Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com

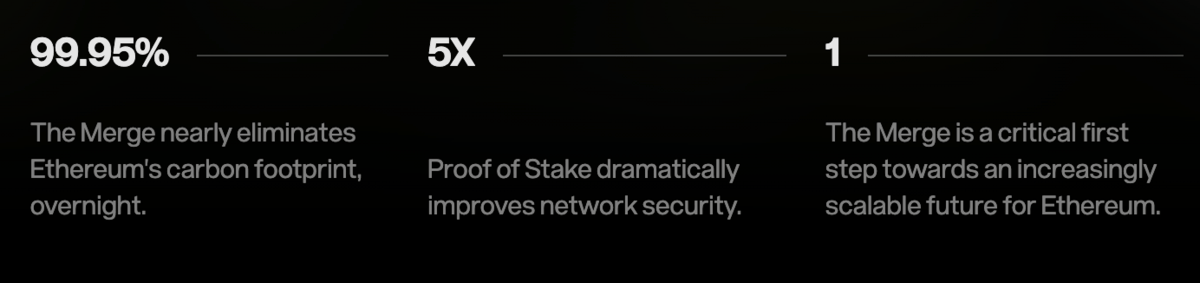

Issue Summary: Ethereum, the #1 global financial internet settlement layer is getting a major upgrade to proof-of-stake which will be going live tonight around midnight ET. We also write about the top crypto news, stats, fundraises, and reports of the week, our webinar tomorrow for large ETH holders, and the world’s first ETH-denominated crypto fund of funds.

Track the final countdown at Ultrasound.money

Source: Consensys Merge

In This Week’s Issue:

🗞️ Top Weekly Crypto News - ETH’s Merge Could Lead to Larger Institutional Adoption, CME Group Announces Launch of Ether Options, Binance Will Stop Supporting USDC

💵 Weekly Fundraises - Mysten Labs ($300M), MetaWeb Ventures ($30M), Community Labs ($30M)

📰 Featured Article: World’s First Ethereum-Denominated Crypto Quant Fund of Funds Launches - Designed for Large ETH Holders

📊 Key Stats - ETH Is Up 70% Since Early July, NFT Mints on Solana Have Surged, Google Searches for, “Ethereum Merge” Have Spiked

🧵 Thread of The Week - Making Sense of Ethereum Scaling Technology

📝 Report Highlights - Governor Note: Coinbase USDC Institutional Rewards for MakerDAO

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

📈 Top 10 Tokens of the Week - AMB, LUNC, BLID

👂Coinstack Podcast Episodes

ETH leading the way right now among major L1s, up 78% since the June lows

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- an AR metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Amphibian Capital is a crypto quant fund of funds investing in the world’s leading crypto quant funds. They have researched 250+ crypto funds, vetted 50+, and selected the 18 best based on a proprietary scoring system, providing accredited investors and institutional allocators with the ability to gain diversified crypto quant fund exposure with one investment. Learn more at www.amphibiancapital.com

We have one remaining newsletter sponsorship spot available for Q4 2022 - please reply to this email for details and see our Coinstack Sponsor Deck here.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) 💸 Ethereum Blockchain’s Upgrade May Lead to Greater Institutional Adoption of Ether - Investors who are barred from buying tokens that run on proof-of-work systems may be able to buy ether after the blockchain switches to proof-of-stake, Bank of America (BAC) said in a recent report.

2) 🚀 CME Group Announces Launch of Ether Options - “As market participants anticipate the upcoming Ethereum Merge, a potentially game-changing update of one of the largest cryptocurrency networks, interest in Ether derivatives is surging," said Tim McCourt, Global Head of Equity and FX Products, CME Group

3) 🏎️ KKR Makes PE Fund Available on Avalanche - KKR is making a slice of one of its private-equity funds available on Avalanache, in the latest bid to expand individual investors’ access to private investment vehicles.

4) 🏳️ Algorand Foundation Declares $35M Exposure to Troubled Crypto Lender Hodlnaut - Algorand Foundation, a nonprofit body that supports the Algorand blockchain and oversees its development, declared a $35 million exposure to beleaguered crypto lender Hodlnaut.

5) 🇦🇺 Blockchain Australia Lands Former BlackRock Director as New CEO - Blockchain Australia, the nation's industry body advocating for appropriate regulation and policy, has appointed Laura Mercurio as its new CEO, the organization said on Wednesday.

6) ⚖️ 40 State Regulators are Opening Celsius’ Books in Search of Fraud – Vermont is requesting the appointment of an examiner with “broad powers” to further investigate embattled crypto lender Celsius and its financials.

7) 💸 Coinbase Looking To Acquire $1.6B of MakerDAO’s USDC - The very-centralized crypto exchange Coinbase has proposed an investment line with MakerDAO, the organization behind the largest decentralized stablecoin.

8) 👋Crypto Lender Voyager to Auction Off Assets on Sept. 13 - Insolvent crypto lender Voyager Digital will auction off the remainder of its assets on Sept. 13 as it moves through the Chapter 11 bankruptcy process, according to a Tuesday court filing. The auction will take place at the New York offices of Voyager’s investment bankers, Moelis & Company.

9) 🇨🇦 Canadian Crypto Exchange Coinberry Files Lawsuit Against 50 Users After Losing 120 BTC - Canadian cryptocurrency exchange Coinberry has filed a lawsuit against 50 users who collectively withdrew 120 bitcoins (BTC) following a software error in 2020..

10) 🇺🇸 US Government Recovers $30M From Crypto Game Axie Infinity Hack - Crypto analytics firm Chainalysis announced Thursday it helped the U.S. government recover about $30 million stolen from online video game Axie Infinity earlier this year.

💬 Tweet of the Week

Source: @patrickc

Webinar: ETH Whales: How To Invest Your ETH Stack

Amphibian Capital announced this month the launch of the Amphibian ETH Alpha Fund, LP, the world’s first Ethereum-denominated crypto quant fund of funds. The fund offers a new way for accredited investors who are large holders of Ether (ETH) to invest in a portfolio of ETH trading funds that pay out returns in ETH. The fund launched with over 10,000 ETH committed. The firm has capacity for 250,000 ETH in the fund. We will be giving a webinar on this topic tomorrow. You can learn more and register here.

Thursday, September 15, 202212pm PT / 3pm ET / 7pm GMT55 minutes on Zoom / register herePresented by Ryan Allis, Publisher of Coinstack and GP at Amphibian Capital

What You Will Learn

Why we are bullish on Ethereum for the 2024/2025 Bull Cycle following the move to Proof of Stake and a reduction in ETH supply

What we recommend large ETH holders (100+ ETH) do to grow their ETH holdings over time

Whether you should HODL your ETH, stake your ETH, or invest your ETH in Ether-denominated trading funds

How we evaluated 250+ funds, vetted over 25 that were ETH-denominated, and selected 8 for our fund of funds, the Amphibian ETH Alpha Fund

How ETH-denominated quant funds have grown ETH over time for large whale holders (we'll look at the historical results for the underlying funds)

How these funds generate ETH-on-ETH returns through derivative selling, algorithmic trading, and machine learning

How we found 8 world-class ETH-denominated quant funds – combining them into one diversified fund-of-funds vehicle accredited investors can invest in with a single allocation

How the underlying selected funds performed from March 2019-August 2022

Details on the next opening for accredited investors to invest in our fund

Requirements

For institutional investors and accredited investors

For portfolio managers inside hedge funds or family offices

For financial advisors advising HNWIs

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📰 World’s First Ethereum-Denominated Crypto Quant Fund of Funds Launches, Designed for Large ETH Holders

Amphibian Capital Launches Ethereum Trading Fund-of-Fund with Over 10,000 ETH Committed, Designed for Investors Holding At Least 150 ETH

Amphibian Capital launched the Amphibian ETH Alpha Fund this month, the world’s first Ethereum-denominated crypto trading fund of funds. The fund is designed for large ETH holders with 150 Ether and up.

The fund offers a new way for accredited investors who are large holders of Ether (ETH) to invest their ETH and potentially grow the amount of Ethereum they have over time, by investing it in a portfolio of vetted ETH trading funds.

The fund launched on September 1, 2022 with over 10,000 ETH committed. The firm currently has capacity for 250,000 ETH in the fund.

Over the last year, Amphibian Capital researched over 250 crypto funds, found 25 that were ETH-denominated, and selected eight funds for the ETH-denominated fund of funds.

This fund is designed for investors who want to hold ETH and are bullish about the future of the Ethereum network and want to grow the amount of ETH they hold.

The selected funds use derivatives, arbitrage, machine learning, and algorithmic trading, with ETH as the underlying token. The fund launch comes the same month as the Ethereum Proof-of-Stake upgrade, which is on track for September 14. This upgrade will reduce new Ethereum supply and miner sell pressure, while making Ethereum more environmentally friendly through an upgraded consensus model.

Ethereum is the world’s largest blockchain based on total value locked in smart contracts with 65% market share and 81% of NFT sales volume (last 30 days).

Amphibian co-founder James Hodges commented, “Ethereum investors traditionally had two options: either hold their ETH or stake it to earn an additional 4-8% annually. Now, accredited investors have a third option -- to invest their ETH in our fund of funds, potentially growing their ETH stack over time.”

For an illustrative example of how this ETH-denominated fund works, if an investor had invested 1000 ETH in the selected eight funds on January 1, 2022 the investor would have had approximately 1217 ETH on June 30, 2022 based on the average net return of the underlying funds of +21.7% for the first half of 2022.

Managing Partner Todd Bendell noted, “Our new fund is a more actively managed alternative to simply staking your ETH. Investors get exposure to the beta/price movements of Ethereum, while potentially gaining “alpha” and accumulating more ETH in their stack.”

The fund is now available to accredited investors and institutional investors globally. The minimum investment is $250,000 in ETH terms (approximately 165 ETH based on current prices).

About Amphibian Capital:

Amphibian Capital is a crypto quant fund of funds investing in the world’s leading crypto hedge funds. In partnership with Chainlink Capital, they have researched and vetted over 250+ funds and selected the best based on their proprietary scoring system, providing accredited investors and institutional allocators with the ability to gain crypto fund exposure with one investment through their USD-denominated and ETH-denominated funds. Learn more at www.amphibiancapital.com.

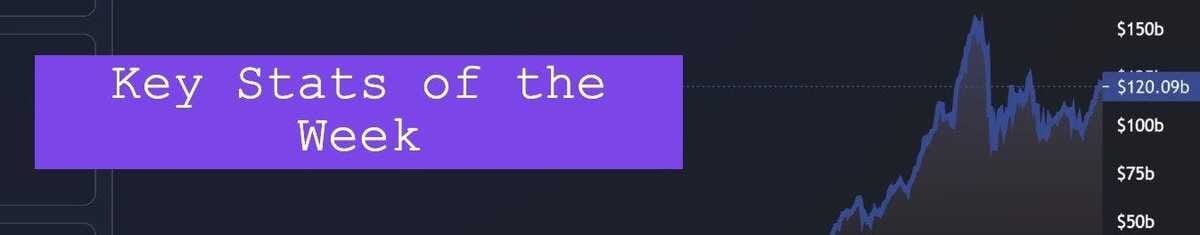

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. ETH Is Up Nearly 70% Since Early July

Source: The Defiant

2. NFT Mints on Solana Have Surged to an All-time High

Source: The Block

3. Google Searches for “Ethereum Merge” Has Now Spiked to an ATH Ahead of the Merge

Source: @CryptoGucci

4. Protocol Revenue for Synthetix Has Grown 9x Since April

Source: @mt_1466

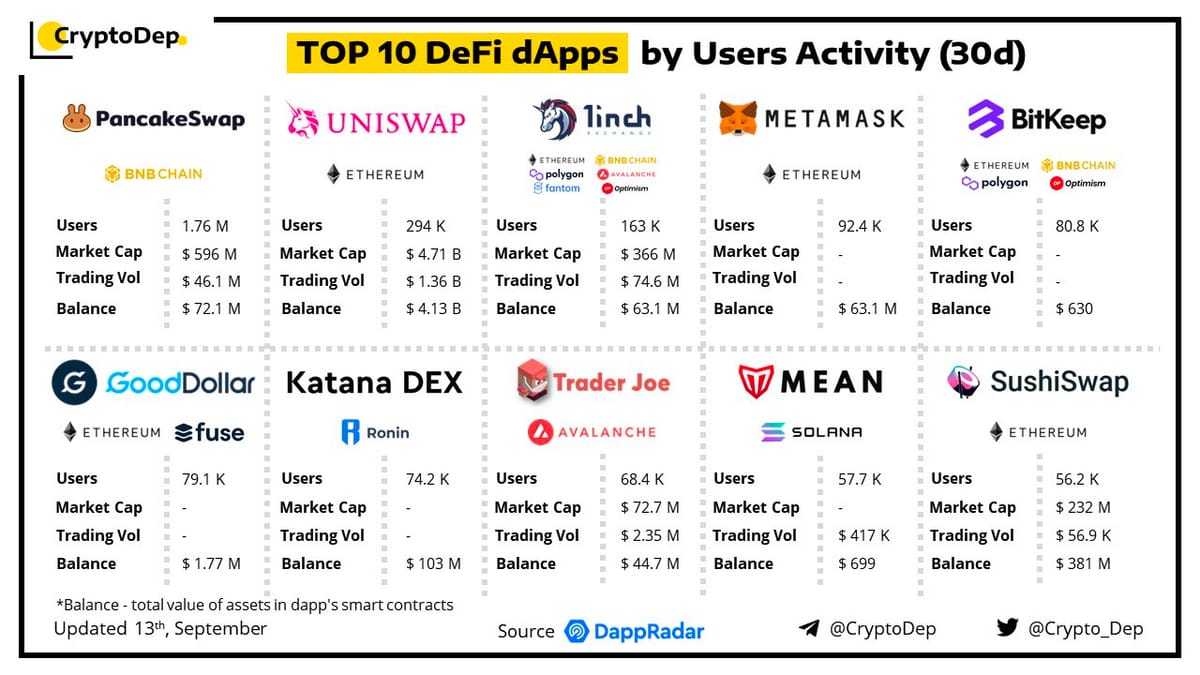

5. DEXs Lead On Top 10 DeFi Apps by User Activity

Source: @Crypto_Dep

6. ETC Is Up More Than 185% Since Mid-July, With ETH Miners Redirecting Their Mining Towards ETC

Source: The Defiant

7. ETH Dominates Market Recovery As Merge Approaches

Source: Kaiko

🧵 Thread of the Week - Making Sense of Ethereum Scaling Technology

By: @SalomonCrypto

(2/15) @Bitcoin is the suggestion that trustless computing was possible;

@ethereum, the World Computer, is the delivery. The World Computer is slow, intentionally. That slowness manifests in two ways: sluggish execution and high gas costs.

(3/15) Which brings us to the framework that defines @ethereum scaling: keep as much execution off-chain as possible while still ultimately settling to Ethereum. If the transaction settles on Ethereum, then it gains all the properties of Ethereum.

(4/15) State channels are the first attempt at moving execution off-chain. Channels are one-time relationships between two or more parties. The parties lock up capital on-chain, allowing them to exchange IOUs for no cost.

(5/15) From @ethereum's perspective, a state channel is 2 txns (per participant): open and close. These txns represent much more computation that happened off-chain, but are ultimately settled to mainnet. State channels provide scaling, but are limited in application.

(6/15) Plasma (chains) were developed to address (some of) these issues. Plasma are independent blockchains that are much higher performance (and much more centralized) than @ethereum. However, they are anchored to the World Computer by posting data back to mainnet.

(7/15) Plasma offers huge improvements over state channels:

- can send assets to users who haven't opted-in yet

- supports a persistent state (exists even when users exit the system)

- data is posted on-chain periodically

But, plasma is only half the solution.

(8/15) The full solution: rollups!

Where plasma only posted the state root (a single line used to verify if a txn happened), rollups post everything you would need to fully reconstruct the chain.

Imagine an entire blockchain that's squeezed into the main @ethereum blockchain.

(9/15) The first category of rollups are optimistic rollups.

Optimistic rollups make the assumption that all txns that are posted to mainnet are valid and so it records them on-chain. But, just in case, they also leave open a challenge window.

(10/15) The rollup creates its own blockchain, which anyone can watch for fraud. When detected, they can publish a fraud proof, proving the batch is invalid and should be reverted.

The result: no txn is finalized until the challenge period (up to 7 days) has passed.

(11/15) Which brings us to the real solution to blockchain scaling and the future of @ethereum: ZK-Rollups.

Like their optimistic brothers, ZK-rollups post ALL data to mainnet, but they also provide a a zero-knowledge proof.

(12/15) The ZK-proof represents mathematically certainty that whatever is posted on-chain was both valid and actually happened on the rollup. If the proof verifies, the transaction is final both on the rollup and on @ethereum.

All the benefits of rollups with instant settlement.(13/15) ZK-Rollups are still the bleeding edge of blockchain technology; (I believe) there isn't a single general purpose/EVM-compatible ZK-Rollup ready for production... today.

But we are not far away, if you look carefully you'll find a testnet or two.

(14/15) Back in November 2021, @ukolodny and @EliBenSasson were on @BanklessHQ. Uri mentioned that

@StarkWareLtd was already fast and cheap enough to support physics simulations.

We are building a legit supercomputer!

(15/15) When you look at @ethereum today, it might be hard to see the World Computer. Even if you wrap your head around the metaphor, it's hard to see how 12 txns/sec is going to support the whole world.

But I'm not looking at today, I'm looking at a zero-knowledge future.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and is building data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here

Introduction

Coinbase has proposed onboarding MakerDAO, creators of DAI decentralized stablecoin, as the first client of its USDC Institutional Rewards program. The proposal involves moving 33% of USDC from Maker Protocol's Price Stability Module (PSM) to Coinbase Prime, an estimated $1.60 billion, for a yield of 1.5%. The move could earn MakerDAO approximately $22.5 million annually.

The submission (MIP81) is a response to MakerDAO's “Declaration of Intent to Invest in Short-Term Bonds.” MakerDAO had requested "any party" to provide a solution that allows the organization to generate revenue from its underutilized balance sheet. The protocol also sought to eliminate the bad PR and counterparty risks associated with holding centralized stablecoins. As a custody provider, Coinbase claims to be uniquely positioned to meet MakerDAO's evaluative criteria for safety, cost structure, and flexibility.

There is support for the proposal from MakerDAO Co-Founder Rune Christensen, Sam McPherson, who authored the proposal implementing the PSM, the MakerDAO Growth Core Unit and Strategic Finance Core Unit, and some of the DAO delegates. However, there was a similar amount of opposition, with recent sanctions against Tornado Cash illustrating how centralized entities can expose the DAO to regulatory risk.

To understand the impact of this proposal on MakerDAO, Coinbase, and Circle's fiat stablecoin USDC, more context is needed.

MIP81 Specifications

Coinbase specifies that Maker Governance will need to appoint an arranger to facilitate its onboarding to Prime via Coinbase, Inc. However, the custodial service will be provided by Coinbase Custody International, Ltd. (CCI).

CCI is a private company incorporated in Dublin, Ireland; it is not licensed in any jurisdiction as a custodial service provider and offers its services to clients in jurisdictions where registrations and/or licenses are not required. Thus, while Coinbase, Inc., the parent company, and Coinbase Custody Trust Company, LLC (Coinbase Custody) are licensed and regulated by the U.S. Government, CCI is not. CCI’s mission is to serve international clients as a custodian and manage Coinbase’s staking services.

This arrangement is supposed to allay fears that the government could pressure Coinbase, Inc. into seizing a client’s asset. Further, the company asserts that clients’ “assets are held in segregated accounts,” not traded, and "cannot be deemed as Coinbase assets” for claims from Coinbase creditors. Therefore, in the case of bankruptcy — à la Three Arrow Capital or Celsius — MakerDAO’s USDC in custody would be safe.

In terms of cost structure and flexibility, Coinbase will not charge MakerDAO any custody fee, and the DAO will be able to unwind the USDC from Coinbase’s custody in under six minutes (MakerDAO’s declaration required a minimum of a week unwinding under normal circumstances and two weeks in stressed situations). On the other hand, Coinbase will pay the USDC reward to Maker based on its USDC Institutional Rewards POC program rates: 1% APY on the first $100 million and 0.1% more APY on each $100 million after that with a maximum of 1.5%, on the calculated weighted average of assets each month on the fifth business day of the following month.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Ambrosus is an L1, Luna Classic is an L1, Bolide is a Yield Navigator, Sperax is a Governance Token

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 29,813 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com