Bitcoin, Ethereum, DeFi, Blockchain, Web 3.0, and the future of money

Published weekdays on Substack and TelegramMonday, January 25, 2021 | Issue 4 | 463 SubscribersPublisher: Ryan Allis

I’m dedicating this issue to why I believe Ethereum will beat BTC in market cap by the end of this decade. The TLDR of today’s issue is make sure your portfolio contains a non-zero amount of Ethereum and hold it for 10-15 years… Here we go…

Graphs of the Day - 12 Month Return of BTC vs. ETH

BTC Return in Last 12 Months

ETH Return Last 12 Months

Bitcoin holders have seen a 301% appreciation in their holdings in the last 12 months while Ethereum holders have seen a 796% appreciation. Source: Coinbase

Monday Analysis - Why ETH May Dethrone BTC This Decade

Ethereum passed its all time high Sunday, reaching $1477 before falling back to around $1400 at press time.

Ethereum has a market cap of $160B compared to $616B for Bitcoin.

Some say, Ethereum will overtake Bitcoin in market cap this decade. I tend to agree.

Ethereum is a much more flexible platform than Bitcoin.

When you compare the number of active developers of Ethereum vs. Bitcoin (404% more for Ethereum) it’s clear that development horsepower is going into Ethereum.

Ethereum’s daily fees (a measure of actual usage of the platform) at more than 3.1x Bitcoin (see above chart)

Ethereum’s price is up 772% in the last year, compared to 285% for Bitcoin.

While Bitcoin is only attempting to be a “store of value” -- it’s not as strong as being a medium-of-exchange or a development platform.

As a former software CEO, it’s obvious to me that the platforms that have the most developers are likely to win.

As a Harvard MBA, it’s also obvious to me that Institutional capital understands things about 24 months after tech developers understand things.

If you remember 1995 (I was 11 then), here’s a good metaphor:

Bitcoin is like AOL (the initial entry way)

Ethereum is like the Internet (the platform upon which everything is being built).

Institutional and retail capital is flowing into Bitcoin first as it’s what the press and hedge funds are talking about. Then, Bitcoin owners begin to get curious about Ethereum and start to think to themselves -- what is this Ethereum thing that is outperforming Bitcoin?

The rabbit hole suddenly gets deeper…

That curiosity then leads naturally to learning about the world of Decentralized Finance (DeFi), which presently is almost entirely built upon Ethereum’s ERC-20 tokens.

A friend said today, “DeFi is a house of cards.”

Yes, some of DeFi is currently built on shaky foundations (that will change). But there’s a difference between investing in a house of cards in inning 2 of 9 (DeFi) and a house of cards in inning 9 of 9 (tech stocks with PE multiples over 100).

Yes, it’s time to think seriously about selling your tech stocks with unsustainable PE ratios over 100.

I told my friends to buy TSLA in May 2013 in a public Facebook post. Yes, it’s now time to sell TSLA and buy and hold ETH. Both will continue to grow. But only one is likely to 20x this decade.

TSLA is at $802B, BTC is at $616B and ETH is at $160B market cap. Which one do you think will get to $2T first? Reply in the comments…

As Polychain CEO (and first Coinbase employee) Olaf Carlson-Wee said in a highly recommended podcast Friday:

"They start with bitcoin. It is the easiest to understand."

"It isn't surprising that these big institutional investors are first getting involved with bitcoin," he said. "This is effectively electronic gold. And everyone can reason about gold and reason about the value of gold in a pretty simple way."

"Once you have $100 million of bitcoin, you might start to think how I could get yield on this bitcoin for example. A lot of the time the answer there is through on-chain financial contracts."

"The summer of ICOs [in 2017] was a summer, the summer of DeFi [in 2020] was just the beginning of multi-years of compounding growth. The financial engineering in DeFi, I think, at this point is inarguably moving faster than the financial engineering anywhere else in the world. The capital coordination is faster than anywhere else in the world. A lot of these DeFi protocols are bigger than IPOs—regularly. Despite that go regularly unnoticed and are hard to interact with. The user experience barriers here are very high and despite that we see significant traction in terms of volumes."

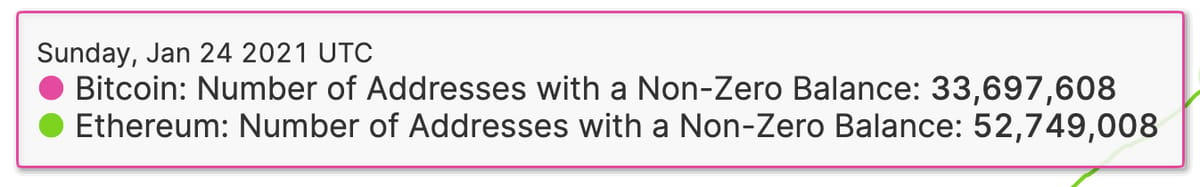

As we see above, there are more addresses that own Ethereum (52. 7M) than Bitcoin (33.7M)

And the trend of growth for Ethereum is much faster.

At this point, I recommend to friends a 10-15 year hold portfolio of ~60% ETH, 30% BTC and 10% others (including DOT, ADA, ATOM, UNI, SUSHI, COSMOS, AAVE, COMP, SNX, LINK, EGLD) -- that’s 90% in the two Blue Chips of ETH and BTC and 10% in the up and coming blockchains, DeFi tools, and Decentralized exchanges.

There will be ups and downs and volatility. Hold throughout. Buy the dips. This is going to be very interesting to look back at on December 31, 2030.

Key Graph: Ethereum Has 57% More Addresses With Non-Zero Balance Than Bitcoin

Two Years Ago (Jan 24, 2019)

Yesterday (Jan 24, 2021)

So I am pessimistic about Bitcoin?

I’m actually very optimistic about Bitcoin. The number of institutions, hedge funds, sovereign wealth funds, and Central Banks starting to get involved with buying Bitcoin as an inflation hedge shows me that Bitcoin will almost certainly be worth more than gold in 10 years ($11.8T market cap). As I wrote above, it’s the gateway… and wayyy better than gold.

Gold, frankly, is pretty useless and really hard to exchange with. Like, try to mail me some gold, OK?

Institutions are moving en-masse from Gold ETFs to Bitcoin and Ethereum exposure, through Grayscale, Pantera, NY DIG, Genesis Prime, and others.

Per Thursday’s podcast of The Bitcoin Standard with Saifedean Ammous, of the total currency reserves globally by nation-states, most are held in USD.

Nation-States are moving out of USD (not buying as many U.S. treasuries) as the U.S. Federal Reserve and Treasury adopt a “print to debase so government debt payments aren’t too high strategy.”

What will they move into? What’s the new global reserve asset? Well, that’s the $100T question.

Some are moving into BTC.

Anthony Scarammuci covers this topic of Bitcoin > Gold well in his Skybridge Bitcoin Fund deck.

That said, I’m even more optimistic about Ethereum than I am about Bitcoin. Both are likely to perform very well as assets this decade with how much cash Central Banks are printing and that there’s only one way out of the major global increase in the Debt-to-GDP ratio -- inflation and currency devaluation, which leads us to inflation hedges like BTC and ETH.

The U.S. dollar is likely to decline around 30-50% this decade, while inflation hedges that are powering the new innovation economy and the entire new global banking system like BTC and ETH are (imho) likely to go up 20-30x (that’s 20-30x, not 20-30%).

Could I be wrong about Ethereum Beating Bitcoin in market cap this decade?

Yes, of course. Bitcoin has a number of new developments coming to allow for faster transaction speed (like Lightning Network) and global remittances (like Strike)

If Lightning Network succeeds, EIP-1559 fails to be implemented (the modification to the Ethereum’s code base that by rule burns some of the transaction fee with each transaction, reducing supply, and thereby increasing the value of each ETH) then we may see Bitcoin stay the GOAT for quite some time.

Lyn Alden wrote a good essay last week about why ETH isn’t quite yet ready for mainstream institutional prime time (main reason: it’s still a platform in development and monetary policy isn’t finalized quite yet until after EIP-1559 and ETH 2.0 goes live)

Does Ethereum have any up and coming challengers?

Yes, Ethereum has many challengers who are working on building “better and faster blockchains” or “interoperable blockchains”

These include Polkadot (DOT), Cardano (ADA), Cosmos (ATOM), Elrond (EGLD), Solana (SOL), Algorand (ALGO), and Avalanche (AVAX)

I’m particularly impressed with DOT, ADA, ATOM, and EGLD based on their tech, their backers, and their founders.

Many of these will be interoperable with Ethereum -- so I don’t anticipate them to dethrone. The network effect is large and there are already 56.2 million Ethereum addresses with a non-zero balance (compared to

Ethereum maintains a huge lead in developer community, dApps, and daily transaction fees generated. Until that flips, keep your money on ETH.

Key Graph - 1.1M Ethereum Addresses With > Than 1 ETH

Chart of the Day - Uniswap Earned More in Transaction Fees Than Bitcoin on Sunday

2021 Crypto Market Outlook Report Excerpts

Here are a few worthwhile highlights from the PDF report (a must read)…

2020 was a record year for crypto assets. The global crypto market capitalization began 2020 at $191.5B and reached $760.7B on Dec 31, increasing 119.55%. (pg 8)

Bitcoin smashed its previous all time high. The benchmark cryptocurrency reached an all time high of $29,000, returning 314.19% year-to-date. (pg 12)

Bitcoin’s status as a hedge against USD inflation became more widely accepted. In response to unprecedented levels of money printing, the ‘BTC as an inflation hedge’ narrative has grown in strength. (pg 14)

Bitcoin balance on exchanges is dropping significantly. The amount of Bitcoin that’s being held in exchange wallets is decreasing as the demand for Bitcoin is increasing. (pg 15)

Institutions showed increased interest in BTC as a macro portfolio optimizer. 2020 can be regarded as the year institutional investors came forward in publicly confirming their interest in crypto. (pg 18)

15 publicly traded companies now hold a total of 115,357 BTC. 15 publicly traded companies now hold a total of 115,357 Bitcoin worth $2.6 billion on their balance sheets. (pg 21)

Grayscale Investments reached $19 billion in asset under management. Grayscale’s AUM has climbed from $2 billion at the start of December 2019 to $19 billion in December 2020. (pg 22)

ETH balance on exchanges is dropping significantly. ETH held on exchanges is at 1.5 year low while the number of addresses holding +10k Ether reached a 9-month high. (pg 26)

DeFi grew from under $1b in locked assets to over $16b. The DeFi sector saw an explosive rise in 2020, with the total value locked crossing $16B. (pg 30)

Stablecoins saw staggering growth in 2020. The total stablecoin market capitalization began 2020 at $5.74B and reached $29.2B on Dec 31, increasing 134.28%. (pg 36)

A Few Good Bitcoin Quotes

Passing along a few good quotes from some of the smartest investors in the world (compiled by Bloqport, join their Substack)... yes I am still very Pro BTC...

“I have warmed up to the fact that Bitcoin could be an asset class that has a lot of attraction as a store of value to both millennials and new the new west coast money, and as you know they’ve got a lot of it. It’s been around for 13yrs, and with each passing day, it picks up more, more of its stabilization as a brand... Frankly if the gold bet works, the Bitcoin bet will probably work better.” - Stanley Druckenmiller, 9 Nov 2020

“The Bitcoin story is very easy, which is that its supply demand economics, which is that Bitcoin’s supply is growing at about 2.5% per year [actually less], and the demand is growing faster than that. And there’s gonna be a fixed number of them. So I think every major bank, every major investment bank, every major high net worth firm is gonna eventually have some exposure to Bitcoin or what’s like it.” - Bill Miller, Miller Value Funds, 6 Nov 2020

“So [Bitcoin] could serve as a diversifier to gold and other such storehold of wealth assets. The main thing is to have some of these type of assets (with limited supply, that are mobile, and that are storeholds of wealth)”- Ray Dalio, 8 Dec 2020

“The adoption of Bitcoin by institutional investors has only begun, while for gold its adoption by institutional investors is very advanced” - JPMorgan Research, 9 Dec 2020

“I like Bitcoin even more now than I did then. It’s like investing with Steve Jobs and Apple or investing in Google early. I’ve never had an inflation hedge where you have a kicker that you also have great intellectual capital behind it, so that makes me even more constructive on [Bitcoin].” - Paul Tudor Jones, 22 Oct 2020

"Bitcoin is the new Gold.” Tom Fitzpatrick, Managing Director, Citibank, 15 Nov 2020

“All the big hitters in the hedge fund world are coming out to endorse Bitcoin. ... We have been positioning in gold for our clients for many, many years now. Now we’re doing it with Bitcoin.”Vimal Gor, Pendal Group Head of Bond, Income, and Defensive Strategies, 23 Nov 2020

Daily Podcasts

“Saifedean discusses chapters 3 and 4 of The Fiat Standard with subscribers. These foundational chapters explain how the fiat system functions with analogy to Bitcoin, studying central banks as nodes and examining their core functions, explaining how lending in fiat is the equivalent of mining in bitcoin, how it translates to supply issuance, and how to understand price inflation in fiat.”

“On this edition of the Weekly Recap, NLW argues that while bitcoin’s price was the short-term story of the week, the medium-term story was all about the transition of power in the U.S. to the new Biden Administration. In it, he discusses what the appointments (reported or confirmed) of Janet Yellen, Gary Gensler, Michael Barr and Chris Brummer suggest about the future of crypto policy.”

“For this week’s Long Reads Sunday, NLW reads the document that started it all - the Bitcoin White Paper. Interestingly, this document was released under an MIT open-source license, available free to all.”

Digital Event Feb 3 - Bitcoin For the Balance Sheet

Bitcoin for the Balance Sheet - Microstrategy CEO Michael Saylor is hosting a February 3 online event for CEOs and CFOs interested in holding bitcoin on their Corporate Balance Sheet.

“Last year, we became the first publicly traded company to adopt bitcoin as a primary treasury reserve asset. Forward-thinking organizations have taken note and reactions have been overwhelmingly positive. We are now taking the opportunity to share our learnings and methodologies, as well as bring together bitcoin luminaries and corporate strategists to discuss how others can benefit from this trend. Join our Bitcoin for Corporations landmark event to understand the array of considerations of this new strategy.” - Michael Saylor, CEO of Microstrategy

The People We’re Following Closely

Beniamin Mincu (new)

Saifedean Ammous (new)

If You’re Just Getting Started With Crypto, Start Here

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coin Times: Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. Please do your own research.

Comments and thoughts welcome:

Telegram channel at t.me/thecointimes

Substack at cointimes.substack.com

Please share with your friends and colleagues.