All things Bitcoin, Ethereum, DeFi, Blockchain, Web 3.0, and the future of money.With daily analysis of the macro trends and technological innovation.Published weekdays on Substack and Telegram to 191 subscribers

Chart of the Day

We are on track to soon pass $25 Billion locked in De-Fi tokens for the first time in human history, almost all running on top of Ethereum (ERC-20) tokens.

Daily News Summary

Published by Ryan Weeks on The Block Crypto on January 18, 2021

Ruffer Investment Company, the British fund manager which recently revealed it had bet £550m on bitcoin, has published more details about the headline-grabbing move.

“We think we are relatively early to this, at the foothills of a long trend of institutional adoption and financialisation of bitcoin,” the company added.

The Guernsey-based Ruffer disclosed its bitcoin exposure in a regulatory filing on December 15. At the time, the company told The Block that the exposure was worth around £550m, equivalent to roughly 2.7% of the firm’s assets under management.

Published by Ryan Foxley on Coindesk on January 19, 2021

The price of ether (ETH), the native cryptocurrency of the Ethereum blockchain network, soared to record levels earlier on Tuesday. Prices hit $1,439.33 around 12:00 UTC – that’s a little over the previous all-time high of $1,432.88 registered on CoinDesk’s price index on Jan. 13, 2018.

The digital asset rallied nearly 12% Tuesday to reach the new peak.

The Ethereum blockchain was co-founded and originally described by Russian-Canadian developer Vitalik Buterin, who remains the project’s most well-known personality.

Decentralized finance (DeFi) is widely regarded as the best Ethereum use case to date. DeFi markets enable permissionless and automated lending, trading and borrowing to anyone with an internet connection.

Daily Podcast Summary

Per a Goldman Sachs insider, the investment bank is preparing a bitcoin custody strategy. Their efforts are catalyzed by the recent rulings from the Office of the Comptroller of the Currency (OCC) allowing stablecoins and public blockchains to be used by U.S. banks.

Gary Gensler, a former MIT Professor who taught classes on Bitcoin and blockchain tech, is officially Biden’s pick for SEC chairman

Grayscale has best day ever with $700 million in investment into their Bitcoin Fund

After a three year wait, Ethereum reaches new all-time high at $1439

Anthony Sassano from the Set Protocol team goes through the 10 DeFI assets inside the DPI index (including AAVE, Synthetix, Uniswap, Yearn Finance, Compound, Maker, REN, Loopring, Kyber Network and Balancer).

Anthony gives takes on the DeFi tokens mentioned, as well as shares his mental models for how he judges various assets on Ethereum.

Also see Bankless’ episode from Tuesday by Lyn Alden on “The Death of Dollar Dominance.” It’s perhaps the most valuable 90 minutes you can spend to understand the link between social unrest in the USA on the left and right side of the political spectrum and the underlying cause -- real income declines for those who don’t own stocks and homes -- primarily coming from major currency debasement since 2008.

Daily Research Report Summary

Published by Ryan Watkins and Wilson Withiam of Messari on December 1, 2020

The Ethereum developer community is in the midst of a three year, multi-phase effort to move to ETH 2.0, on track to be complete around December 2022 including adding sharding and moving to a Proof-of-Stake (PoS) model.

ETH 2.0 is leading toward a much faster, more stable Ethereum that will have a predictable and more deflationary monetary policy. If implemented as expected, net issuance of new ether will go from around 4% per year to <0% per year due to the burning of transaction fees, likely leading to price appreciation and further institutional support within 2 years (see below chart).

With Ethereum being a “Turing-complete” blockchain technology, more sophisticated logic is possible with Ethereum than Bitcoin.

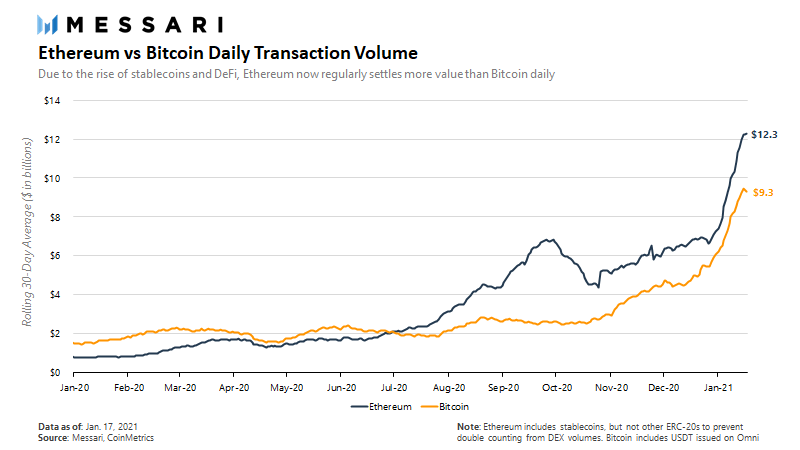

Ethereum already has more daily transaction volume than Bitcoin

The People We’re Following Closely

If You’re Just Getting Started, Start Here:

Michael Saylor - Bitcoin is Hope (Podcast)

The Coin Times: Tracking the most important blockchain stories of the 2020s including the creation of Web 3.0 and the creation of a new global monetary system that works for everyone. As always, published for informational purposes only. Not intended as financial advice. Please do your own research.

Comments and thoughts welcomed here and on our Telegram channel at t.me/thecointimes. Let us know in the comments what you’d like us to write about in upcoming issues.

Please subscribe and share with your friends and colleagues.