Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem. This week we cover Michael Saylor stepping down, a new U.S. Senate bill to give CFTC authority over Bitcoin and Ether, and Ethereum’s 85% price increase the last six weeks. We also write about Amphibian Capital crypto quant fund of funds model and share part one of the Peer ICX Whitepaper. If you’re an accredited investor or institutional allocator, join us tomorrow for our webinar: “Investing in Crypto Quant Funds”

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Michael Saylor Departs as CEO, CFTC Proposed Regulator for BTC and ETH, Nomad Raided for $190M, Solana Hacked for $8M+, Tether Holds No Chinese Paper

🐸 Featured Article: Investing in Crypto Quant Funds: Designing a Fund For Bull and Bear Markets by Ryan Allis

📺 Institutional Webinar - Investing in Crypto Quant Fund of Funds - Thursday Aug 4, 3pm ET

💵 Weekly Fundraises - Unstoppable Domains ($65M), VeeFriends ($50M), Sweatcoin ($13M)

📊 Key Stats - ETH Options Breakout, Solana Daily Active Addresses, ETH Price Performance

📄 Whitepaper Excerpt: Peer: Introducing the Initial Coin Exchange (ICX) - A New Method for Blockchain-Based Capital Raising - Part 1

🧵 Thread of The Week - 3AC’s Insolvency Latest Update

💊 Vitamin3 of the Week: What Are L2s?

📝 Report Highlights - Bankless: 5 Ways to Fix DeFi Tokens

🎧 Top Crypto Podcasts - Coinstack, Bankless, Delphi Media

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is a Web3 social network and blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Amphibian Capital is a crypto quant fund of funds investing in the world’s leading crypto hedge funds with a strong track record with low drawdown. They have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.amphibiancapital.com

🗞️ This Week in Crypto: The Top News

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

A New U.S. Senate Proposal Would Give CFTC Responsibility for Bitcoin & Ethereum, Classifying Both as Commodities: A bipartisan proposal from the Senate would clarify agency oversight of the two largest cryptocurrencies to the CFTC, which already supervises futures trading for BTC and ETH. The bill has been proposed by Senators Debbie Stabenow (D-MI), John Boozman (R-AK), Cory Booker (D-NJ) and John Thune (R-SD).

🪑 Michael Saylor to Step Down as CEO of MicroStrategy and Become Executive Chairman - Michael Saylor will assume the new role of Executive Chairman and Phong Le, the Company’s President, will also serve as the Company’s new Chief Executive Officer and as a member of the Board of Directors. Mr. Saylor will remain the Chairman of the Board of Directors, an executive officer of the Company, and controlling shareholder of 67.8% of the vote due to his 10x voting rights.💰 Tether Says That It Holds No Chinese Commercial Paper: Stablecoin issuer Tether said today that it holds no Chinese commercial paper, the first time it has made this statement, indicating they are working to further strengthen the safety of their reserve-backed stablecoin. You can see Tether’s USD reserves breakdown here.

👮♂️ SEC Slaps Founders, Promoters of Alleged Ponzi Scheme Forsage With Fraud Charges: The U.S. Securities and Exchange Commission charged 11 people tied to the alleged $300 million crypto Ponzi scheme Forsage with fraud on Monday.

😢 Nomad Token Bridge Raided for $190M in ’Frenzied Free-for-All: ‘Security-first’ token bridge Nomad accidentally allowed anyone to submit illicit transactions; 41 hackers took advantage for $190M.

Solana Hot Wallets Raided for $8M & Growing: So Far Over 8,000 individual wallets on Solana have been raided this week after their seed phrases were somehow discovered.

✨ Solana Spaces Store To Bring 100K People to Solana per Month, Says CEO: Solana Spaces CEO Vibhu Norby said the new physical Solana stores will introduce up to 100,000 people per month to the Solana ecosystem while also signaling plans to open a virtual storefront in the near future.

🔥 Meta Metaverse Unit Has Lost $5.7B This Year: Meta and its CEO Mark Zuckerberg might be bullish on the metaverse, but their pivot into virtual reality has so far weighed heavily on its balance sheet.

🇨🇴 Colombia Enlists Ripple Labs To Put Land Deeds on Blockchain - Colombia’s government has launched a partnership with Ripple Labs, the company behind the cryptocurrency XRP, to put land titles on the blockchain, part of a plan to rectify land distribution efforts

🤭 Celsius Reveals Customer Data Breach by Vendor’s Employee: Embattled crypto lender Celsius Network has revealed via email that some of its customers’ data were breached by an employee of Customer.io.

💸 Binance Taps Co-Founder Yi He to Head $7.5B Venture Arm: Binance Labs announced a new $500 million fund to invest in Web3 and blockchain projects and has tapped Binance co-founder and CMO Yi He to head up the venture arm.

💬 Tweet of the Week

Investing in Crypto Quant Funds: Designing a Fund for Bull & Bear Markets

By: Ryan Allis, Publisher of Coinstack & General Partner of Amphibian Capital

Summary: Three friends of mine have launched a crypto quant fund of funds called Amphibian Capital. This article is about their process of researching over 250 crypto hedge funds, vetting over 50, and selecting the 13 best with an eye toward optimizing returns in both bull and bear markets -- and (big news!) about my process in deciding to join them as a General Partner this month.

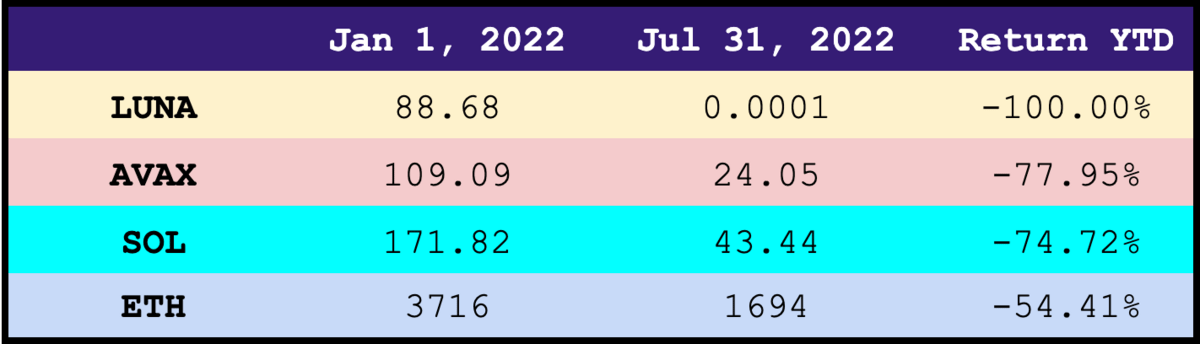

There’s little doubt it’s been a challenging year for many crypto funds. Many crypto token funds are down big after the darlings of 2021 like LUNA, SOL, AVAX, and ETH took big hits in the first half of this year.

However, there is one big exception to the parade of losses so far in 2022.

It’s a search that I got obsessed with in May 2022 after the UST/Luna debacle. Could I find a fund that thrived during this turbulent time?

What I learned is that there are certain type of crypto quant funds that use machine learning and algorithms to trade digital assets bi-directionally, taking both long and short positions based on their models.

Many of these funds actually made money while the market was crashing in May and June. And a select few of these funds have had spectacular years so far, benefiting from the exceptional volatility of 2022. I know, because I’ve seen their fact sheets.

I’m going to be writing below about these crypto quant funds -- and a new fund of funds that my friends David Langer, James Hodges, and Todd Bendell have launched called Amphibian Capital, a firm I am joining as General Partner this month that identifies and invests in a portfolio of these best performing crypto quant funds.

These “quant funds” trade digital assets using code -- and if their algorithms are properly tuned, can generate positive returns regardless of the directionality of the market.

If you’re an accredited investor or institutional allocator and are interested in this topic, join us tomorrow for our webinar: “Investing in Crypto Quant Funds”

The Challenge of Identifying & Selecting The Best Crypto Quant Funds

How to identify, research, and vet these funds is what we will look at first.

For institutional allocators and high-net worth investors, it’s a big challenge knowing which funds to invest in.

There are over 150 crypto quant funds, and more are being created every quarter. It’s a full-time research job (and then some) to build a relationship and then track the fact sheets and returns for all of them.

Even if you had a full research team and did know which funds were doing well in various market environments, getting access to those funds is difficult, some of which require minimum investments of $5M and have caps on the maximum number of investors.

So, if you don’t have time to vet and allocate across many funds or you don’t have $5M to hit a fund minimum, it can be difficult to build a diversified portfolio of the best crypto quant funds in the world.

That is, until now.

A Fund That Combines Multiple Crypto Quant Funds Into One Investment

When a fund invests in other funds primarily, it is called a “fund of funds.”

About a year ago, three friends of mine David Langer, James Hodges, and Todd Bendall of Amphibian Capital set out to build a crypto quant fund of funds that would:

Research, vet, and track all the crypto quant funds in the world that could be invested into

Invest in a diversified portfolio of the best-performing crypto funds

Allow investors to make one single investment that gave them access to all the underlying funds

Amphibian also brought on a very experienced team from Chainlink Capital to help them structure and set up the fund. Collectively the team has experience managing over $6B in AUM.

The first thing the team had to do was to canvas the market and get introduced to as many crypto quant funds as possible.

Over the last year, Amphibian researched over 150 crypto quant funds, vetted over 50, and identified the best performing 13 of these funds using a proprietary system of metrics that looks at returns, drawdowns, Sharpe ratio, % of winning months, size, and liquidity.

Once they had all the data, they inputted into their model and selected their funds and made their first allocations on July 1, 2022. Today, their fund has $23M in AUM and is officially open for accredited investors and institutional allocators who want exposure.

It was actually very helpful that there was a major market downturn in May-June 2022, as that helped Amphibian see which funds perform well in all market conditions -- not just when prices are going up.

With 13 underlying funds currently (rolled up into one investment), each crypto fund they’ve allocated to represents between 2% and 14% of the overall fund of funds portfolio, depending on size constraints, liquidity, and performance. So even if one fund does have a bad month (which does happen), the other funds can make up for it if they perform well.

The result of their analysis and fund of funds structure is a diversified portfolio of some of the top crypto quant funds -- and a historical portfolio that has had only one down month going back to January 2019.

The Results of The Selected Funds (2019-2022)

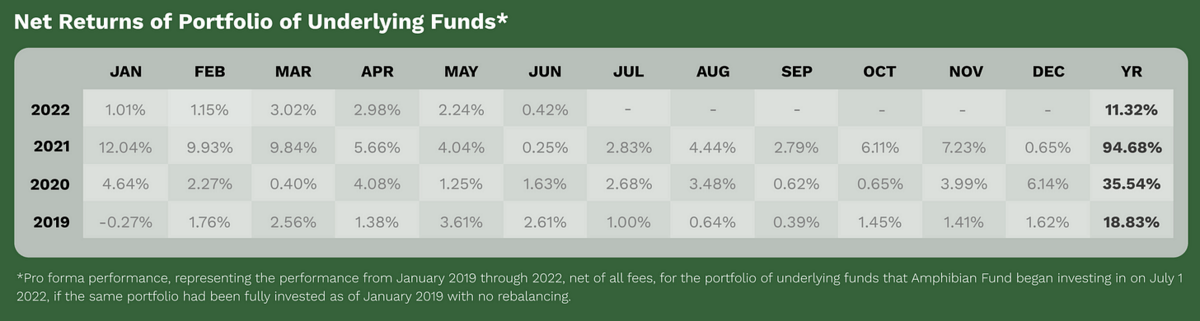

Amphibian launched their fund on July 1, 2022 and so far manage about $23M AUM and growing. You can see the track record of their underlying funds below.

It’s important to note this track record below is prior to their fund starting up last month, and so the return data is from the results of the underlying funds Amphibian has selected, net of all fees. It’s also important to note that not all their selected funds even existed back in 2019, so the funds get added to the historical record only once they launch.

Gathering all the data going back four years for all the available funds was an essential part of their portfolio construction in selecting both the funds as well as the amounts per fund.

So how did their selected funds do?

Since January 2019, Amphibian’s pro forma portfolio of underlying crypto quant funds had an average monthly return of 3.02% and only one down month. The worst month was -0.27% (Jan 2019) and the best month was +12.04% (Jan 2021).

These returns above show pro forma performance, representing the average annualized performance from January 2019 through 2022, net of all fees, for the portfolio of underlying funds that Amphibian’s Fund of Funds began investing in on July 1 2022, if the same portfolio had been fully invested as of January 2019 with no rebalancing.

For 1H 2022, Amphibian’s portfolio of underlying funds was up +11.32% net, while BTC was down -59.68% in the same period and the DJIA was down 15.01%.

This outperformance was very interesting to me, especially in the chaotic environment of May and June when the market was down big yet the Amphibian portfolio was up.

Amphibian’s selected funds compare very well against both DJIA and Bitcoin’s performance for all of 2021 and the first half of 2022.

Amphibian’s portfolio of selected crypto funds outperformed the DJIA and BTC (by a lot) in both the bull market of 2021 and the bear market of 2022.

In the last 18 months (Jan 2021-June 2022), Amphibian’s optimized portfolio of underlying funds is up by 116.72% (net after all fees) while BTC is down 36.44% overall and the DJIA is up less than 1%.

Over a longer time period (since Jan 2019), you can see below that the DJIA has had a total compounded return of 32.4% from Jan 2019 - June 2022 (3.5 years), while Amphibian’s underlying funds had a total return, after all fees, of 249%.

Making Money in Various Market Conditions. Can it Be Done?

So, how was this all achieved?

Many of Amphibian’s underlying funds use a variety of strategies that are bi-directional -- they make money going up, sideways, and down. The strategies of the crypto funds they’ve invested in include:

Market marking

OTC trading

Arbitrage

DEX liquidity provision

Systematic machine learning

Algorithmic trading

While their underlying funds have historically performed better during bull markets, they have also earned positive returns even in the worst of crypto markets like May/June 2022, when UST, 3AC, and Celsius blew up.

If Amphibian’s underlying funds are up +11.32% net in the harrowing conditions of 1H 2022 while many other crypto funds are down more than 50%, it’s exciting to see what may be possible when the bull market fully returns as we close in on the ETH merge and the April 2024 BTC halving.

Any accredited investor can invest in Amphibian’s fund of funds--a balanced portfolio of these selected top crypto quant funds in the world--with one investment and with a minimum investment of $250k. They currently have both a U.S.-based fund and a BVI fund for international investors -- and they have a USD fund and an ETH fund.

Where did the unusual name come from? Amphibians are all-environment animals that can thrive on land or in water. The memorable name, Amphibian Capital, is meant to indicate the potential to thrive in all market environments.

While past results, no matter how long, can never guarantee the future, they do allow for thoughtful portfolio construction designed to provide diversified exposure to a basket of the top-performing crypto quant funds.

As always, never invest in something without doing your full due diligence and reviewing the full confidential private placement memorandum and other materials to make a proper decision based on all the risks.

We shall see if a fund like this can identify and find the crypto version of the famed Renaissance Technologies, whose Medallion Fund averaged a best-of-class 39% net return in the thirty year period from 1988-2018. That is certainly the holy grail that many crypto quant fund managers are working toward.

Joining Amphibian as a General Partner

I’ve been building Coinstack since December 2020. We’re now up to over 45,000 subscribers, have one of the best read weekly institutional crypto newsletters, and are fortunate to have built a nice little business -- with solid sponsors like FTX, Peer, and now Amphibian Capital.

I first heard about Amphibian in May and after spending two months diligencing them myself, I was impressed -- by both their model, the fund selection, and the team.

I was so impressed, that as of this month I’ve become a General Partner in Amphibian Capital and they have signed on as a long term Coinstack partner. So if you are an accredited investor or institutional allocator and have any questions about them, I’m happy to answer them and guide you. You can book a call with me here to discuss further.

We’ll be putting on a webinar tomorrow August 4th sharing more about them and crypto quant funds in general.

If you’d like to learn more about Amphibian Capital, please join our upcoming webinar this Thursday for accredited investors and institutional allocators. You can also learn more at www.amphibiancapital.com.

Webinar: Investing in Crypto Quant Funds

We will be hosting a free webinar this Thursday on investing in crypto quant funds where will be giving an overview of the space and talking about Amphibian Capital’s crypto quant fund of funds model. You can learn more and register here.

This webinar is tailored to high net worth individuals, portfolio managers, institutions, family offices, and RIAs who would like to learn more about vetting, selecting, and investing in crypto quant funds.Thursday, August 4, 202212pm PT / 3pm ET / 7pm GMT55 minutes on Zoom / register herePresented by Ryan Allis, Publisher of Coinstack and GP at Amphibian Capital

What You Will Learn

The four types of crypto quant funds

The primary trading strategies of crypto quant funds including market marking, liquidity provision, OTC trading, arbitrage, systematic machine learning, and algorithmic trading

How Amphibian researched 150+ crypto quant funds, selecting the 13 best for its fund of funds

How the portfolio of selected funds performed in 2019-2022

How Amphibian achieved +94.6% in '21 and +11.3% YTD in '22 even in a bear market

How accredited investors and institutional investors can invest in their crypto quant fund of funds

How the fund of funds model mitigates risk

Requirements

For institutional investors and accredited investors

For portfolio managers inside hedge funds, private equity firms, or family offices

For financial advisors advising HNWIs

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Ethereum Creates History With ETH Options Interest Exceeding Bitcoin by 32% Ahead of the Merge

2. Solana Daily Active Addresses Are Sitting Just Under 800k Currently. The 7D Moving Average Is Highest of Any Chain Right Now.

3. Ethereum Leads Price Performance Across Risk Assets Since June 16

4. Cryptoassets Have Now Recovered 40% From June Lows Following Last Week, the Federal Reserve Increasing Rates by 75 BPS

5. Up to 80% of Transactions Are Now Consistent With the New EIP-1559 Transaction Type, Positioning Ethereum for Potential Negative Net Issuance After Merge

6. The Number of Unique Fee Payers Has Been Steadily Climbing on Solana

7. Despite the Bear Market There Was More Invested in H1 2022 Than All of 2021. Over $30B.

8. The Fed Is No Longer Taking Baby Steps To Rein In Inflation. Today, With America’s Consumer-Price Index Running at More Than 9%

9. ENS Continues Strong Momentum in July with 378k New .ETH Registrations

✨ Peer: Introducing the Initial Coin Exchange (ICX) - A New Method for Blockchain-Based Capital Raising - Part 1

About the Author: Peer is a Web3 social network and blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc. You can read the full Peer ICX whitepaper here.

Whitepaper Abstract

This whitepaper discusses the Initial Coin Exchange (ICX), a newly defined protocol for enabling established and vetted blockchain-based companies and DAOs to raise funding via selling digital assets and tokens.

The ICX presents an improved format to the Initial Coin Offering (ICO), adding substantial vetting and stage requirements to enable investors to identify quality projects, while enabling blockchain-based companies to access capital markets and fund the development and growth of their platforms and protocols.

The ICX process allows companies with established products to raise money, while working to protect against lower quality or riskier early-stage token offerings through a vetting process, a substantial innovation in capital raising. Companies must already have an operable product on a launched blockchain, significant IP, and a token or coin with existing utility to list and access the ICX market, removing many of the lower quality offerings or outright scams.

The ICX provides a framework for an evidence-based fundraising standard for established blockchains and decentralized apps that promotes responsible innovation, global participation, regulatory compliance, and rapid validation. Companies win with easier access to capital, and investors win with easier vetting of quality projects. The ICX process was first defined and created by Seattle-based Peer, Inc. in June 2022.

Peer's Initial Coin Exchange is intended to establish a truly global standard to qualify and quantify viable projects. It will serve as a new key performance indicator for innovation and allow other established projects to issue tokens.

Part 1: The Origins of Technology Capital Allocation

Private capital raising goes back to at least 1600 when the first British corporation, The East India Tea Company, was formed to share the risk of the shipping trade among many so that no individual was ruined if a ship was lost at sea in an otherwise profitable and societally important endeavor.

Fast forward three centuries to post-WWII America, and a new format of capital raising for high technology companies was emerging.

In the 1950s, Silicon Valley was primarily the farmlands and rolling hills between San Francisco and San Jose, California. Then in the late 1950s came Fairchild Semiconductor, founded in 1957 by Arthur Rock and Sherman Fairchild. Sherman Fairchild was a brilliant engineer who had left Shockley Semiconductor to find something new, while Arthur Rock was a recently minted Harvard MBA graduate.

Arthur would later go on to contribute to inventing the venture capital industry, invest in Intel and Apple, and help found the famous Sand Hill Road next to Stanford’s campus. Soon after, some of the top venture capital firms formed there, beginning with Kleiner Perkins and Sequoia Capital in 1972.

"It was a different era; there was really no one putting together money to go into high technology. Even the term 'venture capital' was unknown until 1965. I think I was the first one to use it. I can't remember anyone using it before that." - Arthur Rock, one of the early Venture Capitalists.

The Venture Capital Model

These early venture capital funds pioneered a new model of allocating early-stage capital to technology companies taking advantage of the boom in microprocessors, PCs, and software. These firms would buy early-stage shares in Series A and Series B offerings to provide capital for research and development costs, often when these companies were quite risky ventures pre-launch.

The methodology for sharing risk among many actors and directing capital infusions into promising early-stage risky ventures has continued to evolve. Fifty years later, in 2022, there are many new ways that early-stage companies are raising capital, from crowdfunding on sites like Republic and StartEngine to early product launches on KickStarter, to offering tokens for blockchain startups.

While technology companies have disrupted industries over the last five decades, a revolution in the funding of early-stage tech startups was also brewing. The 1970-2015 process for funding technology startups was usually something like:

A Lack of Access for Companies & Regular Investors

The issue with this old way of funding was that companies outside of traditional high-tech epicenters couldn’t access capital, and regular people couldn’t legally purchase the stock of early-stage private companies, keeping them out of the best opportunities.

Ever since the U.S. Securities Exchange Act of 1934, the general public has been expressly forbidden from investing in private company stock unless they met a certain income threshold to be an accredited investor, which today is $200K per year as an individual or $300k per year with a spouse.

Regular people couldn’t invest in Facebook when it launched in 2004, for example, as only accredited investors can invest in pre-public stock. Non-accredited investors, which make up 91.75% of Americans as of 2022, had to wait until the IPO in 2012 after much of the value was already created. While the goal of preventing the public from scams and risky companies was achieved, this also prevented the large majority of Americans from being able to invest in early-stage companies.

A New Model: Crowdfunding and Token Sales

A new model for early-stage technology companies accessing capital markets was needed. Some new hope came with the U.S. JOBS Act of 2012, which allowed regular people to invest in smaller early-stage companies as long as those companies filed the right paperwork using Regulation CF (for up to $5M) or Regulation A+ (for $5M+).

Companies like StartEngine and Republic made this type of crowdfunding accessible. Another option for blockchain-related technology companies, starting around 2013 was to issue and sell tokens directly or via SAFT’s (Simple Agreements for Future Tokens). The first company to do this was Mastercoin which raised 4,740 BTC, which at the time was worth $500,000 and today is worth around $100 million.

With crowdfunding and ICOs, brand-new ways of accessing capital arose. The new method for funding technology startups, at least blockchain-related ones, might look more like:

With early-stage token offerings now commonly taking the place of equity rounds and many venture funds willing to directly purchase tokens with lockup schedules, a new format is emerging for allocating capital efficiently into blockchain-related technology companies.

Blockchain companies will often sell their early tokens with lockups to specialized crypto venture capital funds (like A16Z, Multicoin, and Polychain) and commonly offer the tokens to the public directly via Initial Coin Offerings (ICOs) and classify these tokens as utility tokens or governance tokens.

With this new fundraising method, everyday people can access early technology investment opportunities, bringing substantial risk and potential reward.

With new Congressional legislation pending in the United States called the Responsible Financial Innovation Act (RFIA) that will classify most digital asset tokens as commodities under the purview of the CFTC, we may see an explosion in the sale of these tokens as a method of providing early stage capital to blockchain-based technology companies and DAOs.

While many ICOs have succeeded, others have turned out to be outright frauds, scams, or simply poor investments, primarily because there isn’t much vetting, if any at all, for ICOs and their newer cousins, the Initial Exchange Offering (IEO) and Initial DEX Offering (IDO).

The Solution: The Initial Coin Exchange (ICX)

This whitepaper is about the Initial Coin Exchange (ICX), an improved format to the ICO that adds substantial vetting and stage requirements to enable those investing to identify what is a quality project that is worth their investment dollars. The ICX model democratizes access to the funding of innovation. Companies win with easier access to capital, and investors win with easier vetting of quality projects. In the next section of this paper, we will lay out the history of ICOs, IEOs, and IDOs, and then discuss the parameters and procedure for listing via an Initial Coin Exchange (ICX).

We will continue to share parts 2-5 of this whitepaper in the coming weeks.

About the Author: Peer is a Web3 social network and blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc. You can view the full Peer ICX whitepaper here.

🧵 Thread of the Week - 3AC’s Insolvency Latest Update

Vitamin of the Week: What Are L2s?

About this Section: Our friends at Vitamin3 have launched a free daily SMS covering web3 topics. You can subscribe free by sending HELLO to 305-614-9440. Here’s an excerpt from their SMS earlier this week on the Metaverse.

(1/4) Yesterday, we said Layer 2's will help Ethereum scale. What are Layer 2's and how do they help? Layer 2's ("L2's" or "roll-ups") are blockchains built on top of Ethereum that bundle hundreds of transactions together into a single transaction that is then posted to Ethereum (the "Layer 1" or "L1"). Thus, Ethereum can process many transactions simultaneously, instead of one at a time.

(2/4) And they already exist! They're still early, but Optimism, Starkware and more are already live. There are 2 main categories - Optimistic and Zero-knowledge (ZK). Very high level: Optimistic roll-ups assume each transaction is valid & have a time period to report fraud; ZK roll-ups use cryptography, compress transactions off-chain and batch them together. Both provide scale for Ethereum.

(3/4) Together, sharding & Layer 2's are estimated to help Ethereum process ~100,000 transactions per second ("TPS") - almost 1000x vs. Ethereum today & 4x Visa's 24,000 TPS. If successful, Ethereum's roadmap will be the largest update of a functioning blockchain in the industry's history - an impressive technological, environmental & financial feat. (But it also might face issues along the way!)

(4/4) Let's end with our recap: Ethereum needs to scale, because its processing time is slow and transaction fees are high. Ethereum's switch from PoW to PoS ("the Merge") will reduce energy consumption by 99% but won't increase speed or lower gas fees. Dividing the blockchain into smaller chunks ("sharding") and Layer 2's will enable Ethereum to scale to ~100,000 TPS, which is ~4x Visa's TPS.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Bankless is a media publication exploring the frontier of internet money and finance. They cover how to get started, how to get better, and how to front run the opportunity in the cryptocurrency markets. This is an excerpt from the full article, which you can find here

5 Things DAOs Need to Do to Fix Defi Tokens

In order to fix DeFi tokens… we must first fix DAO governance.

1. Run the DAO Like a Business

DAOs aren’t magically immune from the laws of economics.

They must take in more value than they expend.

Corporate governance is a tried and true science. Just because it has the word “corporate” in the name doesn’t mean it’s evil or antithetical to what we’re doing here in DeFi.

Good DAOs will apply the lessons of corporate governance structures to their own organization while also being cognizant of the aspects that are meant to leave behind in TradFi. They will think critically about how to map corporate governance onto this new decentralized form factor: DAOs.

And then they will execute on it.

DeFi tokens that represent their respective DAOs will go up or down based on the value that flows into or out of the DAO.

Sure, Uniswap...it’s great that you’re directing $9M daily in fees.

So let’s start putting some of that into the DAO treasury and funding sustainable compensation for DAO growth.

$9M per day is ~$3.3B per year. If Uniswap charged just a 1% fee on its LPs, it would earn $33M in yearly revenue for the DAO and its contributors, going from cash-flow negative to positive.

However, this doesn’t just mean that DAOs need to turn on their fee switches. It also means they need to become far more judicial with their expenses. There’s no point in pouring water into a leaky bucket!

All DAOs have a PnL (profit and loss), and the health of that PnL needs to be considered! The profit mechanism is a market test of whether the product is of value to consumers. Without that test, we don’t know if it holds up against market forces.

This is no longer 2021, where we could print billion-dollar treasuries whenever we feel like it.

This is 2022. Interest rates are high, and money is tough.

Won’t anyone consider the PnL? 😭

2. Define a Constitution

All DAOs need to write a constitution.

This constitution should instantiate the purpose and vision of the DAO. It should codify the core values and high-level strategy of the organization. It should be used as a document to refer back to and reference when making decisions in the DAO.

Having a clearly defined constitution for what a DAO is, what it’s here to do, and how it’s going to do it will help eliminate redundant and unhelpful conversations in DAO discourse.

If the members of a DAO cannot agree on what its mission is, then different parties in a DAO will engage in rent-seeking efforts to try and pull in the direction that they see as best. These efforts will often be antagonistic to other parts of the DAO and, therefore will soon come into conflict rather than working towards a common vision.

Organizations need to move together as a unit!

But without a defined goal, no one knows where we’re going!

Blindly into the night, they go, funding random things along the way.

3. Stop Having Global Token Votes

Governance decisions impart a huge cost to the DAO.

Every time there is a governance decision, it’s crucial that the DAO carefully consider it in order to produce the correct outcome. Good business management means making good business decisions!

DAOs should optimize for having 100% hit rates to make the correct decision.

The easiest way to do this? Make fewer decisions - especially only on the ones that matter.

Each decision should be carefully considered, analyzed, and debated. Therefore, the kinds of decisions that go to a global token vote need to be only the most crucial ones, ones that cannot be decided alone by smaller sub-components of the DAO.

Global token votes are only for decisions that affect the DAO in its entirety.

Global token votes should be considered the “Supreme Court of the DAO”. Good DAO decision-making processes should have 99% of decisions decided upon before being elevated to the highest level of DAO decision-making.

SubDAOs are critical for this. The engineering department doesn’t make marketing decisions, and marketing doesn’t make product decisions.

SubDAOs need to be enabled to make decisions independently without having to ask the broader DAO for permission. Any organization that forces all departments to ask for permission to do things is simply NGMI.

Asking for forgiveness runs circles around asking for permission.

A simple addition to this makes this very crypto-economically awesome: All subDAO decisions can be vetoed by a global token vote. This gives the entire organization the power to say no to an errant subDAO decision but doesn’t require the organization to be analyzing every single decision of every single corner of the DAO.

Remember: when people are making governance decisions, they’re not doing work.

The goal is to do work.

About the Author: Bankless is a media publication exploring the frontier of internet money and finance. They cover how to get started, how to get better, and how to front run the opportunity in the cryptocurrency markets. This is an excerpt from the full article, which you can find here

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

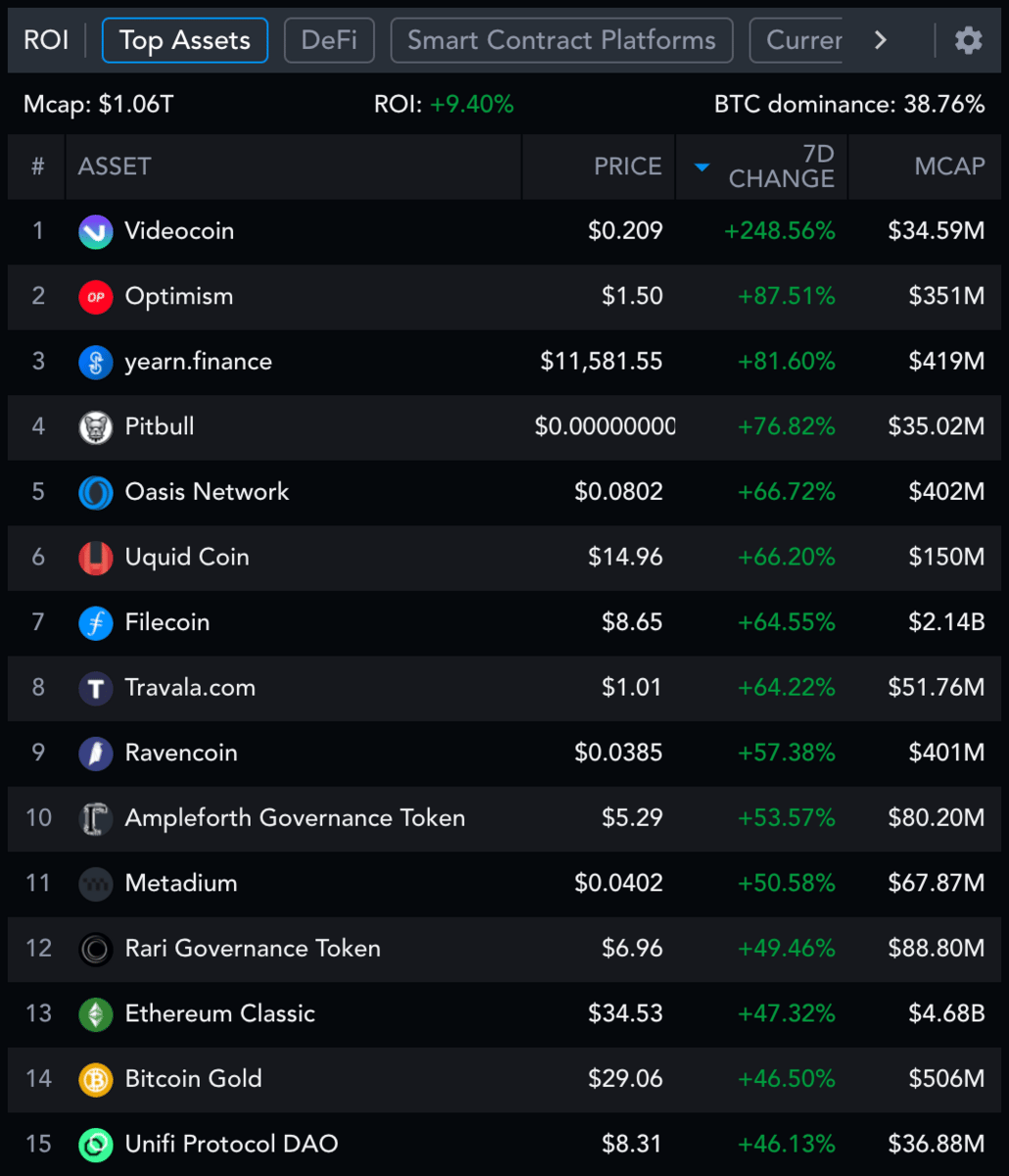

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: BarnBridge is a Derivatives Protocol, Videocoin is content network, Optimism is an L2, Tellor is an Oracle

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 28,087 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the most recent episodes:

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.