Social Links: Twitter | Telegram | Newsletter

Learn More at www.oeth.com, www.tokenx.is, and www.decard.io

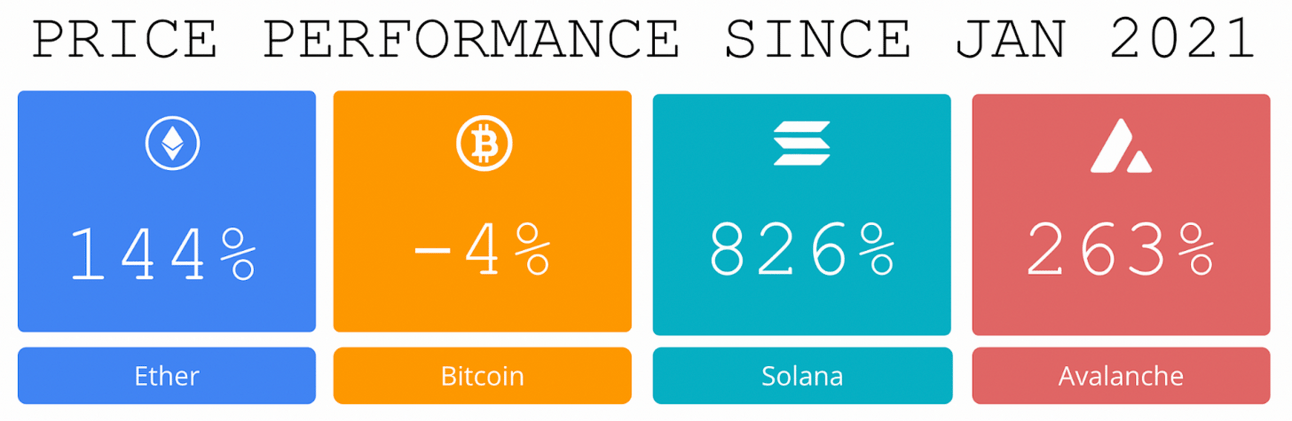

Price performance of top L1 tokens since we began writing Coinstack in January 2021. Hey BTC is almost back to the positive!

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

Thanks to Our 2023 Coinstack Sponsors…

At a trailing 7-day APY of 12%, Origin Ether offers the best liquid staking yield on the market. Users can deposit ETH or liquid staking tokens for OETH to earn over twice the yield from liquid staking tokens. The protocol has already accrued over 7,200 ETH ($13.5M+) in deposits from holders of stETH, rETH, frxETH, and ether. Origin Ether is audited by leading auditor OpenZeppelin, the team responsible for security audits of Coinbase, Aave, and The Ethereum Foundation. To learn more and to start stacking ETH faster, head over to www.oeth.com

TokenX streamlines Web3 tokenization for Web2 companies, simplifying the integration of blockchain technology into existing applications. Powerful APIs tokenize assets with on/off blockchain metadata, policies, and authentication. Leveraging TokenX, Web2 companies can access the benefits of decentralization, ownership, authentication, and transparency provided by Web3, unlocking new opportunities for growth, customer engagement, and innovation. Learn more at www.tokenx.is

Unleash the power of DECARD’s DEX, the decentralized exchange designed to conquer the $11.5 trillion spot market. DECARD’s unique and patented tech stack, build on Tagion infrastructure, ensures a seamless trading experience and delivers never-before-seen effective order books in a decentralized environment. Bid farewell to frontrunning and custody risks and embrace a secure future with DECARD’s DEX. Join and revolutionize the way you trade at DECARD.

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

To reach our weekly audience of 110,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top stories of the week…

📈 Fidelity Is Preparing To Submit Spot Bitcoin ETF Filing- Asset management giant Fidelity is close to submitting its own filing for a spot bitcoin exchange-traded fund, joining a long list of issuers keen to be first to market with such a product.

This follows the June 15 ETF submission by Blackrock, which has since been followed by other asset managers including Invesco, WisdomTree and Bitwise.

An ETF, or exchange-traded fund, is a publicly-traded investment vehicle that tracks the value of its underlying asset—such as Bitcoin. Shares in a Bitcoin ETF would be tradable on a traditional stock exchange.

The SEC has repeatedly rejected proposals for Bitcoin ETFs in the U.S., but there is new optimism in 2023 that approval is coming.

⚖️ Judge Denies Motion to Dismiss Most Charges Against Sam Bankman-Fried- The federal judge presiding over Sam Bankman-Fried’s case denied a motion from his defense team to dismiss most of the charges filed against the FTX co-founder. Bankman-Fried blamed ‘crypto winter’ for FTX failure in seeking dismissal of most charges.

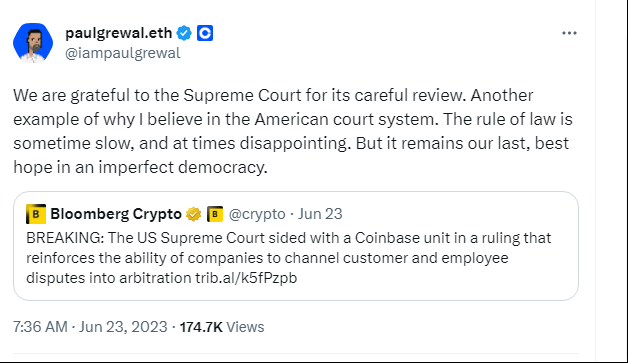

🎉 Coinbase Celebrates Win at US Supreme Court Over Arbitration- Coinbase celebrated a victory at the U.S. Supreme court on Friday, even if it wasn't directly related to the broader dispute it's been embroiled in with regulators in the country.

🦀 Alameda Seeks to Claw Back $700 Million SBF Paid ’Super Networkers'- Former billionaire and founder of bankrupt exchange FTX Sam Bankman-Fried dolled out millions for access to the world's most powerful people. And now the estate wants those millions back.

⚖️ SEC to Forego BlockFi’s Outstanding $30 Million Penalty—For Now- Bankrupt crypto lender BlockFi—a knock-on casualty of FTX’s historic collapse last November—has been granted temporary relief from settling an outstanding penalty of $30 million levied on it by the SEC in February 2022, according to a Thursday court filing.

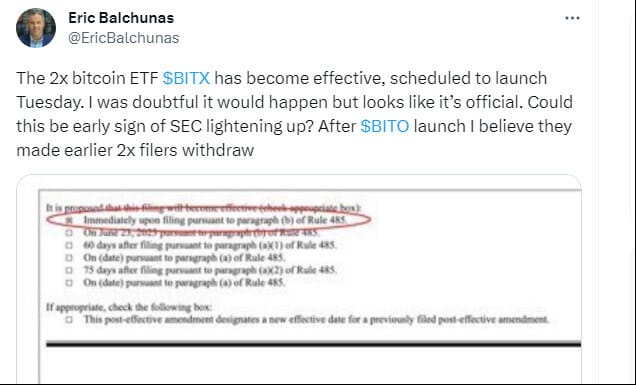

⚖️ SEC Approves First Leveraged Bitcoin Futures ETF- The U.S. Securities and Exchange Commission (SEC) has approved the first leveraged Bitcoin futures exchange-traded fund (ETF) on Friday.

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @intotheblock

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

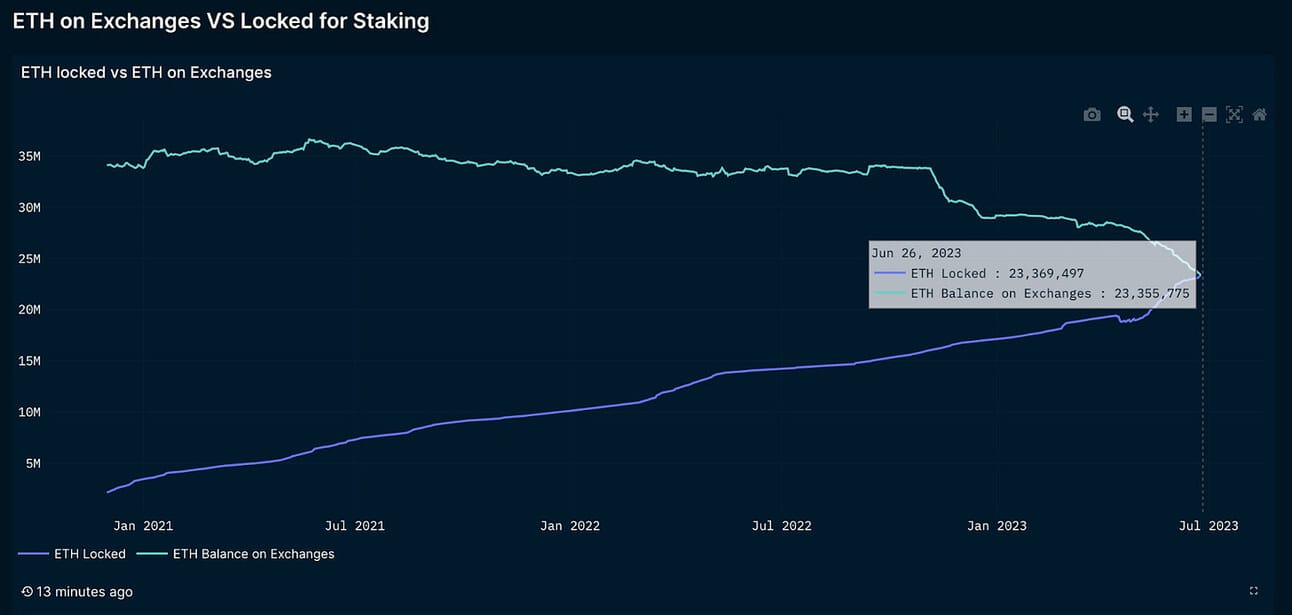

1. Staked Eth now Exceeds Eth on Centralized Exchanges

Source: @eking0x

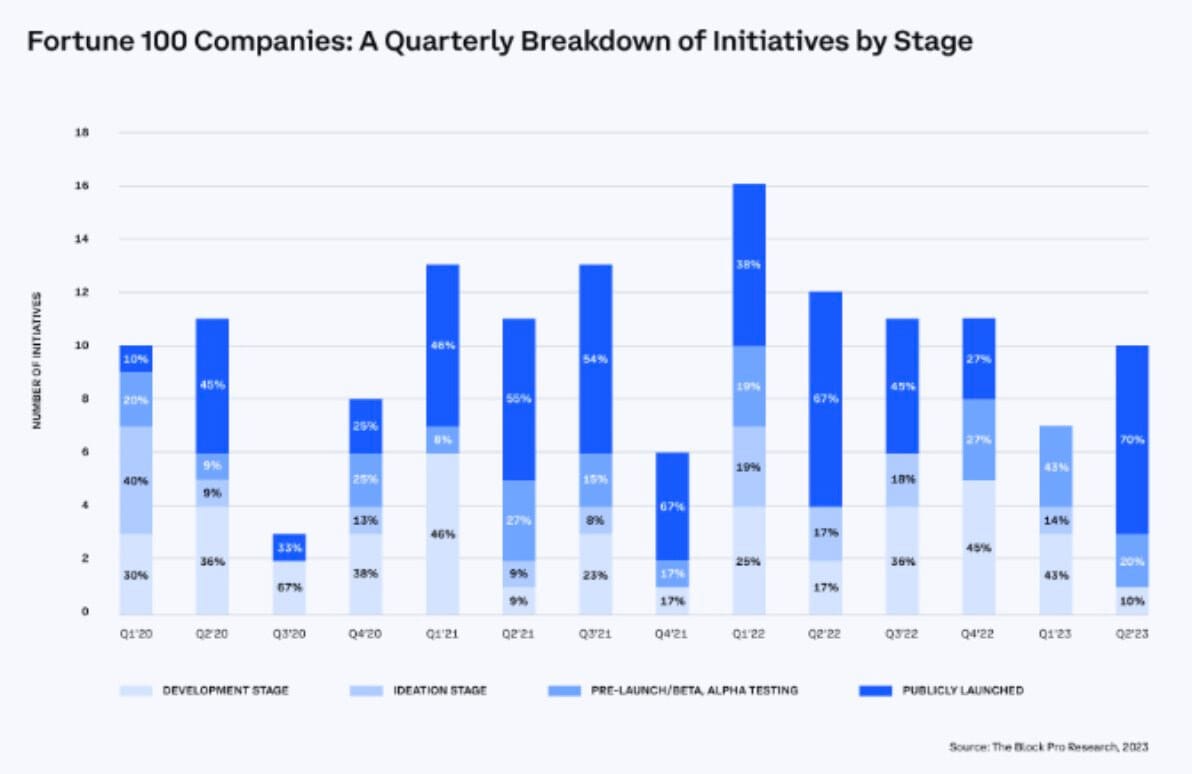

2. More than 50% of the Fortune 100 have pursued Web3 initiatives since 2020. Furthermore, 83% of surveyed Fortune 500 execs say their companies have either current initiatives or are planning them.

Source: @singularity7x

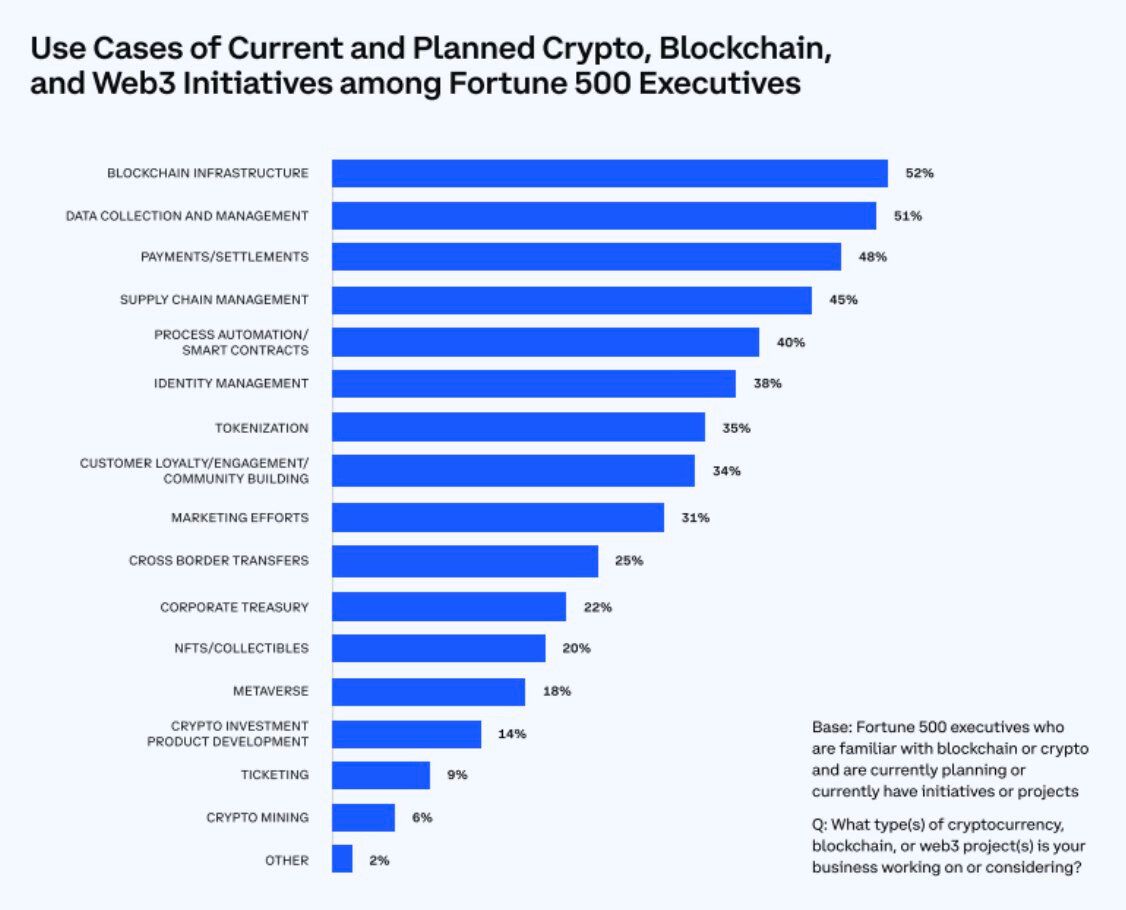

3. Blockchain infrastructure, data collection/management, and payments/settlement are the top Web3 use cases in the works. Within the financial services sector, initiatives have skewed heavily toward payments, crypto trading products, and tokenization.

Source: @singularity7x

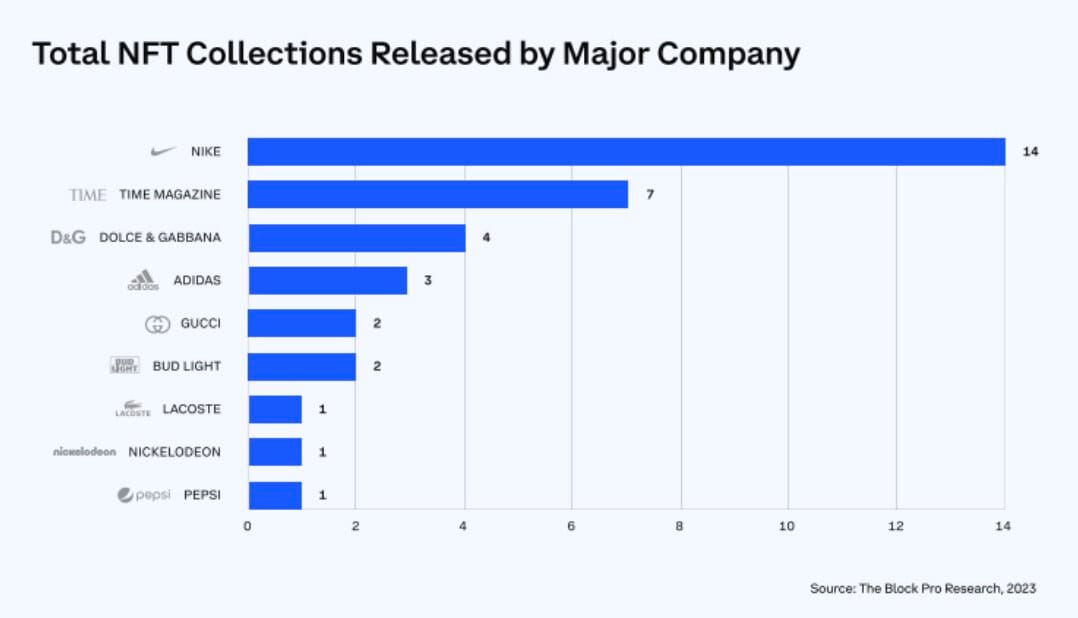

4. NFTs are driving retail’s Web3 initiatives by offering companies a path to ROI. Fortune 100 companies together have amassed royalty revenue of more than $100M, while collections linked to the Fortune 100 companies have generated secondary market volume exceeding $1.6B.

Source: @singularity7x

5. Fortune 100 companies have made Crypto VC investments participating in rounds totaling more than $8B.

Source: @singularity7x

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Solana’s Emerging Tech Stack

The ultimate goal of Solana is to facilitate the millions of interactions required by leading financial and consumer use cases on a single shared state to retain maximum asset composability. There are a few prerequisites for any chain to achieve the above end goal:

Validator Scaling: At both the hardware and software level, validators need to be able to process hundreds of thousands to millions of transactions a second to accommodate Web2 use cases on chain.

State Management: to lower cost of storage on chain, mechanisms need to be established to optimize the amount of data stored onchain which directly impacts the unit cost of certain transactions.

Hotspot Isolation: The chain needs to be able to support multiple independent use cases where one use case doesn't prohibitively drive costs or increase liveliness risks for other applications on the chain.

Solana’s approach to meeting these prerequisites hinges on the success and further development of a few key initiatives already in play, namely:

Firedancer

State Compression

Local Fee Markets

Firedancer

If there’s one thing in the Solana ecosystem most people are bullish on, it’s Firedancer.

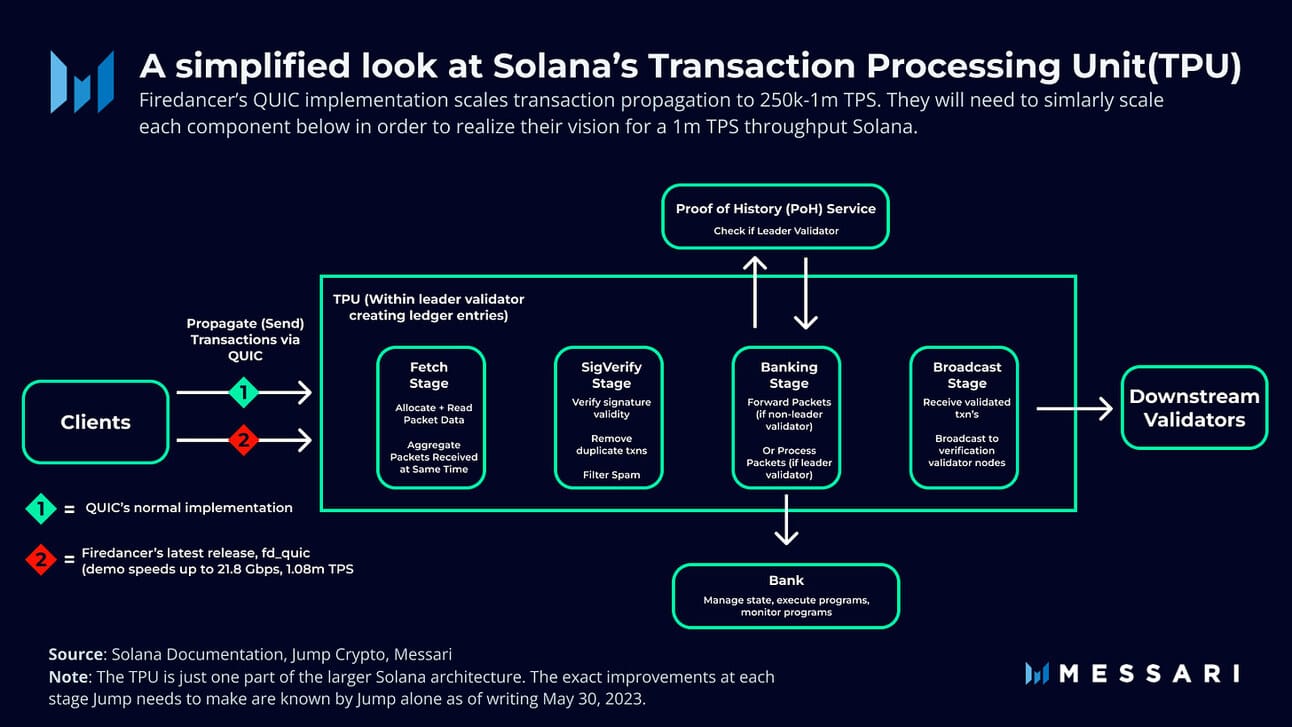

What it is: Firedancer is a new validator client developed by Jump Crypto. Initial tests showed capabilities of over 1 million TPS – 20x higher than Solana’s current theoretical limit. In order to move Firedancer from test to production, Jump Crypto must scale each function Solana validators handle.

After all, you’re only as fast as your slowest link.

Broadly speaking, the four functions Jump Crypto seeks to scale are:

Transaction Propagation: Sending transaction data from network users to leader validator / receiving transaction data as the leader validator

Transaction Processing: Running the computation needed to execute transactions, update, and maintain account state

Transaction Broadcasting: Broadcasting transactions to validators across the network

Transaction Verification: Verifying transaction validity and finalize transactions

Jump Crypto attacked the problem of propagation scaling through its first big milestone, a Firedancer-optimized version of QUIC (the transaction messaging protocol used by Solana) dubbed fd_QUIC,. In order to execute transactions at over 1 million TPS, a network must first be able to receive transactions at that speed. fd_QUIC proves Firedancer will be able to handle that.

That said, it’s only the first of many subcomponents scaled. There’s many more to go.

The scope of the project does introduce significant execution risk. That said, Firedancer is objectively in good hands. Jump Crypto and Jump at large have extensive experience in high-speed networking, and the project is led by Kevin Bowers – a former Bell Labs and D.E Shaw scientist. For reference, Bell Labs is credited with the invention of photovoltaic cells, the transistor, and several other tech innovations. Without getting lost in their respective backgrounds, know that this is a collection of companies that should not be understated with respect to high-performance systems.

What it unlocks for Solana:

Firedancer would make Solana capable of handling the NASDAQ, NYSE, Twitter, and all of Visa’s daily transactions all at once, all on the same shared state – and with room to spare. Those platforms would all add up to roughly 150k transactions per second – Firedancer’s initial tests show roughly 600k transactions per second as a lower estimate.

A successful Firedancer release likely confers a persistent throughput advantage to Solana. Ethereum can and will improve scaling by summing up all its rollups, but it’s a tall order to seamlessly and securely connect these rollups to a near-Firedancer-level degree.

The second key benefit of Firedancer, at least in theory, is improved client diversity for Solana. Solana has historically struggled with client bugs, which are one of the main sources of its infamous network halts. Since there’s really only one validator client (technically, there are two, but the Jito client is a fork of the Solana Labs client and is subject to the same bugs), a single bug can cause significant degradation or outright halts to the network.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.oeth.com, www.tokenx.is, and www.decard.io