Welcome to the weekly Coinstack Newsletter. I write this newsletter about my experience with crypto investing in order to help others learn. I’m up 697% YTD. In this issue I explain how to estimate the intrinsic value of Ethereum and how to invest in Ethereum on leverage in perpetual markets and make 2x the returns you would normally make by betting Ether (ETH) will continue to grow in value.

Inside This Week’s Issue:

Ethereum’s Intrinsic Value Comes From Its Cashflows

Leverage Trading: Get 2x Returns Betting on Ethereum

Coinstack Alpha Fund Update - Deposits Reopened - Up 23% in Last 3 Weeks

Portfolio Update: Up 697% YTD 👀

Join the Weekly Advice Call on Crypto by Buying an NFT

NFTs of the Week by Mrs. Bubble

A Long-Term Crypto Portfolio

Who I’m Following Closely on Twitter

Getting Started in Crypto

Ethereum’s Intrinsic Value Comes From Its Cashflows

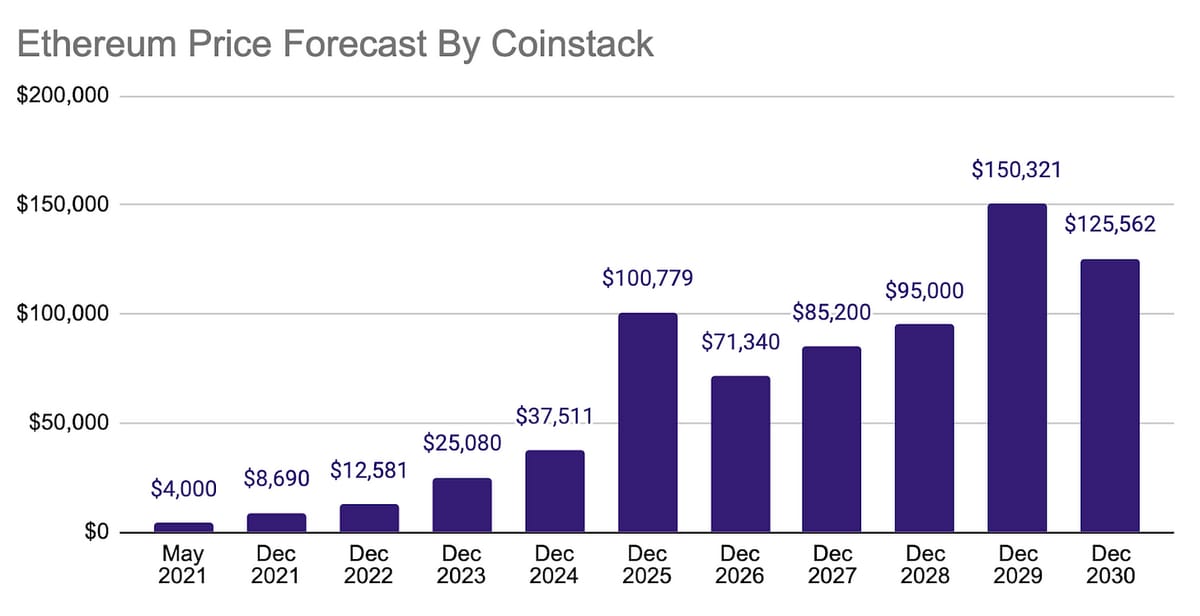

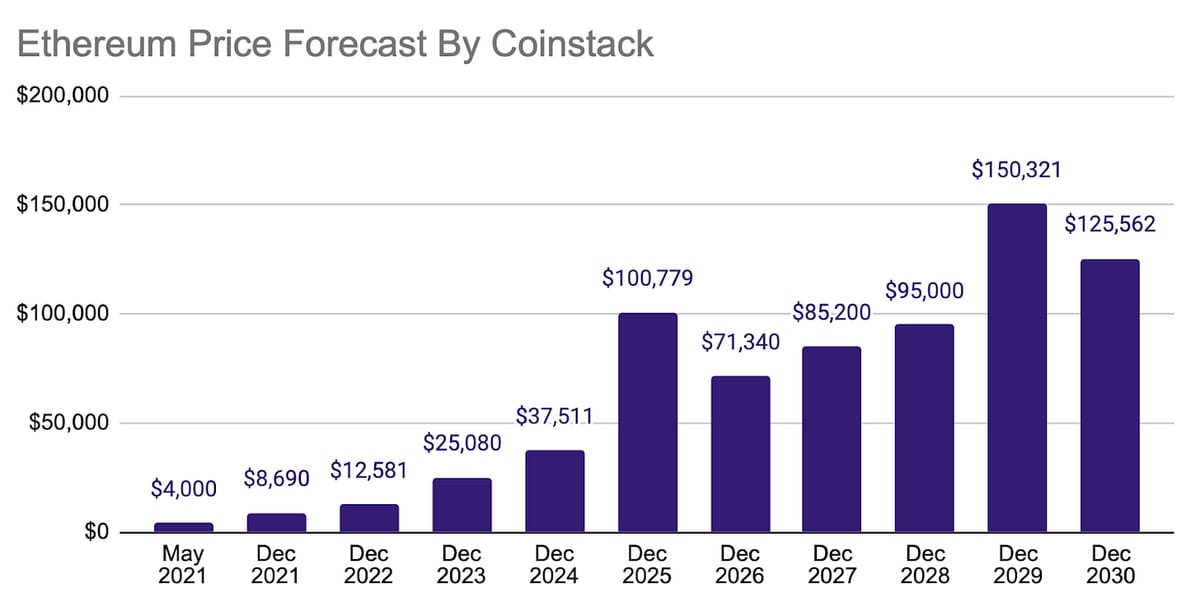

Here’s my latest ETH price forecast, updated for the full decade through 2030…

Why do I think ETH is going to $25k+ in the next 3 years?

Well, because of its cash flows. All assets have an intrinsic price that is derived from their utility and their cash flows.

Yep, intrinsic value comes from utility and cash flows. Never forget that in crypto investing.

When I published “The Investment Case for Ethereum” two weeks ago on April 28, Ether (ETH) was trading at $2600. Two weeks later and we’re up 53% to ~$4000.

It’s been a good two weeks.

Below I will be explaining my updated price predictions for Ethereum.

But first let’s start with two definitions:

Speculative asset value = Whatever someone is willing to pay at that moment

Intrinsic Asset Value = The present value of future cash flows.

While Bitcoin is seen by some as a speculative asset that has no cash flows to holders and little utility for building dapps, Ether is programmable money with smart contracts and will soon have cashflows going to its long-term holders (indirectly via token supply reductions from transaction fee burning starting July 14, 2021 and directly via staking rewards starting December 2021).

Based on this insight that ETH has cash flows while BTC doesn’t, the last couple months I’ve been focused on calculating what the intrinsic asset value of Ether (the native token of Ethereum) will be once these cash flows to holders go live later this year.

I see Ether (ETH) as having an intrinsic value equal to the present value of future cash flows of the Ethereum network.

As Buffet would often teach, if you can calculate the actual value of something based on its cash flows and buy it at a value lower than that with a margin of safety, you can do exceptionally well in investing and be able to hold through short-term market fluctuations.

How I Estimate Ethereum’s Intrinsic Value

So to estimate the intrinsic value of ETH, and get beyond the noise of short-term markets that don’t understand the asset yet, all you need to know is:

What are Ethereum’s current annualized cash flows?

What % of these are going to holders when ETH 2.0 launches in December 2021?

How much do you expect the annualized cash flows to grow in the future?

The simple answers to these three questions are…

Ethereum is on track to have revenues in May 2021 of $956 million and has annualized revenues of $11.5 billion and growing.

100% of these Ethereum transaction revenues will flow to long term ETH holders directly (via staking rewards which operate like dividends) or indirectly (via token burns which reduce supply and operate like stock buybacks). 99% of people don’t realize this yet. They are just investing because they hear about it from friends or because the price is going up without realizing why the price is massively increasing.

70% of Ethereum’s transaction revenues will start flowing to holders via burned transaction fees on July 14, 2021 when EIP-1559 goes live

The rest (the other 30% plus staking rewards) will start flowing to holders directly in December 2021 when ETH moves to the Beacon chain and becomes a Proof of Stake (PoS) asset.

Thus 100% of Ethereum’s revenues are cash flows to long-term holders.

Ether isn’t just a speculative asset like Bitcoin. Ethereum has cash flows to holders and and thus has fundamental long-term value that can be modeled and forecasted using traditional financial modeling.

99% of people don’t realize that Ethereum today on a Price to Sales (P/S) basis is substantially cheaper than it was in May 2020.

Yes, Ethereum’s revenues have grown a LOT faster than its price, making it look cheap right now. And because 100% of Ethereum’s revenues go to its holders as of December 2021, this P/S ratio below is will actually become very cheap 47x Price to Earnings (PE) ratio (very cheap compared to other high growth tech companies, see last week’s issue).

In my DCF valuation model I estimate Ethereum’s revenues will grow 50% per year next year, growing at a decreasing rate down to 15% by 2035.

I actually think the growth rates will be much higher, but I wanted my model to be conservative.

I also wanted to be conservative because Ethereum is launching sharding in late-2022 which will allow the network to be 64x faster and have ~64x lower transaction fees assuming constant demand (demand will likely be much higher by then).

The trillion dollar question is whether the eventual 64x lower transaction costs from sharding will generate 64x+ more usage and thus drive a net increase in revenues to the token holders or a net decrease.

I chatted about this with Ethereum 2.0 Researcher Justin Drake this week and here’s what he had to say (essentially that he believes the reduction in fees per transaction will increase usage enough to actually increase total revenues).

The takeaway is that we both believe that sharding will take some time still, will be rolled out in stages, (maybe late 2022?) and that any gas fee reductions that come from it should be more than made up by the number of additional transactions done on the Ethereum mainnet as prices per transaction come down.

The conclusion from my valuation model is that based on today’s cash flows alone, Ether should be worth $25,212 today. That’s what I believe is the “fair value” for ETH based on today’s cash flows, assuming cash flows keep growing at a moderate pace. Even with a 50% execution risk haircut based on EIP-1559 and PoS not yet being live that’s still a $13k target.

Also recall that that the supply of ETH will start declining next year and should reach 100M by 2032, making each ETH more valuable.

Based on all this, I think TODAY’s fair value of ETH should be in the range of $13k to $25k based on there still being some execution risk for EIP-1559 and ETH 2.0 not having launched yet--and that we don’t yet know the actual impact of sharding and L2 on mainnet Ethereum transaction revenues.

Most of that risk should go away entirely over the next 12 months -- but by then ETH will cost a lot more as the de-risked asset suddenly has institutions piling in. Keep in mind the PoS ETH 2.0 chain is live (Beacon Chain) and has been running since December 1, 2020 and test transactions are already happening. It’s just a matter of time.

When I have a good sense that something is actually worth $13k-$25k today based on its current cash flows but is selling for $4k today, I go in deep.

Reasoning for My Price Predictions for Ethereum (ETH)

So yes, I believe we are going to see $8000+ ETH this year. My actual belief is we will pass $10k but I’m trying to be a bit conservative with my official forecast.

Most people in the market don’t yet understand that holding Ether will be a cashflow generating asset. But in 9 months they’ll know :). That is the information advantage you now have.

Information asymmetry is everything in crypto investing.

My Discounted Cash Flow (DCF) model has each ETH being worth $25,212 right now based on its cash flows to holders alone (which start July 14, 2021) and Justin Drake’s new ETH valuation spreadsheet puts his best guess for the long-term ETH value at $51k.

No, I don’t think we will get all the way there to $51k in the next year… but I do think we get all the way there by 2025 and end up around $100k per Ether by December 2025.

So yes, I believe the “intrinsic value” of Ether is currently $13k to $25k per token (and this number may increase or decrease in the future based on how actual cash flows grow faster or slower than my expectations).

I really don’t care if price goes down in the short term. If it does, I’ll just buy more. I increase my position weekly with every minor dip.

Some like SquishChaos think we will get to $150k ETH by December 2023 based on the impact to supply reduction from 1559 and PoS combined with a speculative bubble. I think we will eventually get to $150k, but not until later the end of this decade. It will take some time.

We will have to get past the launch of both ETH 2.0 and sharding to be able to properly predict transaction revenues for Ethereum in 2023 and beyond. If Ethereum’s transaction revenues keep growing (even at 30-50% per year), we will be on a clear path to eventually reaching $150k by the end of decade.

Can Solana, Cosmos, or Polkadot offer an alternative? For some specific use cases, yes -- but not as the global settlement layer and primary digital currency of the internet (DeFi, NFTs, Stablecoins like USDC). I expect Ether will continue to win on that.

And I now expect Ethereum to be worth more than Bitcoin within 18 months or less. The flippening is inevitable, especially after Tesla announced they are no longer accepting Bitcoin to purchase their vehicles today after their concerns about Proof-of-Work mining using too much electricity.

Ether As The New Global Reserve Currency by 2030?

We must keep in mind that $150k ETH implies a market cap of $15 Trillion (after token supply burning from transaction fees we expect ETH supply to be around 100M tokens in 10 years down from 116M today).

There are currently $19.9 trillion U.S. dollars in the whole world (M2 money supply) and $420T of total household wealth.

I believe that by the end of this decade the total value of all the Ether (ETH) in the world will be greater than the total value of the national fiat currency of one single country (the USA).

Yep, I believe ETH’s market cap will eventually be around $20T, representing a 45x increase from today’s $450B.

What’s gonna win? A government-controlled centralized inflation-prone fiat currency representing 4% of the world’s population or a decentralized globally-neutral currency representing 65% of the world’s population and growing (internet users).

Yes, internet money is going to beat centralized and inflatable U.S. government money (USD) and centralized and inflatable Chinese government money (RMB).

And my friends, Ether is the internet’s money. Ether is the non-inflatable decentralized people’s money. Ether is the commodity needed to interact on Web 3.0. If you don’t realize this yet, you’re about to.

Why ETH Price is Increasing So Much Right Now

So why has ETH price gone up 50% in the last two weeks?

You may remember that starting July 14, 2021 with the go-live of EIP-1559 about 70% of ETH total transaction revenue will start benefiting holders in the form of token burns (like a stock buyback that reduces supply).

You may also recall that starting in December 2021 when the Proof-of-Stake ETH 2.0 launches, 100% of remaining ETH revenues not being used for token burns will be flowing to long-term ETH holders (aka stakers).

Stakers will get the other 30% of the transaction fees and the new Ether issuance of about 1,100,000 new Ether per year. That’s another $4.3B in annual cash flow to holders in today’s price terms, let alone what the price will be by December 2021.

This means that Ether (ETH) holders will be getting $15.7 billion and growing in annual cash flow from holding their Ether (based on today’s prices).

Cash Flows Create Intrinsic Value for ETH

What’s $15.7B in annual cash flow worth? Well it depends on its growth rate.

Ethereum transaction revenues are up 9,070% since May 2020. So how do you value $15.7B in cash flows when they have grown 9000% in the last year...

While it’s proper to apply a PE ratio of at least 100x based on that rapid growth rate, which makes the fair market cap of Ethereum today AT LEAST $1.6 trillion.

That market cap alone would give ETH a price of $13,711, before applying any additional value for its utility as a consumable for apps and payment settlements.

In my DCF I assume a modest 50% annual growth rate in transaction revenues going down to 15% by 2035. I expect actual growth rates will be MUCH higher.

Yes, sharding is coming on Ethereum mainnet in mid-to-late 2022 that will make mainnet gas fees about 64x MUCH LOWER (around $2 per transaction instead of $128 per transaction) however I expect that Ethereum will continue to be price elastic -- meaning that if the cost per transaction goes down by 64x that the total number of transactions done will go UP by more than 64x, meaning a total overall increase in transaction revenues for Ethereum in 2022/2023.

So while Bitcoin pays $0 to its holders and will continue to pay $0 to its holders, Ethereum 2.0 holders get $16B+ in annual cash flows either directly through staking rewards or indirectly through token burns. Talk about a productive asset.

Cash flows and utility is why Ethereum has intrinsic value.

Buy and hold my friends. Buy and hold.

The ETH Price Forecast Now Till 2030

Once again, here’s my latest ETH price forecast, updated for the full decade…

So if you believe ETH should be worth $13k to $25k and is currently worth $4k, what do you do? Buy it. Hold it. And tell your friends.

I think we’re on to something big here… and it’s still quite early. And read the next article on how to double your returns through leverage trading on Binance and FTX perpetual markets.

By July 14, 2021 (60 days from now) a lot more people will understand what’s happening with Ether and why it’s growing at such a fast pace, and why it will surpass Bitcoin in valuation in the next 18 months or sooner.

So WTF is Etherea?

Yes, Etherea (the fictional global decentralized home of Ethereans) will soon be the most influential and powerful collection of human beings in the world as we enter into a new cultural, artistic, and scientific Renaissance powered by programmable money.

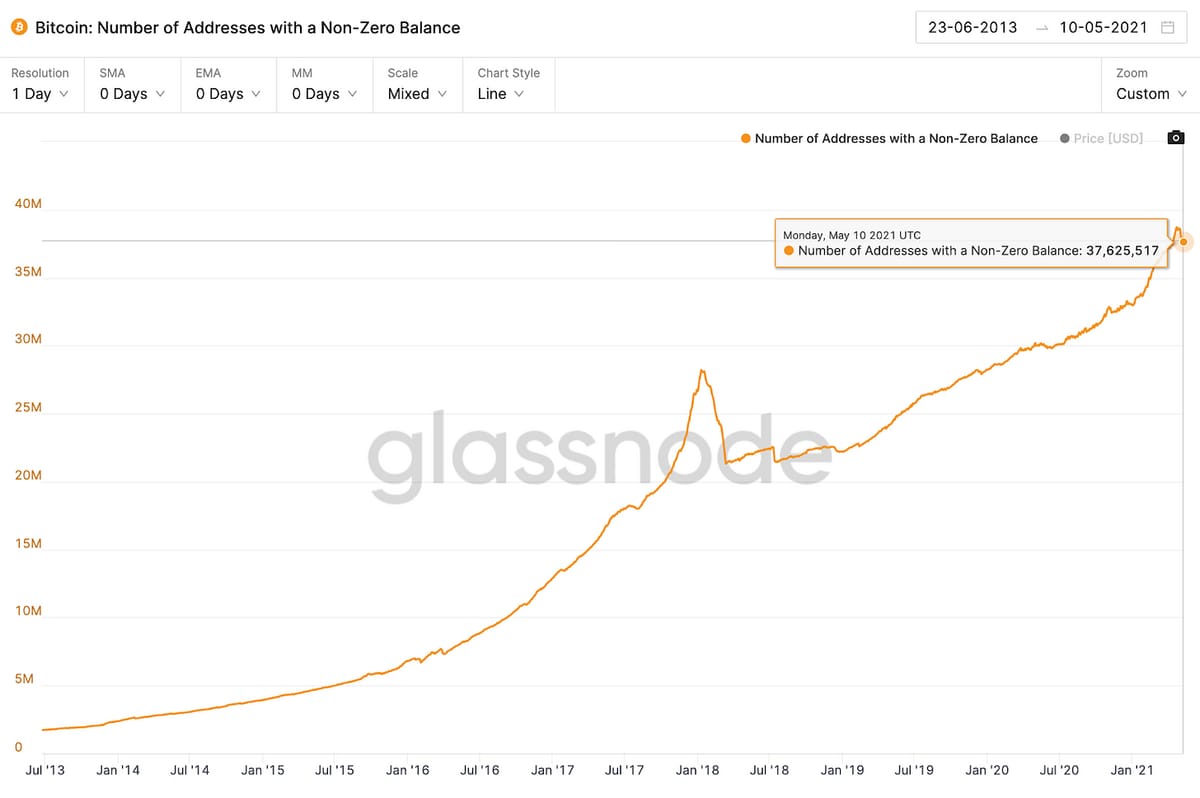

Today there are at least 58 million Ethereans in the world (people who hold ETH). This number is understated as it groups Exchange addresses into 1 address when in fact that can represent millions of holders.

This compares to at least 38 million Bitcoiners (see below chart from Glassnode). This number of course is also understated due to exchanges who have many users sharing the same address. You can see below that the number of unique Bitcoin addresses in the world with a non-zero address has been declining the last 2 weeks while Ethereum has been rapidly increasing.

Bullish for Ethereum.

Leverage Trading: Get 2x Returns Betting on Ethereum

So, IF you have a good deal of confidence, like I do that ETH is going to $8k+ this year, then you can do one of three things to make (a lot of) money off of this prediction:

Buy more ETH and hold.

Hold your ETH in Nexo and then take out a loan against your ETH to get more ETH.

Buy ETH with leverage on Binance or FTX with a small part of your portfolio value.

I’m doing all three.

I’m using the instant 5.9% cryptoloans in my Nexo account to buy more Ethereum. That’s how I went from 32 ETH to 283 ETH the last 4 months without putting in any more of my own cash.

I maintain a 40% or less loan to value ratio in Nexo -- right now I have about a $1.8M Nexo portfolio and $750k of Nexo loans, making the net portfolio worth just over $1M.

AND…

I just put $100k earlier today (about 7.5% of my crypto portfolio net value) into buying another 50 ETH.

How did I buy 50 ETH today using just $100,000? That’s just $2k per ETH.

I used the Binance Perpetuals ETHUSDT market.

There you can make bigger bets that the price of certain crypto assets will go up or down.

You can do the same thing on FTX too or Huobi.

I bought 50 ETH earlier today when the price was $3928 per ETH. From this trade alone, for every $100 ETH goes up, I make $5,000.

So if I’m right that ETH reaches $8,000 (+$4,000) I will earn an extra $200,000 from this trade (+200% return on $100k). And if ETH eventually reaches $25k (+$21k) I will earn an extra $1,050,000 from this trade. (+1000% return on 100k).

And if I’m wrong and ETH goes under $1953, I’ll lose my $100k investment.

This type of trade essentially doubles the returns I’d make normally from just holding ETH, while introducing a risk of liquidation (total loss) if the price drops too far. This is just one way that I work to outperform ETH returns as my primary benchmark.

What is the Risk I’m Taking? Well, Total Loss of My Position

It’s important to point out that these types of leveraged long positions bring the risk of losing your entire investment if the market price drops below the liquidation price.

With the headwinds toward EIP-1559 and ETH 2.0, I personally believe that the chance ETH ever drops below $2000 to be less than 5%.

Yep, if the price of ETH drops under $1953 (the liquidation price) I get totally wiped out and lose the entire $100k bet.

Yep, I’m essentially betting $100k that ETH never again goes below $2k (a 50% drop from where we are now).

I feel safe doing this with 7.5% of my portfolio. I would NOT recommend taking that kind of risk with more than 10% of your total portfolio -- as routine 20%-30% drops in crypto do tend to happen about every 4-8 weeks.

In crypto, you want any multi-month leveraged positions to be able to withstand a 30%-35% short-term fluctuation without getting liquidated.

Worst case scenario, I lose $100k (7.5% of my portfolio).

If ETH eventually gets to my DCF value of $25k, I make an +$1 million from this trade alone.

Unless I get liquidated from a shocking drop under $2k, I plan to HOLD this leveraged ETH position until at least December 15, 2021. I may hold it all the way until $25k (or further if ETH revenues grow faster than I predict which will make my fair value DCF prediction increase).

I LOVE asymmetric bets, especially when I understand the dynamics of what I’m actually investing in better than most.

You can execute this same strategy. I call this ETH leveraged long trade “The God Trade” -- as it uses a prediction of future price based on a deep knowledge of intrinsic, cash flow based value -- knowledge that isn’t yet priced in but will become more priced in once PoS launches in late 2021.

Some friends who deeply understand ETH have been executing this trade all the way since ETH was $150 two years ago -- and are up tens of millions so far. I’m just 130 days into crypto investing, so I’m glad I’m figuring out how to do this now while the major adjustment toward ETH’s fair value is still in progress.

Here is the BIG rule of thumb to do this trade relatively safely...

Make sure your ETH liquidation price is under $2k. We want to be able to withstand a 50% short term drop and still be in the game for the longer term gains.

Wait until a 10% drop before you get in. As soon as you see markets recovering from the drop, get in. Earlier today we had a short-term 10% drop in ETH so I doubled down and increased my leveraged positon to 100 ETH. I waited until a drop to expand my position size.

How I Made $19k in 7 Minutes Shorting Worthless Dog Meme Tokens Yesterday

Leveraged perpetual trading can also be used to short projects that are crap. Yesterday I made $19k in 7 minutes shorting the worthless meme dog token SHIB after I saw news on Twitter that Vitalik Buterin (the wonderful co-founder of Ethereum) was selling the massive amount of SHIB that was airdropped into his account by its creators in order to help reduce dog coin speculation and reduce gas fees.

Yep, Vitalik sold dog tokens. And I shorted the heck out of Shiba Inu. And I made $19,000 in 7 minutes before closing out the leveraged short. That’s the stage of the market we are in. Here’s the position when I was up $13.7k about a minute before I closed it out.

Here’s how many now 100 ETH leveraged trade is doing so far as of publication. I decided to take a bit more risk and now my liquidation price is $2726.

I entered at $3930 earlier today, ETH is at $3962 as of the screen shot, and I’m up $3294 in net profit so far. If I hold this position all the way to $25,000 ETH I would make $2.1 million.

Of course if ETH ever drops below $2726 even for a few minutes, I lose the $130k I’ve now bet (unless I add more USDT to the portfolio to reduce the liquidation price before hand).

I also did a 10x Kusama leveraged long trade earlier today on 100 KSM as soon as I saw the news drop on Twitter that their parachain auctions are about to go live. I’m up $6338k on that trade so far today and plan to hold it for another 2-3 months. I entered at $491 per KSM and now they are trading at $554 per KSM.

Kusama of course is the early stage Polakdot network that is launching this summer before Polakdot’s Fall 2021 launch. I’ve been writing about Polkadot and Kusama since February 2021.

With leveraged perpetuals trading, practice with small amounts first and have airtight risk management processes when you do trades like this (liquidation prices that are at least 30-35% below current market price and never ever more than 15% of total portfolio value in a single trade no matter how much information asymmetry you think you have an edge with).

Be careful out there folks. Learn and earn. Start small. Stay sharp.

Know that every crypto trader is just a baby (myself included) until after you’ve experienced your first liquidation.

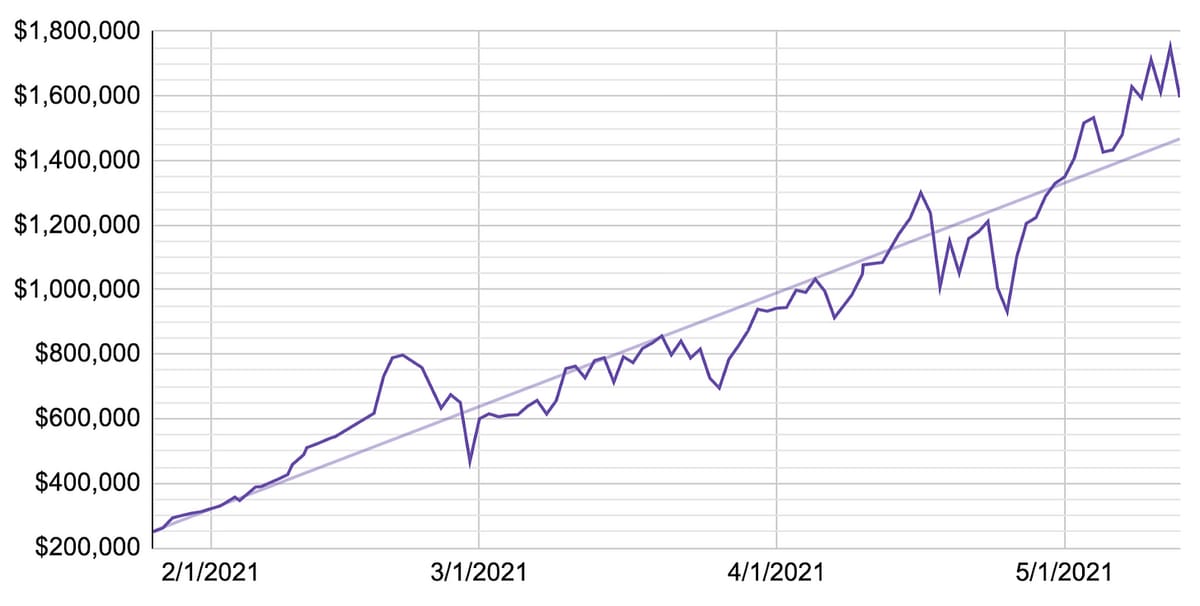

Coinstack Alpha Fund Week One Update - Deposits Reopened

As I announced last week I am experimenting with using Enzyme so that you can invest in a crypto strategy passively that I actively manage for you.

The Coinstack Alpha Fund on Enzyme is up 23.23% in the last month while Bitcoin is down 15.05% in the same time period.

In our first week open we now have $74,455 in AUM from 14 depositors.

Enzyme shut down new deposits for 5 days due to an Enzyme system upgrade Friday through Wednesday, but they are now open again for new deposits.

You can now invest yourself if you’d like me to manage some of your crypto portfolio for you. Enzyme holds your crypto and I invest it for you, hopefully generating a better return than you would on your own through passive investing.

For now, I suggest a minimum investment in the fund of $10k as gas fees are a bit high right now and would eat up too much of your capital if you invest less. Ethereum gas fees have gone up 3x in the last week ironically due in part to dog meme coins trading on Uniswap (temporary issue), so the Ethereum network gas fee to deposit is around $700-$800 right now.

Technically speaking you can invest any amount you want, but the gas fees eat up too much if you’re investing less than $10k right now. If investing over $10k then fees are less of an issue on a percentage basis. I expect the fee issue will all be fixed by Enzyme in 4-6 months by using a layer 2 scaling solutions. Once they move to layer 2 fees should drop 95-99% thankfully and I can open back up to amounts starting at $1,000.

I am still in an experimental phase for the next three weeks between now and June 5. If you’d like to be one of my first investors, you can invest here using ETH or USDT from MetaMask.

I’ll be perfecting the strategy over the next 30 days then opening up to more capital and announcing it more widely in June.

Performance and holdings are shown transparently down to the minute.

You can invest and withdraw capital at any time with no notice. No paperwork. I never hold your money. It’s all held by Enzyme. I just invest it and they send me the 2/20 fee.

The fee to invest is the standard hedge fund fee of 2/20, which is 2% annually of assets under management (AUM) and 20% of profits.

I created the fund two weeks ago and it’s up 23% so far as you can see above.

No guarantees, it’s experimental right now.

If you wish to invest in my experimental fund, you can do so here. It requires using ETH or USDT and one of these three wallet types:

MetaMask

WalletConnect

Coinbase Wallet

The fund started out at $1 per share and is now at $1.16 per share -- based solely on the returns of the capital invested.

I will be investing the funds deposited in what I believe will get an optimal return in both up markets (now) and potential sideways/bear markets (2022). As always, know that crypto investing is risky no matter how good the investor is. You should never invest an amount you aren’t prepared to lose 85% of.

And do know that it costs a gas fee when you invest and when you withdraw, so only invest if you’re prepared to hold for at least 6 months.

If you have any questions you can message me on Telegram. I’ll write again about it next month when it’s no longer experimental and ready for prime time.

Portfolio Update: Up 697% YTD 👀

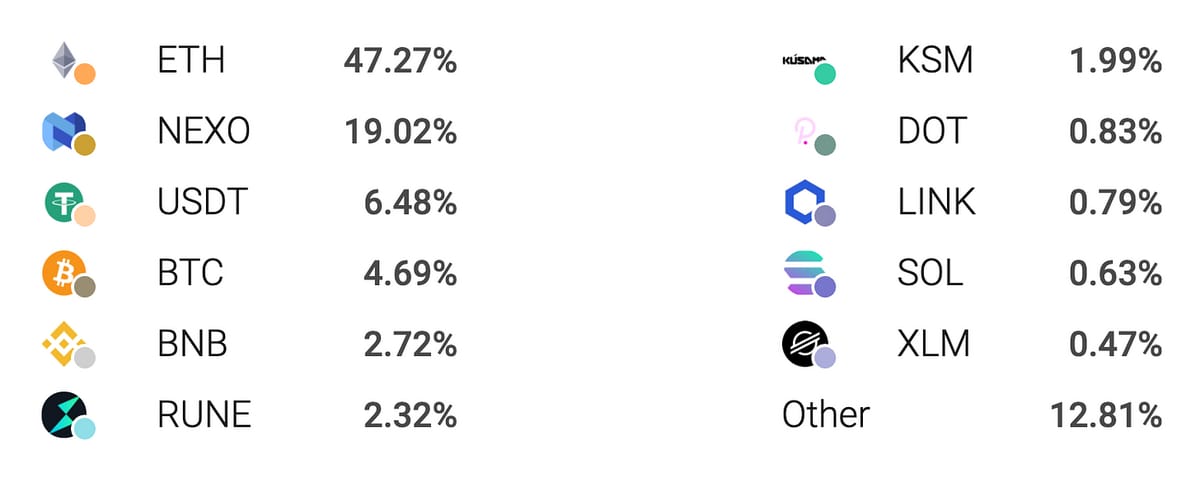

Below is my actual portfolio holdings as of today. I actively manage my own portfolio and make about 20-30 trades per week. As of this moment I am up 697% YTD while BTC is up 74% YTD.

I remain very bullish on RUNE however I have reduced that position a bit this week to free up capital to invest in ETH leveraged longs as I wrote about above. Stellar (XLM), the open source version of Ripple, has also moved into my top 10 holdings this week. I now hold over 300 unique tokens.

I also am getting more bullish on Kusama whose parachain auctions are about to begin.

While this chart says that I have 6.48% in USDT, I actually have 0% in USDT right now. That 6.48% represents the leveraged ETH longs I have on Binance (which are shown in USDT in Coinstats).

This means that 54% of my portfolio is now in ETH. That’s how much I believe in it and how much I believe ETH will overtake BTC in market cap in the next 18 months.

Programmable money will win. And without native smart contracts, BTC just isn’t programmable.

About three weeks ago I swapped 1 of my BTC for more ETH based on my conviction that ETH will continue to substantially outperform Bitcoin. I also plan to accumulate more DOT this summer as we prepare for Polkadot’s launch in Q3 2021. You can read more here about my crypto investing strategy. You can also invest in my Coinstack Alpha Fund here using Metamask and USDT or ETH.

Buy an NFT And Get Access to My Weekly Crypto Advice Call

I am now doing a live 30 minute Crypto Advice Zoom call at 9am PT / 12pm ET / 5pm GMT every Tuesday. All buyers of Mrs. Bubble’s NFTs are invited to join and ask questions and share learnings with each other. Just buy any Mrs. Bubble NFT on OpenSea and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite. Think of buying the NFT as supporting beautiful joyous art AND a ticket into our community. We had 5 callers on this week’s call and we went deep on perpetuals, leverage trading, Ethereum, Polkadot, and timing the market cycle. Join our community by getting a Mrs. Bubble NFT!

Mrs. Bubble’s Featured NFTs of the Week

Mrs. Bubble the artist is of course my wife Morgan Allis, so supporting her work directly supports our family and this newsletter -- and makes her yell with joy with every sale notification!

Here is the featured Mrs. Bubble art piece for this week. Remember that Mrs. Bubble is putting up a new piece each day and plans to build a long term NFT following.

You can think of her NFTs are both beautiful art that uplifts the world AND your digital ticket into my live weekly crypto advice calls every Tuesday.

This week we will feature Bubble #125 - Mordra The Dragon. Her buyer will receive the original signed and framed 8.5”x11” artwork mailed to them globally anywhere in the world -- making a great gift for any child. She is available for 1.11 ETH. The buyer will also be invited to the weekly crypto advice call every Tuesday.

This week we are also featuring BUBBLE #122 - The Soul Twins… available for 0.11 ETH.

Finally this week we are featuring the new BUBBLE #120 - Girafficorn... available for 0.2 ETH.

Thank you for supporting Coinstack by investing in our NFT art. And thank you to JonCRX and 3599C9 who purchased a Mrs. Bubble NFT and joined our weekly crypto advice call community.

As I wrote about I am doing a weekly live 30 minute Crypto Advice Zoom call at 9am PT / 12pm ET / 5pm GMT every Tuesday. All buyers of Mrs. Bubble’s NFTs are invited to join. Just buy any Mrs. Bubble NFTs on OpenSea and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite.

Join The CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1250 members on our Telegram.

A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

75% of Portfolio

Ethereum (ETH) 30% of portfolio

Polkadot (DOT) 10% of portfolio

Nexo (NEXO) 10% of portfolio

ThorChain (RUNE) 10% of portfolio

Kusama (KSM) 5% of portfolio

Bitcoin (BTC) 5% of portfolio

Binance (BNB) 5% of portfolio

25% of Portfolio - About 1.5% Each

Voyager (VGX)

Uniswap (UNI)

Chainlink (LINK)

Terra (LUNA)

Cosmos (ATOM)

Polygon (MATIC)

Decentraland (MANA)

Aave (AAVE)

Maker (MKR)

Travala (AVA)

ZenFuse (ZEFU)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymath (POLY)

I made a few updates to the above list to now include AAVE, Maker, Travala, and an early stage project I like called ZenFuse.

The People I’m Following Closely on Twitter

Mrs. Bubble The NFT Artist (my wife Morgan Allis)

How To Get Started With Crypto Learning

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

Coinstack Twitter at twitter.com/coinstackcrypto

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Substack at CoinStack.substack.com

Please share with your friends and colleagues.