Learn more at www.ftx.us and www.wemeta.world, and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the best weekly newsletter for crypto investors and industry insiders, where we review the top news and reports in the digital asset ecosystem. This week we’re covering FTX’s planned sale to Binance after a wild week that saw Binance rapidly sell $500M in FTT tokens in order to weaken FTX, leading to $6B in FTX withdrawals, ultimately giving FTX no choice but to sign an LOI to sell itself to its top competitor.

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Binance Plans to Acquire FTX, FTX Pauses Withdrawals, Alameda Balance Sheet Published, Coinbase Not Impacted

💵 Weekly Fundraises - TRM Labs ($70M), Ramp ($70M) — Archax ($28.5M)

📊 Key Stats - ETH Addresses Holding 32+ ETH Hits ATH, Top Projects By Earnings, Magic Eden’s ~99% Market Share

🧵 Thread of The Week - Binance vs. FTX

📝 Report Highlights - Messari - Governor Note: Introducing Staked aTokens

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

📈 Top 10 Tokens of the Week - MASK, PHA, VOLT

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

📚 How to Get Started in Crypto Learning

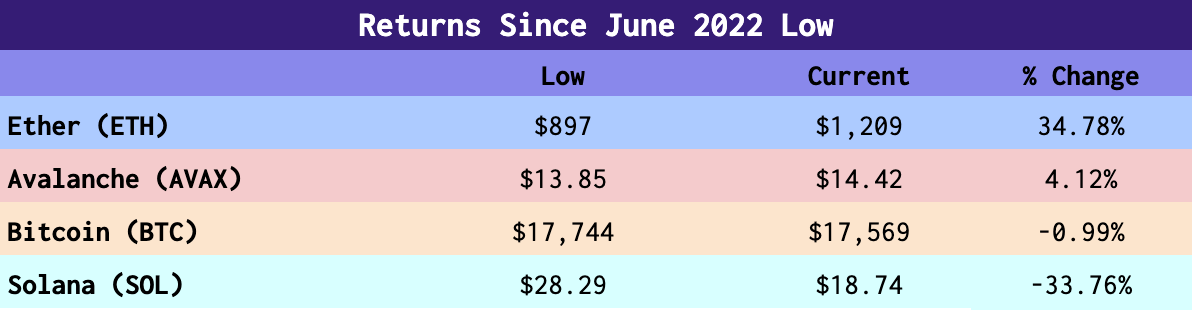

While BTC and SOL are down over the last 4 months, ETH is up 34% since it’s June 2022 low, leading the way among major L1s by price performance.

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

WeMeta is the Zillow for Metaverse. Their robust data insights and accessible UI makes it easier than ever to buy, sell, and track visitors and the value of your digital land. WeMeta is constantly releasing new features and tools to address the growing needs of their users amidst the booming Metaverse land ecosystem. Learn more at www.wemeta.world.

Amphibian Capital recently launched the Amphibian ETH Alpha Fund, with the goal of outperforming staking Ether. The fund offers a way for accredited investors and institutions who are large holders of Ether (150+ ETH) to invest in a diversified portfolio of ETH quant trading funds that pay out returns in ETH. Learn more and see fund results at www.amphibiancapital.com.

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms for Series A/B/C rounds of $1M to $50M. The firm has relationships with all of the top 100 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck.

We have one open sponsorship spot available for your firm - please see our sponsor deck and schedule a call to discuss.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

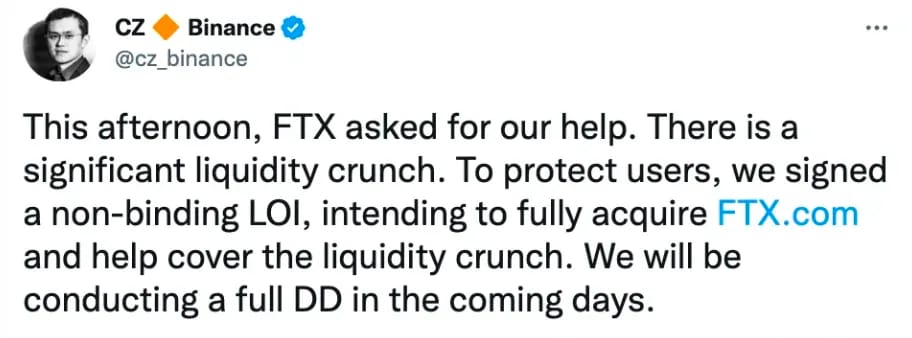

1) 🤯 FTX.com Agrees to Sell Itself to Rival Binance Amid Liquidity Scare - The two crypto exchange giants signed a a non-binding letter of intent, Binance CEO Changpeng "CZ" Zhao confirmed on Twitter. FTX.us is a separate entity from FTX.com and is not being included in the sale to Binance.

The deal, which is pending due diligence, reflects a sudden de-escalation of what had been a building feud between the two prominent market makers.

2) 📝 CoinDesk Publishes Alameda Balance Sheet, Leading to Attack from Binance on FTT Token, Forcing Sale of FTX.com to Binance - Alameda Research, a trading firm founded by Sam Bankman Fried in November 2017 had $14.6 billion of assets and $8B of liabilities as of June 30, 2022, leaving $6.6B in net assets. However $5.8B of their assets were stored in the FTT token, issued by FTX, another Bankman-Fried company. FTX.com was brought to its knees in a liquidity crisis with the value of FTT dropping this week by 84% due to Binance rapidly selling $500M worth of the FTT token.

3) 🏦 FTX.com Halts Withdrawals Tuesday From Exchange After Seeing $6B in Withdrawals in 72 Hours - On Tuesday FTX Halted Withdrawals after Reuters reported $6B was withdrawn in the prior 72 hours. FTX CEO Sam Bankman-Fried indicated they expect to be able to honor all withdrawals and cover all assets 1:1 if the sale to Binance goes through.

4) Crypto Firms, Executives Step Up Campaign Donations & Lobbying Ahead of Midterms - The crypto industry has significantly increased its political spending ahead of the midterm elections. Crypto firms and their employees poured $73 million into the 2022 elections, up from $13 million in the 2020 cycle, according to OpenSecrets.

5) 🇺🇸 US Authorities Seize $3.36 Billion in Bitcoin From Decade-Old Silk Road Hack - The Department of Justice has announced that last year they seized over $3.36 billion worth of bitcoin from a hacker who stole 50,000 bitcoin from Silk Road a decade ago. Officials said the action was the DOJ's biggest cryptocurrency seizure ever.

6) 🪙 Coinbase CEO Says Company Doesn't Have 'Any Material Exposure' to FTX or Alameda - Brian Armstrong reassured the market about his firm's stability after Binance announced its FTX buyout.

7) 💳 LBRY Loses Case to SEC - In a move that could have serious repercussions for Ripple and other cryptocurrency companies, a federal judge has ruled crypto startup LBRY completed an unregistered security offering when it sold LBC, the protocol’s native token.

8) 🇺🇸 Paradigm Crypto Policy Council Enlists Paul Ryan Among Other D.C. Vets - Web3 venture capital firm Paradigm has launched a Crypto Policy Council that includes former Speaker of the House of Representatives Paul Ryan (R-WI) and former U.S. Congressman Steve Israel (D-NY), among other political figures, the company announced Monday.

9) 📜 February Vote for EU MiCA Crypto Bill Is Tentatively Planned - Europe’s landmark Markets in Crypto Assets regulation (MiCA) won’t be implemented until next February at the earliest, as EU lawmakers pushed back voting on the regulation due to the text’s length and complexity.

10) ⚖️ Crypto D.C. Influence Spending Levels Off After Massive Boom Year - After several boom years, crypto industry spending on lobbying in the U.S. has cooled in the most recent quarter. Relative to the rest of the industry, the sector remains resilient in the face of a challenging market.

📺 Webinar - Vetting Crypto Hedge Funds

Amphibian Capital has researched over 250 crypto hedge funds, vetted over 50, and selected the 21 best for its crypto fund of funds. In this webinar we will be giving an update on how these 21 selected funds have performed year-to-date in 2022.

We have designed this webinar to share what Amphibian Capital has learned about the process of vetting crypto hedge funds and identifying the best crypto hedge funds for your investment objectives. You can learn more and register here.

Thursday, November 10, 202211am ET | 55 minutes on Zoom / Register herePresented by Ryan Allis: Publisher of Coinstack & GP at Amphibian Capital

All registered attendees will receive a copy of the presentation deck and recording in case you can’t attend live.

What You Will Learn in the Webinar

The key questions to ask when you’re diligencing a crypto hedge fund: counterparty risk, leverage, domicile, partner background, investment committee, security, custody, chain exposure, stablecoin exposure, AUM, trading strategies, monthly returns, fees, and liquidity

How Amphibian Capital designed its fund of funds by researching 250 crypto funds, vetting 50+, and selecting the 21 best

How Amphibian’s currently selected 21 underlying crypto funds in its USD-Denominated Fund of Funds have averaged a +13.61% net return in 2022 YTD (estimated through Oct 31, 2022) while many other crypto funds were down more than -50% on the year

We’ll show the YTD results of the 21 selected crypto funds

How Amphibian’s currently selected 7 underlying crypto funds in its ETH-Denominated-fund-of-funds have averaged +21.39% net return YTD through October 31, 2022 (in excess of ETH’s performance)

The four types of crypto hedge funds - yield funds, token funds, venture funds, and quant funds -- and what each type of fund is optimized for

How the fund of funds model can add diversification while mitigating risk and drawdowns — while enabling lower minimums per investor

What each type of crypto fund offers for minimums, liquidity, potential returns, and potential drawdowns

How the underlying selected funds performed in 2019-2022 for both the USD-denominated fund and the new ETH-denominated fund

The primary trading strategies of crypto quant funds - algorithmic, machine learning, arbitrage, market making, and derivatives

Why avoiding major market drawdowns matters so much for long-term investment results

If you're a long-term Ethereum holder, how to earn ETH-on-ETH returns (USD Fund vs. ETH Fund)

Details on the Dec 1 opening for accredited investors to invest in Amphibian’s fund of funds that enables diversified exposure to their selected crypto hedge funds

Who This is For…

This webinar is tailored to accredited investors, institutions, family offices, large ETH holders, hedge fund managers, wealth advisors, and RIAs.

For institutional investors and accredited investors

For hedge funds or family offices

For large ETH holders (see the ETH-denominated fund)

For financial advisors advising HNWIs

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

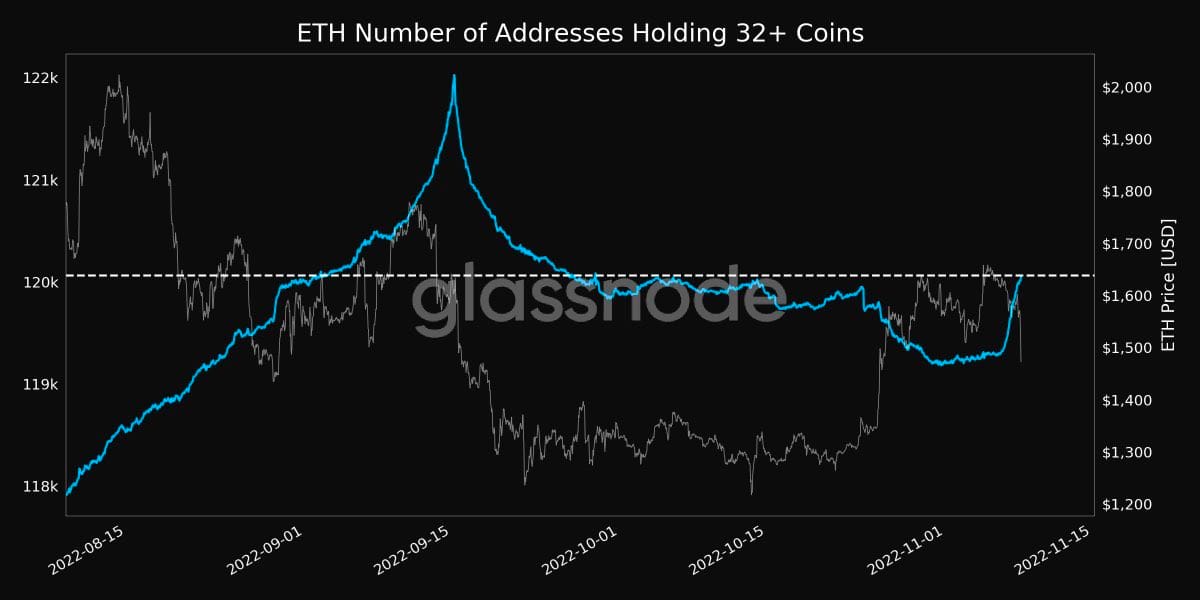

1. Ethereum Number of Addresses Holding 32+ ETH Just Hit a 1-Month High

Source: @CryptoGucci

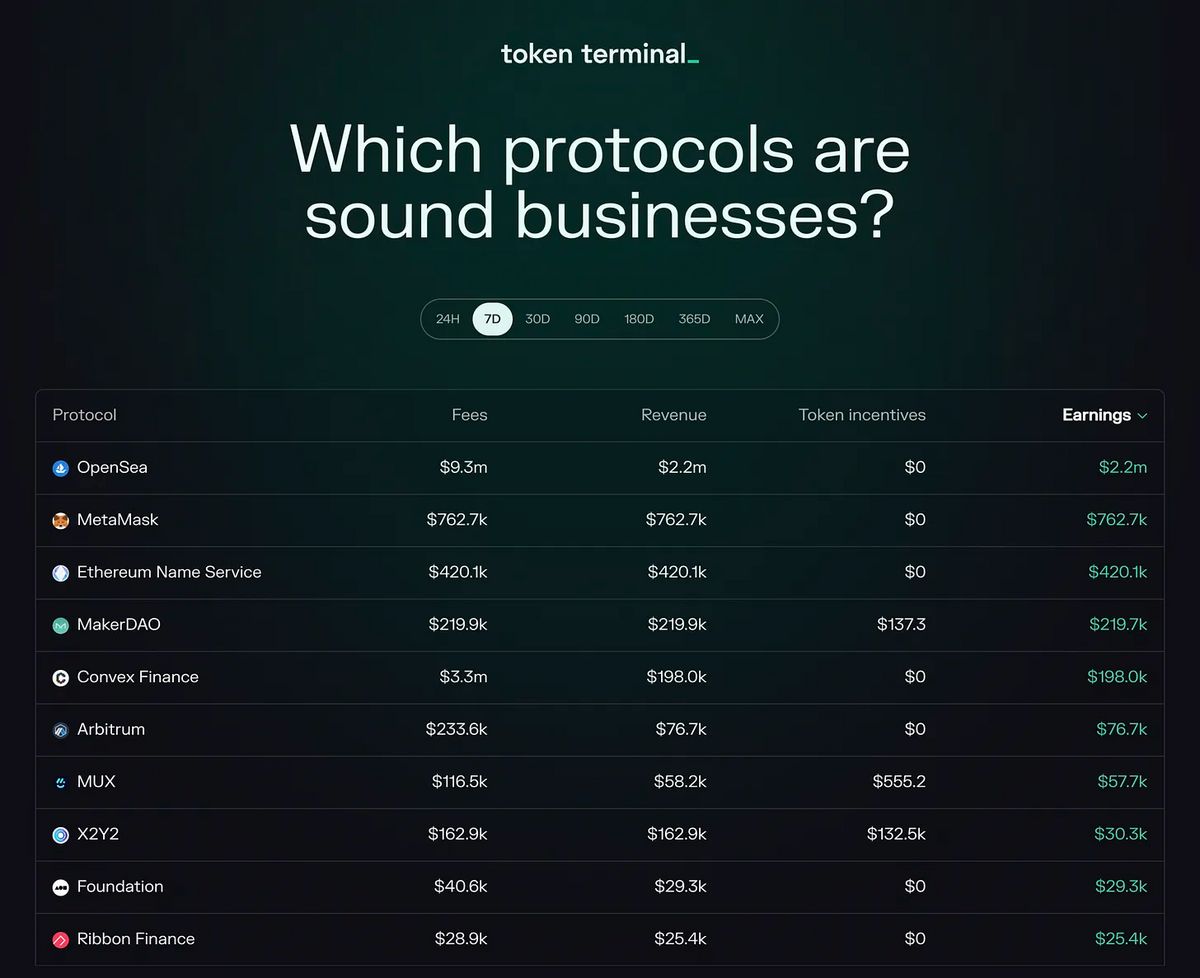

2. Top 10 Projects by Earnings in the Past 7 Days

Source: @TokenTerminal

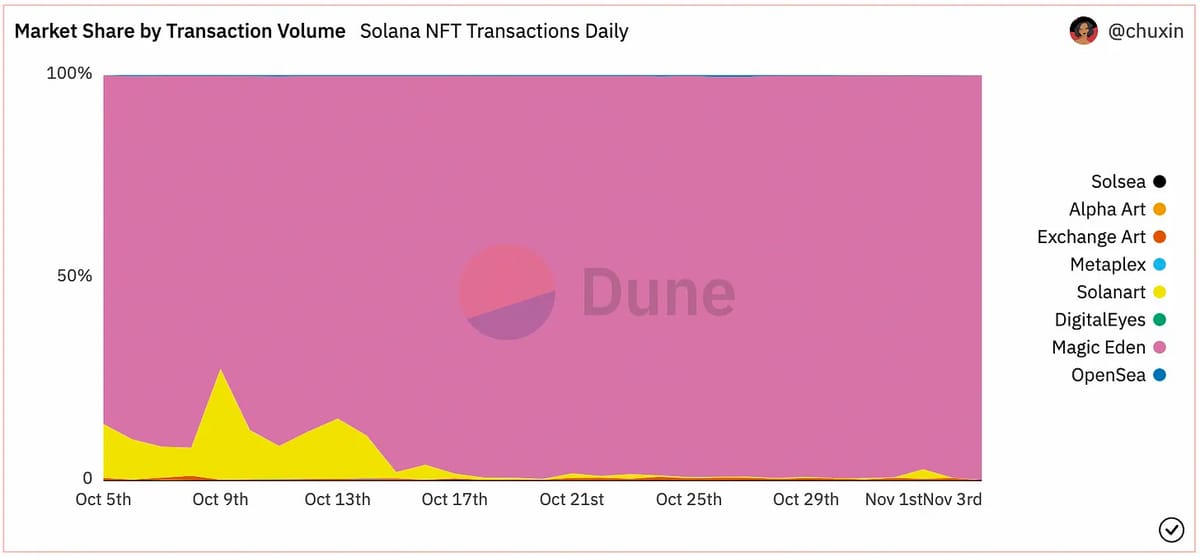

3. Magic Eden Defends Its ~99% Market Share

Source: @OurNetwork

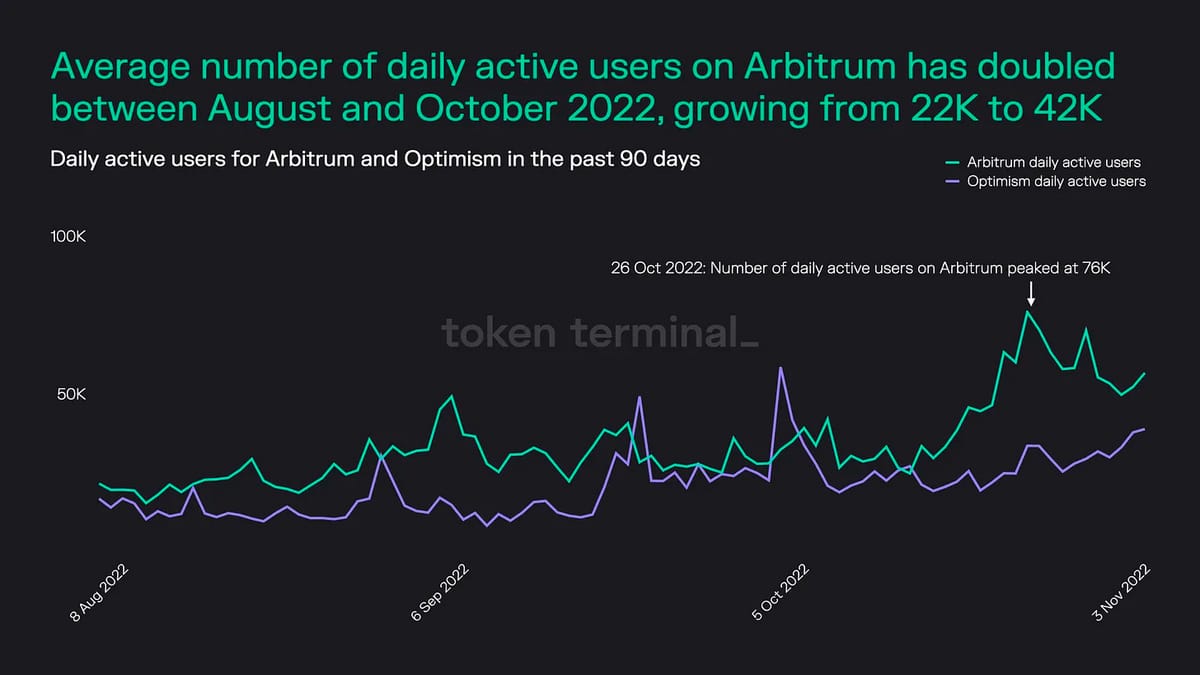

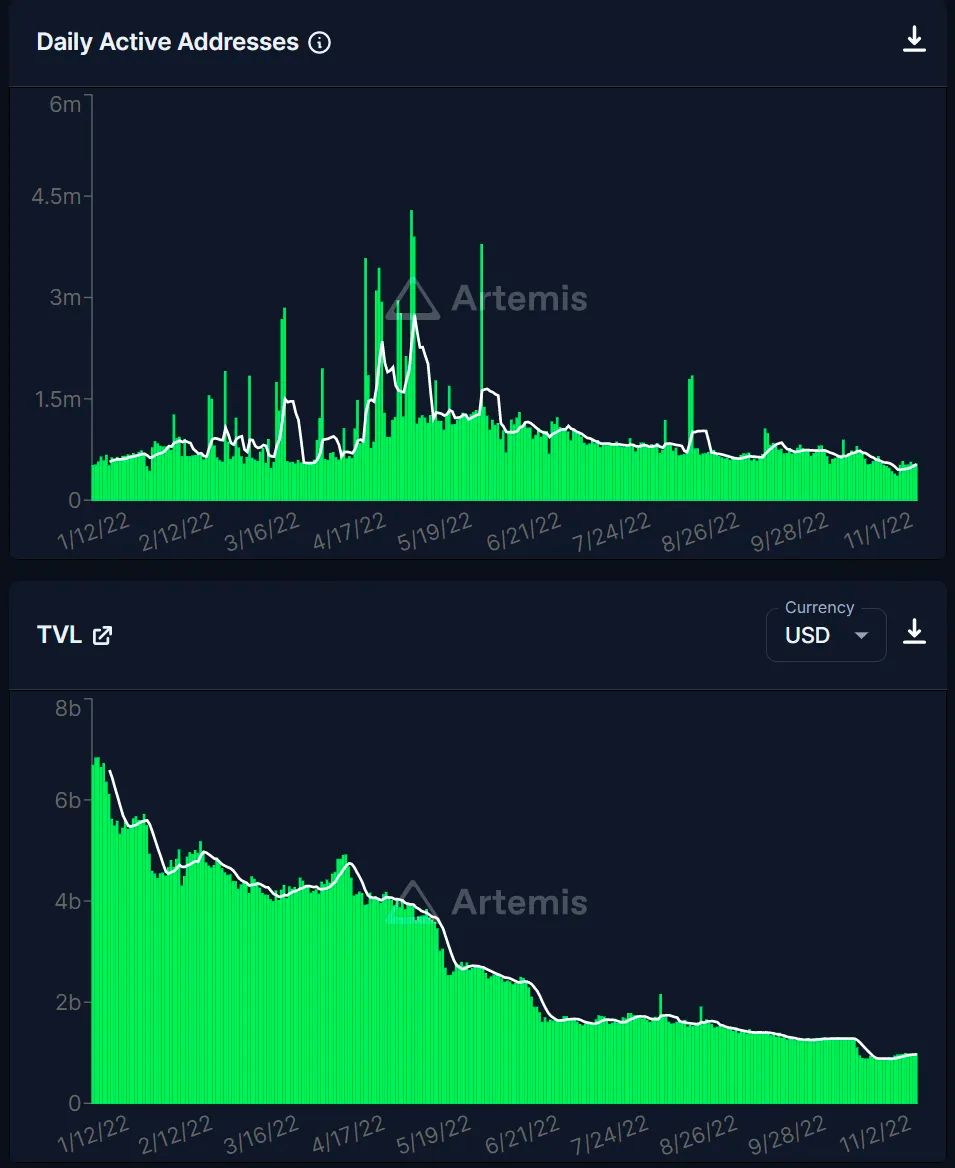

4. The Number of Users on Arbitrum Is Growing Rapidly

Source: @TokenTerminal

5. Almost Two Months On From the Successful Completion of the Merge, Lido Staked ETH (stETH) and ETH Have Reached Parity for the First Time Since April

Source: @Kaiko

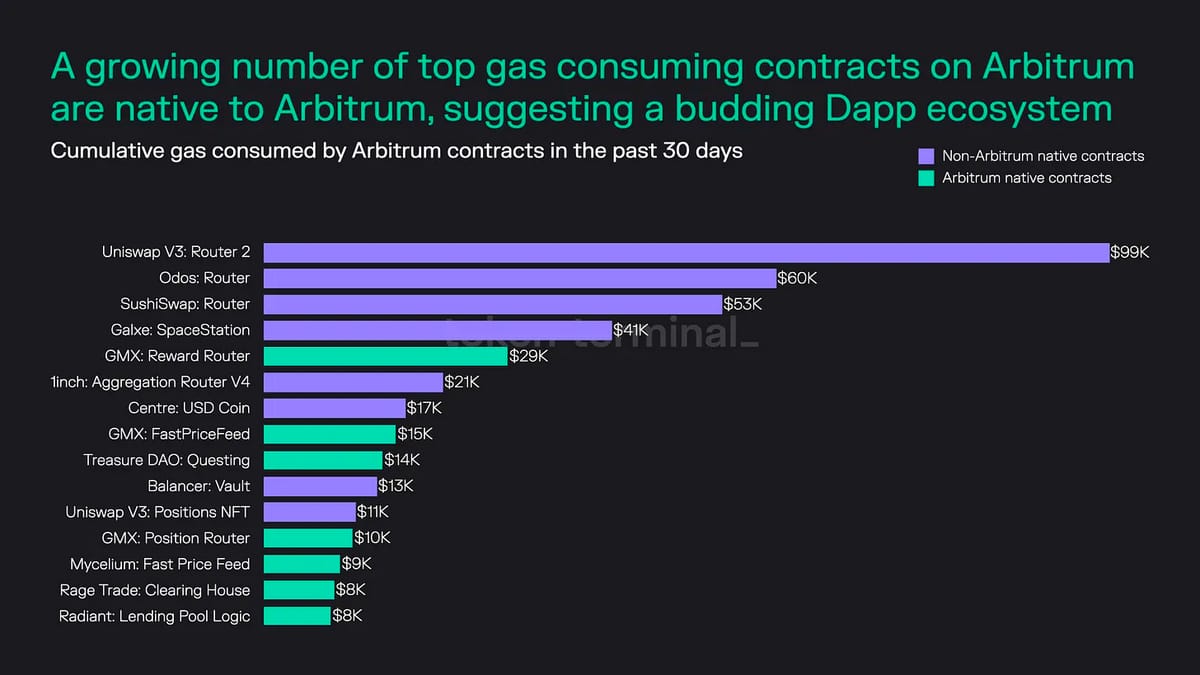

6. A Growing Number of Top Gas-Consuming Contracts on Arbitrum Belong to Arbitrum-Native Protocols

Source: @TokenTerminal

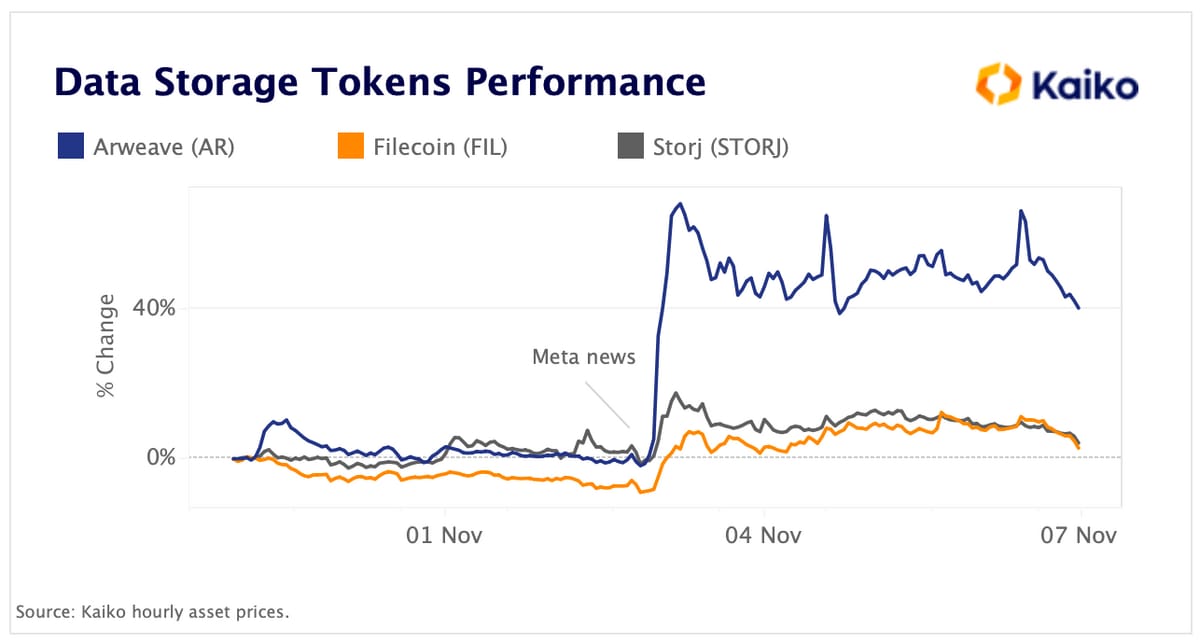

7. Meta Embraces Decentralized Data Storage

Source: @Kaiko

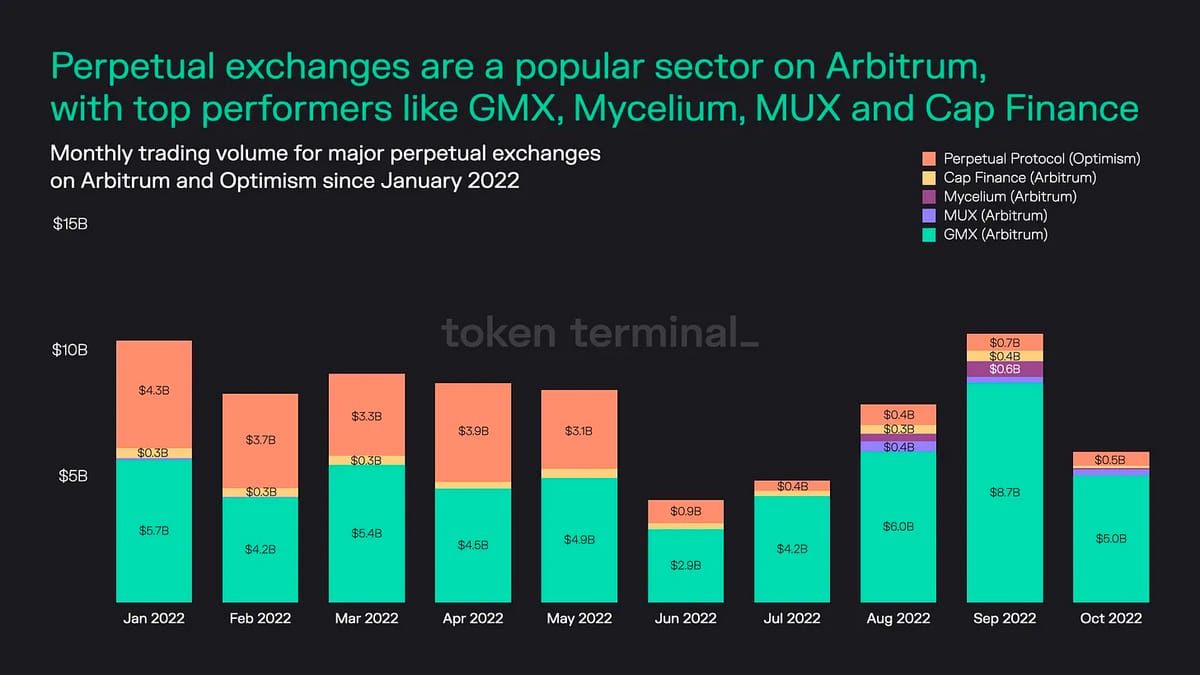

8. Perpetual Exchanges Are a Particularly Popular Sector for Arbitrum

Source: @TokenTerminal

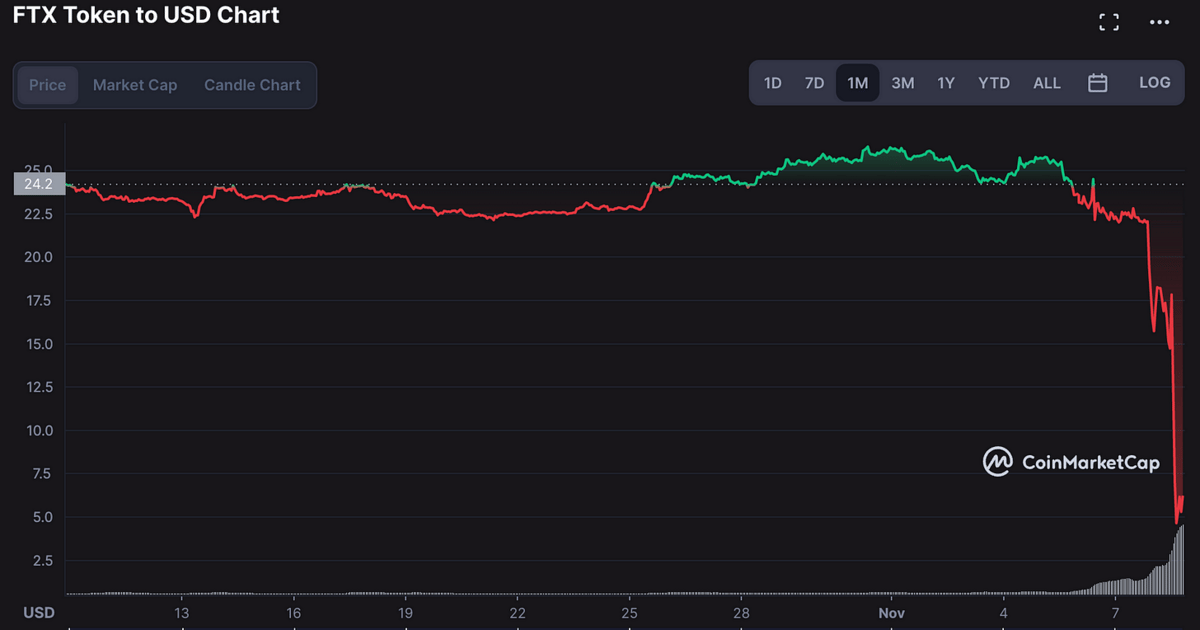

9. FTT Is Down Almost 50% in a Day and Clearly Facing Its Biggest Liquidity Crisis in History

Source: @CoinMarketCap

10. Solana NFT Marketplace Use Remains Strong at 512k MAUs

Source: @OurNetwork

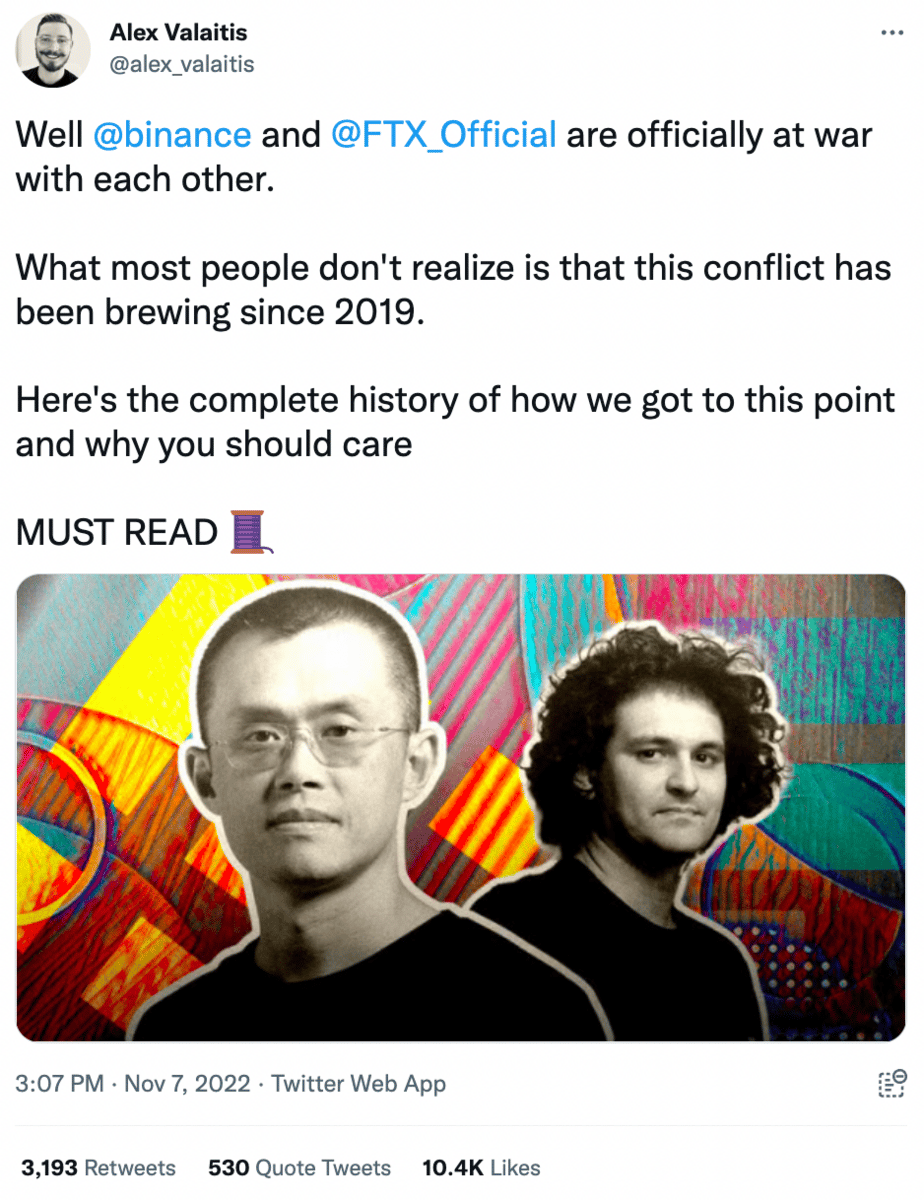

🧵 Thread of the Week - Binance vs. FTX

By: @alex_valaitis

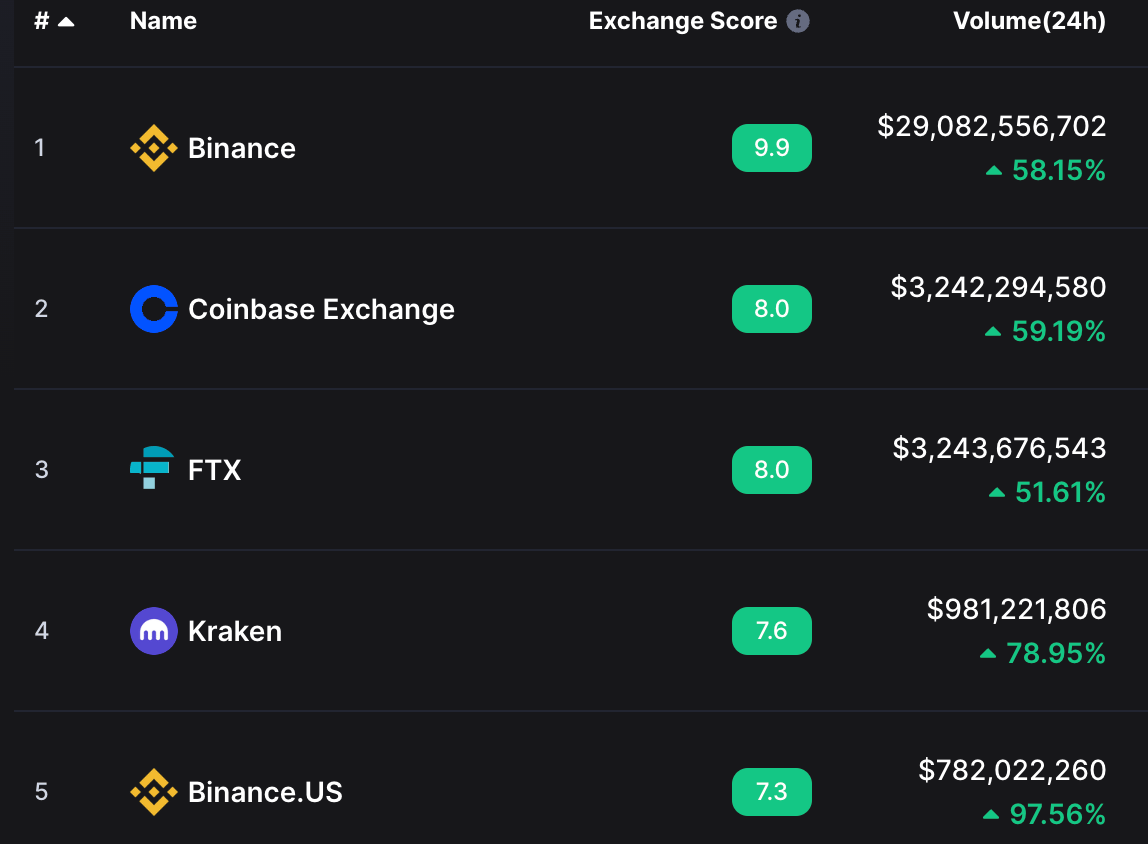

1/ Back in 2017, @cz_binance founded @binance, and it quickly grew to be the largest centralized crypto exchange in the world.

Since it launched, many exchanges (Coinbase, BitMEX, Gemini, etc.) have unsuccessfully tried to take its crown.

2/ In May of 2019, a new player entered the space when @SBF_FTX founded @FTX_Official.

Immediately it was clear that these guys were on another level.

SBF had the smarts & the competitive drive to quickly rise to the top.

3/ CZ didn't build the largest crypto exchange by being lucky, he's an extremely smart person.

That is why he made the strategic decision to have Binance invest in FTX back in 2019.

It was also announced FTX would build institutional product offerings for the Binance ecosystem.

4/ However, as FTX continued to rapidly grow during the last bull market, CZ sensed that they were becoming a threat.

That's why in 2021, Binance chose to divest from FTX during its $900 million funding round.

CZ called it a "normal investment cycle" but we now know it was more

5/ Fast forward to 2022 and FTX is now the #2 exchange behind Binance.

While Binance still does 10x the volume of FTX, the rate of growth for FTX is surely alarming to CZ.

However, there's another reason CZ is worried...

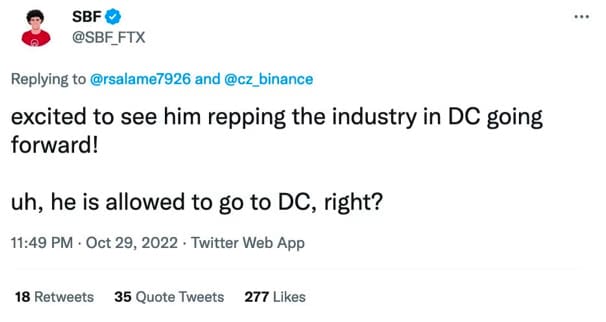

6/ It's no secret that SBF has grand ambitions, and he realizes the only way to maximize FTX's potential is by winning over regulators

That's why he is one of the biggest donors in not just crypto the industry, but in US politics overall

(He was the #2 donor to the Biden campaign)

7/ SBF understands that in order to one day beat Binance, he needs to leverage US politics as a weapon.

And he also knows his angle. CZ was born in China & there are rumors of Chinese involvement with Binance.

As US<>China tensions rise, he has an angle to attack Binance.

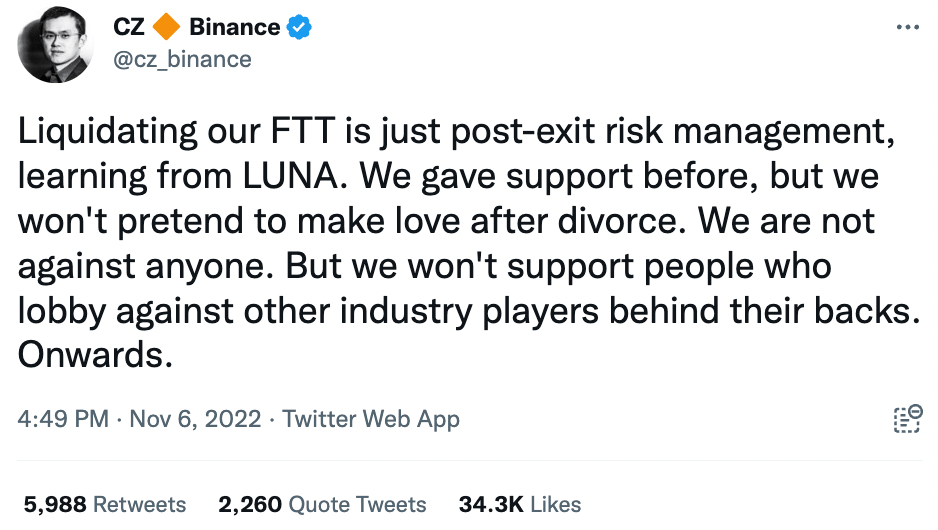

8/ However, CZ is not going down without a fight. And he recently got the opening he needed to strike back.

There were 2 events in particular that opened SBF/FTX up to an attack from CZ/Binance:

9/ 1. The first was after SBF published proposals on crypto regulation.

These proposals were met with SEVERE backlash from the crypto industry, with many claiming that SBF was trying to kill DeFi & push for regulatory capture.

SBF was suddenly an "enemy of crypto"

10/ 2. @CoinDesk published a story which stated that much of the $14.6 billion in assets on the Alameda (FTX's investing arm) balance sheet, was actually its $FTT token that the company prints itself.

This meant that if $FTT price dropped, FTX itself could be at risk.

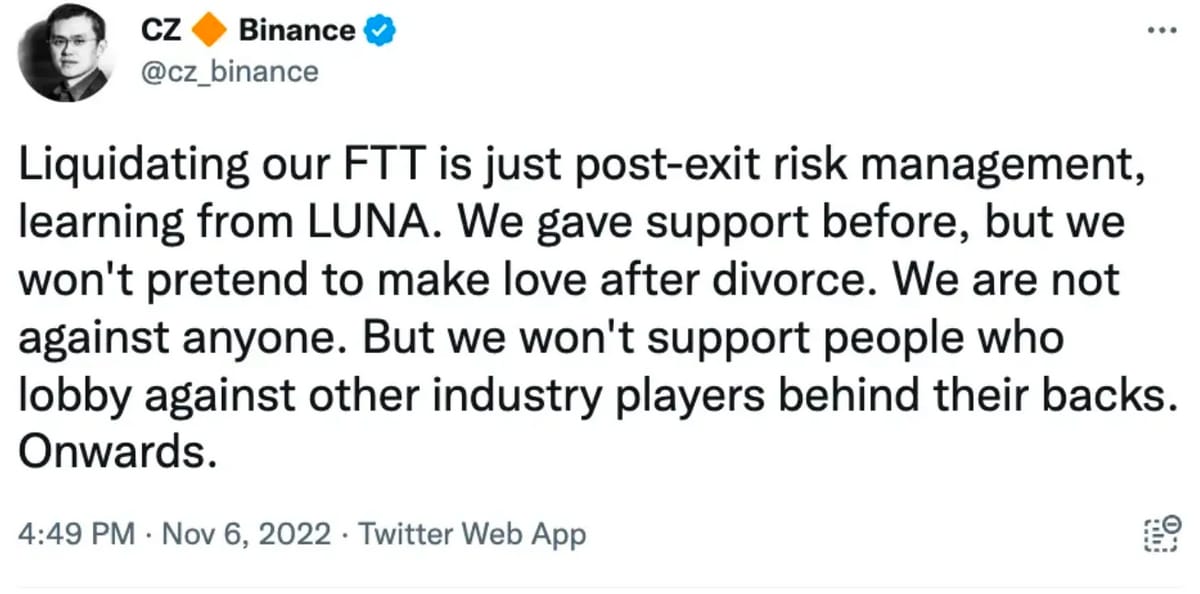

11/ Regardless of whether or not the financial risks from $FTT were real or not, CZ had the angle he needed to make his attack.

As part of the divestment from FTX back in 2021, Binance had received $2.1 billion worth of $FTT & $BUSD.

Then CZ went on the offensive...

12/ 1. It helped fuel the FUD narratives around FTX insolvency & it further framed FTX as being against crypto.

2. It would allow Binance to make a material impact on the $FTT price by selling their tokens.

13/ The result of CZ's tweet was an immediate drop in the price of $FTT.

Recognizing the risk, @carolinecapital and @SBF_FTX were quick to speak up.Caroline offered to buy the $FTT via OTC trade & SBF called for the exchanges to "make love (and blockchain) not war."

14/ However, it was clear that CZ had no desire to make peace.

He further stoked the FUD flames by highlighting a @whale_alert transfer of $584M worth of $FTT & then later comparing FTX to LUNA:

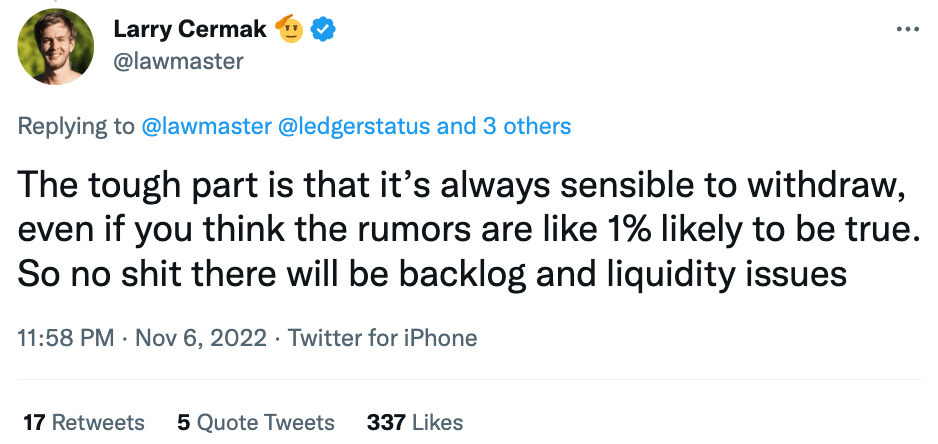

15/ The strategic brilliance behind CZ's attack was that he realized the current state of the industry.

After months of large firms (that were previously considered safe) becoming insolvent, crypto participants are mentally rattled.

Nobody wants to take any chances.

16/ As @lawmaster pointed out in a tweet, the logical move for prudent crypto investors is to withdraw funds from FTX, even if there's an extremely low chance of FTX insolvency:

17/ The irony is that these fears and rumors could very well trigger a bank run on FTX that could actually become self-fulfilling.

Even if FTX doesn't go insolvent, there's no doubt they are going to be damaged by this attack.

And who stands to gain? Competitors like Binance.

18/ So what does all of this mean for crypto industry participants?

Well the obvious risk is that this exchange war leads to FTX insolvency.

At this point that would be near catastrophic for the crypto industry given the size of FTX.

19/ There's a very good chance that FTX is able to weather this storm.

However, it's clear that the gloves are off between Binance and FTX.

This will almost certainly not be the end of their battle, and I fear of collateral damage that could occur from it.

20/ Fans of the series Game of Thrones, will recognize the quote "Chaos is a ladder"

Both CZ & SBF know the game that they are playing, and will do ANYTHING they can do to climb.

We as a crypto community need to reject these sorts of players as they go against the ethos of crypto.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

Aave and Balancer have a long-standing relationship, dating back to January 2021. Each protocol has since evolved. Aave continues to execute on its roadmap, planning to release an overcollateralized stablecoin, GHO. Balancer is doubling down on its ambition as a baseplate protocol, using vetokenomics to align LP incentives with protocol growth. Though each path is unique, the mutual benefits of Balancer integration have never been clearer.

The latest Aave proposal, Staked aTokens: A New Aave Primitive Exploring Vote-Escrow Economies, is the next step in this partnership. If approved, the proposal would lay the foundation for a cross-chain go-to-market strategy for GHO that avoids using Aave-native incentives. The strategy would leverage Aave-held veBAL to incentivize Balancer Boosted Pools while using Aave’s ability to control GHO borrow rates to attract lenders and bootstrap GHO liquidity. To contextualize the proposal and its implications, we’ll observe each protocol’s roadmap and how it binds them closer together.

Balancer: The Liquidity Stack

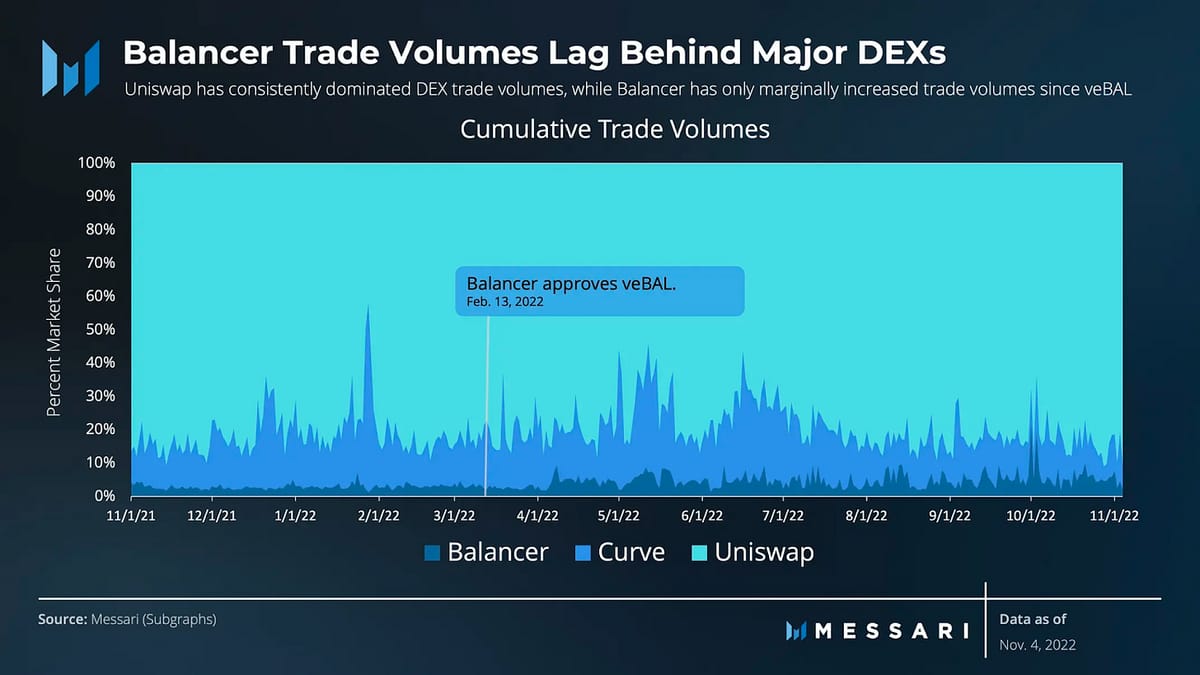

Balancer competes for TVL and volume with decentralized exchange (DEX) giants Uniswap and Curve. In a move to attract liquidity and grow partnerships, Balancer introduced a vote escrow (ve) tokenomics framework. The new tokenomics allows LPs of the 80 BAL / 20 ETH pool to stake their Balancer Pool Tokens (BPT) to earn veBAL. veBAL holders can direct BAL emissions to LPs or themselves and accrue a portion of protocol revenue. While veBAL tokenomics has dramatically affected Balancer operations, the protocol is still waiting for liquidity, TVL, and volumes to catch up with Uniswap and Curve.

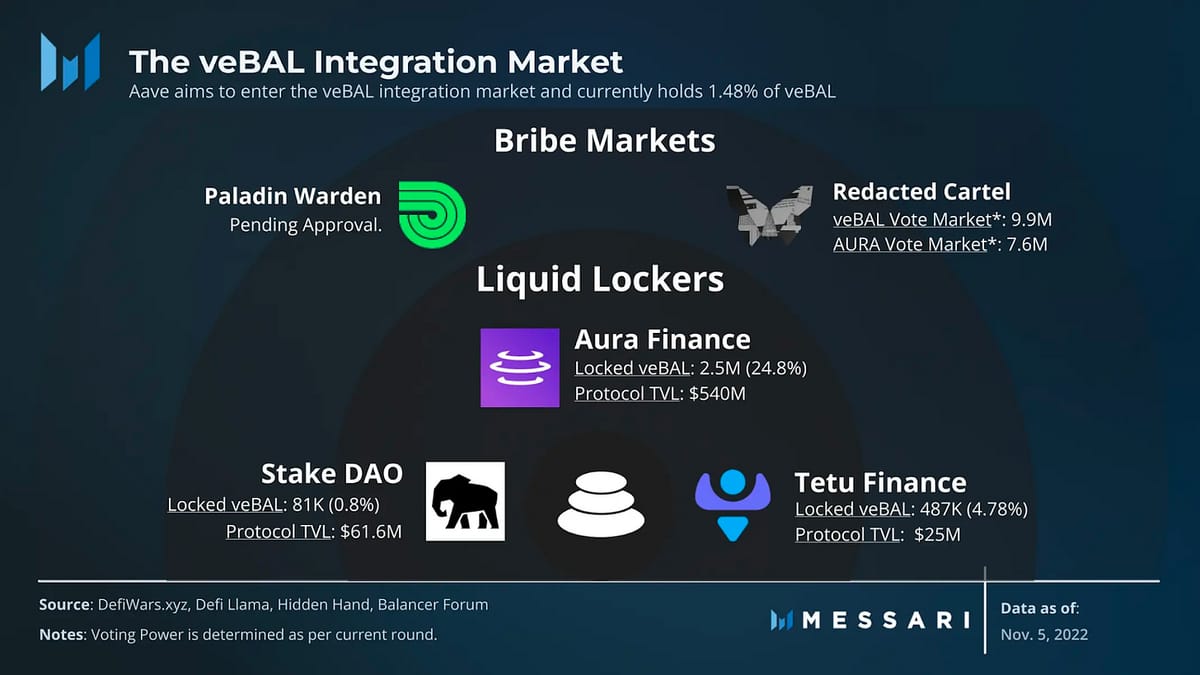

While not without growing pains, in the eight months since launching veBAL, Balancer has sprouted an entire ecosystem of applications and markets on top of its base layer. The veBAL ecosystem comprises a marketplace of liquid locker providers and bribing markets. However, new use cases and composability for Balancer Pool Tokens (BPTs) are lacking. A deeper Aave integration would be the start, providing leveraged LP opportunities with the added benefit of socializing boosted yield from veBAL emissions.

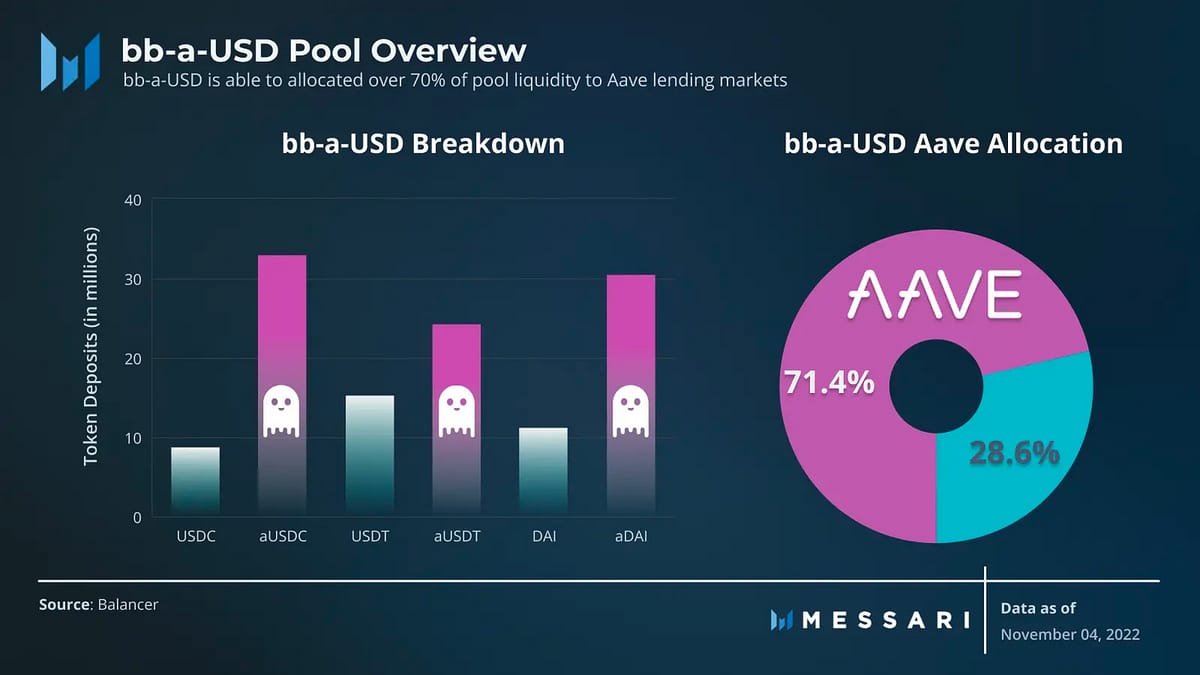

Boosted Pools are the most relevant innovation on Balancer for Aave. These pools increase capital efficiency for depositors by sending idle tokens to lending markets (currently only Aave) to accrue interest. Boosted Pools can be compared to Balancer’s staBAL3-USD pool, an equal-weighted DAI/USDC/USDT pool. If there were no trading volume in the staBAL3-USD pool, it would earn zero yield. By comparison, Balancer’s bb-a-USD meta pool comprises three Boosted Pools (bb-a-USDC, bb-a-USDT, and bb-a-DAI) and would still generate yield in the result of zero trading volume as over 70% of the pool's assets are yield-bearing aTokens. Boosted Pools additionally provide greater swap efficiency as they’re composed of Phantom BPTs, which abstract away the costs of minting and burning LP tokens.

bb-a-USD is the third largest pool on Balancer with over $122 million TVL. As LPs continue to search for new ways to increase yield, boosted pools offer a unique, risk-averse solution. If only there were a way to leverage BB-A-USD positions…

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

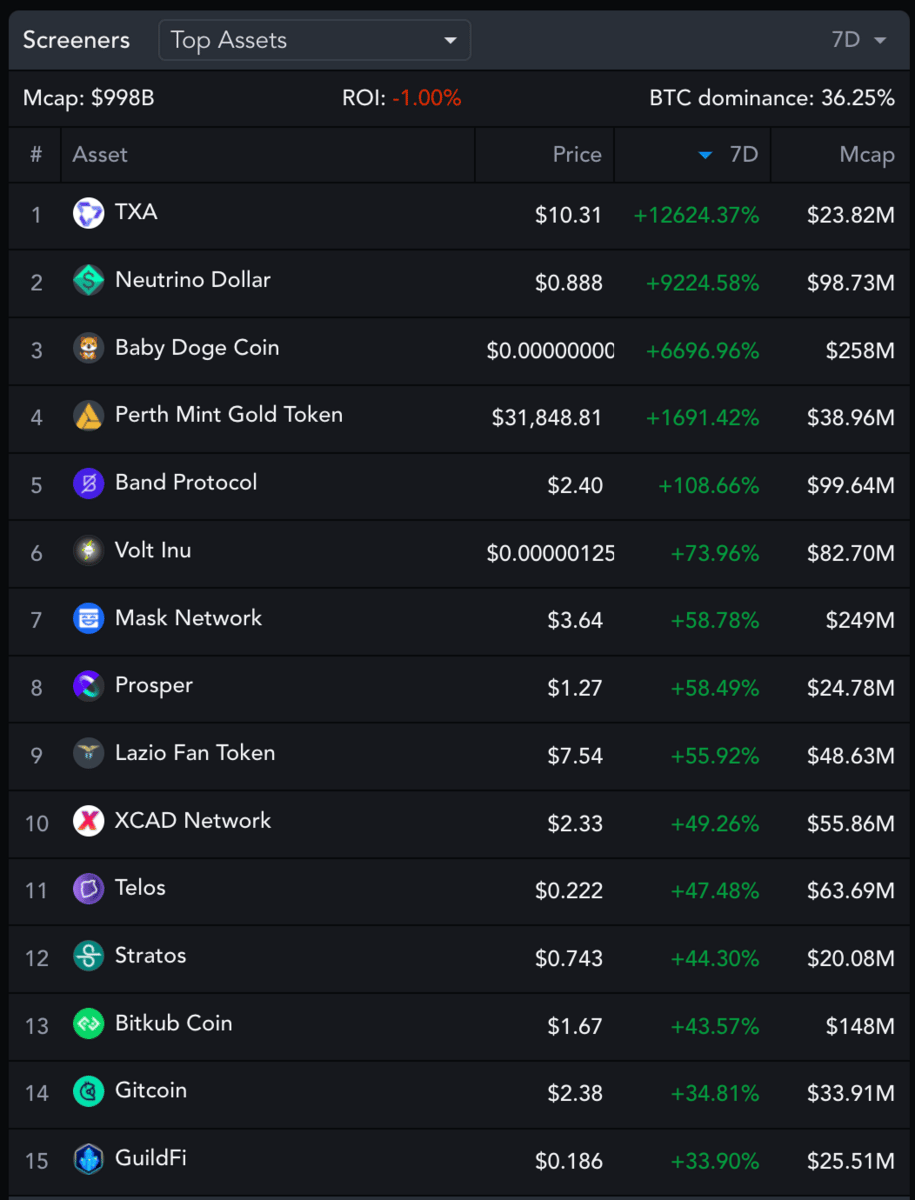

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

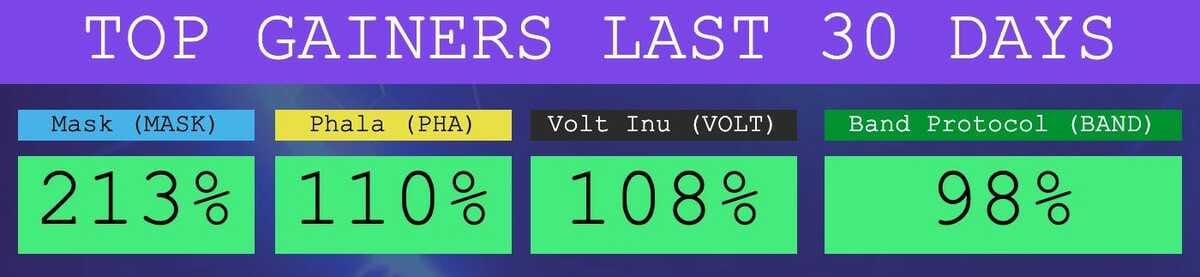

The Top Performers The Last 30 Days

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 32,938 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.wemeta.world and www.amphibiancapital.com