Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors. Below we cover the impact from Three Arrow Capital’s bankruptcy on CeFi providers Blockchain.com, Voyager, Celsius, and Genesis, share an excerpt from Pantera on just how well DeFi lending protocols have performed during this crisis, and summarize the new Lummis-Gillbrand crypto bill. Let’s jump in…

Below In This Week’s Issue:

This Week in Crypto - The Great Shakeout

🗞️ Top Weekly Crypto News - Blockchain.com’s $270M Hit, 3AC Founders Surface, Voyager Recovery Plan, Celsius Sued by KeyFi

💵 Weekly Fundraises - Gnosis Safe ($100M), Hidden Road ($50M), Meta World ($30M), Thalex ($7.5M)

📊 Key Stats - Lido Staking, Solana Active Wallets Up, BNB Token

🧵 Thread of The Week - Lummis Gillibrand Bill Summary - The Responsible Financial Innovation Act (RFIA)

📝 Featured Industry Post - Pantera: DeFi Worked Great - Aave, Maker, and Compound Win While CeFi Fails

🎧 Best Crypto Podcasts - Coinstack, Bankless, Delphi Media

📈 Top 10 Tokens of the Week

Coinstack Podcast Episodes

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

💬 Tweet of the Week

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is a Web3 social network and blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

💸 Blockchain.com Faces $270M Hit on Loans to Three Arrows Capital - Blockchain.com “remains liquid, solvent and our customers will not be impacted,” wrote CEO Peter Smith in a letter to shareholders.

⚖️ Three Arrows Liquidators Ask U.S. Court to Force Crypto Fund Founders to Cooperate, 3AC Responds - Creditors of Three Arrows Capital (3AC) have asked for and received approval from the U.S. bankruptcy court in Manhattan to force the cryptocurrency hedge fund's founders to participate in the liquidation proceedings. Creditors have been saying they can't be located and have not responded to requests for necessary information. After these articles came out, 3AC Founder Zhu Shu tweeted the below along with a letter from their law firm Advocatus Law LLP of Singapore. This was Zhu’s first tweet in nearly a month.

😢 Voyager Expecting Only a Partial Recovery for Crypto Holders - Following Voyager Digital filing for bankruptcy on Tuesday, the crypto lending firm said its recovery plan was aimed at preserving customer assets but may not be able to return full amounts to affected users. Users may receive a combination of Voyager tokens, cryptocurrencies, common shares in the newly reorganized company, and funds from any proceedings with 3AC. “The exact numbers will depend on what happens in the restructuring process and the recovery of 3AC assets,” said the lending firm.

Genesis Reveals Exposure to 3AC; Parent Company Digital Currency Group (DCG) Assumes Risk - Cryptocurrency lender and broker Genesis Trading said on Wednesday that it had exposure to recently bankrupt Three Arrows Capital (3AC). In a Twitter thread, CEO Michael Moro said, “DCG has assumed certain liabilities of Genesis related to this counterparty to ensure we have the capital to operate and scale our business for the long-term.”

🚫 Former Celsius Capital Manager KeyFi Sues Celsius - The suit argues that Celsius used customer deposits to engage in risky trading strategies while falsely claiming to be hedging against potential losses from market exposure. The suit appears to stem from a dispute between Celsius and KeyFi CEO Jason Stone regarding unpaid fees for managing capital and losses from impermanent loss while providing liquidity within decentralized exchanges.

✨ Polygon Scores Deal with Reddit for New NFT Marketplace - On July 7, Reddit, the popular social networking website, launched an NFT marketplace for online avatars that is powered by the Polygon PoS Chain, Polygon’s commit chain and flagship Ethereum scaling solution.

💰 Aave Proposes Decentralized, Yield-Generating Stablecoin GHO - The U.S. dollar-pegged algorithmic stablecoin will be minted by users and generate interest yields. The fully collateralized stablecoin will be native to the Aave ecosystem and available on the Ethereum network initially. Our take: It’s important to differentiate between fully or overly collateralized algo stables like DAI and the proposed GHO vs. undercollateralized algo stables like Terra’s UST which depegged and crashed in May 2022

🗞️ Shanghai Hopes to Cultivate $52B Metaverse Industry by 2025- Shanghai wants to create more than 100 companies in a plan that focuses on virtual reality and increased connectivity.

🎉 GameStop’s NFT Marketplace Goes Live - Video-game retailer GameStop's NFT marketplace is live after being in the works since last year. GameStope earlier had announced a partnership with ImmutableX for up to an $100 million fund for grants to creators of NFT content and technology.

☀️ DTI Says no Basis to Ban Binance in Philippines - The Philippines’ Department of Trade and Industry (DTI) said it cannot ban Binance for cryptocurrency-related sales and promotion as there are no clear regulations issued by the Banko Sentral Pilipinas (BSP), the nation’s central bank. Share Coinstack

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Over 90% of ETH Is Currently Being Staked on Lido

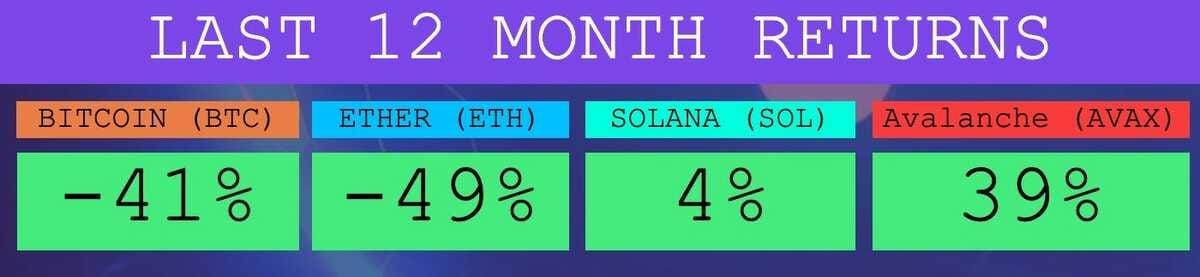

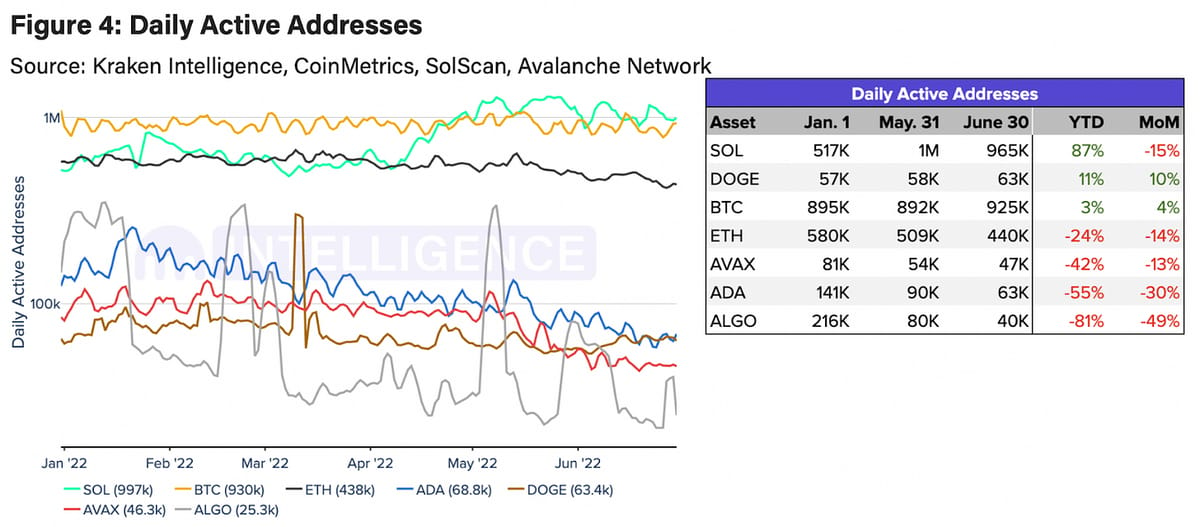

2. Solana Shows an 87% Growth YTD in Daily Active Wallet Addresses

3. Binance BTC Volume Breaks All-Time Highs After Fee Elimination

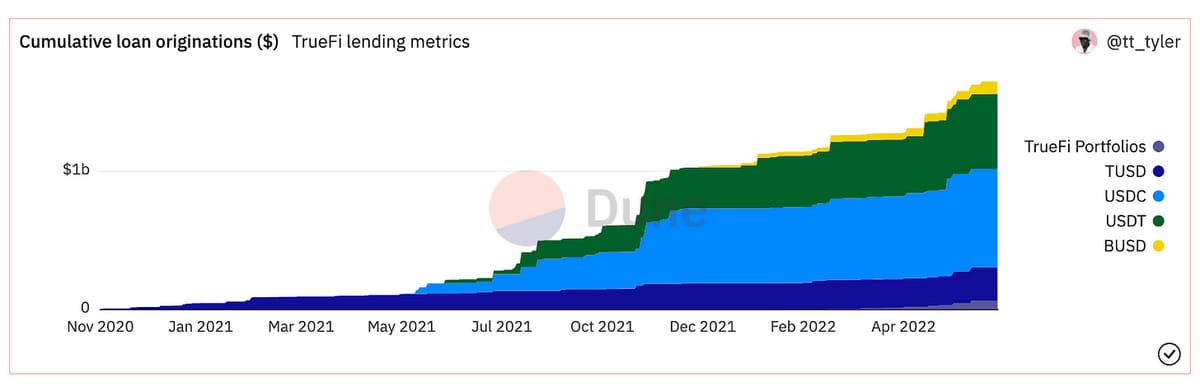

4. TrueFi Passes $1.6B in Loans, Serving 5+ Verticals

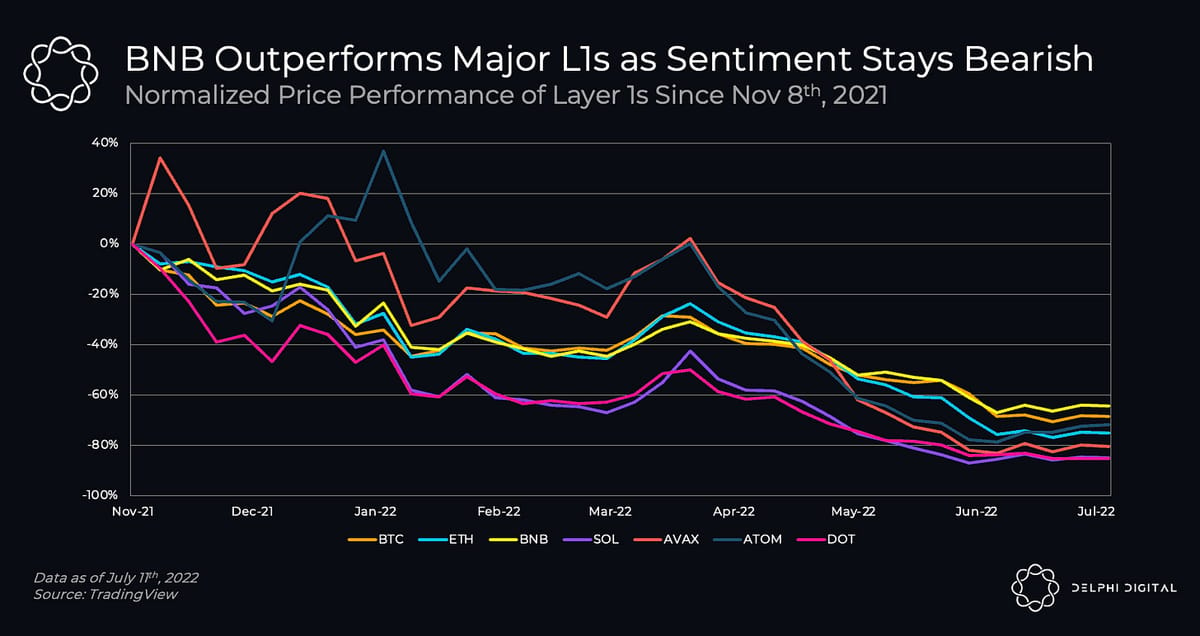

5. BNB Has Outperformed BTC, ETH, and All Other Major Layer-1 Protocols Since Nov 1 In Terms of Price Performance

🧵 Thread of the Week - The Lummis Gillibrand Crypto Bill Summary

By @Crypto8Fi

1/ In this thread we will cover the: - Lummis Gillibrand Bill - Web3 Frameworks - Chris Dixon's Policy Discussion - NFT Law Let's dive in ⬇️

2/ Regulation in Crypto You need to understand that too much regulation hinders innovation. But uncertain regulation is equally as bad. Businesses won't dedicate time, effort and capital into crypto - only for their actions to be declared illegal.

3/ The Problem The U.S. financial markets are regulated by independent agencies whose jurisdiction overlaps. This creates confusion and chaos. Imagine how difficult it must be to enforce laws. The SEC and the CFTC are the two important ones mentioned in the bill. Here's why:4/ The SEC They benchmark protocols with "The Howey Test". The Howey Test determines what qualifies as an "investment contract" and would therefore be subject to U.S. securities laws. A security being loosely defined as a tradable financial asset. Examples are stocks and bonds.5/ Responsible Financial Innovation Act The Lummis-Gillibrand bill effectively divides the digital asset world into three: - Commodities - Securities - Ancillary assets (crypto tokens with no revenue) So is the bill actually good for crypto? Yes, here's why:6/ The CFTC Under Section 301 of the bill, issuers of ancillary assets would be required to make certain disclosures to the SEC. By complying, digital asset issues will be "commodities". So most of crypto will be regulated by the CFTC But the SEC has jurisdiction on securities.

7/ Projects that want to tap into the U.S. market will make disclosure about: - Their businesses - Financial condition - Plan for protecting consumers in the event of bankruptcy. This will reward those with genuine economic utility and honest intentions.8/ The bill also allows for innovation. It enable states to establish “financial regulatory sandboxes” within which crypto projects could work, for a maximum of two years, without risk of being shut down by regulators. Although 2 years may still be too short. It's still a start.9/ In a recent AMA, @cdixon , @JakeAuch & @milesjennings shared their thoughts on Web 3 and the bill: Web 3 is a movement set to unlock immense innovation. Communities can operate on these networks that have been created by blockchain enabled tokens. There are many use cases:10/ Some are digital, some are offline. Like allowing for creative people like musicians & writers to earn - which is pretty exciting. Also, removing the need for large intermediaries like Google & Facebook who take the profits. Web 3 will unlock lots of new business models.

11/ Enforcement Policy It hasn't worked well so far. Smart government policy balances innovation and ability to allow start ups to prosper as well as protection for consumers, investors and others. @JakeAuch had this to say:

12/ Currently there are no real sides being taken - they are "pre partisan" . That's why it's an opportunity to do real policy work, within the U.S. government. These are the 3 principles to focus on:

13/ 1/ Strengthening the role of the US dollar Contrary to the declining dollar myth, the demand for US denominated stables has grown significantly. People want to store wealth in a digital dollar USD. Stablecoins could expand the USD - Congress should look further into this.

14/ 2/ Innovation Entrepreneurs are moving to crypto friendly countries The U.S. is paradoxically targeting good actors rather than those engaged in bad activity. The U.S wants the brightest innovation to occur domestically. So it makes sense for clearer regulation policies:

15/ 3/ Not taking sides Congress is not meant to have a market opinion. They are referees ensuring: - Fair play - Consumer protection - Market integrity - Contract enforcement Politicians shouldn't be manifesting their own version of what an industry should be:

16/ There are 6 areas where the Lummis-Gillibrand bill becomes useful if it was to pass Congress:

17/ 1/ Terminology Clarity Terms are getting thrown around. We're seeing this with the SEC enforcement in the courts now and elsewhere, that don't really have strong grounded definitions. This bill defines them. Everything from digital assets to distributed ledger technology.

18/ 2/ SEC vs CTFC The CFTC will have more authority to regulate and legislate crypto. Most digital assets are commodities unless proved otherwise. The task is for the CFTC and SEC to co-operate and form a self regulatory organisation for the industry.

19/ 3/ Stablecoin Policies The bill strikes a medium between banks as stablecoin issuers and anyone, in general. Banks and non banks can both issue stables. Non banks have to work through federal regulators and liquidity requirements. Algo-stablecoins are outlawed in the bill.

20/ Some stablecoins like USDT have been here for a while. But, it's a relatively new industry and we need more experimentation. It may be better to provide a hierarchy of stability of stablecoins, that's both accessible and digestable by consumers.

21/ 4/ Tax Clarity The bill cleans up tax issues. If you're using crypto as a medium of exchange and you're exposed to negligible appreciation. You don't have to pay taxes on this. It's marks the start of greater tax clarity in the crypto industry.

22/ 5/ State Expectations It provides more clarity and disclosure for states and consumers: For state governments - about how they're allowed to regulate crypto. And for consumers - about what they should expect when they're engaging with crypto issuers or stablecoin issuers.

23/ 6/ DAO's It makes an initial step towards establishing some legal frameworks for DAO's in the context of the federal tax law. Initial steps are the foundation we need in this market. DAO's are still trending. Better legislation means we could see more people flock to the U.S.

24/ What is missing from the bill? We need greater disclosure on insurance and rated markets. And we need NFT legislation. They will both pose a regulatory problem in the near future:

25/ Some NFT's could be regarded as securities - according to The Howey Test. Because an NFT can do a lot more than a physical piece of art. You can imbue it with external value. We need a framework that aligns the incentive to protect consumers from scams but still deliver value.

26/ Perhaps some good ways to do this would be to integrate better with policy makers. NFT influencers working to provide a high level education to Congress. An idea for short term regulation could be SRO's:

27/ SRO's (Self regulatory organisation) Bring some frameworks to legislate. Let the community take initiatives on the financial services side of SRO’s. Create your own apparatus to police bad actors. SRO's can be beneficial and act as a good buffer for industry regulators.

28/ If you want, watch the full recording of @cdixon Twitter space, (which I highly recommend).

📝 Highlights from the Top Crypto Reports - DeFi Worked Great

About the Author: Pantera is an institutional investor with full exposure to the crypto space, ranging from illiquid venture capital assets (including early-stage tokens and multi-stage venture capital equity) to more liquid assets like bitcoin and other cryptocurrencies. The below is an excerpt from their great blog article on DeFi vs. CeFi. The full version of this article is here.

Introduction:

“Cryptocurrencies keep nosediving . . . The chaos has spread to DeFi: Celsius, a crypto lender with assets of around $20 billion, was recently forced to freeze deposit withdrawals. Last week, crypto exchange FTX said it was bailing out one of Celsius’ troubled rivals, BlockFi, with a $250 million loan, not long after rescuing crypto broker Voyager Digital.”

— Jon Sindreu, Wall Street Journal, June 30, 2022

The whole article is a screed gleefully ruing the alleged failure of DeFi.

There’s a huge misconception that DeFi – Decentralized Finance – failed. It didn’t – it worked great!

Unfortunately the author – and all the skeptics who are promoting this narrative – have it totally backward. DeFi’s flawless performance over the past months will be seen as a pivotal moment. DeFi is a very important movement.

It’s CENTRALIZED finance that failed.

All five of the companies that the reporter listed on are CENTRALIZED. They are just old-fashioned venture-backed start-up companies. They are not DeFi or on the blockchain at all. Just some start-up banking entities that got overleveraged. Very old school failure actually. Nothing new or novel about them.

DECENTRALIZED finance protocols – like Aave, Compound, Uniswap, MakerDAO – all functioned flawlessly 24×7. This crisis proves the opposite of the common narrative. It proves DeFi works great. Way better than centralized finance firms like Celsius, BlockFi, Lehman Brothers, et al.

First, I really try to avoid having to read journalists who reference tulips. I can’t recall ever reading anything intelligent in an article with that four-hundred-year-old trope. However, my desire to support blockchain is so strong that I dutifully muscled through the whole thing.

Let’s break down the common misunderstandings contained in the article:

#1. “Remember how the banking system self-destructs every few decades? Now imagine if banks only lent money to finance other banks, and you may get a notion of the house of cards that is ‘decentralized finance,’ or DeFi.”

You don’t need to remember. It did again. Celsius, BlockFi, Voyager Digital are all banking entities. They are not decentralized in any way.

Those start-ups are just banks that took in short-term deposits and lent long to each other and others. They were 20-to-1 leveraged business models run by mortal humans.

DeFi, on the other hand, is not an empty house of cards. Its foundations are rock solid and totally transparent. DeFi removes human subjectivity in financing decisions. Parties agreeing to conduct transactions openly and transparently on the blockchain, as opposed to backroom deals by opaque, human, potentially-conflicted financial actors, is the vision we should be striving for, rather than clinging on to inefficient centralized financial systems.

The author holds a misguided view of yield in blockchain. He ignores that DeFi is the financial backbone for the entire blockchain ecosystem that is used to power all manner of transactions – retail, institutional, and even the type of green loans that he claims does not exist on the blockchain. Staking yield to ensure blockchain security and incentivization of liquidity to prevent slippage are merely some of the ways yield is generated in crypto today.

#2. “To the glee of its critics, DeFi has ended up committing all the same sins as Wall Street, essentially becoming a vehicle for a new generation to engage in the rampant speculation typical of pre-2008 investment bankers.”

Oh, so sins in banking supposedly stopped in 2008? Hmmmm…I’m not sure the record supports that. Banks have paid an astounding $321 billion in fines since their supposed redemption at the hands of us taxpayers in 2009.

I remember one anti-bitcoin nut wrote an article “Bitcoin Is Evil”. I don’t get that. It’s a piece of open source code anybody can use. It certainly has not ever done evil to anyone. Banks, on the other hand, have been convicted of $321 billion worth of evil deeds. (And, that’s only the ones they were caught at.)

To put that number in context: the United Nations food-assistance branch, the World Food Programme, estimates “$6.6 billion would help stave off starvation for 42 million people across 43 countries.”

Banks spent fifty times the amount that would solve world hunger on fines. Maybe the article should have been “Banks Are Evil”.

As further perspective, the banks’ fines are equivalent to the combined GDP of 84 nations. If banks had not sinned they could have given all 363 million citizens of those 84 nations an entire year’s wages.

DeFi has never “sinned”. The rules of engagement are coded into the smart contract. You do not need to trust a counterparty who may be incentivized to twist the truth, nor rely on trust to engage in financial transactions. The code just executes what both parties agreed to.

#3. “Crypto lenders’ exclusive focus on other crypto projects suggests their problems run much deeper than a Lehman-style liquidity crisis.”

Nah…Celsius, BlockFi, Voyager were just like Lehman Brothers.

#4. “Digital currencies like bitcoin are too inconvenient to live up to their promise of ending the concentration of money in a relatively small number of banks, asset managers and governments.”

Why does a reporter – and here I love borrowing a classic Marc Andreessen line – “who can’t chin 12,000 followers” get to pronounce 300 million people wrong? 300 million people see the promise of blockchain. Not my problem if a reactionary who completely misunderstands the basics can’t see it.

I’m a true sportsman though. I made a serious effort to help this young whippersnapper through his misunderstanding.

To quote from Cool Hand Luke (starring Paul Newman, 1967), “Some men, you just can’t reach.”

This is an excerpt from the full article, which you can find here.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 26,980 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.