Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn More at www.wemeta.world, www.amphibiancapital.com, and www.investdefy.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders, where we cover the top news and reports in the digital asset ecosystem. This week we focus on the fallout from the surprising FTX bankruptcy and the decision to secretly use FTX customer funds to bailout their affiliated trading fund, Alameda Research. For a good summary of what happened to FTX, read this article by Maomao Hu and listen to this podcast from NLW.

Workers remove the FTX sign from the arena that is home to the Miami Heat on Friday in Downtown Miami.

In This Week’s Issue:

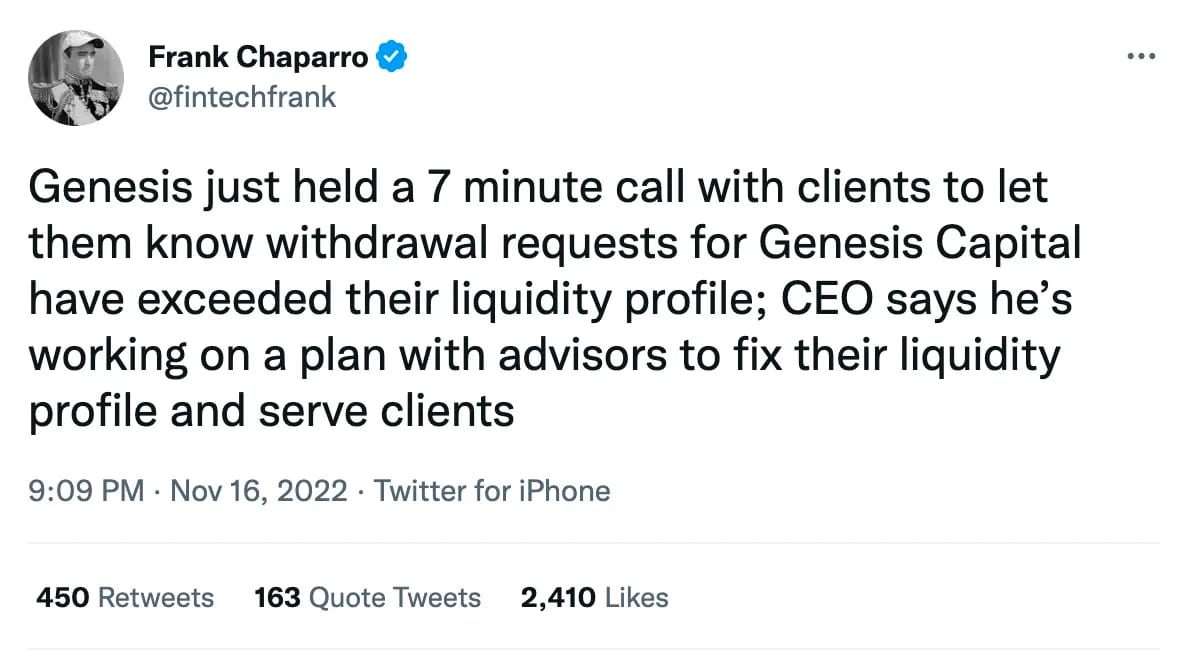

🗞️ Top Weekly Crypto News - Alameda Admits To Using FTX Customer Funds, FTX Hacked for $477M, FTX Files for Bankruptcy, Genesis Capital Pauses Withdrawals

💵 Weekly Fundraises - Matter Labs ($200M), Ping ($15M), Yakoa ($4.8M)

📊 Key Stats - Binance Increases Market Share, Growth in Perpetual Exchanges, 12.45% of ETH Supply Is Now Being Staked

📰 Learnings from FTX By Maomao Hu

🧵 Thread of The Week - Perspective From an Ex-FTX Employee

📝 Report Highlights - Messari - FTX’s Lack of Balance Sheet

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

📈 Top 10 Tokens of the Week

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

Among major L1s, Solana (SOL) has had the best price performance since we began writing Coinstack in January 2021

Thanks to Our Coinstack Sponsors…

Coinstack Partners helps crypto and web3 companies raise funding from crypto VC firms for Series A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 225 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

WeMeta is the Zillow for Metaverse; their robust data insights and accessible UI makes it easier than ever to interface with the digital worlds. What's more - WeMeta is just getting started. They are constantly releasing new features and tools to address the growing needs of their users amidst the booming Metaverse. Learn more at www.wemeta.world.

Amphibian Capital recently launched the Amphibian ETH Alpha Fund, with the goal of outperforming staking Ether. The fund offers a way for accredited investors and institutions who are large holders of Ether (150+ ETH) to invest in a diversified portfolio of ETH quant trading funds that pay out returns in ETH. Learn more and see fund results at www.amphibiancapital.com.

InvestDEFY offers structured digital asset products and has deep expertise in quantitative trading, technology, AI, risk management, derivatives, global equities, regulatory compliance, and investment banking. Learn more at www.investdefy.com.

We have one open sponsorship spot available for your firm - please see our sponsor deck and schedule a call to discuss.

🗞️ Crypto News Recap: The Top 10 Stories

What a crazy year the last week has been. Here are the top 10 stories of the week.

1) 💳 After Binance Passes on Acquisition, FTX Files for Chapter 11 Bankruptcy and SBF Resigns - Sam Bankman-Fried resigned on Friday from his position as FTX CEO, and the 130+ companies in his crypto empire will file for chapter 11 bankruptcy.

2) 🚩 Alameda CEO Admits to Using FTX Customer Funds To Prop Up Risky Hedge Fund - According to Alameda Research CEO Caroline Ellison, a small inner circle of FTX and Alameda executives knew that FTX had been using customer deposits since June 2022 to prop up their affiliated hedge fund, attempting to save Alameda from bankruptcy following the Three Arrows Capital crash. These secret loans from FTX to Alameda were backed with FTT tokens that have now greatly dropped in value. FTX CEO Sam Bankman-Fried said in an interview that he had expanded too fast and failed to see warning signs. All we can say is, what the actual f*&%.

3) 💳 FTX Hacked for at Least $477M in Mega-Heist Friday Night - Adding insult to injury, hackers drained hundreds of millions of dollars from insolvent crypto exchange FTX Friday night, just hours after it declared bankruptcy, in one of the largest heists in crypto history. The crypto-tracing firm Elliptic revealed that the $663 million total outflow seemed to be a combination of FTX's movement of coins into its own storage wallets and a mysterious theft. According to Elliptic, fully $477 million of the funds appear to have been stolen

4) 👀 Over 1 Million Depositors Owed Money by FTX - Per the FTX bankruptcy filing, over 1,000,000 depositors are owed money by FTX, including some of the industry’s largest hedge funds like Galois Capital and Ikagai.

6) Genesis Capital & Gemini Earn Pause Withdrawals - Gemini announced that its Earn program will be unable to meet customer redemptions in the service-level agreement’s time frame of 5 days. The news follows Genesis Global Capital — its lending partner — pausing withdrawals.

7) 🎭 FTX Contagion’s Next Victim: A Japanese Exchange - FTX-owned Japanese exchange Liquid Global will halt all withdrawals including both fiat and cryptocurrencies.

8) 🤯 JP Morgan: Collapse of FTX Might Prove to Be the Catalyst That Moves the Utility Value of Crypto Two Steps Forward - Moreover, while the news of the collapse of FTX is empowering crypto skeptics, we would point out that all of the recent collapses in the crypto ecosystem have been from centralized players and not from decentralized protocols.

9) 📊 Uniswap Overtakes Coinbase As Second-Largest Exchange Trading Ethereum Today - Today, Uniswap became the second-largest exchange after Binance for Ethereum trading in the last 24 hours.

1⚖️ Crypto Lender SALT Pauses Withdrawals, Citing FTX Impact - Crypto lender SALT paused withdrawals on Tuesday, becoming the latest casualty in the collapse of Sam Bankman-Fried’s crypto empire. In an email to customers, SALT Chief Executive Shawn Owen said the “collapse of FTX has impacted our business” without disclosing the extent of the firm’s exposure to FTX.

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size… it was a bit of a slow week for crypto VCs, given the craziness of what happened with FTX.

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Binance Picked Up the Entire FTX Futures Market Share Loss

Source: @ThanefieldCap

2. Growth in Perpetual Exchange Trading Volume Due to Market Volatility and User Migration From CEXs

Source: @TokenTerminal

3. 12.45% of the ETH Supply Is Now Being Staked

Source: @LidoFinance

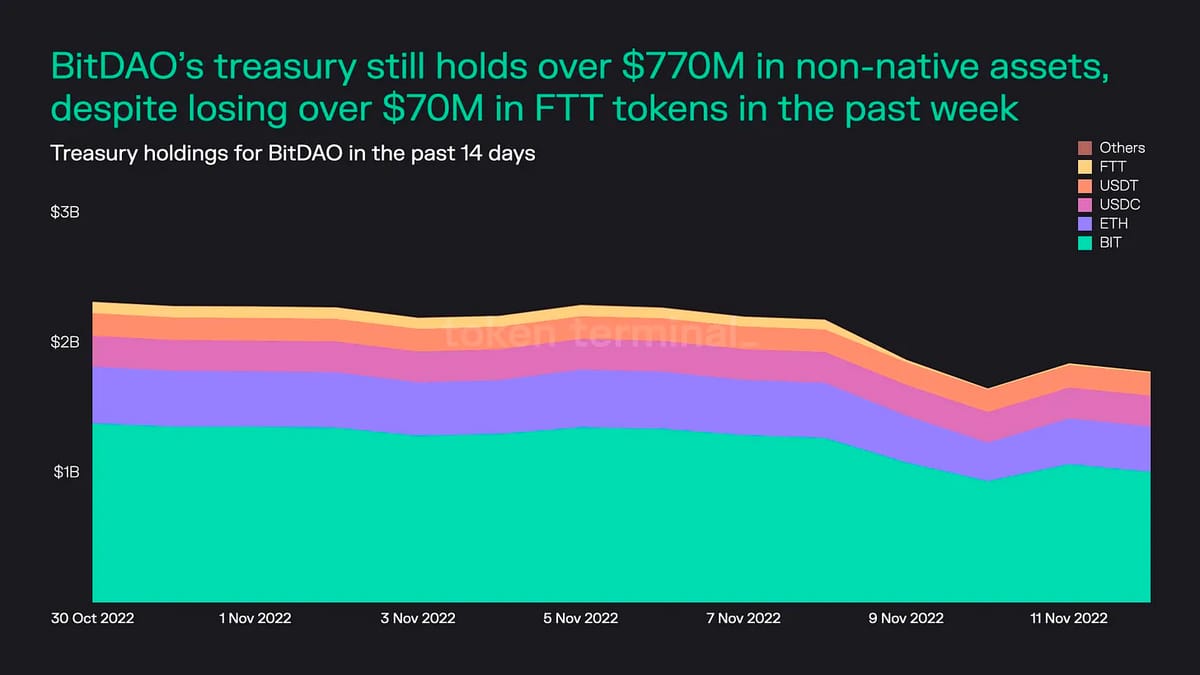

4. BitDAO Treasury Remains Strong and Diversified Despite Losing $70M in FTT

Source: @TokenTerminal

5. Aave’s DAUs Spiking Relative to Other Lending Protocols

Source: @tokenterminal

6. Ren’s TVL Was Cut in Half Following the Announcement That It No Longer Has Control of the Protocol Treasury

Source: @TokenTerminal

7. The Top 10 DEXs Together Are Valued at Roughly 1.5x the Valuation of Coinbase

Source: @tokenterminal

8. Blockchain Revenues Spiked While the Number of Active Users Stayed Constant, Suggesting More Frequent Transactions by Existing Users

Source: @tokenterminal

9. New Users of Uniswap’s Web App Reached a 2022 High

Source: @Uniswap

10. ETH Staking Yields Are Currently Over 10%

Source: @CryptoGucci

🧵 Learning from FTX: By Maomao Hu

It is both shocking and disappointingly familiar what has happened with FTX. I met Sam Bankman-Fried for the first and only time at Huobi APAC’s Singapore headquarters in late 2018 (incidentally at the same party I met Trent Barnes, which would lead everything I’ve done with Zerocap). The impression I got was of immense self-confidence and an obsessive need for profit. I was thoroughly impressed and a little envious. It’s people like this that combine an insatiable appetite with towering intelligence that are the “Kobe Bryants” of the trading industry, and that make the big bucks. That was also where I met up with Constance Kang and Darren Wong, who would later join Alameda and eventually become COO and (ex) CMO of FTX, and who by all reports was kept out of the loop.

After parsing through the scuttlebutt, this is what I can piece together on what happened:

Alameda used to be primarily a market-maker that aggressively pursued advantageous fee structures. At some point they started an OTC desk, using their market making infrastructure to hedge out risk.

After FTX launched, Alameda provided most of the liquidity. In order to reduce toxic flow to FTX users, liquidations on FTX would be sent directly to Alameda as an OTC transaction. This helped FTX grow by reducing toxic flow to 3rd parties. Alameda may have been used as a loss leader to bootstrap FTX. After all, toxic flows are still toxic flows, and it looks like people were keeping a lot of profits on FTX. Given Alameda was essentially running a B book on FTX, they were either the other side of the trade, or had to hedge on Binance (after the fact, since price discovery will almost always happen faster on Binance), either of which is, statistically and in the long run, likely to result in a loss. But maybe SBF et al figured it didn’t matter, since they would either make it back on the growth of FTX’s valuation, or simply via transaction fees (aka Alameda maker rebates).

FTX launches FTT and Alameda serves as market maker and probably does some price management. As a result Alameda builds long exposure to FTT. This is a marked departure from its strategy up to now, which is delta neutral, however as a prop trading firm it exists to express the views of its principals. Since these people, who also operate FTX, are all long FTT both literally by holding the token and indirectly since the performance of FTT is positively correlated to the growth of FTX, and also because the price of FTT goes up, it’s all OK and everyone is happy.

Liquidity pools start making money and Alameda starts running prop strategies where they get tokens at low prices from pre-sales or OTC transactions, shove them into a liquidity pool, and dump the tokens on exchanges. Possibly to help Alameda hedge risk, FTX launches DeFi perps, however Alameda is probably still long some or all of these tokens.

SushiSwap pulls its little stunt and SBF steps in to save the project. In retrospect this may be because SUSHI going down would lead to a massive loss at Alameda due to being long DeFi. SUSHI’s liquidity and price action on FTX is crucial to the recovery, so Alameda steps in as a market maker again, and probably supports SUSHI’s price and builds a long position. But it’s OK because the price goes up eventually. The newfound confidence in DeFi energizes the market and Alameda begins printing shipping containers of money.

The thing about farming is that, if you’re doing it the way Alameda was, it’s highly profitable, but also highly capital intensive. SBF faces consistent frustrations getting capital, while sitting on a treasure chest of customer deposits at FTX. Now it would clearly be illegal to just give money to Alameda. So instead FTX extends a loan, which Alameda collateralizes with FTT. On paper this is a perfectly above-board, mutually beneficial arms-length transaction. FTX can monetize deposits and can theoretically always sell the FTT to cover a default. FTX customer deposits are now powering Alameda farming strategies.

At some point Alameda starts playing little games with their tokens, where they use their brand, social media presence and the minimal float of some tokens to pump the price up before dumping. SBF literally describes his process on a podcast with Matt Levine. However, since it’s in their interest to have minimal liquidity for some time, risk builds as they’re holding more and more illiquid tokens while getting rich on unrealized gains.

This is an excerpt from the full article, which you can find here.

🧵 Thread of the Week - Perspective From an Ex-FTX Employee

By: @vydamo_

1/ Aptly named, this function allowed Sam to use elx to send fraudulent logger messages through the negative flux back to auditors if they ever queried the DB. Adding in this was +EV for Sam. It's a very common function but; he is much more mischievous than we knew.

2/ Logs are parsed to wallet 0x1c69 which initiate the transfer function of the glm; here is just one example of washing 76k + 10k eth through tornado. As an auditor, an echo sending logs server side does not look particularly alarming and on the frontend funds look safu

3/ As part of my scrum @ftx_app we were tasked with designing the ADD's (Augmented deficit decoders) that helped to obfuscate and protect the codebase. It seems that these were then used malicously to hide any wrongdoing by executives. When FTT was touching 200wma

4/ these decoders were used to bounce it on the LTF. With each bounce $FTT gained more strength but over a HTF it wasn't holding up and this is when the bricks starting to crumble, so to speak. My team were 'laid off' because we were not a good fit - to speak candidly we

5/ were fired after bringing up the fact that these messages were obfuscating transactions used to prop up $FTT. Our ADD that we had spent 4 years working on was now being used fraudulently with very little regard for our wishes. Now we are left with this - lots of questions.6/ My main one is how did Rupert managed to wipe his hands clean of the whole fiasco. Sam, Gary and Caroline have been making headlines, but multisig signer Rupert Calloway (SBFs longtime friend and hacker buddy from MIT who @MarioNawfal drew light to yesterday) is now gone.

7/ It's likely Rupert will never see the bars of a jail cell, as signing a multisig is barely a crime and he could argue he was under duress. But it is astonishing how $783m goes missing which required four signatures and none of them seem to know about it.

8/ Ruperts doxed wallet (again, thanks to the work of someone else on @MarioNawfal spaces yesterday) has $6.6m of ether currently which seems to be bouncing between a variety of different addresses - why?

9/ One of these being 0x72. It just so happens that 0x72 owns Milady#241. Well, who is the proud owner of that? you guessed it. None other than Caroline. This beggers more questions than answers, but an interesting tidbit nonetheless.

10/ I hope this thread helped you understand a little more about the situation. Sharing insider knowledge like this is often risky (both professionally and physically) but in the current climate I feel I need to get it off my chest. Thanks for reading!

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

The Financial Times recently shared a document reportedly created by Sam Bankman-Fried (SBF), the founder of the fallen crypto exchange FTX and trading firm Alameda Research. The document, an unbalanced record of creditors owed and assets owned, was reportedly prepared on Nov. 10, 2022.

Assuming the document is accurate and free of significant errors, we calculate that customers may recover up to 40% to 50% of their deposits. These numbers require some assumptions on the fair value of the assets and the priority of payment.

Liquid Assets

The document reports $900 million in liquid assets, but the Chapter-11 filings do not include the entity that owns shares in RobinHood. We assume there is a 50% probability that holdings in RobinHood will be liquidated to pay back the customers and lenders.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers The Last 30 Days

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 33,226 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.wemeta.world, www.amphibiancapital.com, and www.investdefy.com