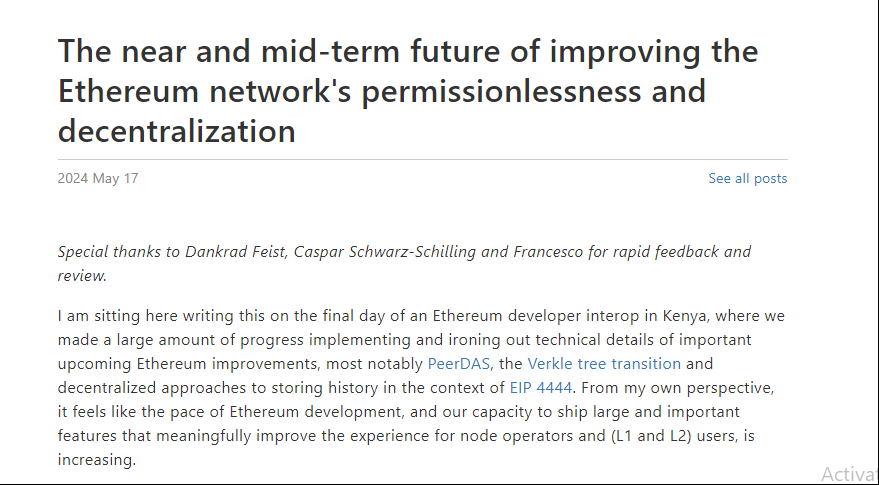

👨💻Vitalik Buterin addresses threats to Ethereum's decentralization in new blog post:Vitalik Buterin, co-founder of Ethereum, has responded to criticism levied at the blockchain in a detailed blog post breaking down three issues core to Ethereum's centralization: MEV (miner or maximal extractable value), liquid staking, and the hardware costs of running a solo node.

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @WatcherGuru

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

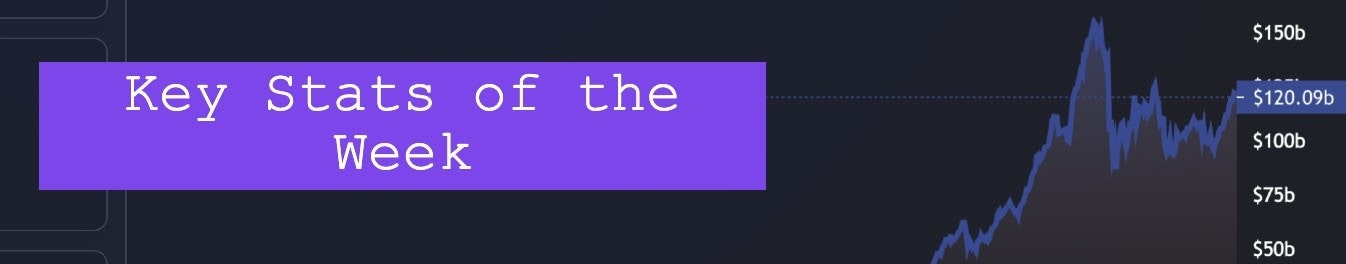

1. Over the last 7 days, 26% ($162M) of flows from Ethereum went to Base. This was the most of any destination chain, surpassing the likes of Arbitrum (generally the leading destination), Optimism, and zkSync. This brings Base's YTD inflows from Ethereum to $1.83B, third most overall of any ecosystem.

Source: @DavidShuttleworth

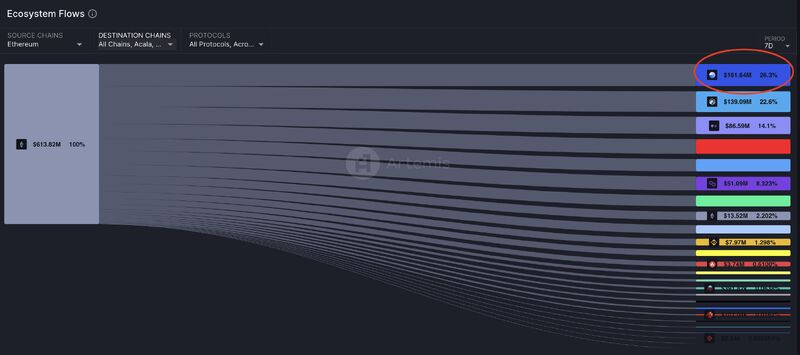

2. Worldcoin drives 18% of total Optimism transactions, 40% of fees

Source: @OurNetwork

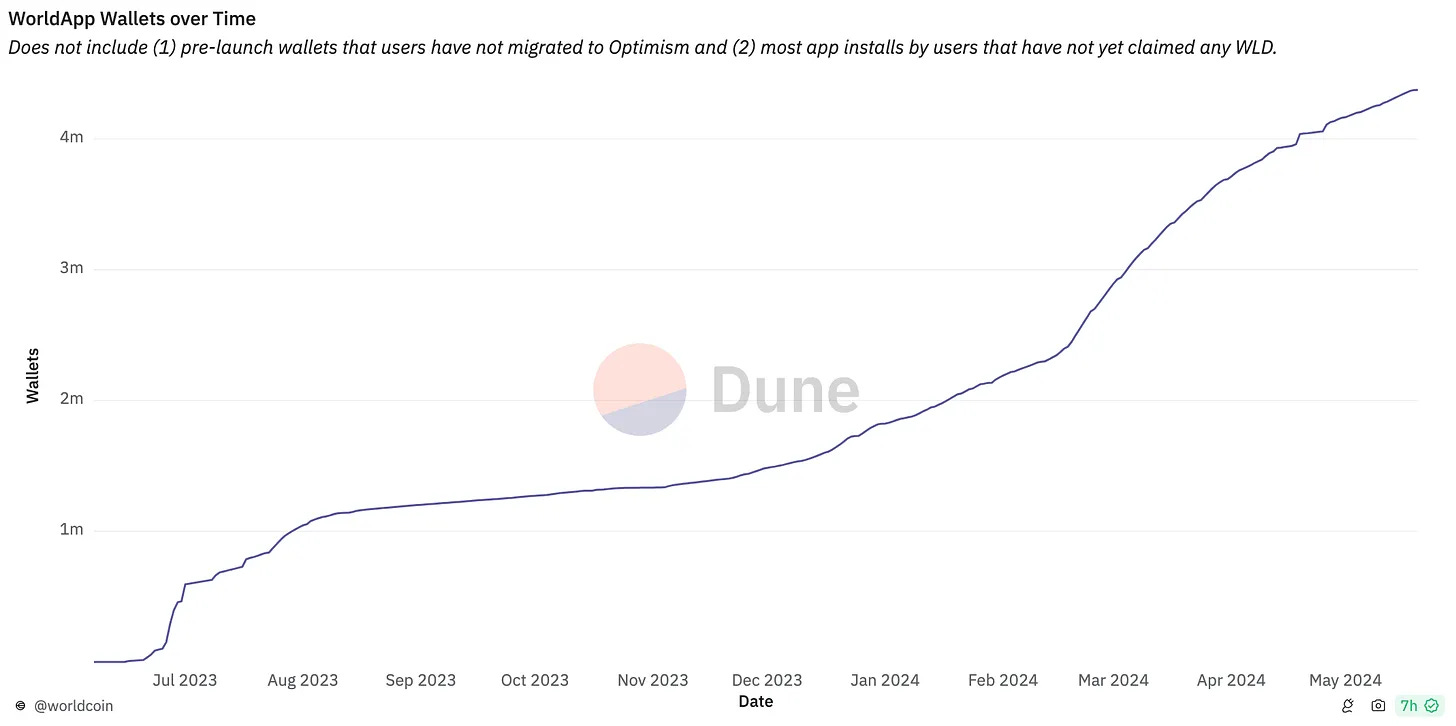

3. Gnosis Safe accounts provide multisig and smart accounts for users and developers. Around 90k Gnosis Safe contracts are deployed daily on Optimism (52% of total).

Source: @OurNetwork

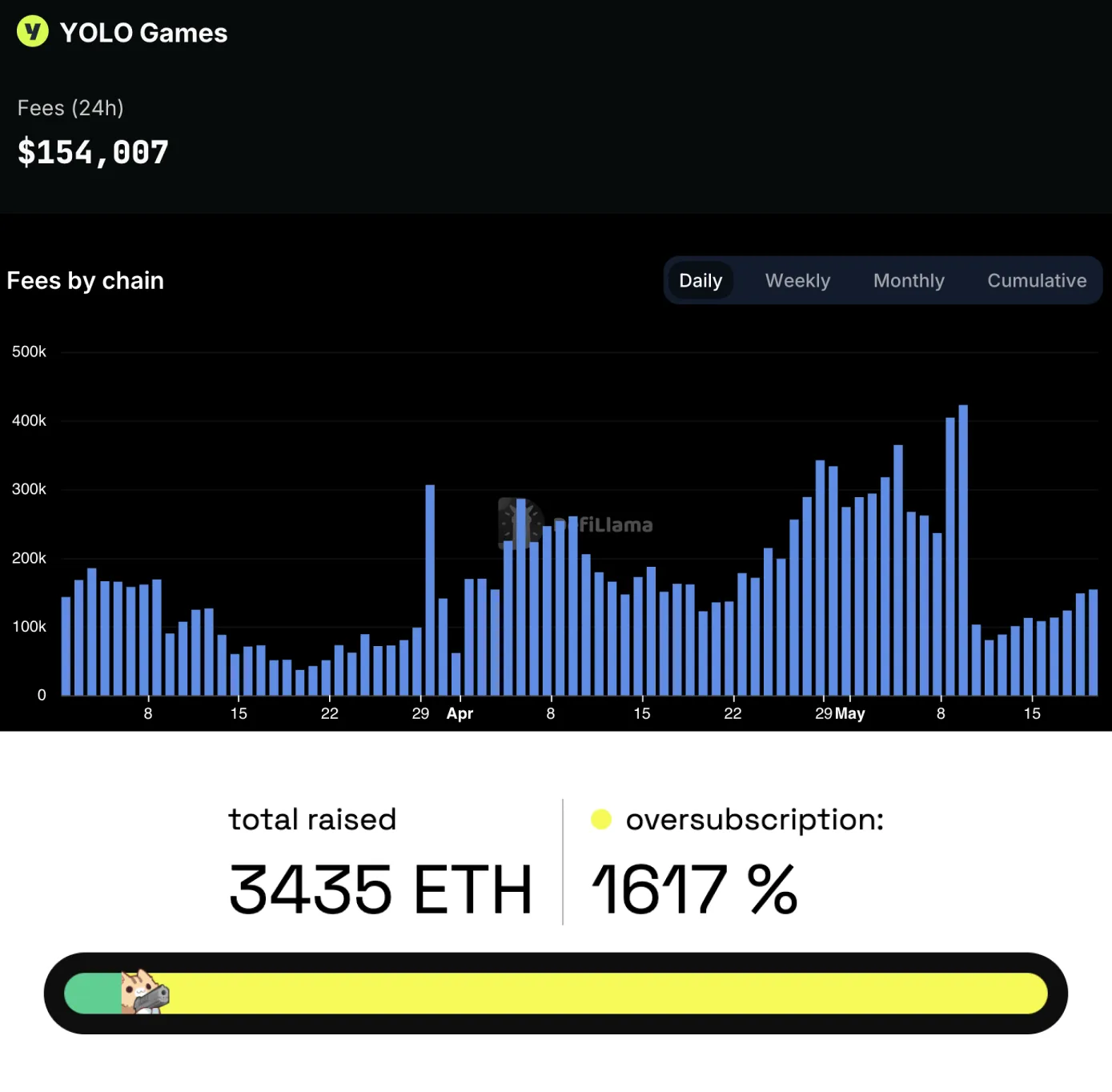

4. YOLO Games, a gaming platform, is actually beating Fantasy Top in terms of 24-hour fees as of May 21. The project reached a high of $422,000+ in daily fees on May 9 and is still averaging over $100,000 in fees per day in the last week.

Source: @OurNetwork

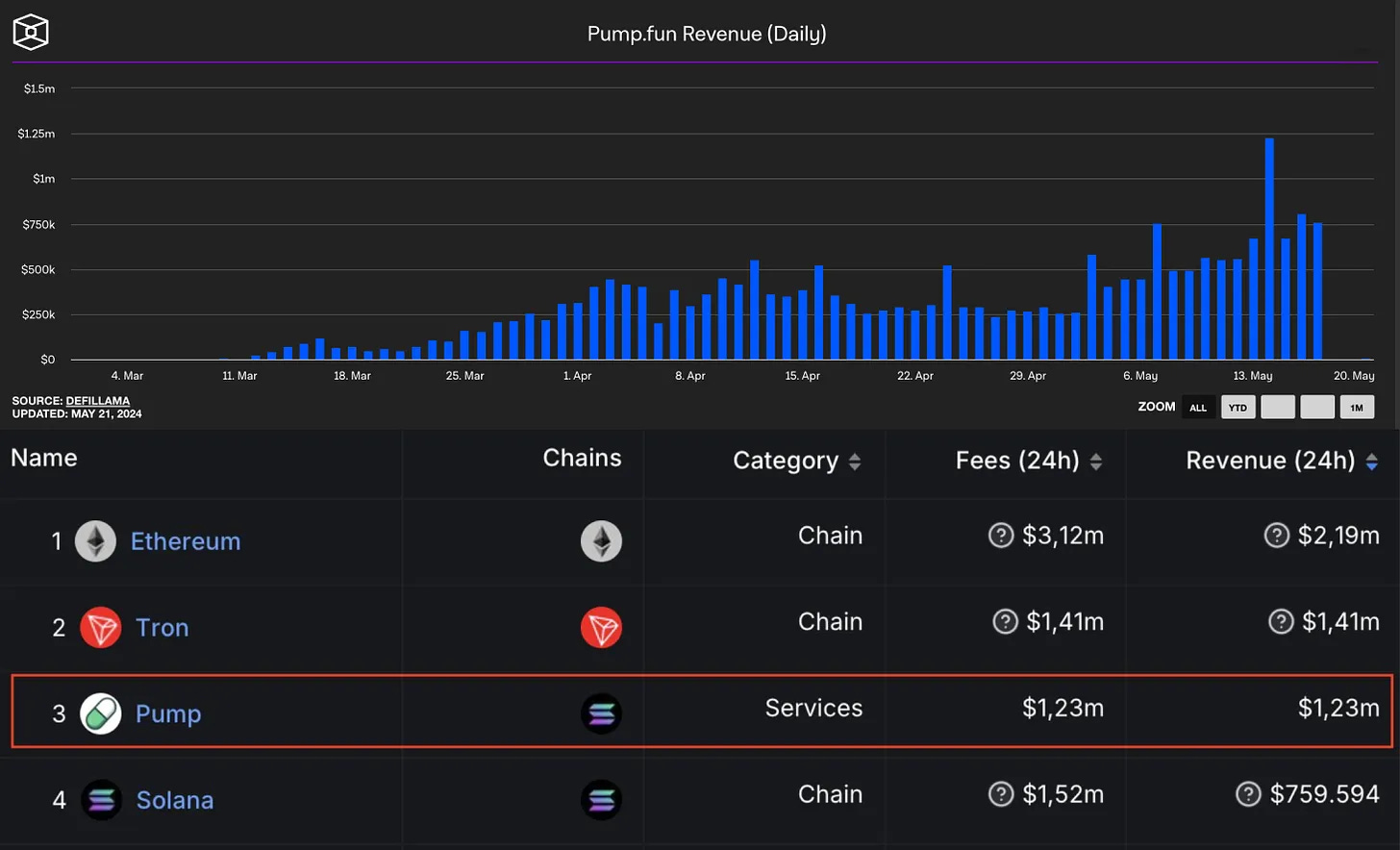

5. Breakout consumer app Pump.fun hacked for 12.3k SOL ($2M), days after becoming a Top 3 protocol by 24h revenue + BOME continues its growth with $255M in 30 day swap volume.

Source: @OurNetwork

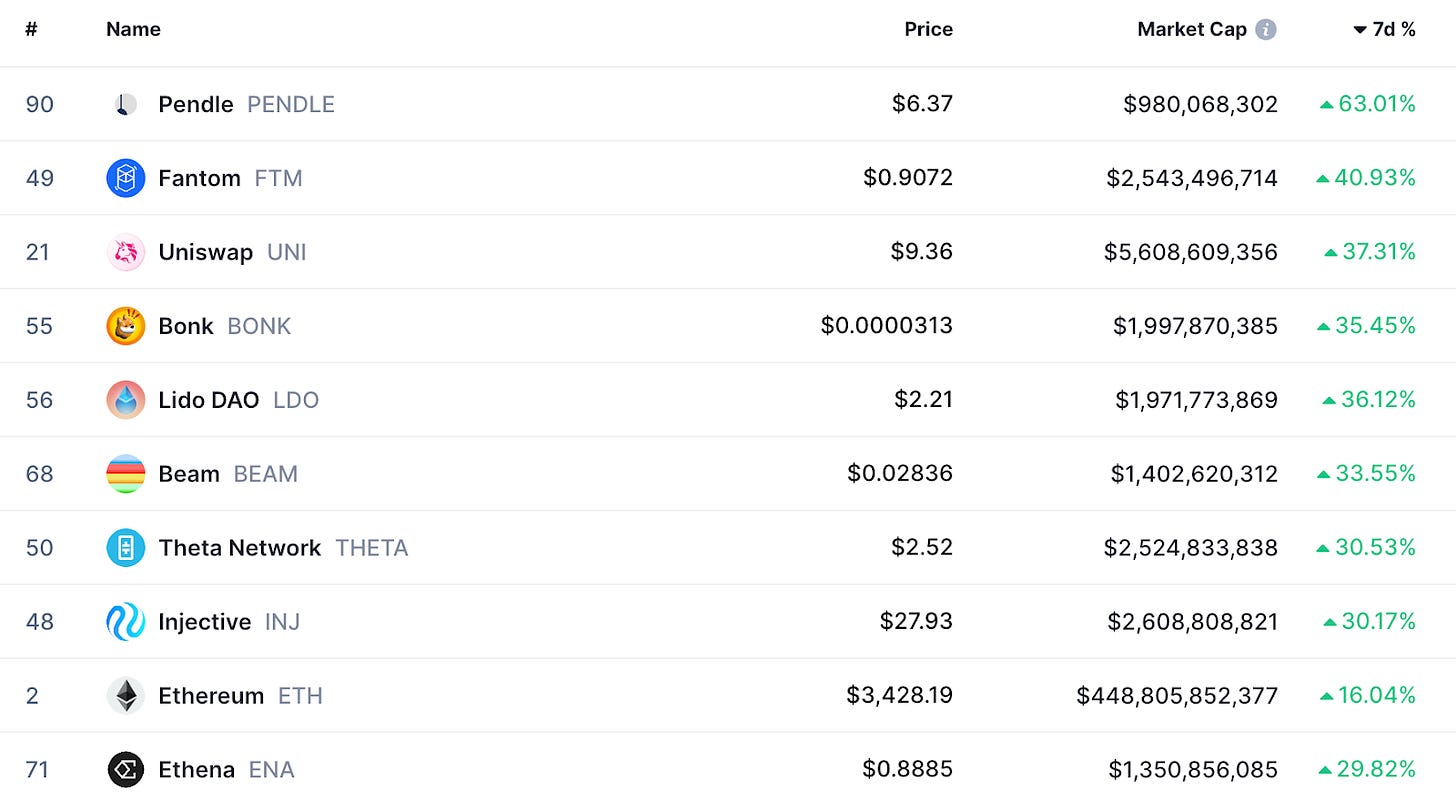

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Cole DeRousse serves as a Research Assistant at 1995 Digital Asset Research, where he blends technical research with social investing strategies. His primary focus is on fostering the growth of the Web3 community and ecosystem, aiming to awaken people to the transformative power of Web3 apps and technologies. This is an excerpt from the full article, which you can find here.

Introduction

The SEC’s Trading and Markets Division informed asset managers Monday morning to amend filings, known as 19b-4 filings, and refile them with the amendments, according to people familiar with the matter. WSJ with the same - @tier10k

ETH is up 18% on the day! Excitement surges through the crypto community as the odds of approval for a spot ETH ETF dramatically increase, potentially marking a pivotal moment for Ethereum. This upswing in Ethereum’s prospects could herald the beginning of 'ETH season,' historically a signal that we're about halfway through the current market cycle. This phase is often associated with a shift to a more risk-on environment where liquidity flows more freely.

Top 3 Compelling Narratives:

We're focusing on—Memes, Artificial Intelligence (AI), and Real-World Assets (RWA)—which are significant because they have notably outperformed other sectors within the crypto space recently. These narratives not only represent the dynamic evolution and adoption of blockchain technologies but also highlight areas where substantial growth and interest have been concentrated. As we move through the summer, keeping an eye on these narratives will be crucial for those looking to capitalize on trends and accumulate potentially lucrative positions in the market leaders. Also, make sure to add Chia Network to your watchlist as it now aligns more with the RWA narrative. Chia is building a decentralized peer-to-peer network and working with climate action trust building a carbon credit trading market with blockchain tech.

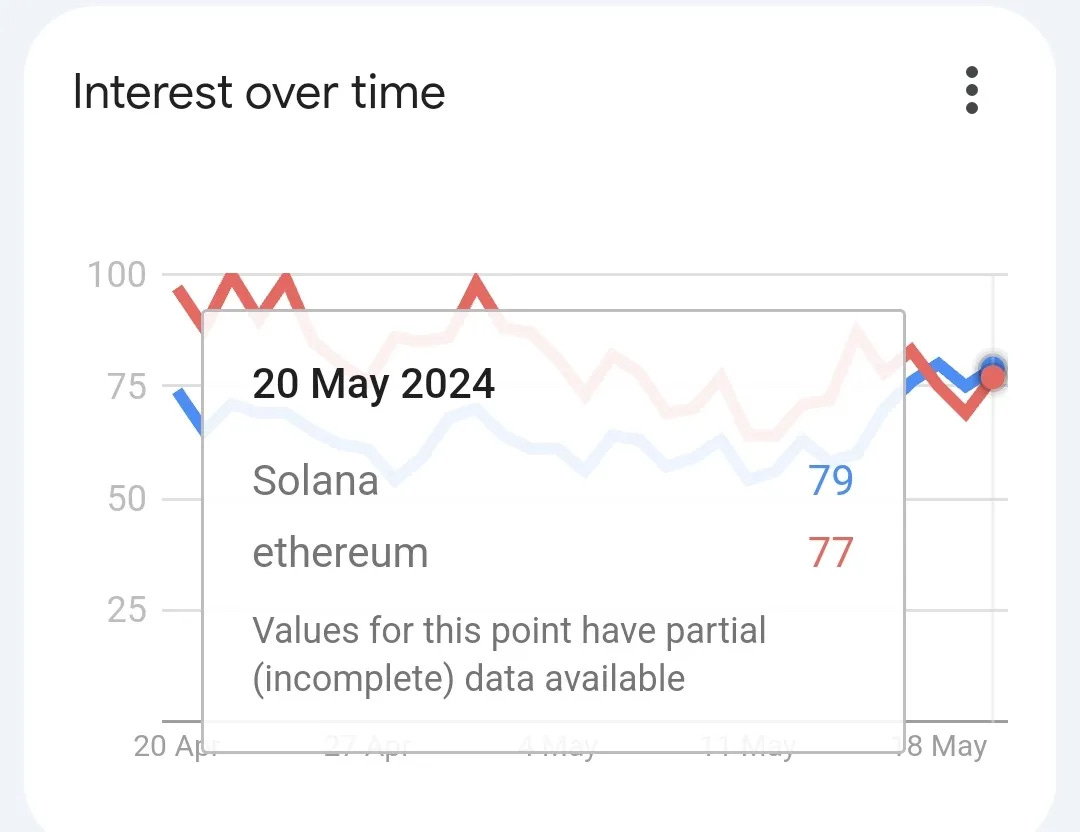

1. Memes:

Solana continues to dominate the meme token spotlight with projects like GME, Wif, and Bonk. The big question remains: will Ethereum manage to claw back some of the liquidity and attention from Solana’s meme tokens, or will Solana keep its lead? The blockchain architecture debate is intense, with many touting Solana as 'the culture chain' or 'the people's chain,' beloved for its user-friendly experience, intuitive apps, and low gas fees. We’ll be keeping a close eye on any potential shifts, as they could provide key insights for L1 trading strategies. Observers like Crash aka @CassiusClay69 advocate for strategies that involve buying top memes on upcoming ecosystems, particularly if ETH's gas fees deter users and propel them towards S-chains like Solana, Sui, and Sei—platforms known for their high throughput and consumer-friendly interfaces positioning in top their memes in these integrated L1’s could prove to be lucrative. Meme projects that come to mind for example are Fud the Pug on Sui and Seiyan on Sei. Remember though these memes are often artificially stimulated by VCs or Insiders to stimulate network activity. Just be sure you understand this before blindly apeing, and who know this hot take could be quite premature given we might have just started Eth season today and it will take a little for Eth fees to get high before people want to speculate on these alt L1’s again.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.fyde.fi