Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week Bitcoin whales increased holdings, Genesis began distributing to creditors, the SEC urged the court to reject Coinbase’s subpoena and big new venture rounds came in for Morpho ($50M) and Daylight ($9M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

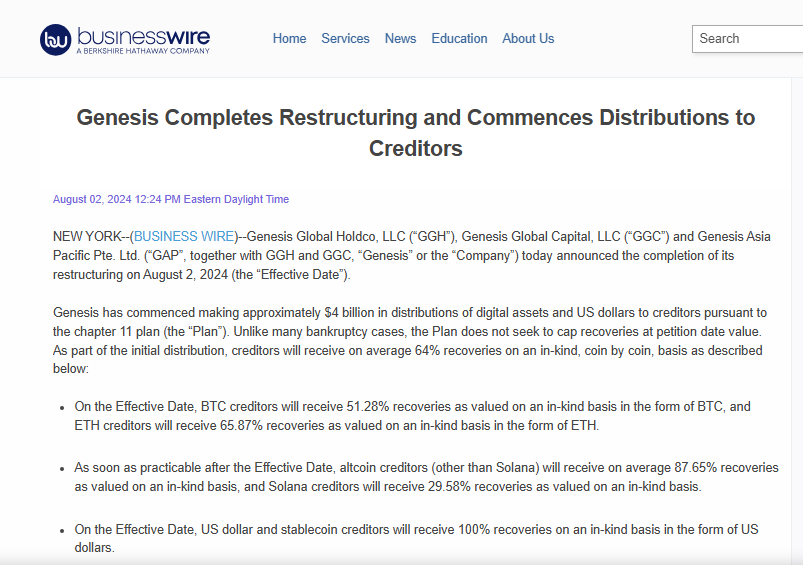

⚖️ Genesis begins distributing $4 billion in assets to creditors, creates legal fund to sue DCG, others: Genesis has finalized its restructuring process and started distributing roughly $4 billion in digital assets and US dollars to creditors, according to an Aug. 2 statement.

💰Bitcoin Whales Increased Holdings During Crypto Market Mayhem, but ETF Investors Didn't Buy the Dip: Bitcoin wallets holding between 1,000 and 10,000 BTC increased their holdings while prices slid over the past few days, while those owning less than 1 BTC were sellers

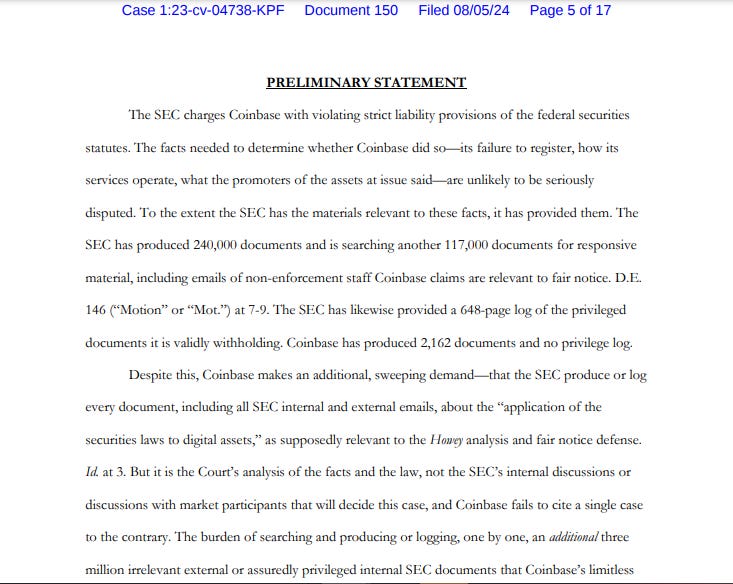

⚖️ SEC urges court to reject Coinbase’s subpoena request for documents: The SEC’s court document on Monday claimed that the agency had been accommodating Coinbase’s requests to disclose additional documents, including fair notice and documents from investigative files outside of the Coinbase case.

📉 Ronin Network Paused After Upgrade Allows Attackers to Drain $12 Million: So-called ‘white hat’ hackers stole 4,000 ETH and $2 million in USDC before the team took action.

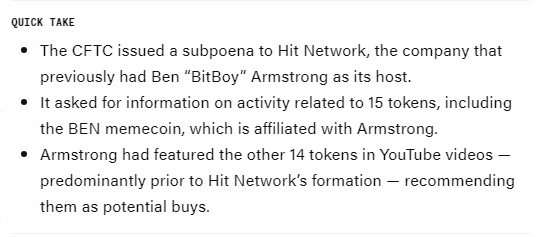

⚖️ CFTC subpoenas Ben ‘BitBoy’ Armstrong’s former company in fraud investigation, asks about activity for tokens such as BEN: The agency issued a subpoena on July 16 to Hit Network, the crypto-focused media company that previously had Ben Armstrong — known as “BitBoy” — as its public face. The subpoena, seen by The Block, requests information about trading activity and digital wallets connected with the 15 tokens. It states that this is part of an investigation into persons engaged in fraud with respect to digital currencies and related unlawful conduct.

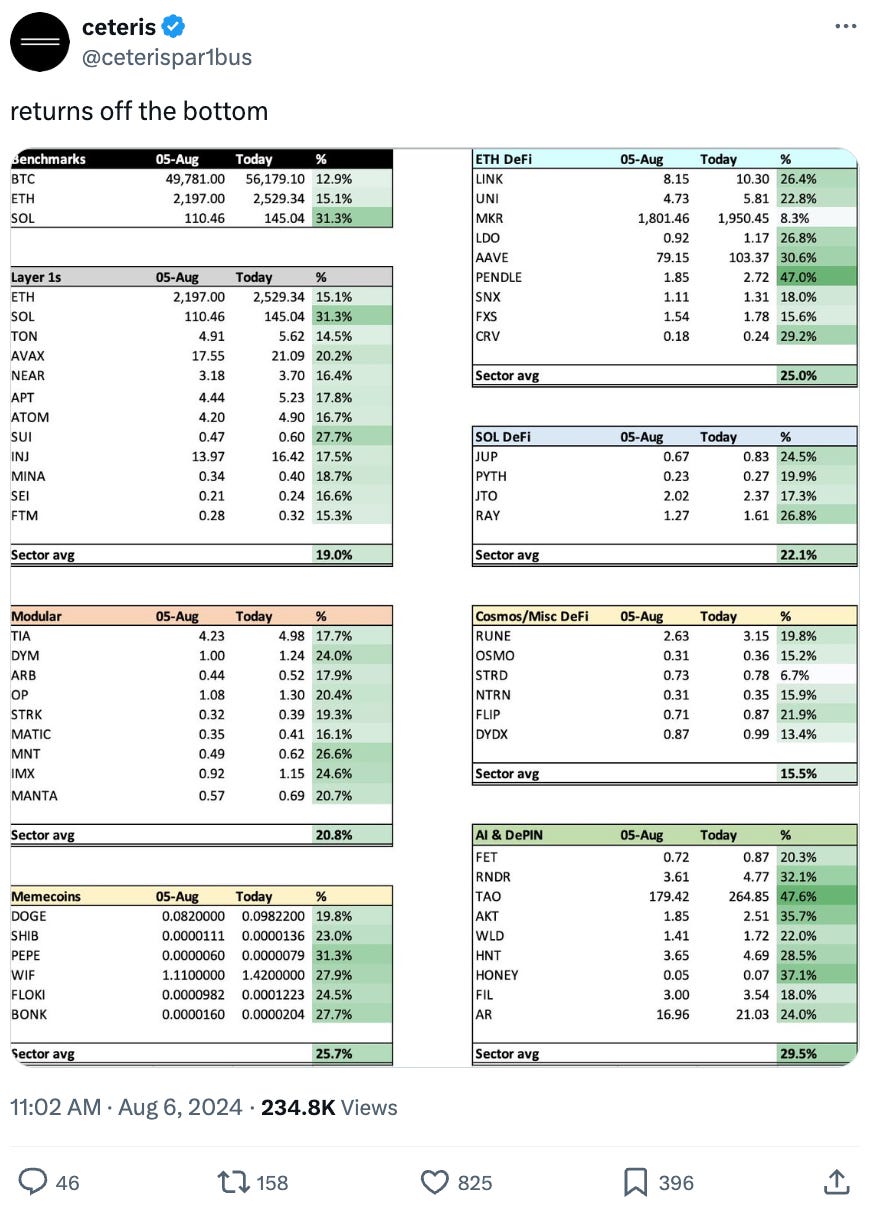

💬 Tweet of the Week

Source: @ceterispar1bus

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Movements on SOL futures open interest this week was even more brutal than BTC (-27%) and ETH (-33%), as a staggering 43% of all SOL OI was wiped.

After falling to 3-month lows yesterday ($1.77B), however, SOL futures OI has since increased by 20% within the last 24 hours. Yet OI-weighted funding rates remain negative.

Source: @DavidShuttleworth

2. Yesterday we saw over $1.02B in liquidations throughout the crypto market, the highest daily total since March ($1.17B). Both BTC and ETH long positions experienced their worst day this year with over $267M and $252M in liquidations, respectively. Interestingly, however, ETH long liquidations nearly doubled their previous yearly highs ($138M), while BTC longs were relatively similar ($261M).

Source: @DavidShuttleworth

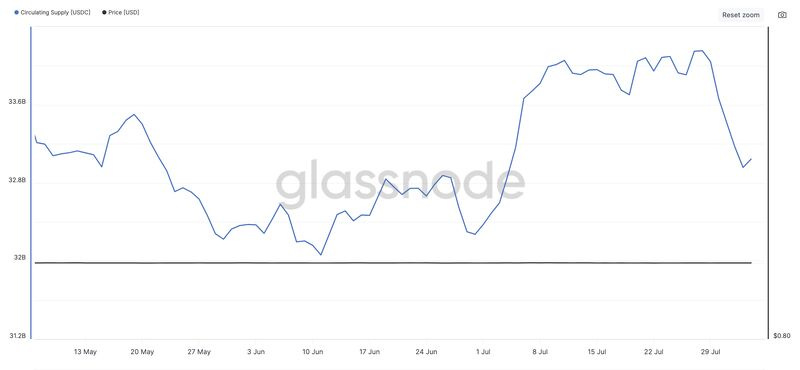

3. Total circulating supply of USDC decreased by $1.11B over the past week. This represents 3% of all USDC in circulation and was mainly confined to ETH-based USDC. Meanwhile, circulating supply of Tether and DAI remained relatively unchanged during this time.

There are several exogenous events to monitor here, including distributions from Genesis, Mt. Gox, BlockFi, and FTX, government holdings, and ETH ETF flows.

Source: @DavidShuttleworth

4. 📈 In 2024, total TVL of Bitcoin sidechains reached a record high of $2B

Source: @OurNetwork

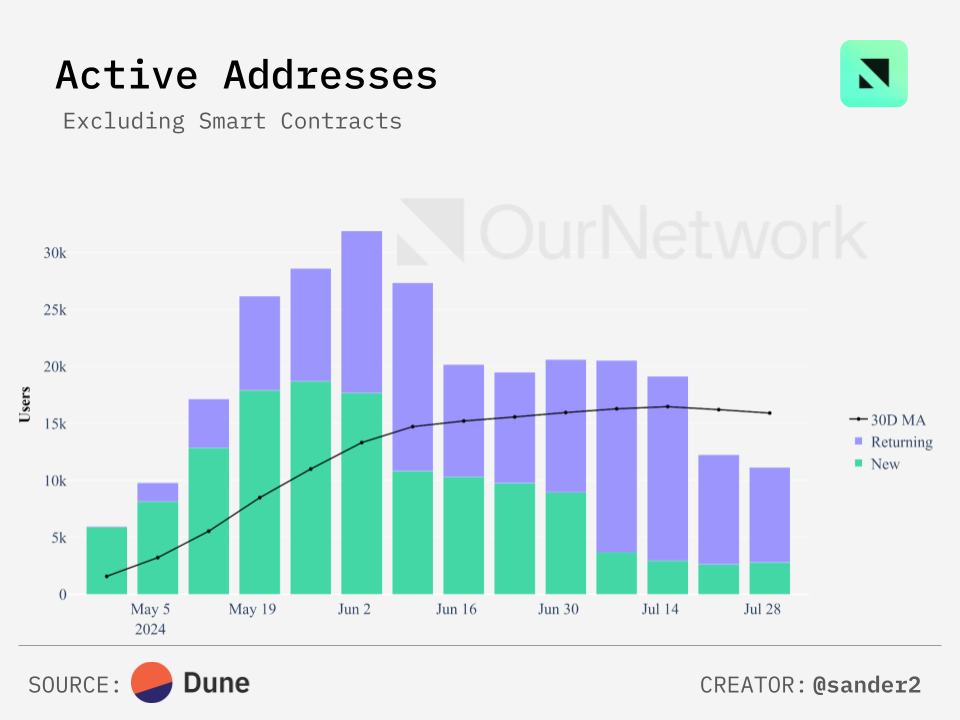

5. BOB Surpasses 130K Unique Addresses with $740K BTC Bridged from the Gateway!

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Cole DeRousse serves as a Research Assistant at 1995 Digital Asset Research, where he blends technical research with social investing strategies. His primary focus is on fostering the growth of the Web3 community and ecosystem, aiming to awaken people to the transformative power of Web3 apps and technologies. This is an excerpt from the full article, which you can find here.

Safety Trade Update

In this report I want to revisit the safety trade and provide an update. By the end of this report you should have a deeper understanding of the safety trade itself, how it can help you predict alt season, and last but not least where we currently are in the safety trade. So let’s dive into it.

The safety trade of this cycle can be measured by combining Bitcoin, Ethereum, USDT (Tether), and USDC (Circle) dominance all into one chart. Let’s start with the first chart above where we are comparing the current safety trade with the safety trade from the 2018-2021 cycle (btc.d). When comparing the two you can notice it has a similar pattern, note they share a similar red box that indicates BTC capitulation and the bottom, notice also the similarity between the dotted verticle lines which indicate the exact moment of each cycle where altcoins bottomed against thier BTC pair. The safety trade chart for this cycle has been one of the most helpful charts to understand better when it’s time to go risk on and when overlayed on top of each other we can glean some compelling insights.

One of the most fascinating insights about the safety trade comparison in the chart above is the amount of time we have spent consolidating. Take a look at the chart above and you will notice we are currently sitting at 1161 days from May 7th, 2021 which marked the technical top for BTC and the majority of alts last cycle. It’s important to note that many debate the top date of the last cycle, I tend to be in the camp that the top was in on May 7th, 2021 because this is when the majority of altcoins topped as BTC price and dominance created a divergence that led to risk on aka alt season. Most altcoins never made a new all-time high after this and were rejected at their .702 retracements when that 2nd top was put in late November of 2021.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com