Issue summary: After a 10% pullback on Tuesday, the crypto bull market structure remains intact as we prepare for a major Fall 2021 run-up over the next 100 days. Coinstack Analyst Mike Gavela writes about how the market is absorbing sell-side pressure after Tuesday’s volatility. We also recap the top weekly happenings in crypto.

In This Week’s Issue:

Latest Crypto Market Forecast

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

📈 Top 10 Performers

🎧 Best Podcasts

🚀 Coin Of The Week - Solana Up 299% in 30 Days

On-Chain Analysis by Mike Gavela - Market Absorbing Sell-Side Pressure

The Coinstack Alpha Fund - Up 9.99% in 30D

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Wednesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

📈 Latest Crypto Market Forecast

It’s almost Fall 2021 -- the time we’ve all been waiting for. We expect the next 100 days to be exceptionally active. Based on on-chain analytics and the amount of capital coming into the space from institutional investors, crypto markets appear headed toward a double market peak as we first predicted July 5. We expect to see new all-time highs in October or November for both Bitcoin and Ethereum. While things could always change, we expect to see $80k+ BTC and $6k+ ETH by the end of 2021.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚡ Crypto Flash Crash Wipes Out $400 Billion In Market Value On Bitcoin Day Before El Salvador’s President ‘Buys The Dip’ - The steep sell-off on Tuesday came less than one day after JPMorgan analysts warned in a note to clients that recently rallying altcoins—or cryptocurrency alternatives to bitcoin and ether—reflected "froth and retail investor mania," as opposed to sustainable gains for the market. (Source)

😮 SEC Investigates Decentralized Exchange Uniswap - The U.S. securities regulator had initiated a probe into Uniswap’s main developer, Uniswap Labs. Enforcement attorneys are seeking information about Uniswap’s marketing and investor services. (Source)

💰 US: SEC Refuses Ripple’s Request To Disclose Employees’ XRP, BTC Holdings - The U.S. Securities and Exchange Commission (SEC) has declined to produce documentation regarding its “trading preclearance decisions” for XRP, BTC, and ETH. It has also refused to provide any documentation regarding the XRP holdings of its employees. (Source)

🤑 Bitcoin Now Legal Tender in El Salvador - Bitcoin is now officially a legal tender in El Salvador, three months after the Bitcoin Law passed the country’s legislature. (Source)

🏦 Project Giant: Nigeria’s CBDC Set for Pilot Rollout on Oct 1 - Nigeria’s central bank digital currency will go into pilot testing on Oct. 1 with a tiered AML/KYC regime for the eNaira. (Source)

🇧🇷 Visa Reportedly Aims To Integrate Bitcoin Payments in Brazil -Visa Brazil executive outlines plans for implementing crypto-assets such as Bitcoin onto the payments platform. (Source)

📈 Crypto Community Advises NBA Star Steph Curry First Steps in Crypto - Steph Curry, the star NBA player for the Golden State Warriors, took to Twitter asking for advice as a crypto newcomer. (Source)

🎆 $1 Billion Now Locked Up in Ethereum Layer 2 Scaling Solutions - Second-layer scaling solutions designed to counteract network congestion on Ethereum are booming, with over $1 billion locked up in scaling protocols, according to layer two ecosystem tracker L2Beat. (Source)

🏧 Panama Introduces Bill To Recognize Crypto for Payments - Following in El Salvador’s footsteps, Panama is introducing a bill to legalize and regulate the use of cryptocurrencies for civil and commercial purposes. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Ethereum Is Now the 21st Most Valuable Asset in the World and Worth More Than Mastercard, Home Depot, & Proctor and Gamble

2. Bull Market Remains Intact Despite $4B in Liquidations

3. L2’s Loopring, Hermes, and ZKSync Continue To Cut Transfer Costs for ETH

4. Current ETH Burn Rate Sits at 2.5M ETH/Yr (~$8.5B USD per Year)

5. Ethereum Is Now Inside a Resistance Zone Formed by Its Prior All-Time High in May

6. During Tuesday’s Flash Crash, Volumes on DEXes Rocketed Up to Over $2B USD During the First 4 Hours of Volatility.

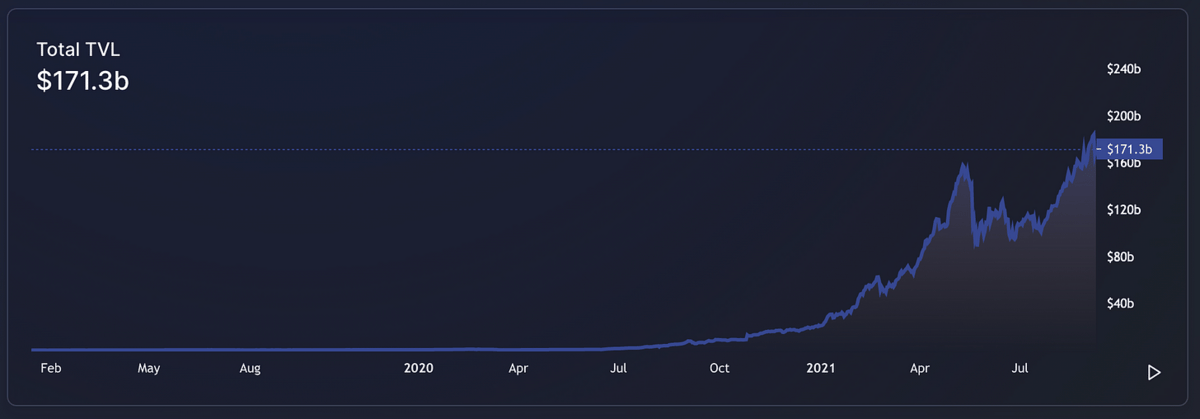

7. TVL in DeFi Sets New Record Above $170bn As The Future of Global Finance Settles on Open Source Software & Distributed Ledgers

8. Ethereum Daily Revenues Nearing New All-Time Highs Even As L2s Scale and Avalanche, Solana, and Fantom get Traction

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. Standard Chartered Says Ethereum Could Hit $35,000 in 2022

Standard Chartered, one of the largest banks in Britain, is more bullish on Ethereum than Bitcoin in its first crypto report. Geoff Kendrick, Head of Crypto Research at Standard Chartered, values Ethereum within $26k - $35k and for BTC at $175k. Geoff says that Ethereum could be thought of as a “financial market” as it enables users to trade and earn yield with their digital assets, among many other services.

“The DeFi industry remains heavily reliant on the Ethereum blockchain, cementing ETH’s status as a digital asset required to power transactions on its network. As the number of applications on top of the network continues to grow, so do the number of transactions and the amount of capital flowing through the ecosystem. The price of ETH is likely to continue to derive support from its role in processing these transactions.”

2. Today, Bitcoin Becomes Legal Tender in El Salvador

The team at Arcane Research published their latest weekly report highlighting the benefits and challenges El Salvador now faces with Bitcoin as legal tender.

“The legal tender decision has been a hotly debated topic within El Salvador and outside the country. The IMF has raised concerns, and within the country, there have been protests against the bill. Some polls ran within El Salvador suggest that many El Salvadorians are skeptical towards bitcoin and the bill and have little knowledge about bitcoin.

Nevertheless, through the Chivo app, El Salvador will give away $30 to every registered El Salvadorian user to incentivize usage. Assuming the entire adult population of more than 4 million El Salvadorians register on Chivo and receive BTC worth $30, this will translate to 2366 BTC paid out to Salvadorans.”

3. Improving Sentiment for Bitcoin As Flows Turn Positive

James Butterfill from Coinshares details in the firm’s latest report that digital asset investment products saw inflows totaling US$98m last week. For the third consecutive week, institutional inflows totaling US$140m suggest improving investor sentiment.

“Ethereum saw a third week of inflows totaling US$14.4m, while market share is at a record 28%, highlighting that while some investors have protocol concerns, its dominance is continuing to rise. Other altcoins, such as Cardano, Polkadot, and Ripple, all saw notable inflows of US$6.5m, US$2.7m, and US$1.2m, respectively.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top 10 Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like FTM, FTT, and SOL had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Fantom and Solana are L1 blockchains. Revain is a blockchain-based review platform, and Arweave is a decentralized data storage app.

🚀 Coin Of The Week

We write about a new token each week to help spread the word about new and upcoming projects. As always, investing in early-stage crypto projects is particularly risky with the opportunity for major gains and major losses.

Coin: SolanaSymbol: SOLPrice: $182.71Available On: Binance, Coinbase, FTXFully Diluted Market Cap: $91BPrice Change Last 30 Days: +299%Coin Ranking: #7 by Market Cap

Background:Solana is a web-scale blockchain that provides fast, secure, scalable, decentralized apps and marketplaces. The system currently supports 50,000 TPS (Transactions per second) and 400ms Block Times. The overarching goal of the Solana software is to demonstrate that there is a possible set of software algorithms using the combination to create a blockchain. (Source)

Tokenomics:The network’s Proof of History (PoH) consensus algorithm is used primarily to ensure node synchrony instead of being used directly for consensus. It runs in parallel with its PoS layer. They allow nodes to create their timestamps, with the leader of each node sequencing messages while others process transactions. Once transactions are sequenced and received from the leader node, the validators/replicators then settle the transactions and publish their signatures as soon as they have confirmation. (Source)

Why It’s Pumping:Solana raised $314M in a funding round led by Andreessen Horowitz back in June to build out their DeFi ecosystem. Today, Solana continues to rise as the fourth biggest protocol with $6.18B in TVL. There are now dozens of new applications built on Solana that mirror the traditional blue-chip Dapps, such as Aave, Curve, and UniSwap. NFT Mania has also spilled over to this L1 attracting users who seek lower transaction and minting costs. Lastly, institutional demand peaked with Osprey Funds registering with the U.S. securities regulators for the first private SOL investment vehicle in the U.S.

📰 On-Chain Analysis: Sideways Momentum While Market Continues Absorbing Sell-Side PressureBy Mike Gavela

The crypto market saw significant gains over Labor Day weekend with Bitcoin breaking through the $50k price level and Ethereum pushing itself up into the $4k range. Both cryptocurrencies are showing fundamental strength on-chain after establishing a new cost basis over the past few weeks. On-chain we can see that this is indeed a healthy and sustainable rally as prices continue appreciating -- even after a 10% pullback on Tuesday.

Using URPD (UTXO Realized Price Distribution), we can see that we've essentially reached a Resistance Zone at the $52k price level, with roughly only 2% of total UTXOs making up the tranche. Keep in mind that the purpose of URPD is to see all of the UTXOs on the Bitcoin network visually. It's essentially showing us the cost basis for all investors, which allows us to see market sentiment by visualizing at what price level coins were purchased and held. A Floor Price of $40k has been established by Smart Money HODLers, who repurchased the dip in late July at the $30k price level and are now realizing profits by selling their coins and buying back inside the Accumulation Zone between the $45k - $50k price level.

Now, let's look at the leverage side of the equation to see the market's overall health.

Notice how sharp we start to climb in Futures Open Interest. The above charts use a 7-day simple moving average to illustrate the significant upward climb for both assets. The market is starting to accumulate a high level of leverage, especially with Ethereum matching its perpetual futures open interest surpassing the previous ATH, hitting $7.8B. The good news about this leverage is that it is all following long positions, as shown in Futures Perpetual Funding Rate for BTC and ETH.

Glassnode’s, The Week On-chain (Week 36, 2021) makes the following assertions based on the current funding rates for ETH.

“Funding rates for ETH futures have similarly accelerated higher, reaching 0.02%, a level coincident with that seen before the May sell-off. While the supply dynamics in spot markets continue to show strength, caution and awareness are appropriate when high degrees of leverage have entered derivatives markets. The combination of favorable funding rates and high open interest can be an essential indicator set for assessing a shorter-term risk of cascading long liquidations.”

We should be wary of a potential long squeeze given the combination of favorable funding rates and high open interest.

Since late July, we've seen profitability tick up as we move closer to people's cost basis. The chart above shows the percent of supply in profit using a 10 day moving average to illustrate the upward trend we see on-chain with 98% of ETH's circulating supply in profit and BTC having 87% of its investor's also in profit.

Takeaway:It is safe to say that the market is absorbing sell-side pressure. Coins at a profit are moving up to a higher price level, and they're realizing a profit while investors are buying those coins and absorbing the supply flow. That is why we're trading sideways now in the $45k to $50k band; we have an equilibrium of spending to accumulation, which shows sustainable movements higher toward a Fall 2021 new ATH.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 4,017 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 4: ETH, DOT, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

📈 The Coinstack Alpha Fund

In April 2021 we launched The Coinstack Alpha Fund, which is an on-chain fund on top of the Enzyme platform.

You can invest here in the Coinstack Alpha Fund. There is no minimum investment, although there is a gas fee you pay to the Ethereum network to invest -- which has been around $500-$700 recently. Because of this, we recommend minimum investments of $10k.

We are now up to $288k from 33 depositors in the Coinstack Alpha Fund. Enzyme allows deposits with both USDT or ETH. We charge a 2% management fee annually plus 20% of profits. Withdrawals are allowed at any time, although we recommend a 5-10 year hold period for optimal returns.

You can invest directly via your Metamask, Argent, TrustWallet, or any wallet that works with WalletConnect. We don’t hold your funds, Enzyme does. We simply invest them on your behalf. You can learn more about Enzyme here.

Our current portfolio allocation in our fund is:

📞 Join Our Wednesday Crypto Community Zoom Calls

Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call every Wednesday at 12PM PT / 3PM ET / 8pm GMT. All HeartRithm investors, all investors in our Coinstack Alpha Fund on Enzyme and all owners of Mrs. Bubble NFTs are invited to join and ask questions and share learnings with each other. After you invest or buy an NFT, just reach out to us on Telegram (or reply to this email) to get added to the weekly call invite.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.