Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn more at www.connect.financial, www.revix.com, www.viridius.io, and www.wemetalabs.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders, where we review the top news, stats, and reports in the digital asset ecosystem. This week we cover stories about Gemini & Genesis making up, Binance suspending USD withdrawals, the UK Digital Pound, and big new rounds from SALT ($64M), SpaceID ($10M), Elementus ($10M), and Giga Energy ($10M). It’s been good to see the recent rally with ETH and BTC prices up about 50% since the November 2022 lows. TVL in DeFi is now back up to $50B after reaching lows of $39B in January.

Thanks to Our 2023 Coinstack Sponsors…

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Connect Financial empowers people and businesses to do more with their digital assets. Their flagship credit cards allow users to enjoy their crypto's spending power, without selling their digital assets and earn rewards on everyday purchases. Learn more at www.connect.financial.

Revix is a multi-asset WealthTech business targeting the African and Middle Eastern market. It allows for effortless purchase of crypto, stocks, thematic ETFs, real estate, currencies, commodities, and more. With Revix, everyday people can easily grow and manage their own wealth, using a personal wealth management platform that is effortless, automated, and engaging. Learn more at www.revix.com.

Viridius is a Decentralized Autonomous Organization (DAO) building a modern, community-driven carbon credit registry that solves the massive problem of transparent carbon credit verification. Learn more at www.viridius.io.

WeMeta is the Bloomberg for web3 and the metaverse, combining on-chain data, social data, and news data from many sources into a single dashboard and API source designed for web3 investors, app builders, and brands. Learn more at www.wemetalabs.com.

InvestDEFY bridges TradFi regulatory and risk management with CeFi’s liquidity and DeFi’s innovation. InvestDEFY has deep expertise in quantitative trading, digital assets, technology, AI, risk management, derivatives, global equities, regulatory compliance and investment banking. Learn more at www.investdefy.com.

We have one open sponsorship spot available for your firm - please see our sponsor deck and schedule a call to discuss.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

1) ⚖️ Gemini, Genesis Reach $100 Million Agreement Over Earn Program - Gemini Earn users are a step closer to recovering their money with an agreement announced today between US cryptocurrency exchange Gemini, Genesis Global Capital, LLC (Genesis), and Digital Currency Group. Gemini co-founder Cameron Winklevoss announced the agreement on Twitter.

2) ⚖️ Seven-Member Committee Formed to Represent Creditors in Genesis Global’s Bankruptcy Case - A seven-member committee to represent unsecured creditors has been established in the U.S. bankruptcy case of Genesis Global.The unsecured creditor committee will serve as a voice for creditors in court. William Harrington, a representative for the U.S. Trustee, appointed the committee, according to a Feb. 3 filing.

3) 🛑 Binance to Temporarily Suspend USD Transfers on Feb. 8 - Binance said Monday that it would temporarily halt U.S. dollar transfers on Feb. 8, a move the company claims would only affect a "small proportion" of its users. “It is worth noting that USD bank transfers are leveraged by only 0.01% of our monthly active users,” Binance CEO Changpeng Zhao tweeted. So yeah, you can’t get dollars from Binance for now. Sad face.

4) 💰UK Looks to Launch Digital Pound by 2030, Roadmap to Be Released Soon- The Bank of England (BoE) and His Majesty’s Treasury will introduce a roadmap to build a central bank digital currency (CBDC) next week. The BoE and Treasury are looking to launch a four-month consultation in which businesses, academics, and the wider public will be invited to share views on the launch of a “digital pound,”.

5) ⚠️ DEX Aggregator CoW Swap Falls Victim to $180k Hack- Decentralized exchange aggregator CoW Swap suffered a major hack, with the attacker making off with over $180,000 in funds, according to security firms PeckShield and BlockSec.

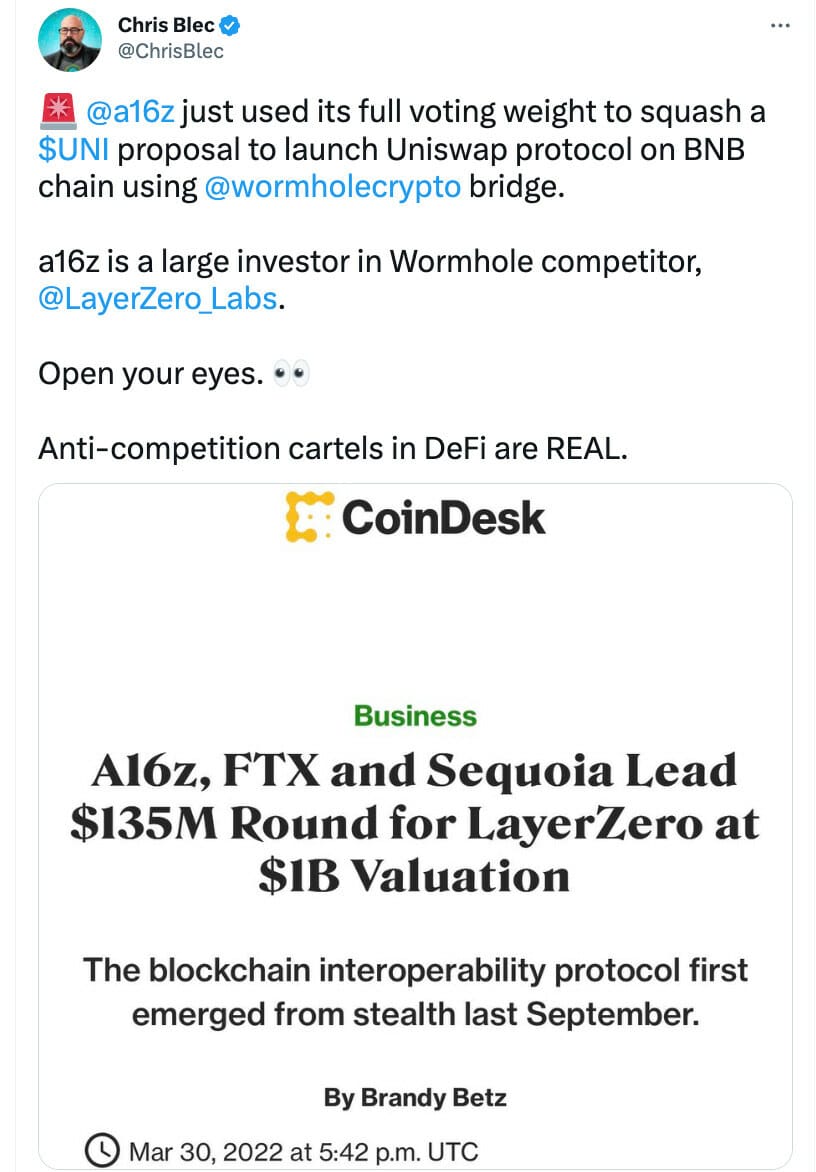

💬 Tweet of the Week

Source: @ChrisBlec

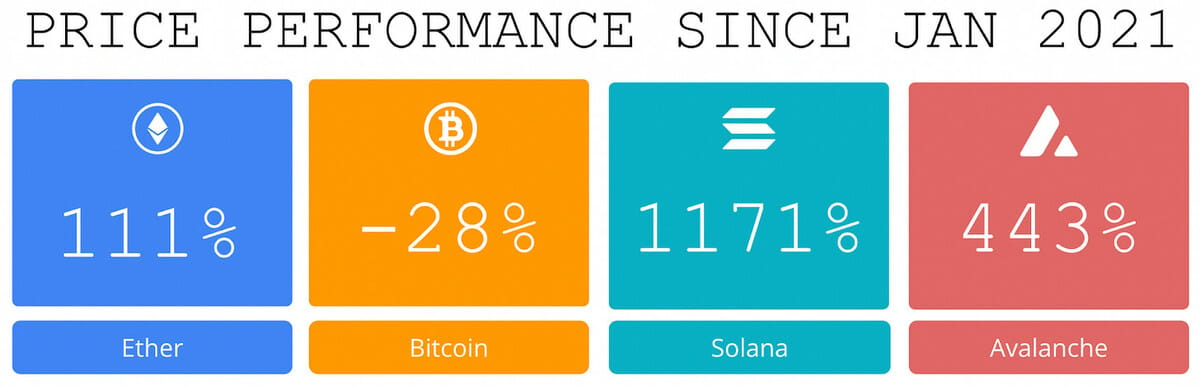

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Incredibly, the Cost Savings of Decentralized Storage vs AWS Is Staggering. Competitive threat?

Source: @dunleavy89

2. Fantom Is One of the Best-Performing Major Crypto Assets of 2023, Up Over 180%, but the Underlying Fundamentals Continue to Point Toward a Stagnant to Declining Ecosystem

Source: @dunleavy89

3. Layer2 Gas Consumption Has Seen a Correction in the Last Few Weeks After Many Weeks of Continuous Increase

Source: @Coin98Analytics

4. @a16z Just Used Its Full Voting Weight to Squash a $UNI Proposal to Launch Uniswap Protocol on BNB Chain Using Wormhole Crypto Bridge

Source: @ChrisBlec

5. Liquidswap Reaches 120k Users

Source: @ournetwork

📝 Thread of the Week - Why We Need NFTs

By: @jordanfried

1/ The internet in its current form is flawed. The smartest people in the world today understand that. ‘The original sin of the internet' was that it was illegal to use the internet for commercial activities due to conditions in the original Acceptable Use Policy or AUP.

2/ Because commercial activity was forbidden on the internet advertising became the default business model. Downstream from advertising is everything people are worked up about - privacy, user data collection, user data targeting, third-party ad networks, data brokers, etc.

3/ But all hope is not lost and again, the smartest people in the world understand that as well. Today, most living adults have conducted commercial transactions online purchasing everything from plane tickets, ordering household goods, and even groceries.

4/ But first, we have to understand the significance of Bitcoin - the internet's first native currency. A globally decentralized ledger that can be used to send money across the globe without intermediaries.

A ledger that is now used by hundreds of millions around the world.

5/ Bitcoin kickstarted the crypto economy, an economy that swelled to about $2.8 Trillion in value by the end of 2021 and now sits around $1 Trillion.

The crypto economy is too big to ignore and it's not a passing fad. It's a viable payment mechanism and an internet native one.

6/ As wallets proliferate and more and more global wealth becomes internet based - which makes sense as every generation going forward will have had the internet for the entirety of their lives - we need private property protection for the crypto economy to truly flourish.

7/ Enter non-fungible tokens or NFTs. NFTs provide a record of authenticity and ownership held and verifiable on the blockchain.

We're no longer just storing crypto money on the ledger, we're storing proof of private property in a verifiable way for all to see.

8/ Historically economies have flourished when clear private property protections are afforded to the people within that economy. The crypto economy will be no different.

The list of things you'll be able to own on the ledger will only grow and you'll own those things as NFTs.

9/ Today we're able to own jpegs, gifs, music, tickets, and virtual land as NFTs on the ledger but to think this technology stops there would be foolish.

Before long we'll be proving the authenticity of Rolexes, handbags, and even title deeds to physical property using NFTs.

📰 Peer Acquires Elite Team of Engineers Behind Zenly’s Popular 3D Maps

Peer today announced the hiring of a specialist team of engineers from Zenly to develop its AI-powered 3D maps. The team, known in tech circles by its codename “Wonka,” developed Zenly’s innovative 3D social maps platform that grew to more than 160 million downloads worldwide and reached 35 million daily active users in 2022.

“Zenly users adored its polished and delightful features,” explained Tony Tran, Founder & CEO of Peer Inc. “We’re huge fans as well, and we look forward to working with the Wonka team to recreate that magic and take it to the next level.”

With this acquisition, the company will be able to fast-track the development of its gamified social network, “Peer.” The highly anticipated app will be available on both iOS and Android in Q2 2023.

“We have an aggressive roadmap to deliver the features that Zenly users loved in an all-new platform they will rave about” said Milan Bulat, Wonka’s former lead engineer and now Peer’s Head of Maps. “Peer will completely transform the way people experience their world.”

Peer is revolutionizing social networking by integrating AI, AR, and blockchain technology into a unique, planet-scale 3D map that delivers a game-like, immersive social experience. Core to the app is the ability for users to construct their personal “places graph” a map of people, places, and memories, making it easy for day-to-day navigation, revisiting memories in real-world locations, and discovering new worlds shared by others.“Our 3D maps sit at the intersection of the digital and physical worlds, enabling users to access both simultaneously,” said Tran. “We see it as a globally connected experience. This is an opportunity to create an exciting new world and bring back the emotional connection and sense of belonging that has been stripped from today’s social networks.”Peer has launched peerclub.com to allow former Zenly users and early adopters to secure their username for the upcoming app launch. By doing so, they will also gain early access to exclusive rewards, secret moves, unlocks, and other engaging gamified features.

To learn more about Peer Inc. and Peer’s ecosystem, visit peer.inc.

About Peer Inc.

Peer Inc. is a social media company focused on building the social network of the future. The company is developing a range of innovative products that combine cutting-edge technologies like blockchain, augmented reality, artificial intelligence and computer vision to allow people to see, share and interact in exciting new ways. To learn more, please visit peer.inc and follow us on Twitter @peerglobal.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Intro

Play-to-Own (P2O, also called Free-to-Own) has gained increasing consensus as the best crypto gaming model. It replaces the pyramid-scheme-esque economics of its predecessor, Play-to-Earn (P2E), with fairer economics centered around the issuance of free NFTs.

P2O is a step in the right direction, albeit an insufficient one. While P2O hits on user ownership of assets, creator IP rights, and increased economic sustainability, these features aren’t differentiated enough from traditional games to significantly change gamer behavior towards crypto gaming.

While content creators will certainly appreciate Web3’s significantly lower middleman take rates, it won’t matter if the gamers aren’t there to consume the content. As it stands, the core selling point of P2O for gamers is the idea of “true ownership” of in-game assets.

We argue that most gamers view true ownership as more of a novelty than a forcing function for change. Without such a forcing function, crypto gaming will not succeed in reaching the lofty aspirations envisioned by those investing capital and time into the sector.

However, a new model has the potential to combine with P2O to turn crypto gaming’s lofty aspirations into money-printing realities.

Some call it risk-to-play. Others have called it kill-to-earn.

We came up with a more generalizable name. This model — which could revolutionize gaming for players and developers alike for years to come — is called “Bet-to-Play” (B2P).

As the name indicates, Bet-to-Play allows multiplayer gamers to bet on themselves against other gamers. Projects utilize crypto payment rails and smart contract logic to automatically pay out winners and losers down to the second. This simple but novel feature may supercharge Play-to-Own (and, by extension, crypto gaming as a whole) by tapping into existing trends in the gaming and gambling markets.

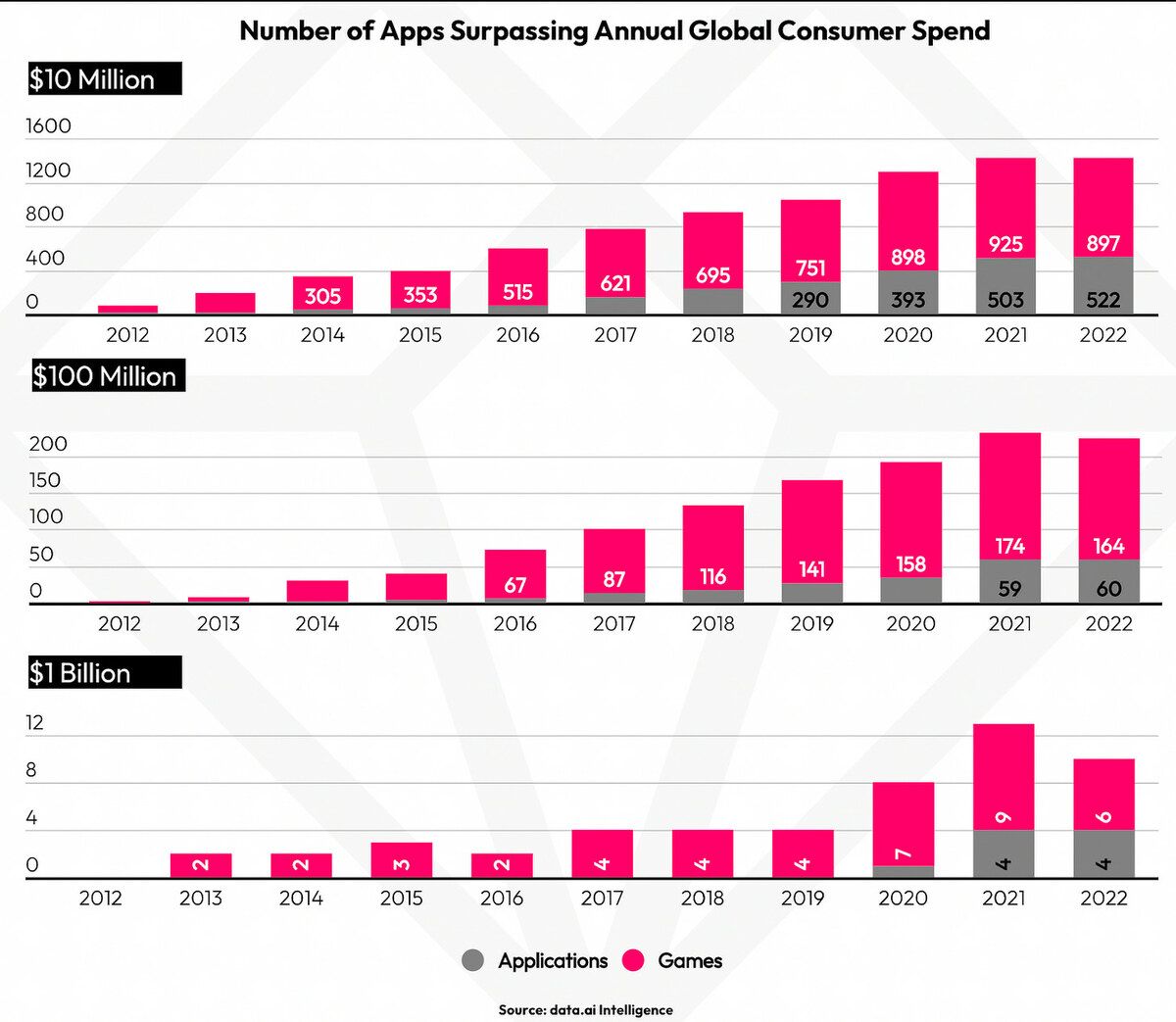

Why Care? Reviewing the TAM of Gaming & Gambling

Before delving into the depths of video game mechanism design, some context. The markets for gaming and gambling are both quite large:

Gaming Overall

About $200 billion in annual revenue is a decent size indeed. For comparison, the ad revenue social platforms generated a comparable $230 billion in annual revenue last year. Those ad networks are considered by many as some of the best businesses in all history, and gaming cumulatively matches them for revenue.

Most notably, mobile gaming dominates the total gaming market by a wide margin. Mobile’s market share is projected to stay at 77% of the overall market through 2027. That amounts to over $200 billion in revenue for mobile games alone by 2025 — just two years from now.

Across all gaming subsectors, the majority of revenues are driven by traditional advertising and especially auxiliary in-app purchases. These purchases include items such as cosmetic skins, gameplay speed boosts (mobile devs often insert cooldown periods into games that can be circumvented with cash), and loot boxes for randomized cosmetics. They can also include “battle pass” subscriptions, which allow gamers to pay for special access to even more loot boxes, gameplay boosts, and cosmetics.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers The Last 30 Days

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 35,353 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.connect.financial, www.revix.com, www.viridius.io, and www.wemetalabs.com