Social Links: Twitter | Telegram | Podcast | Newsletter | Fund

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we summarize the top news, stats, and reports in the web3, crypto, and metaverse ecosystem.

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Ethereum Upgrades Successfully, White House Releases Framework for Crypto Regulation

💵 Weekly Fundraises - Doodles ($54M), Portofino ($50M), Yellow Card Financial ($40M), Messari ($35M)

✨ Peer Partners With Fresh Consulting To Bring the AR Metaverse to Market

📊 Key Stats - Ethereum Average Daily Active Addresses Grew by 5%, Transactions on Arbitrum Grew 3x, Bitcoin Returns Correlated With US-Tech Stocks

🧵 Thread of The Week - Consequences of the Ethereum Merge

📝 Report Highlights - Messari’s State of Ethereum Q3 2022

🎧 Best Crypto Podcasts of the Week

📈 Top 10 Tokens of the Week

👂 Coinstack Podcast Episodes

Ethereum is leading the way among major L1s in price performance since the June bottom

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Amphibian Capital is a crypto fund of funds investing in the world’s leading crypto hedge funds. They have researched 250+ crypto funds, vetted 50+, and selected the best based on a proprietary scoring system for their fund of funds, providing accredited investors with the ability to gain diversified crypto quant fund exposure with one investment. Amphibian Capital offers a USD-denominated fund and an ETH-denominated fund. Learn more at www.amphibiancapital.com

We have one newsletter sponsorship spot available for Q4 2022 - please reply to this email for details and see our Coinstack Sponsor Deck here.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) 🥳 Ethereum Switches to Proof-of-Stake After 7 Years of Work - Ethereum has finally switched its underlying consensus model to proof-of-stake (PoS), following the culmination of seven years of planning by the blockchain’s core developers.

2) ⚖️ White House Releases ‘Comprehensive Framework’ for Crypto Regulation and Development - The White House has today released a “First-Ever Comprehensive Framework for Responsible Development of Digital Assets” outlining the conclusions and recommendations of various federal agencies after six months of studying the crypto industry.

3) 🇰🇷 South Korea Issues Arrest Warrant for Terra CEO Do Kwon - A South Korean court has issued an arrest warrant for Terraform Labs founder Do Kwon, four months after the Terra ecosystem’s $40B implosion.

4) 😔 Wintermute Hacked for About $160 Million in DeFi Operations - Crypto market maker Wintermute said about $160 million had been hacked from its decentralized finance unit, the latest in a string of exploits hitting the digital assets industry.

5) ⚖️ Senator Toomey Challenges Gensler’s View That Nearly ‘All Crypto Tokens Are Securities’ - SEC Chairman Gary Gensler faced a fierce grilling over the regulatory body’s role in defining rules for crypto, including the chairman's view that nearly all cryptocurrencies currently trading today are likely unregistered securities.

6) 😮 SEC Suit Makes Novel Case for US Jurisdiction Over Ethereum Network ICO Fundraising Transactions - Potential argument for SEC oversight is buried in a lawsuit against Balina stemming from a 2018 ICO raise. The SEC says Ethereum network nodes are most densely clustered in the US.

7) 💸 U.S. Permits Tornado Cash Users to Access Crypto Deposits - Persons requesting a license must provide detailed information concerning the previous transactions involving Tornado Cash, including the wallet address, the date and time of the transaction, the sum of crypto assets sent to Tornado Cash, and previous transaction hashes.

8) 🤑 L2 Boba Integrates with Avalanche – Layer-2 scaling solution Boba Network has expanded its support to the Avalanche blockchain. According to Ava Labs, Boba is Avalanche’s first Layer 2 solution and will offer developers a new scaling toolkit.

9) 😐 Ethereum Fork ETHPoW Gets Off to Rocky Start - Hours after Ethereum successfully completed its historic merge to proof of stake, ETHPoW—the POW rival offshoot that lacks major stablecoin and app support—took its own mainnet live Thursday afternoon and ran into some big tech issues.

10) 🏦 Celsius Banks on Future With New Plan Named ‘Kelvin’ - Celsius sparked a flurry of anxiety over liquidity issues in the crypto lending space after the company was unable to meet $5.5 billion in liabilities due to bad loans.

📺 Webinar - Vetting Crypto Hedge Funds

Amphibian Capital has researched over 250 crypto hedge funds, vetted over 50, and selected the 18 best for its crypto fund of funds. We have designed this webinar to share what Amphibian has learned with other accredited and institutional investors about the process of vetting crypto hedge funds and identifying the best crypto hedge funds for your investment objectives. You can learn more and register here.

Thursday, September 22, 202212pm PT / 3pm ET / 7pm GMT55 minutes on Zoom / register herePresented by Ryan Allis, Publisher of Coinstack and GP at Amphibian Capital

What You Will Learn

The key questions to ask when you’re diligencing a crypto hedge fund: counterparty risk, leverage, domicile, partner background, investment committee, security, custody, chain exposure, stablecoin exposure, AUM, trading strategies, monthly returns, fees, and liquidity

How Amphibian Capital designed its fund of funds by researching 250 crypto funds, vetting 50+, and selecting the 18 best

How Amphibian’s currently selected 18 underlying crypto funds in its USD-Denominated Fund of Funds have averaged a +15% net return in 2022 YTD (through Aug 1) while many other crypto funds were down big (see the results of the selected funds)

How Amphibian’s currently selected 7 underlying crypto funds in its ETH-Denominated-fund-of-funds have averaged +20% net return YTD through Aug 1, 2022 (in excess of ETH’s performance)

The four types of crypto hedge funds - yield funds, token funds, venture funds, and quant funds -- and what each type of fund is optimized for

How the fund of funds model can add diversification while mitigating risk and drawdowns — while enabling lower minimums per investor

What each type of crypto fund offers for minimums, liquidity, potential returns, and potential drawdowns

How the underlying selected funds performed in 2019-2022 for both the USD-denominated fund and the new ETH-denominated fund

The primary trading strategies of crypto quant funds - algorithmic, machine learning, arbitrage, market making, and derivatives

Why avoiding major market drawdowns matters so much for long-term investment results

If you're a long-term Ethereum holder, how to earn ETH-on-ETH returns (USD Fund vs. ETH Fund)

Details on the Oct 1 opening for accredited investors to invest in our fund of funds that enables diversified exposure to our selected crypto hedge funds

Who This is For…

This webinar is tailored to large ETH holders, accredited investors, institutions, family offices, hedge fund managers, wealth advisors, and RIAs.

For Large ETH holders

For institutional investors and accredited investors

For hedge funds or family offices

For financial advisors advising HNWIs

💬 Tweet of the Week

Source: @brian_armstrong

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

✨ Peer Partners With Fresh Consulting To Bring the AR Metaverse to Market

About Peer: Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Peer Inc., a metaverse technology company, has announced a new partnership with Seattle-based innovation agency Fresh Consulting. Peer will be working with Fresh to deliver on its vision of a gamified digital layer on top of the world, and support its mission to bring people and content into the metaverse. Fresh will provide an elite team of engineers, developers, designers, and strategists who build innovative end-to-end solutions for some of the world’s largest tech companies.

“AR is eating the metaverse,” said Tony Tran, CEO & CTO, Peer Inc. “We were searching for a crack-shot execution team to deliver on our massive AR vision to leapfrog ahead of the competition. We found it at Fresh. Their impressive portfolio and extensive service offerings position us to advance our mission in short order.”

Peer will work with Fresh to develop hardware and software experiences over Peer’s decentralized blockchain to drive mass adoption, give users ownership of their data and help them monetize what they create online. “The metaverse is inevitable,” said Tran. “We see a clear path to a magical AR experience in a coherent product that people will want to use every day. Blockchain will give peers what they need to go from digital experience to digital reality. We’re so excited about what’s coming we can hardly sit still.”

In a recent podcast with Fresh Consulting on the metaverse, Tran elaborated on its immense potential. “In the simplest embodiment, the metaverse will exist as a three-dimensional expansion of the web that we know and love today. Metaverse content will exist everywhere and connect everything. It’s really like a merging of the present web that we know, all the data that’s on the web, plus all of the connected devices, and then mapping that against the physical world.”

Fresh is a fifteen-year-old company with over 380 employees, headquartered in Bellevue, Washington, with offices in Portland, Bangkok, Austin, Dallas, and Houston. Fresh has delivered award-winning work while serving over 400 clients, from startups to Fortune 100 companies. They provide holistic, end-to-end solutions across strategy, design, software, and hardware.

“We're really excited to be working with Peer given where the future is going,” said Fresh Consulting CEO Jeff Dance. “Today, there are already a billion devices with augmented reality, and in the future, the Holy Grail is where technology disappears. How we make AR a natural human experience is the promise of the metaverse.”

For more insight on the future of AR and the metaverse, please watch this 5 minute interview with Jeff Dance, Tony Tran, and Peer COO Heath Abbate.

About Peer Inc.

Peer is an AR metaverse technology company building a gamified digital layer on top of the world. Peer is headquartered in Seattle, Washington. To learn more, please visit peer.inc and follow Peer on Twitter @peerpmc.

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Ethereum Average Daily Active Addresses Grew by 5% to ~550,000

Source: Messari

2. Average Transactions on Arbitrum Grew Almost 3x, From 39,000 in January 2022 to 115,000 in August 2022

Source: Messari

3. Bitcoin Returns Have Increasingly Correlated With US-Tech Stocks Since the Liquidity-Fueled Bull Market Ended in Late 2021

Source: Messari

4. Transactions on Rollups Are Up to 20x Cheaper Compared to ETH

Source: Messari

5. In August, the Spot Trading Volume on Top Exchanges Rose 41.6% to $1.79T, the Highest Monthly Volume Recorded in 2022

Source: CryptoCompare

6. Average Lending Volumes Declined Sharply in Q3. Daily Average Fell From $280M per Day in Q2 to $116M

Source: Messari

7. The Total Long Liquidations in August Were $5 Billion, Less Than Half of That in June ($10.8 Billion)

Source: Messari

8. NFT Sales Have Averaged Less Than $1 Billion per Month in Q3 Compared to $4.6 Billion in Q2

Source: Messari

9. Ethereum and Its L2 Ecosystem Have a Combined Share of 62% of Total Crypto Smart Contract TVL

Source: Messari

10. In the Bear Market, Development Activity on Ethereum Has Stood Up Better Than on Other Ecosystems, With Its Share Increasing by 10% Compared to Last Year

Source: Messari

🧵 Thread of the Week - Consequences of the Merge

By: @VivekVentures

1. ETH ISSUANCE IS DOWN 95%

This means that under PoS, the protocol needs to issue 95% less ETH (for arguably more security)

http://Ultrasound.money shows that in the last 3 days, post-Merge ETH issued was 2,365 ETH. Under PoW, that issuance would have been 42,691 ETH

In USD terms (using $1400/ETH), that means the total potential USD sell pressure under PoS over the past 3 days was $3.3mm

Under PoW, this would have been $59.8mm of potential sell pressure

Is this a meaningful dollar amount? Today, no. But it will compound over time

Validators cannot sell block rewards for 6-12mo, so this makes PoS sell pressure ~ zero

If we assume ETH price stays at $1400 for a year, total annual PoW sell pressure would be ~$7bn, or 4.2% of ETH’s market cap

4.2% -> 0% is a meaningful reduction in sell pressure

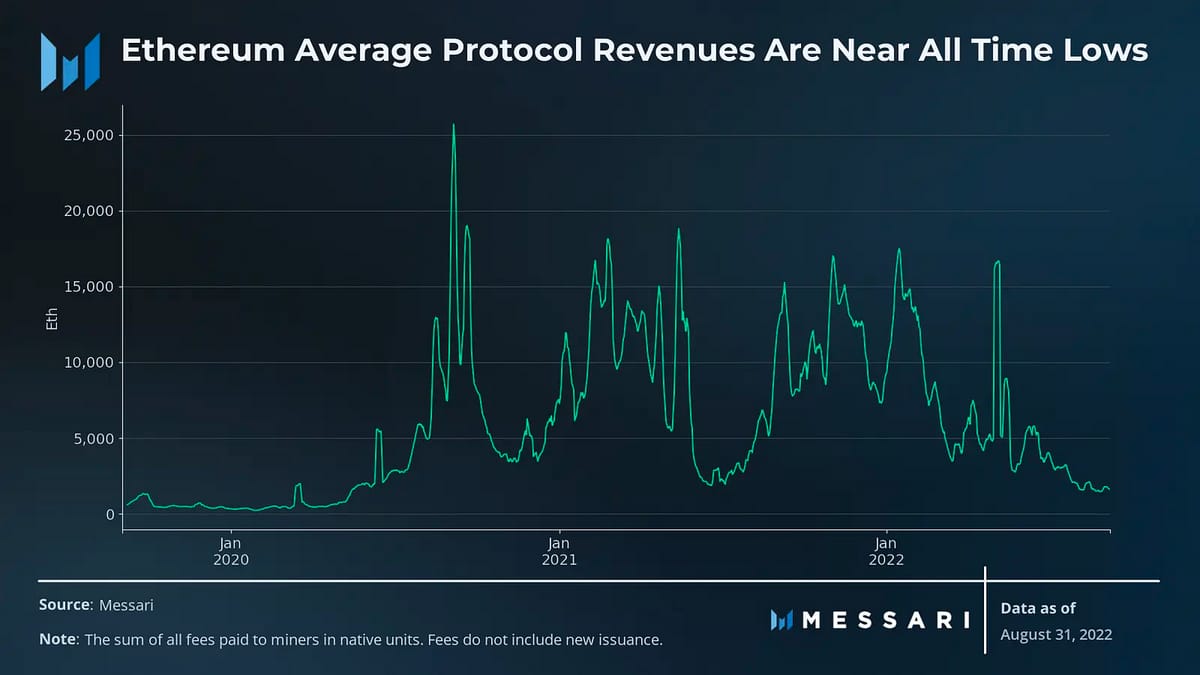

Note that ETH fees are in a bear market

If ETH gas is > 15 gwei, ETH issuance is deflationary and there is buy pressure under PoS vs sell pressure under PoW

ETH’s structural issuance shift is massive, and the effect will play out over time (just like BTC halvings)

2. ETH ELECTRICITY USAGE IS DOWN 99.988%

Without getting into mental gymnastics of PoS vs PoW, we are in a global energy crisis; using less energy is better

Institutions can now allocate to ETH an ESG-friendly crypto asset

(Table from Crypto Carbon Ratings Institute)

In summary, post-Merge PoS ETH has two immediate monumental changes:

1. 95%+ reduction in issuance and zero sell pressure from block rewards

2. 99.988% reduction in electricity usage

This makes ETH an increasingly attractive part of a diversified crypto portfolio

So why are knives out from BTC maxis?

1. They attack PoS - labeling it as a security and as a centralization vector. That argument is tenuous

2. There’s a belief that PoW security and decentralization is better. That’s just mathematically wrong

We’ll get into PoS vs PoW next time

However, competition (which BTC maxis should support) is good for the industry

And the ETH Merge results in a fully differentiated competitor to BTC that can bring in new capital

Isn’t that what we want for widespread crypto adoption?

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and is building data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Key Insights

Ether, the asset, experienced a strong bounce back from Q2 lows, but Ethereum the network struggled to regain the same level of transaction volume, fee revenue, total value locked, or user activity from prior to the May sell-off. Behind the scenes, the picture was brighter as Ethereum continues to dominate smart contract network developer share.

User activity did pick up on Layer-2 as Ethereum’s rollup-centric roadmap seems to be slowly materializing. Total value locked on both Optimism and Arbitrum reached $1 billion.

A successful transition to Proof-of-Stake just prior to the release of this report set up a new era for Ethereum. With a 99% reduction in energy usage, a potentially deflationary underlying currency, and an investable yield, Ethereum may finally find some of the institutional adoption proponents have long clamored for.

A Primer on Ethereum

The Ethereum Blockchain network is a decentralized data storage and transaction validation platform. The breakthrough introduction of smart contracts and a virtual machine on the network creates a decentralized Turing-complete software solution. There are thousands of individual tokens and applications built on top of the Ethereum blockchain. The protocol gained broad recognition after developing a deep decentralized finance ecosystem and, more recently, many interesting Web3 use cases. The protocol made the transition to Proof-of-Stake from Proof-of-Work on September 15, 2022. Today, Ethereum is the world’s second-largest cryptocurrency by market capitalization.

Key Metrics

Performance Analysis

Crypto markets rebounded in Q3 2022, partially recovering from the Terra and macro-induced meltdown in Q2. Ether outperformed from a price perspective in anticipation of the changing tokenomics and users accumulating spot assets on the potential for airdrops stemming from The Merge. On September 15, Ethereum successfully executed its consensus change from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This transition ushered in a new era for the largest smart contract platform. Post-Merge, daily block rewards declined from roughly ~13,500 ETH to ~2,000 ETH, which has greatly reduced the network’s security expense.

Active addresses and transactions have remained largely stable for Ethereum with relatively minor changes QoQ. While addresses and volumes may tick up with wider crypto adoption, Ethereum’s scaling will come from Layer-2 solutions rather than a more performant base layer.

The protocol’s revenue was brought down by the combination of another crypto bear market, increased volume on L2s, and the upgrades in protocol contracts for gas efficiency. Consequently, total fees fell off a cliff in Q3, dropping to their lowest levels since 2020. If these fees continue to fall into the back half of the year, they will directly impact the staking yields in a post-Merge world.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

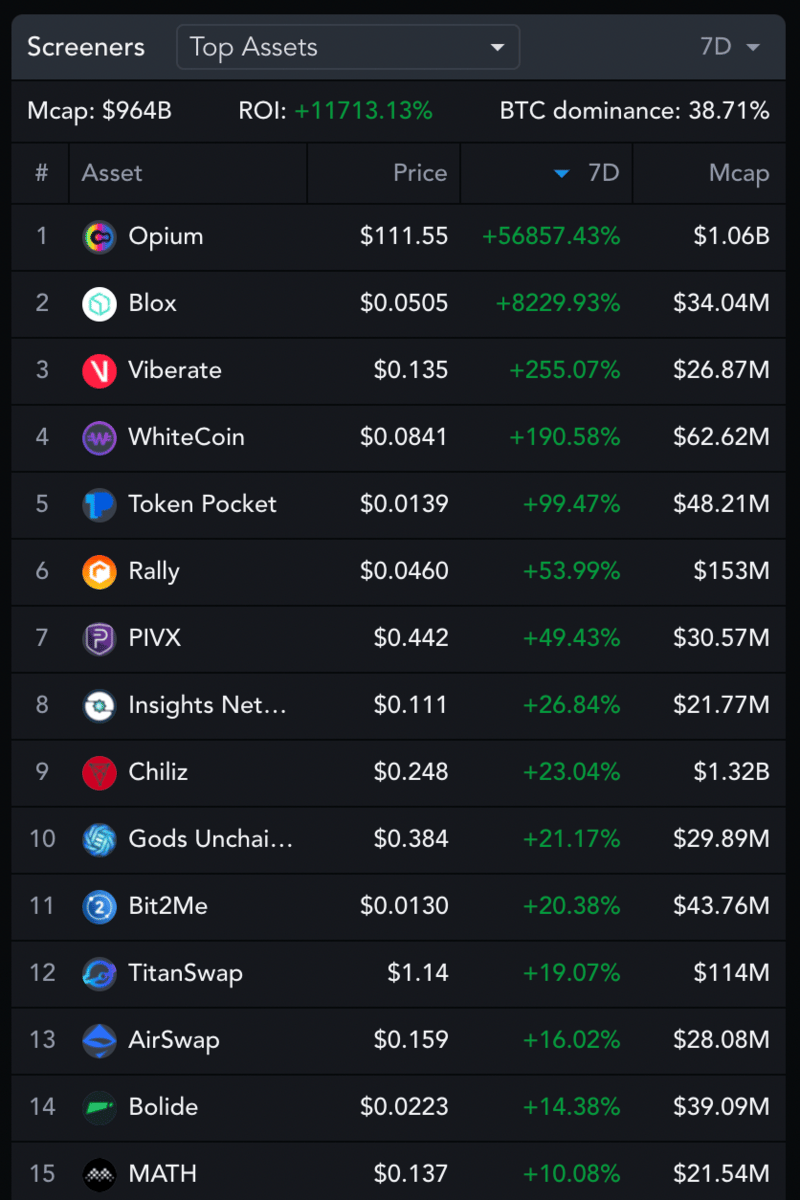

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Viberate is a Governance Token, Bolide is a Yield Navigator, Luna Classic is an L1, Neblio is an L1

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 31,086 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com