Welcome to the weekly CoinStack Newsletter. This issue shares why Ethereum will beat Bitcoin in market capitalization by 2025 due to having smart contracts, more apps, faster transactions, a better security-model, and a lower annual supply increase.

Why Ethereum Will Beat Bitcoin by 2025

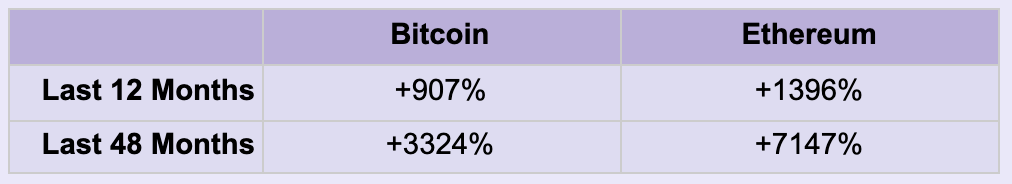

Yes, Ethereum has beaten Bitcoin in returns over the last year and the last four years. Yet Ethereum has only 19% of the market cap of Bitcoin so far.

But, I’m going to let you in on a little secret that not a lot of people know yet. Ethereum’s market cap will likely be higher than Bitcoin’s by 2025.As an investor you want to know where things are going, not where they are today. So let’s take a few minutes to understand why Ethereum is likely to beat Bitcoin over the next 48 months. The top five reasons Ethereum will beat Bitcoin in market cap by 2025 are:

More Apps - Ethereum has 38 apps built on top of it with 30 Day Volume Above $100M. Bitcoin has 0. Without smart contracts or programmability, it’s not even possible to build an app on top of Bitcoin. More apps mean more usage. More usage means higher demand for the native token powering the ecosystem (ETH).

Better for the Environment - Ethereum 2.0 uses Proof-of-Stake while Bitcoin uses Proof-of-Work. Proof-of-work requires mining which requires using a lot of electricity. Ethereum doesn’t have this issue, which will make it more socially acceptable as a clean form of money once it converts to Proof-of-Stake in early 2022.

Speed - ETH 2.0 will be able to process 100,000 TPS, while Bitcoin will be stuck at 3.4 without the Lightning Network and just 7,000 with the Lightning Network. ETH 2.0 will be 13x faster than Bitcoin’s Lightning Network, positioning ETH as the better global store-of-value, neutral global currency for trade settlement, and decentralized app platform.

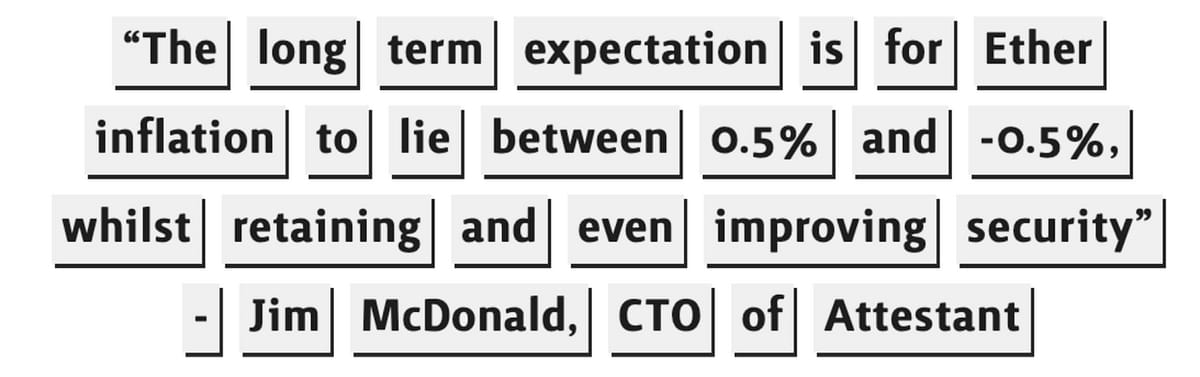

Lower Annual Supply Increase - Starting in 2022, Ethereum 2.0 will be issuing a maximum of 1.1 million new ETH per year (0.9% of the total supply) to validators while Bitcoin will be issuing 1.74% new supply to miners, making Ethereum sounder money (less inflation) than Bitcoin. The 0.9% new annual supply of ETH will be further reduced by the expected 1.5% annual supply of ETH that is burned from transaction fees starting in July 2021 with EIP-1559 and the London update, making the net increase of ETH less than 0%. Yes, that’s right, Ethereum is about to be a more sound money supply and long-term store-of-value than Bitcoin.

With Lower Issuance, Bitcoin’s Advantages Evaporates - Without being able to claim that “Bitcoin is sound money because it has a lower annual issuance than any other major cryptocurrency” and “Bitcoin is safer money because it costs more to attack than any other blockchain” Bitcoin’s two current advantages over Ethereum go away and it’s entire meme of being Digital Gold becomes well, an inaccurate meme. And memes don’t spread as fast when they aren’t true.

Before I go deeper, first, I’ll explain why Bitcoin is beating the dollar today, then I will explain why Ethereum is beating Bitcoin now and into the future.

What does all this mean? You should probably get more Ethereum.

ETH is money.

But First, Why Bitcoin Is Beating the Dollar...

Historically, Bitcoin has been known as the “sound money” alternative to central bank fiat currencies that are being printed into oblivion.

Few realize that the M2 money supply in the United States of America grew by 26% over the last year (from $15.4 Trillion in January 2020 to $19.4 Trillion in January 2021).

While the Federal Reserve created out of thin air $4 trillion new dollars into existence in the last twelve months (26% of the total supply), Bitcoin added just 445,500 new Bitcoins in 2020 (a 2.46% increase in total supply).

If you have $100M you previously had 0.00065% of the U.S. dollar money supply. Now you have 0.00052%. Everyone’s dollars are now worth 26% less than a year ago.

Bitcoin has a much better monetary policy. Since the last four year halving event on May 11, 2020, Bitcoin has produced just 900 new Bitcoins per day from mining, which is 328,000 new Bitcoins each year or a 1.77% increase in annual supply.

This amount of new Bitcoin supply declines automatically by 50% every 4 years with each halving event. This programmatic supply formula was created in 2008 and cannot be changed by anyone.

Starting in April 2024 at the next halving event, Bitcoin will be adding just 450 new Bitcoins per day (164,250 per year).

It’s clear that Bitcoin has a much less inflationary (and thus better) monetary supply than the U.S. Dollar.This is one of the major reasons why the value of Bitcoin compared to the USD has gone up by 921% in the last year, while the value of USD compared to Bitcoin has declined by 89.8% in the same time period. In fact, it is the low rate of supply increase that created the Bitcoin Stock-to-flow model that has so accurately predicted the price of Bitcoin. The thinking goes, the lower the annual issuance rate, the “harder” or less inflationary the money is, making it simply a better form of money.Institutions around the world are investing heavily into Bitcoin realizing that in a world where the Bitcoin supply is capped at 21 million and the dollar supply is uncapped, Bitcoin will win over fiat, at least for as long as Bitcoin is seen as the best cryptocurrency in terms of monetary policy and security.

It’s now pretty clear that as networks become more powerful than nation-states, a globally-neutral decentralized currency that can be instantly transferred around the world will become the primary form of global trade settlement by the end of this decade.

And using basic supply and demand economics, the currency with the most users and the lowest new supply is the one that usually increases the value the most.

So which of the two major cryptocurrencies (Bitcoin or Ethereum) will have the most users AND the lowest rate of new supply by 2022? The answer is Ethereum.

Why Ethereum is Gaining on Bitcoin

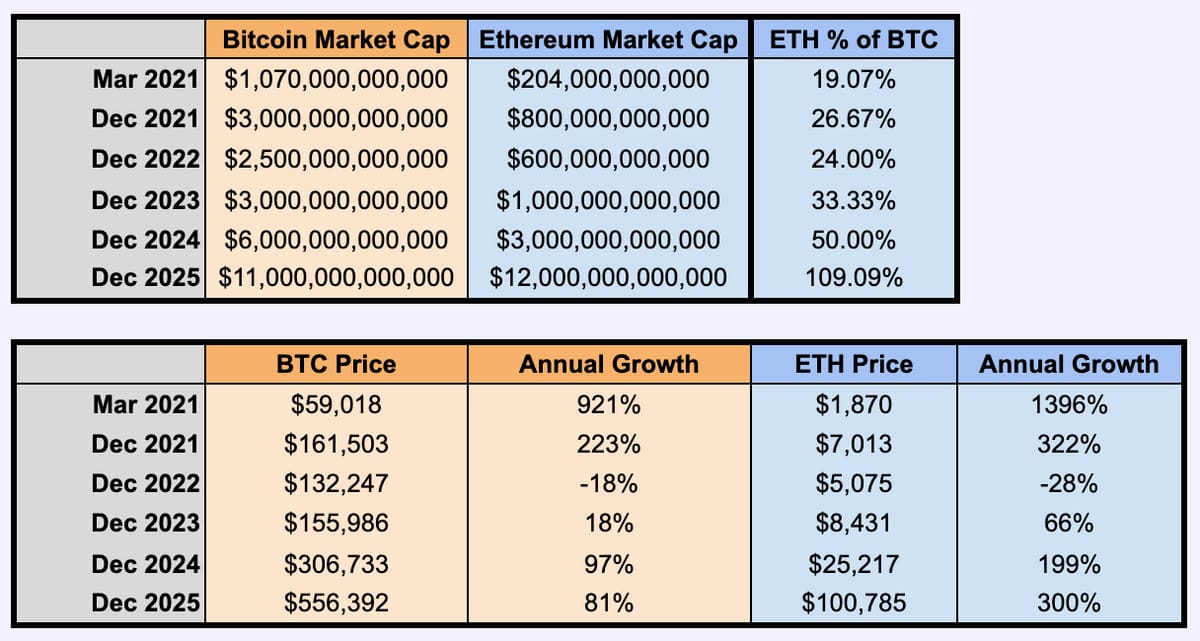

As of today, Bitcoin’s market cap is $1.07 Trillion and Ethereum is $204 billion.

Ethereum is now valued at 19.13% that of Bitcoin.

This percentage has been trending upwards the last year -- from a baseline of 13.72% a year ago.

Since inception, Ethereum has increased in value as a % of Bitcoin’s value from 4.69% in August 2015 to 19.13% today. It’s on the way up. Over the past 12 months, the value of ETH has grown 1355% while the Value of Bitcoin has grown 921%. Ethereum has been growing faster than Bitcoin.Not only has the price of Ethereum been growing faster than Bitcoin, Ethereum also wins on all these metrics too:

Ethereum 2.0 Has a Much Better Monetary Policy Than Bitcoin

Bitcoin has historically been the cryptocurrency with the best and least inflationary monetary policy.

However, that is changing in 2022. As it moves from Proof-of-work to Proof-of-Stake, Ethereum is moving to a deflationary monetary policy in which the total supply of ETH each year will be going down, not up.

The importance of this change cannot be overstated.

There are two key milestones that will make this happen.

July 2021 - EIP-1559 will go live with the London update, which has been approved for this July. This will begin to burn transaction fees, which will reduce the total ETH supply.

2022 - ETH 2.0 will go live in 2022 (it may go live as soon as Q4 2021 based on the latest proposal)

Let’s see what this means for BTC vs. ETH supply over the next four years (this is the supply side of the equation).

Let’s simplify this table a bit to make it clearer what’s happening...

And now let’s turn it a line graph for maximum effect…

And here’s a second visualization of Ethereum issuance this time showing each key step along the way (credit to Attestant).

As you can see, by around this time next year, Ethereum will have a better monetary policy than Bitcoin. Few realize this currently.

I think someone should call up Michael Saylor, Lyn Alden, and Elon Musk and let them know.

Mark Cuban and Gary Vaynerchuk get it already :). And so does Meitu the publicly-traded company that bought $22 million worth of Ethereum last week.

Where Does the New ETH Issuance Come From If There Isn’t Mining?

Starting next year with Eth 2.0, new issuance goes to the validators. Assuming full participation, which is safe to assume, validators will earn about 5% per year in additional ETH by participating in the validator network as a “staker”.

If you incorrectly validate the transaction (try to forge an incorrect blockchain record) you will lose your stake. Hence there is an economic incentive to keep the blockchain accurate.

Once ETH 2.0 goes live next year, all ETH validators will earn up to a maximum of 1.1 million ETH per year (equivalent to 0.9% new issuance per year). However the net new issuance of ETH will be much lower (and likely negative) as the amount of new issuance will be offset by transaction fees being burned with EIP-1559.

Based on the current (March 2021) level of Ethereum transaction fees, when the London upgrade goes live in July 2021, 708,000 ETH per year will be burned.

So based on today’s level of Ethereum usage, we will see a net issuance of around 390,000 new ETH per year (0.33%). However, it’s likely by then that Ethereum usage will be much higher, making the net issuance likely negative by 2024/2025.

Why Proof-of-Stake is Better for the Environment

The biggest issue with Bitcoin is that it is a fixed technology. It was created in October 2008 by Satoshi and has ossified, meaning it doesn’t change. It doesn’t have smart contracts. It doesn’t have programmability. And it’s running on top of an inefficient and outdated Proof-of-Work mining model that uses a lot of electricity which is becoming more and more socially unacceptable.

Even with 39% of Bitcoin electricity usage from renewables, that still means that Bitcoin today emits more carbon dioxide than the entire country of Argentina.

Ethereum 2.0 however, uses a Proof-of-Stake model. There’s no mining and there’s no wasted electricity and ASIC farms heating up our planet. Ethereum achieves security through staking which takes no electricity.

What does this mean? It means that Ethereum validators (those who secure the network, keep a decentralized record of transactions, and confirm transactions to be valid) will use the Ethereum they have to secure the network.

Why Proof-of-Stake Enables Better Security

It currently takes about $2.3 billion in mining costs per year to secure the Bitcoin network ($7k per Bitcoin mined x 328,500 new Bitcoins per year). This means it would cost at least that in hardware and electricity costs to attack the Bitcoin blockchain network via a 51% attack.

In security, you want it to cost more to attack.

With 6 million ETH staked already in ETH 2.0 (worth $10.8 billion as of this writing), it would cost at least $5.4 billion to attack the Ethereum network based on today’s value and when we reach 20 million ETH staked (assuming ETH is $2000 per ETH) it will cost $20 billion to attack the Ethereum Network.

So as of this moment, it would cost at least $2.3 billion to get half the Bitcoin mining supply and $5.4 billion to get half the ETH staking supply. ETH 2.0 already has better economic security than BTC.

Assuming ETH reaches $100k per ETH by the end of 2025, that means it would cost $1.2 Trillion to 51% attack Ethereum (you’d have to own 51% of the staked Ethereum, or about 10% of the overall Ethereum supply to do it). This cost is a major barrier and major generator of economic security.

Long story short, because of PoS, attacking Ethereum will cost a LOT more than attacking Bitcoin, making ETH more secure as a store of value.

There’s also less sell pressure from PoS. With mining, miners need to spend a lot on hardware and electricity every month, creating a major sell pressure in the market from the new coins that miners get. This sell pressure doesn’t exist in a Proof-of-Stake model, as there is no cost of mining -- but rather a return-on-capital from staking. (You get paid by keeping your ETH tokens in one place as a volunteer validator).

Further, unlike Bitcoin where 51% attacks are fatal to the network (since you don’t know which miners are giving accurate info and which aren’t), 51% attacks on the Ethereum network aren’t fatal as it’s possible to simply slash the stake of the attacking validators, essentially turning them off from the network.

Further, Ethereum’s hashing algorithm will be much easier to make quantum resistant than Bitcoin since Bitcoin can’t really be upgraded.

So in addition to having smart contracts, programmability, DeFi, NFTs, and thousands of apps, ETH will have a better monetary supply AND better security than Bitcoin by this time next year.

Game over.

And yes, that means you may want to explore shorting Bitcoin mining stocks who make all their money from Bitcoin mining… but not quite yet.

But, wait about another year to do that, as they will gain a lot in market cap the next 12 months as the price of Bitcoin gets above $100k. The short-term is bullish -- the mid-term is blah. Mining is thankfully going the way of the coal mine… something from the past.

But What About Ethereum’s Gas Fees?

High Ethereum gas fees won’t be an issue at all in 2022. Those are going away over the next 6 months as transactions move to Layer 2 Ethereum solutions like Optimism, ZKRollups, Loopring, Arbitrum, and Starkware. These types of rollups make transactions efficiently and cheaply and then update the main Ethereum blockchain in batches instead of with every single transaction.

While it costs $50 in gas fees today to do a Uniswap trade or to buy an NFT on OpenSea, that will be down to roughly $0.10 by the end of 2021, opening the floodgates for usage, for Decentralized Exchanges (DEXs) like Uniswap to overtake Centralized Exchanges (CEXs) like Coinbase, and for lower cost NFTs to become available on Ethereum.

Layer 2 protocols are reporting transaction fees that are less than 2% of current gas fees.

When these Layer 2 solutions go live (Summer/Fall 2021) we will see a massive increase in Ethereum usage. This combined with EIP-1559’s transaction fee burning lays the foundation for a massive 2nd half of 2021 for Ethereum price increase.

Gas fees on the main Ethereum network will stay high, but all the apps will be using Layer 2 scaling solutions to perform updates on the side and then batch-updating the main net every so often (like once per day instead of once per transaction).

Gotta love innovation.

My Predictions for Bitcoin and Ethereum’s Price

Based on the above analysis, I see Bitcoin and Ethereum reaching the current market cap of gold ($11T) by 2025, and Ethereum passing the market cap of Bitcoin by December 2025.

I’m predicting prices for BTC and ETH will fall a bit in 2022 not because of any fundamental reason, but only because based on the current four-year market cycle is still driven by Bitcoin, where prices go up a lot in year 1 and year 2 after a halving, and then usually stay flat in year 3 and 4 after a halving. Prices are likely to get a bit overheated by December 2021 and then come back to Earth slightly by 2022, before beginning to skyrocket again at the next halving around April 2024.

Could I be wrong about Ethereum beating Bitcoin by the end of 2025? Well, I am attempting to predict the future based only on what is known now. So of course I will be wrong in some way. The question is only if I am directionally correct.

Time will tell. My bet is made.

Into the Ether I go.

But What About Polkadot?

Polkadot is going to thrive in 2021-2025 as well. I expect Polkadot will be worth about 20% of what Ethereum will be worth by December 2025 - so around $2 Trillion in market cap (up 57x from $35 billion today).

The good news is that the launch of Polkadot in Fall of 2021 is putting needed pressure on the Ethereum developer community to speed up the merge of ETH 1.0 to ETH 2.0, potentially moving it into late 2021.

While Polkadot is a competitor to Ethereum for app deployment, with a 10% initial annual inflation rate it won’t be a competitor to Ethereum in terms of being a widely used store of value at least in its first few years. Further, Polkadot is being designed to be interoperable with all blockchains, so apps on Ethereum and apps on Polkadot will be able to work together (sort of like on the www where some apps are written with PHP and some with Ruby-on-Rails).

So yes, both Polkadot (DOT) as well as Polkadot’s initial dapp testing network Kusama (KSM) are likely to do extremely well the next four years.

And if I’m wrong about the general sentiment of this newsletter, it will be more likely be because Polkadot has beaten Ethereum than Bitcoin has suddenly innovated and stayed in the race.

Just like the web became a launching pad for many programming languages and many database architectures, web 3.0 (the blockchain-powered decentralized web) will spawn many successful blockchains.

The future is definitely a multi-chain world.

There are many other blockchains as well that will likely grow in the next four years. Besides Polkadot, some of my favorites right now include Cosmos (ATOM), Terra (LUNA), Harmony (ONE), Casper (CSPR) and Plasma (PPAY).

Chains I’m less bullish on include Solana (SOL), Tron (TRON), and Binance Smart Chain (BNB) due to lack of decentralization (which makes the data on the chains subject to being changed and thus less trustable) and Cardano (ADA) due to lack of app development traction.

So Should I Sell My Bitcoin

No. Definitely don’t sell your Bitcoin. Just start acquiring more Ethereum and Polkadot. I recommend ensuring that ASAP you hold AT LEAST as much ETH and DOT as you do in BTC (in dollar value).

The formula for success for winning this decade is simple.

BTC + ETH + DOT = WINNING THE 2020s

Why Many People Are Quiet About Bitcoin

Most people in the Ethereum and Polkadot communities are quite quiet currently about predictions that ETH or DOT will “flip Bitcoin” for a few key reasons…

There’s still another 12 months or so of development before these predictions I’m making become a fait accompli. It’s not yet a sure thing… though it’s about about 80%+ in my estimation. It’s more of a when rather than whether.

Right now the general public is just starting to understand why Bitcoin is beating fiat currency -- and we don’t want to confuse the message as Bitcoin is bringing in lots of capital into the overall cryptoeconomy, which is helpful for emerging blockchain projects. The general public won’t know that Ethereum has beaten Bitcoin until around 2025. You now have key information that is likely to come true four years before most people. What will you do with it? What would you have done if you could have known Bitcoin was going to moon back in 2013?

Those who “know” have an incentive not to say anything. There’s a clear sense to not fight the Bitcoin Maximalists too hard, as they are doing much of the heavy lifting in the media narrative to bring people into crypto right now — which leads everyone right into Ethereum the moment they want to actually do something like get an NFT on OpenSea, use a NeoBank like Nexo or DeFi app like Aave to get yield, or play a popular game like Decentraland, Gods Unchained, or Axie Infinity. The only thing worse than a Bitcoin maximalist is a Fiat Maximalist. :)

Bitcoin is the gateway drug for the 2021 cycle… though it won’t likely stay preeminent by the end of this decade. Bitcoin is like AOL was in 1995, soon to be replaced by the wonders of the world wide web, powered by Ethereum and Polkadot.

However if you’re reading this newsletter, you probably want to know more… which is why I’m sharing now what “most people in the mainstream” will be writing about in 4 years from now (in 2025) just as the “flippening” is happening.

You’ll point back to this article from March 22, 2021 and say wow, that was helpful.

Want to Learn More?

If you want to learn more about the line of thinking the led to this bullish Ethereum post, check out these great resources:

CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

75% of Portfolio

Ethereum (ETH) 20% of portfolio

Bitcoin (BTC) 10% of portfolio

Polkadot (DOT) 10% of portfolio

Kusama (KSM) 10% of portfolio

Nexo (NEXO) 10% of portfolio

Voyager (VGX) 5% of portfolio

Uniswap (UNI) 5% of portfolio

Chainlink (LINK) 5% of portfolio

25% of Portfolio - About 2% Each

Terra (LUNA)

Cosmos (ATOM)

Sushi (SUSHI)

Polygon (MATIC)

Polystarter (POLS)

Decentraland (MANA)

Ocean Protocol (OCEAN)

Harmony (ONE)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymath (POLY)

Ren (REN)

The People I’m Following Closely on Twitter

Start Here If You’re Getting Started With Crypto

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The CoinStack Newsletter

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly and written by Ryan Allis. Comments and thoughts welcome:

Telegram channel at t.me/thecoinstack

Substack at CoinStack.substack.com

Please share with your friends and colleagues.