Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn more at www.wemeta.world, www.amphibiancapital.com, and www.investdefy.com

Issue Summary: Welcome back to Coinstack, the best weekly newsletter for crypto investors and industry insiders, where we review the top news and reports in the digital asset ecosystem. Reporting live from the depths of crypto winter, where there’s still much more activity than in 2018. Hang on till 2024, and keep building friends. Good times remain ahead as we evolve to a world where all financial assets are tokenized, and all markets operate 24/7 on transparent distributed ledgers.

One thing we all learned this month from the FTX fiasco is that more transparency in markets is needed — not less. We are excited to witness the move to real-time on-chain accounting with visible proof of reserves in the years ahead — for all major companies. The old system of “trust us because we’re a big brand and sponsor arenas” is moving aside to a new system of “trust us because we have live visible public proof of reserves.” Toward this effort, this site is now publishing a CEX Transparency Dashboard. A good first step.

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Genesis Warns of Potential Bankruptcy, Asks Binance and Apollo for Cash, Four Day Silence from DCG Spooks Investors, Coinbase Releases Letter Supporting Grayscale Deposits

💵 Weekly Fundraises - Arkon Energy ($28M), Thirdverse ($15M), Tropee ($5M)

📊 Key Stats - 100+ ETH Holders Hits ATH, Exchange Volume Declines, AVAX Subnet Leads 51% of All Avalanche Transactions

🧵 Thread of The Week - FTX - Where Did The Money Go?

📝 Report Highlights - Messari - We're All Losers Here, Just Some Less than Others

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

📈 Top 10 Tokens of the Week - MASK, TWT, MATH

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

📚 How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms for Seed and Series A/B/C rounds of $1M to $50M. The firm has relationships with all of the top 200 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation. #timetobuild

WeMeta is the Zillow for Metaverse; their robust data insights and accessible UI makes it easier than ever to interface with the digital worlds. What's more - WeMeta is just getting started. They are constantly releasing new features and tools to address the growing needs of their users amidst the booming Metaverse. Learn more at www.wemeta.world.

Amphibian Capital recently launched the Amphibian ETH Alpha Fund, with the goal of outperforming staking Ether. The fund offers a way for accredited investors and institutions who are large holders of Ether (150+ ETH) to invest in a diversified portfolio of ETH quant trading funds that pay out returns in ETH. Learn more and see fund results at www.amphibiancapital.com.

InvestDEFY bridges TradFi regulatory and risk management with CeFi’s liquidity and DeFi’s innovation. InvestDEFY has deep expertise in quantitative trading, digital assets, technology, AI, risk management, derivatives, global equities, regulatory compliance and investment banking. Learn more at www.investdefy.com.

We have one open sponsorship spot remaining - please see our sponsor deck and reach out to schedule a call to discuss.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) ⚖️ Crypto Brokerage Genesis Is Said to Warn of Potential Bankruptcy Without Fresh Funding - Digital-asset brokerage Genesis has paused redemptions and new loan originations, and it’s warning potential investors that it may need to file for bankruptcy if its efforts fail. The lender has approached crypto exchange Binance for investment and to bid for its loan book, according to this Bloomberg article.

2) 🤯 SBF Explains Why FTX Didn’t Make It In Letter to Employees - Former FTX CEO Sam Bankman Fried wrote a four page letter to FTX employees this week, but somehow didn’t once directly mention the actual problem: giving customer deposits to a risky trading fund (Alameda) in exchange for its own self-minted FTT token collateral. Here’s the full four page letter, found via Coindesk.

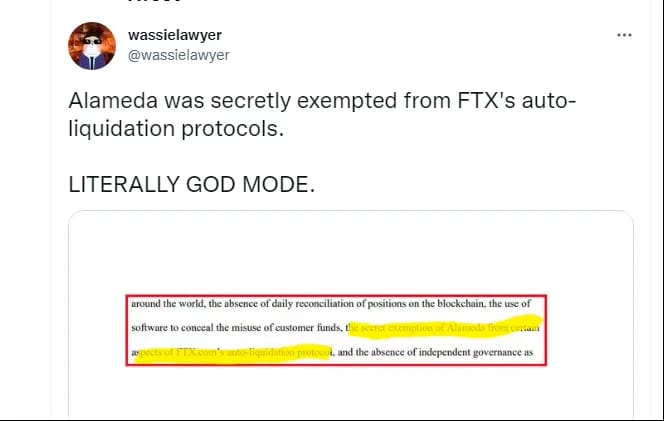

3) 🚩 'God Mode': SBF’s Alameda Had 'Secret Exemptions' on FTX, New CEO Alleges - Bankman-Fried’s FTX crypto exchange and Alameda Research trading firm were deeply intertwined, as the world has increasingly discovered since the firms filed for bankruptcy protection last week. Now FTX’s new CEO, John J. Ray III, has alleged that Alameda had secret benefits on the FTX exchange that other traders didn’t. Mr. Ray previously oversaw Enron’s bankruptcy proceedings, filed a court statement in support of the firm’s Chapter 11 filing—and it’s a scathing rebuke of the firm’s corporate controls and prior approach to doing business.

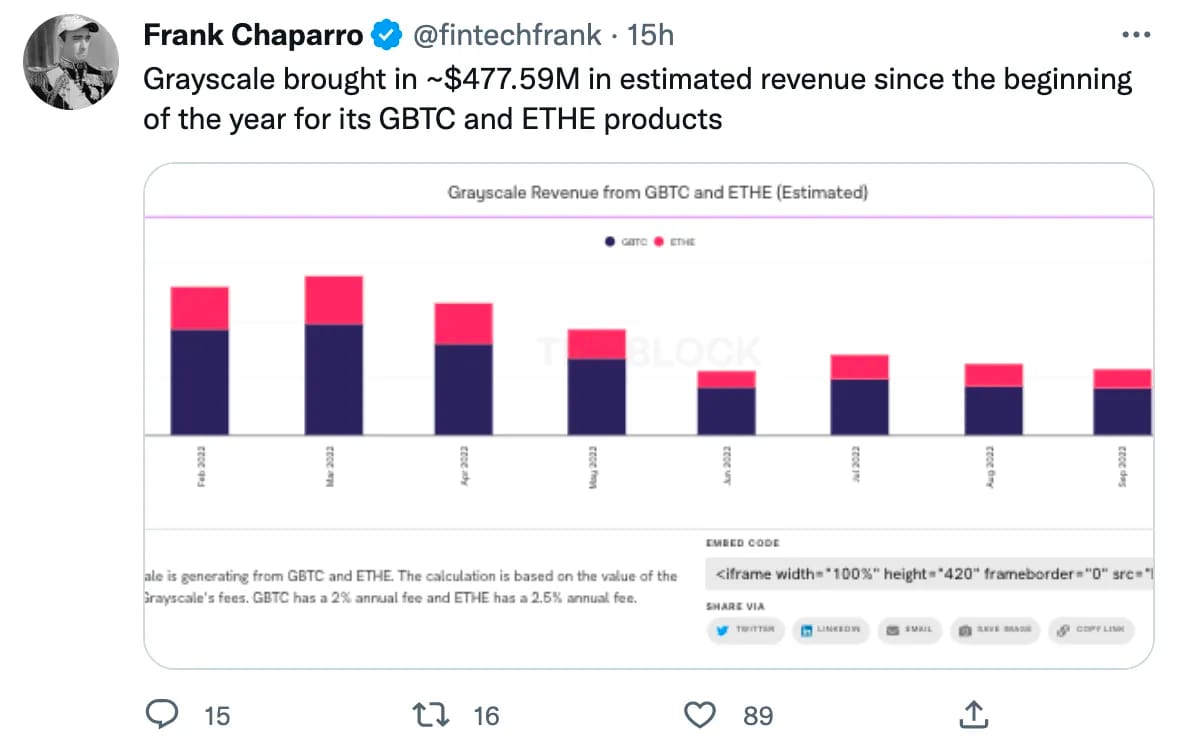

4) 💼 DCG Owned Grayscale Holds 635K BTC as Coinbase Custody Reveals Holdings - Following recent uncertainty regarding the future of the Grayscale Bitcoin Trust, its custodian partner Coinbase released a report detailing the assets held on behalf of Grayscale Bitcoin Trust. The letter revealed that holdings are segregated from other funds. However, no on-chain addresses were published in the document. Grayscale has brought in over $477M in revenue in 2022 YTD from it’s Bitcon and Ether trusts.

5)😥 Court Sets Jan. 3 Deadline for Celsius Customers to File Claims in Bankruptcy Case - The deadline for Celsius customers to file a claim in the company’s bankruptcy case is Jan. 3, 2023. The bankruptcy court handling Celsius’s case set Jan. 3 as the bar date, the last day creditors can file a proof of claim against the failed crypto lender. After that date, creditors who have not filed a claim may not be eligible for distributions from the case.

6) 🤔 Binance Temporarily Suspends Deposits of USDC, USDT on Solana- Binance has announced that it temporarily suspended deposits of the stablecoins USDC and USDT on the Solana blockchain “until further notice.” USDT and USDC, created and managed by the companies Tether and Circle, are stablecoins pegged to the U.S. dollar, which exist on a wide variety of blockchains, including Solana and Ethereum.

7) 💵 Cardano-Based Stablecoin USDA Will Hit the Market in Early 2023 - Emurgo, the official commercial arm and a founding entity of the Cardano blockchain, plans to launch USDA, a U.S.-pegged stablecoin, in early 2023 per the firm. USDA will be the “first fully fiat-backed, regulatory-compliant stablecoin in the Cardano ecosystem.”

8) ⚖️ Bahamas Securities Regulator Says It Ordered FTX Crypto Transferred to Government Wallets- The Securities Commission of the Bahamas announced Thursday that it ordered the contents of FTX's crypto wallets to be transferred to government-controlled wallets on the previous Saturday.

9) 🐦 FalconX Resumes Use of Silvergate Bank - FalconX resumed using the Silvergate Exchange Network (SEN) this week, after it stopped using it last week, citing “an abundance of caution.” Silvergate’s shares have fallen ever since it disclosed exposure to FTX in the form of deposits. Silvergate’s CEO Alan Lane clarified that the company had “no outstanding loans to, nor investments, in FTX, and FTX is not a custodian for Silvergate's bitcoin-collateralized SEN Leverage loans.”

10) 🎭 Two Estonian Citizens Charged With Running a Series of Crypto Scams Totaling $575M- Federal prosecutors in Washington state have charged two Estonian citizens with running a series of crypto scams that allegedly defrauded hundreds of thousands of investors around the world of a combined $575 million. According to the indictment released Monday, Sergei Potapenko and Ivan Turogin – 37-year-old residents of Tallinn, Estonia – were partners in a series of interconnected fraudulent schemes.

💬 Tweet of the Week - Michael Lewis FTX Book and Feature Film Coming Soon to Apple TV?

Source: Deadline

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Ethereum Number of Addresses Holding 100+ ETH Hits a 20 Month High

Source: @CryptoGucci

2. Trade Volume Cooled Off Significantly Last Week After One of the Busiest Weeks Ever During the FTX Collapse

Source: @KaikoData

3. Avalanche Surges to New High in Boost for ‘Subnet’ Strategy, DFK Chain Subnet Drives 51% Jump in Transactions Processed in September

Source: @TheDefiant

4. Gearbox, Allows Users to Deploy Leveraged Positions Across DeFi Protocols and Enable Boosted APYs in a Composable Manner, Passes $100M TVL

Source: @OurNetwork

5. GBTC Discount to NAV Reaches -45%

Source: @DecentralParkCapital

6. Football Fan Tokens Crater As the FIFA World Cup 2022 Begins

Source: @DelphiDigital

7. Daily Volumes Falling to $15.3B but Could Be on Track to Make New Annual Lows As We See Further Market Inertia Post FTX

Source: @DecentralParkCapital

8. Despite the Recent Crisis, Confidence in Euler Has Hit a New High. Utilization Consistently Hits Between 80 – 100% Versus Aave’s ~40% or Compound’s 44%

Source: @OurNetwork

9. Weekly Commits in Free Fall for Solana Over the Last 12 Months

Source: @Mega_Fund

10. Optimism Transaction Volume Continues to Grow Reaching 300k Transactions per Day

Source: @GiulioRebuffo

🧵 Thread of the Week - FTX - Where Did The Money Go?

By: @LucasNuzzi

2/ First, let's get something straight:

The line between Alameda and FTX was immensely blurred from the very beginning.

Our analysis showed thousands of large transactions from FTX to Alameda, so user funds were likely siphoned over the course of many months.

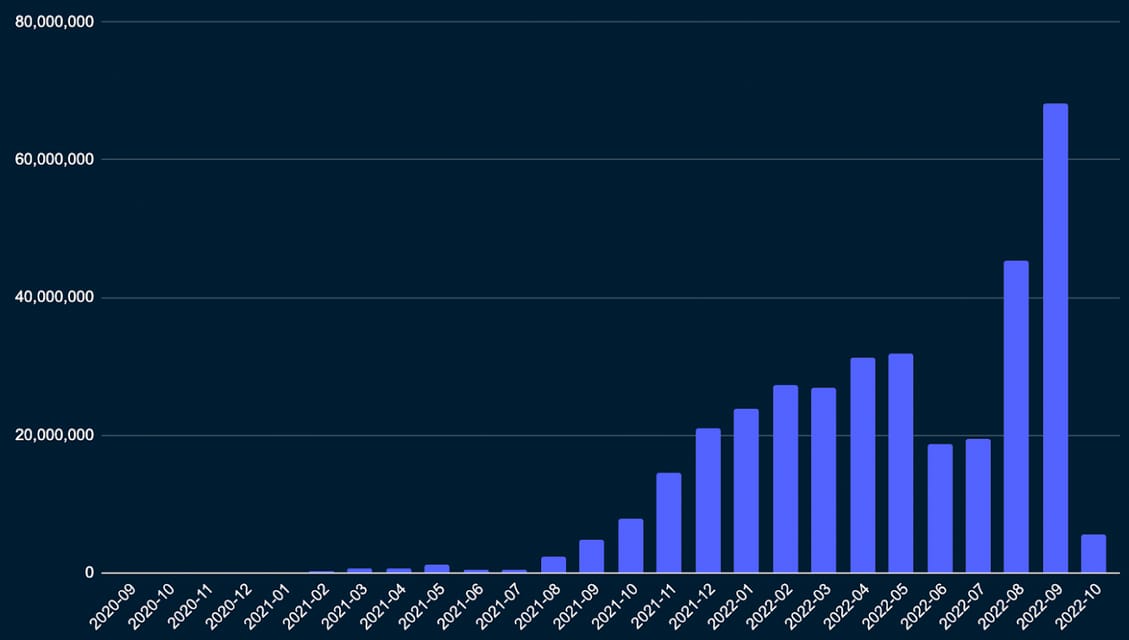

3/ The chart below shows the amount of ETH sent by Alameda in USD terms and the various applications they used.

It's truly astonishing: Alameda was involved in everything from DeFi borrowing and lending to cross-chain bridges across many different ecosystems.

4/ Their approach was similar w.r.t ERC 20 tokens, which were also frequently sent cross-chain via bridges

They sent a total of $9.5 billion to bridges alone(!!!). We're still investigating the extent to which they might have lost user funds as a result of bridge hacks.

5/ As you can see, the majority of the outflows happened in Q4 2021. Things noticeably cool down after that.

To us, this is a sign that they took a huge hit as markets contracted in Q4.

As mindblowing as this might be: it's possible by the time Terra happened, they were broke.

6/ So to recap where they might have lost considerable amounts of user funds by early 2022:

📉Directionally wrong trades, likely leveraged

📉DeFi lending markets, esp. stablecoin-denominated

📉Cross-chain bridges, either hacked or their native tokens becoming worthless

7/ At that point, the right thing to do would've been to come clean and return what was left of user funds.

However, as we now know, SBF is both narcissistic and delusional so instead they focused on 2 things:

1. Keeping the lights on and morale high

2. Pumping their FTT bag

8/ FTT became central to both Alameda and FTX's survival.

As long as FTT performed adequately, they could use it as collateral for loans and sell it in the open market.

So when the CoinDesk article revealed that FTT was FTX's largest position, they faced an existential threat.

9/ It's clear looking at FTT markets on Binance that a large investor was allocating a considerable amount of USDT into protecting key price levels. First at $23.5, then at $10.

Our hypothesis is that Alameda was propping up that market, potentially with FTX user funds.

10/ This evidence adds a whole new dimension to the question of "where did user funds go?"

It's possible that funds were also used to prop up FTT's price starting in early 2022 when it outperformed several other similar tokens.

11/ For better or worse, the FTX bubble was popped on Binance's FTT-USDT market, potentially by Binance.

Binance was where price discovery was happening as FTT collapsed. This sharp increase in sell order volume on Nov 7 had something to do with it.

12/ Binance is a key player in this because, as I speculated previously, they might have seen this coming via similar on-chain analysis or by sensing Alameda's desperation.

Regardless, they positioned themselves favorably and walked out with FTX's entire share of futures volume:

13/ One thing I've realized is that the FTX/Alameda story is also a story about arrogance. Up until the very end they thought they could trade their way out of this mess.

On Nov 10 we caught them borrowing 1,000,000 USDT on Aave at a 52.9% interest rate:

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

The collapse of FTX presents an opportunity for competitors in the market. Between other centralized exchanges and DeFi protocols, there’s no lack of trading volume looking for a new home. FTX was the third largest exchange in terms of perpetuals trading, doing an average of $9.5 billion of volume per day. This equated to about 10.1% of the market share for FTX.

As FTX volume collapsed over the past 10 days, the question becomes where does the activity flow? There are three main venues capital could have migrated to: exchanges, DeFi, and self-custody.

Where Have the Volumes Gone?

FTX demand that sought to continue active trading operations outside the failed exchange likely would migrate to a competing centralized exchange. While certainly there was a migration of activity, the overall market has taken a hit with a 43% decline in aggregate interest, falling from $22.1 billion on November 8 to $12.5 billion on November 14.

FTX was roughly 25% of the open interest before the collapse. Additionally, Binance, the largest venue, saw open interest drop 30% from nearly $10 billion to $7 billion.

In terms of volume market share, Binance emerged as the main beneficiary, capturing a 9.6% increase in market share. This equates to nearly the entirety of the market share previously owned by FTX. One can assume a significant amount of activity moved from FTX to Binance. The other noteworthy beneficiary was OKX, which rose 2.4% from the week prior.

Notably, DeFi failed to capture significant perpetuals trading in the aftermath of the FTX implosion and continues to hover around 3% of the total market. A limiting factor for DeFi’s ceiling remains expensive transactions and slow block times of decentralized derivatives. Scaling solutions are still in their infancy. Therefore, more time is needed to build out dedicated infrastructure. dYdX’s recent pivot to the Cosmos ecosystem and GMX still being very young showcase continued development in the space before decentralized alternatives become reliable enough to convince institutional capital to flow into protocols.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers The Last 30 Days

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 33,286 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.wemeta.world, www.amphibiancapital.com, and www.investdefy.com