Learn More at www.amphibiancapital.com, and www.digitalassetresearch.substack.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week, the ETH ETF approval was delayed, VanEck filed for Solana ETF, a judge excluded a secondary sales charge from the SEC case against Binance, and big new venture rounds for Iris Energy ($413M) and AlloraLabsHQ ($35M).

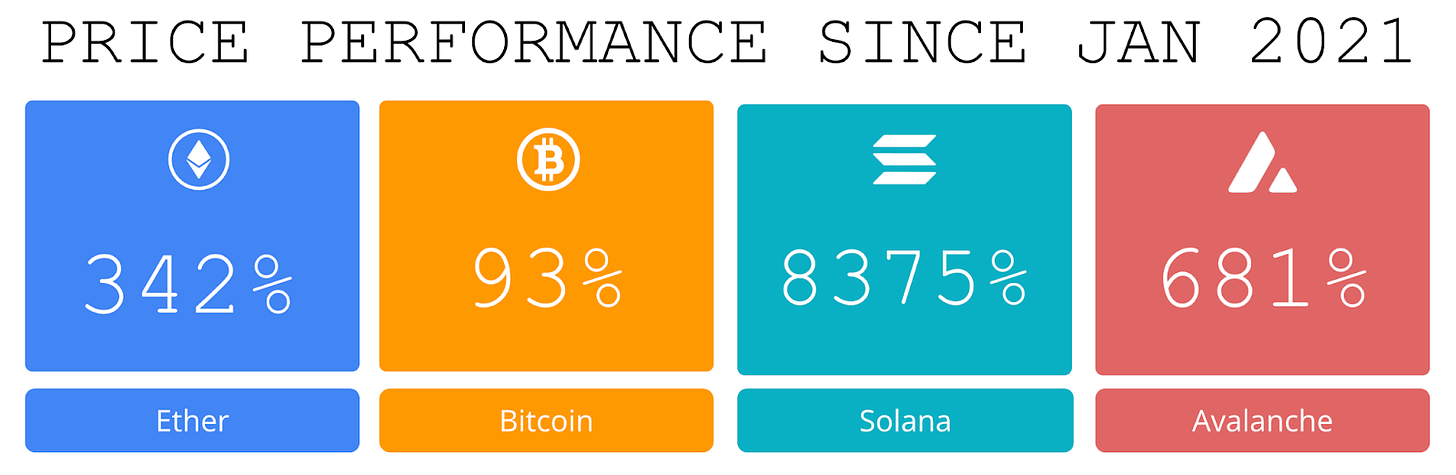

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

1995 Digital Asset Research pushes the boundaries of conventional investment wisdom, uncovering hidden market secrets to provide you with a truly unique and unmatched edge. Our emphasis on broader market cycles and in-depth analysis of on-chain crypto projects aims to help you achieve your investment goals. With our actionable insights, market research, and Web 3 tech tutorials, we empower you in the crypto universe, awakening you to the immense power of digital assets.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

👨⚖️ Ethereum ETF Approval Delayed Until July 8: The highly anticipated launch of spot Ethereum ETFs has been delayed. Analysts had expected approval by July 2, but the U.S. Securities and Exchange Commission (SEC) has requested issuers submit revised filings by July 8.

⚖️ VanEck files for Solana ETF in the US, claiming SOL is a commodity: Fund manager VanEck filed for an exchange-traded fund that would track the price of Solana.

🏛 Judge upholds 'bulk' of SEC case against Binance but nixes secondary sales charge, among others: A federal judge mostly rejected Binance’s attempt to throw out the SEC’s charges against the exchange and its founder in a widely-anticipated lawsuit separate from the Department of Justice case that has already landed Binance founder Changpeng Zhao in prison.

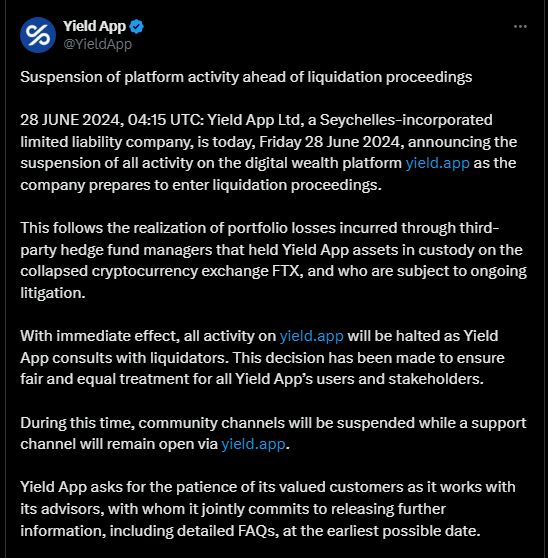

⚖️ Yield App suspends activity and enters liquidation proceedings, citing FTX collapse: Yield App announced the immediate suspension of all platform activities as it enters liquidation proceedings. Community channels will also be suspended, while a support channel will remain open via the yield.app.

🚀 Circle becomes first stablecoin issuer to secure regulatory approval under MiCA: Circle announced on July 1 that it has received an e-money license from France, positioning it as the first global stablecoin issuer to comply with the EU’s Markets in Crypto-Assets (MiCA) regulations.

💬 Tweet of the Week

Source: @tradetheflow_

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Solana is now on the way to doubling Ethereum in daily DEX volume

Source: @martypartymusic

2. ENS FDV up from $1B to $3B over the past year

Source: @tokenterminal

3. Through the month of June, over 1.12M $ETH ($3.8B) net outflows occurred from exchanges as ETH liquidity continues to trend downwards. This represents a change of 6.4% month-over-month.

Meanwhile, ETH staking rates continue to grow to new all-time highs, with now more than 33.2M ETH staked, roughly 28% of the entire supply.

Source: @DavidShuttleworth

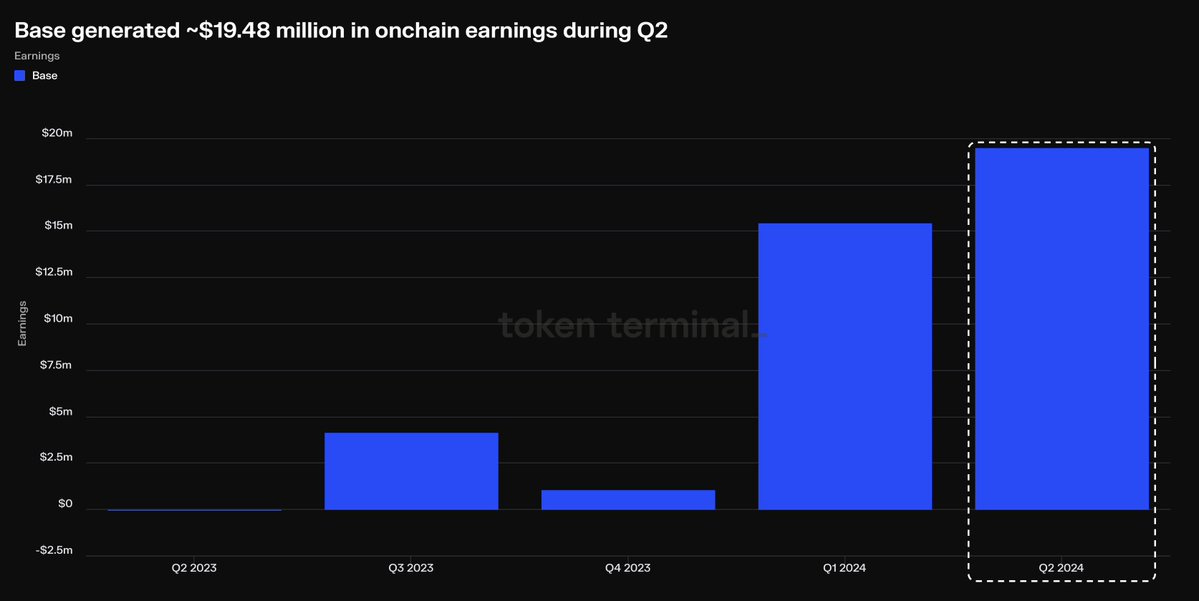

4. Base generated ~$19.48 million in onchain earnings during Q2.

Source: @tokenterminal

5. Polymarket saw ~$213 million in trading volume during Q2.

Source: @tokenterminal

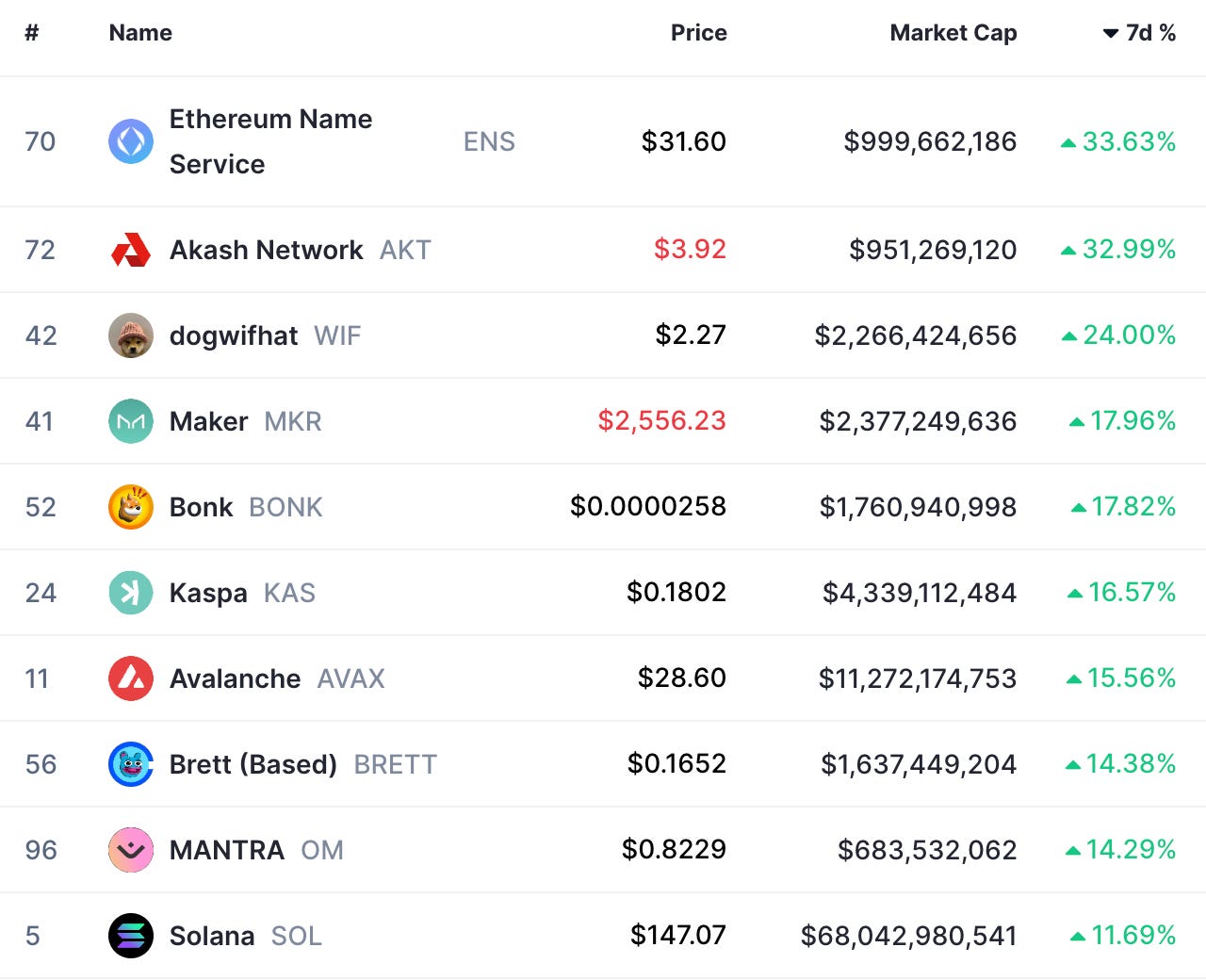

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Introduction

The first half of the year has been a rollercoaster for investors, with markets experiencing significant upside and relatively low volatility. The majority of investors have been stumped by the market because of the disconnect between this market and what they have experienced in the real economy.

As we approach mid-year, stocks have rallied impressively through the first half, sparking optimism among traders. However, this optimism comes with cautionary notes this month as technical indicators and time cycles suggest potential turbulence ahead.

Meanwhile, the crypto market has faced its own set of challenges, yet it now presents what appears to be a substantial buying opportunity, especially for and Ethereum and other alts. As the first half comes to a close, it's crucial to understand the signals and patterns that may shape the coming months.

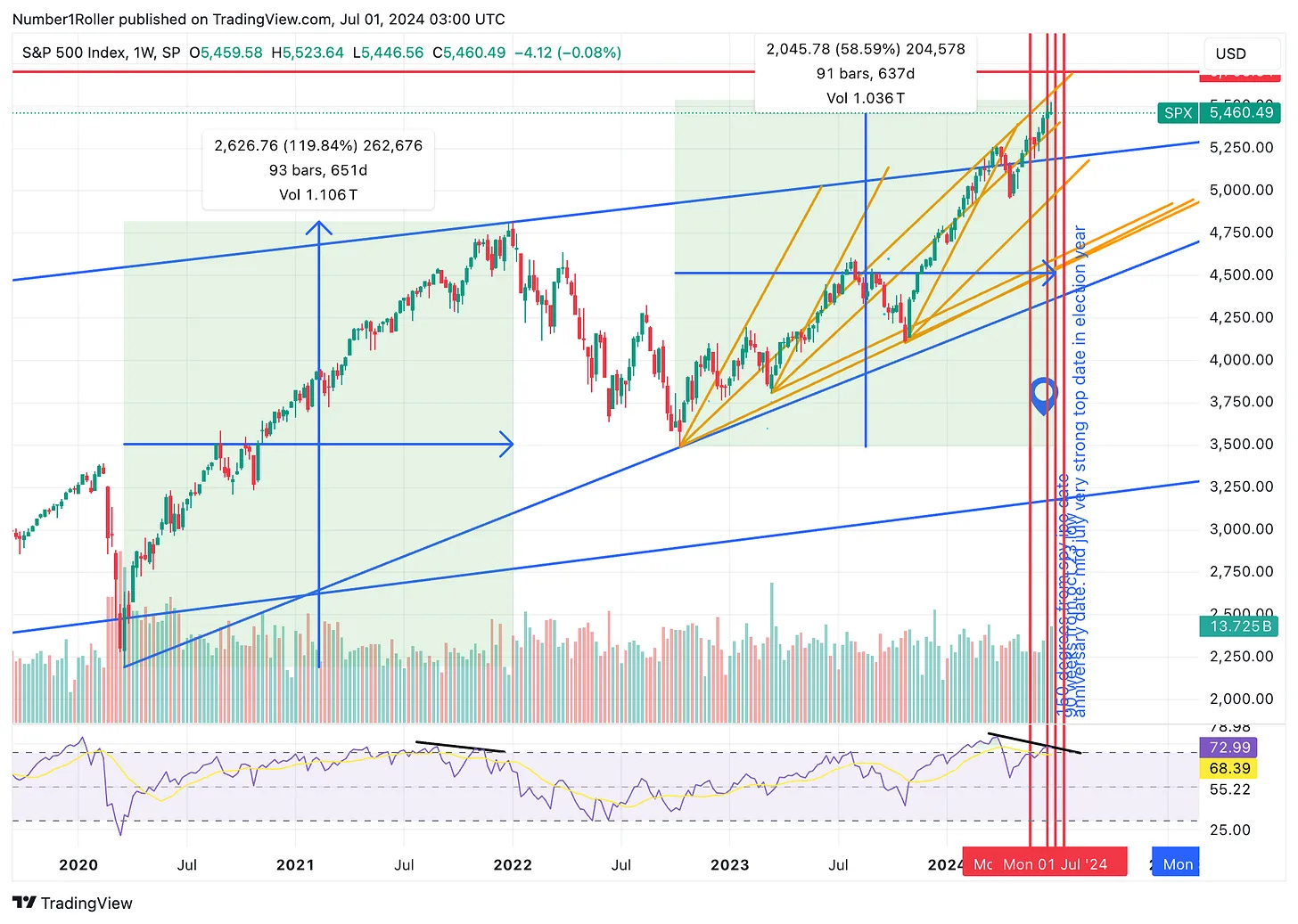

Now, lets take a look at where we are starting with the S&P500.

I believe stocks may be entering a danger zone on this rally. Zooming out here to the weekly we can see the balance of time coming into effect. From the covid crash to the top was 93 weeks. We are now entering week 91 of this move. Additionally we have a bearish divergence forming on the RSI as you can see in the two black lines below. Price is making a new high while RSI is not. There is still room to move up over the next week or two but be warned we could see a correction into that August window that I have been highlighting since the beginning of the year.

If we zoom in to the daily we are also seeing warning signs.

First, we have the two nearly symmetrical moves off of the bear market low. Again another 200 points to the upside would not surprise me here as it would bring this move to 150% of the previous move and create an even bigger divergence. Additionally, getting even closer we can see a cluster of signal candles forming a double top. And finally, you can see that I have the 17th of this month marked as an anniversary date that is a very strong top date in election years.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com, and www.digitalassetresearch.substack.com