Welcome to CoinStack Newsletter #20. This issue explains why Ethereum is likely to substantially outperform Bitcoin in 2021 with EIP-1559 coming July 14, 2021 and the ETH 2.0 launch in December 2021.

In This Issue:

The Investment Case for Ethereum

Reason #1: 45% New Supply Reduction Starting July 2021

Reason #2: All Mining Revenues Go To Holders Starting in Dec 2021

Reason #3: Negative Net Issuance Starting in December 2021

Reason #4: Scaling to 100,000 TPS By End of December 2021

Reason #5: Ethereum Has Cash Flows and Bitcoin Doesn’t

Reason #6: Transaction Revenue Post Layer 2 Scaling Will Grow

So Who’s The King: Bitcoin Vs. Ethereum?

What About Ethereum’s Competitors?

Guest Article: Crypto Investing in South America By Andres Guzman of Chile

NFTs of the Week By Mrs. Bubble

A Long-Term Crypto Portfolio

Portfolio Update: Up 512% YTD 👀

Who I’m Following Closely on Twitter

Getting Started in Crypto

The Investment Case for Ethereum

by Ryan Allis

Since the start of 2021, Bitcoin has appreciated in value by 85% while Ethereum has increased by 263%.

Friends often ask me why is Ethereum growing much faster than Bitcoin right now?

Ethereum as a decentralized computing platform has a big advantage Bitcoin doesn’t: smart contracts and apps that power everything from DeFi to token creation to NFTs. Ethereum has 30 apps operating on top of it with more than $100 million in monthly volume. Bitcoin has 0.

Ethereum is also gaining big in 2021 due to these two big upgrades happening this year:

Supply Reduction in July 2021 due to the burning of transaction fees

ETH 2.0 Launching in December 2021 that will mean:

Mining Revenues Start Going to Holders

Negative Annual Issuance

Scaling from 15-30 to 100,000 TPS

Yes, that’s right: while Bitcoin doesn’t provide any cash flows to its holders, Ethereum will be providing 100% of its transaction revenues to its holders by the end of 2021.

That means Ethereum will have cash flows -- and with cash flows you can more easily value it as an asset using traditional financial methods.

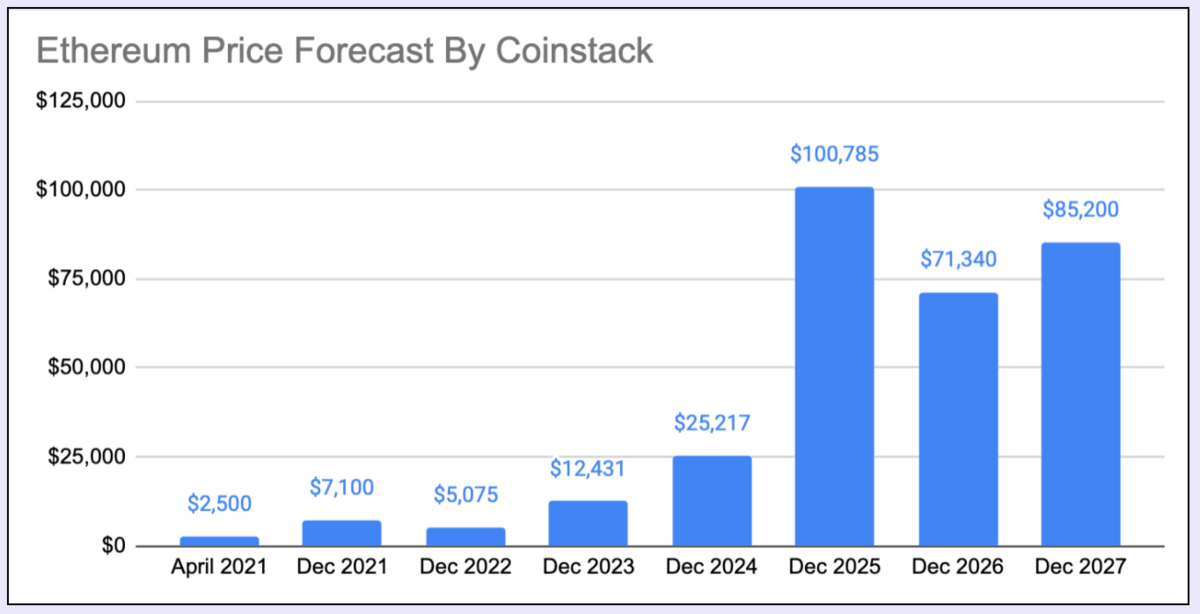

Based on all of these reasons, I expect that Ethereum will be going to $7,000+ by the end of 2021.

Let’s dig deeper and start by looking at what is happening to Ethereum in mid-July.

Reason #1: 45% New Supply Reduction in July 2021

On July 14, 2021 Ethereum will have a major upgrade to its protocol called EIP-1559 that will, for the first time ever, begin reducing the supply of Ether (ETH), the monetary asset that powers the Ethereum network.

Starting that day, every 13 minutes (every block) instead of transaction fees being paid out to Ethereum miners, the majority of transaction fees (60%-70%) will be used to buy back Ether and remove them from the total supply.

Once this goes live each day about 6,000 Ether will be destroyed daily through using daily transaction fees to buy back ETH supply.

This will have a major positive impact on price… as suddenly the equivalent of $15 million per day of ETH is bought back and destroyed automatically, every day.

The Math = $25M in daily transaction fees x 60% burned = $15M Extra Daily Buy Pressure

To put that figure into perspective, the entire Grayscale Ethereum Trust (one of the largest ETH buyers in the world) has purchased an average of 1,982 ETH per day so far in 2021.

So the daily buy pressure from EIP-1559 will be more than 3x the buy pressure from the largest ETH trust in the world.

And these ETH tokens, once bought, are burned and removed from the ETH supply forever -- never to create selling pressure ever again.

Let’s look at what the overall impact of EIP-1559 will be on total ETH issuance.

Yes, that’s right, in 75 days from now, the daily new supply of Ethereum is being cut by about 45%.

The Bull Case For Ethereum writes:

“The introduction of a fee-burning mechanism included in EIP-1559 will effectively destroy the majority of transaction fees. Fees must be paid with Ether, therefore destroying transaction fee revenue has an unavoidable effect over the supply of Ether. The more users Ethereum has, the more fees are paid, and the more ether is destroyed. If the amount of Ether destroyed is greater than the issuance rate, then ether irrefutably becomes a deflationary asset.”

Reason #2: All Mining Revenues Go To Holders Starting in December 2021

Starting in December 2021 when Ethereum 2.0 launches there won’t be any more miners. Instead, Ethereum will use a network of stakers (holders of the token who stake their tokens to provide validation of network transactions).

All the money that was previously paid out to miners will now be paid out to token holders. As a holder of Ethereum, you can very easily (it’s as easy as tapping one button on Coinbase for example) stake your coins and participate in the network validation and earn between 7.2% and 25% annually, paid out to you in additional ETH.

So on top of the transaction revenues flowing to holders in the form of token buybacks, staking rewards for Ethereum holders will be 1,100,000 Ethereum per year.

Ethereum researcher Justin Drake estimates that Ethereum stakers will be earning about 25% annually in the form of staking rewards.

And as Ryan Sean Adams and David Hoffman in the Bankless newsletter point out in their April 26, 2021 members-only Substack post The Case for Never Selling Ethereum that

“A 25% ETH APY will not last long… it’s too lucrative. Especially when you consider the decreased execution risk and a stronger narrative post-delivery of these ultra sound upgrades. New stakers will pile in fast. But the way the 25% APY gets arbitraged down is by net buying pressure on ETH. People who want exposure to this 25% APY need to buy more ETH. The 25% APY gets arb’ed down by new buying demand on ETH. In the long term, maybe we only have 5% ETH APY from staking, but ETH will likely be priced significantly higher as a result.”

Reason #3: Ethereum Will Have a Negative Annual Issuance Starting in December 2021

When ETH 2.0 goes live in December 2021, the annual issuance of Ethereum will be immediately dropping from 4,945,750 ETH (4.28%) down to 1,100,000 ETH (0.94%), making the annual issuance rate immediately lower than that of Bitcoin.

That’s annual issuance of Ethereum will be LOWER than the 1.82% annual issuance rate of Bitcoin by the end of this year.

Now that’s sound money.

HOWEVER… when you factor in that 60% of transaction fees will be burned further reducing supply, the actual annual issuance rate of Ethereum starting in 2022 will be around -0.92%.

Now that’s ultra sound money.

Yes, Ethereum will be a deflationary asset by around the end of this year.

Here’s another great excerpt from the article The Bull Case for Ethereum.

“Ethereum is founded on the same principles and mechanics of Bitcoin, but it has expanded them into a generic computing framework. It is similar to an operating system like Windows, but it is simultaneously running on thousands of computers around the world and it is practically impossible to shut down or disrupt. For this reason, Ethereum has been nick-named “the world’s computer” by Vitalik Buterin (Ethereum’s co-founder and thought leader).

What are the practical applications of Ethereum? For starters, it allows users to interact with any digital asset in the same way that Bitcoin operates bitcoins. Users can also create programs that are transparent and guaranteed to be executed according to the original source code.

This provides a foundation for vastly superior banking and financial systems that automate the intermediation that would normally be done by institutions. The framework provided by Ethereum has already been proven to work effectively as a more efficient substitute to remittance systems like Western Union, security exchanges like the New York Stock exchange, collateralized debt markets like mortgages and as a system to define and exchange digital/intellectual property like art. These are just a few of the use cases that Ethereum is capable of; the most important of all is “ultra-sound money” in the form of ether.”

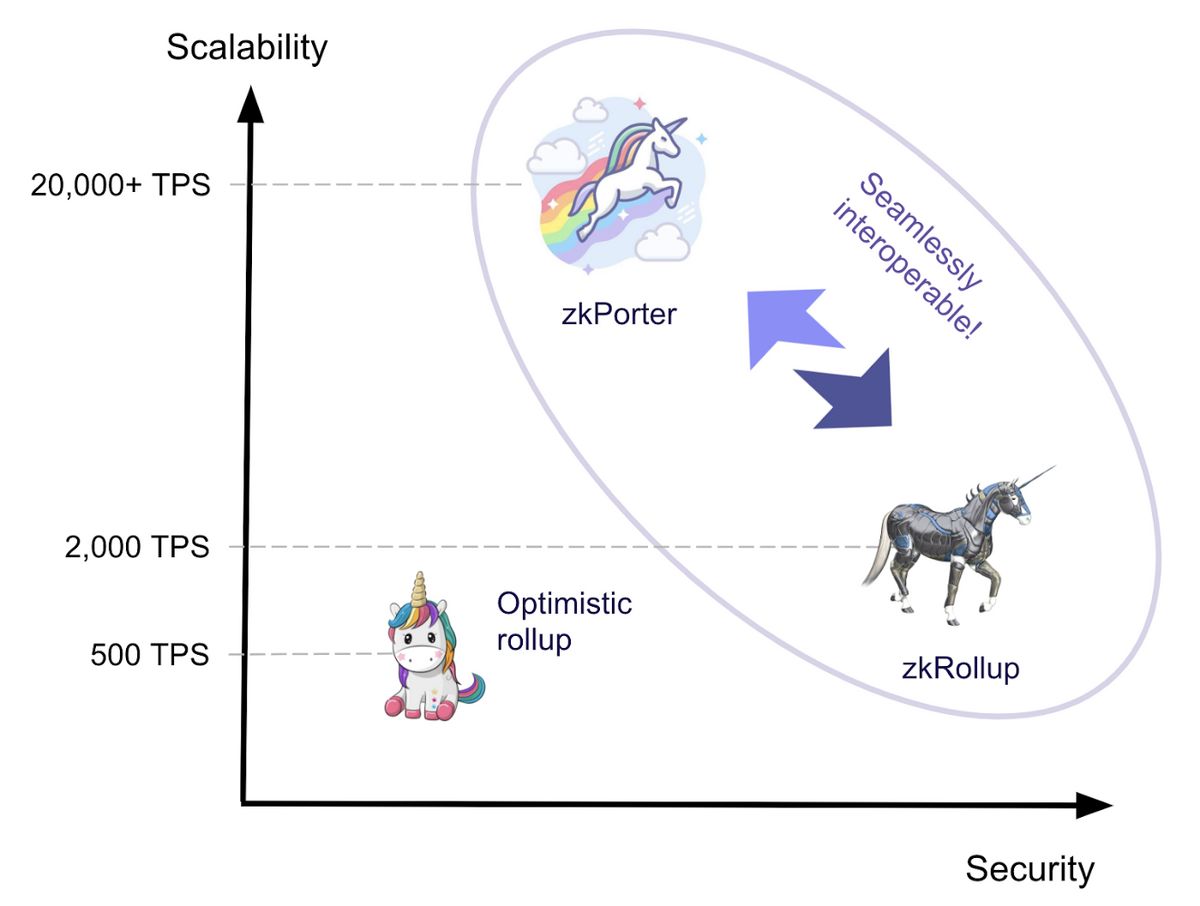

Reason #4: Scaling to 100,000 TPS By End of December 2021

Currently the Ethereum network can handle about 18-30 transactions per second (TPS)

By this summer using Optimism, the Ethereum network will be able to handle about 500-4,000 TPS.

And by December 2021 using ZKPorter the Ethereum network will be able to handle 100,000 TPS.

I haven’t even begun to try to model how many transactions will be happening on Ethereum’s Layer 2 networks when gas costs for most simple transactions are $0.10 instead of $50 by the end of this year.

Reason #5: Ethereum Has Cash Flows and Bitcoin Doesn’t

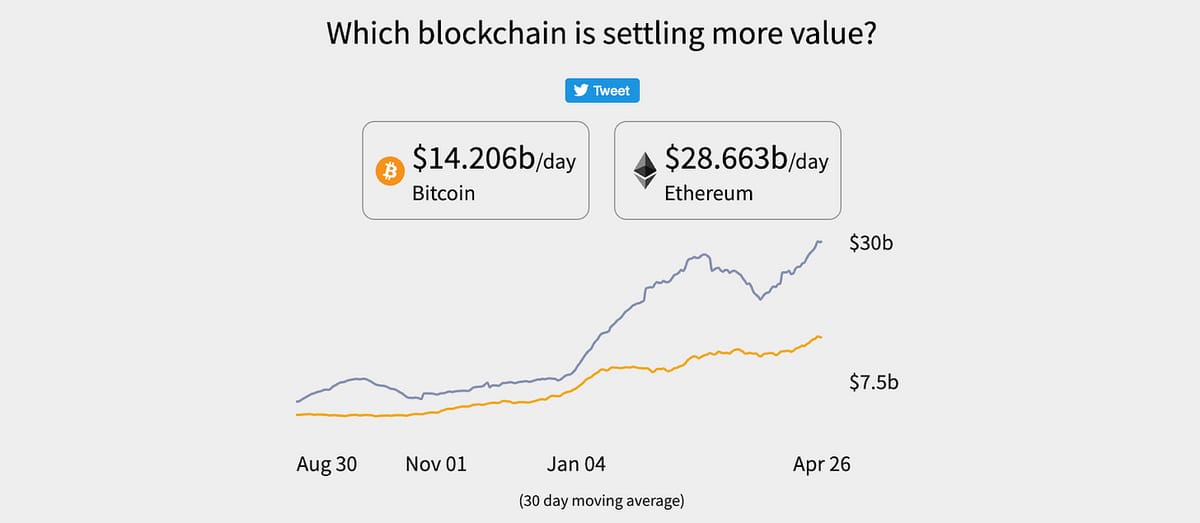

Ethereum is generating $7.7 billion in annualized revenues.

Bitcoin, in comparison, is only at $1.9 billion in annualized revenues.

Where does all that money go? Well today it goes to miners who secure and validate the networks.

However, by July 2021 60% of that Ethereum revenue will be given to holders in the form of token supply reductions.

And by December 2021 when ETH 2.0 goes live, there won’t be any more Ethereum miners…

That remaining 40% will be given to stakers (aka: long term holders who stake their coins to help provide transaction validation).

Yes that’s right. Cash flows from crypto.

While Bitcoin will NOT be providing cash flows to its holders, starting July 14, 2021 Ethereum will.

This is the fundamental point of this essay.

Bitcoin uses its revenues to pay miners. It pays out 100% of its revenues to miners and has 0% profits that go to holders.

Ethereum on the other hand will be using 100% of its revenues to reduce token supply and pay its holders staking rewards -- making 100% of its revenues by definition profits that flow through to holders.

By July 2021 60% of revenues will start being burned and used to reduce supply. Those revenues are equivalent to net income as they get paid out to holders in the form of a token buyback (just like a stock buyback). And starting in December 2021 with the launch of ETH 2.0, 100% of Ethereum revenues will be paid out to holders either indirectly via buybacks or directly via staking rewards.

So let’s look at what the intrinsic value of Ethereum will be in 2021-2023 if you value Ether on the basis of its cash flows to holders.

The above table shows us that based on the value of its cash flows alone (not to mention its utility within DeFi or apps) if we hit the above projections that represent a modest 4x growth over where are now, Ethereum should be worth about $34,000 per ETH by the end of 2023.

Ethereum is already at an annual run-rate of $7.7 billion so reaching $40 billion by 2023 is very much within range.

And what is a monetary network worth that is on track to be generating $40+ billion of cash flows to its holders by 2023?

Roughly 100x annual earnings. Compare that to Tesla’s 1100+ PE ratio. 100x seems appropriate.

So about $4 trillion.

And at a $4 trillion market cap, each ETH token will be worth around $35k.

So if these numbers hold we can expect ETH to be around $35k within 3-4 years once the market realizes and prices in what I’m writing about now.

Yep, cash flows. Direct cash flows in the form of staking rewards. And indirect cash flows in the form of using transaction revenue for token buybacks.

Yep, Ethereum holders get cash flows. And a lot of them.

And Bitcoin holders don’t.

Game over.

The flippening is inevitable.

Yes, Ethereum’s market cap will be higher than Bitcoin’s by 2025.

Here is my latest updated price forecast for Ethereum taking into account everything I’ve learned about EIP-1559 supply reductions and ETH 2.0 staking rewards.

Reason #6 - Ethereum Transaction Revenue Post Layer 2 Scaling Will Grow

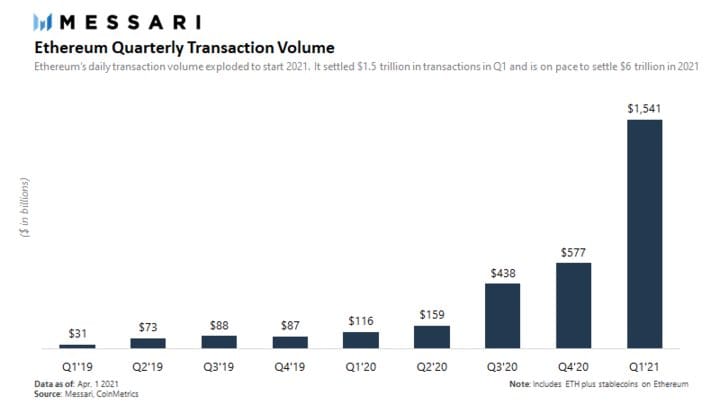

Ethereum settled more than $1.5 trillion in quarterly transaction volume in Q1 2021, up 167% quarter over quarter from Q4 2020.

While some think total Ethereum revenue may decrease after layer 2 scaling solutions go live, I expect total monthly transaction revenue from Ethereum to continue to grow.

Ethereum scaling solutions like Optimism, Arbitrum, Polygon, ZkRollups, and ZkPorter will dramatically reduce transaction costs for end users -- making many common DeFi and token swapping transactions by the end of summer cost just $0.10 to $0.30 instead of $30-$70. Yes, this is very very bullish.

However, these scaling solutions are *not* expected to reduce Ethereum mainnet transaction costs by much. They use separate rollups that batch transactions onto the Ethereum mainnet instead of sending every single transaction there.

So while end users will pay much less per transaction, apps that settle onto Ethereum mainnet in batches will still be paying around $50 per settlement. Fortunately, that’s a lot more affordable when you are settling many millions of dollars versus simply buying a single token on Uniswap. Uniswap is launching their “low-gas trading” on May 12 using a solution called Optimism. It’s a complete game changer.

And Ethereum has shown time-and-again that its usage is price elastic, meaning any reduction in transaction costs are more than made up for with additional usage -- increasing total transaction revenue even as per transaction costs go down.

The takeaway? Ethereum revenue is going to be a lot higher in the future as the network scales.

I’ll end with my forecast for the price of Ether for the rest of 2021:

So Who’s The King? Ethereum vs. Bitcoin

Let’s look at the latest version of my comparison chart to see who’s winning between Ethereum and Bitcoin.

What About Ethereum’s Competitors?

Ethereum is the most used general purpose blockchain in the world.

As I wrote about two weeks ago, other upstarts will likely do quite well also. The entire market is growing substantially.

I am particularly bullish on Polkadot, Cosmos, and Solana’s prospects. I like Polkadot due to it allowing cross-chain communication and the creation of a new blockchain “parachain” for each application with security settled on the main chain. That said, Polkadot will be no competitor for Ether as the global standard monetary asset, with 10% annual inflation initially.

Here are the top Ethereum competitors. I expect most will continue to grow in value.

Ethereum (ETH) - $313B

Binance (BNB) - $86B

Cardano (ADA) - $41B (not yet live)

Polkadot (DOT) - $31B (not yet live)

VeChain (VET) - $13B

Solana (SOL) - $12B

Tron (TRON) - $8.5B

NEO (NEO) - $6.7B

EOS (EOS) - $6.2B

Cosmos (ATOM) - $4.2B

Tezos (TEZOS) - $4.1B

Algorand (ALGO) - $3.5B

Avalanche (AVAX) - $3.3B

NEM (NEM) - 3.1B

Elrond (EGLD) - $3.0B

If I’m wrong about Ethereum reaching $100k per ETH by December 31, 2025, it will most likely be because one of the above competitors outshines it as a decentralized and scalable app development platform. So I recommend investing a little bit of your portfolio in each one as a hedge. Even 0.5% to 1% each can help hedge to ensure that whomever the winners are (and there will be many) — you hold enough of them in your portfolio to do very, very well this decade as we enter the Era of Blockchain Computing.

Crypto Investing in South America

Guest Article by Andres Guzman of Chile

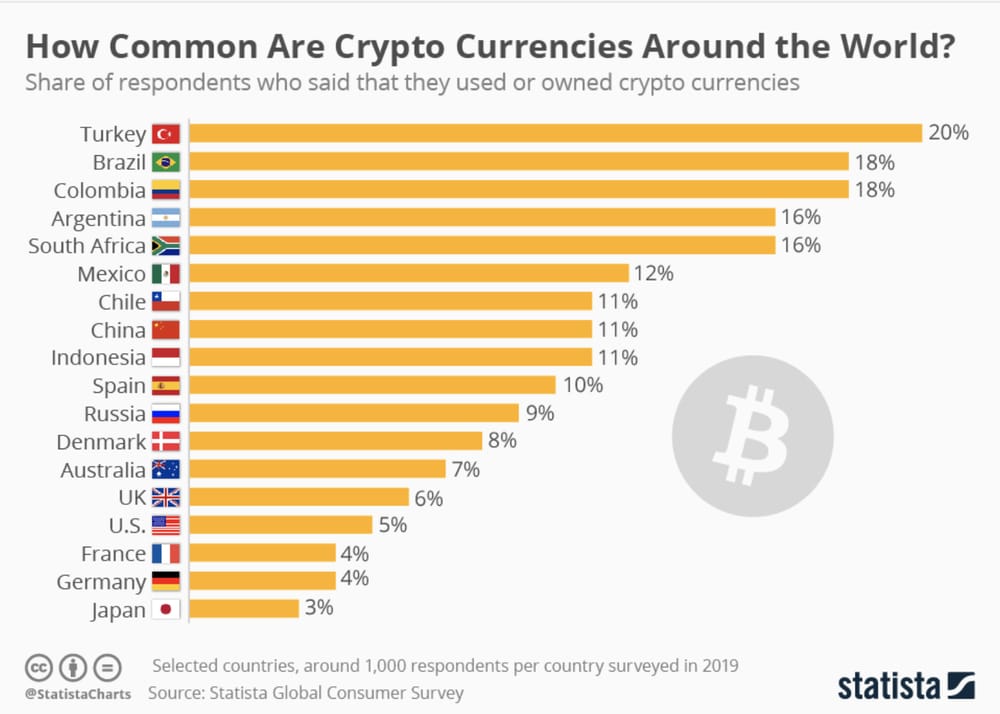

South America is one of the regions where cryptocurrencies are most used. 3 of the top 5 countries by crypto currency usage are in South America (Brazil, Colombia, and Argentina).

This high rate of usage can is caused by five reasons.

Higher Levels of Fiat Inflation - One of the main reasons for the use of cryptocurrencies is due to the weakness of their economies and the high levels of inflation that exist, which can cause the currency to depreciate in a short span of time and lower the purchasing power of the people who keep their wealth in their local currencies.

Low Access to Formal Financial Systems - South America is one of the regions with the highest percentage of people who do not have access to formal financial systems, such as having a bank account; 65% of the population does not have access, being the third region with the lowest access ratios behind Africa and the Middle East. As a consequence, many people keep their money in their homes at great risk considering the high rates of crimes in the region.

International Transfers - Many people in the region have had to leave their countries due to political instability, such as Venezuela and Argentina, among others, so the easiest way to send money to their relatives is through cryptocurrencies, considering the point above -low rates of banking in the region- this is the safest and most efficient way to transfer. Dash is one of the most used currencies in Venezuela, for example to transfer money to families back home.

A Younger Population - The continent maintains one of the youngest populations in the world; a large part of the population is between 20 and 40 years old, which facilitates the use of cryptocurrencies compared to other continents with an older population - assuming correlation between technological proficiency and age. In addition, 73% of the region has access to the internet, which facilitates the purchase of cryptocurrencies.

More Corruption - In less economically developed continents, where there is more corruption, greater instability in their currencies and fewer banking options for people, cryptocurrencies appear as a great option to manage money. This is clearly seen in some South American countries. It can be clearly seen how this decentralized financial system has its advantages for the inhabitants of certain regions where governments are perceived as less committed to their citizens.

How To Buy Crypto in South America

The main exchanges in the region are:

Buda.com: Founded in 2015 and based in Santiago de Chile, Buda.com is a company that develops and operates cryptocurrency markets in Chile, Colombia, Peru and Argentina. It has been the largest Exchange in Latin America (highest volume traded). The platform allows you to invest in BTC, ETH, Litecoin and Bitcoin Cash while having one of the lowest (lowest por best?) commissions on the market, charging between 0.2% and 0.8% depending on the amount invested.

CryptoMKT: CryptoMarket is the first Ethereum Exchange (Exchange Platform) in South America Currently it facilitates that thousands of people and companies can access Blockchain technology by buying ETH, BTC, XLM and EOS using their respective local currencies (CLP, ARS, BRL MXN and EUR). It operates in Brazil, Argentina, Chile and certain European countries, with headquarters in Chile and Brazil. In addition, it also has one of the lowest rates in the region, with commissions varying between 0.25% and 0.85% depending on the amount traded.

It is worth mentioning that there is still the possibility of using larger Exchanges such as Binance, Kucoin, Crypto.com, among others; these accept a credit card with which you can transfer in dollars and then transfer them to cryptocurrencies, another way to do it is deposit your money through Buda.com for example, and make a transfer from Buda.com to another larger Exchange such as Binance.

Thanks Andres for our first ever guest post in Coinstack!

Mrs. Bubble’s NFTs of the Week

Each week I feature a few art pieces from Mrs. Bubble. Thank you for supporting her art work.

Here are two featured Mrs. Bubble art pieces for this week. First we will feature BUBBLE #76 - The Golden Goddess of Ethereum.

The Golden Goddess of Ethereum is available on OpenSea for 0.44 ETH. She represents the prosperity that comes into all of our families as we invest wisely in Ether, the future digital currency of the world. The Golden Goddess of Ethereum reigns over the world of Etherea with light, love, and kind magic. She joins her King to guide Ethera into a beautiful borderless world. Hand painted on a life-sized canvas and then digitized by Mrs. Bubble. Took 2 weeks to paint this beautiful Goddess. Wow she's gorgeous!

Our second featured piece this week is BUBBLE #89 - MetaFoxy. MetaFoxy is of course the female fox representing the Metafox wallet. She is eating a Unicorn hamburger and coming out of MetaKovan’s Metapurse, which has quite a bit of Ether in it!

Thank you for supporting Coinstack by investing in our NFT art. And thank you to Inigo Montoya and 1DEB4D who purchased Mrs. Bubble’s beautiful NFT art pieces last week. You can see Mrs. Bubble’s full art collection here.

CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1000 members on our Telegram.

A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

75% of Portfolio

Ethereum (ETH) 25% of portfolio

Bitcoin (BTC) 10% of portfolio

Polkadot (DOT) 10% of portfolio

Nexo (NEXO) 10% of portfolio

ThorChain (RUNE) 10% of portfolio

Kusama (KSM) 10% of portfolio

25% of Portfolio - About 2% Each

Solana (SOL)

Chainlink (LINK)

Binance (BNB)

Voyager (VGX)

Uniswap (UNI)

Terra (LUNA)

Cosmos (ATOM)

Polygon (MATIC)

Harmony (ONE)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymath (POLY)

Origin (OGN)

PankcakeSwap (CAKE)

Portfolio Update: Up 512% YTD 👀

Below is my actual portfolio holdings as of today. I actively manage my own portfolio and make about 20-30 trades per week, so it may look a bit different than the long term portfolio above. As of this moment I am up 512% YTD while BTC is up 85% YTD.

I’ve achieved good results by using Nexo to get crypto collateralized loans to get more ETH. I use these Nexo instant loans to invest in both more ETH as well as more early stage projects on Binance and Uniswap. I plan to pay them all back before ETH gets to 5k later this year.

About a week ago I swapped 1 of my BTC for more ETH based on my conviction that ETH will continue to substantially outperform Bitcoin. I plan to accumulate more DOT this summer as we prepare for Polkadot’s launch in Q3 2021. You can read more here about my crypto investing strategy.

The People I’m Following Closely on Twitter

Mrs. Bubble The NFT Artist (my wife Morgan Allis)

How To Get Started With Crypto Learning

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. Our forecasts are to the best of our ability however may or may not come true. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Substack at CoinStack.substack.com

Please share with your friends and colleagues.