Learn More at www.amphibiancapital.com, and www.digitalassetresearch.substack.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This FTX claim values soared, the German government offloaded 900 Bitcoin, a judge signaled the likely continuation of an SEC lawsuit against Kraken, and big new venture rounds came in for Particle Network ($15M) and Saltwater Games ($5.5M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $70M+ AUM, is a fund of the world's leading hedge funds. +11.20% net YTD with their USD fund, +9.29% net YTD in their ETH fund (80.01% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

1995 Digital Asset Research pushes the boundaries of conventional investment wisdom, uncovering hidden market secrets to provide you with a truly unique and unmatched edge. Our emphasis on broader market cycles and in-depth analysis of on-chain crypto projects aims to help you achieve your investment goals. With our actionable insights, market research, and Web 3 tech tutorials, we empower you in the crypto universe, awakening you to the immense power of digital assets.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Hedge Funds Made a Killing on FTX—Then It Got Complicated: The core problem underlying this and other disputes: FTX claim values have jumped as the prospect of a larger eventual payout has grown, thanks in part to a fierce rebound in crypto prices. That means many FTX clients who sold quickly missed out on getting a better price later or securing a direct payout from the FTX estate.

🔻 German Gov’t Offloads 900 Bitcoin, 400 BTC sent to Coinbase and Kraken: The added selling pressure from the German government tanked the Bitcoin price below the key $60,000 mark.

⚖️ Judge Signals Likely Continuation of SEC Lawsuit Against Kraken: A federal judge in California indicated that he is inclined to let the US Securities and Exchange Commission’s (SEC) lawsuit against Kraken proceed, casting doubt on the exchange’s efforts to have the case dismissed, according to media reports.

⚖️ CFTC Reportedly Probing Jump Crypto’s Trading, Investment Activities: The US Commodity Futures Trading Commission (CFTC) has initiated a probe into Jump Crypto for undisclosed reasons, Forbes reported on June 20, citing people familiar with the matter.

🚀Layer 2 Network Blast to Roll out its Token Airdrop Next week: Blast, an Ethereum Layer 2 network created by the founder of NFT marketplace Blur, is officially launching its token airdrop in a week.

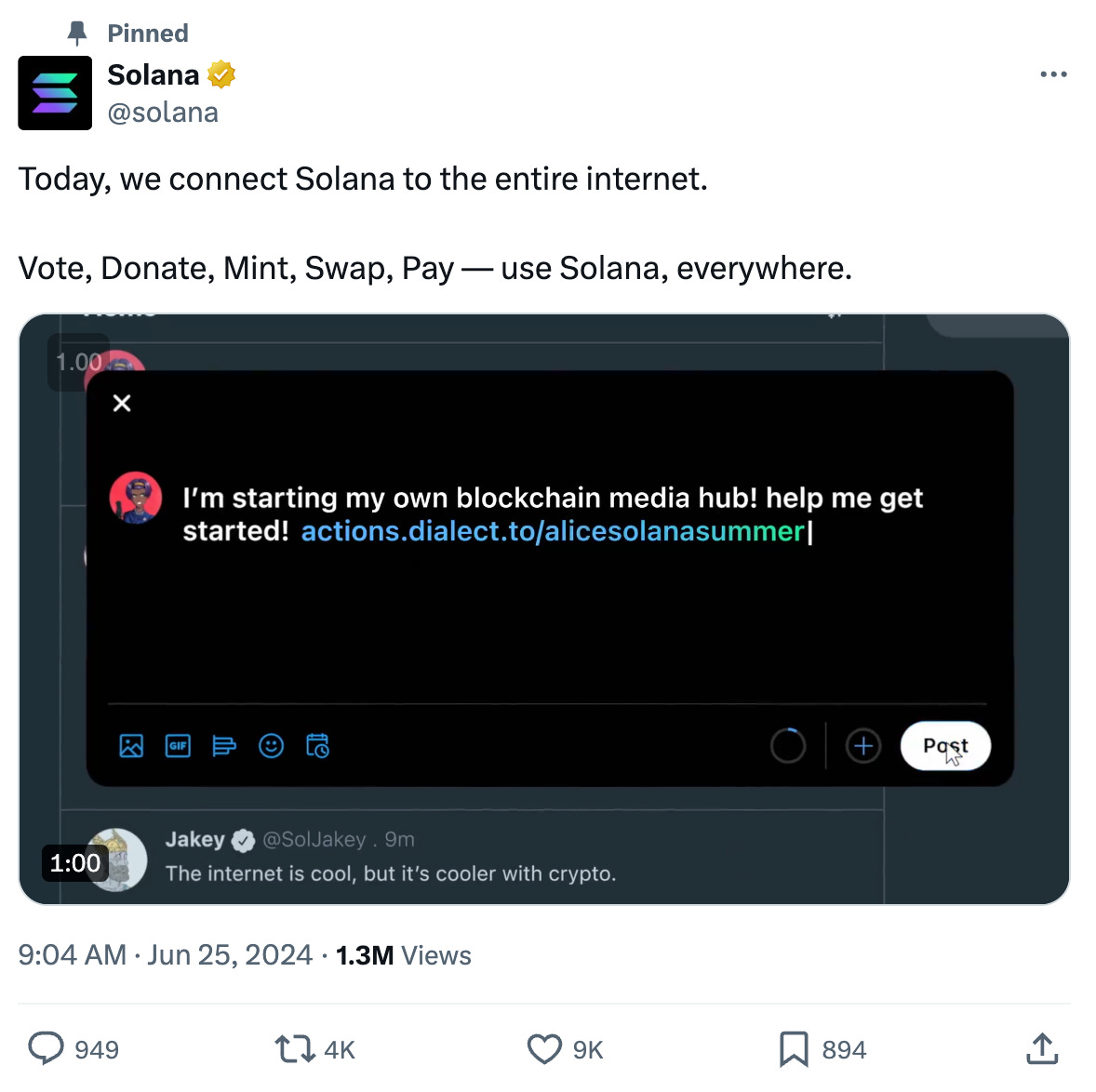

💬 Tweet of the Week

Source: @solana

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

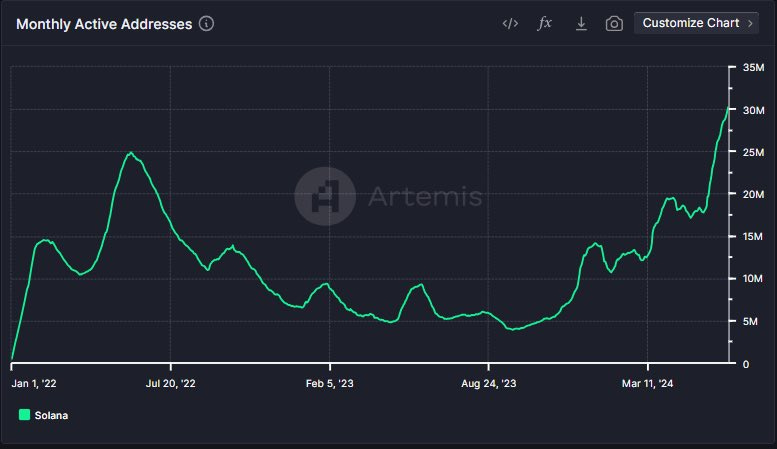

1. Solana monthly unique users hit 30 million worldwide with user median 16 tx/day - both new records for blockchain adoption benchmarks.

Source: @martypartymusic

2. Despite macro headwinds and a rough few weeks across crypto markets, activity on Base continues to surge. Earlier this week, the network handled over $3.05B in daily stablecoin transfer volume, a new record, and brings the total volume to $33.4B in June.

Source: @DavidShuttleworth

3. One of the more interesting movements this past month is just how pronounced of an impact memecoins have had on Solana DEX activity as well as the broader DEX ecosystem, pushing both sectors to historic levels… Overall, Raydium is now responsible for 63% of all DEX volume and has become the market leader for the first time ever.

Source: @DavidShuttleworth

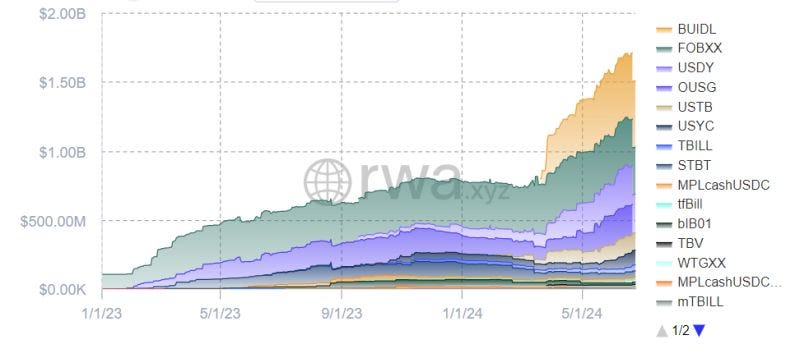

4. BlackRock's tokenized liquidity fund BUIDL, investing in short-term treasuries, amassed nearly $500M since launch in March. That's 30% of the total tokenized treasuries market.

In comparison, crypto-native firms like Maple Finance which operate an equivalent product since as early as 2022 hold just $18M.

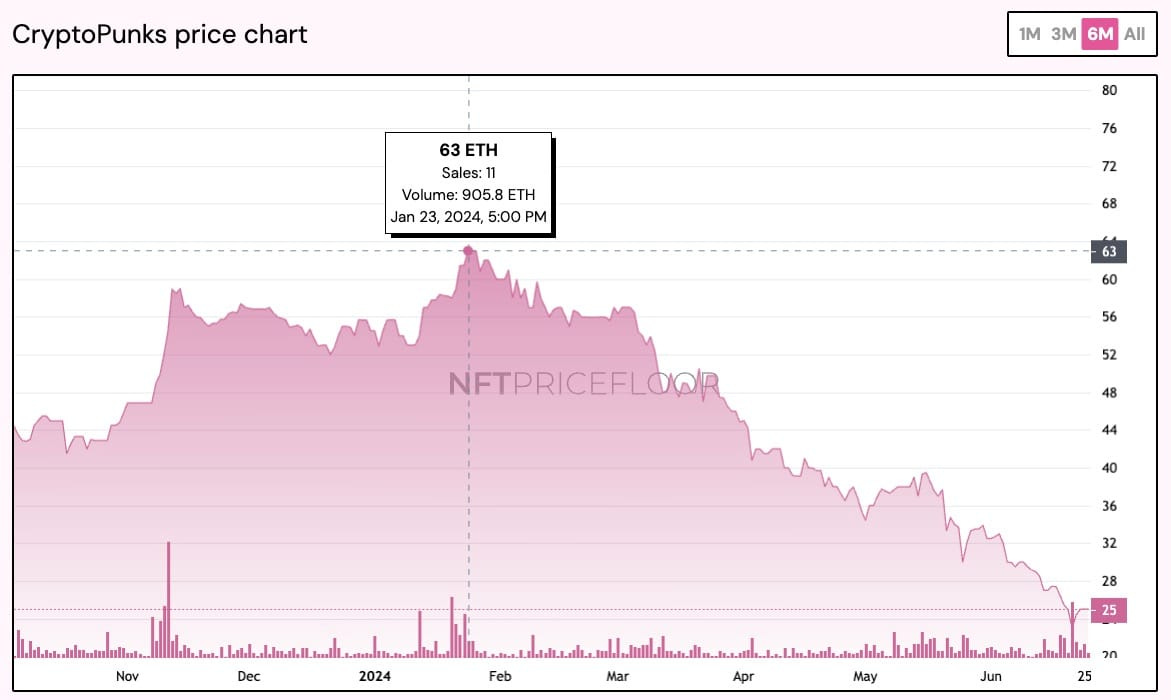

5. CryptoPunks down 60% from 2024 high of 63Ξ

Source: @OurNetwork

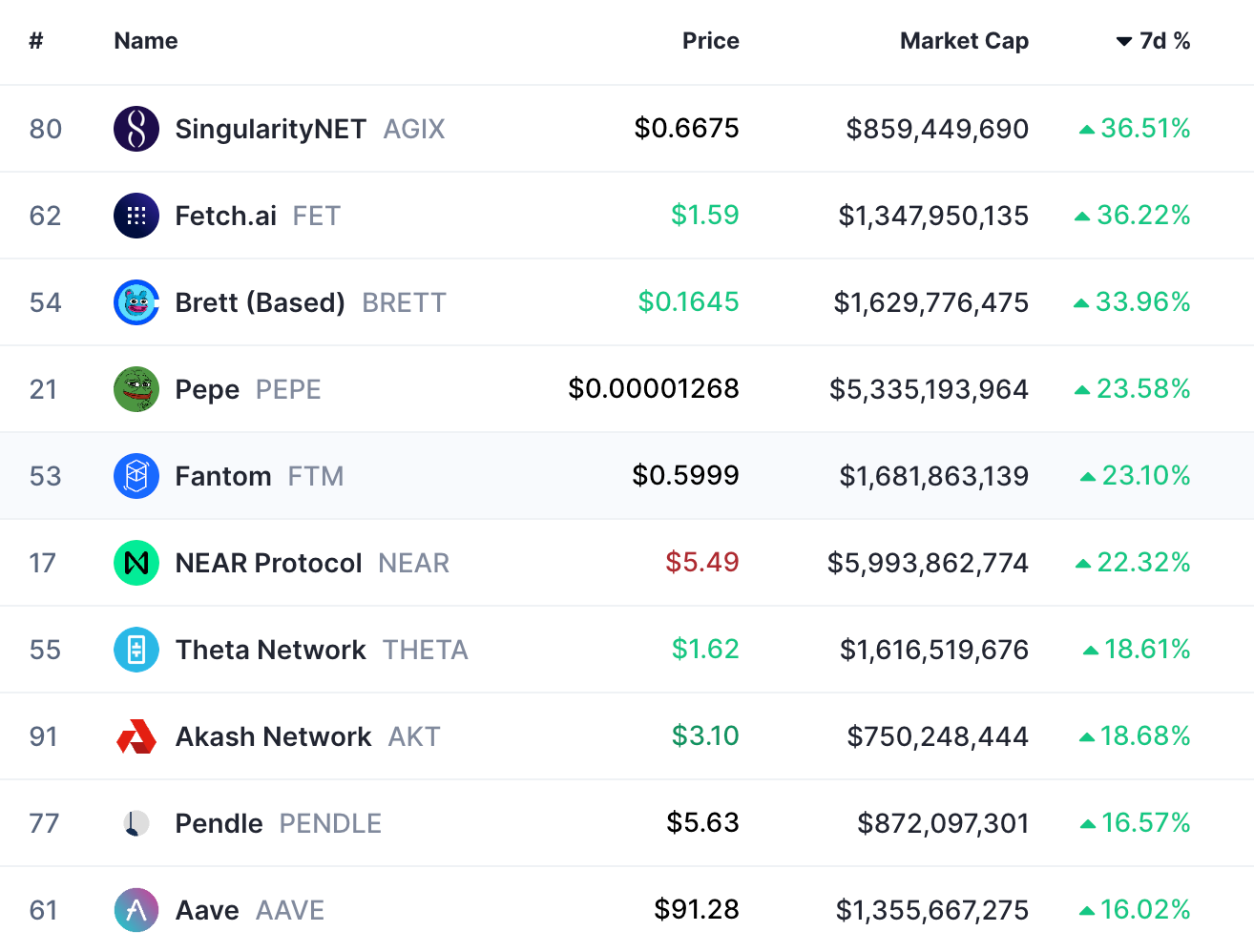

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Introduction

Today marks June 21 and the official start of summer. The past week has felt to me like a bear market as I’m sure many of you have been feeling the same way. Yes prices are down in crypto but it has more so felt like a bear market in the sense that things are extremely boring.

However, given the change in seasons and the Gann time factors we are working with I think all that is about to change soon. If you did not get a chance to watch our Wednesday update I recommend you do so here.

Otherwise let’s just jump right into it as my feelings have not changed.

First, looking at the stock market.

Be ready for a pullback to buy here. As you can see we have two symmetrical moves up. Each move was 20 calendar days (not trading days) and exactly 310 points. So two symmetrical moves in time and price are coinciding with the red line which marks the 150 degree date from the SPY IPO. The red line with the arrow pointing to it marks the last time by degrees date which was also a short term high as you can see.

We also have a lot of people noting that the RSI on QQQ is at historically high levels.

So, all this is coinciding with our natural date of the summer solstice. That tells us be ready for a change in trend. The good news is that our seasonality of the election cycle still tells us the market has more room to the upside as does the above graphic. We also have our next natural date on July 7 which falls on a Sunday but would perfectly align with the previous 10 day correction putting a possible low ( if we correct here) around our next natural date.

As for crypto the setup in nearly the exact same but just opposite.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com, and www.digitalassetresearch.substack.com