Today we are celebrating passing 1000 subscribers as well as Bitcoin passing $50k. Today’s issue is about the rapidly growing Polkadot and Binance Smart Chain ecosystems and how to invest in the quickly growing projects within these ecosystems. Welcome to our weekly newsletter on blockchain and the future of money. Please pass this along to your friends.

Binance Smart Chain DeFi Growth Exploding

Polkadot Ecosystem Tokens Up 60% In Last Week

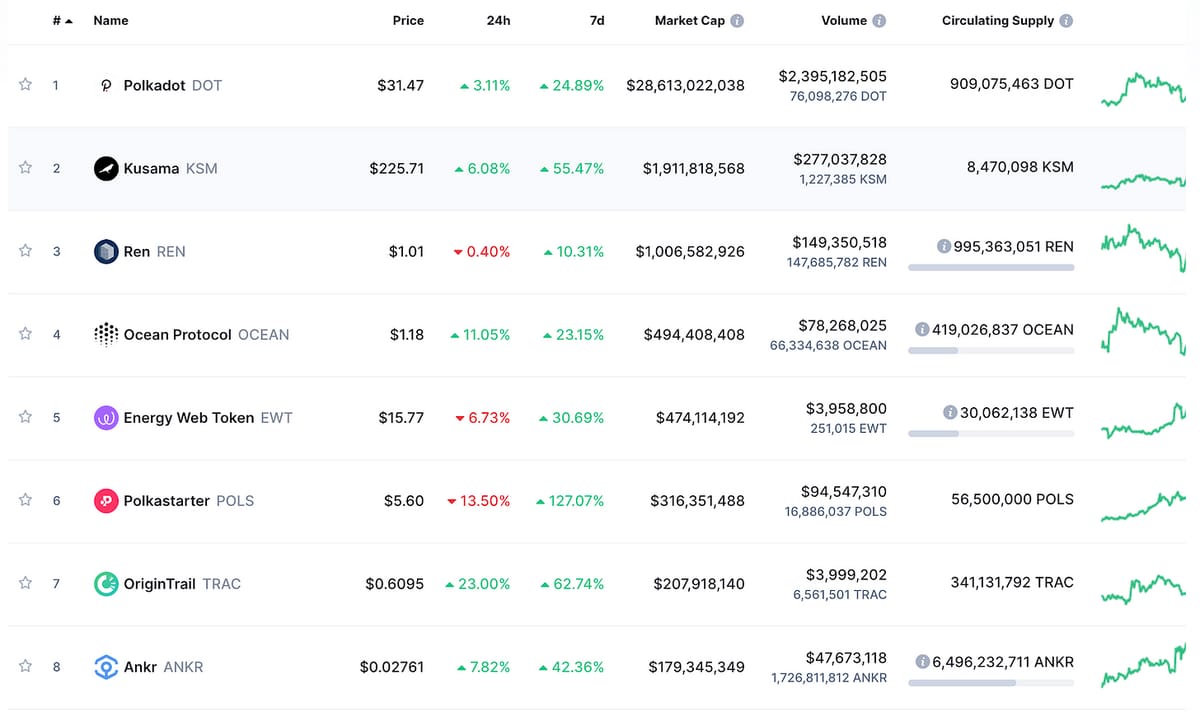

In Saturday’s issue of The Coin Times, I wrote about Polkadot and Kusama and projects in their ecosystem like Polkastarter, Celer, and RioDeFi. I mentioned 12 tokens in total. On average, in the last week, these Polkadot ecosystem projects have increased in value by 60%. That’s 60% growth in one week. Had you put $10k in a week ago, you’d have $16,000 today.

Let’s take a look at each of them.

An Entire Sector up 60% in a Week = Much Wow

Yes, it’s sort of unheard of for an entire market sector (not just one token) to go up by 60% in one week. Yet that is exactly what just happened this last week. And because this market is so new (Polkadot launched only six months ago in August 2020), many of these projects are likely to keep rising for many months and years to come.

Ethereum has a market cap of $218B yet Polkadot has a market cap of $28B.

I would not at all be surprised to see both of these top 3 blockchains go to a market cap of $1T to $2T in the next 5-10 years, leading to ETH around $20k per token and DOT at $2000 per token.

So whatever you invest now at ~$32 per DOT will, in my estimation, go up 35x+ or so this decade as Polkadot approaches a $1T market cap by 2030 (about where Bitcoin is today). Buy and hold, my friends.

While the current bull crypto market may end in about 6-9 months, Polkadot is well positioned to be a top 3 chain (BTC, ETH, DOT) going into the 2024 market cycle, creating a fundamentals-based long-term growth opportunity.

Long story short, buy what you can now… and plan on holding through 2035 and you will do very well. Buy and hold. Buy and hold. Buy and hold. And yes, I will write to give warnings when we are nearing the top of the markets in this cycle likely in late-Summer 2021.

And tell your friends to get some too! This is sort of like 1994 and the invention of the Internet — but now we are creating a new global monetary and financial system for everyone that is actually fair, transparent, and non-corrupt.

Yes, It’s Still Really Early for Polkadot

The market is starting to realize how much the Polkadot ecosystem will be growing in 2021 and 2022. And yes, it is still early.

Polkadot will be launching their parachains in Q2 2021, so if you invest now you are 3-4 months ahead of most.

As you study the field of Polkadot ecosystem projects, we also recommend taking a close look at Frontier (FRONT, up 376% last 7 days), Polkacover (CVR, up 235%), Phala Network (PHA, +60%), and Mantra Dao (OM, +67%).

We are in such exciting times as we reimagine our global financial system based on a fair and trustable distributed ledger technology and smart contracts instead of paper inside filing cabinets. Yay for a monetary system that works for everyone where money can’t be inflated away at the whim of a few.

Why the Binance Smart Chain DeFi Ecosystem has grown 1400% in 30 days & How You Can Invest...

The rise of Decentralized Finance (DeFi) applications was the story of 2020. Applications like Maker, Aave, Compound, Curve, and Uniswap grew like there was no tomorrow.

Now, however, the actual users of these Ethereum-based DeFi platforms and exchanges are seeing high transaction fees due to so much use of the Ethereum network (remember, lots of use is a good thing!).

It’s going to take a few months of development within the Ethereum DeFi platforms to move over to layer 2 solutions like Polygon (MATIC) and Loopring (LRC) or sidechains like Skale (SKL).

In the meantime, lots of DeFi activity is moving over to the Binance Smart Chain. Launched in August 2020 by Binance, the world’s largest crypto exchange, the Binance Smart Chain is built on top of the Cosmos blockchain. Its growth has been phenomenal the last month.

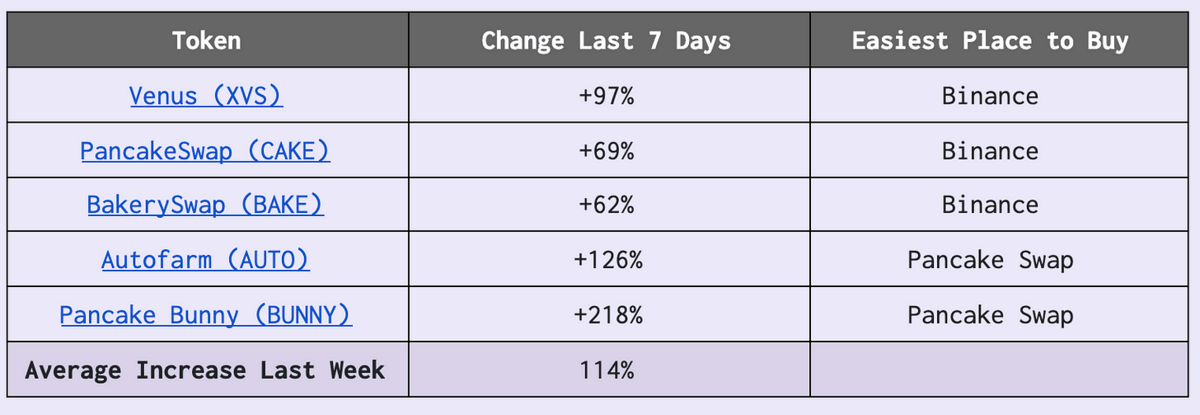

Here are some of the DeFi projects launched on the Binance Smart Chain and how much their total value locked inside of them has grown in the last 24 hours.

Based on the rapid increase in value being locked up in this platforms by their users, I strongly recommend looking into investing in these Binance Smart Chain DeFi projects...

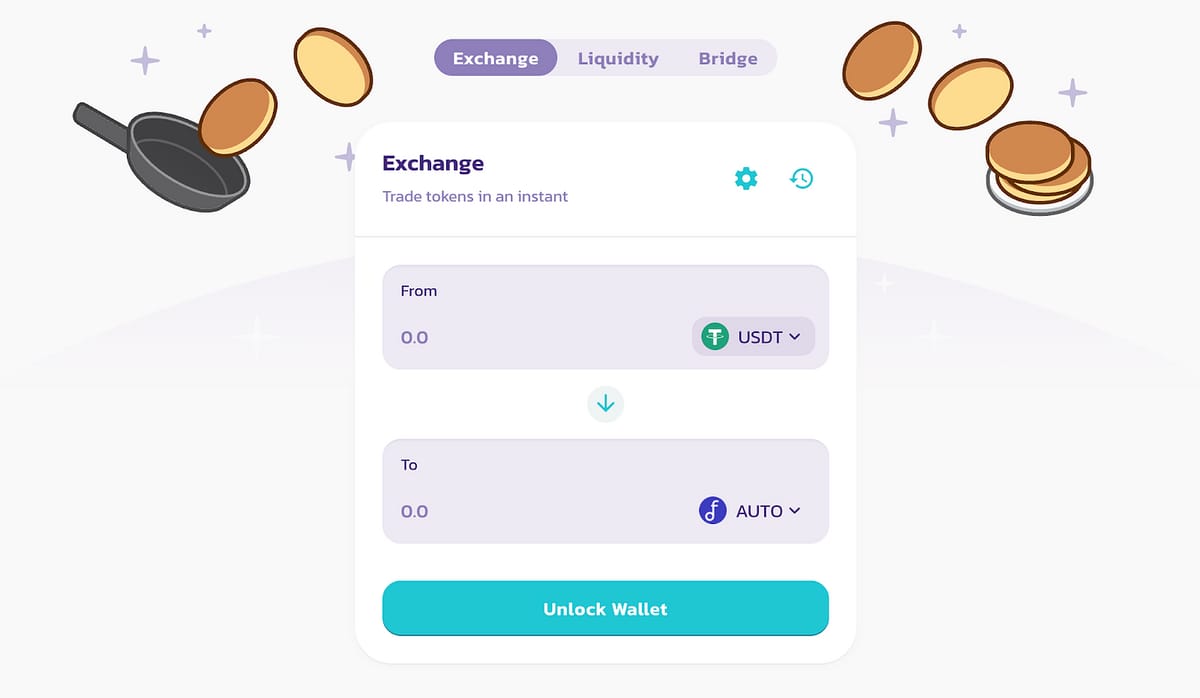

If you can figure out how to use Pancake Swap to get some Autofarm and Pancake Bunny, well, you my friend, have officially graduated into being intermediate skilled at crypto.

We’ll check back in next week to see how these have performed.

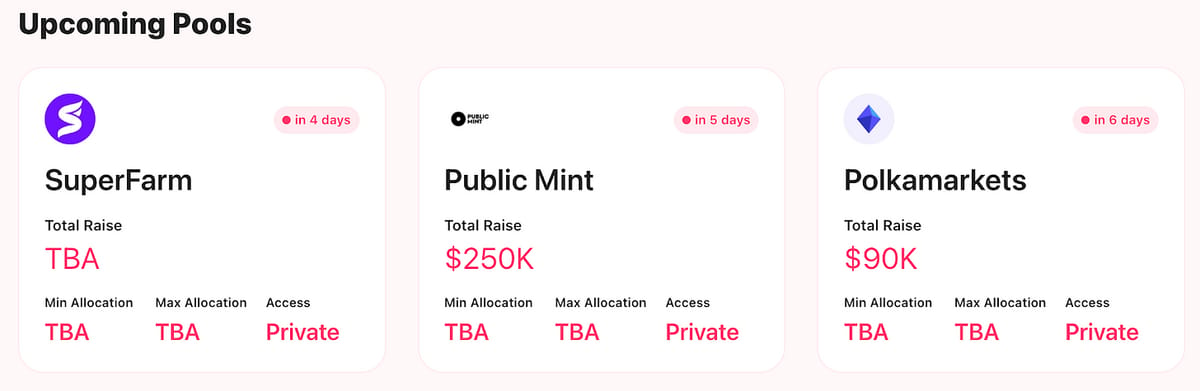

Investing in IDOs on Polkastarter

This week will see five exciting Initial Decentralized Offerings (IDOs) on Polkastarter. Polkastarter (POLS) is building the Uniswap of the Polkadot world. Here are the three we are excited about this week.

Feb 22 - Super Farm (FARM) - Cross-chain DeFi protocol based on PolkaDot

Feb 23 - Public Mint (MINT) - Platform for bridging fiat and crypto

Feb 24 - Polkamarkets (POLK) - Prediction markets on Polkadot

On average the Polkastarter IDOs have gone up 32x from their IDO price. The worst (ROYA) went up 3.5x while the best (PAID) went up 118x.

Polkastarter usually limits investors to around 0.25 ETH per investment (around $500). So it’s a nice way (on average) to turn $500 into $4,000 a couple times per week by investing in projects very early on.

You can register at www.polkastarter.com to participate. You need to get your MetaMask wallet address whitelisted in advance. When there is high demand for a particular project there are lotteries to see who gets to invest. Play around and see what you can learn.

Investor Update: We’re Now in the Middle of This Bull Cycle

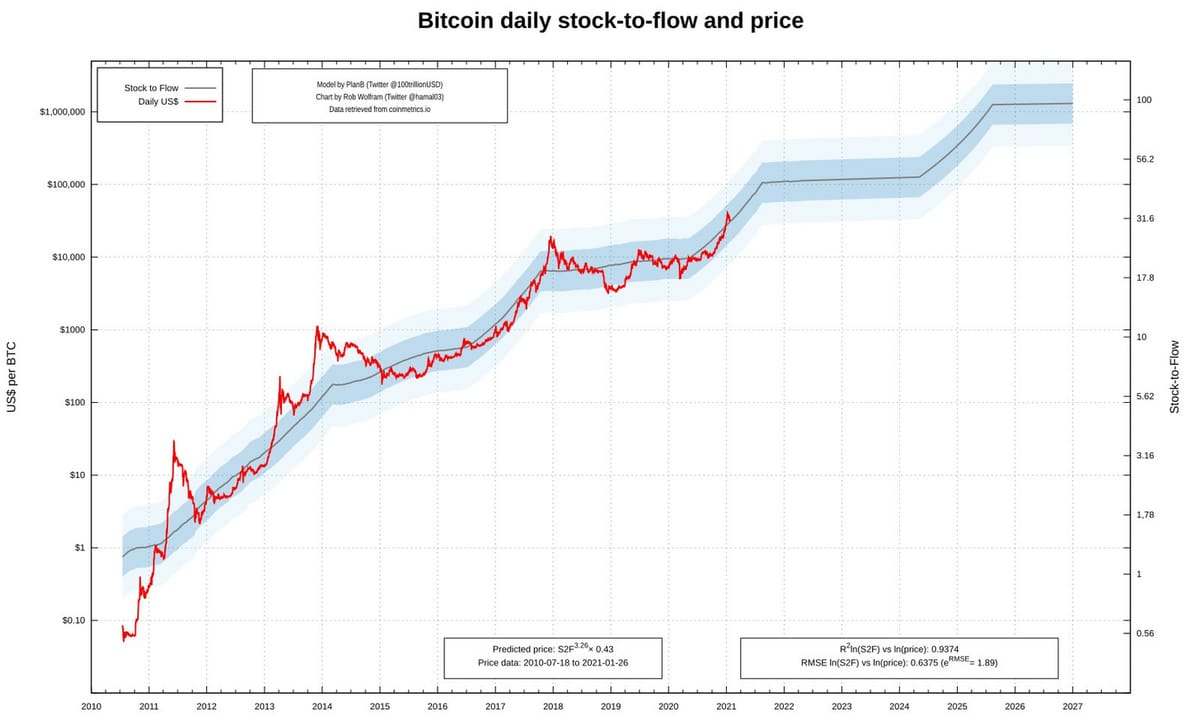

We still have another 6 months or so to go in this bull market cycle when you look closely at the Stock to Flow model and what happened in the the 2013 and 2017 post-halving bull cycles.

As a reminder, the stock to flow (S2F) model predicts a cycle peak around August 18, 2021 when Bitcoin reaches around $103k per coin. We think this indicator has been spot on over the past three cycles, and it will continue to track actual price movements closely.

While no one knows yet exactly what will happen, I expect we will likely see a major run-up to around $200k per Bitcoin by December 2021 and then a “crash” back to $100k or so in Q1 2022.

Based on the 2017 cycle, we will reach around $292,000 before a 70% correction back to $90,000.

Many in early 2022 will say “Bitcoin crashed” when in reality it went up from $4k per token to $100k per token in 18 months. LOL.

While we may see 10-20% small corrections from time to time, based on all the analysis I’ve reviewed and three cycles of patterns, we aren’t likely to see a 50-70% crash until after we get well above $100k.

The crash is also likely to be less severe this time due to amount of long-term institutional holding and inherent usage of BTC, ETH, and DOT.

Right now there is a lot of demand and very little supply interested in selling. Supply will increase a bit as prices get overheated above $100k per BTC. Until then, keep buying and holding.

I expect by mid 2022 the BTC price to stabilize around $100k and then take off again in April 2024 after the next halving cycle begins, heading toward $1M.

Willy Woo wrote in his private Substack newsletter, “Mean reversion modelling continues to suggest a price target of $200k-$300k by the end the of this year. Despite very steep climbs in price, we are still only half way into this exponential run.”

Eventually, Bitcoin will be at $1M per coin (likely by 2030), so anyone investing at $50k is likely to do very well. Just do everyone a favor and get your friends in before $100k.

Are You Still Early to Crypto? Yes

Here’s a basic assessment, and the answer is… yes, you’re still early...

Invested before BTC $1k: Super super early

Invested before BTC $10k: Super early

Invested before BTC $100k: Early

Invested before BTC $500k: Not early, not late

Invested after BTC $500k: What most people will do

Invested after BTC $1M: Late, but still growth potential, focus more on use case as store of value and medium of exchange than rapid asset price appreciation.

There’s just no way that Bitcoin doesn’t eventually become worth more than gold, which would make it worth $534k per BTC.

Keep in mind today Bitcoin has about the same number of users as the internet did in 1997 (1.7% of humanity), but adoption is increasing at a pace that is faster than the internet.

Updated Crypto Portfolio Recommendations

Here are my specific recommendations for anyone getting started in crypto investing with a balanced mix of potential return and asset preservation. I adjust these each week based on what I learn and any changes in the marketplace.

Never invest an amount you can’t afford to lose. Crypto is volatile and downswings of 80%+ happen. Don’t invest more than 50% of your total net worth in crypto.

Be careful investing on borrowed money (margin). We don’t recommend it until you’re experienced.

Unless you’re an experienced and professional trader with many years of training, your best bet is to buy and hold for the long term (10-15 years) and not attempt to time the market. If you are going to attempt to time the market, be very familiar with the Stock to Flow model and the timing of BTC halvings and be very familiar with the research backing up the blue chips like BTC, ETH, DOT. While it will have swings along the way, we do expect the current bull market to continue until at least September 2021.

We recommend Coinbase for those investing small amounts (<$10K) and Binance (use a VPN if needed), Coinbase Pro, Huobi, Kucoin, Gemini, or Kraken for those investing larger amounts ($10k+). You can also use the no-fee Voyager or Nexo which give you no-commission trades and 6-8% annual interest in exchange for holding your cryptodeposits.

Many tokens don’t yet trade on Coinbase. Binance has most of them. Huobi, Kucoin, and Uniswap have anything Binance doesn’t have.

See the research at Simetri, Messari, Trade the Chain, and Flipside Crypto for even more due diligence.

For a mix of long-term capital preservation and growth, we recommend keeping 20% of your holding in BTC, 20% in ETH (“The Blue Chips”), 10% in Polkadot (“The New Ethereum”), 10% in Kusama (“Polkadot’s First Blockchain”), 10% in NEXO (“The best NeoBank”), 10% in Binance’s BNB, and the remaining 20% in up-and-coming projects. Here’s what we like the most right now based on months of research (the ones I like the most are bolded):

I like these blockchain techs: ETH, DOT, KSM, ATOM,ADA, SOL

I like these NewFi Banks: NEXO, VGX, CAS

I like these Exchanges: BNB, HT, UNI, SUSHI,FTT, 1INCH, BURGER

I like these Binance DeFi Protocols: XVS, CAKE, BAKE, BUNNY, AUTO

I like these Ethereum DeFi protocols: AAVE,COMP, SNX, CRV, BAL, REN

I like these Oracles: LINK, BAND

I like these Web 3.0 Tools: THETA, GRT, FIL, MATIC

I like these Insurance Tools: CVR, WNXM, ARMOR

I like these Polkadot Apps: POLS, TRAC,OCEAN, ONT, RFUEL, XFT, PHA

I like these Payment Platforms: EGLD,CELO, XLM

I like this Security Token Platform: POLY

My Top 20 Recommendations Right Now...

If I were creating a portfolio from scratch now, I would be absolutely sure to include:

80% of Portfolio

Bitcoin (BTC) 20% of portfolio

Ethereum (ETH) 20% of portfolio

Nexo (NEXO) 10% of portfolio

Polkadot (DOT) 10% of portfolio

Kusama (KSM) 10% of portfolio

Binance Token (BNB) 10% of portfolio

Remaining 20% of Portfolio - About 1.5% Each

Voyager (VGX)

PancakeSwap (CAKE)

Polystarter (POLS)

Venus (XVS)

Cosmos (ATOM)

Pancake Bunny (BUNNY)

AutoFarm (AUTO)

Chainlink (LINK)

OriginTrac (TRAC)

Ocean Protocol (OCEAN)

Ontology (ONT)

PolkaCover (CVR)

RioDeFi (RFUEL)

Polymarket (POLY)

The People I’m Following Closely on Twitter

If You’re Just Getting Started With Crypto, Start Here

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coin Times: Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published and written weekly by Ryan Allis.

Comments and thoughts welcome:

Telegram channel at t.me/thecointimes

Substack at TheCoinTimes.com

Please share with your friends and colleagues.