Issue Summary: Welcome back to Coinstack, your weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem. This week we feature an article on why I joined Amphibian Capital as a General Partner as well as updates on Galaxy, BitGo, Genesis, Celsius, Tornado, and Terra Founder Do Kwon. Tomorrow Aug 18, we are hosting a webinar called, Investing in Crypto Quant Funds Ahead of the Next Bull Market Run. Let’s jump in…

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Galaxy Digital Ends BitGo Acquisition, Celsius Updates, dYdX Confirms Blocking Tornado Cash Accounts

🐸 Featured Article: Why I Joined Amphibian Capital by Ryan Allis

📺 Institutional Webinar - Investing in Crypto Quant Fund of Funds - Thursday, Aug 18, 3 pm EST

💵 Weekly Fundraises - Injective ($40M), AfricaDAO ($20M), Unstoppable Finance ($10.5M)

📊 Key Stats - ETH Google Search Uptick, Puell Multiple Signaling a Bottom, Web Node Centralization

✨ Peer Whitepaper: Introducing the Initial Coin Exchange (ICX) - A New Method for Blockchain-Based Capital Raising - Parts 3 & 4 - ICOs, IEOs, and IDOs

🧵 Thread of The Week - DeFi Research Tools

💊 Vitamin3 of the Week: What is Tornado Cash?

📝 Report Highlights - The Essential Guide to GMX

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

🏫 How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Amphibian Capital is a crypto quant fund of funds investing in the world’s leading crypto hedge funds. They have researched and vetted over 250+ funds and selected the 13 best based on their proprietary scoring system, providing accredited investors with the ability to gain crypto fund exposure with one investment. Learn more at www.amphibiancapital.com and see the article below about the team and fund.

🗞️ This Week in Crypto: The Top News

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

⚖️ Novogratz’s Spurned Takeover Target Seeks Termination Fee - Crypto custody firm BitGo said the termination of its acquisition by Mike Novogratz’s Galaxy Digital Holdings is “improper” and it plans to seek a $100 million termination fee.

💰 Genesis CEO Steps Down as Crypto Broker Slashes Its Workforce- Genesis Chief Executive Officer Michael Moro is stepping down as part of a leadership shuffle after the crypto brokerage was stung by $2.34B in exposure to bankrupt hedge fund Three Arrows Capital. Genesis also said it is eliminating 20% of its 260-person workforce to reduce costs.

😡 dYdX Confirms Blocking (and Unblocking) Some Accounts Flagged in Tornado Cash Controversy: Cryptocurrency derivatives trading platform dYdX said it blocked some users’ accounts with funds linked to Tornado Cash, including mistakenly suspending some that never directly engaged with the controversial mixer.

💸 Russia Plans To Roll Out Digital Ruble Across All Banks in 2024 - The Bank of Russia continues working towards the upcoming adoption of the central bank digital currency (CBDC), planning an official digital ruble rollout in a few years.

🙌 Indian Authorities Freeze More Crypto Funds Over Money Laundering Allegations - India’s Directorate of Enforcement (ED) announced Friday that it had frozen the financial accounts of Bengaluru-based financial services company Yellow Tune Technologies, some of which were held by Flipvolt crypto exchange, the Indian branch of Singaporean Vauld.

🌙 Do Kwon Breaking Silence Triggers Responses From the Community - As the Terra co-founder and CEO, Do Kwon breaks his silence about the collapse of the algorithmic stablecoin TerraUSD Classic (USTC) and LUNA 2, the community responded with various sentiments against the Terra executive.

⚖️ Funds Would Have To Disclose Crypto Under SEC, CFTC Proposal - In an effort to better monitor what US regulators perceive as systemic risks, the SEC is moving to get more insight into the dealings of private funds open to accredited investors.

🥳 BlackRock Launches Private Trust Offering Direct Bitcoin Exposure - Investment manager BlackRock has launched a private trust offering US-based institutional clients exposure to spot bitcoin.

🔴 DeFi Protocols Aave, Uniswap, Balancer Ban Users Following OFAC Sanctions on Tornado Cash - Several decentralized applications on the Ethereum network have implemented code changes to revoke access from “sanctioned” addresses. The currently identified protocols are Aave, Uniswap, Ren, Oasis, and balancer. Banteg from Yearn identified the GitHub repositories in question via a Tweet early Saturday morning.

🎉 Ripple Shows Interest in Acquiring Celsius - Ripple Labs could be interested in buying the assets of embattled crypto lender Celsius Network

Why I Joined Amphibian Capital

By Ryan Allis, General Partner at Amphibian Capital and Publisher of Coinstack

About this article: In July I became a General Partner at a fund called Amphibian Capital. Amphibian is a crypto fund of funds. We have researched over 250+ crypto funds and selected the top 13. You can view the pro forma fact sheet here. If you’re an accredited investor or institutional investor and would like to explore an investment in the fund, you can book a time with me here. You can also join our webinar this Thursday August 18. Below is the story of why I joined Amphibian.

When I was in my first year of my Harvard MBA in 2012, we read the case study of Facebook’s hiring of HBS alum Sheryl Sandberg. I still recall a well known quote from her recounting her 2008 Facebook hiring, “If you're offered a seat on a rocket ship, don't ask what seat! Just get on.”

That’s how I feel about finding Amphibian Capital and joining their crypto fund of funds this Summer. Feels like I’m joining a rocket ship that’s been very thoughtfully designed.

I had been looking extensively earlier this Summer for a crypto fund to partner with that was actually up in 1H 2022 while much the rest of the digital assets market was down over 60%.

This search led me to Amphibian.

Here’s the story of why I joined Amphibian Capital, a crypto fund of funds, as a General Partner this summer, their underlying fund historical results, and how you can learn more about the fund.

We have two funds, a USD-denominated crypto quant fund of funds, and an ETH-denominated crypto quant fund of funds, that earns returns for long-term ETH holders.

If you’d like to talk to me about our funds you can book a time here or join our webinar tomorrow Thursday August 18. For interested accredited investors and institutional allocators who like a personal update and for me to walk you through our strategy, team, and fund structure, you can can book a 1:1 call with me here.

Now for the story…

My Story & How I Ended Up Joining Amphibian Capital

When I began writing Coinstack in January 2021 (89 issues ago), I began writing about my personal crypto investing experience every Wednesday.

After seeing the major market turbulence of May 2021 (back when China banned Bitcoin for the 37th time) and losing some personal money in that crash, I became pretty interested in finding a way to avoid the major and inevitable downturns in crypto while still benefiting from the upside of bull markets.

I believed in the digital asset space and sensed it would do very well over a 5-10 year period -- and I wanted to find a fund that would be likely to generate positive returns regardless of the market environment.

So I started exploring and evaluating the world of crypto hedge funds.

In August 2021 I joined a crypto fund called HeartRithm and worked with them for 9 months and learned a lot there. They are a fantastic team and fund. I still have many friends there. They operate a market-neutral DeFi fund and had some exposure to UST, the algorithmic stablecoin that depegged and crashed in May 2022. They had a down month and needed some time to build their new offerings.

I led marketing and fundraising -- and there was nothing to market or fundraise for some time. So I went searching for a new fund to work with.

This time, I really wanted to find an all-weather quant fund instead of a yield fund.

Finding the “Renaissance Technologies of crypto” had become a passion of mine after reading the book, The Man Who Solved the Market last year about the rise of the highly successful Medallion quant trading fund.

Seeking A Fund Designed to Perform in Bull & Bear Markets

Around the time of my son’s birth this June, I was re-introduced to the team at Amphibian Capital, a crypto quant fund of funds.

I was especially looking for funds that would be up in the first half 2022 while many other crypto funds were down 50-85%. Any fund could do 50%+ in 2021, but few funds were up in the brutal environment of 2022.

I was re-connected with David Langer and James Hodges, founders of Amphibian Capital and friends of mine going back a few years — and was VERY impressed by what they had put together.

David, James, and a third partner Todd Bendell had spent the last year launching Amphibian Capital. They canvassed the crypto fund space and researched over 200 crypto quant funds. They identified 50 finalists which they vetted -- and finally ended up selecting 13 funds to invest in that were consistently high performers regardless of market environment.

The team is solid and has experience managing over $6B in AUM with more than 130 years in traditional and digital asset management combined.

So, yes, Amphibian Capital is a crypto fund that invests in other, highly vetted and high performing crypto quant funds. We are a “fund of funds.”

We are a fund that invests in other crypto funds.

So instead of trading digital assets ourselves, we research, vet, and pick funds that are experienced at using algorithms and quantitative models to trade digital assets -- and allocate capital to those funds to provide a diversified portfolio that is designed to weather any market environment.

The Amphibian Team created a proprietary evaluation model utilizing six key pieces of data for each fund including:

Monthly Returns

Maximum Drawdowns

Sharpe Ratios

% of Winning Months

Liquidity

Fund Size

Amphibian also ran each finalist fund through a 40-point integrity checklist on security, team, counterparty risk, technology, operations, and legal setup.

Once they got their finalist funds, they gathered all the fund monthly historical return data going back to January 2019 and created an optimized and diversified portfolio made up of the 13 best-performing funds.

Now, investors could access a portfolio of these 13 funds by making a single investment, with a minimum of $250k instead of the often larger minimums required by the funds when you invest directly.

How Amphibian’s Capital Selected Funds Performed Historically

Here’s how these selected underlying funds performed from 2019-2022, after fees. There were no down quarters and only one down month in 41 months.

You can see the pro forma monthlies below.

It’s important to note that Amphibian’s fund of funds began accepting LP investments on July 1, 2022 -- so these figures above are for the underlying 13 funds selected -- noting that some of the funds started during 2019-2022 and thus were added as they were created.

These pro forma results were really, really impressive to me. So, I dove deeper with my diligence of the team, funds, and results.

Up In Both Bear Markets & Bull Markets

I wanted to see how Amphibian’s underlying funds performed during the bull market of 2021 and the bear market of 2022, compared to the DJIA and to BTC.

I found the following…

Once I saw these historical pro forma results for the underlying selected funds, I was captivated. I was excited by the fund of funds model where our job was to select great funds instead of attempting to trade digital assets ourselves.

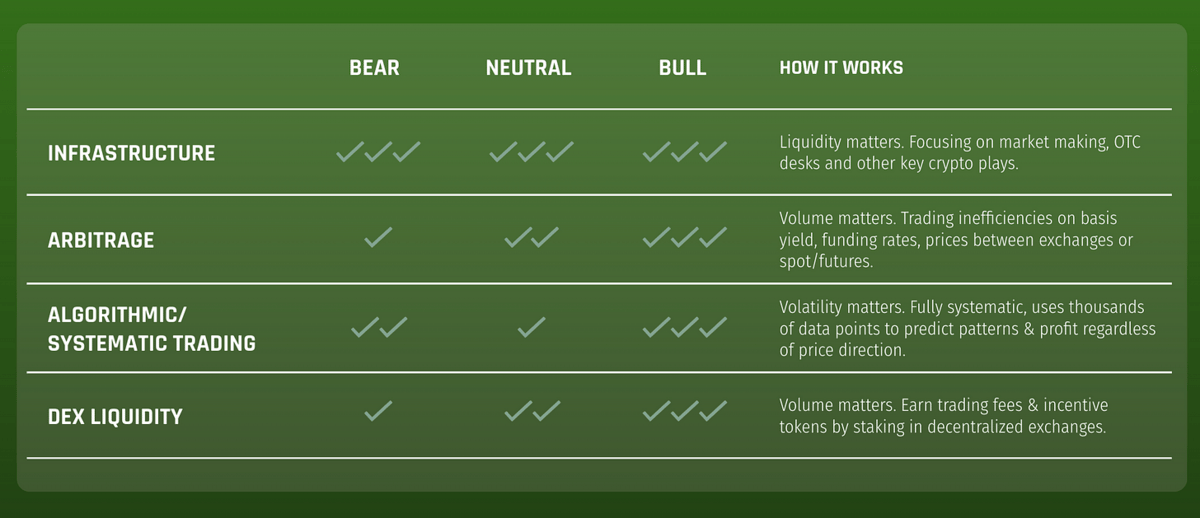

What the Selected Funds Do To Earn Returns

Many of Amphibian’s underlying crypto funds were long/short and multidirectional trading firms, and thus are able to earn good returns in both bull and bear markets -- if their algorithms and signal libraries are tuned properly..

We invest in six major types of crypto trading funds -- all of which can perform well in all types of market environments.

Market Making & Liquidity

OTC Desk Funds

Arbitrage Funds

Algorithmic Trading

Machine Learning

DEX Liquidity Funds

Why Avoiding Drawdowns in Crypto Investing Matters So Much

As I began to go deeper into my personal diligence of Amphibian Capital, I started to realize just how important it is as a long-term investor in the crypto space to (if you can) avoid the big drawdowns that happen in the space (sometimes multiple times per year).

In crypto investing, when you have a bad year and you lose 60% (like BTC did in the first half of 2022), it takes a 150% return just to make it back to your original investment amount.

You can see this effect in the below table.

How much you need to earn to get back to your original position is magnified the deeper your drawdown.

And if you lose 80%+, like a number of token funds did in 1H 2022, it takes 400% to get back to even.

I saw one digital assets token fund (which I won’t name here) that was down 84% in the first half of 2022 after being up 314% last year -- erasing all of their 2021 gains, and then some!

So it’s essential when planning out your long-term crypto investing strategy that you avoid these major drawdowns that historically have happened every four years in year 3 of the Bitcoin cycle (where we are now).

What I learned was that for accredited investors and institutional investors, there are specialized quantitative trading funds available that are designed to avoid drawdown while still participating in much of the upside of winning years, creating high Sharpe Ratio opportunities.

These are the types of all weather crypto quant funds that Amphibian Capital has selected.

In this hypothetical example below you can see the final impact of two different funds. One that had a great 2021 but a bad 2022 and one that had a great 2021 and a good 2022.

The effects of avoiding drawdowns over longer time periods are even more pronounced. Avoiding drawdowns in years like 2022 is essential to long term compounding -- and that’s one of the key reasons I decided to join the Amphibian team last month and begin working with them.

Deciding to Join the Amphibian Capital Team

In July I joined Amphibian Capital as one of their General Partners. I’m excited to be joining Amphibian.

We have raised $31M in AUM (9/1 estimate) through our USD-denominated fund and our ETH-denominated fund so far -- and are looking to grow further and add additional Limited Partners.

We have two funds available -- one that is denominated in USD (Amphibian USD Alpha Fund) and one that is denominated in ETH (Amphibian ETH Alpha Fund), which pays ETH returns on top of ETH. So if you’re an ETH bull, the ETH fund may be attractive to you. Reach out to me about either fund if you’re an accredited investor and would like to chat.

You can view our pro forma fund fact sheet here, which shows the net performance of the selected underlying funds from 2019-2022 for the Amphibian USD Alpha Fund.

If you’re an accredited investor or institutional investor and would like to explore an investment in either of our fund of funds, please take a look at our fact sheets above and book a time to chat with me here.

You can also join our August 18 webinar, “Investing in Crypto Quant Funds” to hear me talking about our two funds and the process we went through to select the underlying funds we invest in.

About this article: Since July I’ve been working at a new fund called Amphibian Capital. Amphibian is a crypto fund of funds. We have researched over 250 crypto funds and selected the top 13 to invest in. You can view our pro forma fact sheet here. If you’re an accredited investor or institutional investor and would like to explore an investment in the fund, please book a time with me here. You can also join our webinar this Thursday August 18.

💬 Tweet of the Week

Webinar: Investing in Crypto Quant Funds

We will be hosting a free webinar this Thursday on investing in crypto quant funds where will be giving an overview of the space and talking about Amphibian Capital’s crypto quant fund of funds model. You can learn more and register here.

This webinar is tailored to high-net-worth individuals, portfolio managers, institutions, family offices, and RIAs who would like to learn more about vetting, selecting, and investing in crypto quant funds.

Thursday, August 18, 202212pm PT / 3pm ET / 7pm GMT55 minutes on Zoom / register herePresented by Ryan Allis, Publisher of Coinstack and GP at Amphibian Capital

What You Will Learn

The four types of crypto funds

The primary trading strategies of crypto quant funds

How Amphibian Capital designed its portfolio by researching and vetting 250+ crypto funds, selecting the 13 best for its fund of funds

How the portfolio of underlying selected funds performed in 2019-2022

How Amphibian's pro forma portfolio of crypto funds achieved +84% net in '21

How Amphibian’s pro forma portfolio of crypto funds achieved +10% net return in 1H 2022 while many other crypto funds were down big

Why avoiding major market drawdowns matters so much for long-term investment results

Why the upcoming Ethereum merge scheduled for September is driving ETH prices

If you're an Ethereum bull, how to earn ETH-on-ETH returns (USD Fund vs. ETH Fund)

How the fund of funds model can mitigate risk and drawdowns

Requirements

For institutional investors and accredited investors

For portfolio managers inside hedge funds or family offices

For financial advisors advising HNWIsRegister Here Free

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Google Searches for the Ethereum Merge Have Now Spiked to an ATH Ahead of the Merge With Searches Up Over 500% Over the Past Month

2. Puell Multiple May Have Signaled BTC Bottom

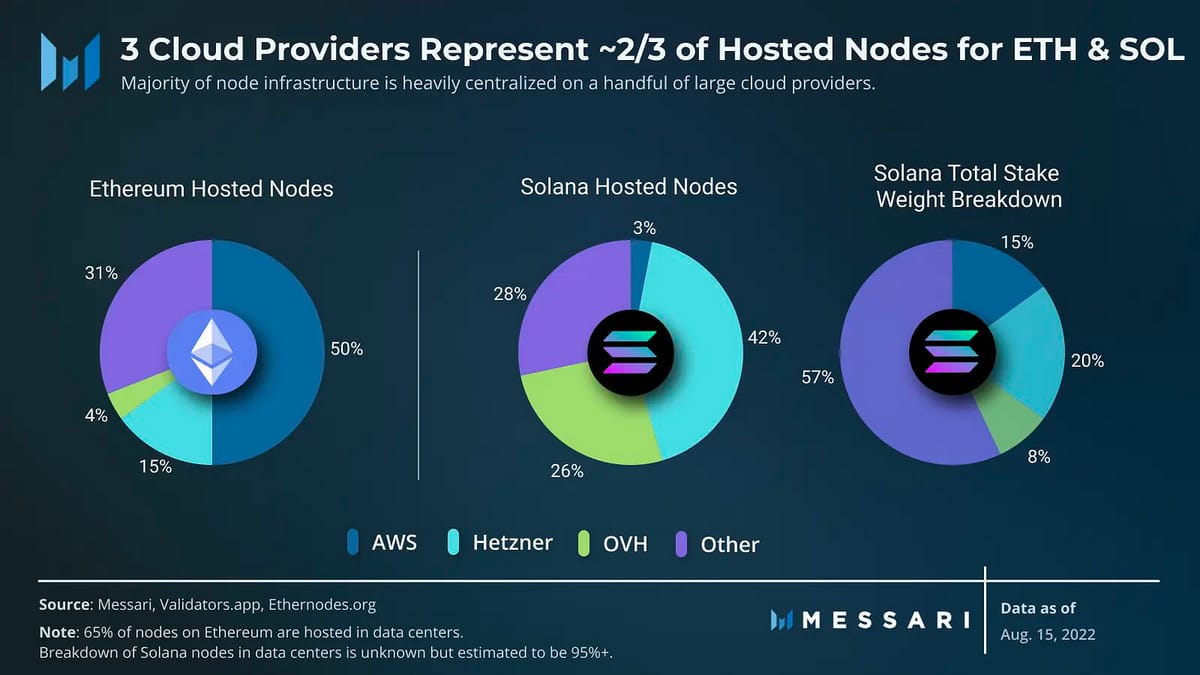

3. Web3 Node Providers Face a Centralization Problem With Three Cloud Providers Representing ~⅔ of Hosted Nodes for ETH & SOL

4. Aztec Network Is a Privacy-First zkRollup Offering Cheap, Private Transactions on Ethereum, Reaching 13k ETH Deposits

5. In the Last 30 Days, Optimism Averaged 146k Transactions / Day (+43% vs Prior 90 Days)

6. Arbitrum TVL Is Tracking ~$952m, Second to Optimism. While Down From Previous Highs, the L2’s TVL Is up ~55% MoM

7. This Week’s Top Gainers by Total Revenue With Goldfinch Reaching 4-Digit Growth

✨ Peer: Introducing the Initial Coin Exchange (ICX) - A New Method for Blockchain-Based Capital Raising - Part 3, 4, 5

About Peer: Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc. You can read the full whitepaper here including all 5 parts.

Part 3: The Invention of the IEO & IDO

Introducing the Initial Exchange Offering - The IEO

The ICO fever in 2017 proved to be a high-risk environment for individuals wanting to participate in new blockchain project token releases, from accidentally sending funds to the wrong wallet, or some project teams absconding with funds. In response to this, a new fundraising mechanism called IEOs came about.

An Initial Exchange Offering, commonly referred to as an IEO, is a fundraising event administered by an exchange. In contrast to an Initial Coin Offering (ICO), where the project team conducts the fundraising, an Initial Exchange Offering means that the fundraising will be conducted on a well-known exchange’s fundraising platform, such as Binance Launchpad, Bittrex International, or BitMax Launchpad.

IEO's are managed by a cryptocurrency exchange. So instead of a company selling tokens directly to the public in an IEO, everything is done through an already existing trading platform. The company pays a listing fee and gives some of its tokens to the exchange. In return, the exchange takes on the responsibility of making the IEO succeed by taking care of various aspects such as marketing, securing funds, and vetting investors. The exchange then lists the IEO on its website, and the token sale is conducted through the exchange. Once the IEO timeframe ends, the tokens are immediately listed on the exchange for trading.

Differences between ICOs and IEOs

Unlike ICOs, an IEO usually aims to raise a moderate amount of money and is usually classified as a utility token offering. However, due to the ambiguous nature of this classification, most IEOs will probably not be available in the US as exchanges for regulatory clampdown by the Securities and Exchange Commission. Crypto projects can conduct both an ICO and an IEO, and many do. Sometimes a company may conduct a private ICO for strategic partners and high-net-worth individuals. Later, the token sale will move to an IEO for the general public.

Case Study: The STEPN IEO

An example of a successful project doing an IEO is STEPN. STEPN, the first Web3 running app with fun social and game elements, raised a $5.0M seed round from leading investors including Sequoia Capital, Folius Ventures, Solana Capital and Alameda Research in January 2022.

Through STEPN’s in-app Marketplace, Swap and Wallet, users can purchase NFT Sneakers which can be used to earn tokens by simply walking, running, and jogging. The mobile app helps by tracking the users’ outdoor movements based on the time and distance covered and awarding them with tokens.

After finding product market fit, the STEPN team wanted to give their users a convenient way to cash out their governance tokens for stablecoins. The STEPN team took advantage of Binance’s Launchpad in March 2022 and used the additional funding from their IEO to continue developing the product and debuting their token to crypto exchanges. The IEO was a success, and 130,672 participants committed 8,742,450.4131 BNB during the subscription period, representing an oversubscription of 828x.

The Pros of an IEO

The first and most important advantage of an IEO is increased trust. Investors rely on the exchange to vet potential IEO projects, and since the exchange’s reputation is on the line, it has an incentive to do extensive due diligence on each project that wishes to be listed. This means the chance for dubious projects or outright scams is reduced dramatically. Second, IEOs are open to everyone who isn't restricted from using the exchange. This opens up a whole market of investors who otherwise wouldn't meet the eligibility standards to participate if a token sale were classified as an STO. Another major advantage is security. In the past, many ICO funds were lost due to hacks or theft.

With an IEO, the exchange deals with securing investor funds instead of an inexperienced startup. Additionally, the company selling the token doesn't need to worry about regulation. The exchanges are responsible for vetting their own users and conducting the KYC process. Probably one of the biggest advantages of an IEO is token liquidity.

Once the IEO ends, people can start trading their tokens instantly on the exchange. This eliminates what sometimes happens with ICOs, where you can't find a marketplace to trade your newly received tokens. And finally, there is a marketing advantage. The exchange can offer the IEO to its existing user base, saving the company the hassle of trying to build a prospect list from scratch. IEOs are aimed to be a win/win/win situation for exchanges, investors, and companies seeking funds.

With an IEO, each party can focus on what is necessary to reach its particular objectives. The exchange deals with funds and regulation, the company can focus on building its product and investors can feel safer knowing that a reasonable amount of due diligence was done for each project.

The Costs of an IEO

There are some downsides to IEOs, mainly for the companies issuing the tokens. First, conducting an IEO costs money and, in some cases, quite a bit of it. The price for an IEO depends heavily on the exchange the company uses. The cost of an IEO on major exchanges ranges from $150,000 to $1,000,000.

In one sense, this premium is an investment for the marketing, security and regulation efforts companies get from an IEO. But in the end, not all startup companies can afford this. Second, an IEO is limited to exchange users meaning if the exchange isn't available in a specific country, local investors are automatically excluded from the IEO.

Our Conclusion About IEOs

As IEOs become more popular, exchanges have started to set up dedicated platforms for them. As token sales become more mainstream and regulated, some people believe that IEOs will become a staple in a project’s fundraising roadmap. Will this happen? Only time will tell.

Introducing Initial DEX Offerings

An IDO (Initial Dex Offering) is a fundraising method by which a project launches a coin or token via decentralized liquidity exchange. This type of crypto asset exchange relies on liquidity pools where traders can swap tokens. A project that issues initial DEX offerings receives financing from individual investors. IDOs can be created for a variety of projects. They share a few similarities with initial exchange offerings (IEOs) where both models aim to raise money to bootstrap a project and allow immediate trading on top of raising funds. The first-ever IDO was introduced by Raven protocol in June 2019 and listed on Binance DEX.

How Does an IDO Work?

The way an IDO works is relatively simple. A project appeals to the general public for fundraising through a platform or launchpad that offers IDO services, such as PolkaStarter. If the potential project meets the launchpad platform’s requirements, it is selected to conduct an IDO. Investors then buy IOUs using the token to be launched. An IOU stands for acknowledgment of debt. Basically investors pay for the tokens in advance and receive them upon the token generation event. Once these stages are completed, the token is immediately listed for trading on a decentralized exchange. Most tokens are based on ERC-20 protocol standards since many projects are still built on Ethereum with many more being conducted now on Solana through Solster.

The Pros of IDOs

IDOs come with several benefits, one of them is open fundraising. Since there is no need for a CEX (Centralized Exchange) and permission to start fundraising, any project can organize and participate in IDOs. Projects also have instant access to immediate liquidity and instant trading, unlike ICOs, which involve an initial waiting period.

Moreover, it is generally cheaper for a project to go down the IDO route. For example, if a project uses a decentralized liquidity exchange for its initial offering without an intermediary, it only pays a gas fee for deploying a new smart contract.

There is also a case to be made for reliability and transparency. Since DEXs function on smart contracts, they execute trades and record them to the blockchain, enabling reliable transactions. Also, there is no intermediary holding your funds, so they are less appealing to hackers who would rather target the faulty code inside a 9-figure plus DAO treasury.

Successful IDOs

Overall, a huge number of IDOs achieved well over 100x growth. Of the 20 best-performing IDOs the two projects that stand out most are Blocktopia and GameFi.

Bloktopia is a VR skyscraper made of 21 floors, in honor of 21 million Bitcoin. It’s the VR metaverse that aims to become the edutainment hub for all levels of crypto experience. The platform achieved a whopping 558x ROI over its IDO price. $100 invested in the IDO was worth as much as $55,000 during the November 2021 bull market peak.

GameFi is a blockchain gaming launchpad currently hosted on the Binance Smart Chain (BSC). GameFi is an all-encompassing hub and one-stop shop for game finance, serving game studios, players, traders, and investors. GameFi brings the gaming community the promising blockchain game initiatives developed on the BSC and Polygon networks, which host most of the top-rated play-to-earn titles. Simultaneously, GameFi is the first marketplace to enable cross-games trading of in-game items and NFTs. GameFi saw a 240x return since their IDO from launch to the November 2021 bull market peak.

Our Conclusion about IDOs

An IDO represents a fundraising method to which a project can release a coin or token using a decentralized liquidity exchange. This type of crypto asset exchange relies on liquidity pools where traders can swap tokens. A project that issues Initial DEX Offerings receives financing from individual investors based on their interest in a project.

An IDO has many advantages, such as immediate liquidity, instant rating, and lower costs. However, it also has cons, such as a lack of control over who buys how many coins. Something else other than an IDO is needed that can actually vet projects and prevent low quality projects and scams.

The Problems With ICOs, IEOs, and IDOs

There are a number of problems with ICOs, IEOs, and IDOs including:

Intentional scams

Lack of proper project vetting

No defensible Intellectual Property (IP)

Low liquidity leading to major price swings

Pump and dump schemes

Capital flowing toward overhyped projects

Lack of Know Your Customer (KYC) integration

The cost of getting listed on exchanges

ICOs often don't even have a finished product which means there is an increased risk. Some ICOs have projects that are working and testable. In fact, many ICOs in the past, especially around 2018 were intentional rug pulls, meaning the developer would raise a bunch of money and then never develop the product simply because there was no official regulation. Rug pulls occur when fraudulent developers create a new crypto token, promote the token to increase its price, sell the bulk of their holdings, and then abandon the project.

ICOs have a negative impression around them due to a number of ICO scams during the 2017 bull market. A 2018 report from Satis Research Group investigated approximately 1,500 ICOs. From the sample, 78% of projects were identified as scams, collectively valued at $1.3 billion.

With an ICO, IDO, or IEO, fundraisers have no control over who buys tokens and how many they buy. The lack of integration with Know Your Customer (KYC) capabilities can also be a con since personally identifiable information for investors is not recorded, which is sometimes needed to comply with laws in various jurisdictions. Immediate price movements and liquidity rug pools are two other cons that stand out because these are malicious maneuvers where crypto developers abandoned the project and ran away with the funds raised from investors.

About Peer: Peer is an augmented reality and Web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc. You can read the full whitepaper here including all 5 parts.

🧵 Thread of the Week - DeFi Research Tools

By: @sgallardo_9

1/10: EtherDrop Bot

Built by @0xCheck and similar to Nansen alerts, this bot allows you to set notifications on your Telegram for any movements in a specific wallet, pool or NFT collection for free.

Full guide:

https://0xcheck.medium.com/etherdrops-bot-the-ultimate-user-s-guide-29b2b6b9aec0

2/10: Wallet Tracker Discord

Created by @slurpxbt, this Discord tracks over 500 wallets including funds, exchanges, protocol treasuries, founders and CT accounts.

More info here:

3/10: Track Governance Proposals

@tallyxyz is a great platform to keep up to date with any governance proposals across different EVM chains. It's also a great tool for setting up a DAO.

4/10: Apophenia's Blog Scrapper

Another bot built by a fellow intern from @InternDAO. This bot sends you a Telegram message every time a project uploads a new article to their medium/blog. Many projects update their blog before tweeting about it.

5/10: Token Unlock Dashboard

@Token_Unlocks is my favourite tool to track token unlocks. Their Dashboard is super intuitive and when you select a project it provides a lot of details about its tokenomics.

6/10: OpenBB Terminal

@openbb_finance is an investment research app that allows users to access a lot of Bloomberg's features for free in a Python-based environment.

More details here:

7/10: MEV and On-chain analysis

@Eigenphi is one of my favourite tools for MEV. Track sandwich attacks, flashloans and identify malicious tokens in their website.

8/10: Deep Dive into MEV

zeromev.org categorises MEV by how harmful it is for users. It differentiates toxic frontruning vs other types of MEV. It can be visualised by wallet or by block.

Here's a walkthrough video covering the basics:

9/10: Identify yield opportunities

@0xCoindix monitors over 10,000 vaults across 27 chains and allows you to filter by protocol, chain, type of yield or TVL.

See below an example of yield opportunities on stablecoins in vaults with >$1m TVL sorted by APY.

10/10: Track Derivatives data

@laevitas1 is a data analytics platform. Probably my favourite app for tracking derivatives and funding rates in crypto.

Their dashboards have a lot of interesting data so I'd recommend checking them out.

Remember to always DYOR. Let me know if there are any other tools you like to use, and feel free to share the first tweet if you found this thread helpful.

Vitamin of the Week: What is Tornado Cash?

About this Section: Our friends at Vitamin3 have launched a free daily SMS covering web3 topics. You can subscribe free by sending HELLO to 305-614-9440. Here’s an excerpt from their SMS earlier this week on the Metaverse.

Last week, the U.S. Treasury Department made it illegal for Americans to use crypto protocol Tornado Cash. Since then, Circle - issuers of stablecoin USDC - and other centralized crypto companies have frozen assets & wallets that have interacted with Tornado Cash. On Friday, Dutch authorities arrested a Tornado Cash developer. In response, the Crypto community has been enraged. Why all the hubbub?

(2/3) Tornado Cash is a decentralized "crypto mixing" protocol, giving users more on-chain privacy. Typically, all crypto transactions are recorded on-chain, so there is no privacy-anyone can monitor all of your wallet's transactions. With Tornado Cash, you can "mix" your crypto with crypto from other users, making it hard to determine whose crypto came from where, thus adding a layer of privacy.

(3/3) There are 2 sides to this story: (A) Tornado Cash is a privacy tool, allowing users to transact safely & without harassment (many used it to donate to Ukraine without Russian retaliation); (B) Tornado Cash is a money laundering tool (North Korea used it after hacking $600m).

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Bankless is a media publication exploring the frontier of internet money and finance. They cover how to get started, how to get better, and how to front run the opportunity in the cryptocurrency markets. This is an excerpt from the full article, which you can find here

GMX is a decentralized derivatives exchange on Arbitrum that specializes in perpetual contracts.

This Bankless tactic will walk you through how to long or short top cryptocurrencies with leverage using GMX’s perpetual swap markets.

Goal: Learn how to trade on GMX

Skill: Intermediate

Effort: 1 hour

ROI: The potential for amplified gains via leverage

What is GMX?

GMX is a decentralized derivatives exchange currently deployed on the Arbitrum One Layer 2 (L2) scaling solution and the Avalanche blockchain.

The protocol offers spot trading for a handful of top cryptocurrencies and stables, namely ETH, WBTC, LINK, UNI, DAI, USDC, USDT, and FRAX.

GMX’s main claim to fame? Its perpetual swap markets allowing traders to long or short major tokens with up to 30x leverage.

For now, GMX offers perpetual swap markets for ETH, WBTC, LINK, and UNI on its Arbitrum deployment. That initially modest selection hasn’t slowed GMX’s growth, however.

The project’s $260M+ total value locked (TVL) on Arbitrum makes it the largest dApp on the largest L2 as it stands today.

Why Perpetual Swaps? Why GMX?

A perpetual swap is like a futures contract that has no expiry, meaning the instrument can be held indefinitely. In DeFi, perpetuals are used to speculate on crypto price action and require little capital upfront to support very leveraged positions.

As for GMX specifically, the project provides non-custodial perpetual swap trading with an emphasis on friendly UX. On GMX, traders can make longs and shorts with rapid transactions and low swap and transaction fees, while liquidity providers (LP) can earn by providing assets to the protocol’s multi-asset pool system to support leverage trading and swaps.

GMX Longs and Shorts Explained

GMX’s perps make it simple to long a token, which is a way to speculate on and earn from, a token’s price going up. Conversely, if that token’s price drops, those who longed the asset lose money and may get liquidated.

The same is true in reverse for GMX’s perps and shorting: these instruments are a means for speculating on and earning from a token’s price going down, and shorters lose money and can get liquidated if the token’s price instead goes up.

When going long or short on GMX, the minimum leverage possible is 1.1x while the maximum allowed leverage is 30x. To start a perp trade, you’d first provide collateral in the form of one of GMX’s supported collateral types. After this, the protocol’s multi-asset liquidity pool would lend you the necessary funds to open your long or short position.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Sperax is a Governance Token, bZx is a DeFi Protocol, ABBC is a Payments Platform, Optimism is an L2

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 28,343 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.