Issue summary: In this week’s issue, we take a deep dive into Nexus Mutual as the leader in the DeFi insurance space, a critical building block for programmable money. We also summarize and highlight the most important crypto news, stats, and reports.

In This Week’s Issue:

Nexus Mutual & DeFi Insurance Deep Dive - By Mike Gavela & Ryan Allis

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Podcasts

📈 Top 10 Performers

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

🏦 Nexus Mutual DeFi Insurance Deep Dive

By Mike Gavela & Ryan AllisAbout the Authors: Mike Gavela is an analyst with Coinstack and produces our weekly newsletter and podcast. Ryan Allis is a Managing Partner at HeartRithm, a crypto DeFi and quant fund with a big social impact mission as well as the founder of Coinstack.

First, Some History from 2016

The DAO was a digital decentralized autonomous organization to make venture capital investments using the 12.7M Ethereum it raised during its 2016 crowdsale. On June 16, 2016, the DAO was hacked, and the attacker made off with 3.6M Ether, 1/3rd of The DAOs treasury.

Hugh Karp, Nexus Mutual’s founder, watched all of this happen live back in 2016. Karp decided then to use his 15+ years of experience in the insurance industry to develop a solution to protect all crypto investors from smart contract risk.

In this deep dive, we take a look at Nexus Mutual’s founder, the protocol, and its tokenomics to see if the fundamentals of the product align with its valuation and growth potential.

Nexus Mutual’s Founder Background - Hugh Karp

Hugh Karp originates from Australia, where he worked as an actuary for various life insurance companies for about 10 years. He later moved to London, where he worked for Munich Re as their CFO for their life insurance division for another 6yrs in the UK before stepping into crypto full-time.

Karp originally heard of Bitcoin back in 2010 and found the concept of transferring value without an intermediary fascinating. About a year after Ethereum launched, Karp’s interest was piqued once he learned about smart contracts. Karp goes into detail below…

"Once I figured out that you could do an if/then statement, then that means you could make an insurance contract. So how could we make this work? How could we put together a DAO-type structure? This is kind of like what Mutual's are, you know, just Mutual's have existed for millennia. In the end, it is just a group of people sharing risks and coordinating together. Except now, we have tokenomics and DAO structures to coordinate people. With smart contracts, we kind of supercharge that process and can scale it.

So I guess I use my expertise to know how insurance works and map it onto how you could make a kind of DAO running on Ethereum work, and it's in a similar way. These structures exist, and like, you know, using kind of economic incentives to revamp the whole thing, but the fundamental structures of a mutual and a DAO are nothing really, that new. So we are kind of not doing anything new from that point of view.

I've always been fascinated with the social aspects of things and helping people. Towards the end of my time in the insurance industry, it kind of just felt like we were moving money around balance sheets and not actually helping the real person down the end of the line. And so that's kind of what we wanted to do."

Insurance Product Overview

Nexus Mutual is a DAO that provides insurance covers for DeFi users. What makes this mutual unique from traditional insurance companies is that the insurance pool is decentralized. Users will pool their assets in a decentralized and transparent manner, and risk is shared across the pool and the potential rewards. At the moment, Nexus currently offers three different types of covers,

Three Types of DeFi Insurance

If your yield-bearing token de-pegs in value by more than 10%, claim up to 90% of your loss by swapping your yield-bearing token for claim payment.

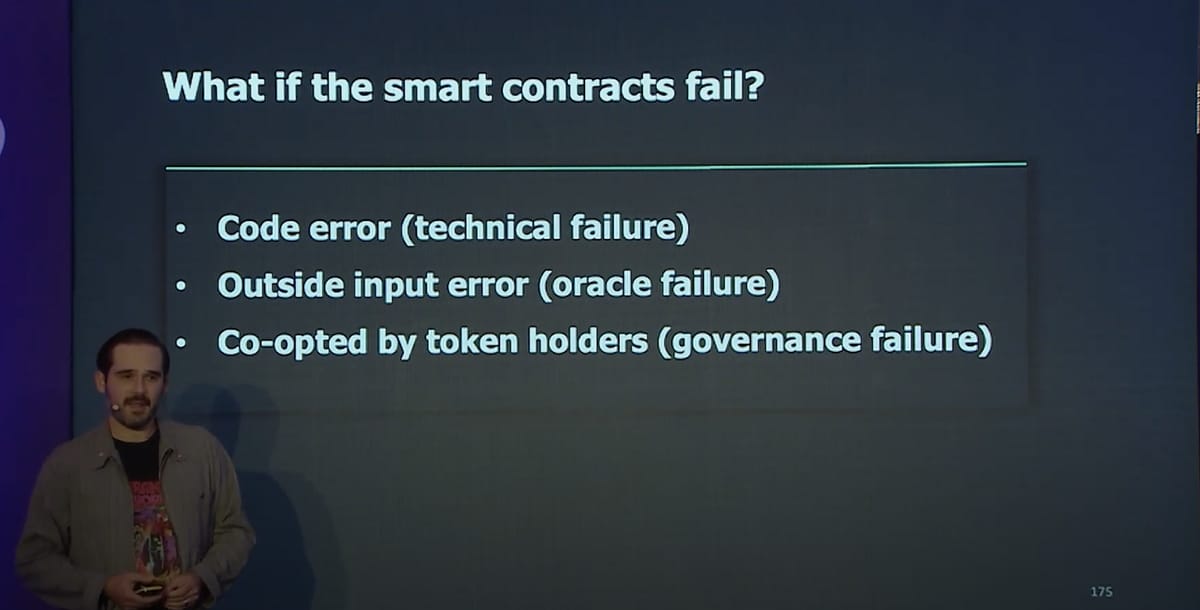

Claims should be paid when users of the protocol suffer material financial losses due to failures in either the protocol code, economic design, governance setup, or oracles.

A claim can be processed in the event that a custodial wallet gets hacked and you lose more than 10% of your funds, OR withdrawals from the custodian are halted for more than 90 days a claim can be.

While having these coverage options sounds like a DeFi degen’s or DeFi hedge fund’s dream, the devil remains in the details. If you are running multiple yield strategies on various protocols (Compound, Aave, Uniswap), you will need coverage for each of these protocols separately to fully ensure your DeFi strategy.

What Nexus Mutual Doesn’t Cover Yet

Moreover, like any insurance company, Nexus Mutual has some exclusions that would invalidate some claims.

Stolen Private Keys

Any events or losses due to phishing, private key security breaches, malware, exchange hacks or any other activity where the designated protocol continues to act as intended.

Rug Pulls - Internal Teams Stealing From Users

Any events or losses resulting from the owners or controllers of the designated protocol confiscating or stealing funds from users in line with the permissions of the designated protocol irrespective of the individual or entity that has access to the private keys of the owner or controller accounts.

To be honest, this is a massive gap in the marketplace -- as rug pulls from rogue teams and stolen private keys are the two biggest risks in DeFi.

So while Nexus Mutual protects from third-party smart contract hacks, they DO NOT yet protect against rogue teams or from lost/stolen private keys.

Offering an upgraded version of their insurance for a higher premium that included stolen keys and rug pulls would be extremely helpful to creating a safer crypto economy.

Crypto hedge funds, particularly those which are yield-focused, are very much looking for these full coverage solutions -- and are willing to pay premiums for them.

We do hope Nexus Mutual or their competitors will add full coverage options in the near future.

Claims & Decentralization

Nexus Mutual has an economic model in which users are part of an ecosystem and have a stake in the riskiness of the pool. When you buy cover from Nexus Mutual, you're effectively becoming part of that decentralized ecosystem.

You are protected in the event of hacks and you can also reap the rewards from the growth of the broader pool. Keep in mind that if you were to buy cover and subsequently file a claim, you have no guarantee of recovering your assets because all cover is provided on a discretionary basis.

Nexus Mutual's covers are not a legally binding insurance agreement. Rather, they are discretionary covers where those members and claim assessors will determine whether the claim is valid or not. Nexus operates under a discretionary mutual structure, which means that all insurance claims are paid at the board's discretion, i.e., all other members of the Nexus Mutual ecosystem.

Claims Backed by Legal Rights

In order to become part of the Nexus DAO, you must go through KYC and become a verified member. When joining the mutual, you become a legal member of a UK company; legal agreements will back your membership rights, all members will have legal rights to the pool of funds.

Karp describes this as "a DAO wrapped in a legal entity." Karp describes his reasoning below:

"It is kind of a necessary evil right now. To be honest, we have KYC because Nexus itself is a legal company in the UK right now. Thus, it is kind of like a DAO wrapped in a legal entity. The reason we did that was that insurance is already a highly regulated space. So what we wanted to do was make sure we get out to market in a safe way. We are following a discretionary mutual structure; that is a well-known existing structure. Essentially, we are automating that with smart contracts on Ethereum. So from a legal and regulatory point of view, we're following a known model.

Now, I guess the other point to note is that some elements of the system aren't fully decentralized right now. For example, a capital model gets run off-chain once per day; the pricing models run off-chain for computational reasons.

We have plans to put that on-chain in the future and have the organization run in a completely decentralized fashion. For now, we are working through that on a progressive decentralization basis. There is going to be an option at some point for the mutual members to vote to get rid of the legal wrapper and go on a fully permissionless basis, but we wanted to centralize some stuff first because we want to make sure we're safely doing things. I agree it kind of jabs with the purity of DeFi initially, but that's because we wanted to do things the right way by taking on our progressive decentralization path."

Protocols Nexus Mutual Covers

Nexus Mutual provides cover for all the major DeFi protocols and exchanges.

Being that Nexus Mutual has a capital pool exceeding $600M they are able to support 8 to 9-figure policies giving major hedge funds and institutions the cover they need to run their yield strategies.

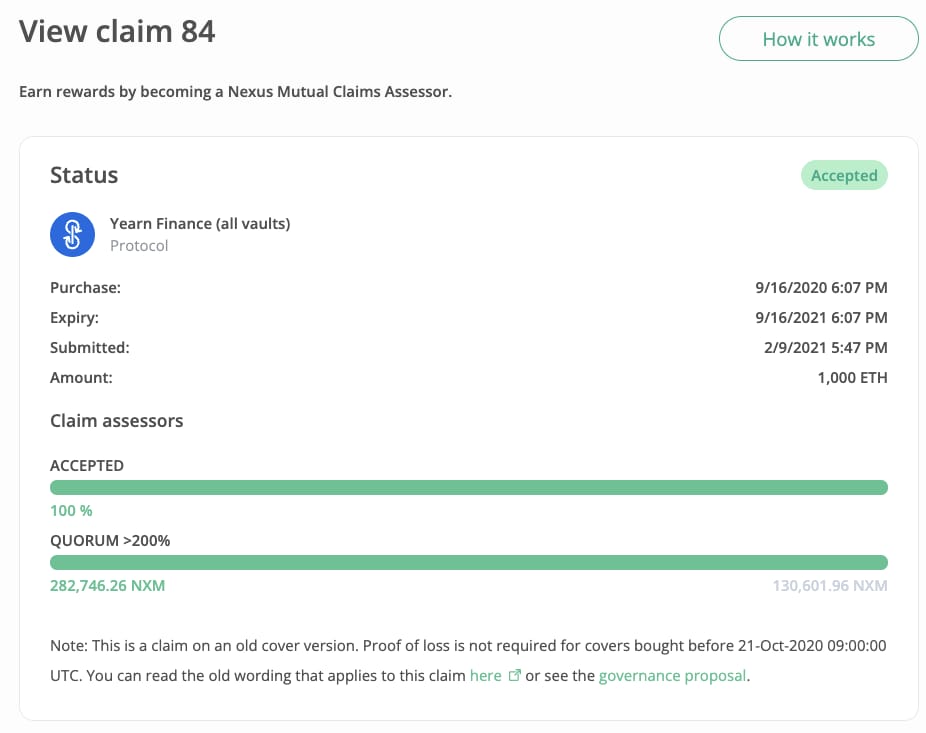

To date, their biggest claims payout came from a Yearn Finance cover of 1,000 ETH or $4M USD.

NXM Tokenomics

Nexus Mutuals' governance token is NXM, and the token runs on a bonding curve to ensure that the mutual always has enough capital to pay all of its claims but discourages excess capital that it is not putting to use. The purpose of this is to grow the capital required in line with the business growth.

This is why Karp decided not to go with an ICO from the beginning so that he would not have hundreds of billions of capital that’s not being utilized until the demand for policy coverage caught up. For this purpose, Karp designed a concept called Minimum Capital Requirement (MCR). This is basically how much capital the mutual needs to back that its existing active covers it right.

In order to control the price of its governance token you can only purchase NXM through Nexus Mutual’s app. This is why you will also see wNXM (Wrapped NXM) on various exchanges such as Binance because only wNXM tokens are freely tradable outside of the Nexus Mutual platform. Native NXM tokens are only available on the Nexus Mutual platform and can only be unwrapped by a member of the mutual.

The Competition - Insurance, Unslashed, Nsure, and Lloyd’s of London

Insurance on cryptocurrency protocols is at an all-time high especially with a new hack being announced every week. This is why Coinbase opted to get insurance since its inception and has been insured without lapse since 2013. Its current policy covers $255 million worth of assets from Lloyd’s of London.Lloyds of London is an insurance and reinsurance company located in London and have been dipping their toes into the cryptocurrency space since covering Coinbase. Today they offer policies to protect cryptocurrency held in hot wallets against theft or other malicious hacks. Without being able to cover for stolen private keys or rig pulls, major institutions are forced to use Lloyds of London to fully cover their major crypto positions and yield strategies.

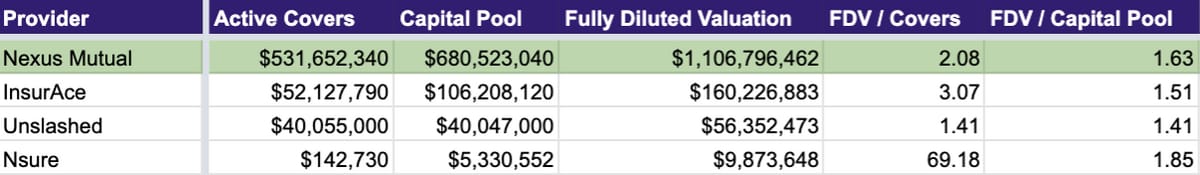

Conclusion - Nexus Mutual Remains the Leader in Crypto Insurance

When looking at the current landscape of insurance Dapps, Nexus Mutual reigns as the largest insurance provider in DeFi with ten times more policies being covered and a capital pool five times larger than its closest competitor.

This is why Dapps such as Armor and iTrust.Finance are building on top of Nexus Mutual to quickly scale their protocol offerings and tap into Nexus’s infrastructure and capital pool. Karp’s vision for Nexus Mutual is to ultimately make the protocol completely permissionless and provide coverage for all types of risks.

Combining Nexus Mutual’s solid fundamentals and being led by a visionary leader with 15 years of experience in the insurance industry, Nexus Mutual may remain the leader in the insurance DeFi space for some time to come.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚡SEC Gets Path to Regulate Stablecoins as U.S. Weighs New Rules - Wall Street’s top watchdog won concessions in a debate between U.S. regulators over which firm would regulate stablecoins, clearing a path for the Securities and Exchange Commission to create a clear regulatory environment for the $131 billion market. (Source)

😮 Mastercard Says Any Bank or Merchant on Its Network Can Soon Offer Crypto Services - This includes bitcoin wallets, credit and debit cards that earn rewards in crypto and enable digital assets to be spent, and loyalty programs where airline or hotel points can be converted into bitcoin. (Source)

🏧 Houston Pension Buys Crypto, an Asset ‘We Could Not Ignore’ - The Houston Firefighters’ Relief and Retirement Fund, which has $5.5 billion of assets, said it has invested $25 million in Bitcoin and Ether through NYDIG, continuing the trend of institutions investing in crypto. (Source)

💰 UK FCA Grants Registration to Crypto Startup Crypterium - The FCA has recently registered Crypterium to provide cryptocurrency services to local citizens and companies, becoming one of few companies to have passed the UK registration process. (Source)

🤑 Dfyn Announces New Incentivized Liquidity Program on Fantom Network - Leading multichain AMM dex platform Dfyn has unveiled a new incentivized liquidity program on the fast-growing Fantom blockchain. (Source)

🏦 Worldcoin Wants To Scan Your Eyeballs. Founder Says It’s the ‘Future of Privacy’ - In order to ensure an equitable distribution of the new cryptocurrency, Worldcoin opted for using biometrics. (Source)

🇺🇸 Terra Founder Do Kwon Files Lawsuit Against the US SEC - Terraform Labs and Do Kwon filed a lawsuit against the US SEC, arguing that the US regulator crossed a line by improperly issuing an out of jurisdiction subpoena. (Source)

📈 Dubai Financial Authority Introduces Regulatory Framework for Investment Tokens - Reflecting proposals outlined in a consultation paper issued in March, the framework marks the first phase of the DFSA’s Digital Assets regime, creating the foundation for a clear regulatory environment in UAE. (Source)

🎆 Near Protocol Offers $800M in Grants in Bid for DeFi Mindshare - Near co-founder Illia Polosukhin said the program has already distributed $45 million in funds this year, with a particular focus on early-stage ecosystem building blocks. (Source)

💳 GameStop Enters the Metaverse With ‘Web3 Gaming’ Job Post - The video game store is hiring an Ethereum specialist after teasing an NFT marketplace in May. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. ETH Futures Open Interest Reaches New Highs As Price Hits New ATHs

2. Algorand Projects Raised $1.9M on Average, Compared to $6.1M for DeFi Projects in 2021

3. Cumulative Fee Burn for Eth Reaches $2.7B USD Over the Weekend

4. Crypto Fund Inflows Hit Record $1.5B As Bitcoin Futures ETFs Go Live

5. As of Oct 25th Over 66% of Total BTC Supply Has Been Held by LTHs Signaling a Supply Shock by End of Q4

6. Bankless’s Latest IndexCoop Proposal Reveals DeFi Gems List They Are Betting Will Have the Highest Appreciation

7. Ethereum on Pace To Surpass Visa As Largest Payment Settlement Layer by End of Q4

8. Total TVL Reaches a New Ath of $245B This Week

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

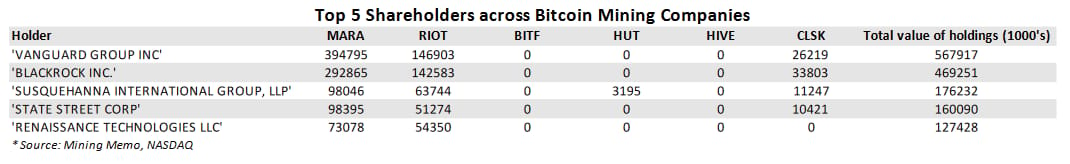

1. Top 5 Institutional BTC Mining Holders

Compass Mining is a crypto mining company that recently released a report showing a breakdown of institutional investments in public bitcoin mining companies.

"Institutions account for over 25% of ownership in RIOT, MARA, and CLSK. Most financial institutions, particularly investment management companies, are subject to strict mandates regarding what they are allowed to include in client portfolios. Based on the data above, it is reasonable to assume that these institutions use bitcoin companies to meet clients' demand for bitcoin exposure.

Moreover, active positions of institutional holders in these stocks experienced a net increase over the past year. Institutions are not selling their mining investments; they are adding to their positions."

2. Bitcoin Balance on Exchanges Sees Further Decline

The team at Arcane Research published their latest weekly report highlighting that Bitcoin’s balance on exchanges continues to fall to a 3yr low.

“The balance on exchanges has declined to 2.44 million BTC, marking a new three-year low after falling 27,500 BTC in the last seven days. 2.44 million BTC is equal to 12.94% of the circulating supply. Relative to the circulating supply, the bitcoin balance at exchanges sits at levels not seen since January 2018. This could suggest that the demand to sell is low at the moment, with few investors seeking to move bitcoin from cold storage to exchanges in order to realize gains with bitcoin trading at all-time highs.”

3. Compound Grows Its Outstanding Loans by 101% in Q3

State of Compound Q3 2021, Oct 21, 2021Messari is an enterprise crypto analytics platform. Ryan Watkins, a senior analyst, released Compound’s Q3 financial report detailing Compounds growth compared to the previous quarter.

“In Q3, USDC became Compound’s largest market by loans outstanding and was the single largest driver to loan growth in the quarter, increasing 101% from $1.1 billion to $2.4 billion. This far outpaced deposit growth in the quarter, driving utilization up from 50% to 85% by the end of the quarter. This caused interest rates in the USDC market to rise substantially from 2.7% at the beginning of the quarter to 7.6% by the end of the quarter.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

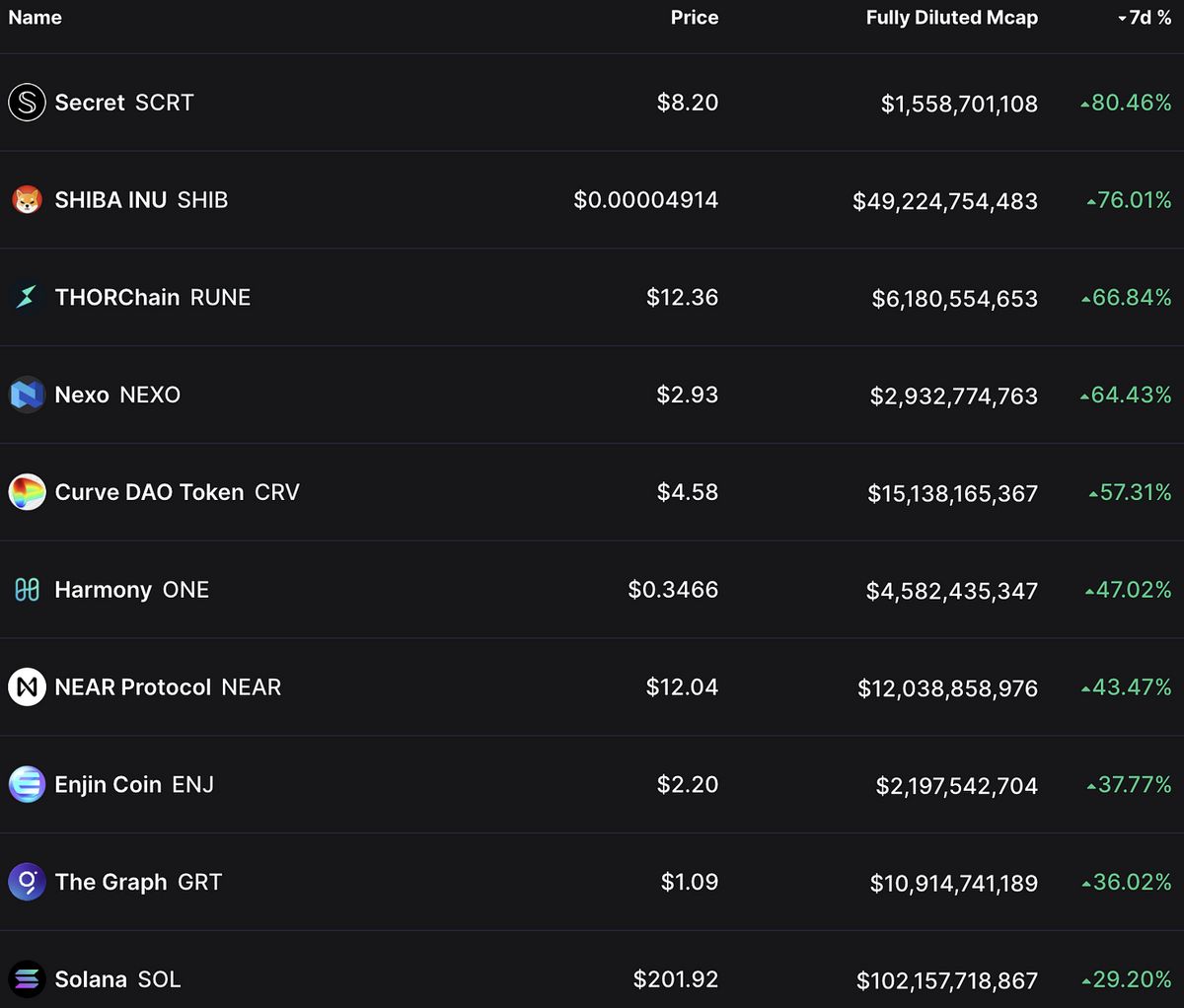

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like SHIB, RUNE, and NEXO had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

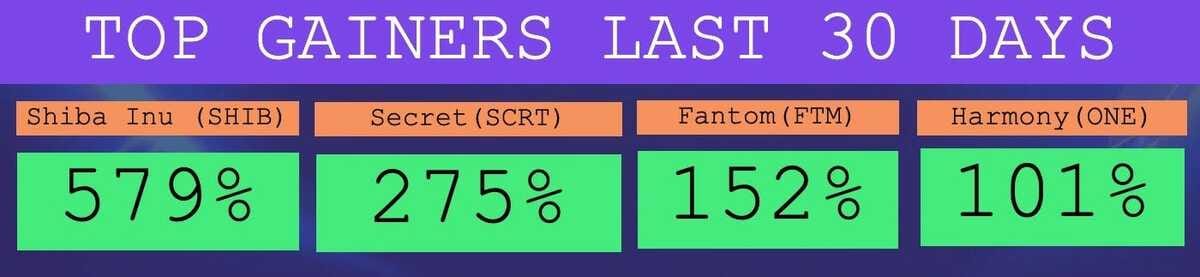

The Top Performers This Month from the Top 100: Shiba Inu is a meme coin, Secret is a privacy network, and Fantom and Harmony are an L1.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 8,294 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.