Learn More at www.amphibiancapital.com, and www.digitalassetresearch.substack.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week Germany has been selling BTC obtained from a piracy website and still holds $1.5B in bitcoin from after a surge of sales and exchange transfers, sentencing dates for ex-FTX executives was set for October and November, Paxful's co-founder pled guilty to anti-money laundering charges, and big new venture rounds came in for Sentient ($853M) and CARV ($50M).

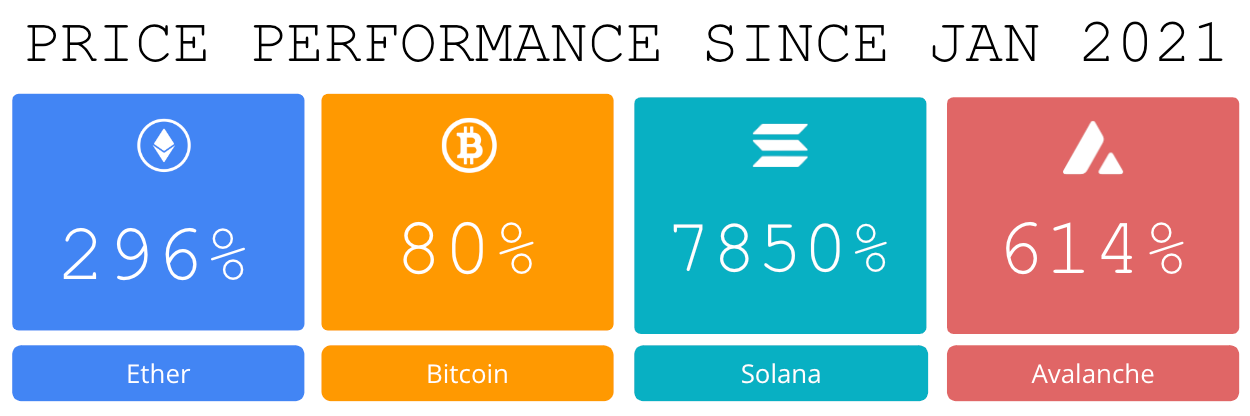

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

1995 Digital Asset Research pushes the boundaries of conventional investment wisdom, uncovering hidden market secrets to provide you with a truly unique and unmatched edge. Our emphasis on broader market cycles and in-depth analysis of on-chain crypto projects aims to help you achieve your investment goals. With our actionable insights, market research, and Web 3 tech tutorials, we empower you in the crypto universe, awakening you to the immense power of digital assets.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🏦 Germany Selling Suppresses BTC Market, Still Holds $1.3B in Bitcoin: Germany has ramped up its bitcoin transfers to exchanges this week, suppressing prices temporarily — but the worst could soon be over. The bitcoin was seized earlier this year from the operator of Movie2k, the defunct piracy portal that shut down in 2013.

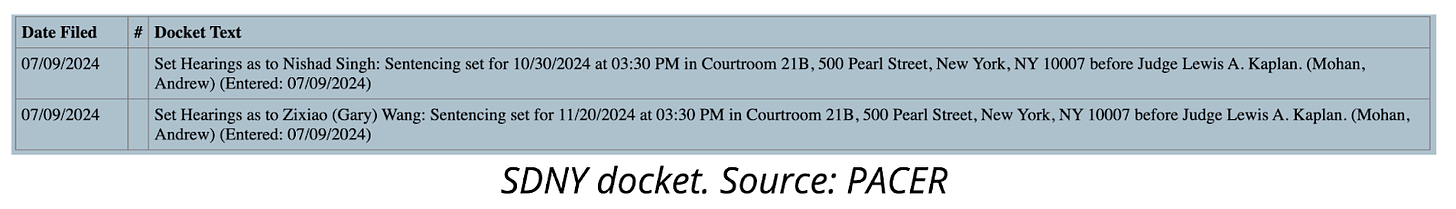

⚖️ Sentencing for Ex-FTX Execs Set for October, November: Former FTX executives Nishad Singh and Gary Wang, who both testified at Sam Bankman-Fried’s criminal trial, are scheduled to be sentenced later this year.

⚖️ Paxful's Co-Founder Pleads Guilty to Anti-Money Laundering Charges: Artur Schaback, the co-founder and former Chief Technology Officer of Paxful, is the latest crypto executive to plead guilty to federal crimes in the United States.

🎉 TON Blockchain Will Release New Layer-2 Based On Polygon’s Technology: The new protocol, called the TON Applications Chain (TAC), will make use of Polygon’s Chain Development Kit (CDK), as well as their AggLayer.

🚀 What Hamster Kombat Did: How Telegram Built a Web3 Gaming Juggernaut: With hundreds of millions of users, Telegram’s TON, aka The Open Network, is building a head of steam in simple, addictive, fun games built on a blockchain.

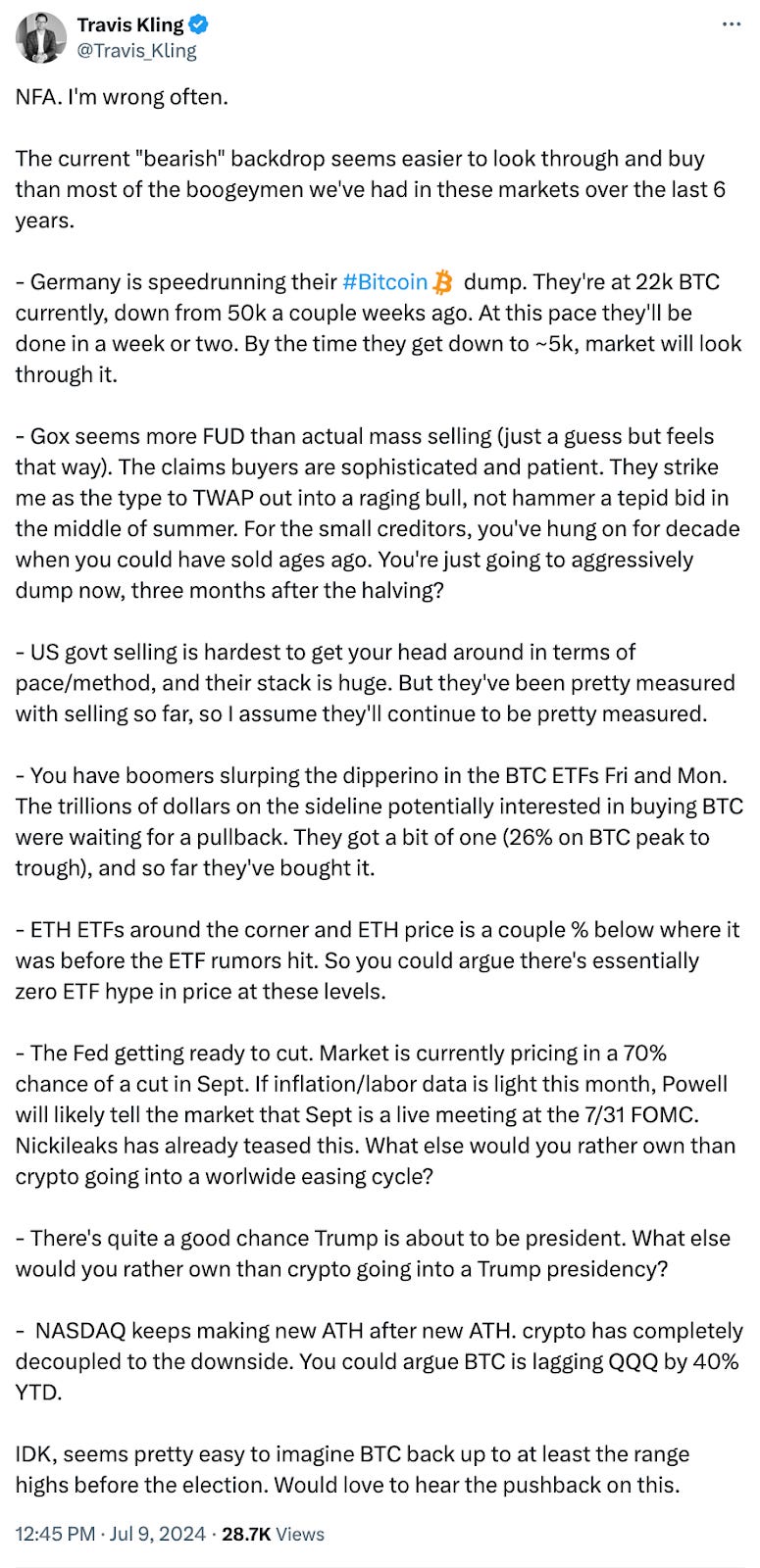

💬 Tweet of the Week

Source: @Travis_Kling

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

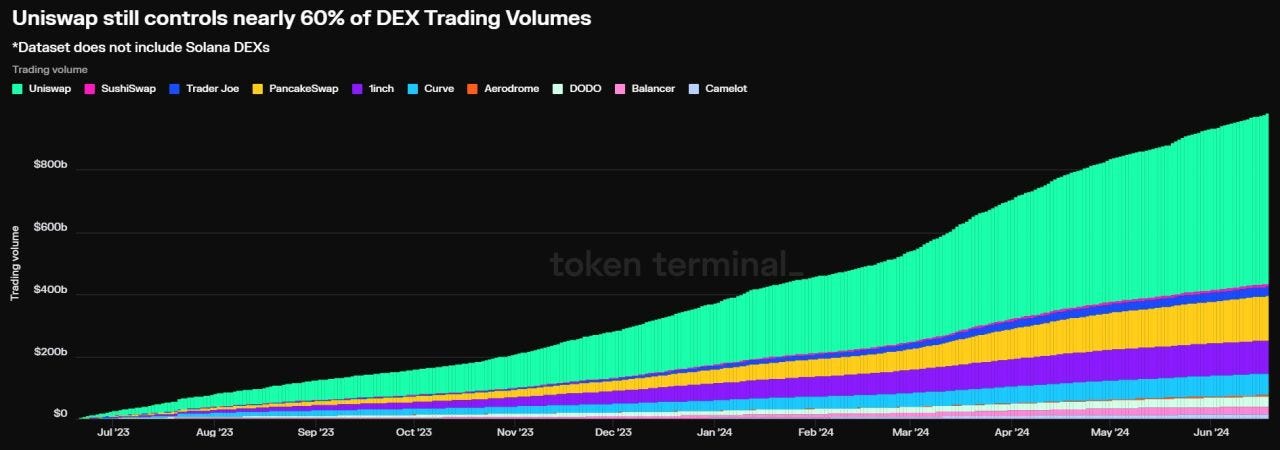

1. Uniswap still controls nearly 60% of DEX trading volumes and it tells an interesting story about network effects as it pertains to open-source software.

Source: @MichaelNadeau

2. Galaxy Digital published an excellent report on expected ETH ETF inflows and outlined the different dynamics surrounding ETH supply. TLDR reasonable to expect 33% the inflows seen in BTC ETFs implying monthly flows >$1B.

Source: @Crypto_McKenna

3. Crypto VC investment rose back over $3 billion in Q2.

Source: @WClementeIII

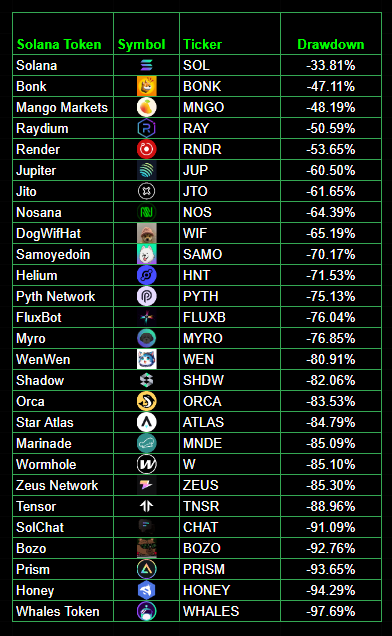

4. Solana token drawdowns since their 2024 highs.

Source: @gnarleysol

5. DeFi had a strong H1, with DEXs, staking derivatives, and lending all up ~100% year to date in key usage metrics.

Source: @OurNetwork

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Introduction

This week, I want to focus exclusively on Bitcoin, as I believe we are approaching a pivotal moment. Here's a detailed breakdown of the current market conditions and what to expect in the near future.

Historical Patterns and Current Indicators

This morning, I mentioned on X that we're observing a unique four-week pattern. Historically, in a crypto bull market, we've never seen four consecutive down weeks without the fifth week turning green and signaling a reversal. This historical trend is working in our favor right now.

Moreover, we have other supporting indicators from a timing perspective. We've seen 48 to 49 days of decline in Bitcoin prices, similar to previous symmetrical moves that also lasted around 48 to 49 days, with declines of approximately 23-24%. These patterns suggest that a reversal is imminent.

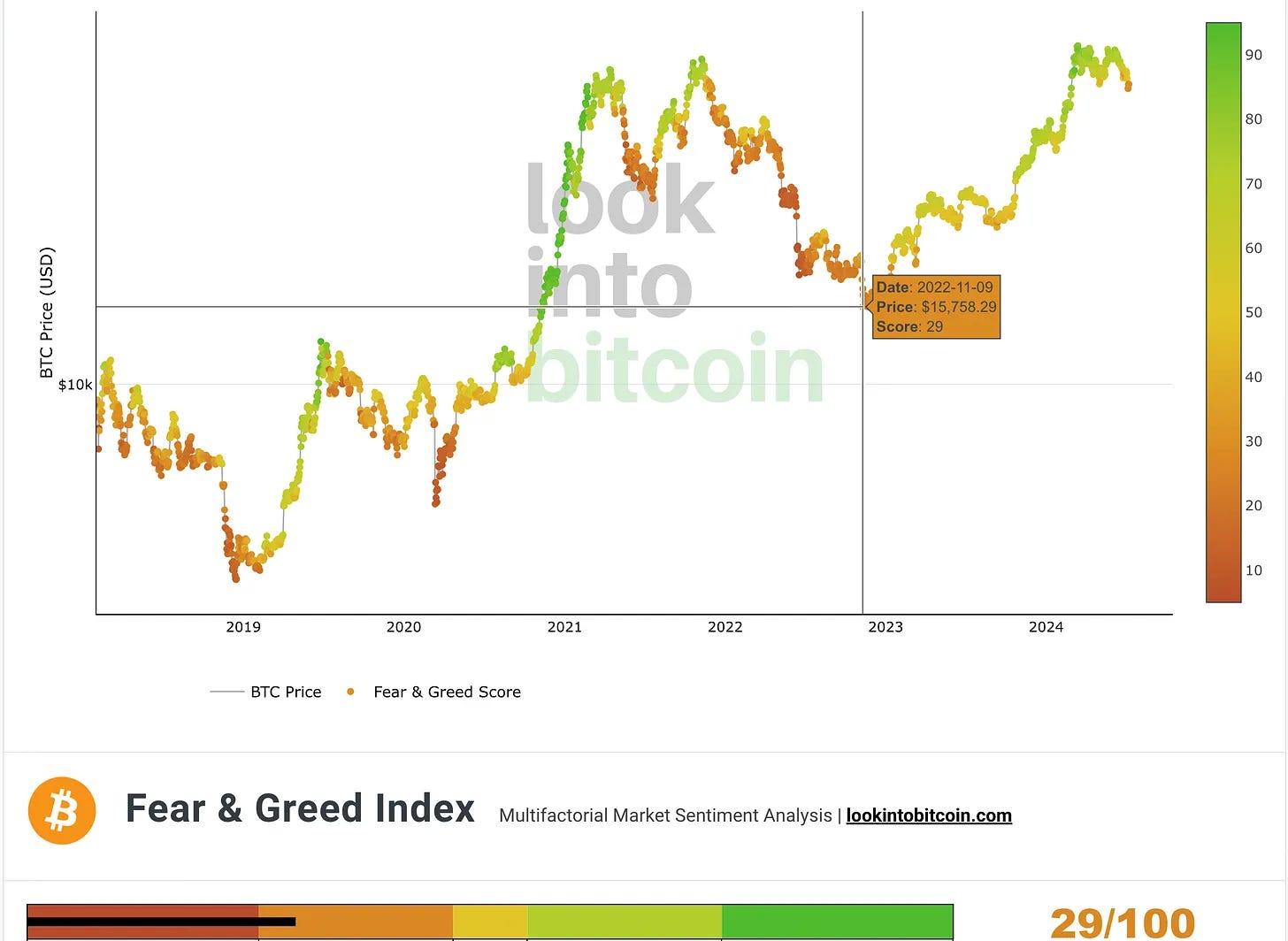

Fear and Greed Index

Bitcoin's Fear and Greed Index is currently at 29, indicating significant fear in the market. The last time we saw this level was during the market lows, which often signal a buying opportunity. This level of fear, combined with our timing and price indicators, suggests that we are at or near a significant low.

Weekly Chart and RSI Analysis

However, there's a concerning pattern that we need to discuss. We've been observing a three-wave down pattern on the weekly chart, which typically indicates further declines. The recent lower close adds to this concern, but our four-week pattern gives us promise for a green week and a reversal.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com, and www.digitalassetresearch.substack.com