Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn more at www.wemeta.world, and www.investdefy.com

Issue Summary: Happy New Year. Welcome back to Coinstack, the best weekly newsletter for crypto investors and industry insiders, where we review the top news and reports in the digital asset ecosystem. This week we focus on the brewing battle between DCG and Gemini. Also, check out Mesari’s Crypto Theses Report for 2023 for a good update on the space and what to look forward to this year.

Even after recent declines, Solana (SOL) has led major L1s in price performance over the last 24 months since we began writing Coinstack in January 2021

Thanks to Our 2022 Coinstack Sponsors…

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms for Series A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

WeMeta is the Bloomberg for web3 and the metaverse, combining on-chain data, social data, and news data from many sources into a single dashboard and API source designed for web3 investors, app builders, and brands. Learn more at www.wemetalabs.com.

InvestDEFY bridges TradFi regulatory and risk management with CeFi’s liquidity and DeFi’s innovation. InvestDEFY has deep expertise in quantitative trading, digital assets, technology, AI, risk management, derivatives, global equities, regulatory compliance and investment banking. Learn more at www.investdefy.com.

We have one open sponsorship spot available for your firm - please see our sponsor deck and schedule a call to discuss.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

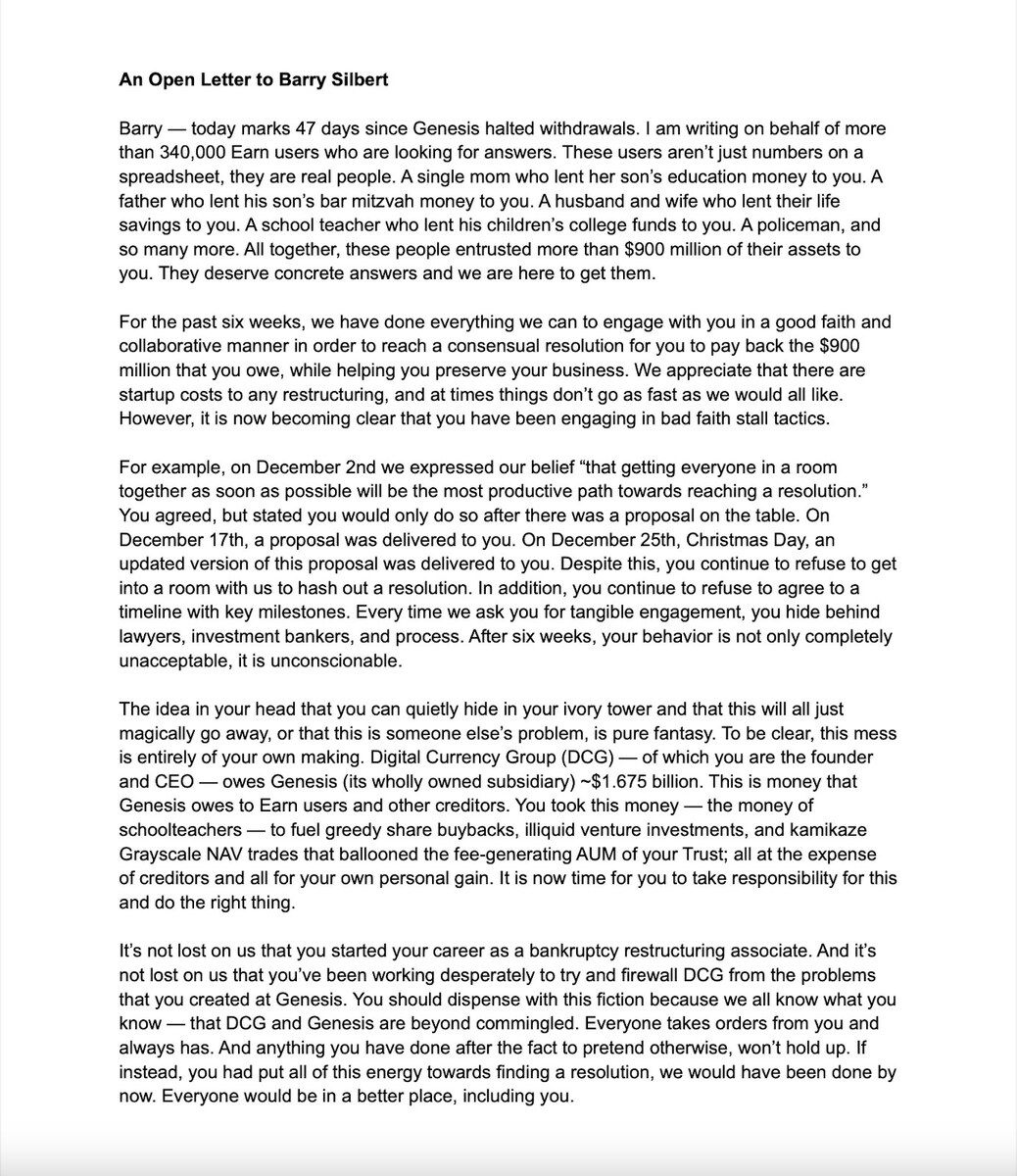

1) ⚖️ Gemini Takes Spat With DCG Public in Open Letter - Cameron Winklevoss, the co-founder of crypto exchange Gemini, claims that the chief executive of Digital Currency Group (DCG) had yet to repay $900 million that was lent to its digital asset prime brokerage arm as part of the Gemini Earn program.

2) 🚩 Genesis-DCG Loan Leads to Class Action Arbitration Case From Gemini Clients - Claimants allege in a filing that Genesis breached its Master Agreement when it became insolvent in the summer of 2022, while hiding insolvency from lenders like Gemini.

3) ⚖️ Australia Overtakes El Salvador to Become 4th Largest Crypto ATM Hub - El Salvador, the first country to legalize Bitcoin, has been pushed down yet another spot in total crypto ATM installations as Australia records 216 ATMs stepping into the year 2023

.

4) 🔗 UK Enforces Crypto Tax Break for Foreigners Using Local Brokers - The U.K. is enforcing a tax exemption for foreign investors purchasing crypto through local investment managers or brokers starting Sunday. The tax break, announced in December, is a part of Prime Minister Rishi Sunak’s plans to turn the U.K. into a crypto hub.

5) 🟩 China Launches National Digital Asset Exchange for NFTs, Metaverse - China launched a state-sanctioned secondary trading platform for digital assets on New Year’s day. After concern about the speculation around non-fungible tokens (NFT), the four tech giants Tencent, Ant, Baidu and JD self-imposed a ban on the secondary trading of digital collectibles in mid-2022.

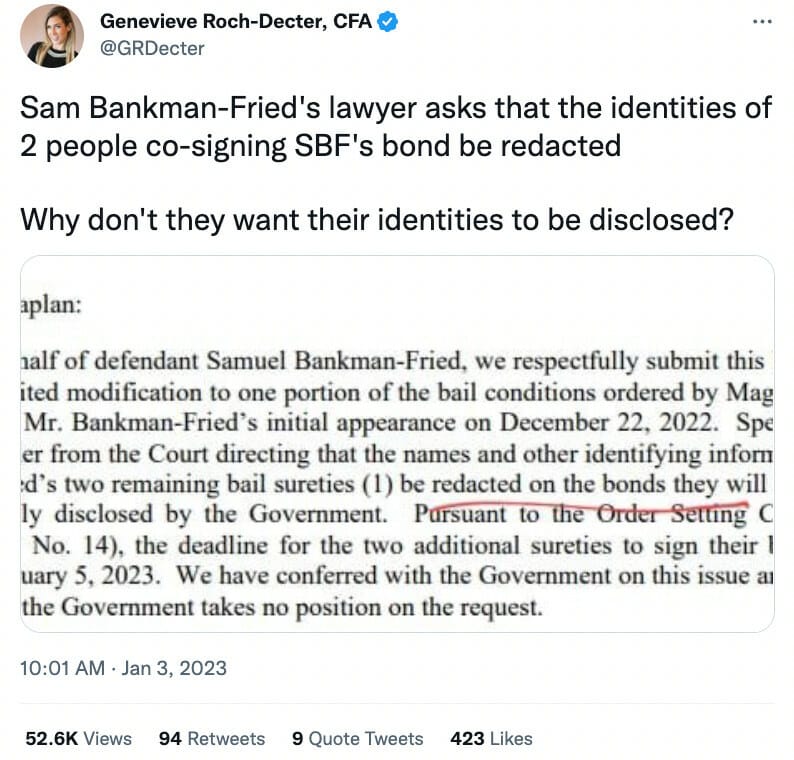

💬 Tweet of the Week

Source: @GRDecter

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Cryptocurrency spot trading volumes decreased by 46.9% in December

Source: @TheBlockRes

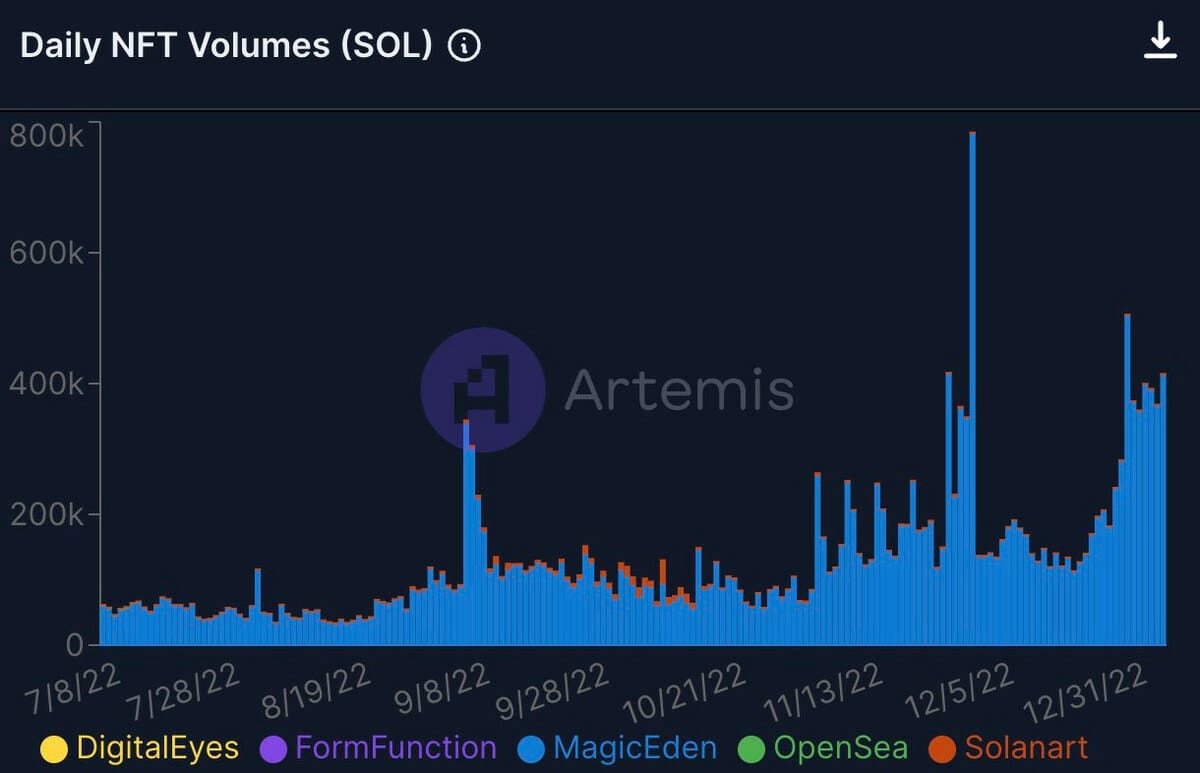

2. Daily NFT volumes on Solana have been growing despite the bear

Source: @AlanaDLevin

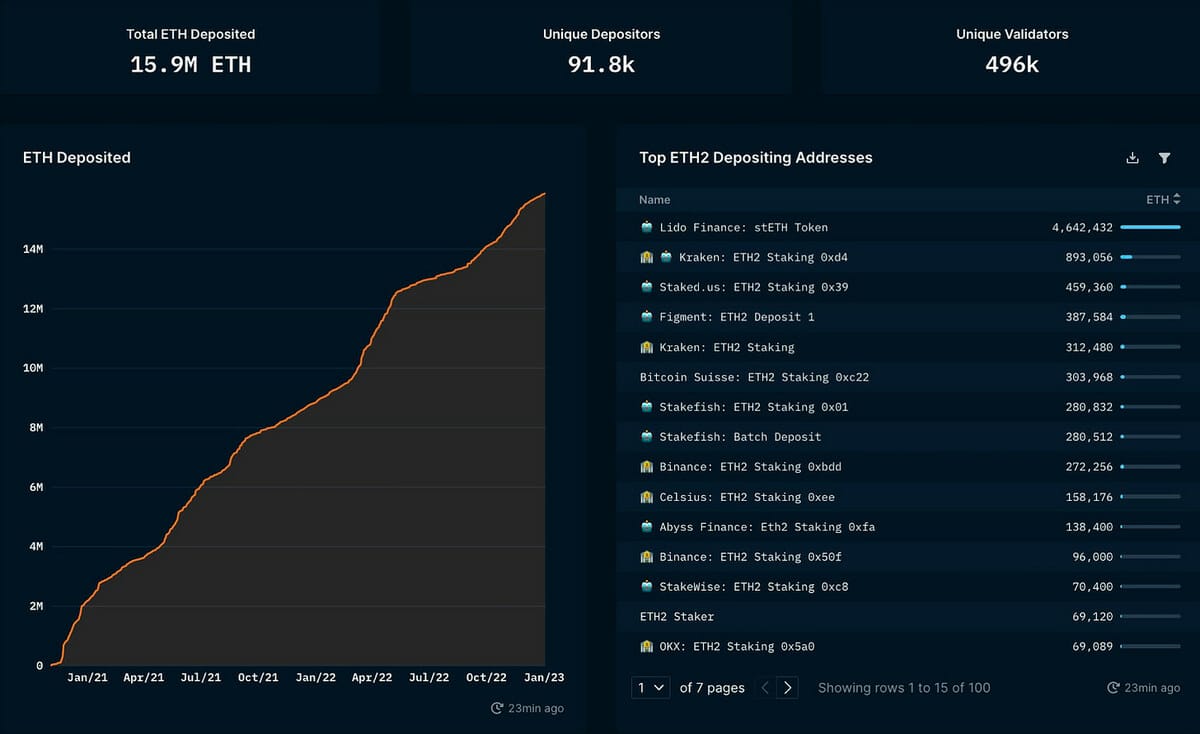

3. 15.87 million $ETH ($19.3 billion) has been staked, accounting for 13.2% of all circulating ETH

Source: @nansen_ai

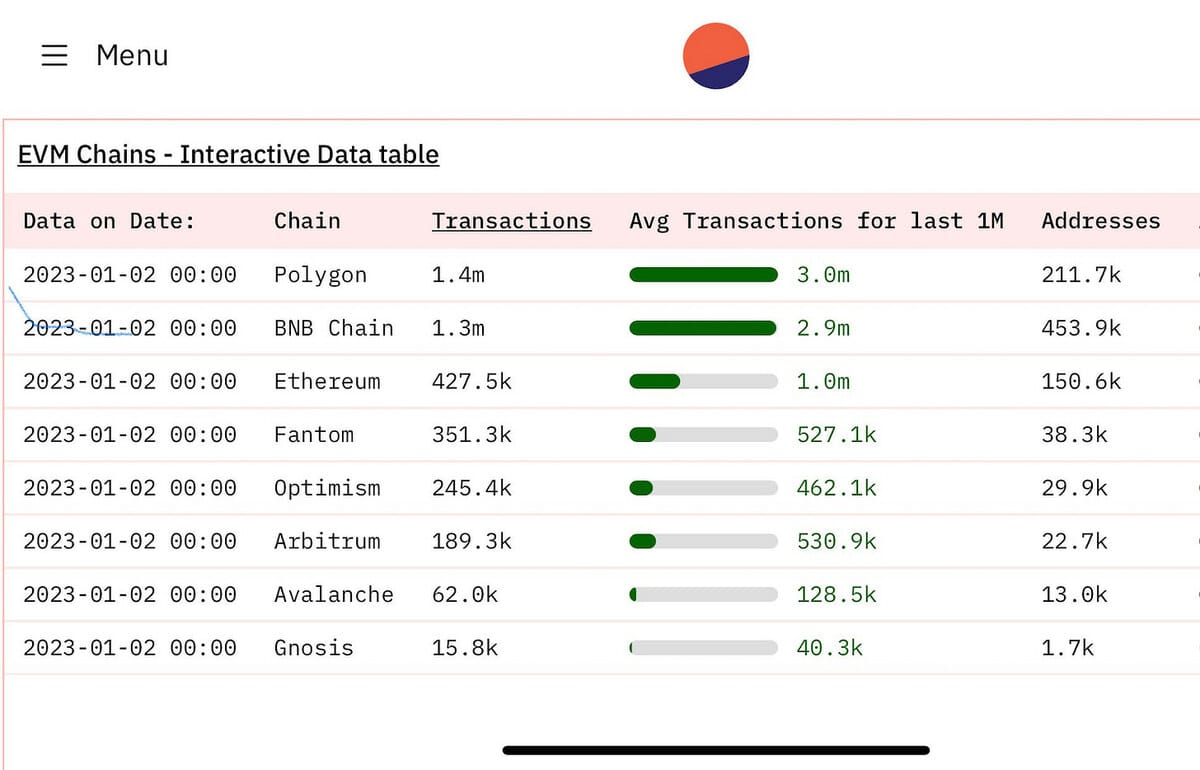

4. Polygon has overtaken BNB Chain in total & average transactions metrics over the past 30 days

Source: @iftikharpost

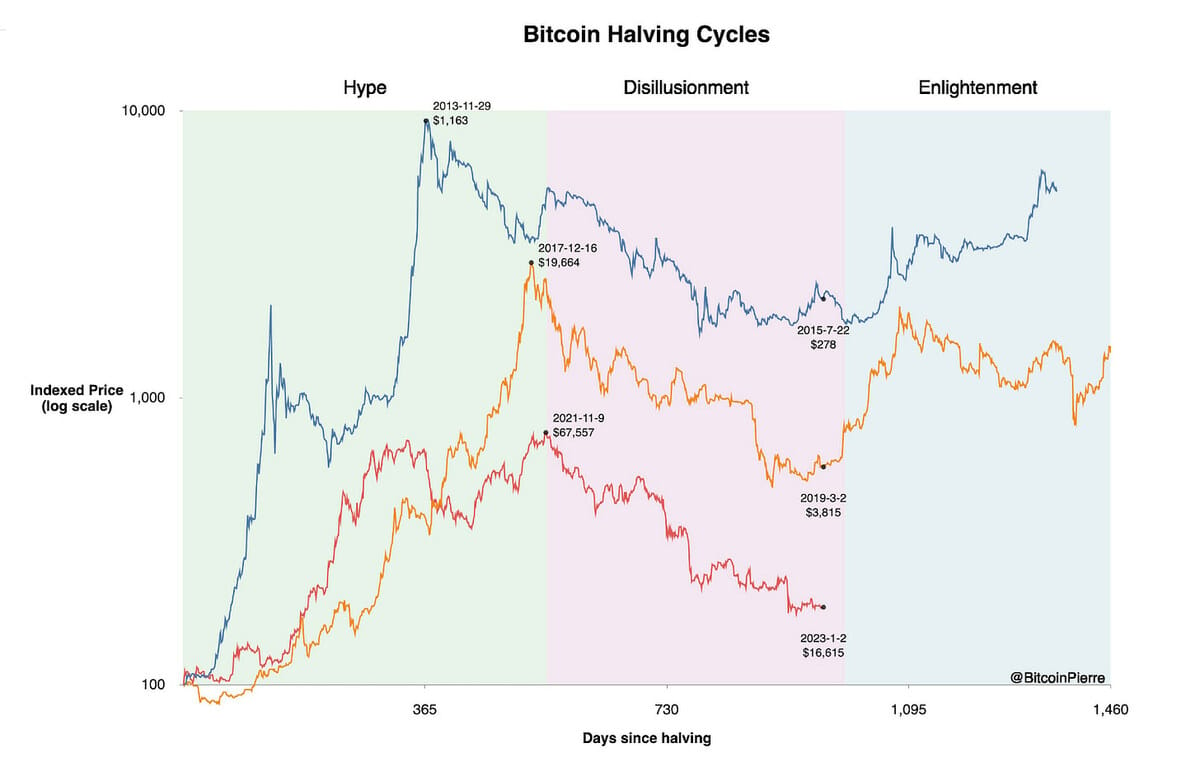

5. Bitcoin in the trough of disillusionment, either we enter the slope of enlightenment this year or the 12 year cyclical pattern breaks

Source: @BitcoinPierre

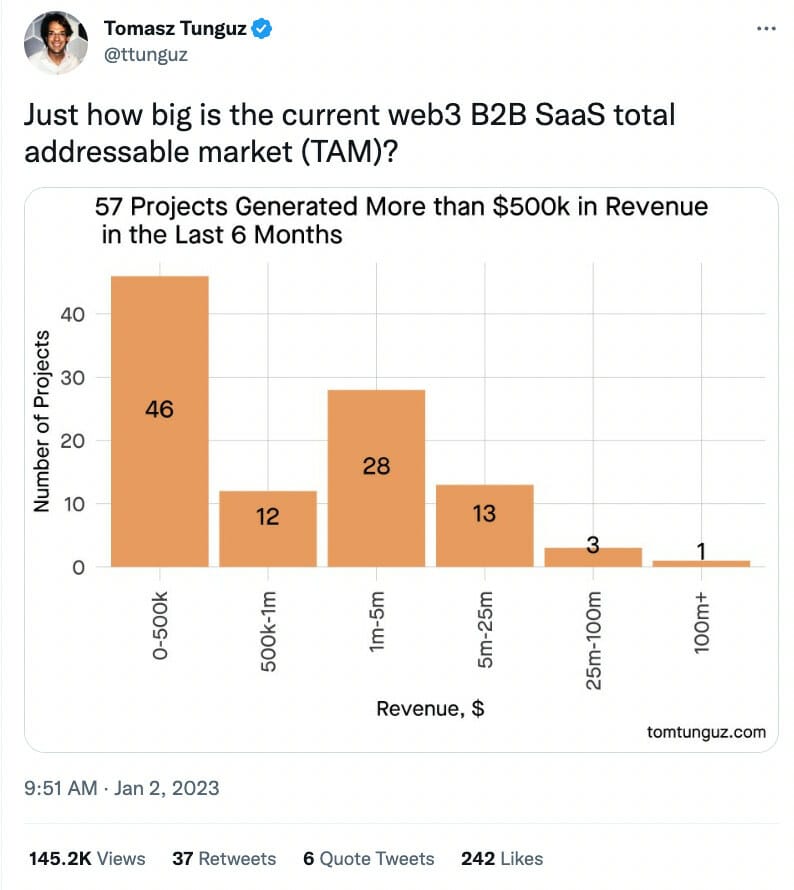

📝 Thread of the Week - Web3 B2B SaaS Total Addressable Market (TAM)?

By: @ttunguz

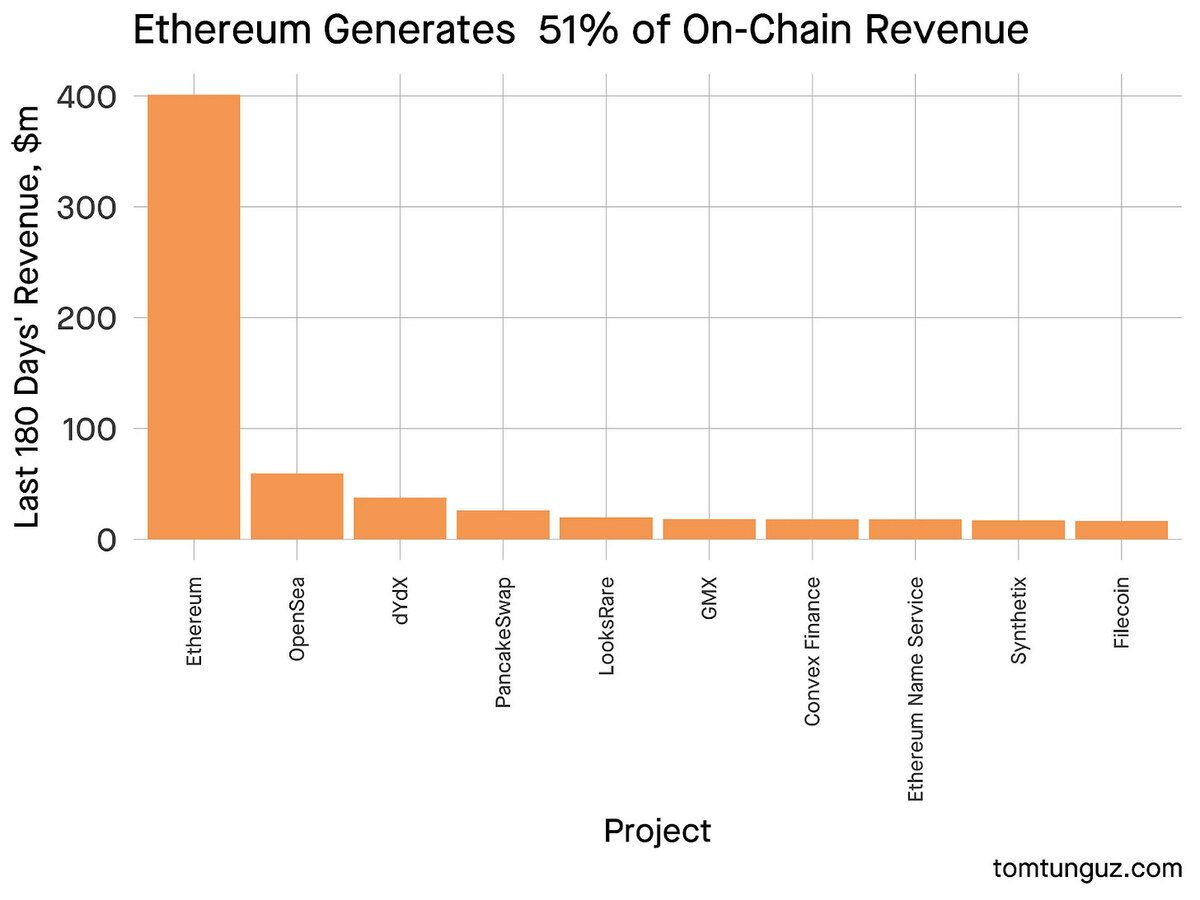

1/ In the last six months, 103 web3 companies generated revenue on-chain, the smallest of which recorded a few hundred dollars of sales & the largest, Ethereum, tallied $401m.

44% of these companies produced less than $0.5m. But 41 companies produced between $5-25m.

2/ The average software company operates at about 70% gross margin, so let’s assume a web3 company is similar. To simplify, we’ll assume the typical web3 company spends all of that cost of goods sold (COGS) on software - about 30% of revenue.

3/ That implies the web3 B2B software TAM is roughly $231m in 2022 & $75m excluding Ethereum, which comprises roughly 60% of the revenue.

Web3 software sales must navigate novel procurement processes: decentralized decision-making, payment for services in kind with tokens etc.

4/ At a 10x revenue multiple, web3 software should support about $0.75b to $2.3b in startup market cap. Depending on your view on web3 revenue growth, a 10x multiple might be high or low.

5/ The limited number of potential customers challenges web3 vendors. With fewer than 100 accounts willing to spend $20-50k on a software contract, every interaction is precious, especially those larger accounts which dominate revenue.

6/ To contrast with web2, Salesforce counts 150k customers in a market of about 650k who spend $57b annually. This is just the web2 CRM market.

7/ While possible to build a business selling exclusively to web3 companies, the bigger market today is selling web3 technologies to web2 companies. Solutions in gaming, marketing, & financial services where decentralized databases or virtual wallets solve a core business need.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

My experience digging into the most front and center bill, the Digital Commodities and Consumer Protection Act (DCCPA), these past few months may provide some helpful perspective on where crypto policy is heading next year.

Before we talk about where DCCPA (and other crypto legislation) is heading, we have to talk about where we’ve been and what happened this fall.

Given the high-stakes moment crypto now faces and the significant policy and regulatory headwinds, I’ll avoid divulging nitty-gritty details shared with me in confidence (and good faith) and will try not to over-editorialize. With one caveat: I’ll break my “no SBF” rule in this section. His actions provide critical (and lasting) context to any analysis, so I’ll share details about my interactions with him and the FTX team to give you a full readout. Just the facts.

Then we can talk about my impression of what’s coming next for crypto policy.

I also want to set the record straight with respect to my brief, limited relationship with Sam. I want to highlight how cunning I suspected him to be, lest anyone be tempted to fall prey to his media-fueled, carefully crafted, and totally bogus post-bankruptcy redemption narrative.

What I saw in my interactions with Sam was not someone who missed nuance or critical details. Or delegated control to his subordinates. Or chose his words without caution and precision. He’s brilliant and – I think – manipulative. He is not “negligent” or “incompetent,” as his crisis PR team seems to be positioning him these days, but rather “strategic,” “calculating,” and “self-pitying.”

Like most other people in crypto, I had no idea Sam might be a criminal (though that now is clear). But I had been suspicious of him and his motives for many months privately before getting more deeply involved in crypto policy conversations this fall in D.C. My misgivings deepened when I began actively working to understand just what the hell he was thinking in slamming the DCCPA down the rest of the industry’s throat.

I’ll acknowledge upfront that I know there will be suspicion, misdirected anger, and baseless accusations thrown around towards anyone who steps foot in D.C. and engages with policymakers on matters related to crypto regulation. You can choose whether to believe anything I claim in this section (though I did keep the receipts), and I won’t hold it against you. Criticism and skepticism are healthy antibodies for crypto.

No one should (or could) pretend to speak on behalf of the entire crypto industry on issues of existential importance. But engagement in D.C. is essential, and there are experts whose full-time jobs are to pound the pavement in D.C. to help our industry. We shouldn’t abdicate responsibility for crypto policy to hired guns, but we also shouldn’t drown the lifeguards we have on staff.

I personally chose to invest time and learn more about the levers at work in D.C. starting this fall.

Here’s what I saw…

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

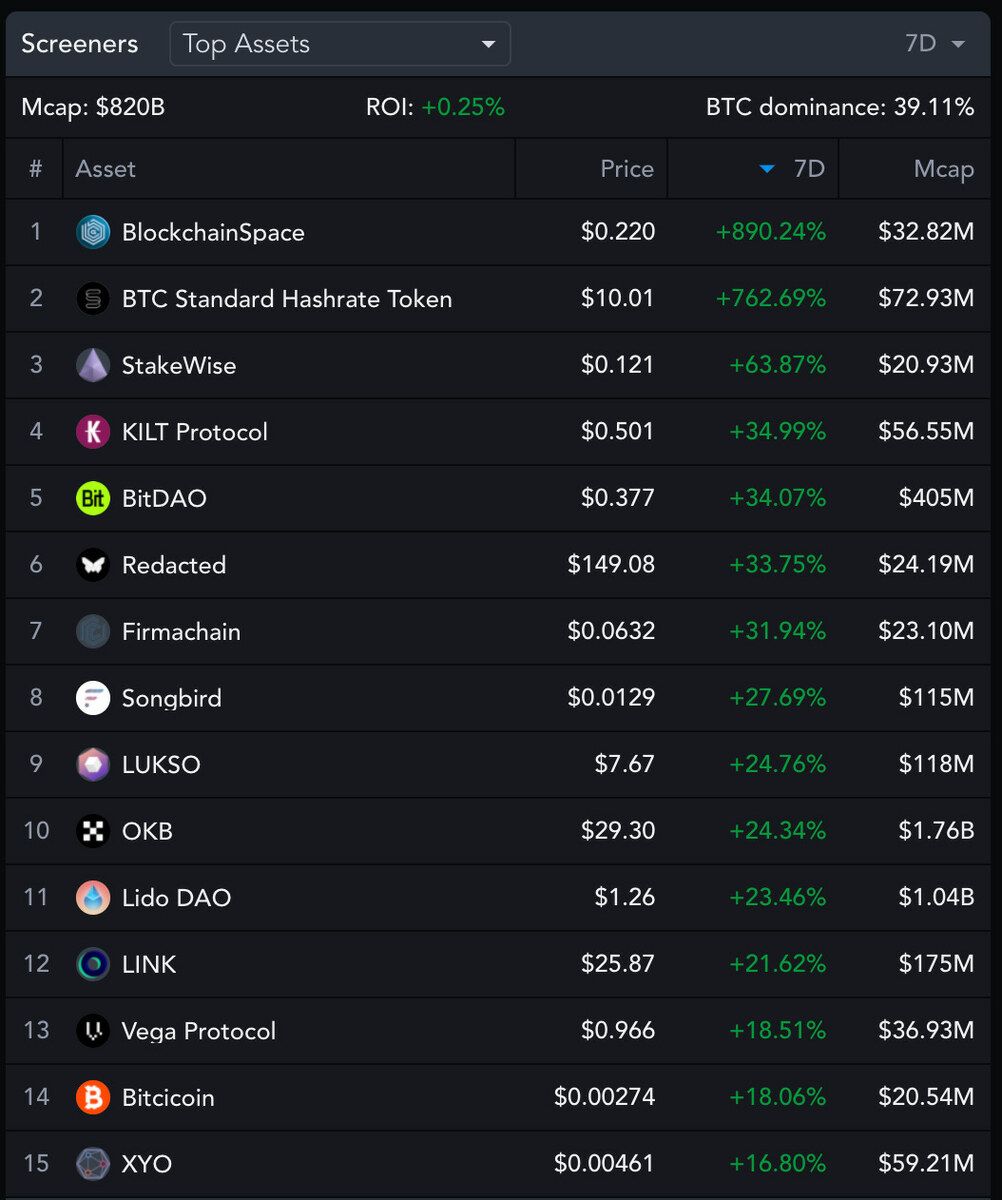

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers The Last 30 Days

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for web2 and web3 software companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 34,301 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.wemeta.world, and www.investdefy.com