Social Links: Twitter | Telegram | Newsletter

Learn More at www.amphibiancapital.com and www.dimitra.io and consensus2024.coindesk.com/register/

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week, Hong Kong gave initial approval for spot ETH and BTC ETFs, US court handed down historic sentence for smart contract hacker, SBF appeals conviction and sentence, and big new venture rounds for Alpen Labs ($100M) and Auradine ($80M).

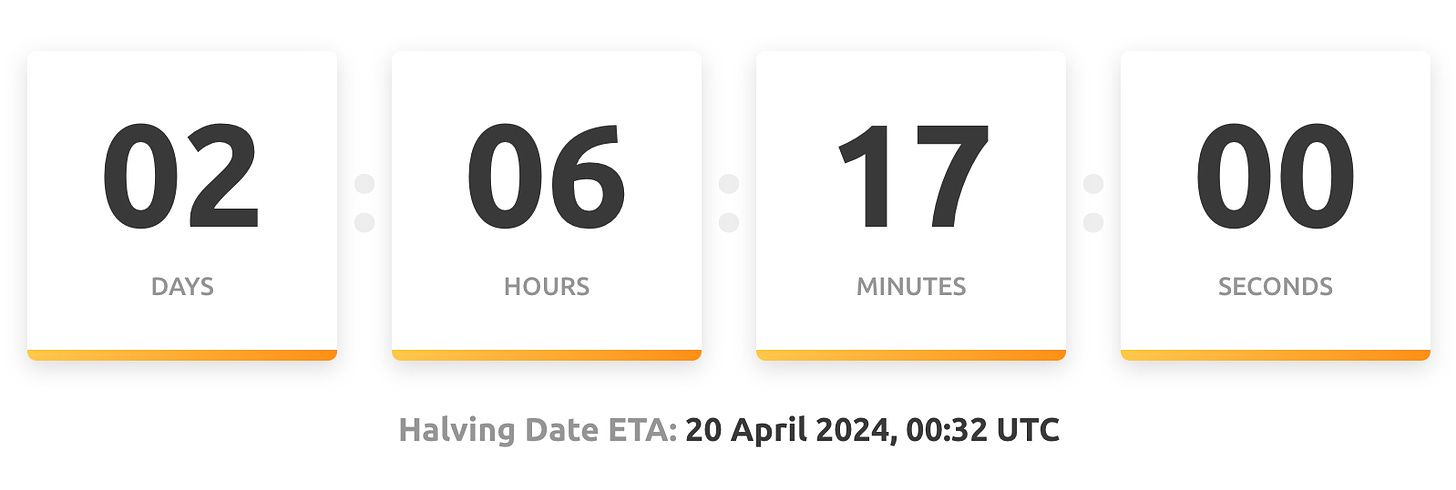

We’re just two days away from the Unofficial Start to the 2024/2025 Bull Market

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund of the world's leading crypto funds, returning approximately 5.44% BTC on BTC in 2024 (77.89% YTD in USD terms) and aim to deeply mitigate downside. Amphibian offers BTC, ETH and USD share classes. Deck here: www.amphibiancapital.com

Dimitra is enhancing agricultural productivity for smallholder farmers worldwide, setting the Agtech standard with cutting-edge AI, blockchain, and real-world application technologies that ensure transparency and optimized yields. Visit their website at dimitra.io or follow them on X for more information @dimitratech.

Consensus by CoinDesk is the world's largest, longest-running and most influential gathering that brings together all sides of the cryptocurrency, blockchain and Web3 community. From hard-hitting conversations with visionary speakers to hands-on workshops aimed at solving industry challenges, developers, investors, founders, brands, policymakers and more will walk away with the tools and insights needed to continue laying the foundation of a more decentralized future. Use code COINSTACK for 15% off your ticket.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Hong Kong Gives Initial Bitcoin, Ether ETF Nod, Issuers Say: Hong Kong gave conditional approvals for asset managers to start spot-Bitcoin and Ether exchange-traded funds, the firms said, a development that boosted both tokens and the wider crypto market.

⚖️ US court hands down historic sentence for smart contract hacker: A US court has sentenced Shakeeb Ahmed to three years in prison for hacking two separate decentralized crypto exchanges and stealing digital assets worth over $12 million, according to an April 12 statement from the US Department of Justice.

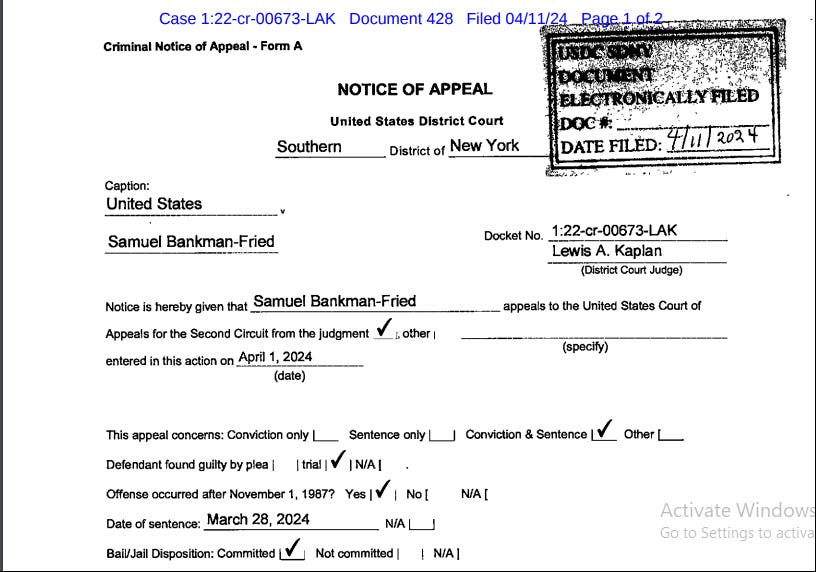

⚖️ Former FTX CEO Sam Bankman-Fried appeals conviction and sentence:Former FTX CEO Sam Bankman-Fried filed an appeal on Thursday after being found guilty on seven criminal counts involving fraud.

⚖️ Coinbase files interlocutory appeal in its case against the SEC: Coinbase filed a motion to appeal a judge's decision last month decision made last month, which allowed a lawsuit involving the Securities and Exchange Commission (SEC) and the exchange to proceed without being dismissed.

⚖️ Lawmakers demand information on CFTC chair's relationship with FTX founder Sam Bankman-Fried:In a letter sent on Monday to Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam, U.S. Sens. Elizabeth Warren (D-Mass.) and Chuck Grassley (R-Iowa) requested documents pertaining to the regulator's correspondence with Bankman-Fried. According to the letter, the request is to determine the nature of Behnham’s relationship with the crypto CEO.

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @dunleavy89

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. With significant upgrades to the network incoming, activity on Solana has reached new yearly highs, handling over 37M transactions in one day. This represents an increase of over 85% from last week, and is also the most activity the network has experienced since September 2022.

Source: @DavidShuttleworth

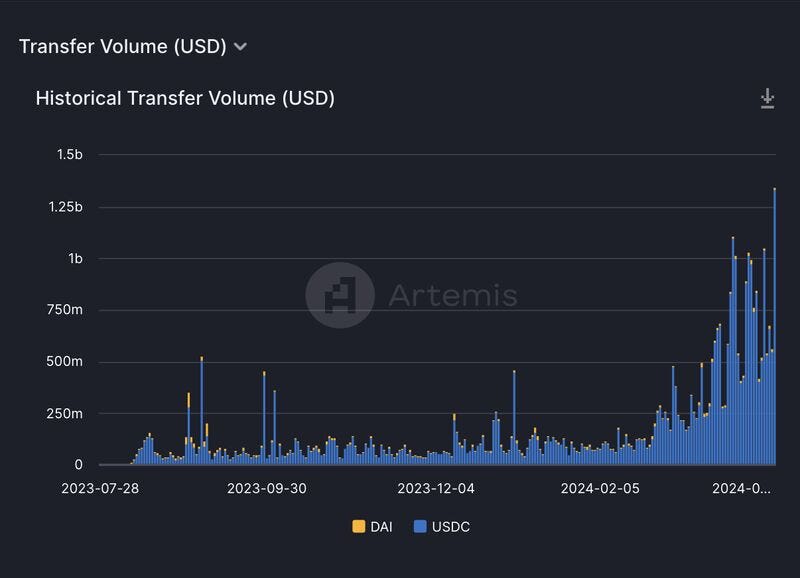

2. Yesterday Coinbase Layer 2 Base handled over $1.33B in stablecoin transfer volume, the most ever on the network in a single day and an increase of 422% since last month.

Source: @DavidShuttleworth

3. Since the beginning of April, ETH inflows into Ethena Labs have increased by 60% and there is now more than 674,000 ETH ($2.33B) deposited into the protocol, with over 142,000 users. While highly debated throughout the space, Ethena's current yield of 17%+ continues to generate significant traction.

Source: @DavidShuttleworth

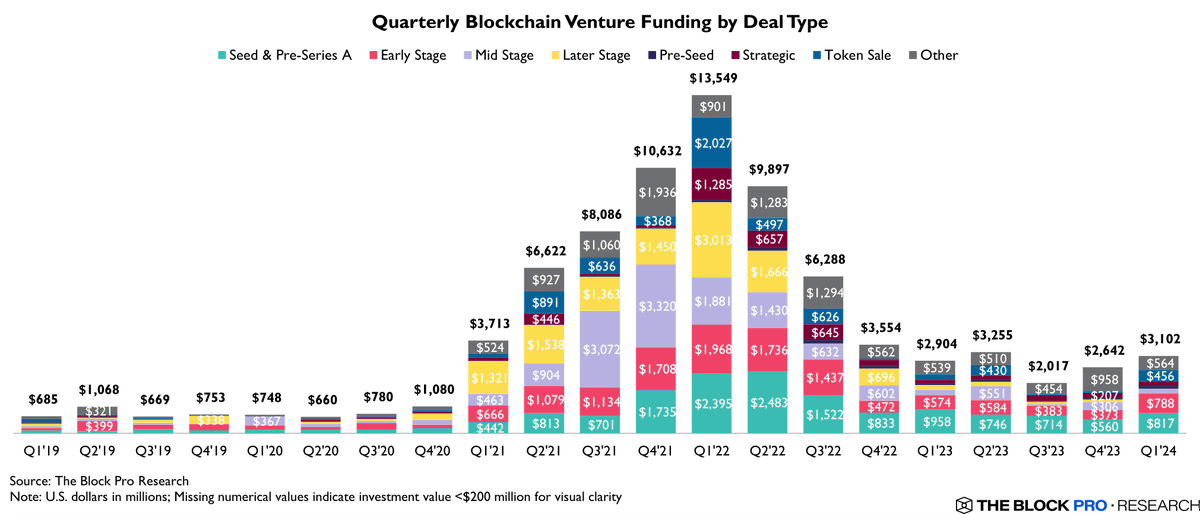

4. Blockchain firms secured $3.1B across 581 deals last quarter, marking a 17% QoQ increase in venture funding. This surge, the largest in over five quarters since Q1'23, highlights robust VC interest in the blockchain sector.

Source: @TheBlockPro__

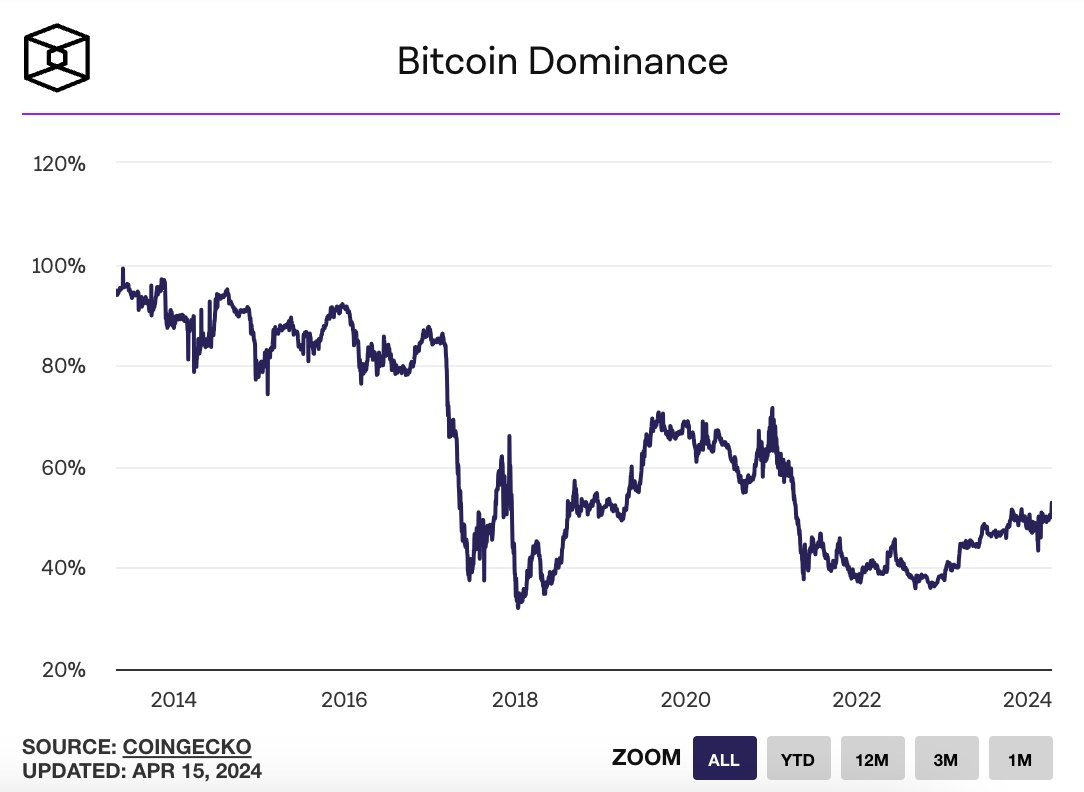

5. Bitcoin's dominance shot up to 52.86% on Sunday, the highest its been in 3 years, as crypto assets tumbled over the weekend due to fears of geopolitical conflict. BTC did drop, but fared better than its more risky counterparts.

Source: @rebeccastev

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

Two years ago, we released Optimizing Your Token Distribution, an analysis of token distribution patterns, to help founders better think through network allocation. Trends in this space shift quickly and, given the renewed market enthusiasm, more founders are starting to draft their token distribution models and launch tokens. This report incorporates the latest data along with updates to our analytical framework to serve as a useful resource to founders.

As a reminder, founders of protocols often raise capital with the intention of releasing tokens to both private investors and their community. These tokens typically involve governance rights, and allow holders - insiders, private investors, and community alike - to participate in a product, service or protocol. Often a protocol has a fixed supply of tokens and therefore teams have to be careful about how they allocate them, optimizing for the greatest set of recipients as well as considering inclusion of their users and partners. Teams will therefore allocate their supply accordingly and create a schema that contextualizes how tokens are earmarked for different user groups.

In the previous version of this exercise in 2022, we explored key trends in token distributions with data pulled from private pitch decks, public medium posts and blogs, and Github READMEs dating back to 2014. Now, two years later, we have been able to improve upon that data set and further explore the latest trends below.

Please note: This report was published as of March 2024 using publicly available information as well as aggregated and anonymized private data points. The authors of this report did not independently verify the accuracy of these distributions today.

Key Trends for Token Buckets

Token distributions can be broken down into 7 main segments:

Core Team

Private Investors

Community Treasury

Ecosystem Incentives

Airdrop

Public Sale

Partnerships and Vendors

We aggregated distributions across 150+ projects and protocols to create a comprehensive analysis of notable trends.

Team

This is the allocation reserved for founders, past and future employees as well as advisors. These tokens are often subject to the longest lockups, typically in line with their investors lockup schedules.

The chart above includes all team allocation, including core contributors, future contributor pools, and advisors. For a closer look at just core team, take a look at the chart below, indicating that core team allocation has actually never been higher.

It’s unsurprising - but still notable - that team allocation does seem to be somewhat correlated with where we are in a particular market cycle. When the aggregated crypto market cap is growing, allocation to team grows, while when market cap shrinks, the team allocation also shrinks.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com and www.dimitra.io and https://consensus2024.coindesk.com/register/