Welcome to the Coinstack Newsletter. This issue explains why I recommend all companies hold 5-10% of their balance sheet in Ether (ETH) and Bitcoin (BTC), with a stronger weighting on Ethereum. We also are celebrating passing 3,000 subscribers!

Social Links: Twitter | Telegram| Substack

Inside This Week’s Issue:

Ethereum on the Balance Sheet

Coinstack Alpha Fund Has Launched

Portfolio Update: Up 613% YTD 👀

Become a Coinstack Sponsor

Join My Weekly Crypto Advice Call - For All Mrs. Bubble NFT Owners

NFTs of the Week by Mrs. Bubble

Podcast Interview - Why Ethereum is Beating Bitcoin

How Did I Get Into Crypto?

Top 5 Reasons Ethereum Will Be Worth More Than Bitcoin by 2025

Why An App Ecosystem is Important for the Value of the Currency

Why Ethereum is Better for The Environment

Why Bitcoin is Better Money Than the U.S. Dollar

Why Ethereum is Better Money Than Bitcoin

Bitcoin’s Security Problem

Why Proof of Stake is Better Than Proof of Work

Price Predictions for Bitcoin and Ethereum

A Long-Term Crypto Portfolio

Who I’m Following Closely on Twitter

Getting Started in Crypto

This week I was interviewed on the DeFi Times podcast. You can listen to it here (Spotify, Apple Podcasts)'

Ethereum on the Balance Sheet

Based on this week’s Ethereum price action (+30%) there is likely a major institutional buyer acquiring a LOT of Ether (ETH) -- and they aren’t stopping.

We don’t yet know they are yet. But when the news breaks in a few weeks it may just be Ethereum’s Tesla moment.

Most of us will recall that beautiful moment on February 8, 2021 when Tesla announced it had purchased $1.5 billion of Bitcoin and the BTC price shot up 14% in a day.

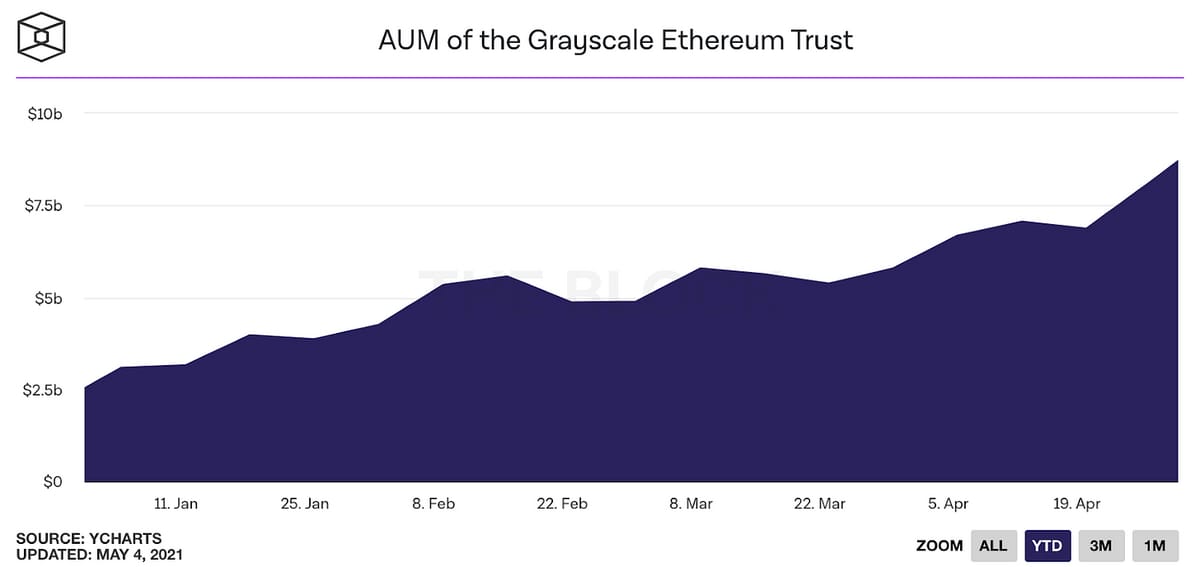

You can see here the Assets Under Management of the Grayscale Ethereum Trust have now passed $7.5 billion and show no signs of slowing down.

And you can see here that Total Value Locked (TVL) in Ethereum DeFi Ecosystem is now $75B+.

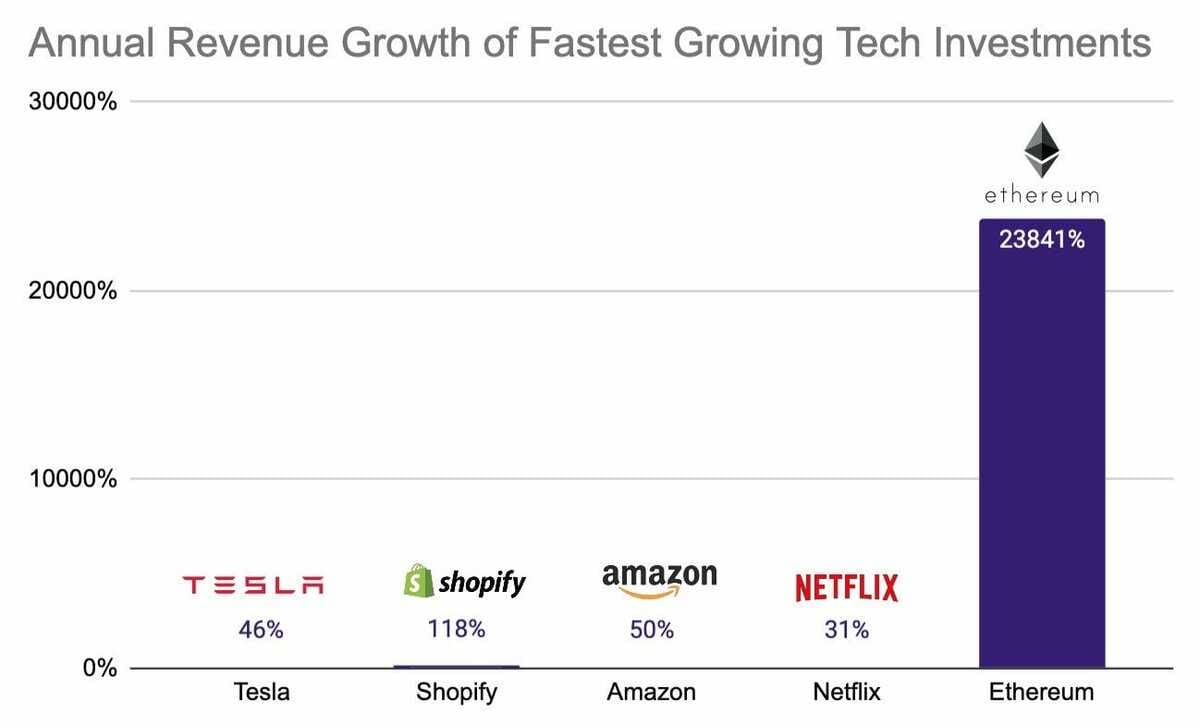

As you can see, even though Ethereum has a 23,841% annual revenue growth rate, it is trading at a lower PE multiple than Tesla, Shopify, Amazon, and Netflix.

Yep, Ethereum’s growth rate is 476x that of Amazon, but with a 30% lower PE ratio. Almost a value stock.

Let’s look at this same chart as a graph:

Yes, Ethereum looks inexpensive compared to these other opportunities. Now let’s graph annual revenue growth rates and you can see that Ethereum is BY FAR growing the most…

It’s clear that of these five investments, Ethereum is the least expensive on a Price to Earnings (PE) basis while growing 200x faster than it’s nearest competitor.

Talk about a good value.

In fact, the price of Ethereum has gone up by 1507% in the last year while it’s revenues have gone up 23,841%. This means on a Price to Sales (P/S) basis, Ethereum is actually cheaper than it was in April 2021, by a lot.

As you can see in the table above, Ether has declined by 93% in the last 12 months on a Price to Sales ratio. That means revenues are growing much faster than the market cap, which means it’s an attractive buy at these levels based on fundamentals.

How does Ethereum compare to Bitcoin? Well, Ethereum has 3x the revenues already and is growing revenues at 6x the pace. The below bar graph shows the one year increase in Ethereum vs. Bitcoin revenues from April 2020 to April 2021.

Yes, 23,000% revenue growth in a year is unprecedented for any tech company. Based on this exceptionally rapid growth, the narrative is shifting from large companies and sovereign wealth funds holding Bitcoin on their balance sheet to holding Bitcoin AND Ethereum on their balance sheets.

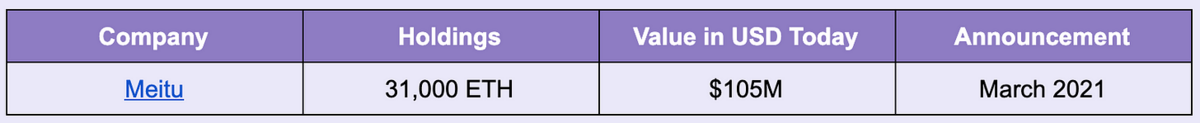

In March 2021, Meitu, a publicly traded Chinese company announced a purchase of 31,000 ETH. Their original purchase for $40M is now worth $105M. While Tesla’s Bitcoin has appreciated just 60% since their January 2021 purchase, Meitu’s Ethereum buy has appreciated by 110% in half the time.

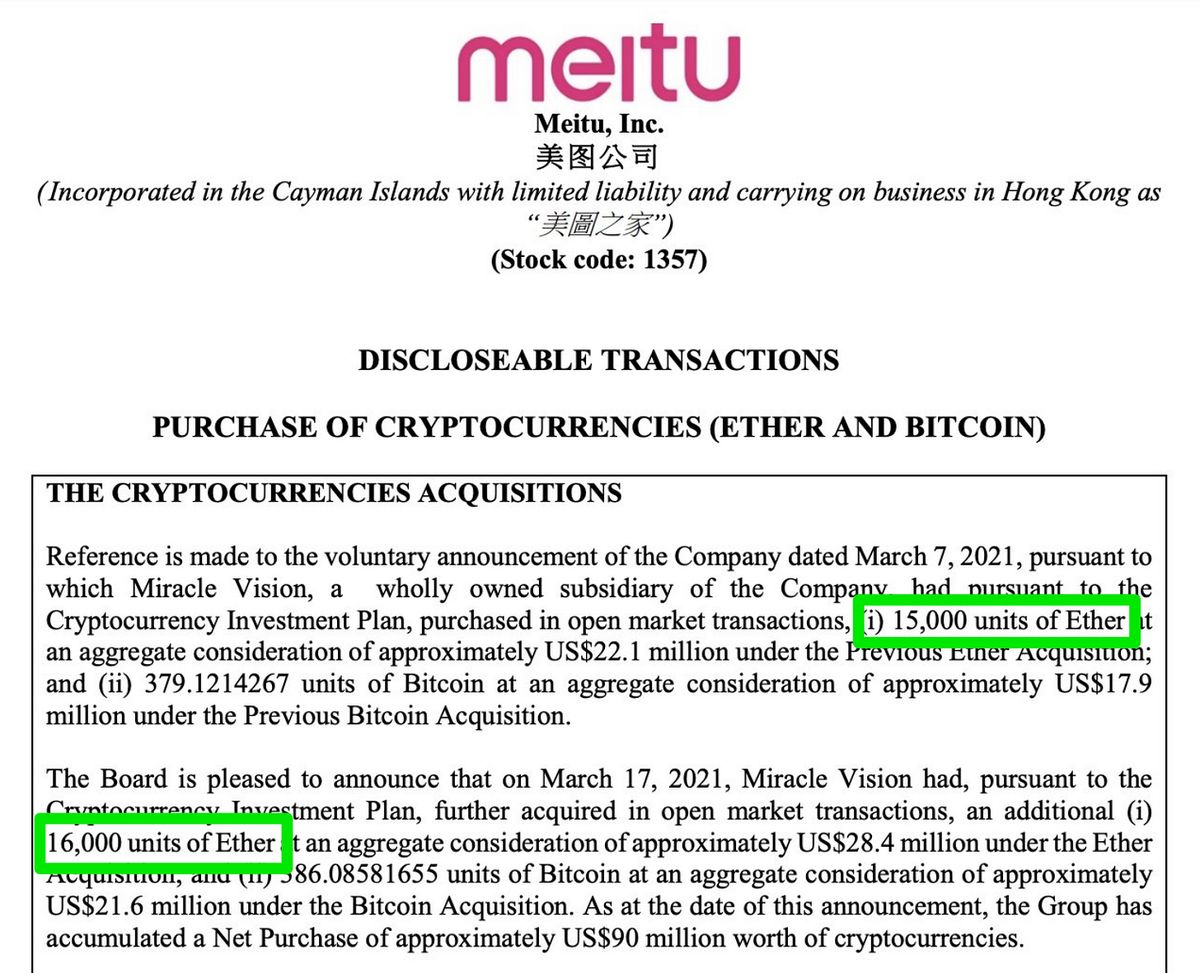

Let’s look at their filing disclosure directly. They bought both Bitcoin and Etherum -- but more Ethereum. Smart.

This is what Meitu said when announcing their Ethereum purchase in March 2021.

“Meitu is currently evaluating the feasibility of integrating blockchain technologies to its various overseas businesses … the Ether purchased would become the gas reserve for the Group’s potential dAPP(s) to consume in the future.”

This is the type of trend you want to be ahead of.

I strongly encourage all companies (and especially tech companies) to allocate 5-10% of their balance sheet cash reserves to Ethereum, and soon.

Coinstack Alpha Fund Has Launched

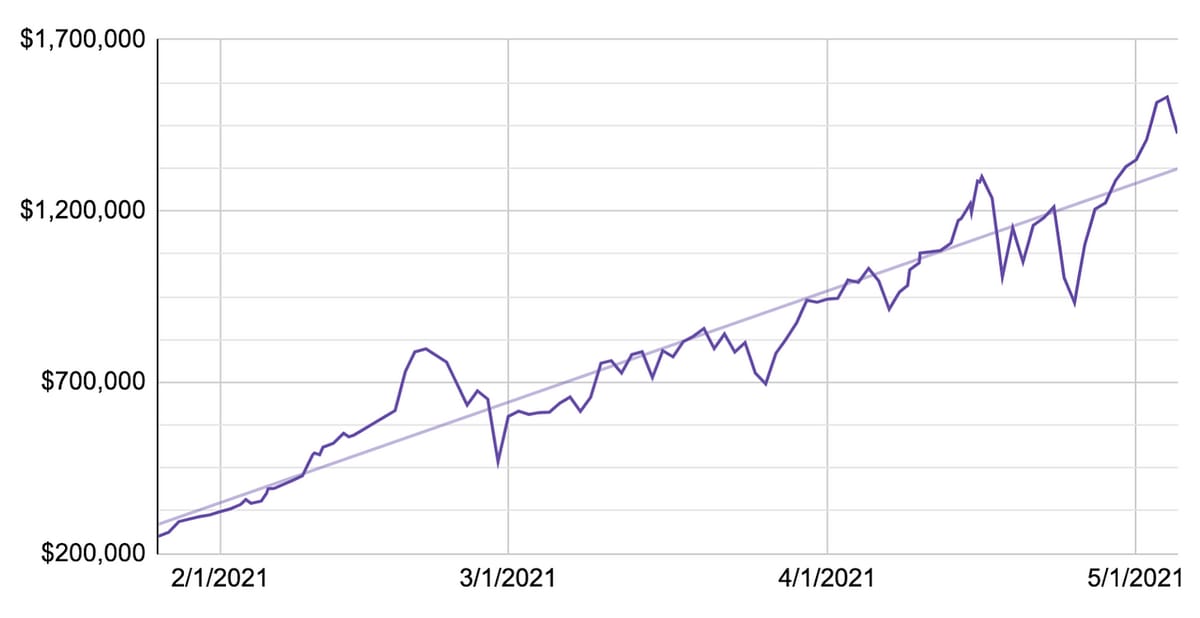

I am experimenting with using Enzyme so that you can invest in the same crypto strategy as me passively.

I do the research and trading for you.

The fund launched last week. I am in an experimental phase for the next 30 days between now and June 5. If you’d like to be one of my first investors, you can invest here using ETH or USDT from MetaMask.

Please don’t invest more than 10% of your total crypto holdings as these funds are still experimental. I’ll be perfecting the strategy over the next 30 days then opening up to more capital and announcing it more widely in June.

Performance and holdings are shown transparently down to the minute.

You can invest and withdraw capital at any time with no notice. No paperwork. I never hold your money. It’s all held by Enzyme. I just invest it and they send me the 2/20 fee.

The fee to invest is the standard hedge fund fee of 2/20, which is 2% annually of assets under management (AUM) and 20% of profits.

The fund is up 25% in the last seven days as you can see above.

No guarantees, it’s experimental right now and I’m still learning which platform gives most flexibility. I’m also playing around with a Zignaly fund but that one isn’t ready yet for capital.

If you wish to invest in my experimental fund, you can do so here. It requires using ETH or USDT and one of these three wallet types:

MetaMask

WalletConnect

Coinbase Wallet

The fund started out at $1 per share and is now at $1.16 per share -- based solely on the returns of the capital invested.

When you invest you pay an Ethereum gas fee to invest — so this is NOT recommended for investing less than $1000 — as right now the gas fees are around $50-$100. (Note: that will improve later this summer as Layer 2 scaling solutions arrive).

I will be investing the funds deposited in what I believe will get an optimal return in both up markets (now) and sideways/bear markets (2022). As always, know that crypto investing is risky no matter how good the investor is. You should never invest an amount you aren’t prepared to lose.

If you have any questions you can message me on Telegram. I’ll write again about it next month when it’s no longer experimental and ready for prime time.

Portfolio Update: Up 613% YTD 👀

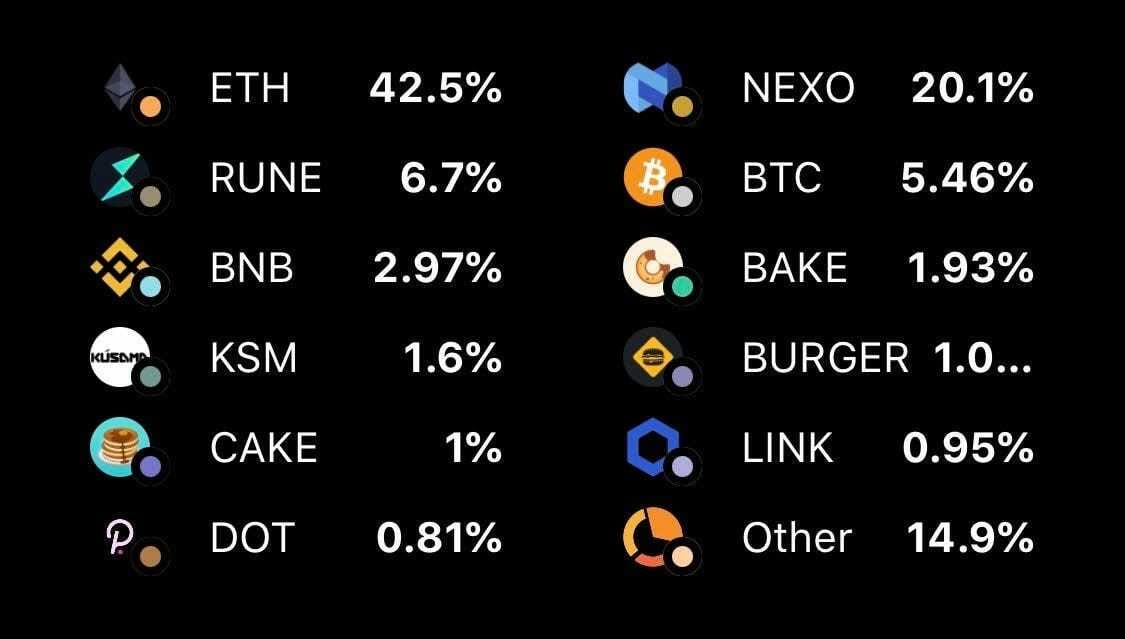

Below is my actual portfolio holdings as of today. I actively manage my own portfolio and make about 20-30 trades per week. As of this moment I am up 613% YTD while BTC is up 92% YTD.

About two weeks ago I swapped 1 of my BTC for more ETH based on my conviction that ETH will continue to substantially outperform Bitcoin. I also plan to accumulate more DOT this summer as we prepare for Polkadot’s launch in Q3 2021. You can read more here about my crypto investing strategy. You can invest in my Coinstack Alpha Fund here using Metamask and USDT or ETH.

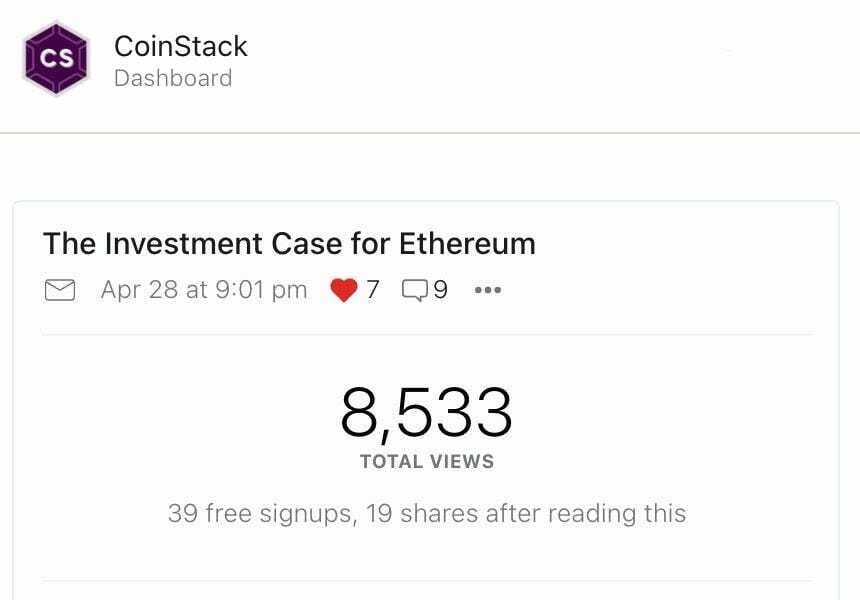

Become A Coinstack Sponsor

Coinstack now has over 3,000 subscribers around the world -- and we’re growing very quickly. We are now seeking 2-3 crypto-related industry sponsors so we can expand our analyst team. Each weekly issue is now getting over 8,000+ views by our subscriber base of global crypto investors and is growing quickly. ‘Sponsorship is $15,000 per month for the first three months.

If your company would like to sponsor Coinstack, just reply to this message, comment, or message me on Telegram. We are especially interested in having an exchange sponsor like Nexo, Kraken, Uniswap, etc. If you have any contacts there please connect me :).

Join My Weekly Crypto Advice Call

I am starting a weekly live 30 minute Crypto Advice Zoom call at 9am PT / 12pm ET / 5pm GMT every Tuesday. All buyers of Mrs. Bubble’s NFTs are invited to join. Just buy any Mrs. Bubble NFT and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite.

Mrs. Bubble’s NFTs of the Week

Mrs. Bubble the artist is of course my wife Morgan Allis, so supporting her work directly supports our family and this newsletter -- and makes her yell with joy with every sale notification!

Here are the featured Mrs. Bubble art pieces for this week.

First we will feature Bubble #116 - Shni Shni, the magical musical snail. Her buyer will receive the original signed and framed 8.5”x11” artwork mailed to them globally anywhere in the world -- making a great gift for any child. She is available for 1.11 ETH.

This is Bubble #63 - The Gods of Snuggle (and painting of her and I). It is available for 0.3 ETH on OpenSea. The Gods of Snuggle hold each other underneath the Lavender tree as the sun sets in Bali. It was hand painted and then digitized for some extra magic.

Next we have BUBBLE #90 - Unicorn Burger. She’s magically delicious and everything your hearts yearns for. This Unicorn burger travels the crypto spaces looking for the ones who want a bit more fun in their life, who believe in magic. I hope you enjoy, we love looking at the painting, she actually has her own seat on our living room couch. She is available for 0.25 ETH.

Lastly this week we are featuring BUBBLE #42 - The Goddess of Color. She turns entropy into brightness. She turns light into rainbows. She is the Goddess of Color. Darkness is transformed in her presence into light, which then transforms into prisms of delightful color all around. She is magical. She is special. She is everywhere. A Bubble original. Hand painted and then digitized for some added magic. She is available for 0.5 ETH.

Thank you for supporting Coinstack by investing in our NFT art. And thank you to RayCarroll55, EricaJ, and FarmBlue who purchased Mrs. Bubble’s beautiful NFT art pieces last week. You can see Mrs. Bubble’s full art collection here.

Podcast: Why Ethereum is Beating BitcoinBy Ryan Allis

This week I was interviewed by Fabian Klauder on the DeFi Times podcast. You can listen to it here or read the transcript below.

Please excuse any typos in this section… it was written by a computer transcribing the audio.

Fabian Klauder: Good Morning DeFi Times Community. I'm your host, Fabian Claudia and I welcome you to another episode of DeFi Times Daily. In today's episode, we have a very, very special guest on the show. Today I talked to Ryan Allis, a serial entrepreneur who is very active in the crypto space. He is the writer of the excellent newsletter, Coinstack and today we discuss five major reasons why Ethereum will flip Bitcoin by 2025. I really enjoyed the conversation and I'm sure you will too. Ryan, Welcome welcome to the D5 times podcast. How are you doing today man?

Ryan Allis: I'm doing so well. I'm so happy to be here.

How Did You Get Into the Crypto Industry?

Fabian Klauder: Okay, so to kick things off, could you maybe first give us an overview of who you are and tell us about your journey and most importantly, how did you get into the crypto industry? I know you started your career by building a software company called iContact, but now you’ve moved to Bali and recently also started a very successful crypto focused newsletter Coinstack, which I recommend to anyone listening. So super exciting story. Could you tell us a little bit more about it?

Ryan Allis: Sure, Fabian. My name is Ryan Allis. I publish the Coinstack newsletter at Coinstack.Substack.com. I started out as a software CEO back in 2002 when I was 18 years old. I left college in order to build iContact in North Carolina in the United States. We built that company up to 300 employees and had us exit for $170 million in 2012. So we had a good exit and then I went and did a two year MBA at Harvard Business School where I learned financial analysis and essentially ended up in class with a lot of investment bankers and a lot of McKinsey consultants.

After that I ended up moving to San Francisco to spend eight years in Silicon Valley, building more tech startups and also building a global community of purpose-oriented leaders called Hive.org. So that's been my background. About a year and a half ago I moved to Bali, Indonesia with my wife Morgan. It's a wonderful place for digital nomads and crypto investors and that's where I live now and where I do my work researching and investing in Blockchain based companies.

What Are The Top 5 Reasons Ethereum Will Be Worth More Than Bitcoin by 2025?

Fabian Klauder: Yeah, super cool, super exciting story. So let's start with today's main topic. We agreed to talk about the recent newsletter that you published on Coinstack.substack.com. Where you made the point that Ethereum will overtake Bitcoin by 2025. In the Ethereum community, we talk about the Grand Flippening the moment when Ethereum reaches a bigger market cap than Bitcoin. And in your newsletter you gave five reasons why you think that this will be the case. So let's talk about that first. Could you quickly describe your top five reasons why Ethereum will flip Bitcoin by 2025 and then we will get into each of them in more detail later.

Ryan Allis: Yes, I'm very bullish on Ethereum as you know, Bitcoin's market cap is around one trillion right now, Ethereum’s market cap is around 300 billion right now. So it's 30% of the total market cap. Up from 13% a year ago. And so it's trending in the direction that Ethereum’s total market cap will be larger than Bitcoin I believe, probably within the next 36-48 months. Certainly by 2025 at the latest.

My top five reasons why I think Ethereum is going to beat Bitcoin in market cap within the next four years.

Ethereum has smart contracts and Bitcoin doesn’t.Ethereum has an Ethereum Virtual Machine (EVM) and because of that we can build apps on top of it. How many apps are now running on Ethereum with more than $100 million dollars and monthly volume? 38. So Ethereum has 38 applications or decentralized applications built on top of it. Bitcoin has zero. With more than $100M dollars in 30 day volume. So without smart contracts or programmability, it's not even really possible or easy to build apps on top of Bitcoin.

Ethereum is Better for the Environment. There's a big movement right now all around the world to create a world that is carbon neutral. To create a world that is environmentally sustainable. And we all know that Bitcoin uses a lot of electricity and currently Ethereum uses a lot of electricity to provide security and to validate the transactions. Now later this year, around December 2021 Ethereum is moving to Proof of Stake which doesn't use nearly as much electricity. We can talk more about that later. So I think Ethereum will be seen socially and in the media as better for the environment.

Ethereum is FasterThe 3rd reason is speed. So right now today, Bitcoin as of this moment, is averaging 3.4 transactions per second. Ethereum is about six times faster than that and has recently been averaging about 18 transactions per second. That's great. Well obviously we need to scale beyond 10,000 transactions per second and by the end of this year when ETH 2.0 launches we will be able to process over 100,000 tps, or transactions per second, while Bitcoin will still be at 3.4. And even with the Lightning Network running on Bitcoin it's only at 7000. So ETH 2.0 is going to be 13 times faster than Bitcoin's Lightning Network and I think that will make ETH, or Ether, the underlying monetary asset of the Internet, a better global store of value, and the neutral global currency for the world.

Ethereum has Better Monetary Policy Than BitcoinReason number four is monetary policy and a lot of Bitcoin maxis, they say well Bitcoin has lower annual issuance than Ethereum and therefore it's a safer store of value. That's true today but actually in about nine months, by the end of 2021 that will no longer be true. There's two things happening, we'll talk about them later in the episode but in July 2021 EIP-1559 is going live with the London update that will start burning transaction fees. That will cut the annual issuance rate from about 4.3% for Ethereum down to about 2.3% immediately. And by the end of this year with the launch of ETH 2.0; we're going to move off of Proof of Work on to Proof of Stake. And the total annual issuance of a theory and starting in 2022 is going to be negative, it's going to be a deflationary asset. So that is going to make a theory a more sound money supply and better long term store value than Bitcoin by the end of this year. And so with that lower issuance all of Bitcoin’s previous advantages evaporate. Not only do you have the ability to build apps on top of it easily, but you also have better monetary supply.

Ethereum is a Better Store of Value (SoV) Than BitcoinAnd so everyone that works in Wall Street or in Singapore and Hong Kong or London, the global financial capitals of the world are going to start looking. Not yet, but in about a year, year and a half they're going to start figuring out that everything that we talked about in terms of Bitcoin’s advantage of a story value over gold is actually going to be a property that's even more improved for Ethereum. So those are the top five reasons why I believe Ethereum overall market capital flip Bitcoin's market cap over the next 48 months.

Fabian Klauder: Yeah, super exciting. Just a quick summary. So Ethereum has way more apps, Bitcoin has zero. Ethereum is better for the environment. It's way faster. We have a better monetary policy and it's actually more secure. So let's start with the apps. So why is it important for a Blockchain to have apps? Bitcoin has zero apps right now. Or basically 0 apps that have a 30 day volume above $100 million. So why are apps important for the value of the currency?

The Four Eras of Computing

Ryan Allis: So you can go on DappRadar.com and see how many apps are currently running on each of the major Blockchain protocols. And as you just stated Ethereum’s blockchain has 38 apps with more than $100 million in monthly volume and it has 13 with more than $1 billion in monthly volume. Bitcoin doesn't have any because it's not an application development protocol.

So why is this important?

Andressen Horowitz (A16Z) is one of Silicon Valley's largest venture capital funds. In 2016, they created their first crypto fund and in 2020 they ran the first A16Z Crypto Startup School, and made videos which they published free online.

In the videos, they talk about the four eras of computing.

1940 - 1975 - Mainframe Era - When big machines took up entire rooms at MIT

1975 - 1995 - PC Era - People like Steve Jobs and Bill Gates created these miniature computers that could fit on our desks and eventually in our pockets

1995 - 2020 - Cloud Era - The rise of web sites and SaaS

2020 - ongoing - Blockchain Era - At the invention of the smart contract around 2015 with Ethereum we have an entirely new fourth era in computing and that's decentralized computing based on block chains. And this is the new era that's going to be dominant over the next 15-25 years.

Why An App Ecosystem is Important for the Value of the Currency

So, in order for computing power to have a monetary value. There has to be a Utility for the asset that is in the blockchain and with Bitcoin the only real utility is payments and long term store of value. But with Ethereum you have payments, you have long term store of value, and you have the ability to utilize Ether as the fundamental monetary good to power all of the apps and in order to interact on Maker (MKR) or to interact on Uniswap (UNI) or to interact on any of the big Ethereum based Dapps you need Ether. And so that is what is making the demand for Ether much greater than demand for Bitcoin right now.

Fabian Klauder: Yeah, it's also funny to think about. On Ethereum you can build basically anything you want but Bitcoin is only there for one specific purpose and that purpose which is payments (and store of value) can be done on Ethereum also. So Bitcoin’s only purpose (Payments and SoV) can be built on Ethereum and that's kind of crazy to think about.

Ryan Allis: That's correct, yep.

Why is Ethereum Better For the Environment?

Fabian Klauder: Yeah so Ethereum is also better for the environment. Why? Why is that so?

Ryan Allis: Well later this year we're moving to a Proof of Stake model. So what Proof of Stake means is that instead of having to purchase expensive ASIC miners that essentially eat up electricity, doing cryptographic proofs all day long to mine and validate Bitcoin transactions.

We're going to allow anyone that owns any amount of Ethereum to be able to generate an annual return by staking their Ether. So what does that mean? Well you don't have to purchase a big mining rig. Mining is something from the past. You can sort of imagine the coal mines of the 19 fifties or 19 thirties, um what the future is as Proof of Stake and Proof of Stake is 99% more electricity efficient than Proof of Work. And it’s able to do that while actually providing better security and have less sell-pressure from the miners that were previously spending all this money to buy equipment then mining Bitcoin and then selling Bitcoin in the market which then reduces the value, reduces the price on the daily exchanges.

So all of that sell-pressure is going to go away from Ethereum when we move off of the Proof of Work onto the Proof of Stake. Now, it requires 32 Ether in order to be a validator or staker yourself with ETH 2.0. However, you can join a pool and with any amount of Ether, $5 of Ether you can join an existing staking pool and make between 7% up to 25% annually paid out to you in Ether just by providing validation and security for the network.

That is all done with 99% less electricity and that means 99% less carbon.

Now, eventually, probably 15 years from now, by 2035-2036 we will have a world running on renewable energy. And when we have a world running 100% on renewable energy, the debate between Proof of Work and Proof of Stake from an environmental standpoint won't matter as much. But today, still 61% of Bitcoins electricity, comes from fossil fuels and that’s 61% too much. And so this is how we are going to create a meme around Ethereum being the environmentally friendly Blockchain that provides better security, better monetary policy, better applications, and better environmental sustainability.

Why is Bitcoin Better Money Than the Dollar?

Fabian Klauder: Yeah, totally agree. So, yeah, we we have this huge global trend, a trend towards clean energy and sustainability and Ethereum really fits into this narrative. Um, into this clean and green future. Um, yeah so, before we are actually able to understand why Ethereum is harder money than Bitcoin. Let's first examine the properties of sound money in general. So in your article you wrote that Bitcoin is worse money than ETH, but it definitely has some sound properties that make it valuable. So to explore why Bitcoin could be considered hard money, Could you explain the main difference between the U.S. Dollar and Bitcoin? And in that sense, why is Bitcoin better money than the dollar?

Ryan Allis: Well, we're moving into a world where the issuer of money will no longer be centralized nation states. The primary issuer of what is commonly accepted as money in say 2035 or 2040 is going to be decentralized, globally neutral, politically neutral, uh decentralized computing currencies and otherwise known as crypto assets and cryptocurrencies. So I want to be clear about Bitcoin. I'm a big fan of Bitcoin! I own Bitcoin. It's a material percentage of my crypto portfolio. It's been a great asset to own. Uh it's gone up on average of 200% per year for the last decade. Uh and I think we in the community owe, a lot of respect and deference to the Bitcoin pioneers that started way back in 2008 with Satoshi.

So I want to say that first. Now, what I'm looking at is, “What is going to be the likely currency of the world in 2030.?” That's the question I'm asking. And so that's where I end up saying, I think Ether is going to be the one. But let's talk about why Bitcoin has beat the dollar over the last decade. Alright. So it's important to understand that since about the end of World War II, about 1945/1946.

Since the Bretton Woods meetings in New Hampshire, the world has operated under what's called essentially the Bretton Woods post-World War II standard. And in the first 25 years of that, we were on the gold standard until 1971 with Richard Nixon, the former president of the United States, who took America off the gold standard and create essentially fiat currency or, “by decree currency” were the only reason that a fiat currency has values because it's decreed by a government to have value and that it can be used within the borders of a nation state.

Now the issue, once we moved off the gold standard. Is that the government currency, the dollar in this case, was no longer backed by anything. Right? And so you couldn't exchange the dollar for gold anymore, for example. And so over the last 40 years we've had a fiat currency backed by nothing. And when the government of any nation state, let's just look at say the Euro and the US dollar. When any governmental entity significantly increases the supply of the base currency of a nation, they decrease the value per unit of that currency. And so in 2020 last year in large part due to covid the coronavirus, the United States of America grew their money supply by 26% in one year. Right? And so on the other hand, Bitcoin is growing at 1.8% a year on a very fixed and declining schedule.

And so in a world where the US. Dollar now has 26% more dollars than you did a year ago, that means that every single one of those dollars is worth 26% less.

Bitcoin & Ethereum Are The People’s Money

What does that mean? That means asset prices on the stock market and in home purchases go way up right. Which really benefits the wealthy frankly, but it leaves out the bottom 50% who don't own stocks and homes and that creates massive societal discontent.

So long story short, the big picture is, that while the amount of supply of any national currency tends to increase substantially over time eventually creating inflation and eventually hyperinflation because we have a fixed supply with Bitcoin and a declining supply with Ethereum.

They, as Decentralized Neutral Currencies, are more likely to be accepted by the people. Crypto-Assets/Cryptocurrencies are the money of the people. Bitcoin and Ethereum is the money of the people. Dollars and Euros are the money of the governments and it's clear who the people will choose over the next 10 or 15 years.

Why is Ether Better Money Than Bitcoin?

Fabian Klauder: Yeah. So with that said let's let's talk a little bit more in detail. Why is it harder money than Bitcoin? So the soundness of um of money in general is determined by the issue. And so how much of it is issued on a daily basis or on a monthly basis? On a yearly basis. And Bankless created a very important meme which is called, ETH is Ultrasound Money. And so that means that if Bitcoin is sound money, ETH is ultrasound money, why is that so and what's the last piece of the puzzle that we need for that?

Ryan Allis: So I want everyone to keep a figure in their mind of 1.8%. So 1.8% is the current annual inflation rate of Bitcoin. Okay, now that's a lot lower than the dollar, right at 26%. So I’ll take 1.8%. However, today, as of the end of April early May 2021 Ethereum annual increase % is 4.28%. There is an issuance per day that goes out to the current Ethereum miners of 13,550 Ethereum every single day, every single block. Every 13 minutes with a new block it goes out. Now some two things are happening this year in 2021, On July 14th, 2021 only 75 days from now, the 60% of the transaction fees from Ethereum are going to be utilized. Not to go back to Miners, but instead to purchase Ethereum and then burn the Ethereum, burn the Ether, the monetary supply of Ethereum. And what that's going to do, as soon as that goes live, right away. Based on today's transaction fees, let alone what they're going to be in three months with DeFi Summer 2021 coming. Just with what's happening right now.

That's going to immediately reduce the annual issuance of the Ether from 4.28% to 2.36%. Okay, so we're about a 50 decline right away. So by the end of this, by the middle of the summer we're going to have similar monetary policy to Bitcoin. Now the final step is the end of this year. Is going to be in December 2021 or perhaps early 2022. We're going to have the ETH 2.0 Beacon Chain which started. Which is already live and working perfectly. It's been running since December 1st 2020. It's going to go live. We're going to merge the Proof of Work and the Proof of Stake chains and we're going to immediately reduce the daily issuance. Okay from 13,550 to 3,013 Ether.

What does that mean? That means that the annual increase percentage, the supply increase is going to go from 4.28% today to -.9% by the end of this year. That means that on average 2987 ETH, 3000 Ether, are going to be burned on average net per day.

And that means that by the end of this year a theory um will be a deflationary asset and we'll have a sounder monetary supply than Bitcoin.

Now it's important to understand that what makes a monetary supply sound is two things. It is lower issuance and it's predictable issuance over time.

So what's going to happen is people are going to start seeing, “Wow Ethereum has the lowest issuance of any major Blockchain way lower than Bitcoin.”. In fact it's going to be slightly negative by the end of this year, which is great because it means the value of each one increases with each year you hold it instead of decreasing it. And on top of that over time it's going to be very predictable. You can go onto Etherscan and see exactly how many Ether were burned that day.

So while Bitcoin ends up with a predictable schedule that reduces in half every four years, um Ether will have a lower inflation rate immediately by the end of this year. So that is not just sound money, that is ultrasound money, and that's what everyone in the bankless community, including Justin Drake is really telling the world about right now and this is what is getting all the former Goldman Sachs and JPMorgan bankers excited because when you have predictable supply, you can actually start to value and you can start to provide cash flow analysis which we'll talk about, I'm sure in an upcoming segment. And when you realize that Bitcoin will have a higher interest rate or higher percentage inflation rate than Ether, and you realize that Bitcoin won't have cash flows while Ethereum will have cash flows. That's why I end up predicting over $7,000 ETH by the end of this year and over $100,000 per each by the end of 2025 which I'm sure we'll talk about in a few minutes.

Why Ethereum’s Security is Better Than Bitcoin’s

Fabian Klauder: Yeah. So so what's really important is that Ethereum will not only have a better monetary policy in the short term but also it's going to be way more sustainable in the long term. Because what happens when Bitcoin doesn't have new issuance anymore? So what happens with Bitcoin when we solely depend on transaction fees to secure the network? So what happens at that point of time?

Ryan Allis: Yeah. So as you know, Bitcoins issuance goes to zero by 2140. Okay. And in fact by the end of this decade, by 2030, something like 99% of the Bitcoin that will ever be issued will have been issued by that point in time. And so as the annual issuance to miners (keep in mind they're still using this outdated mining system) goes lower and lower and lower and lower there's going to be less and less and less rewards that are able to be paid to the people providing economic security for Bitcoin, which are the Miners. And so I was having a good conversation on twitter earlier today with Robert Breedlove who is a well known Bitcoin advocate and he was sending me an article saying you know, Bitcoin security is fine even though it's going to zero issuance by 2140. We're going to just provide Bitcoin's security off of the transaction fees.

Well that's a problem.

That's a problem because Bitcoin’s daily transaction fees today, right now, are less than one third the daily transaction fees of Ethereum. Ethereum is already more than three times the transaction fees of Bitcoin just today, let alone what's going to happen with DeFi Summer 2021 and all the apps that are being built on Ethereum over the next 5 to 10 years. And so what's going to happen is Ethereum is going to have probably about 100 to 200 times more transaction fees than Bitcoin transaction revenue. And what that's going to mean is the theory um security is going to be much more robust than Bitcoin security and eventually probably two or three years from now people will start figuring this out.

Why is Proof-of-Stake Better Than Proof-of-Work?

Fabian Klauder: Yeah. Um, another reason why you think that ETH will overtake Bitcoin is that Ethereum will actually be more secure than Bitcoin once Proof of Stake comes live. So why is Proof of Stake better and more robust than Proof of Work?

Ryan Allis: Yeah. So let's talk about that. So with Proof of Work there's two problems. Right? And by the way, this was a big invention. This was a huge innovation when Satoshi brought it to the world 13 years ago. So I'm a big fan of Proof of Work but you know, we've just been able to figure out something better over the last 13 years.

So there are two problems with Proof of Work. The first, besides the environmental issues, so three problems. But 2 other problems besides the environmental issue, number one is when you mine through Proof of Work, you immediately have a pressure to sell your Bitcoin that you just mind in order to make back all the costs of upfront investment in electricity and mining rigs and GPU’s. Right? So there's a huge mining sell pressure in the market. And what that does is it makes the price of the asset, it basically deflates it. or it doesn't allow it to go up as much as it would if all that sell-pressure wasn't there. So, that's the first issue. All right.

And then the second issue with Proof of Work is what you're talking about now, which is Security. So right now, it takes about $2.3 billion dollars in mining costs per year to secure the Bitcoin network. That’s simple math right, about $7,000 per Bitcoin is what it costs per for electricity and mining hardware to mine a new Bitcoin. And right now there's about 328,000 new Bitcoins mined every year. So that's $2.3 billion in mining costs. That means it would take at least that amount. At least 2.3 billion in hardware and electricity costs to attack the Bitcoin Blockchain network via a 51% attack.

So if a nation state spent say three or four or $5 billion to buy a bunch of hardware, it could successfully attack the Bitcoin network. Now when you're doing security in a decentralized network, you want it to cost more to attack. Right? Because if China or the US, not that they ever will frankly from a game theory standpoint. But in theory, if someone wanted to attack Bitcoin or Ethereum, you wanted to be more expensive to be able to attack. Not less. Now with the amount of Ether that is already staked in ETH 2.0, which as of today is worth $12 billion dollars already. That means it would cost at least half of that. $6 billion dollars at minimum today to attack the Ethereum Network. And when we reach 20 million ETH staked, which we think we will reach by the end of this year, it's going to be at least three times that.

So not $12 billion, but $36 billion dollars in staked Ether security, meaning it's going to cost about half of that or about $18 billion dollars to attack Ethereum and that’s at today’s prices. Now if Ether triples like I think it will by the end of this year. We're looking at about three times that, which is about $54 billion dollars by the end of this year to successfully even try to attack the Ethereum network compared to roughly four or five billion for Bitcoin.

And so it's because of the Proof of Stake model, you have to not buy hardware, you have to buy Ether. Right? Because in order to have 51% of the supply, you have to literally own 51% of all the staked Ether in the world. Now we would sort of notice if some large, I'm not talking about a whale, I'm talking about like a nation state type whale coming in and buying $50 billion dollars. $1.5 billion moved the needle on Bitcoin when Tesla bought it three months ago.

Imagine what $50 billion dollars of buy pressure on the Ether network would do. Everybody would notice it would drive the price up. And because of the way Ethereum works, we would be able to simply get rid of those attackers and their attack would not work. So what that means, you have better security, you have less sell-pressure and in order to attack you'd have to buy up half of the staked supply which would actually be great for the price.

Fabian Klauder: Yeah. And the higher the price goes, the more secure Ethereum gets basically because um if ETH finally reaches like $10k or even $100k sometime in the future it will be so difficult. So expensive to attack Ethereum that literally no one in the world could actually do so except like you said nation states.

Ryan Allis: That's exactly right and if anyone did attack, they would have their stakes slashed, which means they would just lose their tokens and everything would move on and be fine. So I think it's a much, much better model.

How Will Ethereum & Bitcoin Scale?

Fabian Klauder: Yeah, totally agree. Proof of Stake will not only make Ethereum, more secure and more robust, it will also make it much cheaper when sharding is finally implemented. So that means that Ethereum will be able to process up to 100,000 transactions per second, as you said earlier. Once sharding is live and all the layer two solutions are thriving. How do you see Bitcoin scaling in comparison to that?

Ryan Allis: Yeah, well we've already sort of talked about this, you know, it's almost like comparing the internet to like AOL. Or it's like comparing a quantum computer to a mainframe computer. You know, Bitcoin is not designed to scale. It is literally not designed to be a technology that you build apps on top of. It's designed to have a single use case which is payments and store of value. So let's talk about what's happening with ETH scaling and why by the end of this year it's not even going to be a comparison.

Right now, the Ethereum network can handle 18 transactions per second. This is the main net. Right. And that's about 5x what Bitcoin does? So already Ethereum is five times faster than Bitcoin. That's great. Right. That's why there's three times the monthly transaction volume in terms of dollars value on Ethereum than Bitcoin already because it's six times faster and it's cheaper. However, by this summer we have to look at what's happening with Optimism with Arbitrum, with ZK Porter, with Polygon, with ZK roll ups and by just this summer. Keep in mind, Uniswap launches in May with V3 on Optimism. This is only a couple weeks away that Uniswap V3 is launching with Optimism where gas fees are going to be in the tens of cents instead of the tens of dollars. It's going to be $0.30 cents to do a transaction on, Uniswap by the end of May not $30 or $40 dollars.

Fabian Klauder: Do we have a date for that?

Ryan Allis: Yes, it's May 12. May 12 Uniswap launches on optimism on May 12th it's two weeks away or less. And so by this summer, the Ethereum network on Optimism, which is a roll up technology will be able to handle 4000 transactions per second. Now that that's that's you know, that's 150 times, that's like 200 times what it's doing right now. So talk about immediate scalability being only two months away. And then by the end of this year we have ZK roll ups launching and ZK Porter launching. ZK stands for Zero knowledge. So ZK roll up in ZK Porter, both by the same company. That is going to bring us immediately right away by the end of this year to 100,000 TPS and that's before sharding launches. Sharting is probably coming in 2022 on Ethereum. It's going to probably come after the Proof of Work to Proof of Stake migration. And so the side nets are the side chains or the roll ups are going to have 100,000 transactions per second by the end of this year.

Ethereum’s mainnet. The Manhattan real estate of Ethereum where everyone wants to be--that will have 100,000 transactions per second about a year from now by the end of Q1 early Q2 2022.

So it's a big deal and this is going to significantly increase the number of transactions that are happening on the layer two networks and once the charting launches on the main net and I think I'm very excited about what that means for the total transaction volume and I think it's going to make revenue goes substantially up because Ethereum usage is price elastic. When you reduce the cost of it by 10x usage goes up 100x. And so we're actually going to generate more revenue in terms of transaction fees on the Mainnet even once we scale and that's what I'm excited about. We'll have $0.20 cents for transaction fees on L2 and still have $30 or $40 for transaction fees on L1 but the only one using the Ethereum L1 Mainnet will be people settling millions of dollars in transactions in batches. Like, when Uniswap does its daily batch or when Visa settles its $50 million that day from USDC. That is what's going to be using the Mainnet and as users we will seamlessly be using L2 without even knowing it at $0.20 or $0.30 cents gas fees.

Price Predictions for Bitcoin and Ethereum

Fabian Klauder: man. Super exciting. Um, what are your predictions for if and Bitcoin in the future?

Ryan Allis: Yeah. Well you know, let's let's let's let's look at what's happened just in the last year. Let's start by that. So since the start of let's look at this year, so since the start of 2021, Bitcoin's appreciated in value by 87%, which is pretty good. It's almost doubled since the beginning of the year. However, Ethereum has gone up by 250% since the beginning of the year and I'm going to give you the price prediction but then I want to take another minute or two and explain why. So my friends are often asking me, “Why is Ethereum growing faster than Bitcoin right now?”. And I think it's important to explain to reiterate whenever anyone asks you, It's really just smart contracts and apps that power everything from DeFi, to Token Creation, to NFTs.

And it's not just apps that are not being used. These are apps with billions of dollars in monthly settlement value and total value locked. There's now over $60 billion dollars in total value locked within Ethereum DeFi. And so why is it going to have a big increase this year if it's already increased by 245% in 2021?

Well we've talked about it. It's going to be the supply reduction from EIP-1559 on July 14th due to the burning of transaction fees and it's going to be ETH 2.0 launching by the end of this year. That means that the mining revenues start going to the holders right? That means negative annual issuance. And that means scaling from 16 or 18 transactions per second up by 5,000x to 100,000 transactions per second. And so the thing I want to explain is that Ethereum is going to be providing cash flows to its holders and I want to take a minute to explain that. But first, let me give you my price prediction. I think that I see a reasonable possibility of Ethereum going from anywhere ending 2021, anywhere between $5,000 minimum up to $25,000 at maximum. That’s my 2021 end of year range. My specific prediction is $7,500.

I think we’ll end the year three X where we are now. I think we'll end the year at about $7,500 by the end of 2021. It could be higher. I did a discounted cash flow analysis last week for Ethereum, looking at the Present Value of its future cash flows and I got a $16,770 per Ether price point today. Not five years from now, today. That's what I think Ether should be worth today based on its cash flows. And so I want to take a moment to explain why Ether has cash flows and what that means for traditional finance people that are used to things like price to earnings multiples and are used to things like excel spreadsheets that calculate the fair value of future cash flows.

So we've already talked about this, but starting at the end of this year, mining revenues are starting to go to stakers. All that a staker is someone who holds it that chooses to participate in a staking pool so that the long term holders are going to start getting 100% of Ethereum’s revenue by the end of this year. They’re going to get 60% of the transaction fees in the form of token buybacks or burning, reducing the supply. And then stakers are going to get not only the other 40% once Proof of Stake goes live at the transaction fees. They're also going to get 1.1M new Ether per year as its issuance for its security budget.

So what that means is that the holders, the long term holders of Ether, the asset of Ethereum are going to be getting predictable cash flows that can be modeled in a spreadsheet and just like stocks like Apple that issue annual dividends, Ethereum is going to be issuing daily dividends in the form of staking rewards and daily dividends in the form of token buybacks which operate like stock buybacks. And so for the Wall Street people out there, the traditional finance people like Michael Saylor, who's a little bit behind the eight ball, a little bit behind the curve of understanding the power of Ethereum and why it's actually better and more resilient than Bitcoin. For the people who are coming from the hedge fund world and the traditional finance world. They're going to start realizing that the present value of the cash flows of Ether make it worth over $15,000 per either today.

Not to mention what's going to happen once we see the Ethereum network apps grow and the usage probably grow another 50x by the end of this decade.

So based on all these reasons, I think Ethereum will be going to $7,500 plus by the end of 2021. And I think as people realize the intrinsic value of the cash flows of this asset, I think it will reach $100,000 by 2025. So I'm super bullish.

Fabian Klauder: So you say ETH will… ? I'm sorry didn’t quite hear. Bitcoin or ETH $100,000?

Ryan Allis: No, I'm talking about ETH.

Fabian Klauder: So you say Ether will hit $100,000 in the long run?

Ryan Allis: By the end of 2025 Ether will be $100,000. That's my median case forecast and $7,500 by the end of 2021.

What is the Total Addressable Market for Ethereum?

Fabian Klauder: Okay, so in the startup world we have this term Total Addressable Market (TAM), which basically refers to the revenue opportunity that kind of a project has. So what's what's the total addressable market for Ethereum and how does it fit into your prediction that Ether will hit $100,000?

Ryan Allis: Yeah, that's a really, really great question. So it's very important to understand the total wealth in the world, right? And so the total value of all the wealth in the world right now, according to Credit Suisse in 2020 is $420 trillion dollars okay. $420 trillion. So right now Bitcoins at about one trillion. So the total value of all the wealth in the world is about 420 times the value of Bitcoin right now. Now, when we add in Ethereum we add in all the other crypto assets right now, the total market caps about 2.1 trillion and so we're at about roughly half of 1% of the total wealth in the world is currently exchanged and traded and secured on blockchains.

So it's important to understand that we're at a very small amount right now and I'm very clear we saw this with Gamestop, we saw this in January with all the Robin Hood issues. That all securities, all companies stocks, will trade on the Blockchain because the Blockchain and distributed ledger technology are simply better ways to secure and verifiably predict ownership and assure ownership of any asset. And so all stocks are going to be trading on the Blockchain by the end of the 2020s. By the end of this decade, the large majority of the global money supply is going to be moving over the next 15 years away from the old model, which is fiat based nation state currency, two Decentralized non nation state based currency and it’s essentially internet money.

You know what is the largest country in the world? It's not China by population, it's the internet. The internet has over four billion people on it now and so we're moving to a world where the internet is becoming its own super nation if you will and the money of the internet I think will be Ether. Um and so when I say, I think per Ether, we're going to get $100,000 per token by 2025, I think probably double that by 2030. We have to look at what that does to the total market cap of Ether. And so when you look at the market cap today, $300 billion. I'm predicting about another roughly call it 100x on that. So I think the Ether market cap will reach about $30 trillion by the end of this decade.

And that will still, keep in mind, I think it's going to be the primary monetary asset in the world, that will still be less than 10% of the total wealth in the world. And so whenever I make an analysis like this, I look at it in terms of the macro picture and you have to make sure that whatever you're predicting makes sense. So right now there's about $20-$26 trillion. Sorry let me get you an exact number. There's currently $20 trillion US dollars in the world. Uh and I think there'll be another $30 trillion dollars worth of Ethereum by the end of this decade.The US dollar will probably expand quite a lot by then. So I think by the end of this decade the amount of value stored in Ethereum will be equal to the amount of dollar amount of value stored in the US. dollar.

Some of Ethereum’s Competitors

Fabian Klauder: Yeah that's what makes me really excited about Ethereum because basically any financial asset in the world can be replicated on Ethereum like, real estate, bonds, stocks, Synthetic assets, derivatives, like literally everything. And that's what the total addressable market for Ethereum is and that's why a price of $100,000 for Ethereum is not that crazy to be honest. So yeah it's super exciting.

Ryan Allis: It's going to happen this decade. It's it's a matter of time. You know, we should talk for a moment about potential competitors, you know, just so just so we cover that topic. The one I'm most excited about that you talk about often on this show is Polkadot. Uh and I, I think it's important to understand Polkadot does not directly compete with Ethereum. I'm a big believer in a multi chain future, just like you. I believe Ethereum will win, I believe Polkadot will win, I believe Solana will win, Cosmos will win, I believe Avalanche will win. Everything compared to where they are now. Everything is pretty much going up 30 or 40x from here, except Doge which is probably going to crash to zero but everything else.

Everything is going up about another 30x or 40x where it is now because it actually has real utility. And a Blockchain technology, like Polkadot, is able to provide application specific block chains that are interoperable. Uh and so I think we're gonna see a lot of development interest in Polkadot. It's going to be launching its mainnet toward the end of this year. Kussama, it’s Canary network is launching in June coming up there about a month and a half from now.

Polkadot, the main network is starting to conduct it's para chain auctions this summer, it's going to be launching its first apps by the end of 2021. I think Polkadot is probably going to go up even faster than Ethereum. Um and I think Ethereum will go up even faster than Bitcoin. So I own all of them, they're all going to win, we're living in a multi-chain world and um I really am excited about all the innovation that is happening to create a global monetary system that works for everybody where the poor, the people who are saving their money don't get screwed by the banks paying negative interest rates and instead people can actually save their money and something that appreciates in value every year in which the supply is fixed or declining and in which everyone can thrive, creating a global world that truly has more equality of opportunity and environmental sustainability. I think those are the two big opportunities of our generation.

Where to Follow Me For More Alpha...

Fabian Klauder: Yeah, totally agree. Um Ryan to end this interview, where should people go follow you if they want to read more about your content.

Ryan Allis: So three places. Number one, follow me on Twitter, I'm @Ryanallis. On Substack my newsletter Coinstack is free. I put it out to over 2,500 subscribers every week, it’s at coinstack.substack.com. I write about a 15 to 20 page newsletter with all the details and graphs and charts and predictions every single week. And lastly, if you want to follow our Telegram group, that's also free, you can go to, t.me/thecoinstack and subscribe to that for free and I'm very happy to support anyone through their crypto journey.

Fabian Klauder: Well, that's it for today. I hope you got some value out of this episode. I really recommend you to check out Ryan's newsletter Coinstack. I'm an active subscriber. Also follow him on twitter and join his telegram group. The links are in the description below as always.

Coinstack Telegram Community

Joinour Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1100 members on our Telegram.

A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

75% of Portfolio

Ethereum (ETH) 30% of portfolio

Bitcoin (BTC) 10% of portfolio

Polkadot (DOT) 10% of portfolio

Nexo (NEXO) 10% of portfolio

ThorChain (RUNE) 10% of portfolio

Kusama (KSM) 5% of portfolio

25% of Portfolio - About 1.5% Each

Voyager (VGX)

Uniswap (UNI)

Chainlink (LINK)

Terra (LUNA)

Cosmos (ATOM)

Polygon (MATIC)

Decentraland (MANA)

Ocean Protocol (OCEAN)

Harmony (ONE)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymath (POLY)

Origin (OGN)

PankcakeSwap (CAKE)

The People I’m Following Closely on Twitter

Mrs. Bubble The NFT Artist (my wife Morgan Allis)

How To Get Started With Crypto Learning

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Substack at CoinStack.substack.com

Please share with your friends and colleagues.